The Bottom Line: Is Brownstone Research Worth It?

Your mileage with Brownstone Research will vary wildly depending on your financial goals, risk tolerance, investment style, and budget. The mixed Brownstone Research reviews you’ll find online reflect this reality.

If you’re an aggressive tech investor who doesn’t mind volatility and wants exposure to early-stage or cutting-edge companies (including crypto), Brownstone might appeal to you. Their deep dives into niche tech sectors and educational content can help you understand emerging markets.

But for most investors, especially beginners, the risk-averse or budget-conscious folks, Brownstone isn’t the best choice.

The sky-high prices of their premium services and the inherent risks of their typical recommendations create a significant barrier to entry. Many also find their aggressive marketing and constant upselling tactics pretty off-putting.

In this Brownstone Research review, I’ll help you explore whether or not the service is worth your hard-earned cash.

A more affordable alternative…

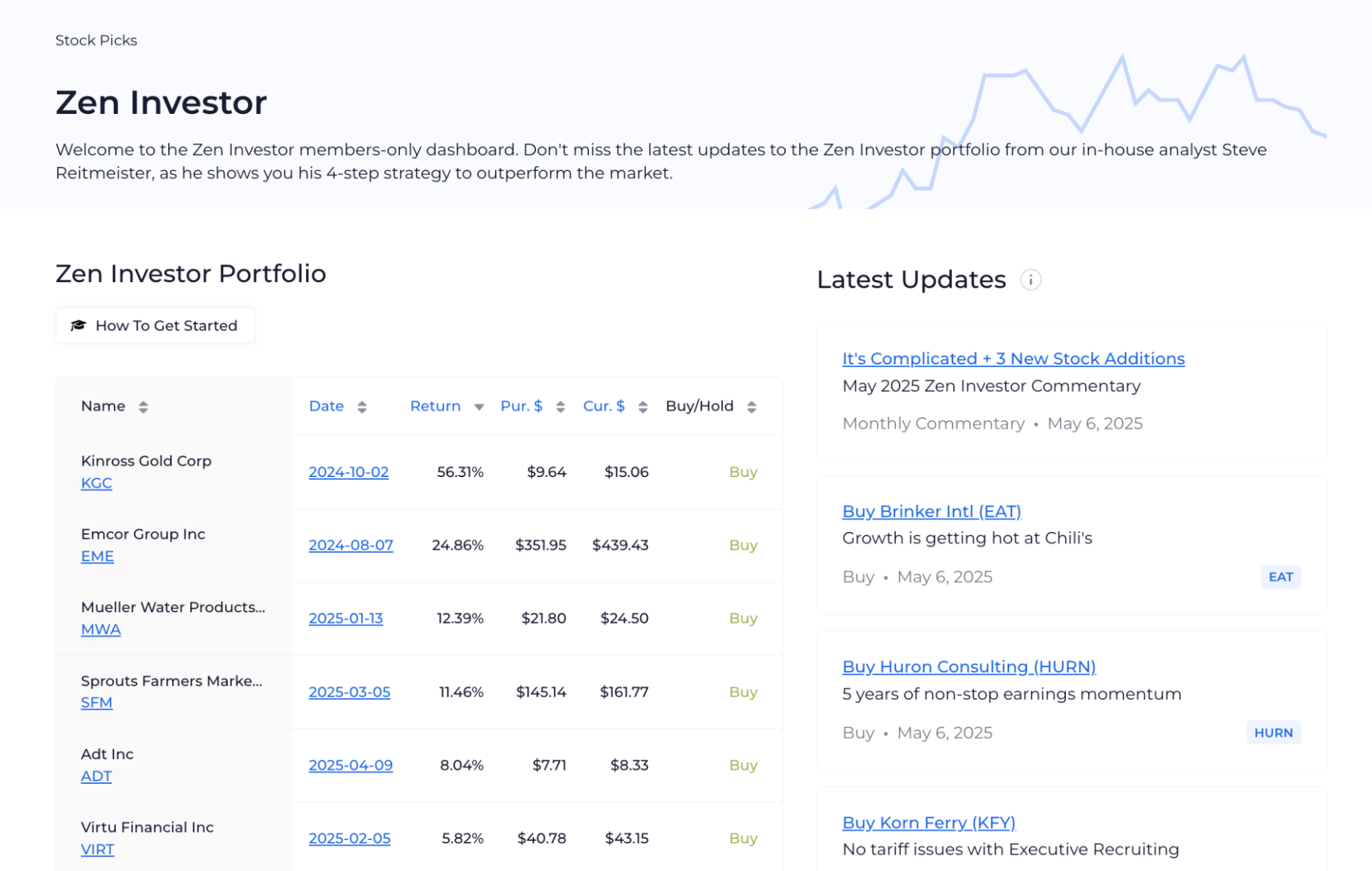

With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

What is Brownstone Research?

Founded in 2020 and based in Delray Beach, Florida, Brownstone Research is an independent financial research firm focused on finding tech investment opportunities. This spans biotechnology, artificial intelligence, cryptocurrency, 5G, and other breakthrough innovations.

Their basic philosophy is that technology drives market growth and investors can secure sizeable returns by spotting tech trends before going mainstream.

Brownstone positions itself as a boutique firm, giving regular investors the kind of research usually reserved for Wall Street insiders. Their publications highlight emerging trends and try to identify specific companies set to benefit from technological shifts.

The company offers various subscription newsletters, from free daily emails about broad tech trends to premium services costing thousands of dollars that provide specific stock picks and detailed reports.

Jeff Brown started the company and remains its public face, though other analysts like Colin Tedards have reportedly joined the team to lead specific research areas.

Note: WallStreetZen also offers several subscription newsletters — including the excellent, and no-cost newsletter, WallStreetZen Ideas. With your subscription, you’ll get several emails a week detailing recent Strong Buy upgrades, features on trending stocks and sectors, and the popular “5 Stocks to Watch” email every Sunday. Subscribe now

Who is Jeff Brown?

Jeff Brown founded Brownstone Research and serves as its chief investment analyst. He is a seasoned tech executive, angel investor, and an expert at spotting high-growth tech opportunities.

According to company materials, Brown has over 25 years of experience in high-tech executive roles. He claims to have worked for big names like Qualcomm, NXP Semiconductors, and Juniper Networks.

He also says he’s been an executive and board member for various tech companies and an active angel investor.

Brown plays the role of tech prophet who can translate complex trends into stock picks for regular investors. He constantly talks up emerging technologies like AI, gene editing, and crypto, making bold predictions about their future impact.

His presentations typically create urgency, suggesting subscribers get exclusive insights that could lead to massive returns. This tech industry background forms the foundation of his investment advice and is the main selling point of Jeff Brown Brownstone Research.

But Brown’s reputation is mixed. Some subscribers praise his knowledge and educational content, while others blast his stock performance, aggressive marketing, and expensive services. These conflicting views matter when determining whether Brown and his research are genuine.

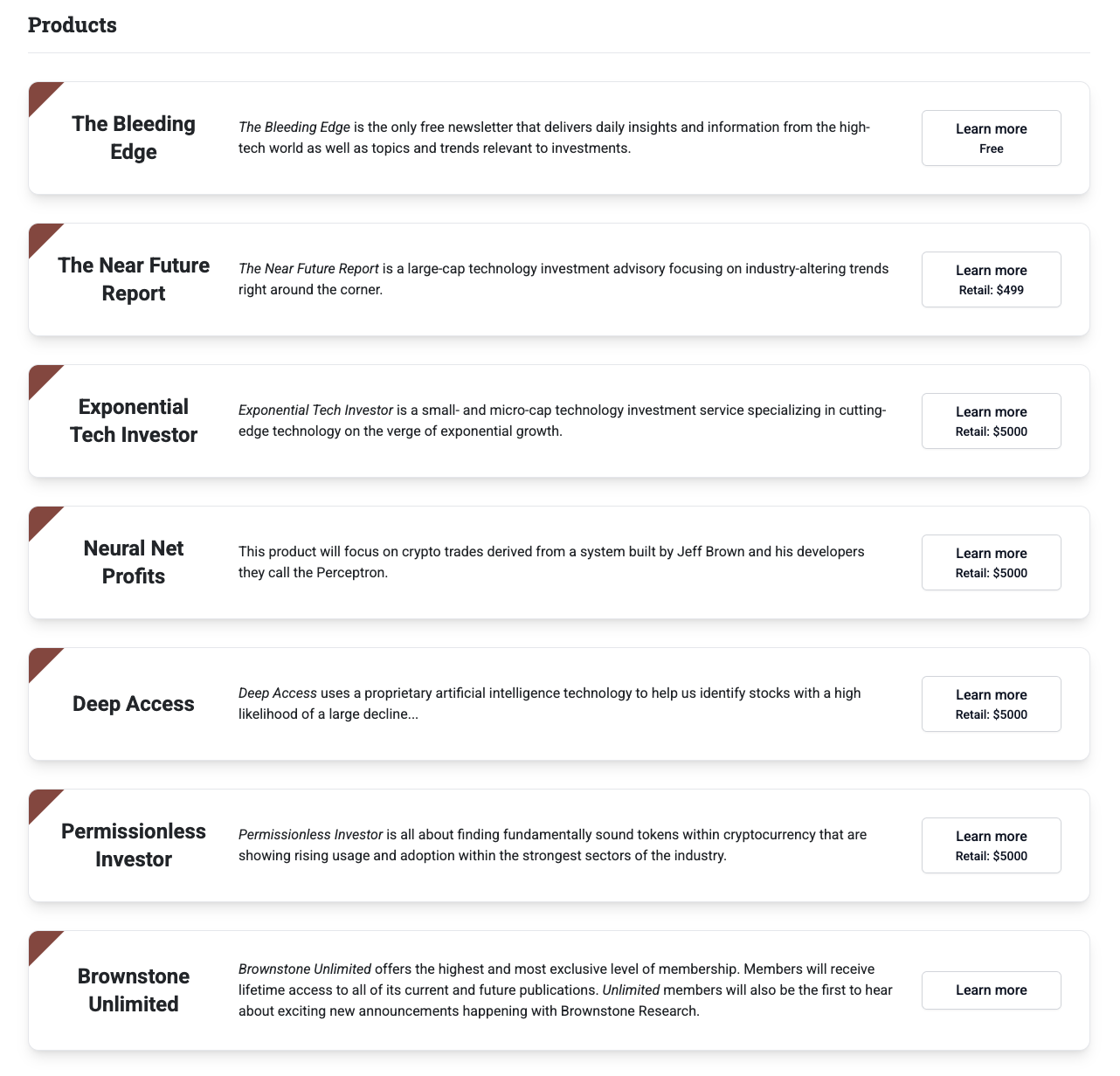

Brownstone Research Services

Brownstone Research sells investment newsletters and reports focused on the tech sector. These products are designed to provide subscribers with insights into high-growth opportunities in fields like biotech, AI, and crypto. Here’s what they offer:

Newsletters and Research Reports

Their services range from free emails to premium subscriptions costing thousands:

- The Bleeding Edge: Free daily email with comments on tech developments, market trends, and economic insights from Brown and his team.

- The Near Future Report: Their flagship paid service focuses on large-cap tech stocks supposedly on the verge of significant breakthroughs. Includes monthly issues with new picks, portfolio updates, and special reports.

- Exponential Tech Investor: Targets small-cap and micro-cap tech companies with higher risk but potentially bigger returns. Aimed at investors with a stronger stomach and interest in early-stage tech. (If you’re interested in this, you might also be interested in the Fundrise Innovation Fund.)

- Neural Net Profits uses an AI system called the “Perceptron” to find trading opportunities, especially in crypto markets. (If this sounds interesting, check out our post about the best AI stock pickers.)

They’ve also offered products like Deep Access (which supposedly spots declining stocks — you can find a much simpler and lower-cost tool here) and Permissionless Investor (focusing on crypto). Their top-tier membership, Brownstone Unlimited, grants lifetime access to all current and future publications.

Most services include research reports explaining their investment picks, regular updates, and educational materials covering both stocks and, increasingly, various cryptocurrencies.

Note: We earn a commission for this endorsement of Fundrise.

Who Should Use Brownstone Research?

Given their focus on tech, startups, and volatile areas like crypto, Brownstone Research services fit specific investor types:

Good match for:

- Thrill-seekers: Investors comfortable with serious risk who want exposure to potentially explosive (but speculative) opportunities

- Tech geeks: People who want to invest at the cutting edge of innovation and can handle wild price swings

- Learning-oriented folks: Those interested in understanding emerging technologies who value detailed explanations of complex trends

If the above seems to resonate with what you’re looking for, I would be remiss if I didn’t mention the Fundrise Innovation Fund. It’s a venture fund available to all investors — not just accredited investors, as is often the case with venture capital. You can invest starting at $10.

With it, you gain access to a variety of cutting-edge tech companies like OpenAI, Databricks, and ServiceTitan, some of which are still in the pre-IPO stage, giving you access to companies with explosive potential. One of my colleagues is an investor on the platform — check out our Fundrise Innovation Fund review to learn more.

Bad match for:

- Safety-first investors: Anyone prioritizing preserving capital and steady returns should stay away from Brownstone Research. A stock-picking newsletter like Zen Investor is likely a much better fit.

- Newbies: First-time investors unfamiliar with tech stock volatility might find themselves overwhelmed

- Budget-watchers: The steep prices require significant capital to justify the subscription costs. Zen Investor comes in at a fraction of the cost.

Browsing Brownstone Research reviews reveals that their recommendations typically fall into the high-risk, high-reward bucket. That makes them suitable for investors willing to gamble part of their portfolio on speculative bets, but problematic for those with conservative financial goals or lower risk tolerance.

To identify and research high-risk, high-reward stocks, check out this screener.

Popular Brownstone Research Newsletters

Let’s take a closer look at Brownstone’s leading publications:

The Bleeding Edge

What it covers: This free daily email is the gateway to Brownstone’s research. Rather than specific stock picks, it offers insights on technology trends, market news, and developments in AI, biotech, 5G, and crypto.

Who it suits: Anyone curious about technology and investing can benefit, from beginners trying to understand tech trends to experienced investors wanting daily tech commentary. Since it costs nothing, it’s a risk-free way to sample their approach.

Did you know that WSZ has a free newsletter?

For regular investing ideas and Strong Buy alerts related to market-moving news, subscribe to our FREE newsletter, WallStreetZen Ideas.

With your subscription, you’ll receive free previews of our Strong Buys from Top-Rated Wall Street Analysts feature, typically only available to WallStreetZen Premium members.

The Near Future Report

What it covers: One of Brownstone’s primary paid services, focusing on large-cap tech companies supposedly about to experience significant growth due to technological shifts or mass adoption. Subscribers get monthly issues with new recommendations, portfolio updates, and special reports.

Who it suits: Investors seeking tech exposure through more established companies that still offer decent growth potential. It works for people comfortable with stock investing who want researched tech picks.

Exponential Tech Investor

What it covers: This service hunts for higher-growth, higher-risk opportunities in small-cap and micro-cap technology stocks. Think cutting-edge fields like gene editing, AI, or quantum computing, where Brown believes massive returns await. The focus stays on companies still flying under the radar.

Who it suits: Aggressive investors with strong risk tolerance looking for early-stage opportunities with the potential for huge gains. You must stomach higher volatility and possible losses associated with speculative small-cap stocks.

Neural Net Profits

What it covers: This service supposedly uses a proprietary AI trading system (the “Perceptron”) developed by Brown’s team. It primarily targets trading opportunities in the cryptocurrency market, analyzing data to predict price movements.

Who it suits: Investors and traders interested in crypto who don’t mind using AI-driven signals. Given crypto’s wild volatility and the black-box nature of AI systems, this fits experienced traders who understand risk management and speculative positions.

Brownstone Research Pricing

Brownstone Research’s prices range from free content to eye-popping premium subscriptions. Here’s what you’ll pay:

Service | Annual Price | Notes |

The Bleeding Edge | Free | Daily Email |

The Near Future Report | $499 | Often discounted to $49-$199 for the first year |

Exponential Tech Investor | $5,000 | Covers small/micro-cap tech stocks |

Neural Net Profits | $5,000 | AI-driven crypto trading service |

Brownstone Unlimited | $12,500 (Lifetime) | All-access pass |

Like many newsletter publishers, Brownstone attracts new subscribers with steep first-year discounts. These low intro prices typically jump to much higher rates at renewal. For example, the Near Future Report might cost just $49-$199 for year one but renews at the full $499 rate.

For refunds, Brownstone usually offers a 60-90 day money-back guarantee on annual subscriptions. This lets you try the service and get your money back if you’re unhappy. Terms vary by product, so read the fine print. Higher-priced or lifetime memberships often have different refund policies.

The free Bleeding Edge email is your best way to sample the Brownstone Research content without spending a dime, as free trials rarely appear for paid newsletters.

11 high-potential stock portfolios for a fraction of the cost

If you subscribed to all of Brownstone Research’s publications listed above, you’d be looking at over $10K per year. WallStreetZen’s Zen Strategies offers access to 11 portfolios, each with 7 stocks each, for a fraction of the cost.

There’s a strategy for everyone: Momentum. Small Caps. Buy the Dip. Under $10. And more. You can choose a lane and stick with it, or select stocks from different portfolios to diversify. Either way, the service’s picks have delivered superior returns, with several of the portfolios boasting 40% (or higher) annual returns.

Pros and Cons of Brownstone Research

Pros

- Tech specialization: Covers cutting-edge sectors with dedicated research you won’t find from general advisors.

- Educational value: The newsletters explain the technologies behind their picks, which is helpful for subscribers wanting to learn about complex, fast-changing fields.

- Big return potential: By targeting early-stage companies and disruptive tech, investors can potentially make significant gains if these predictions are correct.

- Service variety: Options from free content to various paid newsletters, letting you choose based on your interests and budget.

- Experienced leadership: Brown’s background as a tech executive and angel investor adds credibility to the research.

Cons

- High-risk focus: Heavy emphasis on speculative tech stocks and volatile crypto means recommendations can result in underperformance.

- Pushy marketing: The newsletters use aggressive tactics, including urgent deadlines, promises of huge returns, and artificial scarcity, which many find off-putting.

- Expensive premium tiers: Despite low intro offers, standard prices for premium services run extremely high, putting them out of reach for average investors.

- Questionable track record: With mixed user reports, long-term performance across all recommendations remains difficult to verify independently.

- Upselling machine: Brownstone’s business model pushes subscribers toward increasingly expensive services and hits them with higher renewal prices.

- Tech tunnel vision: Investors seeking broader market advice or guidance on traditional investments will find offerings too narrowly focused.

Alternatives to Brownstone Research

Looking for different approaches, risk levels, or pricing? Check out these alternatives:

Zen Investor

Price: $99/year ($79/year using this link)

Best for: Investors wanting data-driven, fundamentals-focused stock analysis.

Zen Investor provides actionable insights emphasizing long-term value investing. It appeals to people who prefer analytical approaches over speculation. It works well for beginners and experienced investors seeking solid stock ideas without high-pressure sales tactics.

The service itself is helmed by 40+ year market veteran Steve Reitmeister, longtime Editor-In-Chief of Zacks.com. Reitmeister has seen a thing or two in the market, and has a great ability to maintain a long-term mindset even in the face of market chaos as we’ve seen this year.

As part of the 4-step process used to select stocks in the Zen Investor, Reitmeister employs the Zen Ratings system, a 115-factor review of stocks that evaluates their overall potential, expressed as a letter grade, as well as 7 “Component Grades” in key areas of interest to investors, like Financials, Sentiment, and Value.

The system also has a proprietary AI factor that sniffs out high-potential investments that might be missed with traditional fundamental checks.

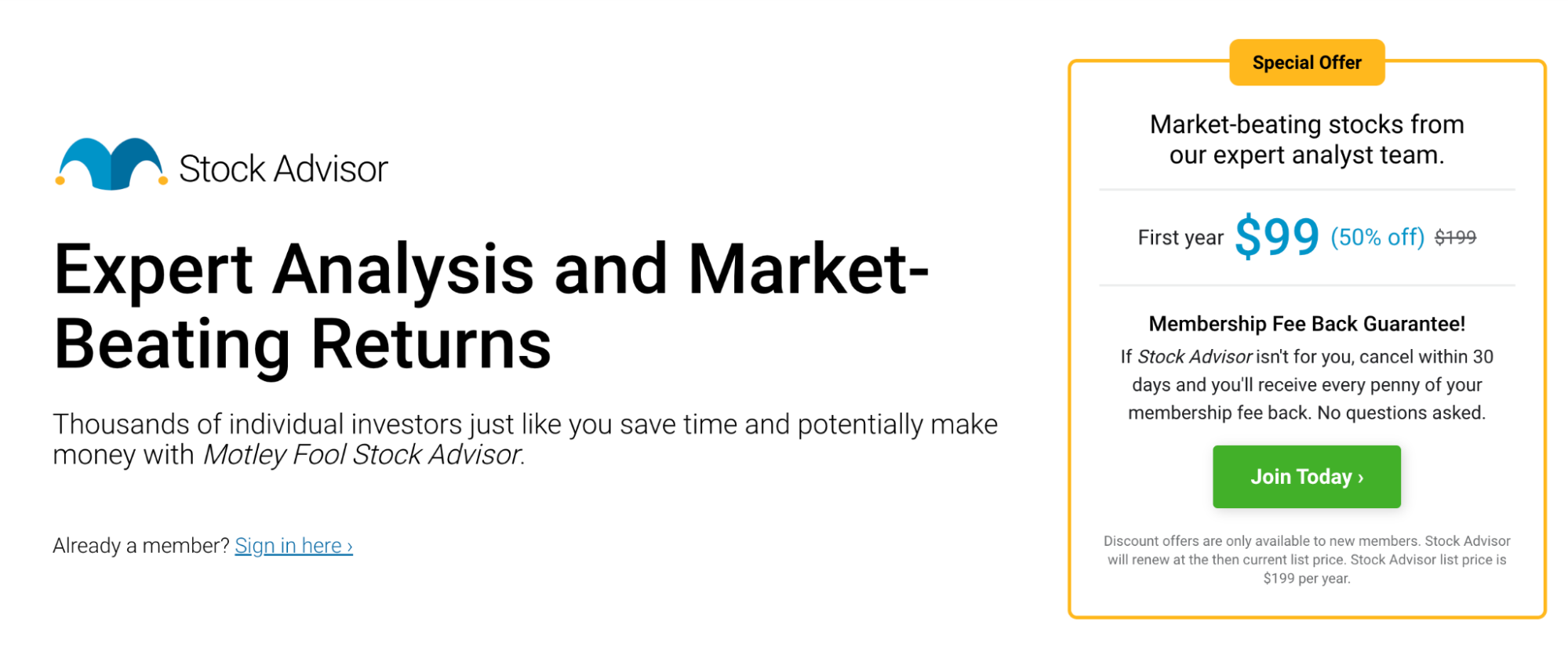

The Motley Fool (Stock Advisor)

Price: $199 per year, ($99 for new members’ first year using this link)

Best for: Long-term, buy-and-hold investors, including beginners.

The Motley Fool delivers two new stock picks monthly, plus foundational stock recommendations and timely buys.

Does it work? Well, the service has been around for more than 2 decades, and as of May 23, 2025, Stock Advisor has nearly 6x’d the S&P 500 over the last 21 years.

Yeah — there’s a reason why it’s so popular.

Stock Advisor focuses on growth stocks but with broader diversification than Brownstone’s tech obsession. Moreover, it emphasizes on quality companies for the long haul.

Seeking Alpha (Premium / Virtual Analyst)

Price: $299/year (get a $30 discount here)

Best for: Investors wanting diverse investment opinions, research from thousands of contributors, and powerful screening tools.

Seeking Alpha is one of the best stock research sites, period. (If you want to know a heck of a lot more, check out our Seeking Alpha review.)

One recent addition to the Seeking Alpha universe? Virtual Analyst, a feature that uses AI to provide concise insights on quant-rated stocks.

Overall, Seeking Alpha is an amazing resource for market commentary, stock research, and stock picks. is ideal for active investors who do their homework and value multiple perspectives.

Trade Ideas

Price: The standard plan costs roughly $1,068 yearly ($89/month if billed annually), while the premium plan runs about $2,136 annually ($178/month if billed annually).

Best for: Active day and swing traders needing real-time stock scanning, trade ideas, and AI trading assistance.

Trade Ideas offers advanced charting, backtesting, and automated trading features. The platform focuses on short-term trading rather than long-term tech investments.

If you’re an experienced, high-frequency trader who is looking for an interactive platform with an AI boost, it may be worth the hefty price tag. (Read our Trade Ideas review.)

The Final Word…

Before spending serious cash on any newsletter service, understand its refund policy thoroughly and consider starting with its free content. Any decision to subscribe should be based on explicit consideration of both the potential rewards and substantial risks.

While Brownstone Research may appeal to some investors, it’s expensive and its laser focus on tech doesn’t leave much room for diversity.

For many investors, alternatives like Zen Investor, The Motley Fool, or Seeking Alpha deliver better value with more balanced approaches. These products offer solid insights without the premium price tag and extreme risk profile that come with Jeff Brown Brownstone Research.

FAQs:

What is Brownstone Research?

Brownstone Research is an independent financial research company founded in 2020. It focuses on tech investment opportunities, covering biotechnology, artificial intelligence, cryptocurrency, and 5G through subscription newsletters designed to help regular investors identify high-growth tech investments before they take off.

Who is Jeff Brown?

Jeff Brown founded Brownstone Research and serves as its chief investment analyst. He claims 25+ years as a high-tech executive with companies like Qualcomm and NXP Semiconductors.

How much does Brownstone Research cost?

Brownstone's prices range widely. Their "Bleeding Edge" daily email is free, while their main newsletter, "The Near Future Report," typically costs $499 annually (though it is often discounted to $49-$199 for the first year).

Premium services like "Exponential Tech Investor" and "Neural Net Profits" run about $5,000 yearly, and their lifetime membership, "Brownstone Unlimited," costs $12,500+.

Is Brownstone Research legit?

Brownstone Research is a real financial publishing company that delivers investment research and recommendations. Some subscribers value its tech focus and educational materials, while others criticize its aggressive marketing, high costs, and speculative recommendations.

While not a scam, potential subscribers should approach it with realistic expectations about the risks involved.

Are Brownstone Research’s stock picks good?

Results from Brownstone Research stock picks vary widely. While they showcase winners in their marketing, overall long-term performance across all services is tough to verify independently.

Their focus on early-stage tech companies and cryptocurrencies means many recommendations carry high risk and volatility. Some subscribers report good results, while others express disappointment.

As with any investment service, past performance doesn't guarantee future results, and suitability for picking depends on your personal risk tolerance and investment goals.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our March report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.