Using a CFD trading platform can take your trading to new levels – if you avoid becoming part of the 70-80% of retail traders who lose money with this strategy.

CFD trading is one of the most uneven playing fields in public markets – the trading experience can be wildly different (and inefficient) from trader to trader.

You must use one of the best CFD trading platforms.

These platforms work with the best CFD brokers, and will be your partner in this risky and unevenly regulated space.

The 5 Best CFD Brokers in 2025:

The best CFD brokers will give you access to the CFD products you’re looking to trade as well as other top-level trading tools. CFD offerings can vary widely, so pay attention.

CFD regulations differ from country to country, but the best CFD trading platforms are self-regulated. Brokers make their money from trading fees – CFD trading casualties negatively impact brokers’ bottom lines as badly as they hurt traders.

Consider opening multiple accounts. Most brokers have little or no account balance requirements for CFD trading – unlike U.S.-based margin accounts, which require a deposit of $2,000 before you can use leverage.

1. eToro – The Best CFD Trading Platform Overall

Overall rating: ⭐️⭐️⭐️⭐️⭐️

Stock CFDs available: 3,000 stocks listed on the NYSE and Nasdaq exchanges. Trade fee – 0.15%.

Index CFDs available: 20 indices for the U.S., Western Europe, Australia, Hong Kong, China, Japan, and global markets. Trade fee – 0.02-10 points (calculated based on the dollar amount of the index).

Forex traded: Over 50 currency pairs. Trade fees on low-volatility pairs range from 0.01-0.07%. High-volatility pairs range from 0.2-1.2%, while USD/RUB is 10%.

Commodity CFDs available: Over 30 offered. Trade fee on most precious metals – 0.04-0.45%.

Advantages:

- User-friendly trading platform

- Paper trading

- Wide range of CFDs available to trade

- Low CFD rates and transparent, standardized fee structure

Disadvantages:

- Only supports USD accounts

About eToro

Everything about eToro is streamlined, including their CFD trading instruments. So it makes sense that eToro has the best platform for CFD trading beginners.

Besides its user-friendly app (rated as the best stock trading app by our editorial team), eToro boasts an exceptionally wide range of stock CFDs. Keep in mind that if you’re a long-term crypto investor, it may make more sense to hold these assets in a retirement account — here’s our Bitcoin IRA review.

Fees on eToro are assessed in a uniform and transparent way, which makes building them into your trading strategy easier. This is important for everyone interested in these risky trading products, not just beginners.

eToro was founded in Israel, and is registered in the U.S., U.K., Cyprus, and Australia. This global reach has helped the broker spread to 27 million users in 140 countries. Due to its international focus, the broker has made CFD trading a core component of its offerings.

It allows CFD trading in every security and asset it offers (except to U.S. residents). eToro doesn’t allow its users to short sell stocks using margin – shorting is accomplished by CFD, at greater leverage than U.S.-regulated margin trading can offer.

eToro’s Social Trading features can provide new CFD traders with a blueprint for implementing this tricky strategy – learning from more experienced traders in eToro’s vast social network who share their trade ideas.

CopyTrader takes this social aspect a step further – giving traders access to the portfolios of experienced traders with a wide range of approaches. You even have the option of copying all of their trades for free.

eToro’s excellent paper trading Demo Account, a $100,000 virtual portfolio you can test strategies in, can help beginners learn how to successfully implement this tricky strategy.

All in all, eToro has everything you’ll need to step into CFD trading the right way – at the shallow end first.

2. Interactive Brokers – The Second Best CFD Trading Platform in 2025

Overall rating: ⭐️⭐️⭐️⭐️⭐️

Stock CFDs available: 8,000 large and mid-cap stocks in the U.S., Brazil, Western Europe, South Africa, Singapore, Hong Kong, Australia, and Japan. Trade fee on U.S. stocks – $0.003-0.005 per share, $0.65-1 minimum.

Index CFDs available: 13 indices for the U.S., Western Europe, Australia, Hong Kong, and Japan. Trade fee – 0.005%, $1 minimum – with discounts for active traders.

Forex CFDs available: 85 currency pairs. Trade fee – 0.08-0.2 basis points, $1-2 minimum.

Commodity CFDs available: London gold and silver. Trade fee – 0.7-3 basis points, $0-2 minimum.

Crypto CFDs available: No

Advantages:

- Powerful trading platform, and integration with TradeStation’s platform

- Can use MetaTrader 4 and 5 through an introducing broker

- Low CFD fees

- More than 8,000 stock CFDs in markets worldwide

- Paper trading

Disadvantages:

-

- Few commodities and no crypto CFDs offered

About Interactive Brokers

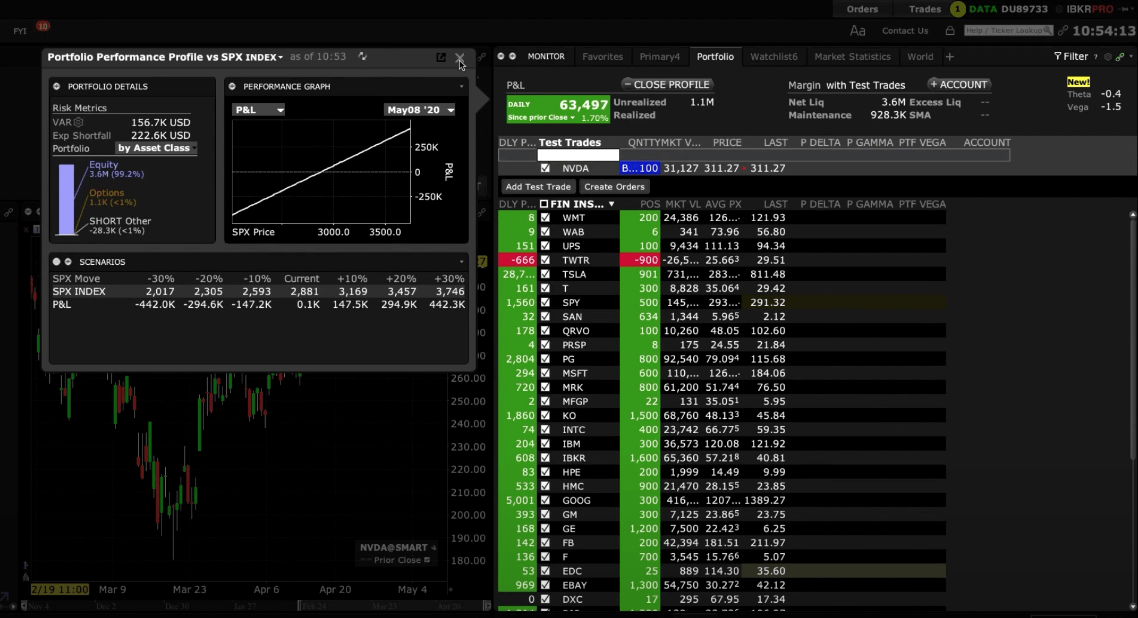

Interactive Brokers (IBKR) is the gold standard for brokers – so it makes sense that it would be one of the best CFD brokers too.

This isn’t just my personal choice, it’s measurable.

This U.S.-based broker offers the most international stock CFDs of any broker to their international users, along with competitive offerings in indices and forex.

The catalog’s only weaknesses are in its limited commodity and mostly non-existent crypto CFD categories – traders in these products would be better served elsewhere.

Like other CFD brokers, the margin interest and leverage afforded differ based on the financial instrument and the market. But IBKR traders can rest assured that they’re getting competitive rates, regardless of their trading style. IBKR’s standard margin rates are some of the best in the field.

IBKR’s CFD trade fees are also among the lowest out there.

IBKR’s Trader Workstation and its forex-specific FX Traders are two of the best CFD trading platforms available. Although they sport a learning curve, you should only trade CFDs if you intend to put in the training time. IBKR traders can also use TradeStation’s powerful platforms.

IBKR’s top-level CFD trading leads to success for its experienced client base – the track record of its CFD traders is among the best in the industry.

3. TradeStation Global – 3 of the Best CFD Trading Platforms, 1 Broker

Overall rating: ⭐️⭐️⭐️⭐️

Stock CFDs available: Large and mid-cap stocks in the U.S., Western Europe, Australia, Hong Kong, Japan, and Singapore. Trade fee on U.S. stocks – $0.007 per share, $1.50 minimum.

Index CFDs available: 13 indices for the U.S., Western Europe, Australia, Hong Kong, and Japan. Trade fee – 0.0015-0.015%, $1.50 minimum.

Forex CFDs available: 26 currencies. Trade fee – 0.6 basis points, $2 minimum.

Commodity CFDs available: No

Crypto CFDs available: No

Advantages:

- Integrates with IBKR, TradingView and TradeStation’s trading platforms

- More than 7,000 stock CFDs in markets worldwide

- Uses IBKR brokerage for executions and market access

About TradeStation Global

TradeStation Global (TSG) is an atypical CFD broker which appeals to a particular subset of traders – those who value access to the best CFD trading platforms above all else.

TSG integrates with IBKR’s Trader Workstation, TradingView and TradeStation’s suite of well-regarded trading programs. Preference for one of these trading platforms is the best reason to pick TradeStation Global to trade CFDs.

TSG is an introducing broker, and it relies on IBKR to execute user trades and hold their positions. While this doesn’t hurt it – IBKR provides some of the best execution speeds of any CFD broker – it also doesn’t set it apart from IBKR. From trade fees to available CFD products, IBKR wins on most counts. IBKR clients can also use TradeStation’s platform.

Why did I give this broker four stars then? For the best CFD trading platforms, it’s often a question of specific need.

TradingView integration is nothing to scoff at. With 30 million users worldwide, access to this charting app will tip the scales for some.

Read our TradingView review

Other prospective traders should look through TSG’s stock CFD list. Its 7,000 stock CFDs are second only to IBKR’s 8,000. There will be many in both platform’s catalogs that don’t overlap.

This is not the best platform for some forex CFD trading strategies. Forex CFDs are only available for single currencies, not currency pairs. Crypto and commodity CFDs are not available through TSG either.

If TSG’s other offerings fit your trading strategy, you’ll find a powerful native trading program to trade them with. 10 custom chart types and 150 indicators come standard with the desktop platform – when you factor in EasyLanguage, TradeStation’s plain English code, TSG’s versatility grows. Other TradeStation innovations like RadarScreen and The Matrix round out one of the best overall platforms for CFD trading.

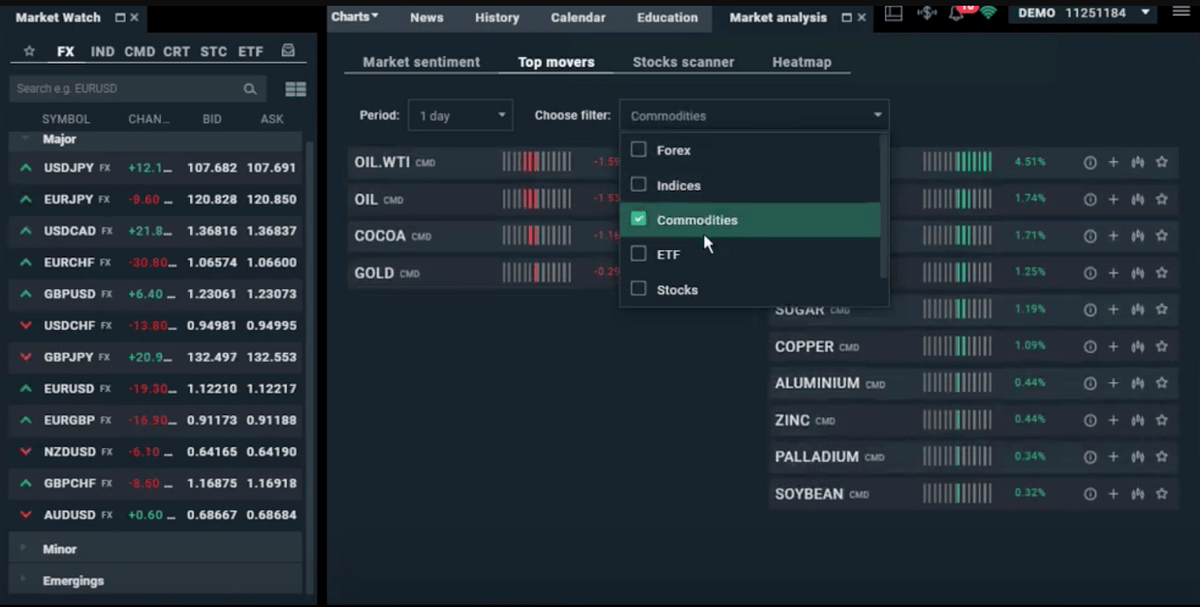

4. XTB Brokers – The Best Forex CFD Trading Platform

Overall rating: ⭐️⭐️⭐️⭐️

Stock CFDs available: Over 2,100 large and mid-cap stocks in the U.S. and Western Europe. Trade fee – built into spread.

Index CFDs available: Over 20 for the U.S., Brazil, Western Europe, India, Australia, China, Vietnam, Hong Kong, and Japan. Trade fee – built into spread.

Forex traded: 48 currency pairs. Trade fee – built into spread.

Commodity CFDs available: 28 available. Trade fee – built into spread.

Crypto CFDs available: Over 10 available. Trade fee – spreads starting from 0.22%

Advantages:

- Powerful native trading platform and MT4/5 integration

- Among the lowest forex spreads, starting at 0.001%

- 24/5 customer service

- Negative balance protection

Disadvantages:

- No guaranteed stop-loss protection

- Paper trading account is limited to 4 weeks

About XTB

XTB is another CFD broker whose offerings won’t appeal to every trader. Those who find a match here will be hard-pressed to find a better broker for their needs.

This Poland-based broker has branches in 12 countries, with an emphasis on European traders (it also has all the necessary authorizations).

XTB is geared to forex traders first, and its forex spreads are some of the best among CFD brokers. It places an emphasis on customer service, with 24 hours a day, 5 days a week telephone support and dedicated account managers. XTB offers negative balance protection to prevent your account from a leveraged forex trade that goes against you – but unlike many forex-first brokers, it doesn’t offer guaranteed stop losses.

There are two account types – standard and pro. The standard account is free and offers slightly higher spreads, the pro account charges commissions with lower spreads built in. However, XTB has stopped promoting pro accounts, reserving them mostly for legacy clients.

Their web-based CFD platform, xStation 5, emphasizes functionality and ease of use over technical robustness. If you want more in the way of indicators and back-testing, you can use the supported MetaTrader4 or 5.

There’s more to discover in this leading European broker. But my advice is to first drill down on your own trading strategy. If you’re interested in trading forex CFDs and understand the risks, XTB is an excellent choice.

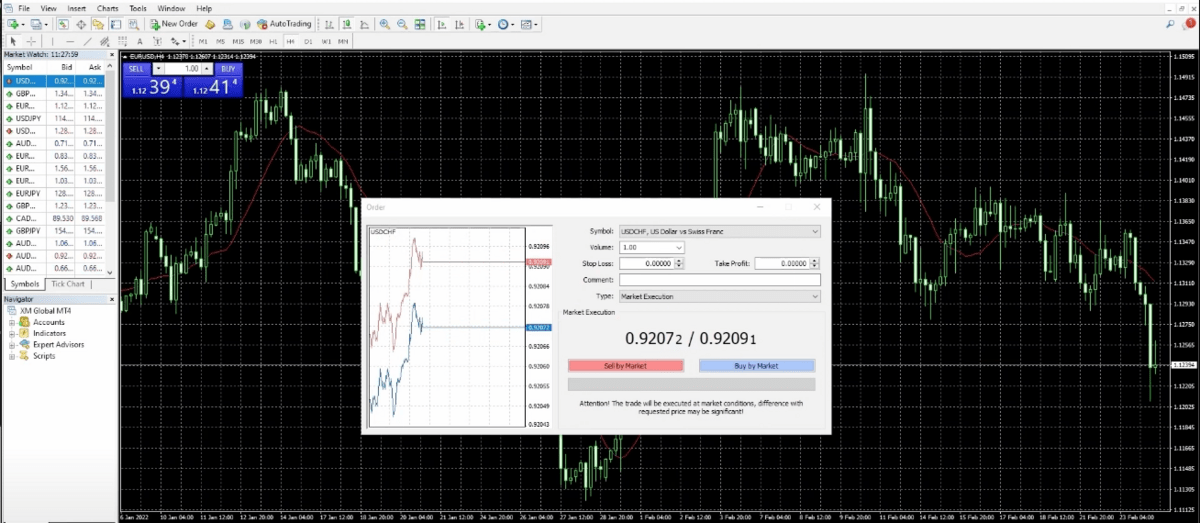

5. XM – The Best CFD Trading Platform for MetaTrader Fans

Overall rating: ⭐️⭐️⭐️⭐️

Stock CFDs available: Over 600 large and mid-cap stocks in the U.S., Canada, Brazil, and Western Europe. Trade fee – built into spread.

Index CFDs available: Major global indices and future CFDs for the U.S., Western Europe, Hong Kong, and Japan. Trade fee – built into spread.

Forex traded: Over 50 currency pairs. Trade fee – built into spread.

Commodity CFDs available: 14 precious metals, energy, and other commodity CFDs available. Trade fee – built into spread.

Crypto CFDs available: No

Advantages:

- User-friendly interface

- Good balance of CFD offerings

- 24/5 customer support in 30 languages

Disadvantages:

- Crypto CFD spreads reach as high as 2%, making it one of the most expensive options

- Limited to MT4/5 trading platforms

About XM

XM is a well balanced international broker with one of the largest user bases out there. It got there by being competent at everything, from spreads and offerings to customer service and education.

This power broker has only one serious flaw in my estimation: it lacks a native CFD trading platform, relying on the MetaTrader4 and 5 platforms. This won’t be a problem for most traders – witness the 5 million account user base – but could be an issue for traders used to other platforms. MetaTrader4 and 5 are popular and powerful platforms, but they are not universally regarded as the best platforms for CFD trading.

XM excels in many of the areas that CFD traders might be looking for, from customer service to tight spreads on major currency pairs. It has a good record of executions, boasting a 100% execution rate with no requotes or rejections. 99.35% of all orders are executed in 1 second or less.

It also offers guaranteed forex stop-loss protection.

As always, XM’s fit depends on your individual strategy. With only a $5 minimum deposit, it’s easy to try this broker out and see how it fits your trading focus and style.

What is a CFD?

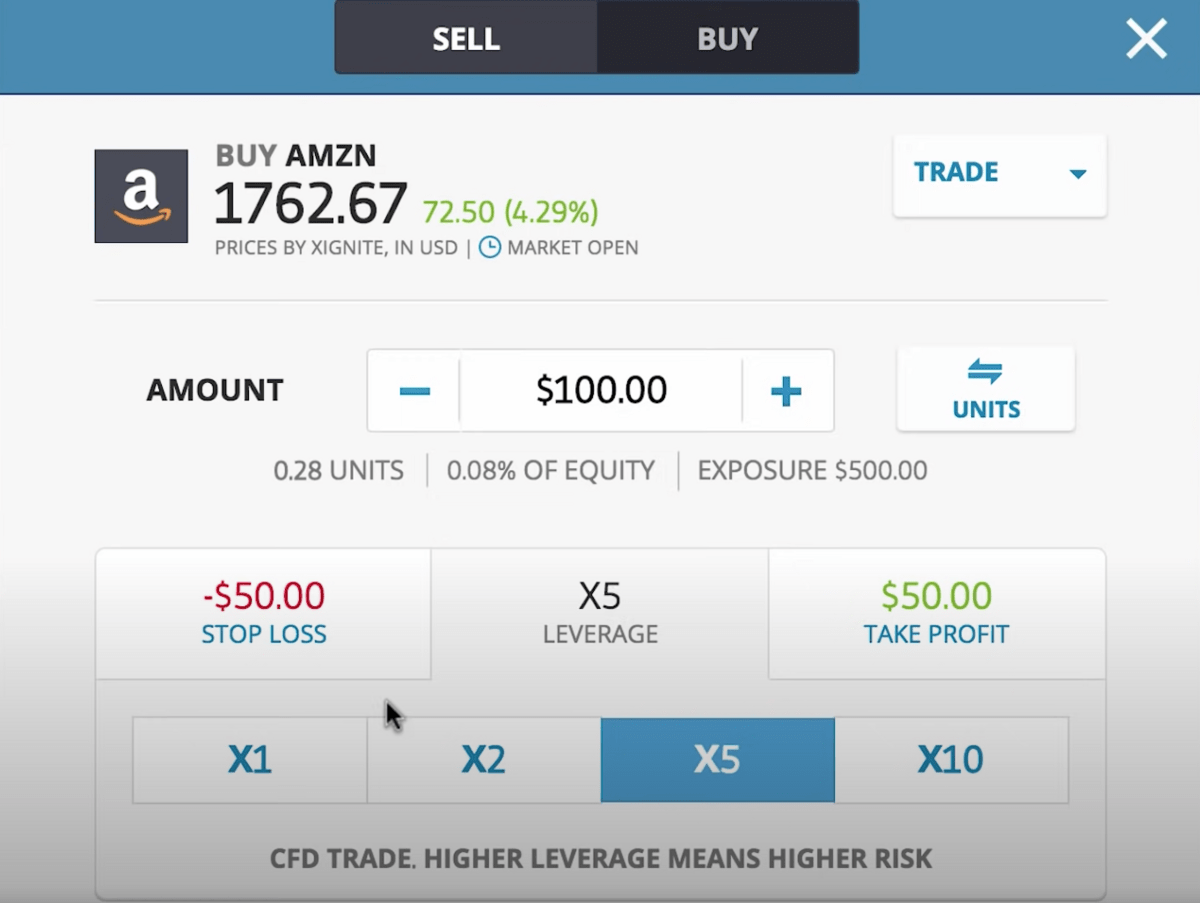

CFD stands for “contract for difference.” It’s an agreement between you and your broker to measure the difference between the value of an asset when a position is opened vs. when it is closed. No physical assets are exchanged, allowing for increased execution speeds and lower costs.

The best CFD brokers provide much more leverage than traders can access with a margin account, allowing you to trade big positions with very little equity. It also means that a trade that goes against you can quickly result in a margin call.

This low equity requirement is one of the reasons that CFD trading is illegal for U.S. traders. Financial regulators in the U.S. require a 25% maintenance margin for stocks. CFD trading platforms offer up to 20 times leverage on stock CFDs – that’s a maintenance margin of only 5%.

Why Trade CFDs?

I think CFDs provide an interesting alternative to stock trading for international traders. CFD traders never own the underlying asset, which allows better access and lower fees in short selling hard-to-borrow U.S. stocks. There can be tax advantages – although you should consult a tax professional to determine your responsibility.

Another CFD use case for international traders with a U.S.-based broker relates to the Pattern Day Trader (PDT) rule. This regulation limits margin accounts under $25,000 to 3 day trades or less in a 5-day span. All American brokers enforce the PDT, regardless of your nationality. But some will allow non-U.S. traders to make CFD trades. If you’re living in the US and can’t meet the 25K requirement, not all hope is lost — take a look at these brokers without PDT rule.

Geo-Specific Recommendations:

The Best Platform for CFD Trading in UK: eToro

The Best Platform for CFD Trading in Singapore: Interactive Brokers

Final Word: The Best CFD Trading Platforms

The best CFD broker overall is eToro. eToro provides the best mix of CFD products and the trading tools I look for in a broker. Its suite of trading platforms feature precise charts and an array of research tools. If you’re an experienced CFD trader, IBKR will give you everything you need in a broker.

The best beginner’s platform for CFD trading is also eToro. If you’re new to CFD trading, the eToro Academy provides a common sense introduction to the strategy. CopyTrader gives you the chance to see how successful traders trade CFDs.

Once again, here’s my list of the best CFD trading platforms and brokers:

- eToro – The Best CFD Trading Platform Overall

- Interactive Brokers – The Second Best CFD Trading Platform in 2025

- TradeStation Global – 3 of the Best CFD Trading Platforms, 1 Broker

- XTB Brokers – The Best Forex CFD Trading Platform

- XM – The Best CFD Trading Platform for MetaTrader Fans

FAQs:

What is a CFD?

A CFD is a “contract for difference.” It’s a derivative product offered by brokers outside of the U.S. for leveraged trading in a financial asset, accomplished without ownership of the asset. It has tax advantages over asset ownership, and leverage advantages over trading on margin.

What’s the best CFD broker online?

Interactive Brokers is the best CFD broker online. eToro is the second best online CFD broker - but it might be better for you depending on your location and trading strategy.

How should I choose the best CFD trading platform for me?

Choosing the best CFD trading platform for you depends on your location, and your broker’s rules. Interactive Brokers is the best CFD broker for most experienced CFD traders; eToro is the best CFD broker for most beginner CFD traders.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.