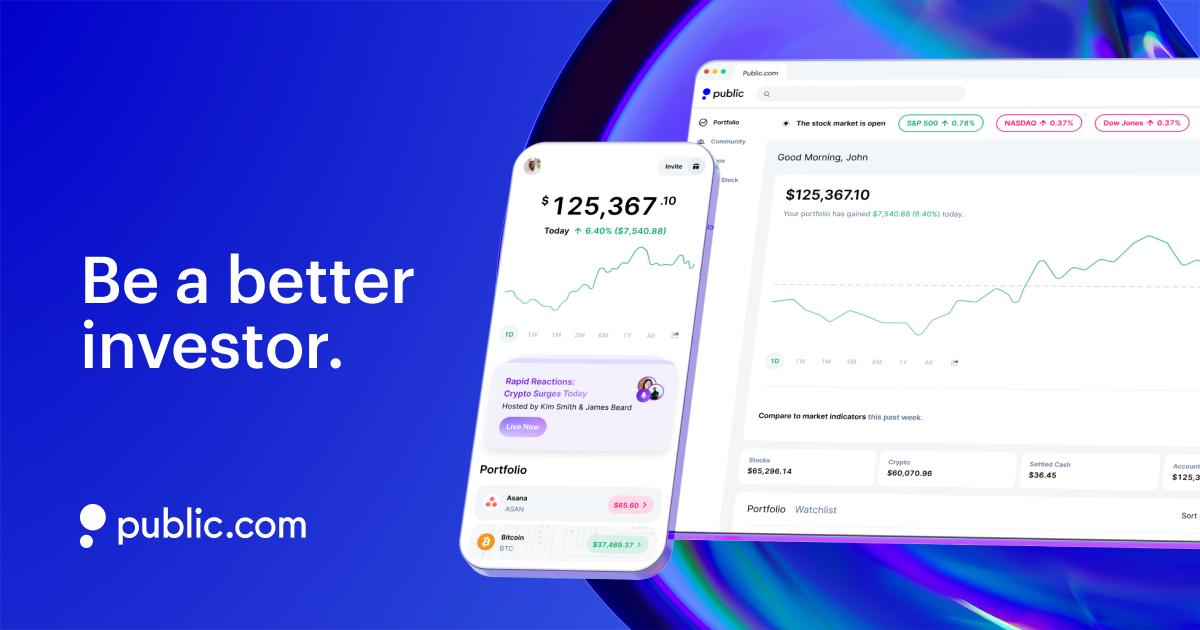

Public.com is best place to invest in stocks, ETFs, options, bonds, T-bills, crypto, and maintain a high-yield cash account all in one place.

The platform offers FDIC insurance and bank-grade encryption – the same level of protection as Fidelity, Charles Schwab, and Vanguard.

Considering the above, it should come as no surprise that Public has become very popular among 2 groups of investors: Experienced and Beginners.

For experienced stock investors who want access to bonds, options, and crypto, and want to maintain a high yield on uninvested cash all in one place, Public is easily my #1 recommendation.

Its mobile app experience and the ability to buy fractional shares of any asset on the platform makes it one of my favorite investment platforms for beginner investors.

Is Public.com Safe & Legit?

The Bottom Line: Yes, Public.com is safe and legit.

Public.com, like almost all investment apps, offers its users SIPC and FDIC insurance (for securities and cash held on the platform). Additionally, Public uses bank-grade encryption to protect all personal information.

But it’s not just safe and legit — it’s an overall great app. It’s easy to invest in a variety of assets, including stocks, bonds, crypto, and even royalties. It also has excellent tools for managing your portfolio and creating automated investment plans.

If you’re at all interested in expanding your portfolio AND/OR want a beautifully designed mobile investing app, Public.com is for you.

Overall Rating: 4.5/5

Commissions/Fees: 4/5

Accessibility: 4.5 / 5

Ease of Use: 4.5/5

Investment Selection: 4.5/5

Availability: Desktop, mobile app

Public.com Review

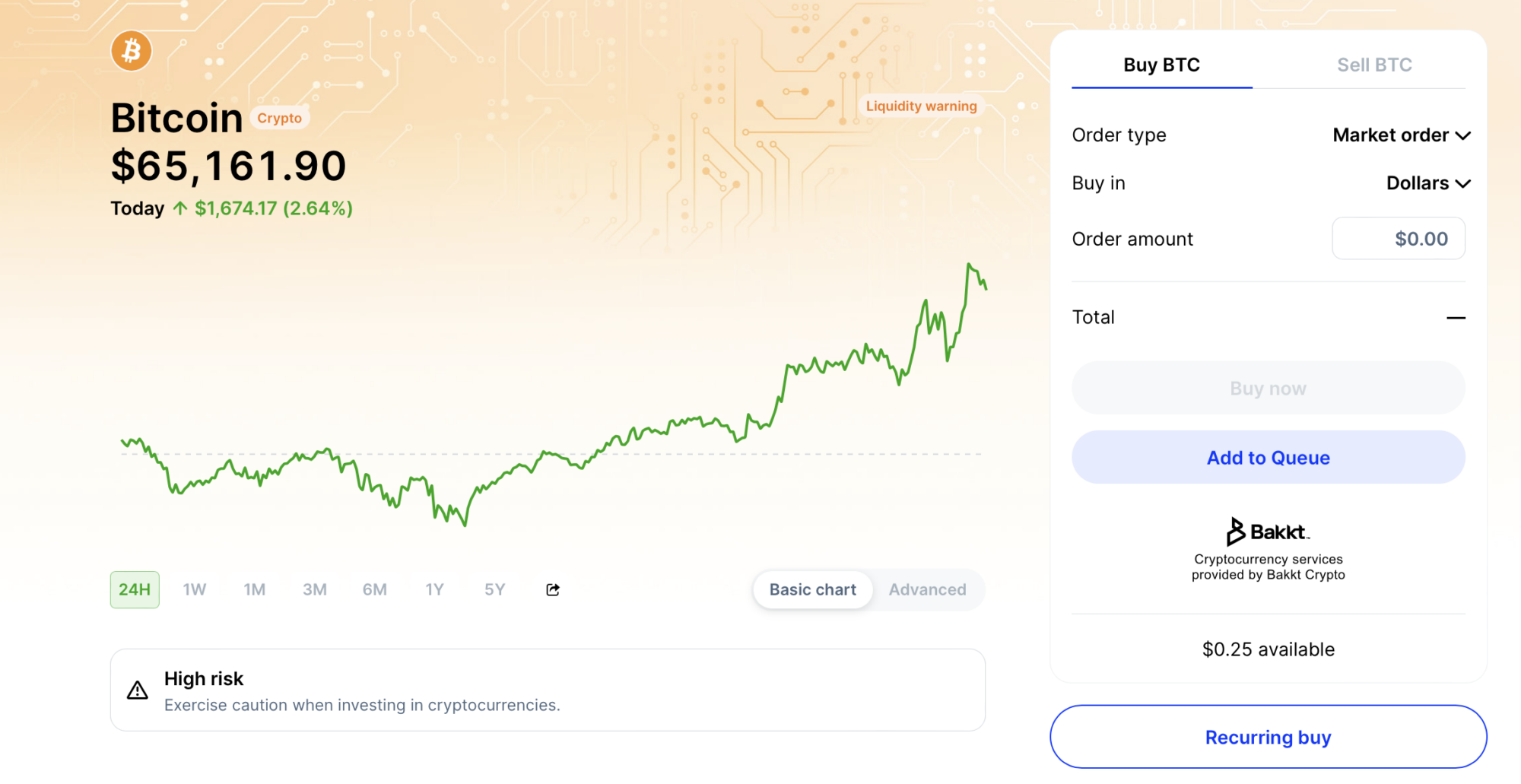

Public is an excellent investment platform for stock, crypto, and ETF investing. Stock and ETF investing is commission-free, and users can buy and sell crypto with extremely low transaction fees through Public’s partnership with Bakkt Crypto.

Given Public’s user-friendly layout and exceptionally-designed mobile app, these offerings alone would make it an excellent investment platform – but I haven’t even covered the best part yet.

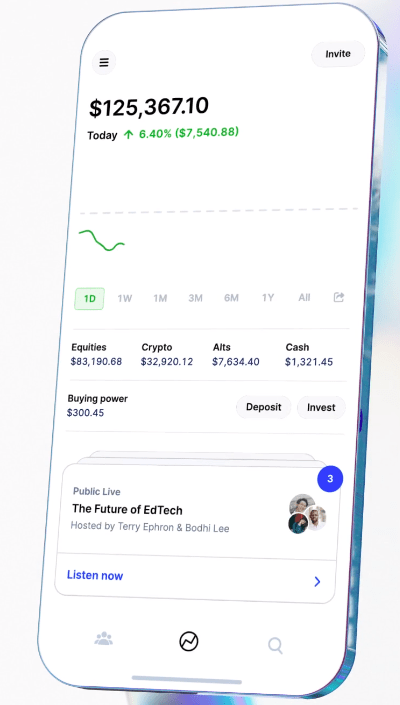

What makes Public.com exceptional is the fact that you can access so many asset classes in one place, and in so many ways.

For one, you can access fractional shares of any asset listed on Public — this is exceptional, as many big brokers only offer fractional shares of a small amount of the stocks they offer.

You can also invest in “investment plans” — for instance, you can choose to invest an amount and allocate it as you choose between assets of your choosing. For example, I have a recurring investment plan where I invest in VTI and VOO. You can also choose from pre-designed investment plans.

But unlike with many other brokers, you can diversify with a treasury account, a bond account, and crypto investments all on the same platform. You can even invest in royalties — an alternative asset class that you won’t find on many other brokerages.

You can buy fractional shares of any asset listed on Public (stocks, ETFs, crypto, and alternative assets).

Public.com Features:

Stock & ETF Investing

You can invest in stocks and ETFs commission-free on Public.

Plus, Public’s social investing elements allow you to get insights from millions of investors and analysts.

Sign up with the button below:

Cryptocurrency Investing

Build and diversify your crypto portfolio via the more than a dozen cryptocurrencies on Public.

Crypto services are provided by Bakkt. The crypto fees on public are as follows:

Transaction Amount | Bakkt Crypto Fee |

|---|---|

$0.01-$10.00 | $0.49 |

$10.01-$25.00 | $0.69 |

$25.01 $50.00 | $1.19 |

$50.01-$100.00 | $1.69 |

$100.01 $250.00 | $3.29 |

$250.01 $500.00 | $6.29 |

$500.01+ | 1.25% of order amount |

Trading Options on Public

If you’re interested in exploring options trading, it’s easy to get started on Public. The platform’s robust educational resources can help you learn about options trading strategies and the risk associated with them — though I strongly suggest checking out an options course like “Selling Options for Income” before you put money on the line.

Once you’re ready to get started, Public has a few key selling points for options traders:

- No per-commission fees

- No per-contract fees

Plus, you can earn up to $0.18 rebate onevery option contract traded.

While the clean, easy-to-use interface makes it easy to get started, I would not suggest Public for active options traders who need advanced charting or want to explore more complex order types. (Check out our post on the best options trading platforms to find the best platform for you.)

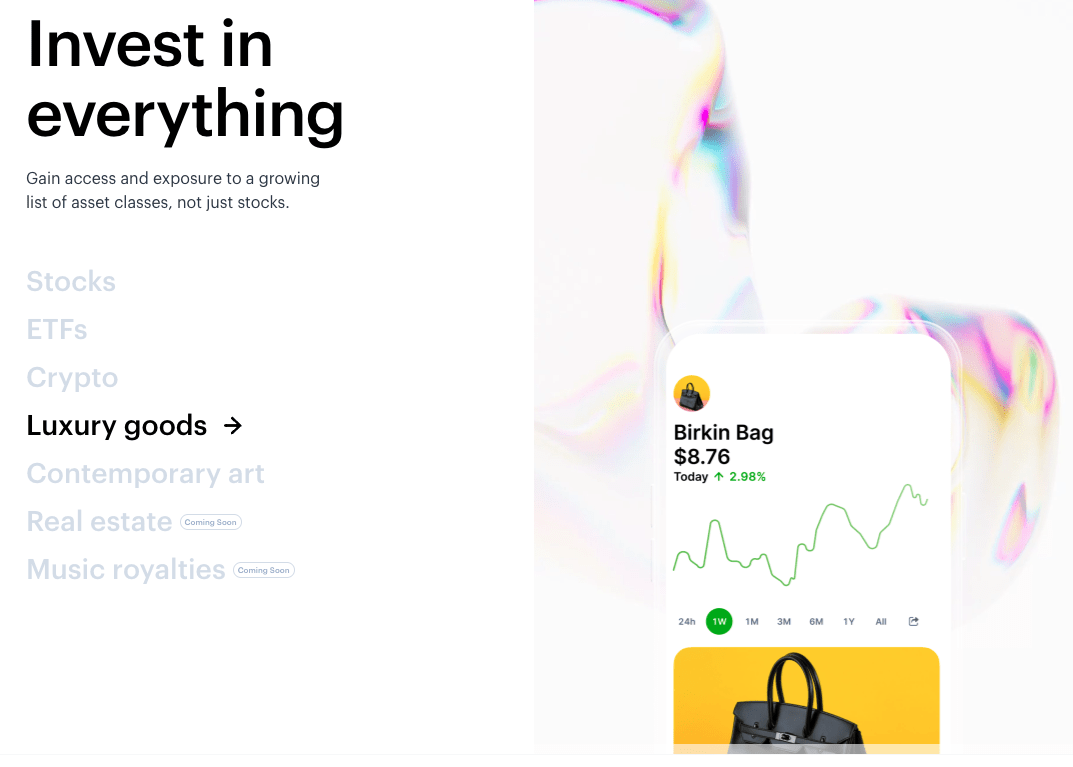

Alternative Asset Investing

Formerly, Public.com allowed users to invest in non-traditional, alternative assets on the platform:

The platform featured partnerships with brands like Masterworks and Fundrise, allowing investors to buy:

-

- Art

- Real estate (coming soon)

- Shoes

- Trading cards

- NFTs

- Video games

- Comic books

- Luxury goods

However, this is no longer the case. While the platform still offers the opportunity to invest in royalties, Public.com has largely narrowed its focus to more traditional financial investment vehicles. So let’s talk about them.

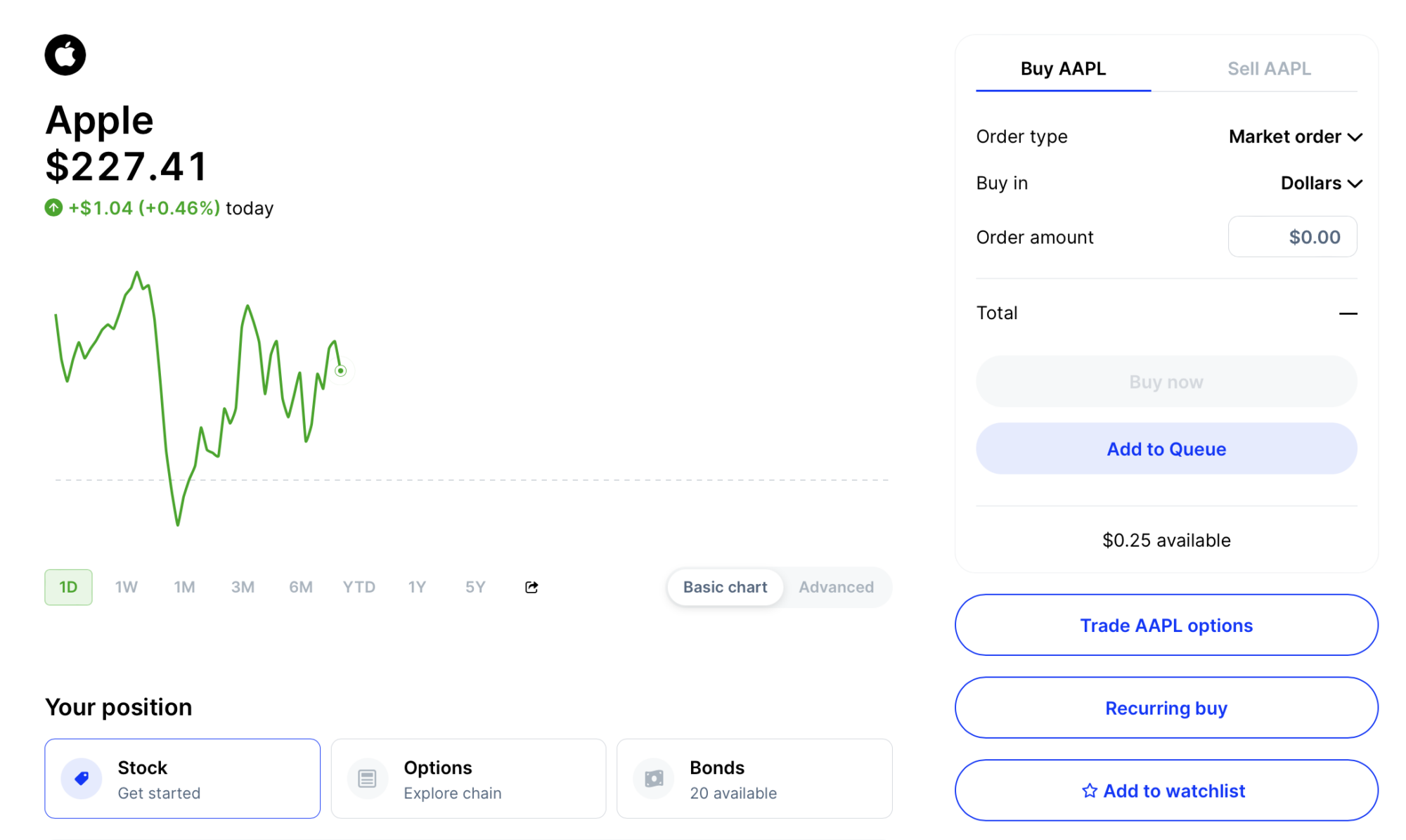

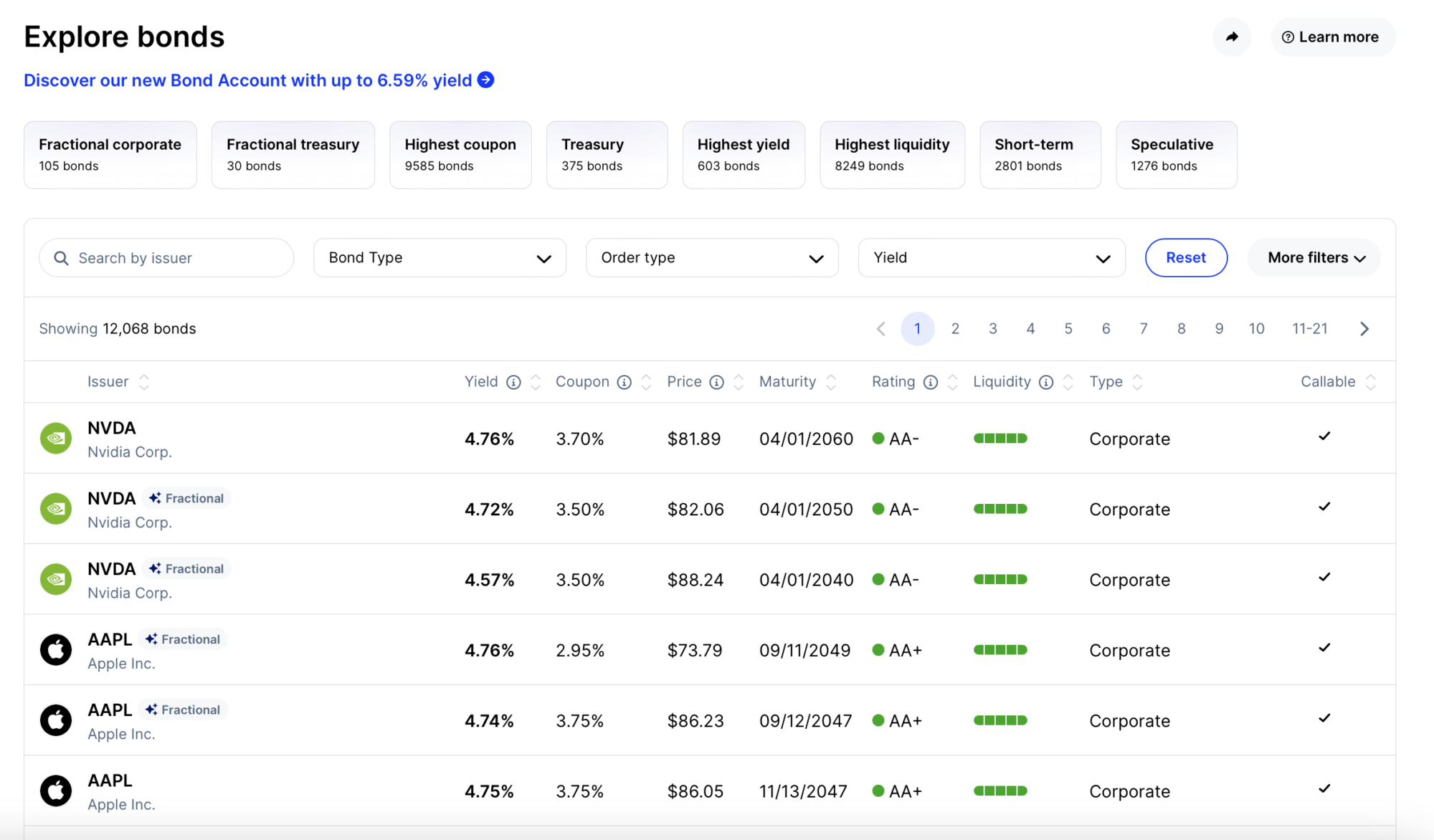

Bond Investing on Public

There are two key ways to invest in bonds on Public.

First, you can invest in individual bonds — simply click on “Bonds” on your account sidebar, and you’ll be able to filter through all sorts of corporate and treasury bonds. You can choose a bond based on your chosen criteria, such as rate, price, maturity date, and more.

But that can get kind of complicated. Personally, I think Public’s Bond Account is a much easier way to get started with bonds, with yields that are typically over 6%.

The way it works is pretty simple:

- Fund your account — your deposit will go toward a portfolio of 10 investment-grade and high-yield corporate bonds.

- Get paid monthly! Public’s Bond Account generates a monthly yield; when your income reaches $1,000, it’s automatically reinvested.

- If you hold to the maturity date, you’ll receive the highest yield; however, you can withdraw early.

One caveat? While a Bond Account is currently fee-free on Public, it will carry a $3.99 monthly fee starting in 2025 unless you upgrade your account. Take advantage of the high rates now!

Treasury Account on Public

Treasuries are largely considered to be one of the safest types of investments. Right now, they offer returns that are on par with many high-yield savings accounts.

If you’re interested in treasury bill investing, you could invest via Treasury.gov — but trust me, that site is hard to navigate. In less time than it takes to log in to that site, you could easily invest in T-bills with Public.com’s Treasury Account.

Treasury bills on Public are provided by Jiko Securities, Inc., a registered broker-dealer, member FINRA and SIPC. When you’re ready to invest, you can start with as little as $100 and track the yield right in the app, right along with the rest of your portfolio. (A note on Public.com treasury account fees: Jiko charges 0.05% per month based on the average daily balance of your account.)

For a time, I had a recurring buy on my Public.com Treasury account, investing $100 every month. If you’re happy with how things are going, your matured t-bills will automatically be reinvested. However, if you want to cash you, you can simply sell the amount that is maturing 1 day before maturity and transfer it to your brokerage account or high yield cash account.

High Yield Cash Account on Public

Right now, Public.com’s high yield cash account offers a rate that’s higher than most high yield savings accounts out there — 4.1% APY. Interest compounds daily, so you can see exactly how much interest you’re earning.

As rates for t-bills have been going down, I have been transferring them to either my high yield cash account or bond account upon maturity. This way, my cash can collect as much interest as possible.

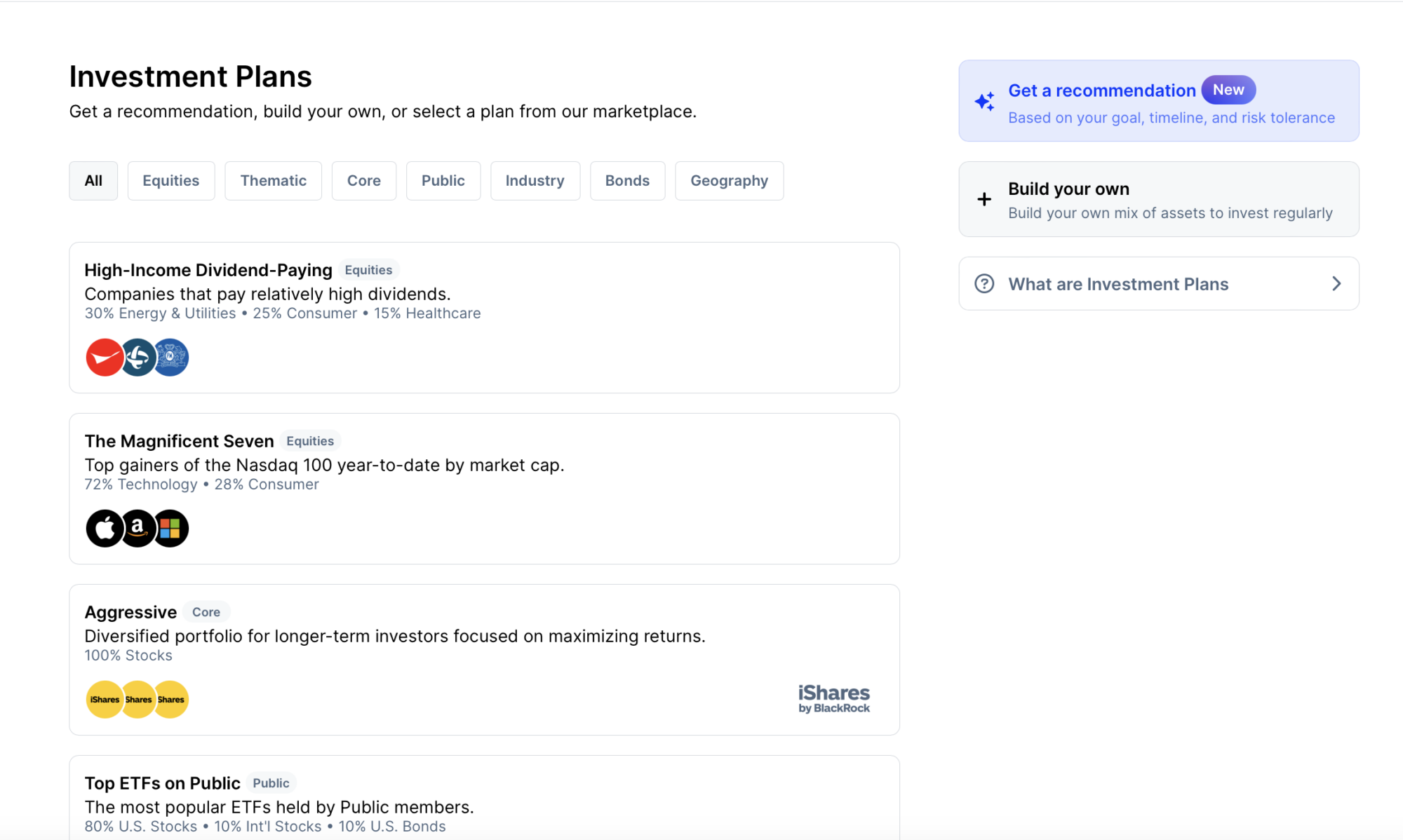

Investment Plans on Public

One of my favorite things about Public is that you can diversify instantly with their Investment Plans.

You have a bunch of different options: You can create your own customized mix of assets or choose from their catalog of ready-to-invest plans. If you’re experiencing decision fatigue, you can even get suggestions for what might suit your style and risk tolerance. All you do is answer a few questions and it gives you suggestions for potential plans that might align with your goals.

Public.com Pricing, Fees, and Commissions

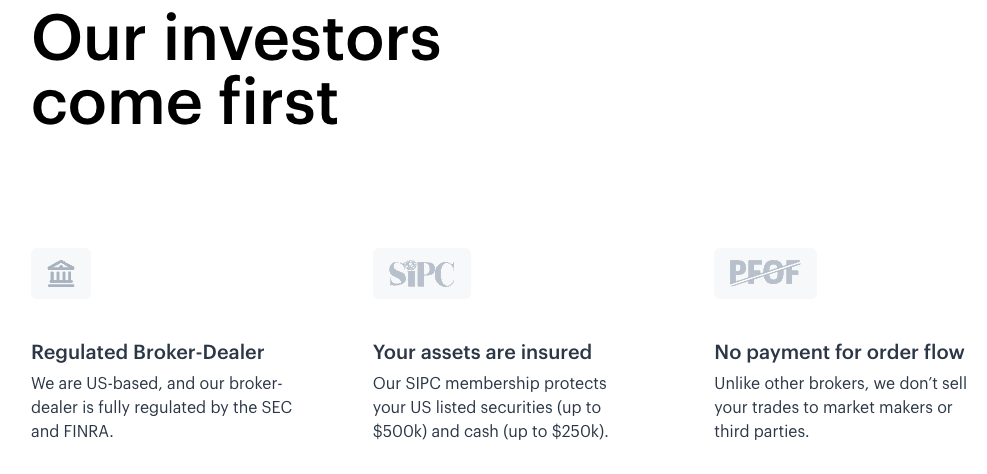

A Public stock app review wouldn’t be complete without mentioning its transparent and investor-first pricing model:

- It does not charge a commission on stock and ETF investing

- It does not charge any account maintenance or inactivity fees on accounts with more than $20 in total value

- It does not earn revenue via payment-for-order-flow (PFOF)

Public.com makes money via:

-

- Its $10/month Premium membership offering (optional)

- (Optional) tips

- Certain services like automatic investment plans, wire transfers (ACH transfers are free), extended-hours fees for non-Premium Members, and foreign exchange conversions may incur fees

Is Public App Safe?

Yes, Public is a safe investing app.

Every account is SIPC-insured which means each portfolio has insurance of up to $500,000. Cash amounts up to $250,000 per account are also protected (via FDIC insurance).

Technology: Public.com uses bank-grade, 256-bit encryption, and all data is secured with Transport Layer Security.

Investing: Public.com uses safety labels to inform investors about potentially risky investments. You still need to perform your own due diligence and decide what’s best for you, but it’s an additional layer of protection Public adds to protect you from bad investment decisions.

Public.com Alternatives

If you’d like to compare my Public investing app review to these potential alternatives, head to my article on Webull vs Robinhood vs eToro vs Stash vs Acorns. Here are some of Public’s closest competitors:

Public.com | eToro | Robinhood | Webull | |

Rating | 8/10 | 9/10 | 7/10 | 6.5/10 |

Best For | All-in-one investing | Overall | Beginner investors | Mobile day trading |

Stock & ETF Trades | $0/trade | $0/trade | $0/trade | $0/trade |

Options Trades | n/a | $0/trade | $0/trade | $0/trade |

Crypto Trades | 1.25% | 1% | 0.35% | 1% |

Virtual Investing | ❌ | ✅ | ❌ | ✅ |

It’s also worth noting that a trading platform is not all you’ll need as an investor or trader. Check out our list of the best stock apps to make sure you’ve got the best tools available.

Final Word: Public.com Review

Public.com is the best investment platform for diversifying within a single platform.

Its mobile app is one of the most user-friendly investment apps available, and its commission-free stock and ETF trades make it one of the best investment apps for beginners. Plus, Public’s desktop platform provides another level of market data and investment analysis, always a few clicks away.

That’s a wrap on my Public.com review!

FAQs:

Is public com trustworthy?

Yes, Public.com is trustworthy.

Every account is SIPC-insured, cash balances are FDIC-insured, and the platform uses encryption to secure all data transferred between its users’ devices and its servers. It also offers two-factor authentication to add an extra layer of security to user accounts.

Is public a good investment app?

Yes, Public is a good investment app.

Public.com offers commission-free stock, ETF, and cryptocurrency trading. This, coupled with its easy-to-use interface, makes it an excellent choice for beginner investors. Plus, its access to alternative investments (like art, NFTs, and other collectibles) make this investment app completely one-of-a-kind.

How can I get $300 from public com?

When you sign up for Public.com, open a brokerage account, and deposit funds, you will qualify to receive a free slice of stock valued anywhere between $3 and $300.

Does Public Com have a monthly fee?

Public.com is free to use.

You can upgrade to Public Premium for $10/month and unlock advanced features such as data, market metrics, and analyst insights.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.