What’s so great about being an accredited investor?

The benefits of being an accredited investor are many. Aside from sounding cool, it can open up a lot of opportunities that aren’t available to the average retail investor — think private equity and venture capital.

It might have you wondering — what are the requirements to be an accredited investor?

Here’s some good news — if you have a certain level of income or net worth, you might already be an accredited investor without knowing it. We’ll get into the specifics later — and even if you don’t qualify via those standards, you can still attain accredited investor benefits in other ways.

Let’s discuss everything you want to know about how to become an accredited investor — What are the requirements to be an accredited investor? What’s the actual accredited investor definition? And more. Let’s go.

Invest like an Accredited Investor … Even if You’re Not

Echo Trade allows you to follow the investments of professional trading portfolios from top registered investment firms.

This “bolt-on” service links up to your existing brokerage account (Supported brokers include Robinhood and many more). With your subscription, you get real-time trade notifications, and trades are made on your behalf, automatically. You can also track portfolio positions and see real-time performance, with regular commentary.

Historically, this type of expertise has not been available to just anyone — it has been reserved for HNWIs. Now, Echo Trade lets you follow these experts and copy their trades for a fraction of the price of a professional advisor. Start your FREE 14-day trial now.

The Bottom Line: How to Become an Accredited Investor

First, let’s deal with accredited investor qualifications in the United States (Note: These are accredited investor requirements in 2024 and are subject to change.)

- Annual income of $200,000 or $300,000 if filing jointly with a spouse

- A net worth of $1 million, excluding the value of a primary residence

- Or, you must obtain a Series 7, Series 65, or Series 82 FINRA license

Increasing your annual income or net worth isn’t easy. Obtaining the aforementioned FINRA licenses isn’t a walk in the park either — but if you have the free time and an interest in finance, it could be a worthwhile pursuit.

Important note — even if you qualify via a FINRA license, the investments you gain access to still have high investment minimums. To cut a long story short, if you’re not earning $140,000 or more, I’d focus on increasing income and investing in traditional securities.

At-a-Glance: Best Accredited Investments

Platform | Asset | Expected returns | Minimum investment | Investor requirement |

|---|---|---|---|---|

Private companies | Varies | $25,000 | Accredited only | |

Private credit | 12% | $500 | Accredited only | |

Commercial real estate | 12-20% | $25K (Varies) | Accredited only | |

Real estate, art, VC, crypto, private credit, & more | 8-20% (Results may vary) | $10,000 | Primarily accredited | |

Farmland | 3-5% | $10,000 | Accredited only | |

Commercial real estate | 17% | $5K | Accredited only | |

Fine art | Varies | $10,000 | Accredited and non-accredited | |

Wine | 5.5 – 12% | $1,000 | Accredited and non-accredited | |

Residential properties | 8%-20% | $100 | Accredited and non-accredited | |

Commercial real estate | 6-8% | $5,000 | Primarily accredited |

* Based on historical data and/or company-stated target returns. Actual results may vary. This article should not be taken as investment advice. No investment offers a guarantee of returns. Your capital is at risk.

What is an Accredited Investor?

The accredited investor definition according to the SEC is an investor who is allowed (due to professional knowledge or income requirements) to invest in securities that are not publicly listed.

To be more precise, accredited investors can invest in hedge funds, venture capital, interval funds, and private equity — while regular retail investors cannot.

Why are accredited investors allowed to do this? Because the SEC considers them well-informed enough to be aware of all the risks. Why does the SEC hold that opinion? Because you have to meet the aforementioned criteria to qualify.

To reiterate, if you want to know how to become an accredited investor, you can qualify by meeting a certain level of annual income or net worth, or by taking the exams for one of 3 FINRA licenses.

The idea behind this designation is to protect investors from investing in risky ventures — at least until they are aware of the risks involved.

Why go through the trouble? Let’s discuss.

Are you already an accredited investor? Great news — there are all sorts of cool opportunities available to you. Click to learn about the best investments for accredited investors.

Benefits of Being an Accredited Investor

The primary benefit of being an accredited investor is that you get more options — apart from good old stocks, ETFs, and derivatives, you can invest in hedge funds, venture capital, or private equity. Apart from that, there aren’t any other benefits of being an accredited investor.

So, what if you want to invest in non-traditional assets, but don’t meet the criteria to qualify as an accredited investor?

You’re not out of options — you can still get access to some incredible alternative investment opportunities through platforms like Masterworks, which focuses on investing in fine art.

Income and Net Worth Requirements for Accreditation

There are a couple of ways to qualify for accredited investor status. First, let’s cover the most straightforward — income and net worth.

In terms of income, earnings over $200,000 for individuals, or $300,000 when filing jointly with a spouse (together with a reasonable expectation that the level of income will be maintained in the current year) can qualify you as an accredited investor.

The second path is through net worth — a net worth over $1 million, excluding the value of a primary residence, also affords you accredited investor benefits.

Alternate Paths to Becoming Accredited

If the income and net worth requirements seem out of reach to you, don’t worry — you have a couple more options to acquire the benefits of being an accredited investor.

Three, to be precise — you can qualify for a Series 7, Series 65, or Series 82 FINRA license. Holding any of these three licenses automatically qualifies you as an accredited investor.

Licenses to Become an Accredited Investor

- The Series 7 license qualifies an investor as a General Securities Representative and allows them to sell securities such as stocks and bonds. The test lasts for 3 hours and 45 minutes, the passing score is 72 out of 125 questions, and to enroll, a person has to be sponsored by a FINRA member firm. It is generally held to be the hardest FINRA license to obtain.

- The Series 65 license qualifies an investor as an investment adviser and focuses on topics like laws, regulations, fiduciary responsibilities, ethics, and portfolio management. The test lasts for 3 hours, a passing score is 94 out of 130 questions, and you don’t have to be licensed by anyone to take the test.

- Finally, the Series 82 license allows holders to sell private placement securities. Like Series 7, it requires sponsorship from a FINRA member firm.

To summarize, unless you’re already working professionally in finance, Series 65 is the most viable way to get accredited investor status.

It’s important to note that the answer to the question of how to become an accredited investor varies depending on where you live. Different countries have different accredited investor qualifications.

In Canada, for example, income requirements are the same as in the US — but qualifying via net worth requires at least $5 million, or $1 million in financial assets.

In the EU, a written test on financial knowledge is required, as well as at least two of three criteria:

- A financial portfolio worth more than 500,000 EUR

- At least one year’s experience working in the financial sector

- At least 10 large transactions on average per quarter, over the previous year

In Australia, net assets of A$2.5 million or a gross income of at least A$ 250,000 in the past two financial years qualify one as an accredited investor.

Pros and Cons of Being an Accredited Investor

Pros | Cons |

|---|---|

Wider array of opportunities | High investment minimums (usually) |

Potential for high returns | Liquidity risk |

Additional avenue for diversification | Higher investment risk |

Networking opportunities | Longer timeframe |

One of the biggest benefits of being an accredited investor? New ways to invest and diversify. You may also have access to opportunities that carry the potential for high returns that retail investors cannot access.

However, investments that require accredited investor status come with high investment minimums — ranging from $100,000 to $250,000 at the low end of the scale, to millions of dollars at the high end.

Knowing how to become an accredited investor and meeting the criteria often isn’t enough — as these investments can easily be out of reach even for those earning more than $200,000 a year.

These investments also take a while to play out — particularly in private equity and VC, where becoming profitable or going public can take years.

On top of that, since those investments don’t operate via publicly traded securities, there is significantly less liquidity in the investment.

Investment Opportunities for Accredited Investors

Now that you understand the benefits of being an accredited investor, let’s talk about some of the specific opportunities you might have access to:

Hiive – Invest in Private, Pre-IPO Companies

Hiive is a platform that allows accredited investors to fund employee stock option plans. In exchange, whenever a liquidity event (like an acquisition, merger, or IPO) happens, investors get a cut of the profits.

Although it is only available to accredited investors, one of the primary advantages of Hiive is accessibility.

Where investment opportunities for accredited investors come with high minimum investment requirements ( $100,000 to $250,000), Hiive has a much more modest minimum requirement — $25,000.

Some of the most promising startups of today are available via the platform — such as Stripe, Instacart, OpenAI, Reddit, Impossible Foods, and many others.

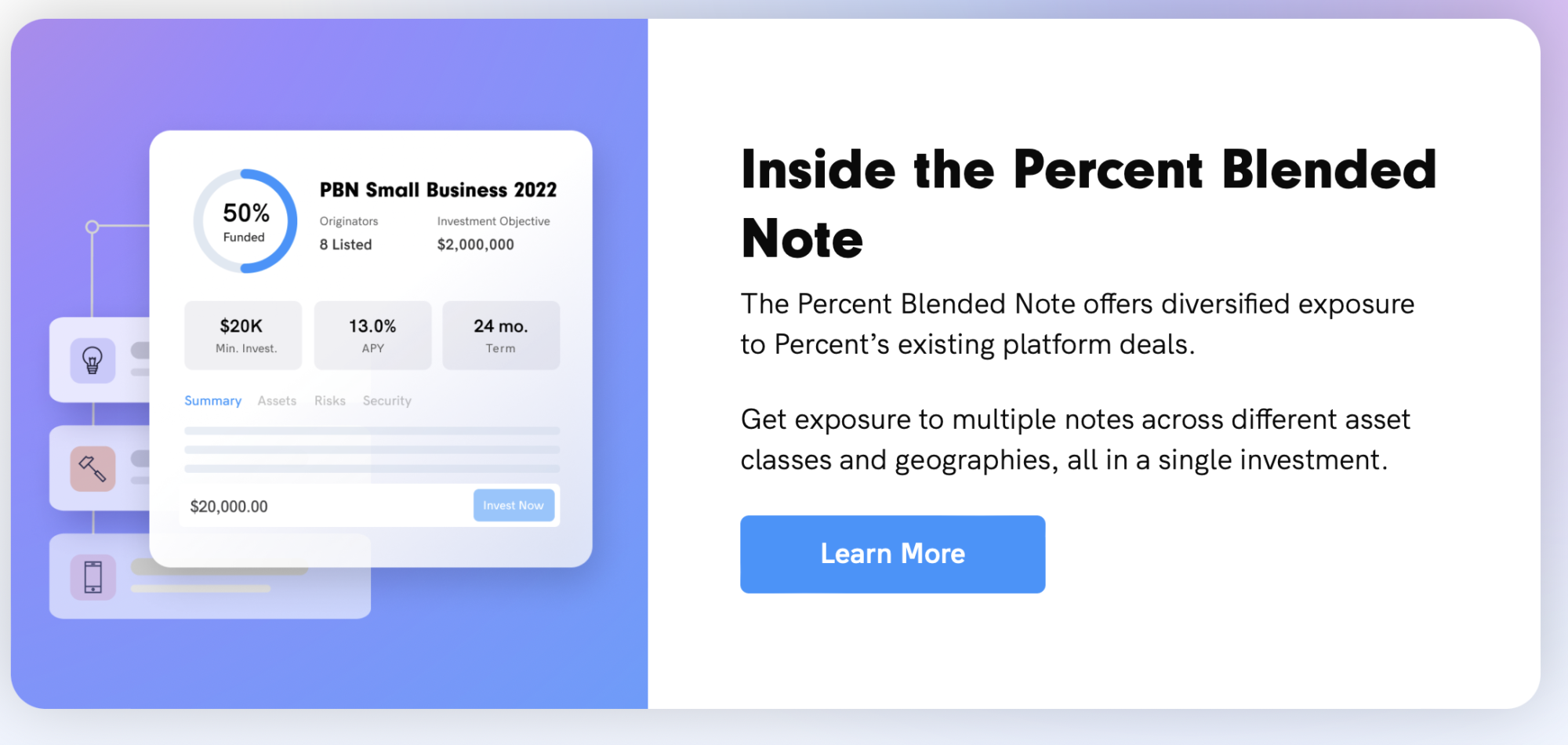

Percent – Invest in Private Credit

Percent allows accredited investors to gain exposure to private credit — basically, non-bank loans paid out to small businesses, start-ups, or consumers. This was once available only to large financial institutions — but with Percent, you can get in on the action for as little as $100.

The platform has paid out more than $28 million in interest payments since 2019, returns are averaging 18.13% APY as of December 2024, and the average duration of loans is 9 months.

You can choose between investing in particular loans or investing in the Percent Blended Note — which is in essence a collection of loans where you get built-in diversity within a single investment.

In terms of fees, investing in a specific loan comes with a fee equal to 10% of interest — for example, for an investment with 15% interest, the fee would be 1.5%, leaving you with 13.5% interest. The same fee applies to blended notes, as well as a special 1% management fee.

Last thing — for a limited time, you can get $500 off your first investment on Percent! Click below to find out more.

CrowdStreet

Crowdstreet is an investing platform for accredited investors that focuses on commercial real estate. As one of the biggest private equity real estate platforms, CrowdStreet has funded more than 700 deals worth a total of $3.9 billion.

The minimum investment requirement varies, although most offers start at $25,000. The average holding period for Crowdstreet investments is three to five years, and the average return is 19%.

If you’re not interested in particular deals, you can also invest in Crowdstreet funds that have a 1-2% management fee on an annual basis, and a recommended holding period of 5-7 years.

Although commercial real estate is a potential goldmine, CrowdStreet is suited to investors who have long timeframes and a healthy risk tolerance. On top of that, each individual project requires due diligence. If you meet those criteria, give it a closer look.

Investment Opportunities for Non-Accredited Investors

Not accredited yet? Don’t fret. There are still plenty of cool opportunities out there:

Vinovest

Did you know that the fine wine market tends to outperform the S&P 500 (1.88% per year over the last 15 years)? The folks over at Vinovest did know and decided to take advantage.

Vinovest is a platform that allows you to invest directly in fine wine and whiskey. You own the bottles and can buy, sell, or even have them delivered to your doorstep whenever you like. Vinovest takes care of the sourcing, storage, and insurance of the bottles.

After signing up, you choose one of three portfolio options — conservative, moderate, and aggressive, along with a timeframe. After that, a combination of human expertise and algorithms is used to construct a portfolio. The entire process lasts 2 to 4 weeks.

The platform has 4 client tiers, with the most accessible requiring a minimum investment of just $1,000. The advanced tiers give access to dedicated advisors, premium wines, and wine futures.

In terms of fees, Vinovest charges between 2.25% and 2.85%, along with a possible 3% early liquidation fee. The recommended holding period is 10 to 15 years.

Arrived

Arrived is another real estate investing platform — but unlike CrowdStreet, this one focuses on single-family homes.

The idea is simple — by purchasing a share in a home, you get all the benefits of being a landlord, but without the hassle and work associated with it.

That means regular quarterly dividends from rental income, as well as capital appreciation once the property is sold off (the holding periods vary from 5 to 7 years)

Arrived is a relative newcomer, having been launched in 2021 — but it has already managed to acquire more than 225 homes across 39 markets, worth more than $119 million in total. The platform currently has 464,000 investors and has paid out a whopping $1.2 million in dividends in 2022 alone.

Arrived Homes is available to both accredited and non-accredited investors — and the minimum investment requirement is just $100.

Final Word:

Becoming an accredited investor opens up quite a few interesting and enticing opportunities. Although those investments used to require huge minimum investments, the recent advent of alternative investment platforms has gone a long way in making things more accessible.

Increasing your earnings or net worth might not be achievable in a short timeframe — but if you already qualify, or can obtain one of the FINRA licenses, you shouldn’t ignore the unique opportunities presented to you.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy or security. Investing in private securities is speculative, illiquid, and involves the risk of loss. Not all private companies will experience an IPO or other liquidity event; past performance does not guarantee future results. WallStreetZen is not affilated with Hiive and may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive Markets Limited, member FINRA/SIPC.

FAQs:

How do you get approved as an accredited investor?

By meeting requirements pertaining to income ($200,000 annually or $300,000 for couples filing jointly), net worth ($1 million excluding primary residence), or by having one of three FINRA licenses (Series 7, Series 65, or Series 82).

How long does it take to be an accredited investor?

There is no average timeline for qualifying via income or net worth — in terms of acquiring a FINRA license, most candidates set aside 1 to 3 months to study for the exams.

What is the easiest test to become an accredited investor?

The Series 65 license test is the easiest test that you can take to qualify as an accredited investor, since the Series 7 and Series 82 licenses require being sponsored by a company.

What licenses make you an accredited investor?

Series 7, 65, and 82 licenses qualify an individual as an accredited investor.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.