Considering investing in crypto? It can be pretty confusing — especially if you’re just getting started. From blockchain wallets to crypto exchanges to the thousands of types of crypto, it can be hard to even know where to begin.

Let’s start out simple — with crypto exchanges. Which one should you go with?

There are several reputable crypto exchanges out there that make it easy to get started, with simple-to-use mobile apps and a great selection of popular crypto to choose from.

Here, we’ll examine the top three crypto exchanges in the U.S. — Kraken vs Gemini vs Coinbase. We’ll evaluate user experience, fees, crypto selection, and overall features so you can determine which is the best fit for you.

Want to trade more than just crypto?

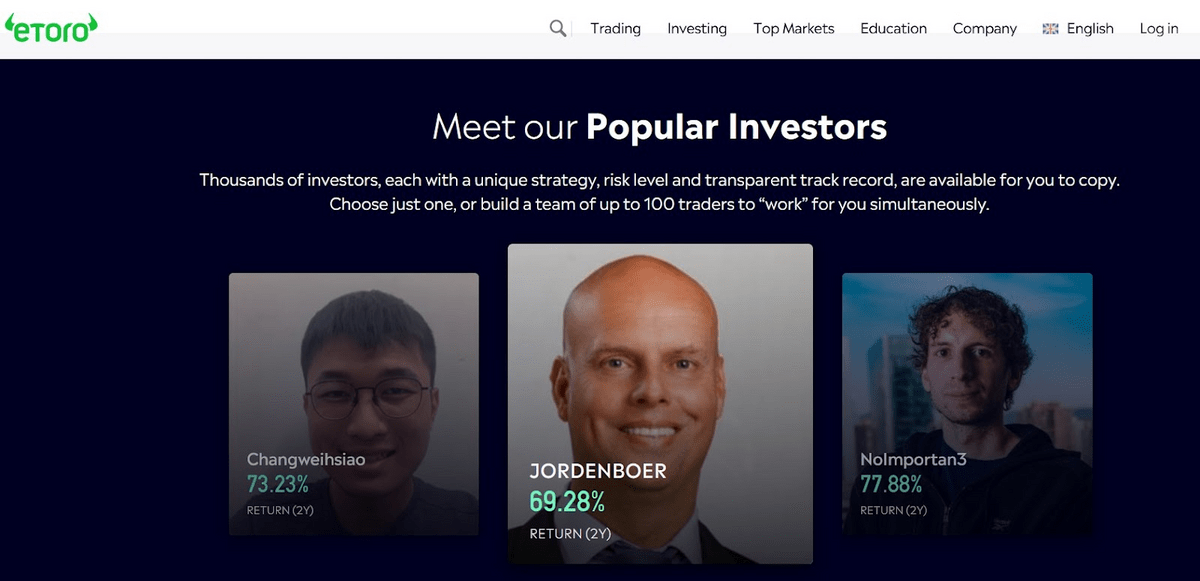

eToro is a social trading platform that offers both crypto and stock trading … Plus the ability to peek top traders at work through a unique CopyTrader tool. If you’re someone who needs to watch to learn, this is the perfect feature for you. (To find out more, check out our eToro Copy Trading review.)

eToro supports a few dozen cryptos for trading (though you can’t take custody). Overall, if you’re interested in crypto and the ability to trade stocks and ETFs on the same platform, it’s well worth your time.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Kraken Vs Gemini Vs Coinbase: Who’s the Winner?

The bottom line: Coinbase is the best crypto exchange in the U.S., offering over 250 cryptocurrencies, a super-simple trading experience, and even the ability to earn interest on your crypto.

That said, Kraken and Gemini both have their place for advanced traders and security-conscious crypto investors. Plus, Kraken has very low fees for active crypto traders.

Let’s discuss…

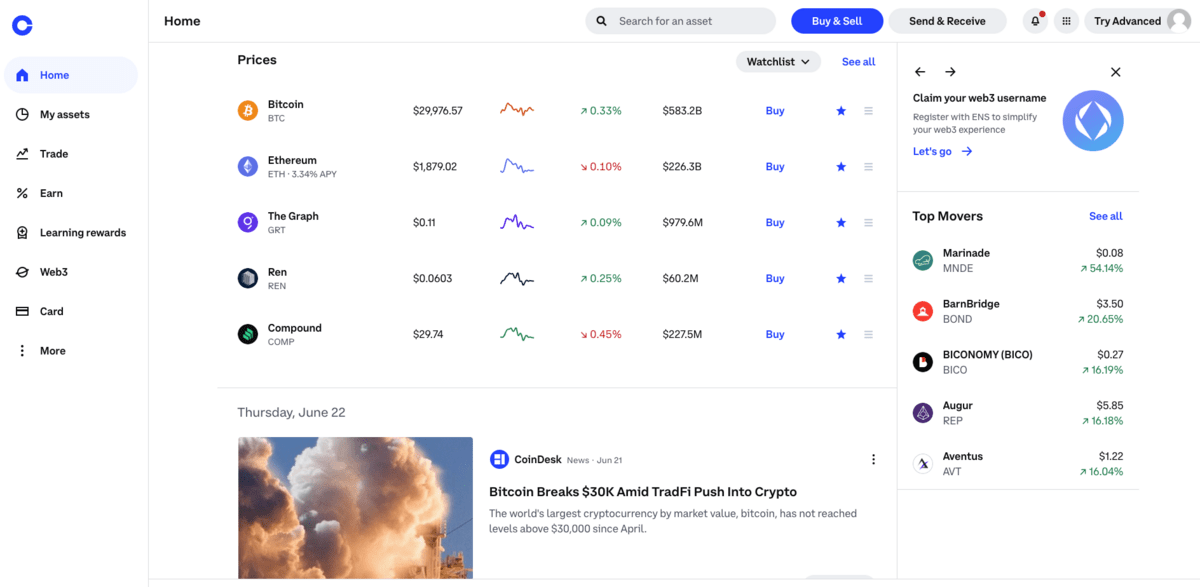

Coinbase

Coinbase is the most popular exchange in the U.S., offering simple access to buy and sell over 250 cryptocurrencies.

Note: Coinbase was recently sued by the Securities and Exchange Commission (SEC) for selling “unregistered securities.”

This lawsuit is identical to one for Binance crypto exchange. User crypto and funds are not at risk during the lawsuit.

Overall rating | 4 / 5 |

Deposit Methods | Bank account, PayPal, wire transfer, Apple/Google Pay, debit card |

Fees | 0.50% per trade + 1.49% (3.99% for debit purchases) |

Capabilities / Platform features | – Crypto Wallet – Crypto staking- Crypto rewards card- Institutional trading desk |

Cryptos supported | 250+ |

Order Types | Market, Limit, Stop |

Security | SSL encryption, Cold Storage, Two-Factor Authentication |

Maximum transfer amount | $100,000 per day (Instant Cashout), Unlimited for wire transfers |

Founded in 2012, Coinbase is one of the longest-standing crypto exchanges around and is a popular option for beginners, advanced traders, and institutional investors alike.

With over 100 million users globally and the most trading volume of any U.S.-based exchange, Coinbase has become the go-to crypto exchange for Americans.

Coinbase is known for its simple user interface and secure access to over 250 popular cryptocurrencies, including Bitcoin, Ethereum, and meme-coin favorites like Dogecoin and Shiba Inu.

Coinbase lets you purchase crypto with a bank account or debit card, or you can use apps like PayPal and Apple/Google Pay.

The Coinbase mobile is one of the best around for beginners, with a slick user interface that makes it easy to browse and trade crypto and earn interest through staking and the Coinbase Earn program.

Advanced users can quickly switch to the advanced trading interface for more trading controls and order types, such as limit and stop orders.

Coinbase does charge higher fees than most crypto exchanges, with a 0.50% trading fee plus a 1.49% transaction fee. You can reduce this fee using the “Advanced Trade” option, but you need some trading experience to understand how to use it.

Overall, Coinbase is a top-notch crypto exchange that puts security and user experience as their #1 priority, and it shows.

- Pros: Easy to use, Well-designed mobile app, Lots of coins to choose from, Secure

- Cons: High fees, Limited advanced trading choices

- Best for: Crypto beginners, institutional investors

Side note: how to stay safe trading crypto

Crypto is an exciting — but potentially risky — asset class. To ensure the safety of your investment, it’s crucial to invest in proper storage for your coins.

CoolWallet is one of the safest and most popular options out there — over 10 million units have been sold!

CoolWallet is a credit card-sized Bluetooth hardware wallet that supports various tokens like Bitcoin, Ethereum, Litecoin, XRP, ERC20, and many more. Best of all? It fits in your wallet like a credit card, making for easy transport.

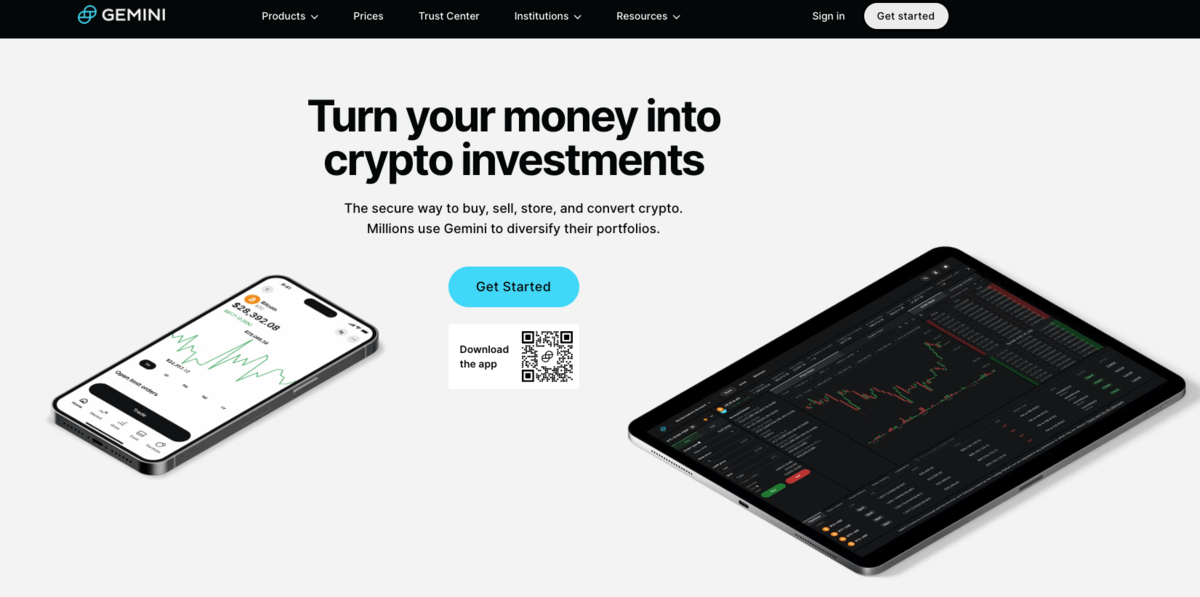

Gemini

Gemini is a U.S.-based crypto exchange known for its over-the-top security and friendly user interface.

Overall rating | 3.5 / 5 |

Deposit Methods | Bank account, PayPal, wire transfer, debit card |

Fees | – $0.99 – $2.99 per trade (when under $200) – 1.49% for orders over $200 (+ 3.99% for debit purchases)- $25 wire transfer Gemini withdrawal fees |

Capabilities / Platform features | – Crypto wallet insurance- Crypto rewards card- Pay with crypto- Institutional trading desk |

Cryptos supported | 200+ |

Order Types | Market, Limit, Stop |

Security | SSL encryption, Cold Storage, Two-Factor Authentication, Insured crypto wallet |

Maximum transfer amount | $100,000 per day for ACH, Unlimited for wire transfers |

Gemini was launched in 2015 by the infamous Winklevoss twins (of Facebook fame), and it has become the go-to exchange for security-conscious crypto investors and institutions.

It offers a minimalistic user interface and super simple mobile app aimed at crypto beginners, making it easy to buy and sell crypto.

But is Gemini exchange safe? In their own words, “Gemini is the world’s first SOC 1 Type 2 and SOC 2 Type 2 certified crypto exchange and custodian.”

They employ two-factor authentication, support hardware keys, and offer whitelisting to restrict who can access and withdraw from your account. They also insure crypto funds in their Gemini Wallet.

Bottom line: Gemini is one of the most secure crypto exchanges on the planet.

Gemini offers access to 100+ popular cryptocurrencies including:

- Bitcoin

- Ethereum

- Tether

- Solana

- And dozens of others

You can easily purchase crypto with a bank account or debit card, and Gemini also lets you use your PayPal account.

Gemini fees vs Coinbase are very similar. Gemini charges a flat fee of $0.99 – $2.99 for orders under $200, and 1.49% after that. There is also an additional 3.49% fee for using a debit card for purchases as well.

There are no fees for ACH withdrawals, but there are Gemini withdrawal fees of $25 per wire transfer.

Overall, Gemini offers a decent selection of crypto with state-of-the-art security and a clean user interface.

- Pros: Very secure, simple user interface

- Cons: High fees, smaller coin selection, no way to earn interest

- Best for: Beginners, Security-conscious investors

Gemini Vs. Coinbase

Gemini and Coinbase are very similar in that they offer a simple mobile app aimed at beginners, making it easy to create an account and buy crypto. And both offer top-notch security to keep your cash and your coins safe.

But while Coinbase offers 250+ cryptocurrencies and hosts a large volume of trading, Gemini is a smaller exchange that only offers just over 100 coins and doesn’t host a lot of trading.

Plus, Coinbase lets you earn interest on some coins, while Gemini had to shut down their “Earn” product due to issues with their custodian partner in 2022.

When comparing Gemini vs Coinbase…

- Coinbase is the better exchange for buying crypto and is trusted by more users globally.

- But Gemini does offer more robust security and insured crypto held in their Gemini Wallet.

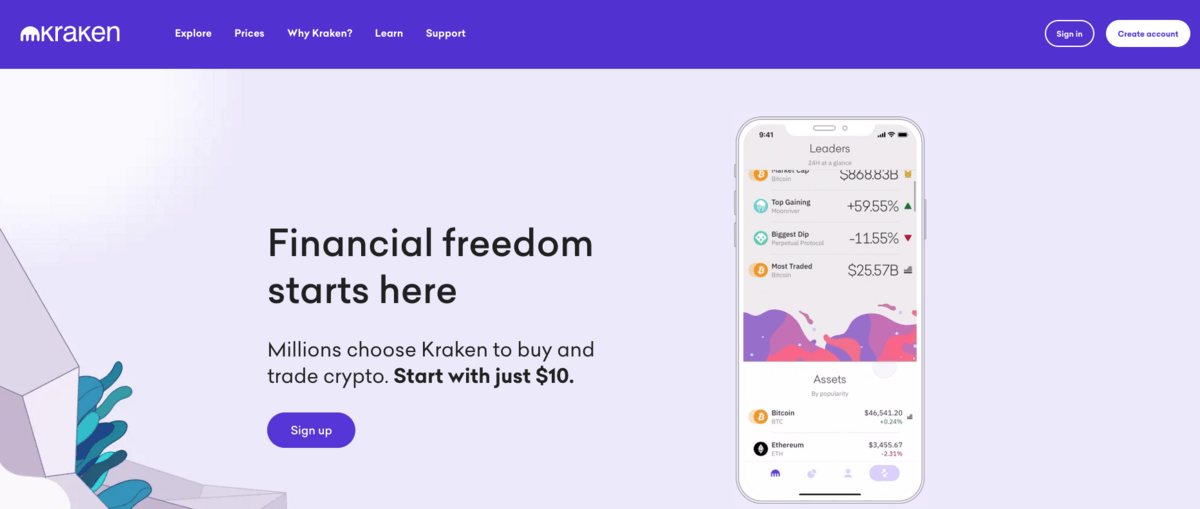

Kraken

Kraken is a global crypto exchange that offers margin and futures trading of popular cryptocurrencies.

Overall rating | 4 / 5 |

Deposit Methods | Bank account, wire transfer, credit card, debit card, Apple/Google Pay |

Fees | – 0.10% – 0.26% per trade- Instant Buy fees vary per trade |

Capabilities / Platform features | – Margin trading- Futures trading- Institutional trading desk |

Cryptos supported | 200+ |

Order Types | Market, Limit, Stop |

Security | SSL encryption, Cold Storage, Two-Factor Authentication |

Maximum transfer amount | $100,000 per day ($10 million for Pro accounts) |

Kraken is a long-standing crypto exchange founded in 2011. It offers access to advanced crypto trading and margin and futures trading.

It’s best for intermediate and advanced crypto traders who want access to trading tools like interactive charting with overlays, multiple order types, and crypto-to-crypto trading pairs.

Kraken is also one of the only U.S. exchanges that offers margin trading — up to 5x margin on certain crypto pairs. And crypto futures trading is also available, though U.S. users cannot access this feature.

When comparing Kraken fees vs Coinbase, Kraken has much lower trading fees, with crypto spot trades ranging from 0.10% – 0.26% per trade.

Instant Buy fees can be much higher, and there’s an additional fee for credit and debit card purchases. Kraken doesn’t list these fees but instead says the fees will be listed before the final purchase screen.

- Pros: Margin trading available, advanced trading interface, low trading fees

- Cons: Instant Buy fees not listed, futures trading not available in U.S.

- Best for: Advanced crypto traders

Kraken Vs Coinbase

Kraken and Coinbase have both been around longer than most exchanges, have brand recognition, and boast simple and advanced trading interfaces.

But while Kraken is geared toward crypto traders, Coinbase is a beginner-friendly platform aimed at new crypto investors. Kraken offers advanced charting and trading tools, as well as margin and futures trading.

Coinbase offers simple-to-use charts and has built-in education to help people who are new to crypto learn more about how it works.

When comparing Kraken vs Coinbase…

Kraken Vs. Gemini Vs. Coinbase: Alternatives

While Kraken, Gemini, and Coinbase are three of the most popular crypto exchanges in the U.S., some crypto traders want to be able to trade other assets as well.

Here are a few alternatives that offer more ways to trade:

eToro

eToro is a social trading platform that offers both crypto and stock trading, plus the ability to follow the trades of popular traders on the platform.

eToro supports a few dozen cryptocurrencies, though you can’t actually take custody of the crypto, you can only trade it. If you want access to crypto trading and the ability to trade your favorite stocks and ETFs, eToro is worth a look.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Robinhood

If you’re a casual crypto trader and want access to stock, ETF, and options trading for low fees, Robinhood is a decent choice.

Robinhood only supports a handful of cryptocurrencies but doesn’t charge commission for crypto investing and you can start with as little as $1. The mobile app design is as simple as it gets, too, making it ideal for new crypto investors to try.

Interactive Brokers

Interactive Brokers is a professional trading platform that offers low-fee crypto trading as well as access to tons of other assets, including stocks, ETFs, forex, futures, options, precious metals, commodities, and more.

While the platform only lets you trade Bitcoin, Ethereum, Litecoin, and Bitcoin Cash, the fees are rock-bottom low and the trading tools are the best in the industry.

Final Word:

Investing in crypto doesn’t have to be hard — especially when top platforms like Kraken, Gemini, and Coinbase all make it much easier.

As this article finds…

- Coinbase is the best overall crypto exchange, though the fees can be on the high side.

- Gemini is ideal for those who value security above all else.

- Kraken is geared toward more advanced crypto traders who want low fees.

But with simple-to-use mobile apps, large crypto selections, and the ability to trade crypto 24/7, all three of these exchanges can help new crypto investors get started.

FAQs:

Which is better: Gemini vs Coinbase?

When comparing Gemini vs Coinbase, Coinbase is hands-down a better platform. However, in terms of security, Gemini is a leader: it boasts SOC I and SOC II compliance, is fully regulated, and even insured crypto funds in its crypto wallet.

Which is better: Kraken vs Coinbase?

In comparing Kraken vs Coinbase, Coinbase is the better overall exchange. Kraken offers a lot in the way of advanced trading. However, Coinbase is ideal for new users that want a simple user interface and a larger selection of crypto to purchase.

Is my money safe in Gemini?

Gemini is one of the most secure crypto exchanges available, with FDIC insurance for cash balances, and even crypto insurance on cryptocurrencies held in their digital wallet. Gemini did have issues with their “Earn” product as they used a custodial partner that faced liquidity issues and froze user funds. That product is no longer available.

What crypto app is better than Coinbase?

Coinbase is one of the best crypto apps on the market for beginners, but it’s not the best app for everyone. Binance.us offers a similar crypto selection and much lower fees than Coinbase, plus a simple-to-use app. And Robinhood makes it easy for new crypto traders to dip their toes in crypto trading without the high fees.

What is the minimum deposit for Gemini?

There is no minimum deposit to sign up for Gemini. There are minimum trade amounts that vary by cryptocurrency. For example, BTC has a trading minimum of 0.00001 BTC on the Gemini exchange.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.