Art has appreciated 11.4% per year over the last 30 years (1995-2024), higher than the S&P 500 (10.0%) and US real estate (3.9%) overall.

Plus, unlike public markets, art is uncorrelated with other asset classes like bonds, gold, the S&P, and housing over the same time frame – making it a potentially strategic diversifier.

Because of this historical appreciation (not to mention its inherent beauty), fine art has always been a highly sought after investment, but only the wealthiest were able to afford it.

Until now.

Today, online marketplaces like Yieldstreet and Masterworks allow you to invest in shares of famous (and wildly expensive) artworks.

These platforms make it easy to start investing in art. Read on if you want to find out how to invest in art, what are its risks and benefits, and which platform you should choose to start investing in art in 2025.

FEATURED OFFER: Masterworks

Want an investment that’s fueled by the ultra-wealthy? Try art.

Since 1995, contemporary art has appreciated 11.4% annually on average. That’s 43% more than the S&P over the last 30 years (1995-2024). After all, there’s a reason why many HNW individuals can invest almost an entire 10%+ of their wealth in art.

Want in? You can invest in shares of million-dollar painting offerings with Masterworks, the world’s first art investment platform.

For a limited time, you can skip the waitlist here

*See important disclosures at masterworks.com/cd

Why Should You Invest in Art?

For the last 30 years (1995-2024), contemporary art has historically been almost entirely uncorrelated with any other popular market (bonds, housing, S&P, gold) – so a bearish period in the stock or bond markets won’t necessarily drag the value of artworks down with it.

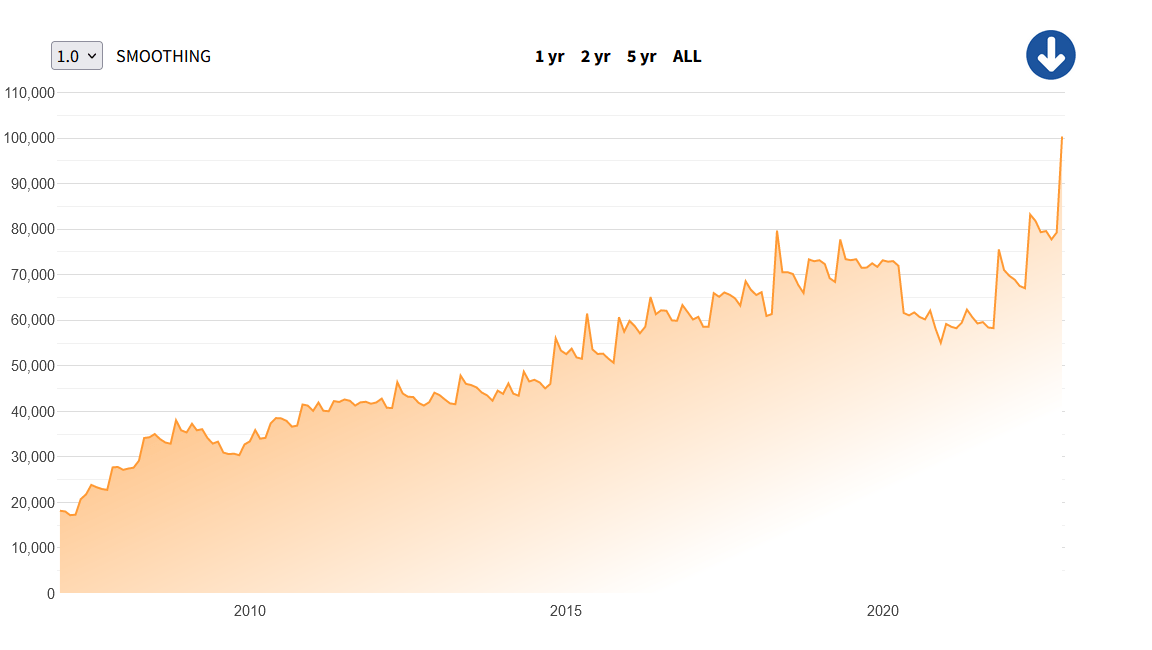

With ebbs and flows, art has still shown consistent historical appreciation. The Artprice 100, an index of the 100 top-performing artists at auction within the last five years, shows that contemporary artworks appreciate in value by 10% per year. That’s higher than the historical average S&P 500 return of 7.8%.

The Mei Moses Index – an index that attempts to track the fair market performance of art – shows the value of art has increased by about 9% per year since 1871:

Over the same period, the S&P 500 increased by about 7% per year.

Recent price growth is even more impressive – the global contemporary art market has appreciated by 11.4% per year since 1995, outpacing the stock market by 43% overall.

Low volatility and strong price appreciation make art an attractive diversifying investment for a slice of your portfolio.

Now that you know what art can do for your portfolio, let’s talk about the nuts and bolts of how to invest in art, including topics like art prices, appreciation, and how platforms like Masterworks make it easier than ever to invest.

How to Invest in Art

There are 2 routes you can take to invest in art:

1. Traditional – Outright Ownership

You can buy physical and digital art directly at auction houses, art galleries, and art fairs.

Pros | Cons |

|---|---|

Outright ownership | Expensive |

Possession of the art | Can be damaged |

Difficult to perform investment analysis | |

Risk of fraud | |

Illiquid |

2. Crowdsourced – Fractional Ownership

You can buy shares of artwork or an art fund through a platform like Yieldstreet or Masterworks.

These platforms both largely lower the costs, and barrier to entry, for offerings featuring iconic pieces from artists like Picasso and Banksy to become a part of investors’ portfolios.

Historically, the primary problems limiting the number of art investors were:

-

- Price barrier

- Physical storage

- Investment analysis (choosing which pieces to buy)

- Authentication

These platforms analyze which artists and pieces have momentum then authenticate and buy the art. After proper storage, the companies offer individual shares or collateralized loans for you to invest in.

Through a much lower fee, these platforms remove those barriers, becoming complete services for art investing that even include insurance, regular appraisals, and your own personal advisor.

(I break down each platform in more detail below.)

What are the Risks of Investing in Art?

There are 4 primary risks associated with investing in art.

One of the biggest risks of purchasing art? A painting or piece of art can be counterfeit or it can get damaged. Both scenarios are disastrous for its value, and you should seek assurances from professionals before buying any art. Identifying artworks and storing them properly requires an expert’s skill.

This is one of the most overlooked reasons why online art trading platforms have become so popular—they offer professional identification, storage, and restoration, while offering insurance.

Thirdly, buying new artworks can be risky. They are difficult to evaluate because of the lack of information—it is difficult to compare a new artist to others and put an appropriate price tag on their work.

Finally, art is an illiquid alternative asset class. It is usually held for years or even decades (so it has time to appreciate) by investors before being re-sold. You should not invest in art with money you’re planning on needing in the near future.

Should You Invest in Art?

There is a reason why many wealthy investors include art in their portfolios – contemporary art is unique in that it has appreciated strongly and consistently for a very long period of time. All while remaining uncorrelated to other kinds of investments like stocks and bonds.

In fact, contemporary art has actually outpaced the S&P 500 overall across the last 30 years (1995-2024) in terms of price appreciation.

Unfortunately for art collectors, it is not a perfect investment. Art needs time to appreciate in value and it is treated as a collectible – the capital gains tax on art is higher than long-term capital gains tax on stocks and bonds.

Types of Art

There are 4 classes of art you can choose between:

-

- Old masters—the most pristine artworks created by renowned painters with historic significance like Michaelangelo, Leonardo, Rembrandt, etc. These are the most valuable artworks but are hard to acquire due to their scarcity and extreme price.

- Blue chip art—like blue chip stocks, these artworks come from established artists who are always sought after and are thus very reliable as investments. This includes great artists like Dali, Frida Kalo, and Warhol among many others. (Check out our post about how to invest in blue chip art)

- Up-and-coming artists—many artists are yet to reach the popularity they deserve, and investing in one can be highly profitable. However, a casual investor is very unlikely to stumble upon the next Picasso, which makes these investments highly speculative.

- Art funds—a fund is simply an art collection that investors can buy shares in. This is probably the most accessible investment vehicle (especially for beginners) because the price of a single share can be very low, and the investment is diversified by nature.

Investing on Masterworks

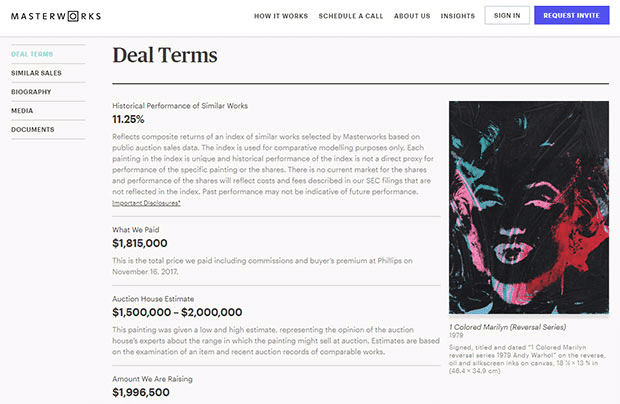

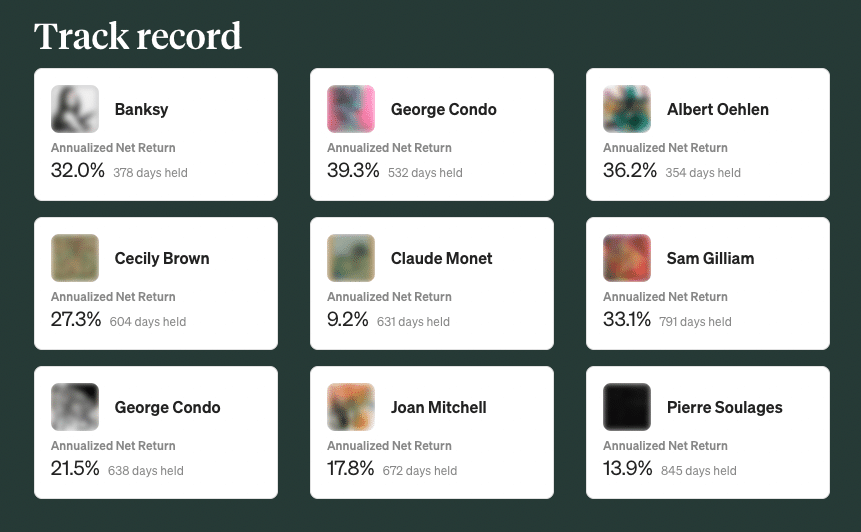

Masterworks analyzes and coordinates the purchase of the art, stores it, and then offers shares of an artwork.

After a holding period, Masterworks will sell the piece and distribute any profits to the owners.

All artwork offerings are registered and qualified with the SEC – where each piece of art is its own special purpose vehicle, what some may know as a “public company.”

After an art piece is purchased, Masterworks offers shares at $20 each, with shares adding up to the size of the artwork offering. This way, investors can allocate a set amount to any offering, and distribute their art investment across multiple offerings. When done investing in shares of an offering, users can wait until it is sold by Masterworks to collect their earnings or they can sell their shares to other users via an unaffiliated secondary market. Currently, the secondary market is only available to U.S.-based clients with a U.S. bank account

Masterworks Investing Platform

To get access to the platform, simply sign up at Masterworks.com, creating a profile to match your investment strategy and goals so an advisor can help you during your art investment journey.

The platform shows the primary offerings and the pieces available on the secondary market. Each piece has description and performance data. You can also look at different artists and see the financial performance of their work through interactive charts.

Masterworks Fees

There is no minimum investment on Masterworks. However, Masterworks retains complete discretion to determine that subscribers are “qualified purchasers” (as defined in Regulation A under the Securities Act) in reliance on the information and representations provided to them regarding their financial situation. Besides the hefty entrance barrier, there are 2 fees users need to be aware of.

-

- Masterworks charges a one-time cash “expense allocation” that adds up to 10% of the offering size

- 1.5% management fee to cover the storage, insurance, and regulatory expenses; and 20% profits interest, if any, upon sale of the artwork.

If you want to own individual shares of art, Masterworks is the best place to do it:

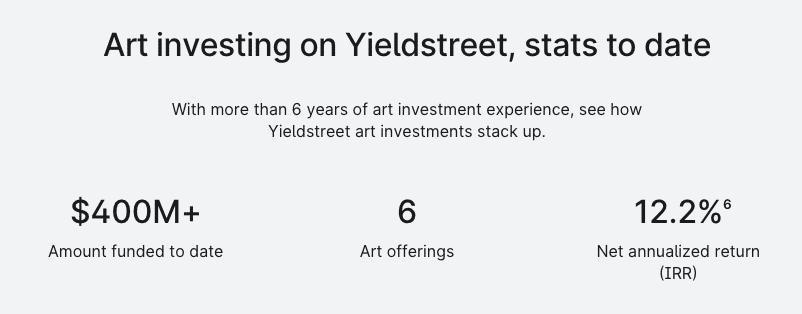

Investing on Yieldstreet

Yieldstreet doesn’t buy art directly, nor does it give you direct ownership.

When you invest in art on Yieldstreet, you’re investing in portfolios of art-backed loans and pools of fractionalized shares.

For example, let’s say Yieldstreet makes a deal with a company that wants to make an art fund. They will crowdfund and give the money to the art collector as a loan. The art collector will then pay back the loan with interest over time and Yieldstreet users will get regular payments.

Yieldstreet only works with companies with strong track records, and the artwork those companies buy is used as collateral. Moreover, the debt is insured and the company is fully regulated by the SEC, so the risks are kept to a minimum.

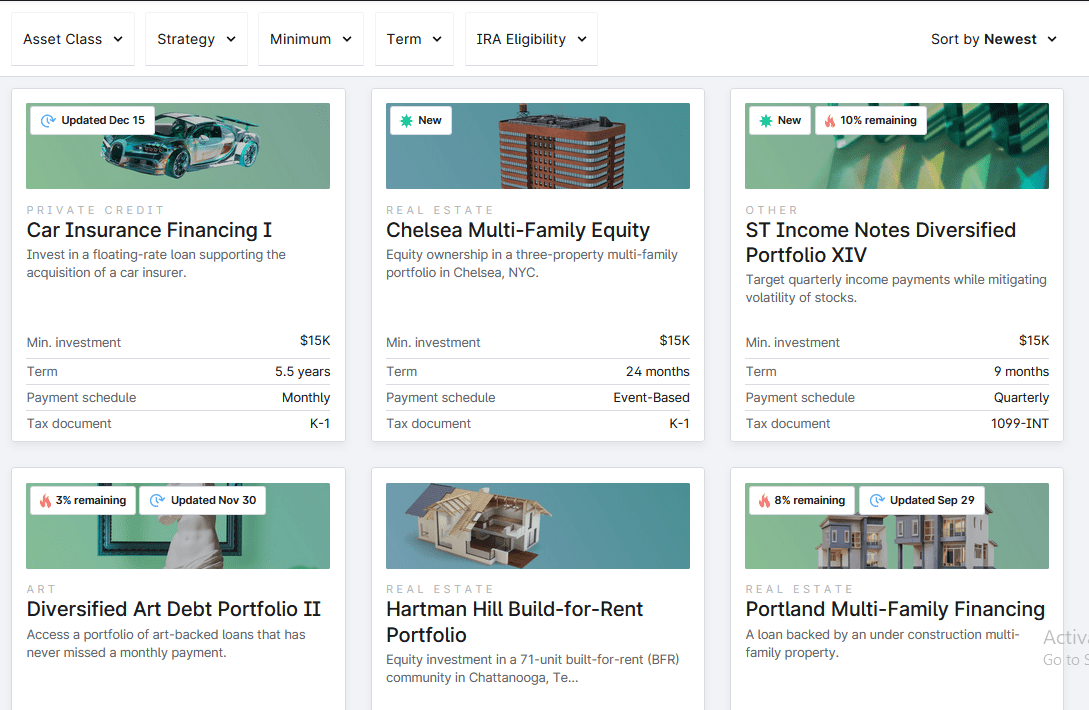

Yieldstreet Investing Platform

Yieldstreet’s investing platform is very simple and easy to use. All of the offerings are on the main page and the list can be narrowed down through various filters.

Each offering has extensive information including its expected yields, info about the borrower and the collateral, and the ownership structure of the debt. All of the benefits and potential drawbacks are included on the same page.

Yieldstreet Fees

The minimum initial investment for art funds on Yieldstreet is $10,000.

The platform charges a yearly management fee ranging from 1% – 4%. Each investment is different, and its specific fee will be listed on its offering page.

Some investments may also have a flat fee charged once per year, usually ranging from $100 – $150 for the first year dropping to $30 – $70 for subsequent years. Both fees are automatically deducted from the user’s regular interest payments.

If you have an existing Yieldstreet account, and are interested in other non-traditional assets (like crowdsourced real estate and other private loans), you should consider art investing on Yieldstreet:

Final Word: How to Invest in Art

The best way to invest in art is on Masterworks or Yieldstreet.

These platforms eliminate the 7-figure price barrier, investment analysis, authentication, and complicated storage and maintenance processes.

If you’re deciding between the 2, here’s your test:

- If you only want to invest in art, use Masterworks.

- If you want to invest in art, real estate, and other non-traditional asset classes simultaneously, use Yieldstreet.

FAQs:

How can a beginner invest in art?

The best way for a beginner to invest in art is via online art marketplaces like Masterworks and Yieldstreet.

What is the best way to invest in art?

In my opinion, the best way to invest in art is to acquire ownership via online marketplaces like Yieldstreet and Masterworks.

While investment-grade art is prohibitively expensive, online marketplaces sell individual shares of artworks, making it easier to acquire art and diversify your holdings.

Is investing in art a good investment?

Historically, investing in the fine art market has been a great investment.

The price appreciation has been strong and the returns have been stable. It is unaffected by other markets which makes it a good long-term inflation hedge and protection against downturns in public markets.

Is there an ETF that invests in art?

At this time, there are no art ETFs or mutual funds.

There are art funds which allow you to diversify your art investments. These funds are typically very expensive and privately-offered investments, but many investors use Yieldstreet’s art funds.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.