Up until recently, investing in private credit was only available to an elite population of well-connected individuals and institutions.

But not anymore.

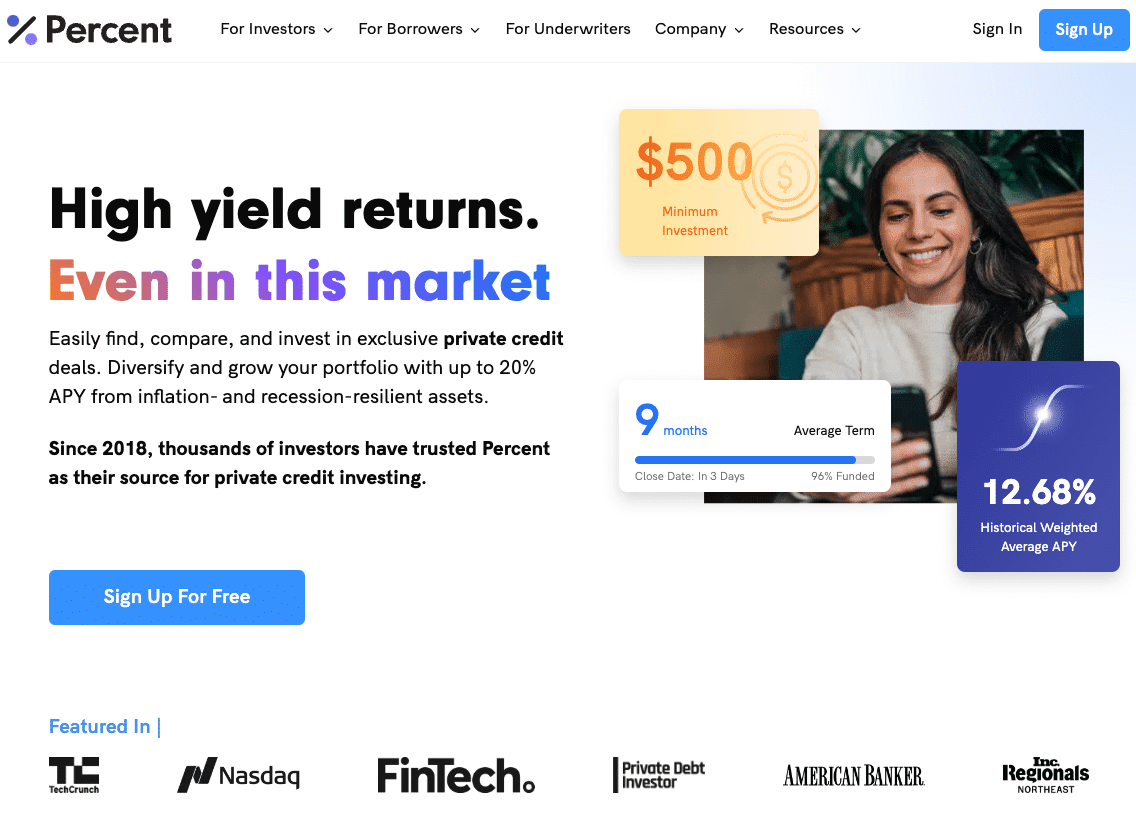

If you’re an accredited investor, alternative investment platform Percent can give you access to private credit investing for as little as $500.

But is investing in private credit actually worth it?

Let’s find out. In this Percent review, I’ll explain how to invest in private credit with the platform, from how it works to the expected returns and investment durations.

I’ll even guide you through an example investment on the Percent platform so you can see exactly how to invest in one of the available deals.

Percent Review: Is It the Best Way to Invest in Private Credit in 2025?

The Bottom Line: Yes, Percent is a great way to invest in private credit. Here are 3 reasons why:

- With exposure to a variety of debt, including Percent Blended Notes, which offer diversity within a single investment, and low fees on individual deals, Percent is ideal for accredited investors looking to diversify into private credit investing.

- Percent has partnered with quality corporate borrowers, many of which originate loans to small businesses and consumers. Then, those syndicated loans are funded by you, the investor. You simply sign up, pick a private credit deal or blended deal you like, and invest.

- As of March 31, 2024, current average deal APY is over 16% and the average duration is 9.5 months. More than $45 million in interest has been paid out since 2019.

What is Percent?

Founded in 2018, Percent is an alternative investment platform that offers accredited investors access to private credit investing, including asset-backed loans that include small business and consumer loans, trade receivables, merchant cash advances and other corporate loans.

These investments are short and medium duration debt instruments that make you the lender, and you may earn interest on the loans, collecting your returns generally over time as the loan matures, though it is dependent on the specific payment terms.

Percent private credit investments have an average duration of under 1 year, but you can choose investments that vary in length from months to years, with most deals offering recurring cashflow through monthly interest payments.

You can invest directly in individual deals, or in Blended Notes, which is a diversified offering of several private credit investments in a single offering.

Percent charges variable fees depending on the investment product.

- For direct deals, 0% management + a % of yield

- For managed products like Percent Blended Notes, 1% management + a % of yield

For example, if a deal paid 15% APY and the fee charged was 10% of interest, your effective APY is 13.5% after fees.

Why Invest in Private Credit?

Percent is a platform that’s funded over $1 billion in deals and exclusively dedicated to bringing private credit investments to accredited investors.

Private credit markets were previously unavailable to individual investors, but due to updated SEC regulations, accredited investors can now access these loan offerings.

There are 3 primary reasons why institutional investors are flocking to private credit:

- Higher yield potential – Since borrowers don’t have access to public market funding or have maximized public market funding available to them, they must turn to private investors who can charge higher rates for providing capital. As rates have risen, this has generally led to higher yield potential as well.

- Shorter durations – The average duration on Percent is around 9 months. The shorter-term investments allow you to regularly re-evaluate and re-calibrate your investments to meet your needs.

- Lower correlation with public markets – Private credit investments tend to have lower volatility than public markets (like stocks and bonds), and many of these loans are backed by assets, loan portfolios, or corporate debt1.

If you’re an accredited investor, Percent can give you access to a wide variety of shorter-duration offerings with high return potential. And they’re currently offering bonuses of up to $500 for making your first investment.

Deals on Percent are only available to accredited investors, consisting primarily of those with $200,000+ in annual income or $1 million in net worth (excluding primary residence).

Percent Investment Offerings:

1. Asset-Based Notes

Percent offers a variety of ways to invest in asset-based notes across borrowers on its platform

Here are a selection of asset classes available:

- Consumer Loans: Consumer loans allow you to invest directly in installment loans, vehicle loans, and short-term unsecured loans. These loans are typically collateralized with assets like a home or a vehicle, and let you access traditional lending markets with a high yield.

- Trade Receivables: Trade receivables are the purchase of a business’s accounts receivables at a discount, with a resulting yield upon maturity. This includes invoice factoring and other receivables accounts that typically have recourse available.

- SMB Loans: Small-and-Medium-Sized business loans (SMB loans) are short-term secured and unsecured loans for business activities. Some lenders provide alternative underwriting requirements for approval, and many loans offer personal guarantees from business owners.

- SMB Cash Advances: Similar to SMB Loans, merchant cash advances are typically completed through the purchase of future receipts. While similar to invoice factoring, repayment is based on future purchases instead of existing invoices.

- SMB Leases: Some lenders offer leases to small businesses of property, equipment, structures, or other assets. These offer secured yields, as they are collateralized by assets already owned by the lender.

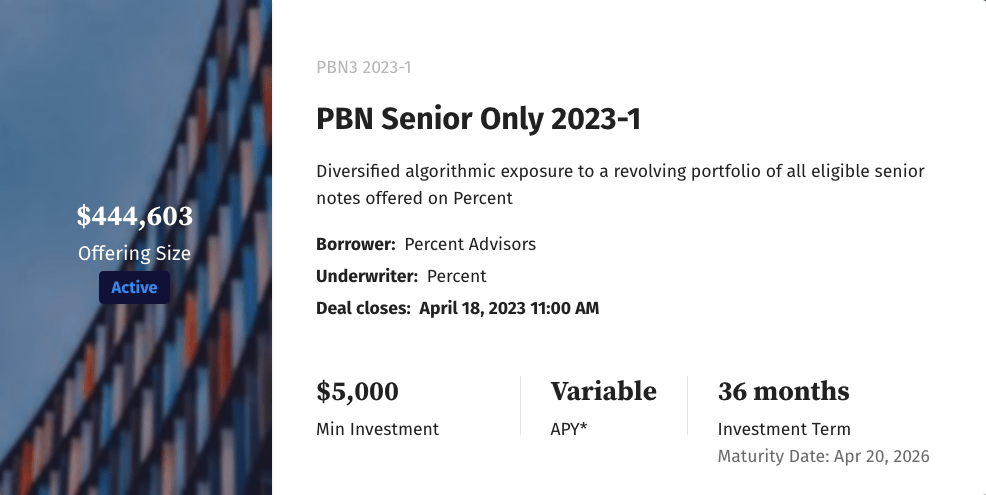

2. Blended Notes

Blended Notes are a diversified Percent investment that gives you exposure to several existing platform deals within a single investment.

You can review the holdings within the deal to see what types of notes they hold within the portfolio. Interest rates are variable, and all blended notes are managed by Percent Advisors.

Blended notes typically have between a $5,000 – $20,000 minimum investment, and charge an additional 1% management fee.

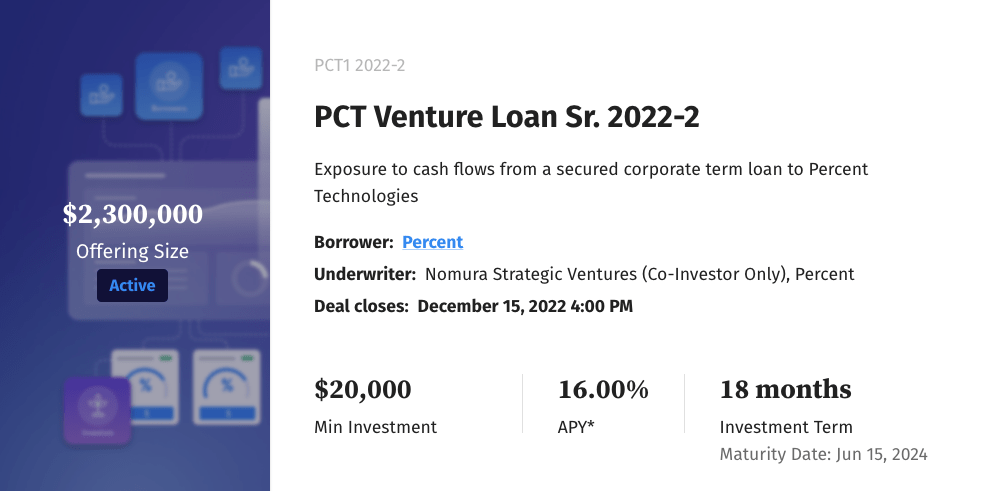

3. Corporate loans and venture investing

Percent allows you to invest in corporate loans including cashflow lending and venture debt. In cashflow lending, these loans are generally underwritten to the cashflows and growth of the business and in venture debt, these loans are used to bridge the gap between fundraising rounds and/or exit opportunities. These types of loans can have higher APY potential with minimum investments starting at $500.

Percent: By the Numbers

As of March 31, 2024

Total Funded: $1.026B

Deals Funded: 553

Current Weighted Avg APY: 18.13%

Default Rate: 1.90%

Average Investment Term: 9.5 months

Minimum Investment: $500 (accredited investors only)

Welcome Bonus: Up to $500

Example Investment on Percent

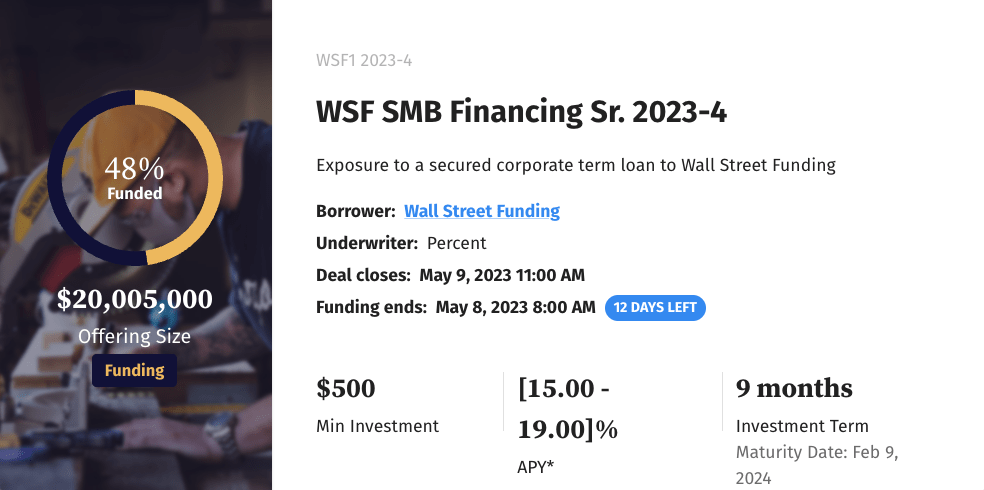

We’ll show an example investment as part of this Percent.com review. This corporate term loan has a low minimum investment and less than a one-year duration.

Borrower: Wallet Street Funding

Underwriter: Percent

Minimum Investment: $500

Expected APY: 15% – 19%

Loan Duration: 9 months

This investment allows you to fund short-term loans through Wall Street Funding, a technology-driven company that offers financing to SMBs. They focus on cash advances and have funded 24 deals on the Percent platform.

his deal expects anywhere from 15% – 19% APY. You can invest as little as $500, and you will receive your funds (and earnings) in 9 months after the loan matures.

Pros and Cons of Percent Technologies:

Pros | Cons |

|---|---|

High average historical yields (over 16% on average) | Accredited investors only |

Low fees | No secondary marketplace available |

Minimum investment only $500 | Deals are funded quickly |

Many deals are backed by assets | |

Lots of detail available for each deal | |

Short to medium investment duration (6-36 months) |

Percent vs Yieldstreet

Yieldstreet is a popular alternative investment platform that offers access to a wide range of assets, including short-term notes, art, fine wine, venture capital, private credit, real estate, and more.

Investors can invest in individual assets, or a portfolio put together by the Yieldstreet team.

In the alternative investment world, Percent is one of the top Yieldstreet competitors. Here is how the 2 stack up:

Percent | Yieldstreet | |

|---|---|---|

Asset(s) | Private Credit | Real Estate, Art, VC, Crypto, Private Credit, & more |

Investor Fees | 0% for individual deals* | 0-2.5% |

Average APY* | Over 15% APY | About 9% APY |

Minimum Investment | $500 | $15,000 |

Accreditation Required | Accredited Only | Primarily Accredited |

* Variable; fees are based on 10% of interest paid

** Based on historical or current weighted expected average performance

In my opinion, Percent is the clear winner in the Private Credit market, But overall, both companies offer solid platforms for alternative asset investing — it’s all about your goals and objectives.

- Yieldstreet is great for diversifying across multiple types of assets

- Percent is the best place to invest in private credit deals

Should You Invest in Private Credit on Percent?

Private credit is a difficult-to-access alternative asset class that offers a potentially higher yield than traditional bond investments.

Percent makes it simple to access deals and offers a very low minimum investment ($500).

Plus,

- Invest on your terms – Specify your desired yield and minimum investment amount during syndication. Only invest if your parameters are met.

- Transparency – With our proprietary technology, see and compare available deals up front. Access comprehensive borrower, deal and market data. Then, track performance and use surveillance reports to keep informed at every step.

Of course, the higher yields do come with higher risk – default risk tends to be higher in these types of loans. And you can’t trade your investment like you could a public stock, so your funds are locked in for the duration of the deal.

But you can invest in debt that has generated 15%+ APY that are largely uncorrelated with the stock and bond markets.

Final Word: Percent.com Review

Percent is one of the only places for accredited investors to invest in private credit deals without high minimums. Its easy-to-use marketplace makes it simple to find deals with just a few clicks.

Overall, as this Percent.com review has shown, if you’re an accredited investor looking to diversify your portfolio outside of public markets, Percent could be a great choice.

Note: Alternative investments are speculative and possess a high level of risk. No assurance can be given that investors will receive a return of their capital. Those investors who cannot afford to lose their entire investment should not invest. Investments in private placements are highly illiquid and those investors who cannot hold an investment for an indefinite term should not invest.

FAQs:

How to invest in private credit?

Previously, investing in private credit typically meant working with a wealth management firm. But now, platforms like Percent, offer accredited investors access to the private credit market. They also offer the Percent Blended Note to invest in a variety of private credit deals within one offering.

Why invest in private credit?

Private credit offers high yield potential with short-term durations, with deals historically offering up to 20% on average APY (or more) for issuing debt capital to corporate borrowers.

And Percent enables potential investors to see and compare available deals up front, where they can access comprehensive borrower, deal and market data before investing. After a deal closes, investors can rack performance and use surveillance reports to keep informed on performance and risks at every step.

Is Percent legit?

Yes, Percent is a legitimate business that has been around since 2018 and has funded over $1 billion in deals as of April 2024. Over 550 deals have been completed, with over $45 million in interest paid out to investors. Percent is also backed by some solid companies, including Coinbase, 10x Capital, and White Star Capital.

How does Percent Technologies make money?

Percent makes money by charging 10% on interest earned from individual deal plus a 1% fee for blended portfolio products. For example, on an individual deal earning 15%, the effective net APY after fees would be 13.5% They also charge fees to corporate borrowers and underwriters.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.