The best options trading alerts services don’t come cheap.

However, the best services are incredibly valuable – they save you time and make you money, which can more than justify their price tags.

But how can you tell whether an options alert service is any good, and more importantly, whether or not it will work for you?

I won’t keep you in suspense. First off, here’s the list of the best options alert services. Below, I’ll explain how I reviewed them, then offer a detailed description and rating on each service.

At-a-Glance: The Best Options Trading Alert Services

- Stock Market Guides — Best Trade Alerts Overall

- The Trading Analyst – Runner-Up for Best Trade Alerts

- Benzinga Options – Best Trade Alerts for Small Accounts

- Mindful Trader – Best Trade Alerts for a Data-Driven Approach

- Motley Fool Options – Best Trade Alerts for Long Swing Trading

- Market Chameleon Options Trader – Best Trade Alerts for Experienced Traders

- Delta Options – Best For Big Accounts

- The Speculator – Best Trade Alerts for High-Opportunity Selections

I used three criteria to determine the 6 best options trading alert services.

Keep in mind, each of these numbers is an estimate, but these estimates can help you make a better comparison:

1. Cost / Trade Alert

This estimate will help you gauge how much money you’d have to make with each trade alert in order to make the service worth your while. If that amount doesn’t match up to other factors such as your account size or your risk tolerance, then the service is probably not a good fit.

2. Projected Annual Return

Most people want to see a triple-digit number here —the bigger the better. However, keep in mind that with great reward often comes great risk —at least in the world of options trading. What you want to analyze here is the amount of risk you might have to take.

The higher the annual return, the greater the likelihood that you are going to have to put up with losing streaks and drawdowns along the way. If an options market service advertises that its average annual return is over 100%, you might need to put up with a 25% drawdown along the way.

3. Strategy and Style

Think of a spectrum that measures win rate and relative win size.

On one side of the spectrum, you may have an options trading style that garners relatively small wins, but has a high win rate. On the other side of the spectrum, you have a trading style that turns up relatively large gains with a lower rate of success.

Think of Shaquille O’Neal, one of the NBA 2-point kings on one side, and legendary 3-point shooter Steph Curry on the other. Both styles have value, but each has a distinctly different goal.

As an investor following an options alert service, make sure your goal is aligned with the strategy and level of risk management. You want to get an idea of whether the service is shooting for a more consistent pattern of wins or if it is trying to shoot the lights out by delivering ten-baggers.

If you’re someone who can’t be patient through a losing streak, you should probably be looking for a style that delivers a higher win rate.

Using these three points of analysis as guideposts, let’s take a closer look at the top six option trading alert services. Each has its distinct strengths, which means some of them will work better for one kind of investor, but not for other kinds of investors.

1. Option Trade Alerts from Stock Market Guides: The Overall Best Options Trading Alert Service

Overall rating: ⭐️⭐️⭐️⭐️⭐️

- Annual Cost: $675 (or do a monthly subscription for $69 per month)

- Average Annual Return: 136% in backtests

- Strategy: Buying Calls for Swing Trading or Long Term Trades

There are a lot of option trade alert services out there … What makes Stock Market Guides stand out?

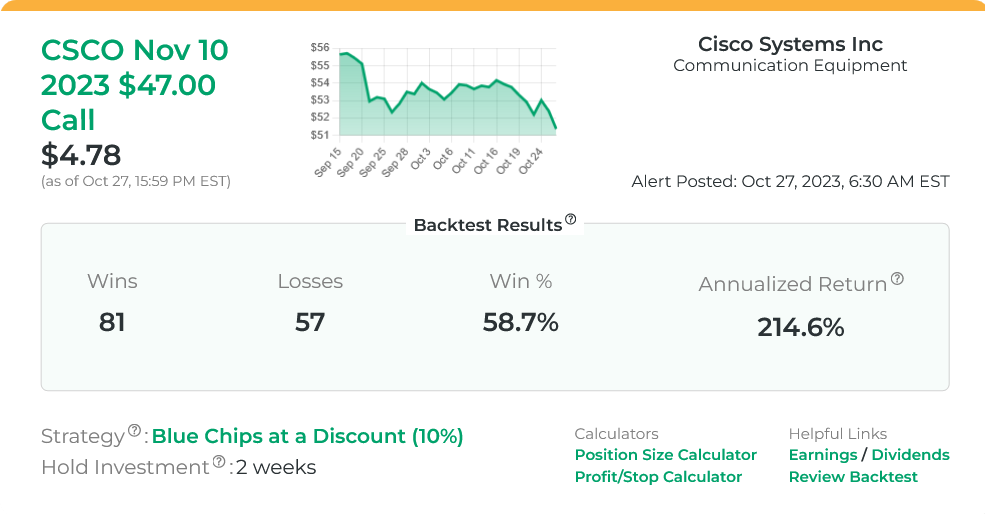

First off, each trade alert is easily accessible (you can get updates by email or text) and easy to understand. The process is pretty straightforward: Stock Market Guides has a scanner that alerts you when it finds good option trade setups. That part is pretty standard, but here’s what’s not: For every trade setup, they show you that exact setup has performed historically.

Here’s an example of how it works. Say Stock Market Guides sends you an option alert for Apple (NASDAQ: AAPL) based on a breakout trading pattern. The alert will show you:

- How many times Apple has exhibited that price pattern in the past

- How it performed using call options

In the stock market (and in life), history may not repeat to the letter, but it rhymes. So having access to a stock’s past performance in similar market conditions is kind of like taking off a blindfold when making trades! In my opinion, visibility on the track record of a given setup is one of the major selling points of Stock Market Guides’ alerts.

Stock Market Guides costs $69 per month. Within the service, you get:

- Pre-market option picks that come before the market opens

- Market hours option picks that come during normal market hours

It’s almost like two services in one! What I really like about Stock Market Guides is that it lets you tailor the alerts to your schedule and trading style. For instance, if you’re not able to make trades during normal working hours, you can just follow along with the pre-market trade alerts. It allows you to tailor the service a bit more to the options trading strategies that work for you.

On a per-alert basis, Stock Market Guides’ pricing is very competitive. Provided you don’t enable filters on their scanner, you might receive 40 or more alerts per month with their option service — a little over $1 per alert.

In terms of the alerts themselves, they’re simple and actionable. They show you the exact call option to buy, including the expiration date and strike price and how long the trade is to be held.

The scanner also gives you the flexibility to fine-tune the option trade alerts you receive. For example, you can set it up so you only get trade alerts if the option price is within a particular price range. You can also specify how long you prefer to hold your trades so you only follow trade alerts for setups that align well with your investing style.

As a final note, something I really appreciate about Stock Market Guides is that they don’t make unrealistic claims. They’re forthright up front about risk management and the fact that you can lose money with options. As a bonus, they won’t spam you with upsells once you sign up — a rarity in the stock alert world in this day and age, and the icing on the cake of why it’s our favorite options trading service for alerts.

2. The Trading Analyst: Runner-Up for Best Options Trading Alert Service

Overall rating: ⭐️⭐️⭐️⭐️⭐️

- Annual Cost: $787 annually

- Strategy: Swing trading – Going for larger wins

Trading is inherently risky. Any service that doesn’t acknowledge that risk is one you should avoid.

On The Trading Analyst site, their description explains, “Since July of 2018, we’ve had 337 winning swing trades and 302 losing trades. But it’s our risk management that really sets us apart from the rest. Our average win is $4,324.02 — while our average loss is -$2,603.29. This gives us a profit factor of 1.66. Our portfolio (starting equity of $100,000 in July 2018) grew to $771,001.67 by the end of July 2023.”

The fact that this service has both a bigger average win size than loss size and a win rate higher than 50% is very impressive. It’s one of the reasons it takes the top overall rating. The service delivers between 2-10 trades per week, with an average of around 165 trades a year, making its maximum cost per alert about $7.75.

Here’s a peek at a few more metrics:

Swing Trade Performance (July 2018 – July 2023)

Starting equity: $100,000

Equity as of July 2023: $771,001.67 Net profit: $671,001.67

Winning trades: 337

Losing trades: 302

Average win: $4,324.02

Average loss: -$2,603.29

Profit factor: 1.66

Win rate: 52.7%

One point of caution for investors to note is that this is an aggressive service. The numbers they use for comparison assume a $100,000 starting balance for its hypothetical portfolio, while their reported average loss size is over $2,500. Here are some numbers:

That means they are risking more than 2.5% of the hypothetical portfolio on each trade. A losing streak of 10 trades would easily lead to a drawdown of greater than 25%.

That said, when you sign up for The Trading Analyst, you get a lot of value, including:

- Weekly Trading Report: A comprehensive recap and forecast of what’s going on in the market

- Private Telegram Channels: Here, you’ll find real-time alerts, potential setups, custom charts, and crucial market news. It’s not a chat room per se, but it does create a sense of a supportive community.

- Detailed Watchlist: You get curated picks — even if you don’t act on them, it can give you an idea of what sectors and stocks are hot.

- Comprehensive Trading Courses: From beginners to advanced, they have a variety of courses so you can further your financial and trading know-how.

- Day Trade Alerts: An entirely separate system of trade alerts for those interested in day trading.

3. Mindful Trader: The Best Option Trade Alerts for a Data-Driven Approach

Overall rating: ⭐️⭐️⭐️⭐️

- Annual Cost: $564 (if you stay on for 12 months, or $47 per month)

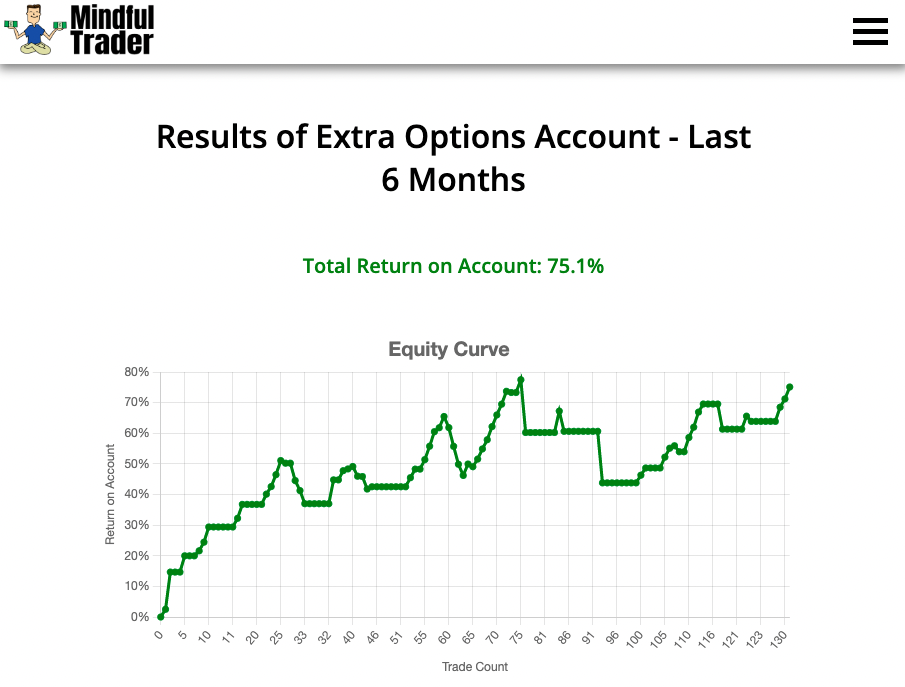

- Average Annual Return: 75.1% (November 2022 – April 2023)

- Strategy: Swing trading with calls

When you sign up for the options trade alerts at Mindful Trader, you’re signing up for a system that is backed up by data and research.

Eric Ferguson, a Stanford graduate who runs Mindful Trader, did years of research about stock price tendencies. He used this information to create trading strategies that have a historical track record of success statistically.

The options trade alerts at Mindful Trader are simple – when he makes a trade in his live account, he posts real time trade alerts to the website. Each alert shows the exact call option he bought, the price he paid, his profit target, and his time limit for the trade. Both entries and exits are very easy to follow.

One of the best parts about Mindful Trader is his transparency. He posts his live trading results for all to see.

From November 2022 to April 2023, he generated a 75.1% return which annualizes to more than 150% per year. If you look into his results, you’ll also notice periods with drawdowns.

As with all of these services, there is a substantial amount of risk that goes with the potential reward, so don’t be fooled by a service that claims to never lose.

Still, 75% over the last 6 months shows the potential of Eric’s strategy. What will the next 6 months bring?

4. Benzinga Options: The Best Options Alert Services for Small Accounts

Overall rating: ⭐️⭐️⭐️⭐️

- Annual Cost: $297 annual (first year can be purchased at a discount)

- Average Annual Return: 23%

- Strategy: High-probability trades

Benzinga Options is authored by Nic Chanine, Benzinga’s star options trader. The service is designed for beginning option traders or experienced traders who don’t have in-depth knowledge about options. His alerts are strategized for simple implementation; the setups he uses for options trades have allowed him to build a track record with a 91% win rate.

The only kind of option trading strategies that reliably win more than 90% of the time are strategies that involve selling options. Strategies such as naked puts and credit spreads allow option traders to collect the option premium and keep it if the option expires worthless. Nic’s methods target options with high probability wins.

Since a high win rate translates into a comparatively small win size, it’s important to understand that Nic looks for the easy layup by forgoing the big winner most of the time.

His trading style might come with an unexpectedly large loss or two if the market creates unusual circumstances, but his high win rate compensates for that over time. The service provides at least two alerts a month, making the cost per alert $12.75 which makes it suitable for smaller account sizes.

5. Motley Fool Options: The Best Option Trading Alerts for Long Swing Trades

Overall rating: ⭐️⭐️⭐️⭐️

- Annual Cost: $999

- Average Annual Return: Not officially stated, gives the impression it is between 40% and 50%

- Strategy: Selling put options each month

Motley Fool Options boasts an 84% win rate, and we don’t doubt they hit it. That’s because the service gives alerts for the sale of out-of-the-money put options trades. Selling options inherently has a high win rate, after all, since most options expire worthless, those who sell the contracts get to pocket the profits.

Even so, an 84% win rate is still impressive. However, a great win rate comes with a great chance for relatively larger losses. That’s always true when selling put options.

Most of the time you get to keep the premium you sold for the option, or if the stock drops below your strike price, you have to buy the stock at a discount. If you love the stock you should love both outcomes, right?

The problem comes when you sell a put option and before it expires the stock drops drastically —say, by 50%. Though this rarely happens, if and when it does, you could end up paying twice as much as the market value of a stock.

You’d have to hold those shares a long time before they make it back above the strike price, and if you sell before then, you’d end up taking a big loss.

The number of option alerts varies, but Fool advisories try to deliver at least two alerts each month, which means that the cost per alert might reach $37.50. That cost is likely prohibitive for smaller accounts, but Fool.com does offer an extensive collection of educational resources.

So if you are looking for a service that helps you learn more about investing as part of the service, you might find it to be worth the cost.

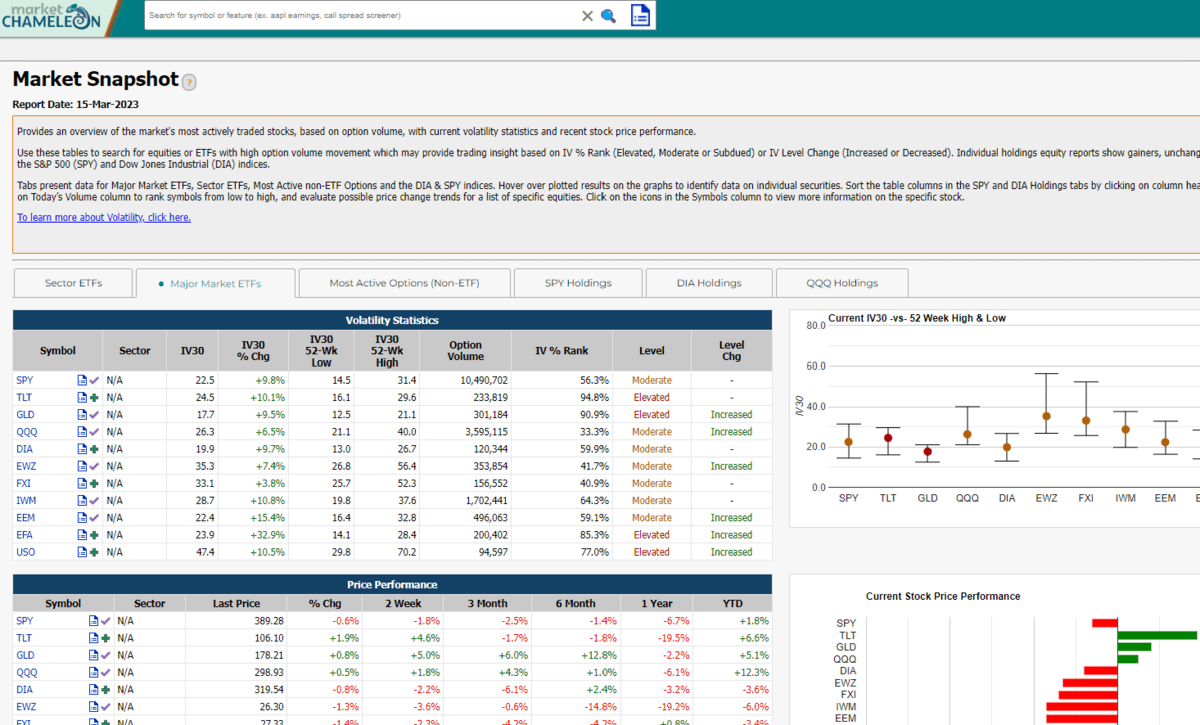

6. Market Chameleon Options Trader: The Best Options Trading Alerts Service for Experienced Traders

Overall rating: ⭐️⭐️⭐️⭐️

- Annual Cost: $828, full site access $1,188

- Average Annual Return: Not officially stated, gives the impression it is between 30% and 60%

- Strategy: Blend of option strategies, each leveraging better-than-theoretical pricing

Market Chameleon Options Trader is more than an option alert service. It is also a heavyweight platform for option market analysis tools. You can buy the options service alone for $828, but you can also get full access to the site for less than $300 more per year — a value that is hard to overlook.

The site claims that its average win size is 64% per winning trade, but that only refers to one particular strategy. Now, if you take in a 64% gain on an option where you could have lost 100% of the premium you paid, then it’s clear that you have a comparatively smaller win size than loss size.

That’s good news for subscribers who feel impatient with losing trade ideas. The service likely has a significantly high win rate, perhaps 70% or higher, which means subscribers may experience smaller drawdowns.

The number of option trade ideas you can generate with the Market Chameleon platform far exceeds the number of trades you could actually take each month.

The alert service gives you two to five trades a week, or roughly 100 per year at minimum, which brings the cost per alert to a maximum of $11.88 each. That makes it a great choice for investors willing to put in the time it takes to master several option strategies.

7. Delta Options – Best for Big Accounts

Overall rating: ⭐️⭐️⭐️⭐️

- Annual Cost: $119/month or $949/year

- Stated returns: +275.70% as of September 2024

- Strategy: Momentum-based

Delta Options is an options-picking service that typically sends 1-2 trade alerts per month. It utilizes a momentum-based strategy. That part sounds pretty normal, but they do it in a very distinctive way.

First, the Delta Options team identifies stocks that are outperforming in their respective industries by following a standard momentum strategy. Then, they validate the price gains by doing a deep dive into the company’s fundamentals. If a stock meets their criteria and rigorous qualitative checks, it becomes a contender for their portfolio.

This is where things get spicy. Delta Options then purchases deep-in-the-money call options on the stock, with an expiration date that’s a minimum of 1 year out. This follows a buy-and-hold approach to a certain degree, but requires a lot less upfront capital.

Here’s an example. If Stock X is trading at $220 per share, then a $180 call option expiring in September 2026 might be priced at $60.00. Your purchase is the equivalent of owning 85 shares, which would normally cost $18,700, but your call option is a fraction of that cost.

This leverage can potentially lead to higher returns — if the stock selections are solid. But remember: leverage also brings on volatility, so this service and strategy might be suited best to larger accounts.

Positions are often held 1-3 years, depending on how the stock is performing.

8. The Speculator: The Best Options Alert Service for High Opportunity Selections

Overall rating: ⭐️⭐️⭐️⭐️

- Annual Cost: $1,499

- Average Annual Return: Not stated, but tipranks.com record implies over 50%

- Strategy: LEAPs on big-opportunity stocks

The Speculator is a publication from Eric Fry, a notable stock picker with InvestorPlace Media. It is dedicated to finding megatrends and trading opportunities before they get started. In particular, he looks for selections that can be leveraged with options.

To leverage these opportunities, he uses what some would consider the most expensive type of options out there: LEAPs. When possible, Fry selects out-of-the-money options that have more than a year until expiration.

These options trades typically have less than a 35 percent chance of becoming profitable on the day of expiration, but those that are profitable can yield healthy triple-digit return percentages. His stock and option selections may be expected to win less than 50% of the time. However, the size of the wins could potentially make up for the losses over many trades.

That’s the way he plays the game. This means a subscriber is likely to experience drawdowns of 15% or more, even if they allocate no more than 2% of their account to each option trade.

Surprisingly, tipranks.com tracked 22 of Eric’s picks and found that his selections won 64% of the time and that the average result of those selections is a 51% gain. That’s an extremely good performance record. With only 24 to 48 picks a year, Eric’s service comes at a maximum potential cost per alert of over $62, which might make it too expensive for small accounts.

The service has great analysis and commentary and some basic education about the kinds of options Eric uses. However, its market commentary and educational resources are not as rich as other services.

That means you are paying for the quality of his selections alone. Eric’s track record indicates that he has an unusual degree of quality, which is why his service makes our list.

BONUS: Speed Up Your Options Trading Learning Curve

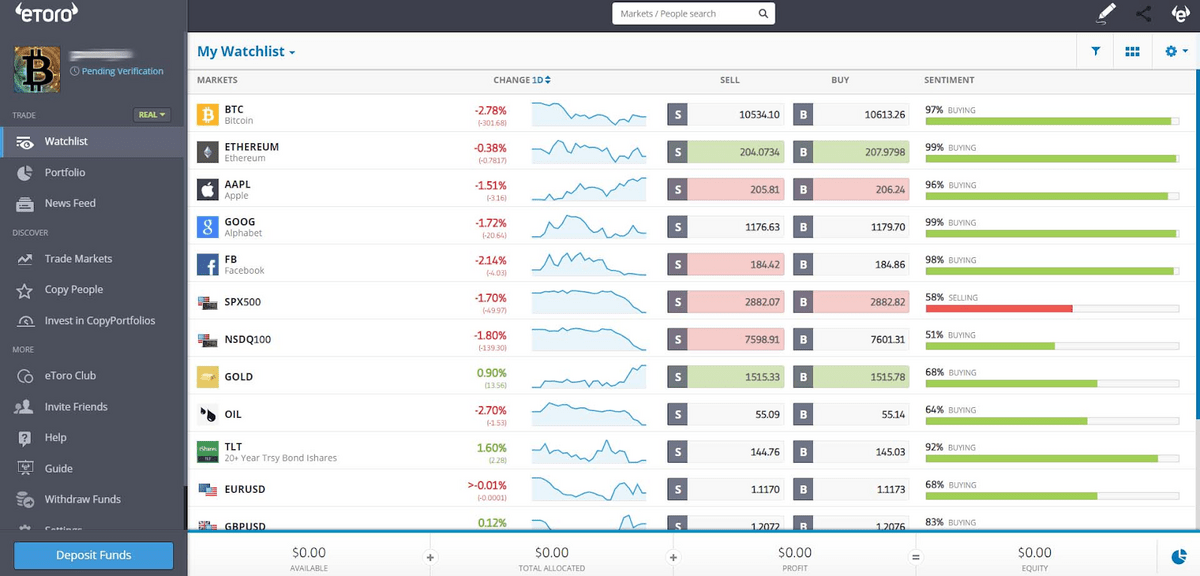

eToro isn’t necessarily an option alert service. However, it’s one of our favorite brokerages for options trading (along with stocks and ETFs), and it has a neat little tool that can help improve your option trading prowess…

eToro’s CopyTrader is a feature that lets you follow the trades of experienced, profitable traders. By watching and learning, you can gain insight to the “how” and “why” behind the trades of seasoned investors.

Plus, every trader featured has a profile with a rating, performance history, risk profile, and more so you can easily compare top traders and find the ones best suited for your goals.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Final Word: The Best Options Trading Alert Service

Option trading can be difficult to master and finding good trade opportunities can be time-consuming. The best options trading alert services solve this problem by identifying high-quality trades on your behalf. Often, the prices are far lower than the value they provide.

Find the best service for you based on the cost and trading style.

Then start trading.

FAQs:

What is the best option alert service?

The best option alert service is one with a low cost-per-alert, a good track record, and minimal potential drawdowns. Our pick is The Trading Analyst.

Which website has the best options trading advisory service?

The Trading Analyst (thetradinganalyst.com) offers the best options trading advisory service.

How do you keep track of option trades?

Tracking options trades will depend on your personal style and what types of options trading strategies you employ. A trading journal may suffice for some traders, or you might subscribe to a tracker. If you follow alerts, they will often be archived by the subscription service so that you can see past alerts.

Which is the riskiest option trade?

Selling options carries a lot of black-swan risk. You rarely lose money doing these trades, but if you don’t fully understand what you are doing, under rare circumstances you could lose a lot of money.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.