Qualified purchaser vs accredited investor: What’s the difference?

These classifications are more than just titles; they determine the types of investments you can access.

Whether you’re aiming to diversify your portfolio with private credit or real estate syndications, recognizing which category you fall into is crucial.

Below, I’ll walk you through the definitions, criteria, and certification processes for both accredited investors and qualified purchasers. I’ll also share the specific investment opportunities available to each class, examine the regulatory differences, and discuss the benefits and risks associated with each designation.

Let’s start by defining what it means to be a qualified purchaser vs accredited investor.

A seldom-seen opportunity for accredited investors…

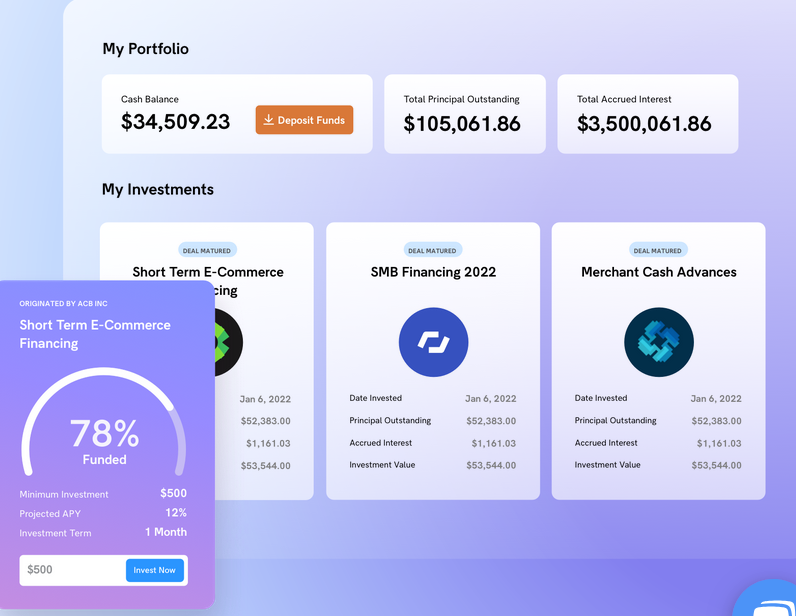

Until recently, private credit was an investment opportunity only available to ultra-wealthy and/or ultra-connected individuals. Thanks to Percent, that has changed.

Here’s what we love about this pioneering private credit investment platform:

- With exposure to a variety of debt, blended note portfolios, and low fees on individual deals, Percent is ideal for accredited investors looking to diversify into private credit investing.

- Percent has partnered with quality corporate borrowers, many of which originate loans to small businesses and consumers. Then, those syndicated loans are funded by you, the investor. You simply sign up, pick a private credit deal or blended deal you like, and invest.

- As of March 31, 2024, current average deal APY is over 16% and the average duration is 9.5 months. More than $45 million in interest has been paid out since 2019.

Accredited Investor vs Qualified Purchaser: Definitions and Criteria

Accredited Investor

Accredited investors are individuals or entities that meet certain financial criteria established by the Securities and Exchange Commission (SEC), allowing them to invest in private placements and other restricted securities.

These criteria ensure that accredited investors have the financial sophistication and ability to bear the risks associated with these types of investments.

Required reading: The Best Investment Opportunities for Accredited Investors

Income and Net Worth Requirements

To be considered an accredited investor, you have to meet either the income requirement or the net worth requirement below, not necessarily both.

Here are the details:

- Individual Income: An individual must have an annual income exceeding $200,000 (or $300,000 together with a spouse) for the last two years, with the expectation of earning the same or a higher income in the current year.

- Net Worth: An individual’s net worth must exceed $1 million, either alone or together with a spouse, excluding the value of the primary residence.

Licensing Criteria

You can also become an accredited investor without meeting the net worth or income requirements above if you have the appropriate professional licensure: a Series 7, 65, or 82 license.

Entities that Qualify

In addition to individual retail investors and professional license holders, other entities can also qualify as accredited investors.

Here are the most common:

- Individual Investors: Individuals meeting the income, net worth, or licensing requirements above.

- Financial Institutions: Banks, insurance companies, and registered investment companies.

- Employee Benefit Plans: If managed by a knowledgeable person or with total assets exceeding $5 million.

- Corporations, Partnerships, Trusts: With assets exceeding $5 million, not formed for the specific purpose of acquiring the securities offered.

Qualified Purchaser

Qualified purchasers are a step above accredited investors. That means they face even stricter financial criteria.

This classification allows access to more exclusive and potentially lucrative investment opportunities, often involving significant sums of money and complex financial instruments.

Net Worth Requirements for Individuals, Entities, and Institutions

- Individual investors must own $5 million or more in investments, either individually or jointly with a spouse, to become qualified purchasers.

- Family-owned companies must also have at least $5 million in investments.

- Entities managing investments must own and invest at least $25 million in discretionary investments to qualify.

- Qualified Institutional Buyers (QIBs) are institutions and include entities that meet the criteria under Rule 144A. These are typically large institutional investors like pension funds, insurance companies, and mutual funds. QIBs must manage at least $100 million in securities to qualify.

Certification Process

How to Become an Accredited Investor

There’s no formal agency or institution that confirms the accreditation of an investor. In other words, you don’t get any kind of formal certificate.

If you’re involved in an investment that requires you to be accredited, then it’s up to the firm in charge of the fund or investment vehicle to verify your status.

If you believe you meet the criteria for accreditation, you can approach a fund to request details on potential investment opportunities. The issuer of the securities will typically provide a questionnaire designed to verify your status.

This form will likely require attaching financial statements and documentation of other assets to confirm ownership as detailed in a balance sheet. Additionally, companies might review a credit report to evaluate any of your existing debts.

If you’re qualifying based on annual income, the submission of tax returns, W-2 forms, and other wage-related documents is usually necessary. Letters from certified public accountants (CPAs), tax attorneys, investment brokers, or financial advisors can also serve as supporting evidence.

Steps to Qualify as a Qualified Purchaser

Becoming a qualified purchaser requires higher financial thresholds and a more detailed verification process.

The first step is to ensure that you meet the required investment thresholds laid out above. You need to document all your investments in order to prove this. So get official documentation on your stocks, bonds, mutual funds, and other securities.

Common examples include brokerage statements, investment contracts, and corporate financial statements. Keeping these documents current and organized ensures that you can present a clear and verifiable picture of your financial health to any verifying entity.

Just like with accredited investors, there is no formal certification for qualified purchasers. Instead, the entities offering the investment opportunities will verify your status.

When you express interest in such investments, you will typically be required to complete a detailed questionnaire provided by the issuer. This questionnaire will ask for comprehensive information about your financial status, which is why having your documentation prepared and ready is so important.

Investment Opportunities

For Accredited Investors

- Private credit: You can also explore lending money to private companies or individuals through private debt funds or lending platforms like Percent. These investments typically offer regular income through interest payments but involve credit risk and potential illiquidity.

- Pre-IPO companies: Accredited investors can invest directly in private companies or through platforms like Hiive. These investments can offer significant returns but may be less liquid than other types of investments than, say, publicly-traded stocks or ETFs. Platforms like Hiive facilitate these types of investments, allowing you to invest in companies like Binance or Juul.

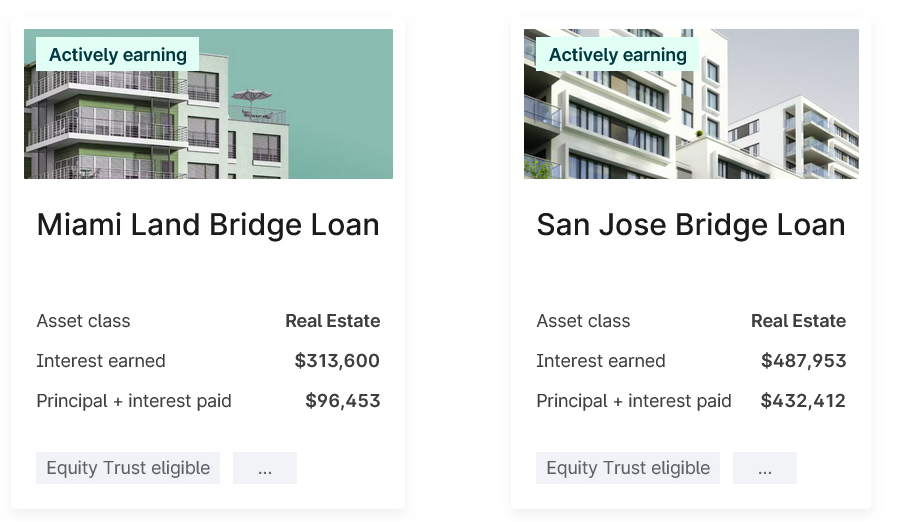

- Real estate syndications: In real estate syndications, multiple investors pool their funds to invest in real estate projects. These investments can provide rental income, potential capital appreciation, and tax benefits. However, they do come with risks related to property management and market fluctuations. These and other kinds of unique real estate investments, like bridge loans, are available to accredited investors on Yieldstreet:

- Hedge funds: Hedge funds employ a variety of strategies to generate returns, such as long and short positions, leverage, and derivatives. They often require substantial minimum investments and operate with less regulatory oversight, allowing for more aggressive investment tactics.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy or security. Investing in private securities is speculative, illiquid, and involves the risk of loss. Not all private companies will experience an IPO or other liquidity event; past performance does not guarantee future results. WallStreetZen is not affilated with Hiive and may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive Markets Limited, member FINRA/SIPC.

For Qualified Purchasers

Qualified purchasers have access to even more exclusive investment opportunities, often involving larger capital commitments and sophisticated financial instruments. Here are some of the options available:

Exclusive Private Funds

These specialized investment funds require high minimum investments and often target niche markets or high-growth sectors. They provide unique opportunities that are typically not available to accredited investors, allowing for tailored investment strategies and potential high returns.

For example, Blackstone Group offers private equity funds that are only accessible to qualified purchasers, focusing on high-value investments across various industries.

Related reading: Discover the 7 Top Largest Private Credit Funds here.

Specialized Investment Vehicles and Venture Capital

Qualified purchasers can invest in complex financial instruments and strategies designed for sophisticated investors. This includes venture capital funds, large-scale real estate projects, and proprietary trading funds.

These investments often involve significant capital and offer the potential for substantial returns through targeted and sophisticated investment strategies.

For instance, Sequoia Capital offers venture capital funds that invest in high-growth tech startups, accessible only to qualified purchasers.

Regulatory Differences

Accredited Investors

Accredited investors are typically limited to participating in 3(c)(1) funds due to the 100-investor limit.

These funds are private investment vehicles that are exempt from registration under the Investment Company Act of 1940. They’re limited to 100 accredited investors.

The restriction to a maximum of 100 investors allows these funds to avoid the more stringent regulations that apply to public investment companies, giving them greater flexibility in their investment strategies.

These funds offer access to a variety of private investment opportunities, including private equity, hedge funds, and real estate syndications.

Qualified Purchasers

Qualified purchasers can participate in both 3(c)(1) and 3(c)(7) funds. 3(c)(7) funds aren’t limited to the 100 investor limit that 3(c)(1) funds are. Instead, 3(c)(7) funds can have an unlimited number of qualified purchasers.

Since qualified purchasers can invest in 3(c)(7) funds, this allows them to invest in venture capital and other more exclusive options.

Benefits and Risks

Investing as a qualified purchaser vs accredited investor comes with both benefits and risks.

When it comes to benefits, one that stands out is diversification. Both accredited investors and qualified purchasers can diversify their portfolios with unique investment opportunities that aren’t available to the general public.

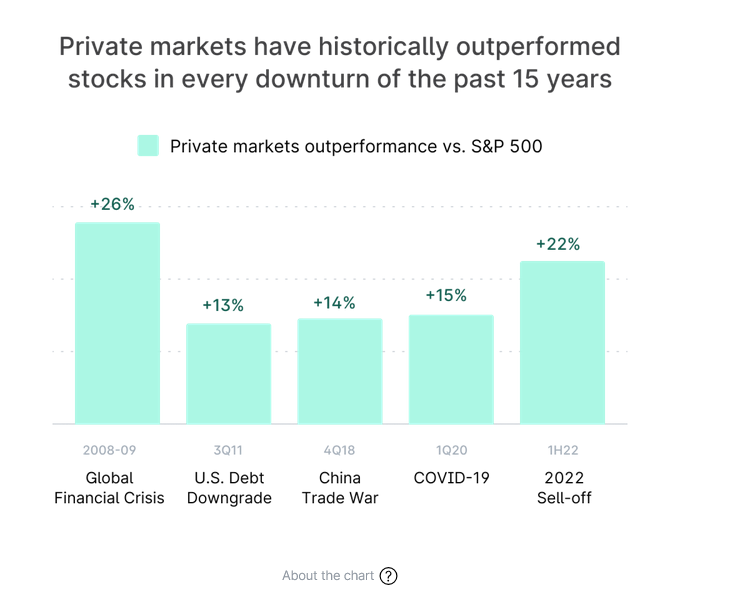

With these exclusive investments comes the potential for higher returns, too. Some hedge funds can outperform the broader market.

Other private investments can outperform during downturns, helping hedge your portfolio:

Private equity and venture capital investments can yield substantial profits if their underlying companies perform well, too, especially if investors get in early.

For example, Airbnb and Uber didn’t even IPO on the public markets until relatively recently. By the time Airbnb went public, it was nearly worth $100 billion already. If you had identified it as a good investment before then, the only way to invest would have been privately.

That said, private investments come with risks too. Investments in private equity and hedge funds are much less liquid than other markets, often requiring you to lock up funds for at least a few years.

Venture capital is notorious for being highly volatile and risky. 80% or 90% of companies funded by venture capital will not make it to the IPO stage, and as many as 90% of startups fail.

There’s also the risk of opportunity cost: while these investments may outperform the broader stock market, there are no guarantees.

Not an accredited investor or qualified purchaser (yet)?

Consider Fundrise. This investment service, which is available to all investors (no accreditation required) allows you to invest in private, diversified real estate and private credit funds. Now, they’ve expanded into innovative technology.

Choose a customized investment plan based on your goals and risk tolerance, or choose from Fundrise funds such as the Flagship Fund (real estate), the Income Fund (real estate credit opportunities), and the new Fundrise Innovation Fund, an investment vehicle focused on backing high-growth, technology-driven companies poised to drive future innovation.

One thing we really love about Fundrise? With a minimum of $10, this service is accessible to a wide variety of investors. (Check out the full Fundrise review here.)

Note: We earn a commission for this endorsement of Fundrise.

Final Word

Becoming an accredited investor or qualified purchaser is a big milestone. The requirements to do so are significant, but the good news is that they’re also very clearly defined.

If you’re dead-set on investing in private equity, certain real estate deals, or venture capital, then becoming an accredited investor or qualified purchaser is an important first step.

Now that you know the difference between a qualified purchaser vs accredited investor, you’re well on your way to getting started. Just make sure to research your investments and make sure they align with your overall risk tolerance.

FAQs:

What is the difference between a qualified purchaser and an accredited investor?

The difference between an accredited investor vs qualified purchaser investor is the level of financial qualification, with qualified purchasers needing at least $5 million in investments, compared to the lower thresholds for accredited investors.

This allows qualified purchasers access to more exclusive investment vehicles, such as 3(c)(7) funds.

Is a qualified client an accredited investor?

A qualified client is not necessarily an accredited investor; they are distinct categories with different requirements. However, some qualified clients may meet the criteria to also be considered accredited investors.

What is the difference between a Qib and an accredited investor?

The difference between a Qib (Qualified Institutional Buyer) and an accredited investor is that QIBs are typically large institutional investors with at least $100 million in securities, while accredited investors can be individuals or entities with lower financial thresholds.

QIBs have access to certain institutional investment opportunities not available to accredited investors. This is a major difference between an accredited investor vs qualified purchaser like a QIB.

What qualifies you as an accredited investor?

To qualify as an accredited investor, you must have an individual income exceeding $200,000 (or $300,000 with a spouse) for the past two years or a net worth over $1 million, excluding the value of your primary residence.

Certain professional certifications or entities with substantial assets also meet the criteria.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.