It’s 2025 – you can do just about everything on your phone, including investing.

There are countless stock trading apps (including some free stock trading apps) to choose from but only a handful are worthy of your consideration. I’ve tried them all so you don’t have to.

In addition to being able to buy and sell shares with no commissions, the best investment apps give you:

-

- A simple user interface that’s easy to navigate

- Investment research material and news to help guide your investment decisions,

- A portfolio tracker that gives insights into your stock holdings

I’ve spent the last 5 years working at various fintech companies and have personally used and reviewed nearly every top stock app on the market.

Here’s my list of the 11 best stock brokerage apps for buying and selling stocks in 2025.

I’ll include an overall rating of the app and all of the relevant information you need, like account fees, account minimums, assets covered, and what type of investor each app is best for. Let’s go:

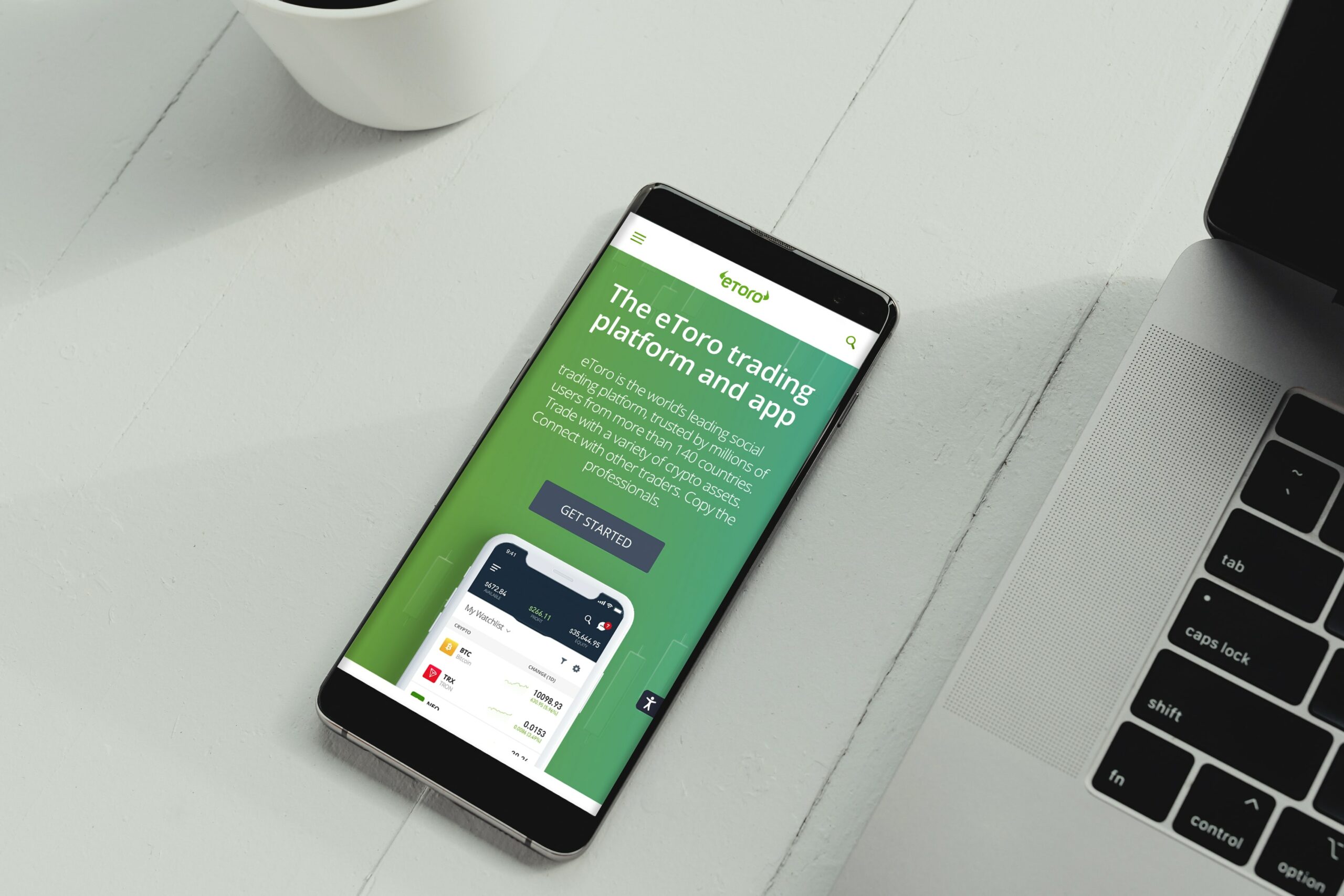

1. eToro – The Best Overall Stock Trading App

Overall rating: ⭐️⭐️⭐️⭐️⭐️

Best for: eToro is the best stock trading app overall.

Assets covered: Stocks, ETFs, cryptocurrencies, currencies (except US), and commodities (except US).

Commissions/Fees: $0 commissions for stocks and ETFs

Minimum deposit: $50 USD (depending on your residency)

Advantages:

- Commission-free trading for stocks and ETFs

- Multiple assets

- Supports international accounts

- CopyTrader

- Social investing

- Demo account

About eToro

eToro is the single best app to buy stocks for most users because it offers access to stocks, ETFs, cryptocurrency, and other assets regardless of where you live in the world (with some exceptions in the US).

Its set of features and user interface makes it useful for complete beginners, experienced traders, long-time buy-and-hold investors, and everyone in between.

eToro boasts more than 20 million users across more than 140 countries. Leveraging its wide and experienced user base, its Social Trading feature allows you to communicate with other investors and stay on top of the latest market trends and sentiment.

If you’re a new investor, CopyTrader allows you to see the performance data of experienced investors and copy their portfolios. Additionally, eToro’s stock simulator provides you with $100,000 of virtual money to hone your investing skills so you can familiarize yourself with the market before investing any of your own funds.

For more experienced investors and traders, eToro allows you to buy and sell multiple asset classes and invest in markets all over the world.

Simply put, eToro is the most complete brokerage.

Opening an account with eToro is fast and easy. Hit the link below and start investing today!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

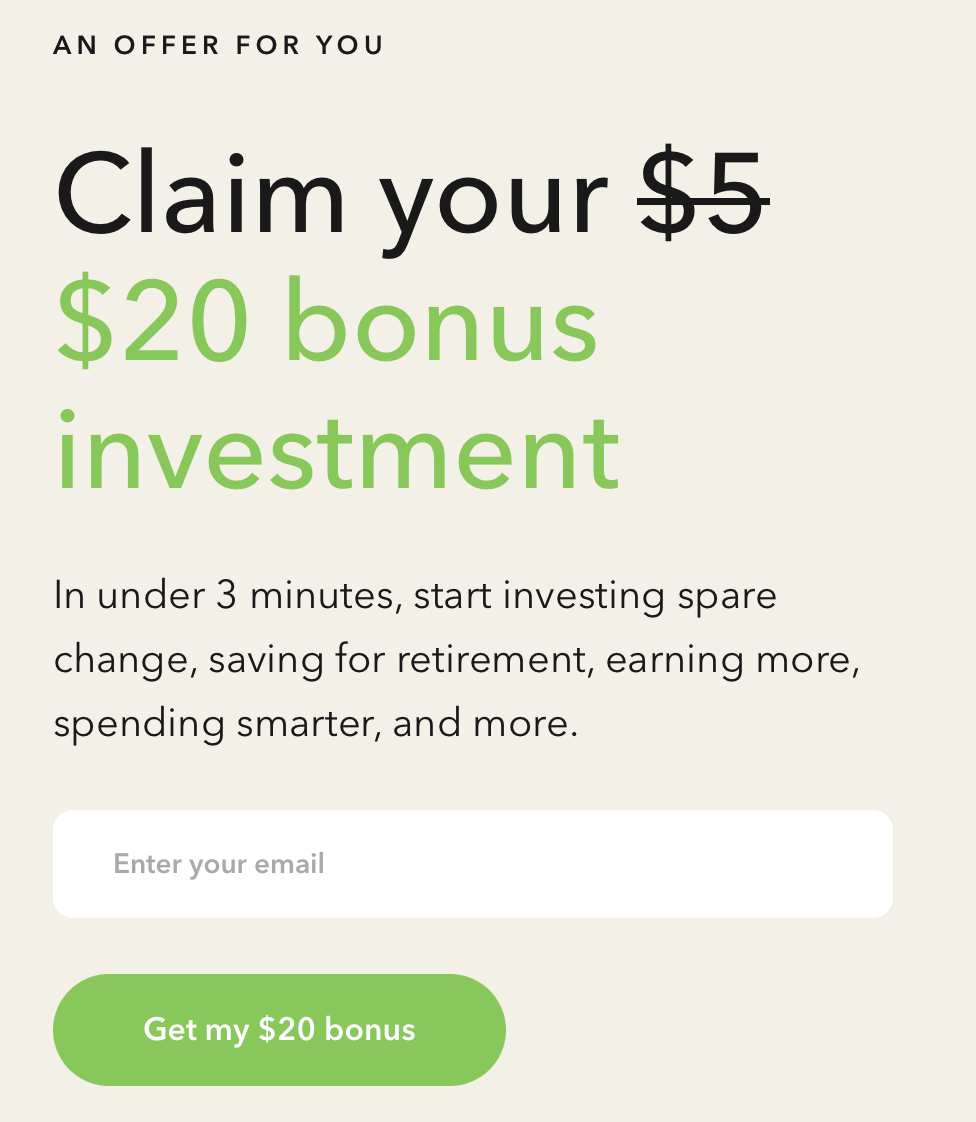

2. Acorns – The Best Robo-Advisor Stock Trading App

Overall rating: ⭐️⭐️⭐️⭐️⭐️

Best for: Acorns is best for beginner investors with no cash to invest.

Assets covered: Stocks, bonds, cash equivalents, real estate, commodities, and cryptocurrency.

Commissions/Fees: $3/month

Minimum deposit: None

Advantages:

-

- Automatically deposit very small sums

About Acorns

Acorns is one of the best investing apps for beginners. It uses software to automate your finances instead of forcing you to rely on your willpower to build your portfolio.

The platform allows you to link up your account with your bank account / debit card and make the most of your spare change by “rounding-up” your purchase amounts and investing the difference.

Say you buy a coffee for $3.57. If the transaction is rounded up to $4.00, and the extra 43 cents is added to your Acorns account. In the course of a month these small contributions can easily add up to $20 or more.

That money is then automatically invested into a plan based on your risk tolerance and objectives, which are determined through a series of questions when you open your account.

With the ability to invest small amounts like this, Acorns makes it easy to start investing even if you’re living paycheck to paycheck. After signing up for the app, you’ll hardly notice those tiny additions to your transactions.

Of course, spare change isn’t the only way to invest on Acorns. For instance, I have a recurring $80 weekly investment in addition to employing the Round-Ups feature.

The one complaint I have about Acorns is the $3 monthly fee. However, as my account has grown, so have my dividends. However, now that I have a larger account (over $20,000), my monthly dividends usually pay more than enough to cover the monthly fee. That helps me get over the mental hurdle since dividend money feels like a bonus anyway.

Right now, you can claim a $20 FREE investment on Acorns — click below for more info.

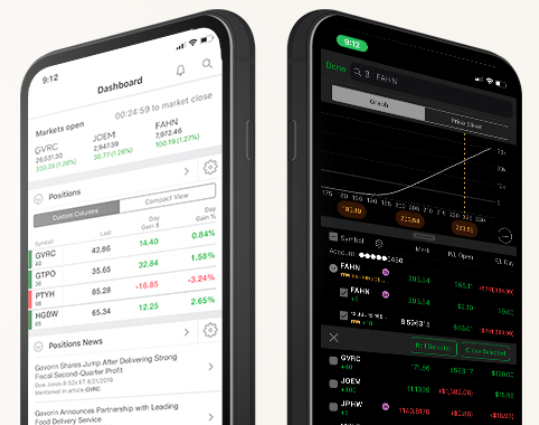

3. moomoo – The Best Stock Trading App for Free Stocks

Overall rating: ⭐️⭐️⭐️⭐️⭐️

Best for: moomoo is an all-around fantastic app for beginner and intermediate traders who are interested in stocks, options, and ETFs.

Commissions/fees: See the latest transaction fees on the moomoo website

Minimum deposit: $0

Advantages:

- Commission-free stock trading

- Amazing promo

- User-friendly

- Free Level 2 data

About moomoo

moomoo is one of our favorite new brokerages. It’s user-friendly, it’s crammed with educational resources, and it has two very compelling promos for new users on its site.

First up? You can get up to 30 FREE stocks when you sign up. Minimum balance terms and conditions apply — click here to find out more.

Plus, for a limited time, you can get up to 8.1% APY on your uninvested cash. Considering that the average savings account offers under 1% annually, that’s certainly a worthwhile promo.

Even after you’ve taken advantage of the promos, there’s a lot to like about moomoo.

For one, it’s brimming with features that will appeal to beginners and more advanced traders.

In addition to commission-free trading, you can get access to real-time Level 2 Market Data for free and gain access to moomoo’s Earnings Calendar and Earnings Hub to stay on top of upcoming announcements. You can also try out strategies with its paper trading module.

Plus, its excellent charting offers technical indicators, drawing tools, custom indicators, and more.

How to find stocks before they explode…

With a Zen Investor subscription, you can save precious research time by letting a 40+ year market veteran do the heavy lifting for you. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

4. M1 Finance – The Best Stock Trading App for Automation

Overall rating: ⭐️⭐️⭐️⭐️⭐️

Best for: M1 Finance is the best stock app for beginner and intermediate investors who want to passively invest in individual stocks and ETFs.

Assets covered: Stocks, ETFs, and a few cryptocurrencies.

Commissions/Fees: None

Minimum deposit: $100

Advantages:

-

- M1 Pies

- Commission-free trading

- Simple dollar-cost-averaging

About M1 Finance

M1 Finance has a beautiful design and was created with one goal in mind: Helping you build long-term wealth. It does this with built-in automations and an interface that helps you ignore the market’s daily fluctuations.

M1 Pies allow you to set a target portfolio mix. Each time you make a new deposit (which you can automate), the app will automatically buy the correct amount of each position in your portfolio to keep your portfolio mix in balance.

Let’s say your portfolio consists of 25% AAPL, MSFT, TSLA, and VT, and you have a $500 auto-deposit scheduled once per month. After your auto-deposit, M1 Finance will automatically divide the $500 into 4 slices and buy $125 worth of AAPL, MSFT, TSLA, and VT. You can do this each month without lifting a finger.

You can also rebalance your accounts whenever your portfolio mix becomes out of alignment.

In addition to offering individual brokerage accounts, M1 Finance allows retirement accounts like traditional and Roth IRAs, SEP IRAs, and Trust accounts.

Like eToro, M1 Finance offers a social investing feature. You can easily share the link to your Pies to show your friends exactly what you’re invested in.

The company has also offered features to tackle all of your money needs: Loans, checking accounts, and debit cards. These features are backed by SIPC and FDIC insurance.

Want to learn more? Ready our full M1 Finance review.

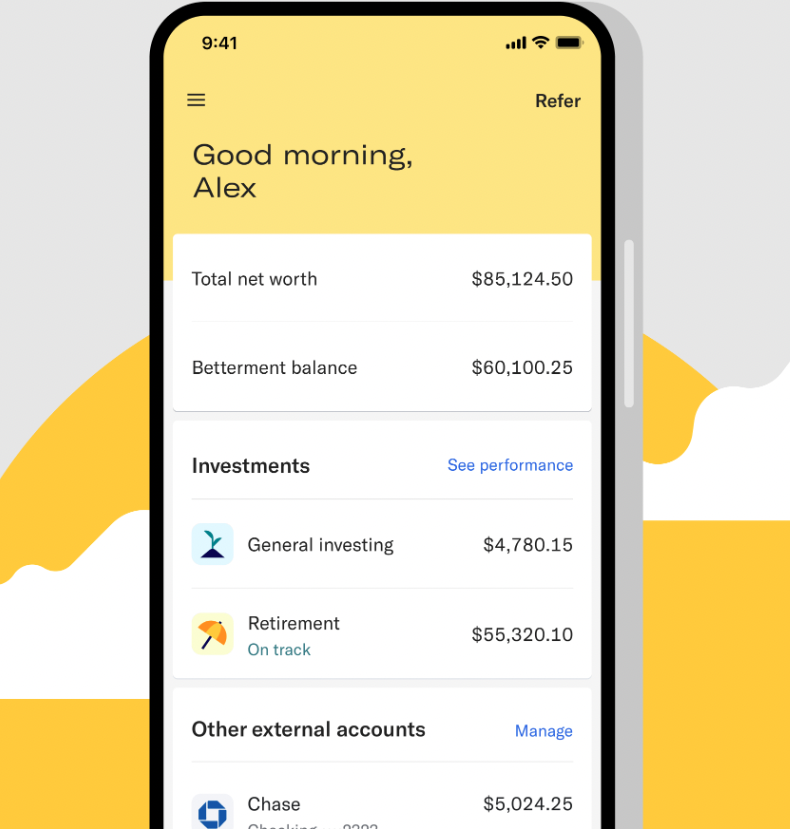

5. Betterment – Another Great Robo-Advisor Stock Trading App

Overall rating: ⭐️⭐️⭐️⭐️

Best for: Betterment is the best stock market app for anybody who wants a completely hands-off approach to their investing and saving.

Assets covered: ETFs

Commissions/Fees: 0.25% annual fee

Minimum deposit: $10

Advantages:

- Automated investing

About Betterment

Not everyone wants to be an investment expert.

If you don’t want to figure out your own asset allocation, asset location, risk/reward profile, and the myriad other barriers to setting up your own investment portfolio, Betterment is for you.

In minutes, you can complete Betterment’s survey of how much you’re investing, what your goals are, your timing, and how conservatively you want to invest.

Betterment takes it from there.

It will create a portfolio of low-cost, diversified ETFs that gives you the best chance of reaching your long-term goals based on the survey you filled out. From there, you can set up auto-deposits that will be automatically applied to your portfolio.

Betterment charges just 0.25% on the assets you have invested with them ($25 for every $10,000).

Here’s the deal: Betterment provides 95% of what a good financial advisor will do for you for 25% of the cost (and puts you in the driver seat).

Even as an avid investor and finance major, Betterment is a compelling option that I’ve strongly considered. If you’re not interested in becoming a finance nerd, I cannot recommend Betterment enough.

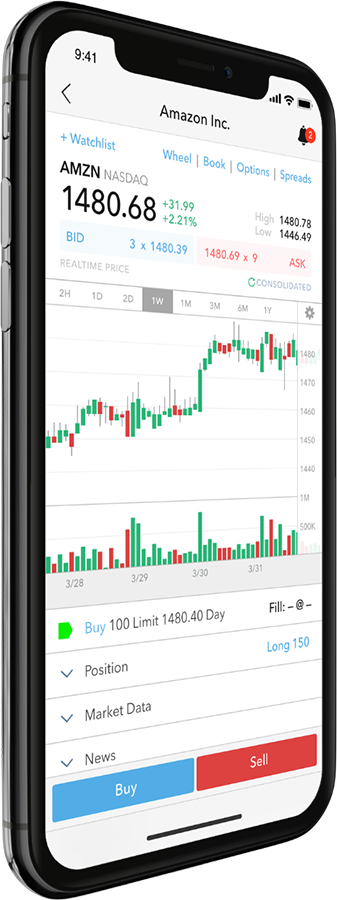

5. thinkorswim – The Best Stock Trading App for Day Traders

Overall rating: ⭐️⭐️⭐️⭐️⭐️

Best for: thinkorswim is the best stock app for day traders.

Assets covered: Stocks, bonds, options, futures, ETFs, and more.

Commissions/Fees: None

Minimum deposit: None

Advantages:

- Charting tools

- Commission-free trading

About thinkorswim

thinkorswim has a user base that is the exact opposite of Betterment’s: It is for active, day-trading stock pickers. It was rated as one of the best day trading platforms for 2025.

Somehow, TD Ameritrade was able to cram the vast majority of the features of its desktop platform into an app and still make it extremely user friendly.

You can chart with drawing tools, add volume and momentum indicators, check time and sales data, and execute orders from inside the app.

Plus, you can place trades from directly within the app (assuming you have a TD Ameritrade account).

If you’re a day trader and want to use a mobile app, there’s really no other viable option.

Read more: thinkorswim vs TradingView

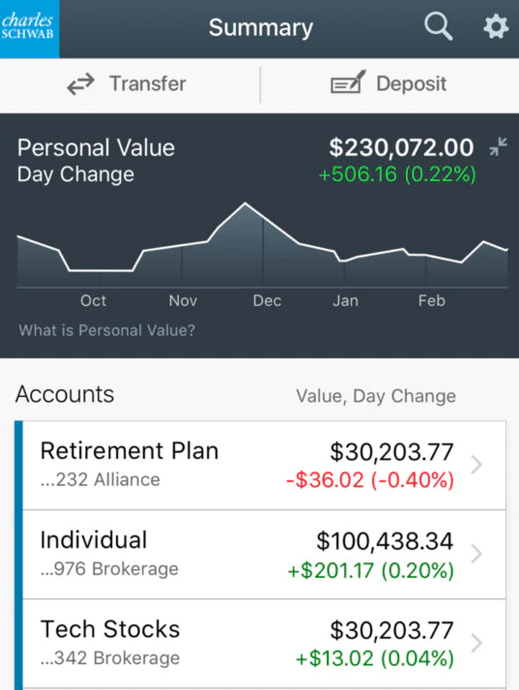

6. Charles Schwab

Overall rating: ⭐️⭐️⭐️⭐️

Best for: Schwab is the best stock trading and investing app for Schwab account holders and for those in or near retirement age.

Assets covered: A variety of investment options, including stocks, bonds, options, futures, ETFs, and more.

Commissions/Fees: None

Minimum deposit: None

Advantages:

- Portfolio dashboard

- Commission-free trading

- Investment research

About Charles Schwab

Like Fidelity, Schwab is another broker that I wouldn’t necessarily ditch for another option, but wouldn’t choose it over the top choices above.

Schwab’s primary advantage is in the retirement space.

Many of its portfolio analysis tools and other features were built with retirees in mind. Plus, its web-based dashboard is easily navigable and simple to use.

There’s nothing wrong with Schwab – it’s a very strong brokerage, has an excellent reputation, and also receives excellent marks for customer service.

Unless the mobile experience is extremely valuable to you, I wouldn’t move my money out of Charles Schwab.

7. Fidelity

Overall rating: ⭐️⭐️⭐️⭐️

Best for: Fidelity is the best stock trading app for Fidelity account holders.

Assets covered: Stocks, bonds, options, futures, ETFs, and more.

Commissions/Fees: None

Minimum deposit: None

Advantages:

- Portfolio dashboard

- Commission-free trading

- Investment research

About Fidelity

If you’re choosing a legacy broker to set up an investment account with and are deciding based on mobile apps, choose TD Ameritrade. If you already have a Fidelity account or still make most of your trades on your computer, Fidelity is a solid second option.

Fidelity has the same feature set as TD Ameritrade and gives investors access to the same asset classes. It may be the case that you prefer Fidelity’s interface over TD’s – if that’s true, go ahead and use Fidelity.

However, Fidelity lacks a comparable trading tool to TD’s thinkorswim platform, so day and swing traders are better off opening an account with TD. Additionally, although it has its own educational content, it lacks the breadth of knowledge you’ll find on TD. For more information, check out our complete Fidelity vs TD Ameritrade comparison.

8. Interactive Brokers

Overall rating: ⭐️⭐️⭐️

Best for: Interactive Brokers is a great trading app for swing traders.

Assets covered: Stocks, bonds, options, futures, ETFs, and more.

Commissions/Fees: None

Minimum deposit: $100

Advantages:

- Trading tools

- Commission-free trading

About Interactive Brokers

Interactive Brokers was built specifically for active investors with a good amount of trading experience – its layout and feature-set is not beginner-friendly.

The brokerage serves a very niche group of traders. If you’ve looked up reviews and think it may be the right choice for you, chances are you’re right.

Interactive Brokers puts function over form though – its site (and especially its app) are difficult to navigate. You should have a very firm understanding of the exact trades you’re placing and anticipate a learning curve when you first start using IB.

(IBKR also ranks #4 on our list of the Best Short Selling Brokers.)

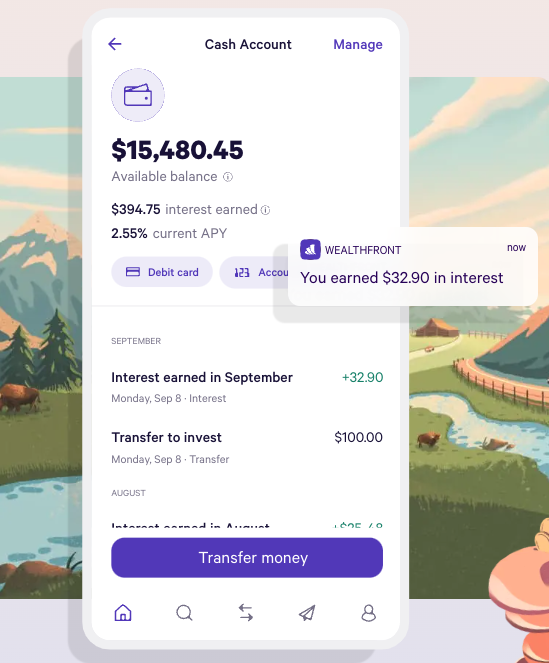

9. Wealthfront

Overall rating: ⭐️⭐️⭐️

Best for: Wealthfront is the best alternative to Betterment.

Assets covered: ETFs

Commissions/Fees: 0.25% annual fee

Minimum deposit: $500

Advantages:

- Automated investing

About Wealthfront

Wealthfront offers a nearly identical solution to Betterment – I prefer Betterment.

Although the exact process may look a little different, the goal of the 2 services is the same: Automated savings and investing.

I prefer Betterment’s investments and user interface. Betterment’s minimum is also just $10, compared to Wealthfront’s much higher $500.

However, if the account minimum isn’t an issue, many Wealthfront users swear by the service – you really won’t go wrong with either option.

In any case, I’m a huge advocate for robo advisors – these services provide at least 10x the value that they charge, much more in some cases.

10. tastyworks

Overall rating: ⭐️⭐️⭐️

Best for: tastyworks is the best stock trading app for non-stock traders.

Assets covered: Options, futures, commodities, stocks, ETFs, indices, and cryptocurrencies.

Commissions/Fees: None

Minimum deposit: None

Advantages:

- Asset classes covered

- Charting tools

- Commission-free trading

About tastyworks

tastyworks as a platform is very similar to Interactive Brokers – while it may be a niche brokerage, it has an incredibly loyal user base.

tastyworks was built by active traders for active traders. The founding team are all experienced traders who weren’t 100% happy with the available solutions – so they made their own.

In fact, this is the team that built thinkorswim which was later acquired by TD Ameritrade for $750 million.

It’s a very strong trading platform and deserves a spot on this list.

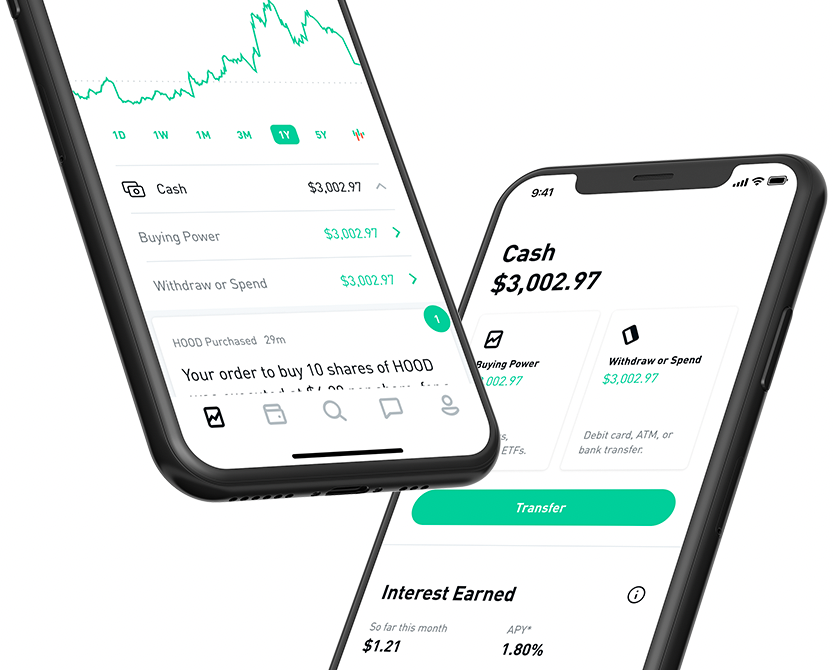

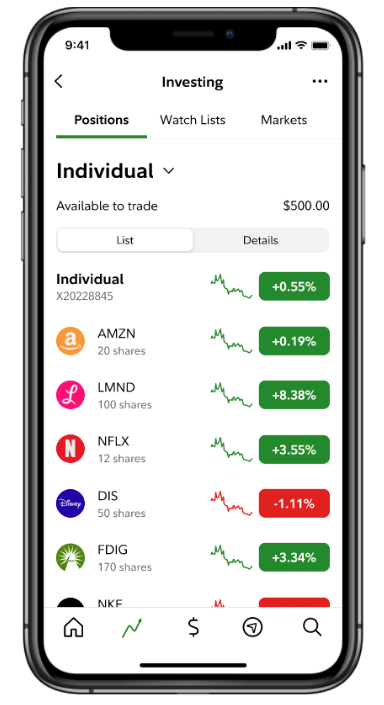

11. Robinhood

Overall rating: ⭐️⭐️⭐️

Best for: Robinhood is one of the best investment apps for beginners to get started investing.

Assets covered: Stocks, options, cryptocurrencies, and ETFs.

Commissions/Fees: None

Minimum deposit: None

Advantages:

- Easy to use

About Robinhood

Robinhood is one of the best mobile trading apps.

It was built for new investors and is the best app for buying and selling stocks from their mobile device. It accomplishes this goal exceptionally well.

While it’s a great app to get new people excited about and investing in the stock market, Robinhood is severely limited.

Robinhood only offers individual brokerage accounts – there is no way to open a retirement account. As more experienced investors know, taxes can play a massive role on your long-term investing returns and add significant drag to your portfolio.

Additionally, Robinhood’s “slot-machine” feel, while exciting, will most likely hinder your long-term returns. It makes it easy to dive into options without knowing about the safest options strategies.

Robinhood is great for new investors but should be replaced quickly by an app higher on this list. Check out eToro vs Robinhood for a full comparison.

Learn how to withdraw money from Robinhood.

Final Word: The 11 Best Stock Apps for Stock Investing

That’s a wrap on my 11 best stock trading apps for buying and selling stocks in 2025.

Note the top 5 choices, each of which receives a full 5 stars and represents the best app for that particular category. In this sense, those top 5 choices are all ranked #1, each in their own category.

That said, eToro is my #1 choice overall because of its mass appeal – it’s the best option for most investors.

I have personally used every single brokerage app on this list of the best apps to buy and sell stocks and the rankings reflect my opinion on each.

The innovation in stock investing in the last 10 years has been incredible and, as investors, we get to benefit from the technology. Choose the one that fits your needs best and start investing today.

FAQs:

What is the best stock app to use?

eToro is the best stock app to use.

It has the best suite of features for domestic and international investors who want access to stocks, ETFs, cryptocurrencies, commodities, and currencies in an easy-to-use mobile app.

Which app is better for stock trading?

eToro is the best app for stock trading.

Domestic and international investors get access to stocks, bonds, ETFs, cryptocurrencies, commodities, and currencies in a simple app you can take with you wherever you go.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our June report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.