What’s The Best Stock Market Simulator?

In my opinion, eToro’s Demo Account is the best stock market simulator in 2025 for both short and long-term investors. This feature-laden platform lets you practice with virtual funds, and easily switch over to a live account when you’re ready to try strategies IRL. If you’re an active day trader, TradeStation is another worthy platform due to its speed and accuracy.

I’ll dig in deeper and offer plenty more options below…

Platform | Why it’s Best + Who It’s Best For |

|---|---|

TOP PICK: eToro | All investors who want to practice investing and/or try new trading strategies. In my opinion, eToro is the best stock market app and it also offers a great paper trading simulator. |

Honorable mention: TradeStation | The best pick for day traders, but not really great for long-term investors. Suggested for active day traders ONLY. |

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

The 7 Best Stock Market Simulators (Free Virtual Paper Trading Platforms & Apps)

In this review, I’m going to cover the 7 best free stock market simulators for paper trading and which one is best for you.

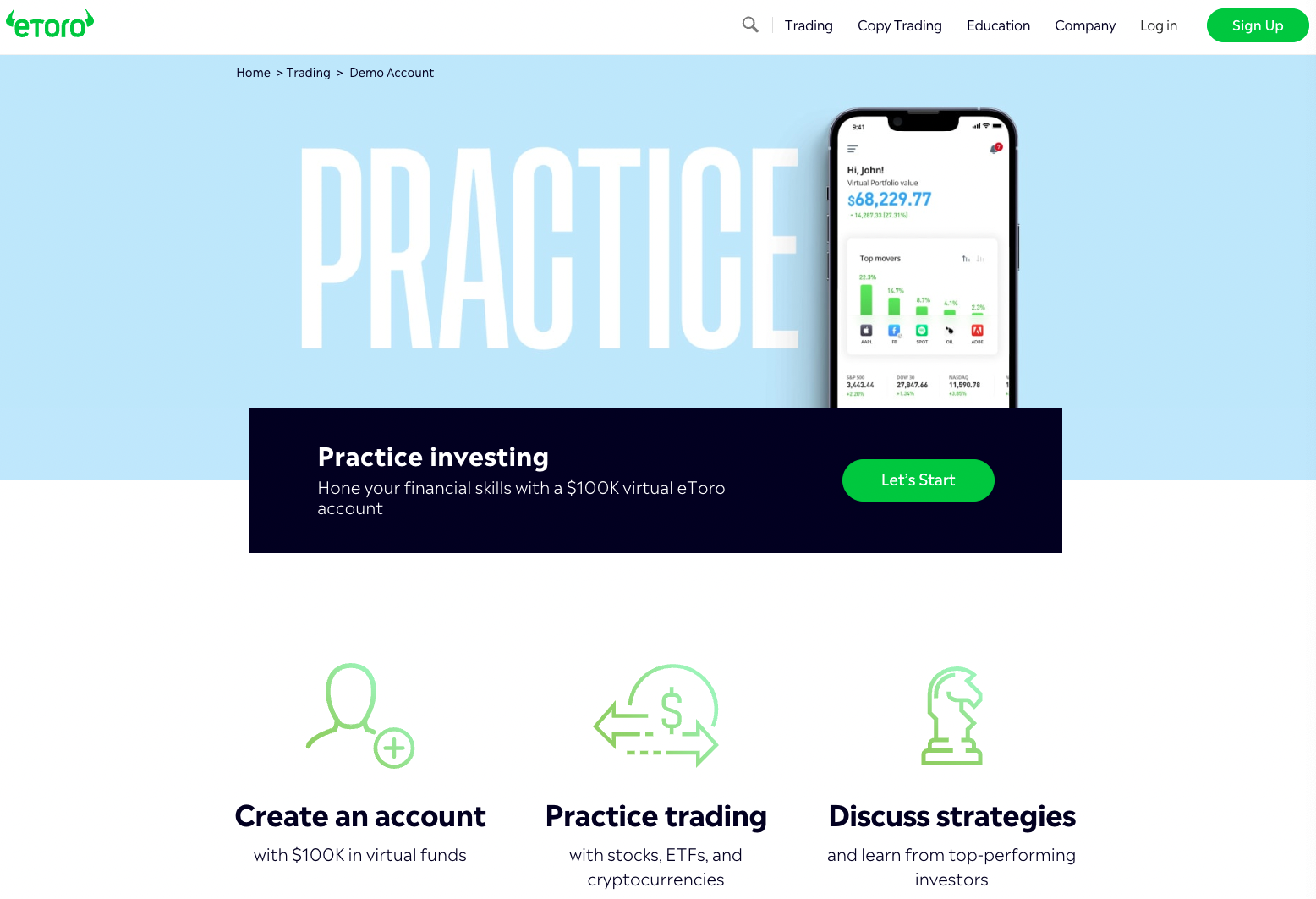

1. eToro – The Best Stock Market Simulator Overall

If you want to fine tune your trading skills and develop trading experience, try eToro. I believe it’s the best trading simulator in .

eToro offers Demo Accounts where you can practice investing with $100,000 in virtual funds:

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

You can buy stocks, ETFs, and cryptocurrencies, and test various buy-and-hold or technical trading strategies.

At the same time, you can experience all of the features eToro offers in its simple, intuitive platform.

Plus, unlike the other simulators on this list, eToro makes it easy for you to switch back-and-forth between your Real and Virtual accounts by clicking on the Real/Virtual button under your username at the top left-hand corner of your account dashboard.

This feature allows you to practice investing at any time, from your phone (eToro’s mobile app) or computer, regardless of your investing experience.

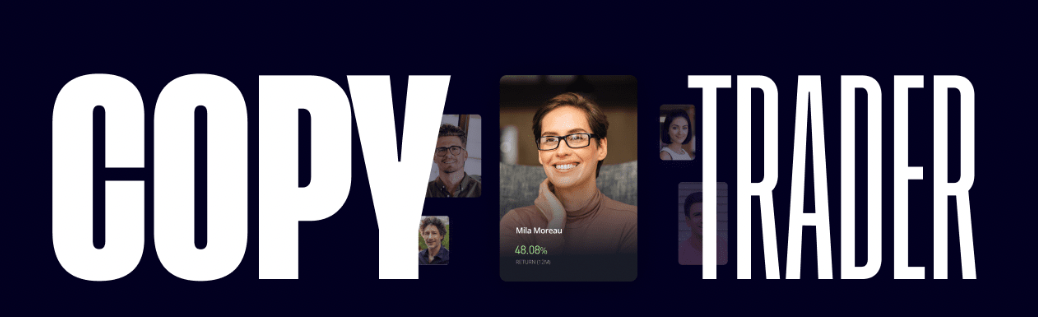

You can also discuss different strategies and learn from top-performing investors within the world’s leading social investment community. You can even copy traders on eToro.

Con: eToro might make it too easy to practice trading – don’t get your Real/Virtual accounts mixed up. You can easily avoid this by not funding your account until you’re ready to invest.

Best for: All investors who want to practice investing and/or try new trading strategies. In my opinion, eToro is the best stock market app.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

2. Thinkorswim paperMoney by Charles Schwab – Runner Up for the Best Paper Trading Platform

Charles Schwab offers a stock simulator called paperMoney which runs on its trading platform thinkorswim. paperMoney uses real-time data rather than historical data, so you can test your strategies in the open market.

It includes a wide range of assets including stocks, options, futures, currencies, Bitcoin, and forex markets. There are also countless indicators and chart studies that traders can use to test a variety of technical strategies.

It’s completely free to use (you don’t even need to open a brokerage account).

Con: thinkorswim paper trading is not as intuitive as other stock market simulators. There will be a learning curve.

Best for: 1) Investors who are considering using Schwab as their brokerage, and 2) Traders who can handle the complexity of the platform.

3. TradeStation – The Best Day Trading Simulator

TradeStation is an online broker geared toward active traders.

Day traders love TradeStation as a trading platform (our editorial team chose it as the best day trading platform in 2025), which comes with a free trading simulator. The simulator offers all the charting and analysis tools you’ll need to test your strategies and gain confidence before you start trading.

TradeStation’s trading simulator offers real-time data for a virtual trading experience that mimics live trading and real market conditions pretty closely, unlimited paper trading dollars, and back-testing. There really is unlimited learning potential with its paper trading simulator.

You can practice with stocks, options, and futures in both real-time or historical simulations. Make sure to experiment with a few different options strategies before putting any real funds into these complex derivatives.

Con: TradeStation is a traders-only platform. Long-term Investors should look elsewhere.

Best for: Active day traders ONLY.

4. NinjaTrader – The Best Software-Based Day Trading Simulator for Active Traders

Like TradeStation, NinjaTrader is another trading platform specifically focused on active traders. If you’re considering TradeStation, I would also check out NinjaTrader – you may like its interface and features better.

Backtesting, charts, indicators, analysis tools, stock screener, and multiple assets like stocks, futures, and forex make NinjaTrader a very compelling option.

Con: NinjaTrader Simulate is downloadable software and does not offer a web-based version.

Best for: Active day traders ONLY who prefer NinjaTrader’s interface, functionality, and features over TradeStation.

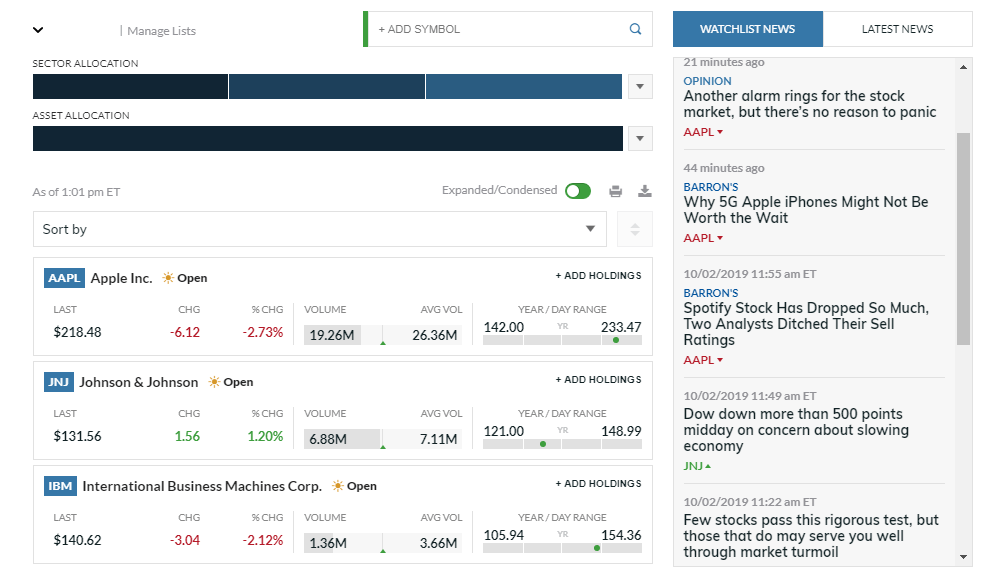

5. MarketWatch

While the other names on this list are heavily gear toward active traders, MarketWatch allows you to create games for traders and long-term investors alike.

In fact, a semester-long trading game on MarketWatch was my first experience with investing. In a class of 22 students, I took dead last in the challenge (I’ve improved as an investors since then).

In addition to its trading games, MarketWatch has real-time quotes, news, signal services, and more. Once you’re done practicing, MarketWatch will be an excellent resource for you to manage your real portfolio.

My biggest complaint with MarketWatch is that it is littered with ads. The app and website are free to use, but you pay for it by needing to click to close advertisements pretty frequently.

6. Pilot Trading

Pilot Trading is a trading platform geared toward active traders.

Its primary product is algorithmic-trading signals, which use artificial intelligence to gauge market sentiment. If that sounds far-fetched to you, you’re not alone.

Hence the company’s paper-trading simulator. Pilot Trader makes it easy for you to put your trading skills to the test in a lifelike simulated trading environment that mimics real market conditions while subtly selling you on their trading signals.

Even if the trading signals aren’t your thing, the trading platform is easy to use and can help you build confidence in your own short-term strategies.

7. HowTheMarketWorks.com

HowTheMarketWorks.com was one of the very first stock market simulators to go live. Today, it has one of the most robust toolkits for traders to learn the ropes and more advanced traders to develop new strategies.

The site has trading games, educational materials, and a realistic environment that will prepare you well for trading with your own cash.

The biggest drawback to using this simulator is the lack of assets. On HowTheMarketWorks.com, you can only trade stocks and ETFs. If you’re interested in trading options, futures, currencies, commodities, or cryptocurrencies, you’ll need to choose one of the other simulators on this list.

What is a Stock Market Simulator?

Stock market simulators, also known as paper trading, are a way for new investors to practice investing in the stock market without fear of losing money.

These platforms provide users with virtual money which they can use to buy and sell stocks or other securities in a simulated platform which mirrors the real stock market.

New investors, armed with $100,000 in virtual money, can build portfolios and test a variety of investment strategies to learn in a completely risk-free environment.

The best stock market simulator is eToro.

Who Should Use a Stock Market Simulator?

Stock simulators are useful for long-term investors who want to practice making different order types, but they’re most beneficial for day traders and swing traders.

Paper trading allows short-term traders to practice various strategies without the risk of losing real money. Once a trader feels confident in a strategy and is assimilated with the ebbs and flows of the stock market, they can start trading with real money.

In this way, paper trading isn’t only for new traders. Any trader who wants to test out a new technical trading strategy or new indicator can do so without risking money.

Additionally, stock simulators are a good way to become familiar with a specific brokerage.

If you’re new to the stock market, I would recommend opening a paper trading account at eToro. Once you feel comfortable placing orders, you can easily transfer your account into a real brokerage account and start investing for real.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Why Use a Stock Market Simulator?

Stock market simulators make it easy for you to practice trading and investing without risking real money.

The stock market is complex and can be volatile. It’s far too easy for new investors and traders to lose money while they’re still learning how the stock market works.

Paper trading, or practice trading, allows new investors to practice investing with virtual money. Users can buy and sell stocks in a simulated platform that mirrors the real stock market. When you’re ready to trade with real funds, you can read all about the best stock trading platform for beginners.

There are quite a few stock market simulators available to you, but they’re not all created equally. Some are paid, some are free. Some paper trading simulators are made for long-term investors, some day trading simulators are specifically designed for short-term traders.

Key Characteristics of the Best Stock Market Simulators

Each of the best virtual trading simulators have a few overlapping features:

- Resemble the actual stock market: To be useful, a stock market simulator needs to be the real thing. Choose a paper trading platform that allows you see how your buy and sell orders play out in real time.

- Many types of securities: You should have access to stocks, ETFs, options, and maybe commodities, mutual funds, futures, and cryptocurrency. If you plan on investing in specific markets, your simulator should provide them.

- Research and charting tools: This should be a complete simulation. Beyond actually placing orders, you should be able to do all of the research and analysis you would need to do before buying or selling in the markets.

- Real-time Market Data: Most of the virtual trading simulators in this post emphasize providing real-time market data to create a realistic simulated environment.

- Educational Resources: Your platform should offer tutorials, articles, or videos to help users improve their trading knowledge and skills. Paper trading may be a risk-free practice, but real markets can bring real losses. It’s important to gain as much education as possible.

- Performance Tracking: Each platform includes tools for tracking and analyzing trading performance and strategies. Understanding what strategies generate profits in paper trading can help you prepare for real markets.

Get the Best Stock Simulator

Paper trading is the best way to practice investing and testing different technical trading strategies.

In my opinion, eToro has the best stock simulator and, once you’re ready to start investing for real, makes it easy to get started with a real brokerage account.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

However, even the most realistic stock simulator is no substitute for the real thing. Simulated trading is risk free in that you don’t put real money on the line, but don’t let it train you to develop bad habits. Instead, use virtual trading to develop skills and build confidence that you can apply to the real market. But remember: Live trading is different emotionally, so there will be a learning curve when you start trading with real cash. When you’re ready to start investing in the live market, go slowly at first.

TradingView, my favorite charting software, released its own stock market simulator after I wrote this article. See my full TradingView review here to learn more.

Final Word

Those are the 7 best paper trading platforms available. Not only are they all no-cost, but they could potentially save you money in the long term by helping you develop better risk management skills, which can potentially reduce future financial loss.

Learn the ins-and-outs of the stock market with these stock market simulators that give you virtual money so you can develop your investment strategies completely risk free. Here’s to successful trading!

Read more: The Best Stock Trading Computer

FAQs:

How do you practice stock trading?

A stock trading simulator allows you to practice trading risk free with virtual money. One of the best ones on the market right now is eToro's Paper Trading.

What is the best stock trading practice app?

eToro Paper Trading is the best stock trading practice app. Unlike the other paper trading platforms on this list, eToro is the only one that offers virtual trading from your mobile device.

It offers free paper trading in a realistic simulator and gives you access to stocks, cryptocurrency, and ETFs.

How do you practice trading stocks with hypothetical money?

Paper trading on platforms like eToro or thinkorswim are the best place for investors or day traders to practice buying and selling stocks with virtual money.

If you're interested in how to learn options trading, Charles Schwab's paperMoney offers the functionality you'll need.

What is virtual trading?

Virtual trading, also known as paper trading, is a way for investors to learn how to buy and sell stocks and other assets without using real money.

You can start virtual trading on one of the 7 stock market simulators listed above.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.