Unless you’ve lived under a rock for the last few years, you’ve probably heard about algorithms or algorithmic trading. While it may not be a buzzword at the same level as AI, it’s pretty close.

But … What are algorithmic trading softwares, anyway?

You could algos as automatically executed trading rules. Sounds cool, right?

Unfortunately, too few people understand how it actually works — or how to use algorithmic trading platforms.

Let’s fix that.

In this article, I’ll define algorithmic trading, highlight top algo trading platforms, and explain exactly how the approach works and how even relatively new investors can leverage the system.

Prefer real people to algos?

eToro’s CopyTrader is a great alternative to algo trading software that lets you watch other traders while you learn.

You can follow in the footsteps of successful traders to see how they think — and how they trade. If you prefer to avoid algos or just want to expand your education, eToro’s CopyTrader is a fantastic alternative.

What is Algorithmic Trading?

Algorithmic trading isn’t as intimidating as it sounds.

At its core, algos are programs that follow specific trade rules. Algos leverage increasingly powerful computers to execute trades automatically based on the direction they’ve been given.

For example, an algo might be as simple as the following:

- When the stock price of XYZ falls below $10 per share, buy 100 shares.

- When XYZ’s stock price exceeds $15 per share, sell 100 shares.

- Only execute up to two trades per day.

The rules that can be applied are virtually limitless. Rules can be simple buy and sell instructions or more complex trading directives.

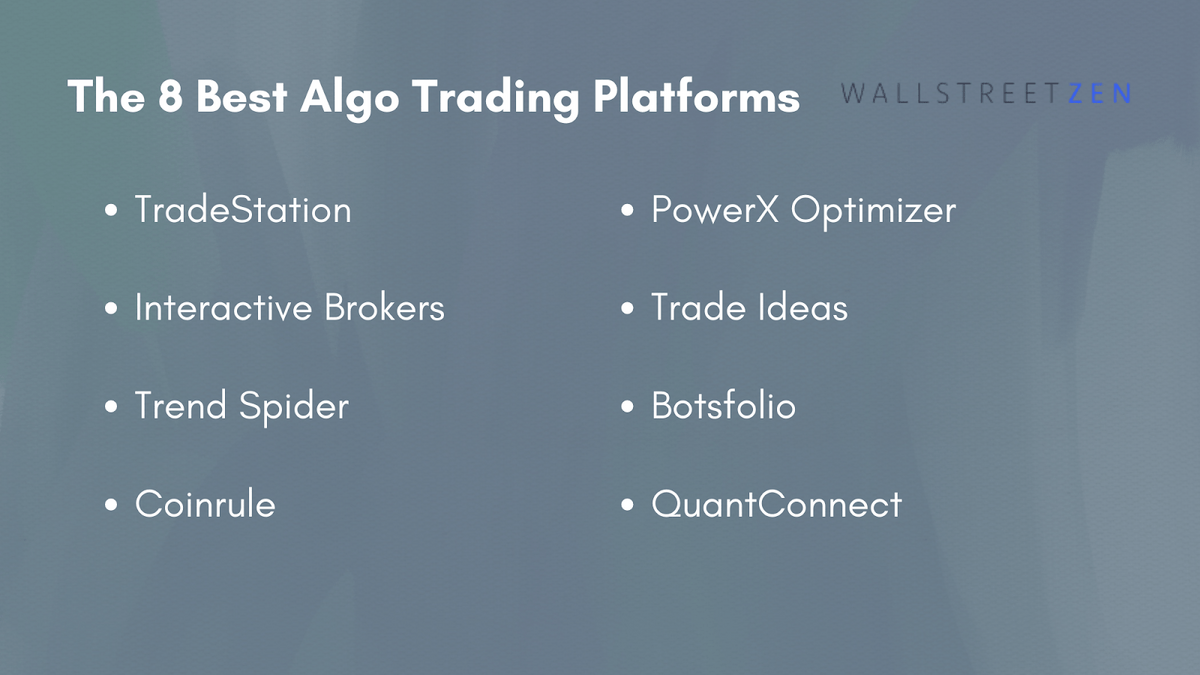

The 10 Best Algorithmic Trading Software Platforms

As you begin to research algorithmic trading platforms, the sheer amount of options available can be overwhelming. Luckily, we’ve combed through top algo trading platforms and highlighted key details to simplify your decision-making.

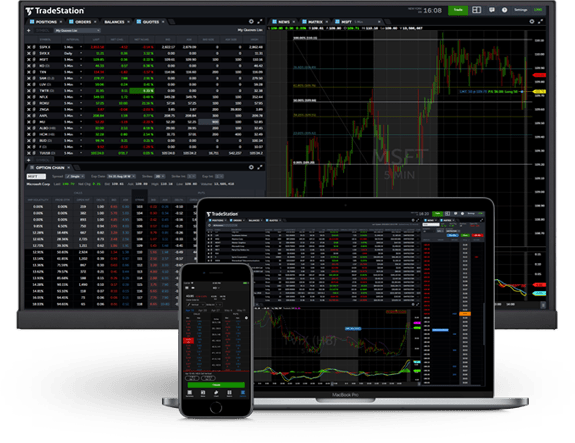

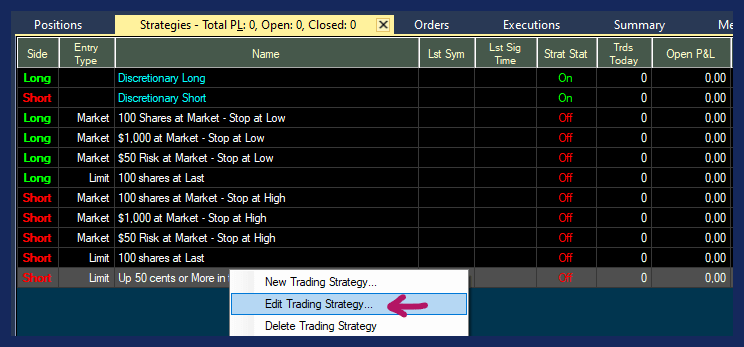

1. TradeStation

Rating: 9/10

Cost: $0 account minimum, $0 fee on stocks and equities, $0.60 per option contract, $1.50 per futures contract ($0.50 for micro e-minis).

Best for: Traders looking for a trusted platform with a long track record.

TradeStation offers traders a professional platform with access to trade equities, ETFs, options, futures, and even cryptocurrency. The powerful platform is suitable for beginners and advanced traders.

New traders will appreciate the YouCanTrade educational resource, while advanced traders will enjoy the powerful scanning tools and ease with which complex trade orders can be placed.

One of TradeStation’s best features is its use of EasyLanguage for its algo trading. Don’t let the fact that this is a computer language intimidate you.

This proprietary programming language developed by TradeStation is widely seen as user-friendly and approachable. Even non-native developers can create powerful and intricate algorithms.

2. Stock Market Guides

Stock Market Guides has already done all the work for you. With their algorithmic trading software, you don’t have to create or code your own algos. They’ve already done years of researching and backtesting to find the most powerful algos possible for their service.

They don’t do the trading for you, but they send you real time alerts by email or text when they find a trade setup with a strong backtested edge, which is the next best thing.

Every trade alert they send is based on automated trading rules, which means they’re algorithmic and therefore they have clearly defined instructions for the entry and exit of the trade. Their trade alerts also show you the backtested track record of that specific trade setup, like this:

They use their algos to generate both stock picks and option picks. And they have two types of stock picks: stock investing picks and swing trade picks.

The average annualized return of their stock investing picks in backtests is 43.1%. For their swing trade picks, it’s 79.4%. For their option picks, it’s 150.4%. My opinion? If you’re looking for premium returns out of an algo software, then Stock Market Guides is definitely a service you should consider. (Check out our detailed Stock Market Guides review.)

Their stock investing picks are available for $29 per month. The swing trade picks are $49 per month, and the option picks are $69 per month.

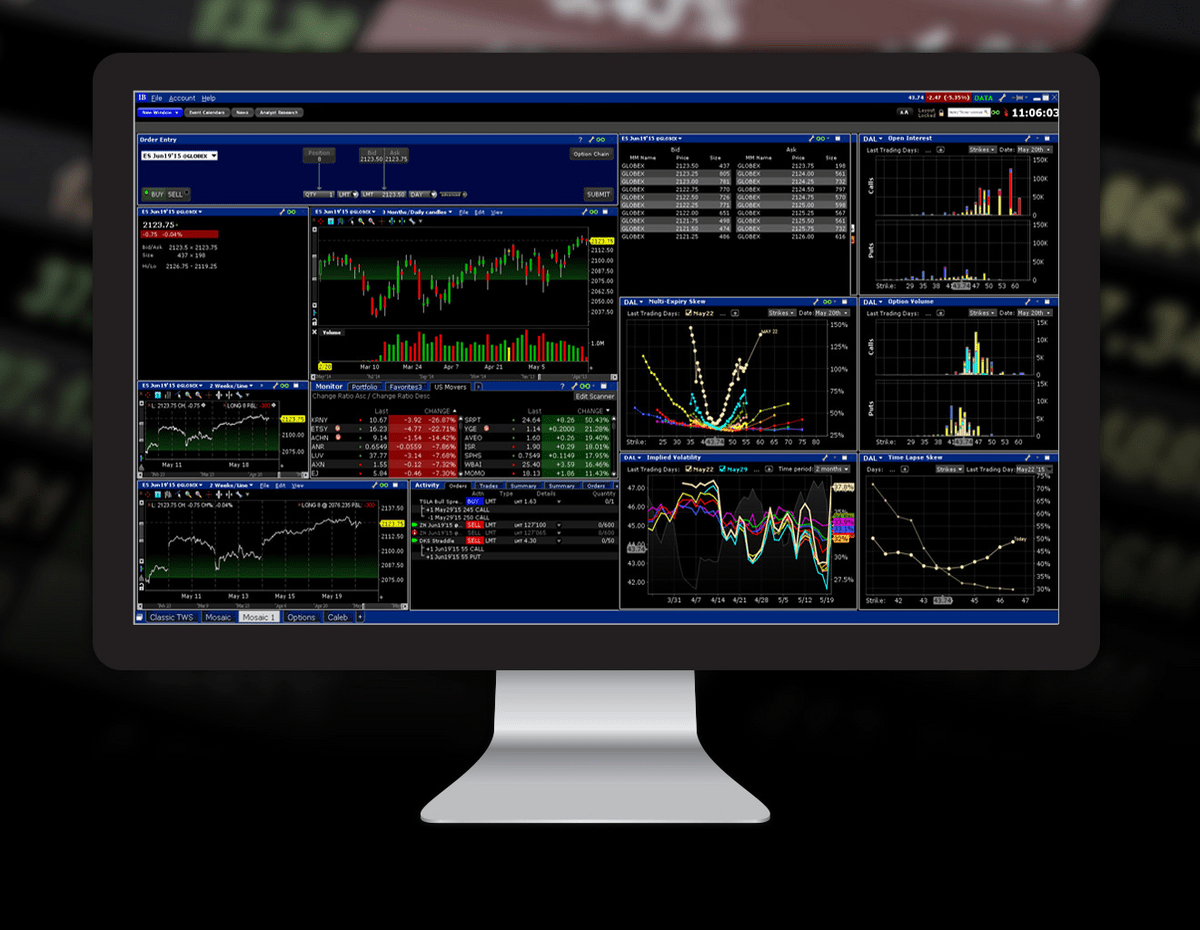

3. Interactive Brokers

Rating: 8/10

Cost: Interactive Brokers (IBKR) has two pricing tiers:

- IBKR Lite: $0 account minimum. Designed for retail investors looking to trade U.S. equities and ETFs commission-free.

- IBKR Pro: $0 account minimum, with commission structured as either fixed $0.005 per share (including exchange fees) or tiered commission between $0.0005 and $0.0035 per share (plus exchange fees).

Best for: Tech-savvy traders comfortable building an algorithm using languages like C++ or Python coupled with the Interactive Brokers API.

Interactive Brokers API allows ambitious traders to build their own customized algorithmic trading platforms. You’ll need familiarity with a programming language, like Python or C++, but the advantage is the tremendous flexibility.

Interactive Brokers also offers an extensive library of educational resources through its Traders Univeristy.

For the most sophisticated traders, FIX CTCI gives you access to Interactive Brokers’ high-speed order routing. Needless to say, this would typically be reserved for the most advanced and active traders.

The best algorithmic trading software won’t do much for you if your hardware isn’t up to snuff.

Ready to upgrade your trading setup? Here’s our top trading computer pick: The Radical X13 EZ Trading Computer.

4. TrendSpider

Rating: 7 out of 10

Cost: TrendSpider Elite costs $29 per month or $348 per year. TrendSpider Advanced costs $48 per month or $576 per year (provides access to automated trading bots).

Best for: Traders looking for comprehensive, U.S.-focused algorithmic trading software or access to Federal Reserve Economic Data (FRED).

TrendSpider shines as a U.S.-focused algorithmic trading platform. It even includes access to Federal Reserve Economic Data (FRED) to help provide macroeconomic insight alongside your financial market data.

This algo trading software extensively covers U.S. markets, including equities and CME futures.

TrendSpider is one of the best algorithmic trading platforms for the busiest traders, permitting up to 16 charts per screen.

Whether automated or manual, drawing tools can be applied to charts, helping visualize strategies. Moreover, this popular algo trading software also boasts hundreds of ready-to-use technical indicators.

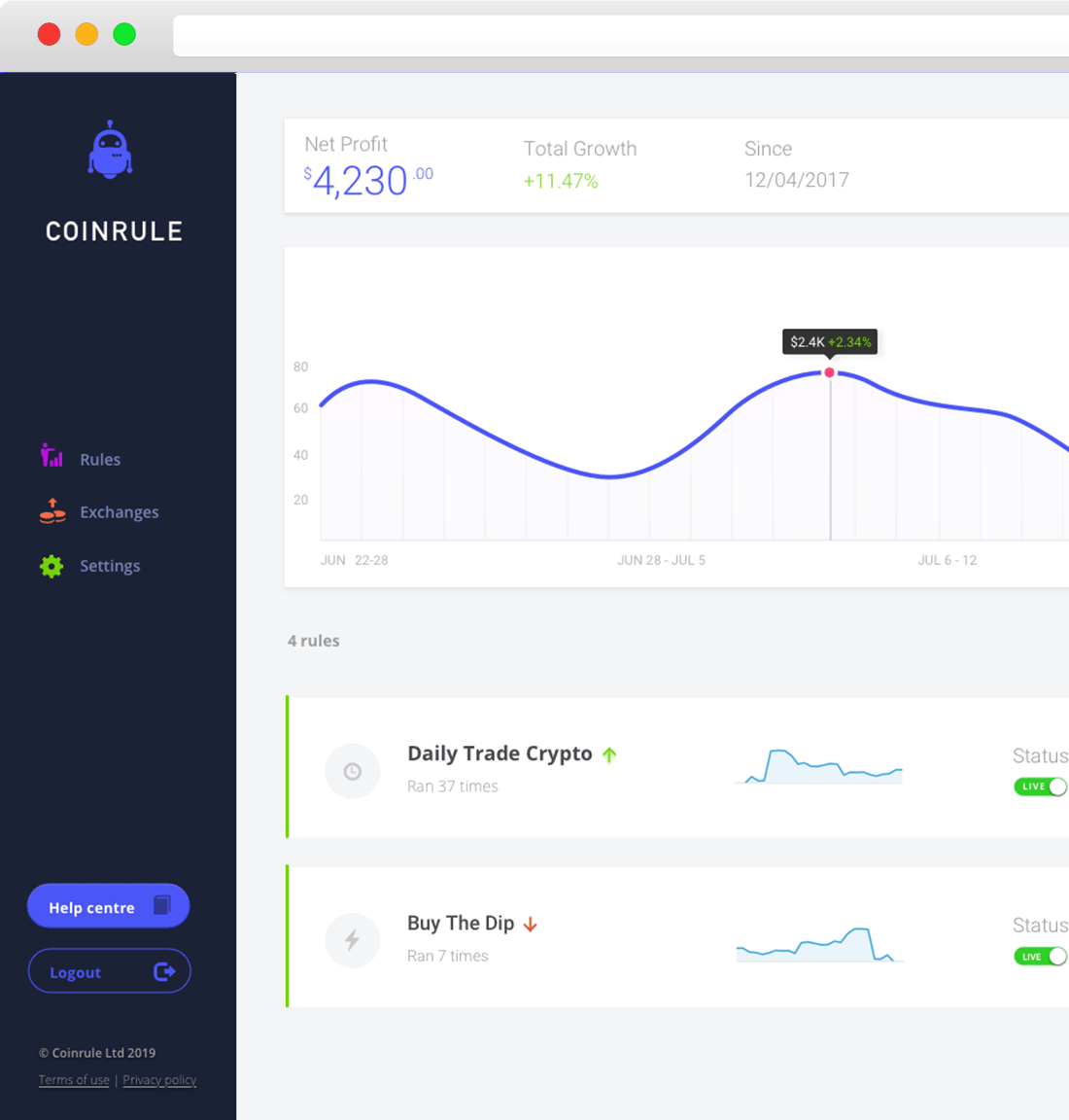

5. Coinrule

Rating: 7 out of 10

Cost: This algorithmic trading platform offers four tiers of plans.

- Starter plan: provides up to $3,000 per month in trade volume free of charge.

- Hobbyist Plan: $29.99 per month (or $359 per year).

- Trader Plan: $59.99 per month (or $719 per year).

- Pro Plan: $449.99 per month (or $5,399 per year)

Best for: Traders seeking cryptocurrency-focused algorithmic trading software

Coinrule focuses on cryptocurrency. Just like with stocks, some traders produced programmatic trading rules for crypto.

With Coinrule, this process is made easy, allowing users to create bots that follow prescribed trading rules.

What makes Coinrule especially remarkable is the pre-defined templated strategies. This feature is particularly useful for newer traders.

In terms of crypto-focused programmatic trading, Coinrule might be the best algorithmic trading software for beginners. Plus, Coinrule also has unique features, like notifications via Telegram or text messages.

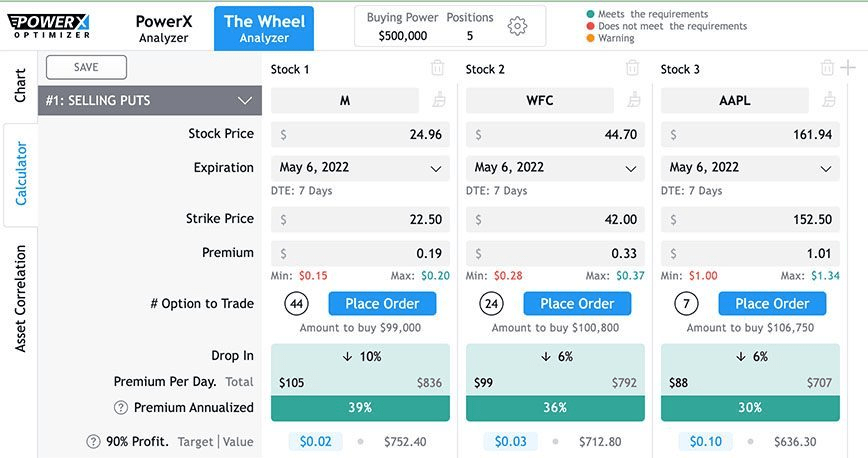

6. PowerX Optimizer

Rating: 7 out of 10

Cost: Lifetime license costs $3,997 (a one-time fee).

Best for: Part- or full-time traders looking to add an edge to their trading strategy.

Are you interested in algorithmic options trading? PowerX Optimizer might be the right choice for you.

The PowerX Optimizer algo trading software is the child of Rockwell Trading, a consistently highly rated platform.

It possesses numerous tools you can’t find on other platforms and also provides unique views that can give traders an edge.

In particular, the Wheel is a feature that helps traders manage and collect option premiums. It does much of the heavy lifting from a research perspective (expiration dates, strike prices, etc.), identifying the highest-potential options trades.

7. Mindful Trader

Mindful Trader is a service run by Eric Ferguson where he shares the stock and option trades he makes in real time. Eric’s trading strategies are all based on algos that he personally developed.

He’s well qualified to be creating algos considering he’s a Stanford grad who got a perfect score on the math SAT test and was the valedictorian of his high school.

All the trades he takes are based on strict trading rules, which means that subscribers to his service should never be surprised when he enters a trade or exits a trade.

You can follow along with his trades, or you can learn his strategies yourself. One of the reasons we like his service is that he teaches all the rules for the algos he uses. If you want, you can sign up for just one month, learn the strategies, and then employ these algorithmic trading rules on your own.

Another great thing about this service is you can communicate directly with Eric. He personally handles all customer service, which means if you send him an email, you’re going to get a reply directly from him. Not many algo services offer that sort of value.

The service at Mindful Trader is available for $47 per month.

8. Trade Ideas

Rating: 7 out of 10

Cost: Standard plans are $84 per month / $999 billed annually. Premium plans are $167 per month / $1,999 billed annually. Premium account required for algo trading.

Best for: Traders who want access to algo trades without coding expertise.

Trade Ideas is one of the most comprehensive platforms for algorithmic trading. This algorithmic trading platform provides access to a massive suite of trading tools, from technical charting, backtesting, one-click trading, and of course, algo trading.

Fortunately, no coding is required to leverage this algo trading software.

9. Botsfolio

Rating: 7 out of 10

Cost: Botsfolio offers a free tier and a paid tier that costs 0.5% of your account value yearly (i.e., a $10,000 account costs $50 per year).

Best for: Beginners eager to start trading crypto algos with minimal complexity.

Some traders want to get up and running with algos quickly and aren’t prepared to learn a complex coding language like Python.

For these traders, Botsfolio is an excellent option.

With Botsfoli, traders select their trading strategy, apply a risk level, and let the software do the rest. It’s that easy.

There is probably no lower barrier to entry for traders looking to begin using algos than Botsfolio.

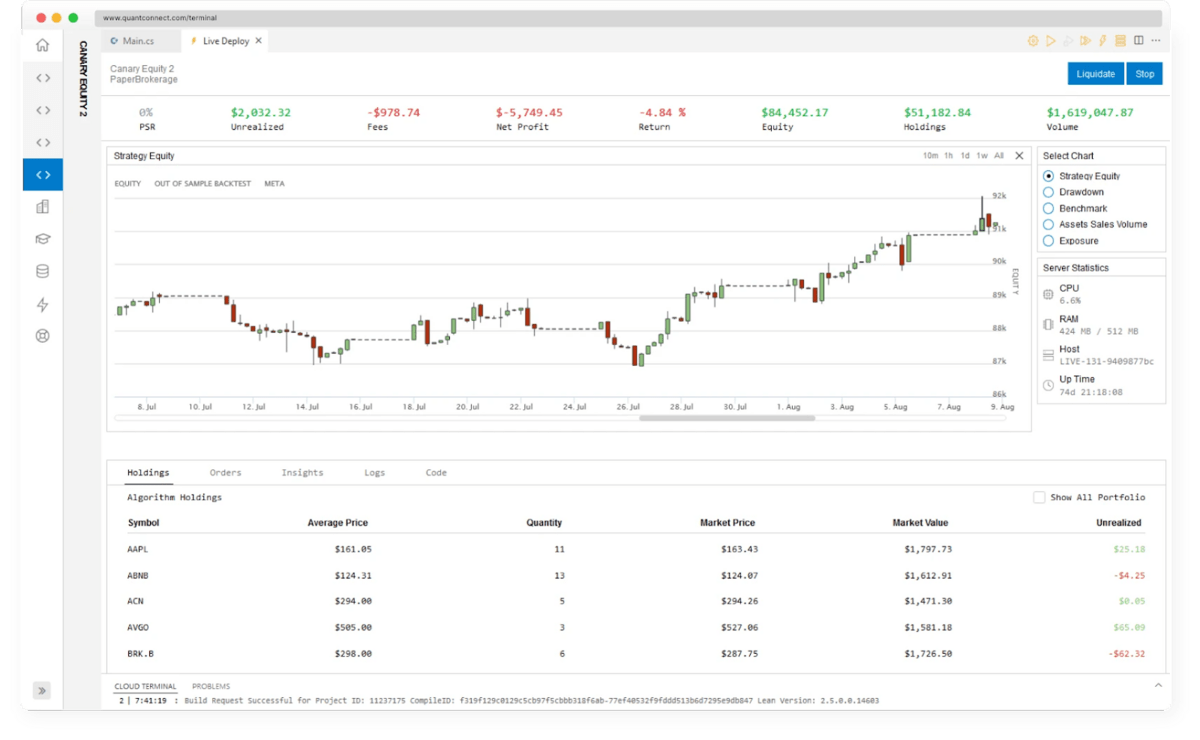

10. QuantConnect

Rating: 6 out of 10

Cost:

- Researcher: $8 per month if billed annually ($10 per month otherwise)

- Team: $20 per month if billed annually ($24 per month otherwise)

- Trading Firm: $40 per month if billed annually ($48 per month otherwise)

- Institution: $80 per month if billed annually ($96 per month otherwise)

Best for: Seasoned traders with a coding background.

QuantConnect is powerful algo trading software, but it’s not exactly intuitive. And that’s okay.

This algo trading platform is not designed for beginners. It’s meant for seasoned veterans focused on technical charting and programmatic trading.

While it’s not for everyone, for full-time quants, it’s an excellent platform for algorithmic trading.

Algorithmic options trading also gives this platform an edge over some competitors.

Users can also trade CFDs, futures, forex, cryptocurrencies, and of course, equities.

Incredibly, this platform for algorithmic trading boats over 100,000 hosted algorithms!

How Do Algorithmic Trading Platforms Work?

Algorithmic trading platforms can help automate your trades. Rather than you having to monitor markets for specific entry and exit prices, for example, algorithmic trading software can automatically detect these levels and execute trades based on predefined instructions.

Typically, a trader will select a specific strategy to deploy using the algorithmic trading platform. The method can be based on factors like market trends or specific technical indicators.

Active algos will monitor markets in real-time and execute trades via a connected brokerage system when certain predefined conditions are met.

A stock-picking newsletter that leverages AI algorithms…

… To locate stocks with market-beating potential. With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. Here’s what you get for just $99 ($79 for a limited time, using links in this post):

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

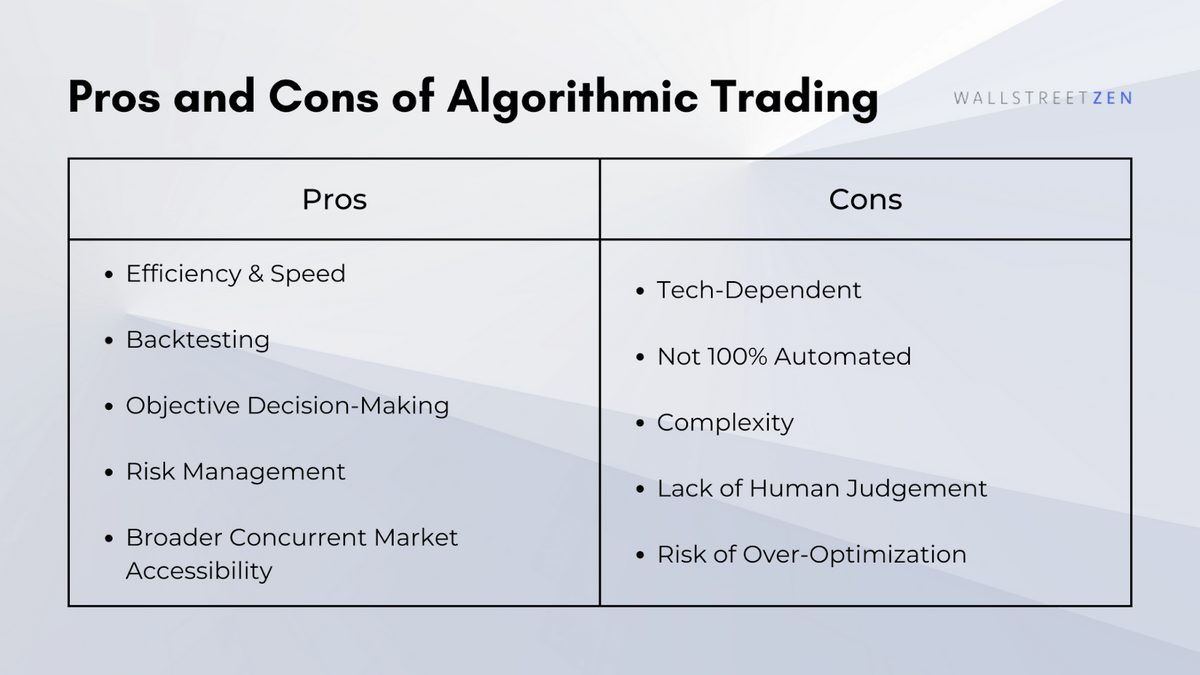

Pros and Cons Algorithmic Trading

Pros:

- Efficiency & Speed: Algorithmic trading allows for near-instantaneous trade execution with real-time monitoring done automatically. Compare that to a human trader — sorry, but you’re far slower.

- Backtesting: Often, algo trading software will include powerful backtesting capabilities.

- Objective Decision-Making: Algorithmic trading can remove the often costly emotional trade decisions that can occur when manually trading.

- Risk Management: Algorithmic trading software often includes risk management features, like position sizing, to help traders manage exposure.

- Broader Concurrent Market Accessibility: Algo trading platforms can allow traders to express trades across different asset classes and markets simultaneously.

Cons:

- Tech-Dependent: Algorithmic trading requires access to powerful software. If this software fails or malfunctions, the results could be costly.

- Not 100% Automated: Algos still require some degree of human intervention. Prudent algo traders will periodically check on their algo and the executed trades, not unlike quality control on an automated factory line.

- Complexity: While not always the case, in some instances, algo trading can be very complex for unique strategies requiring specific coding expertise.

- Lack of Human Judgement: With little human intervention, algos rely on computer hardware and software. This can present a risk during unexpected or unforeseen market environments.

- Risk Over-Optimization: Backtesting can provide valuable insight into potential future movements, but there is no guarantee that the future will replicate the past. As a result, historically successful strategies may underperform in the future due to changing market conditions.

How to Choose the Best Algorithmic Trading Software

Choosing the best algo trading software can be daunting, but we’re here to help. Here are some important considerations when selecting an algo trading platform.

- Learning Curve: is the algo trading platform easy to use? What are existing and former users saying? Do you require coding knowledge?

- Price: is the algorithmic trading software affordable? Does it cost more or less than similar software?

- Backtesting Capabilities: do you require the ability to backtest ideas and strategies? If so, is the feature user-friendly? Does it have access to a sufficient historical dataset?

- Execution Speed and Reliability: Is the algorithmic trading platform fast? If needed, can it handle high-frequency trading?

- Data Access: does the algo trading platform have access to timely and accurate data?

- Risk Management: Does the algo trading software offer risk management capabilities, like portion sizing and trailing stops?

- Support: Does the vendor of the algo trading software offer reliable technical support and assistance when needed?

- Security and Data Privacy: is the vendor trustworthy? Can you trust the algorithmic trading software to keep your data safe and secure?

BONUS: Alternative to Algorithmic Trading Software

eToro’s CopyTrader is a great alternative to algo trading software that lets you watch other traders while you learn.

You can follow in the footsteps of successful traders to see how they think — and how they trade. If you prefer to avoid algos or just want to expand your education, eToro’s CopyTrader provides a great alternative.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

At-a-glance: top algorithmic trading software

- Best track record: TradeStation

- Best for “done for you” algos: Stock Market Guides (Options & stocks!)

- Best for tech-savvy traders: Interactive Brokers

- Best for Federal Reserve Economic Data (FRED) data: TrendSpider

- Best crypto algo software: Coinrule

- Best way to gain an edge: Power X Optimizer

- Best for learning algos: Mindful Trader

- Best for traders without coding experience: Trade Ideas

- Best user-friendly crypto platform: Botsfolio

- Best for traders who can code: QuantConnect

Plus, while it’s not an algo trading platform, we also suggest checking out eToro’s CopyTrader.*

Final Word:

Automated trading softwares are becoming increasingly common. Here’s why:

- The ease with which algos can be implemented has dropped substantially.

- The cost of running algos continues to shrink.

Right now, algorithmic trading options are plentiful. The ones we’ve listed have something for every type of trader.

Whether you’re a part-time hobbyist with no coding experience or a full-time quant with a developer background; there’s now something for everyone in the algo trading platform space, from long-standing favorite TradeStation to platforms that offer access to Federal Reserve Economic Data (FRED) data like TrendSpider.

FAQs:

Which algorithm is best for trading?

There is no single best algorithm for trading since their effectiveness largely depends on numerous factors, like market conditions and individual preferences. Some popular algorithmic trading options include mean reversion, trend following, and momentum trading.

Is algorithmic trading profitable?

Yes, algorithmic trading can be very profitable. Albert Mate, an algo trader based in Montreal, Canada, has reportedly generated returns averaging 23% annually since 2000.

Can I do algorithmic trading on my own?

Yes, advancements in technology mean individuals can easily perform algorithmic trading on their own. Platforms for algorithmic trading continue to lower in cost and complexity.

Is algorithmic trading illegal?

No, algorithmic trading is not illegal. Of course, some market participants may not like algos trading against them, but this is simply an endorsement of the system.

What’s the best algorithmic trading software for beginners?

The best algorithmic trading software for beginners is Botsfolio for cryptocurrency and Trendspider for equities.

Are all Automated Trading Softwares the same?

No, all automated trading softwares are not the same. On the surface, there are many overlapping features among automated trading softwares, but each will typically have unique features or data.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.