If you’ve set up a Robinhood account, you’ll know it’s easy-peasy to send your first deposit.

But what about withdrawing money from Robinhood?

While it’s not difficult to get money off of the platform, the deets on how to withdraw from Robinhood aren’t as upfront as how to deposit during sign-up.

Ready for a new broker?

Invest in invest in 7,000+ instruments with advanced trading tools on eToro.

In my opinion, it’s as easy to use as Robinhood, but geared more toward serious investors.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

But don’t worry! Your funds aren’t locked forever on this brokerage app.

You just need to learn a few simple steps on how to pull money off of Robinhood.

Let’s talk about how to cash out on Robinhood:

How to Withdraw Money From Robinhood: What You Need to Know

Robinhood makes it a little tricky to find the withdrawal option, but there is a way to get here.

Once you’re savvy to this platform’s icons, it’ll become second nature to transfer money from Robinhood to a bank.

Before we get started, ensure you already have a bank account or debit card linked to your Robinhood account.

If you don’t and you’re looking for a convenient, mobile-friendly bank account, consider checking out our previous Chime review.

How to Withdraw Money From Robinhood on Your Phone

It doesn’t matter if you’re on team Apple or Android; withdrawing money from the Robinhood mobile app follows the same process:

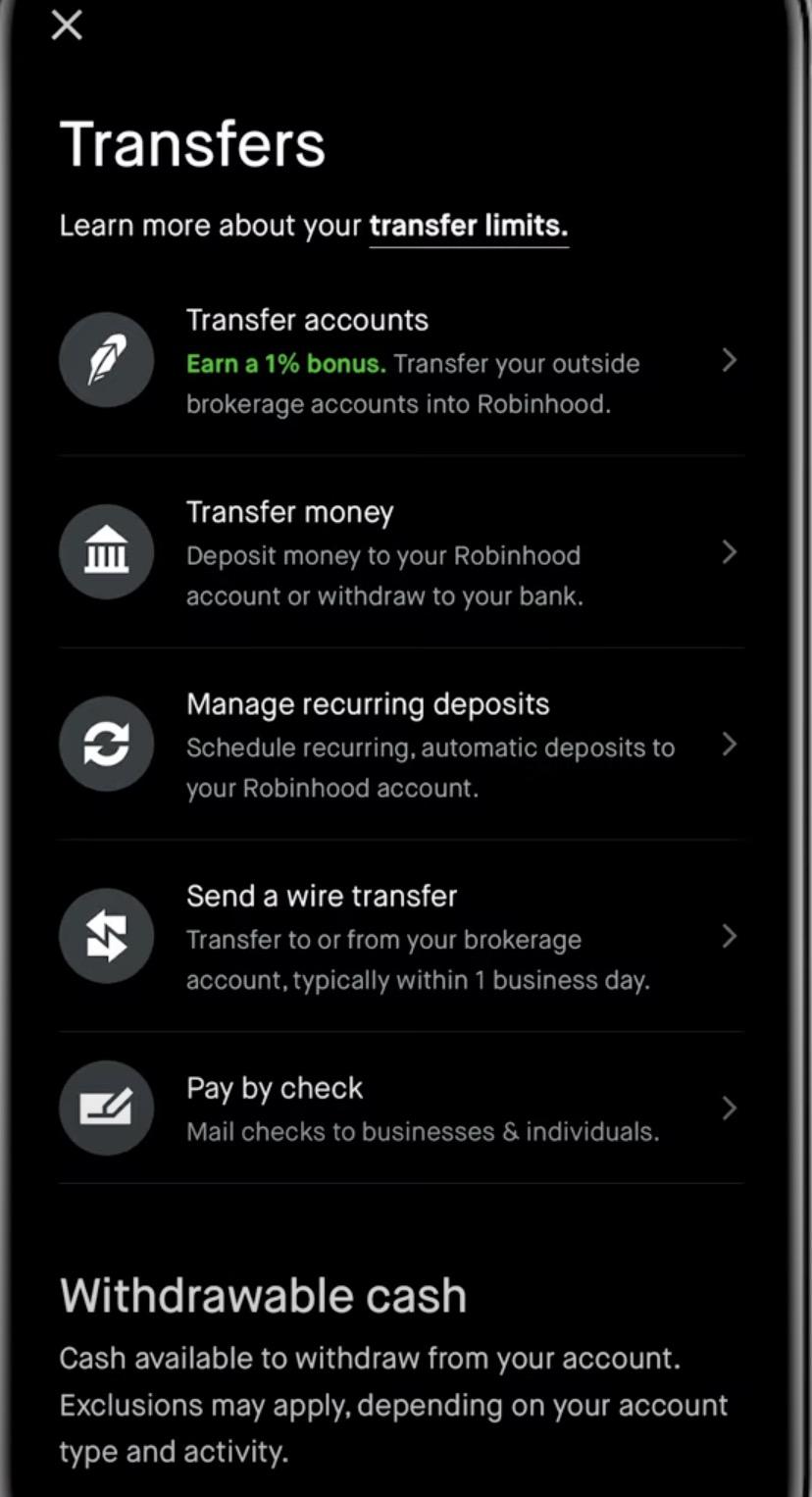

- Tap “Account” (the person icon on the bottom right)

- Select the three-line menu in the top left

- Tap “Transfers”

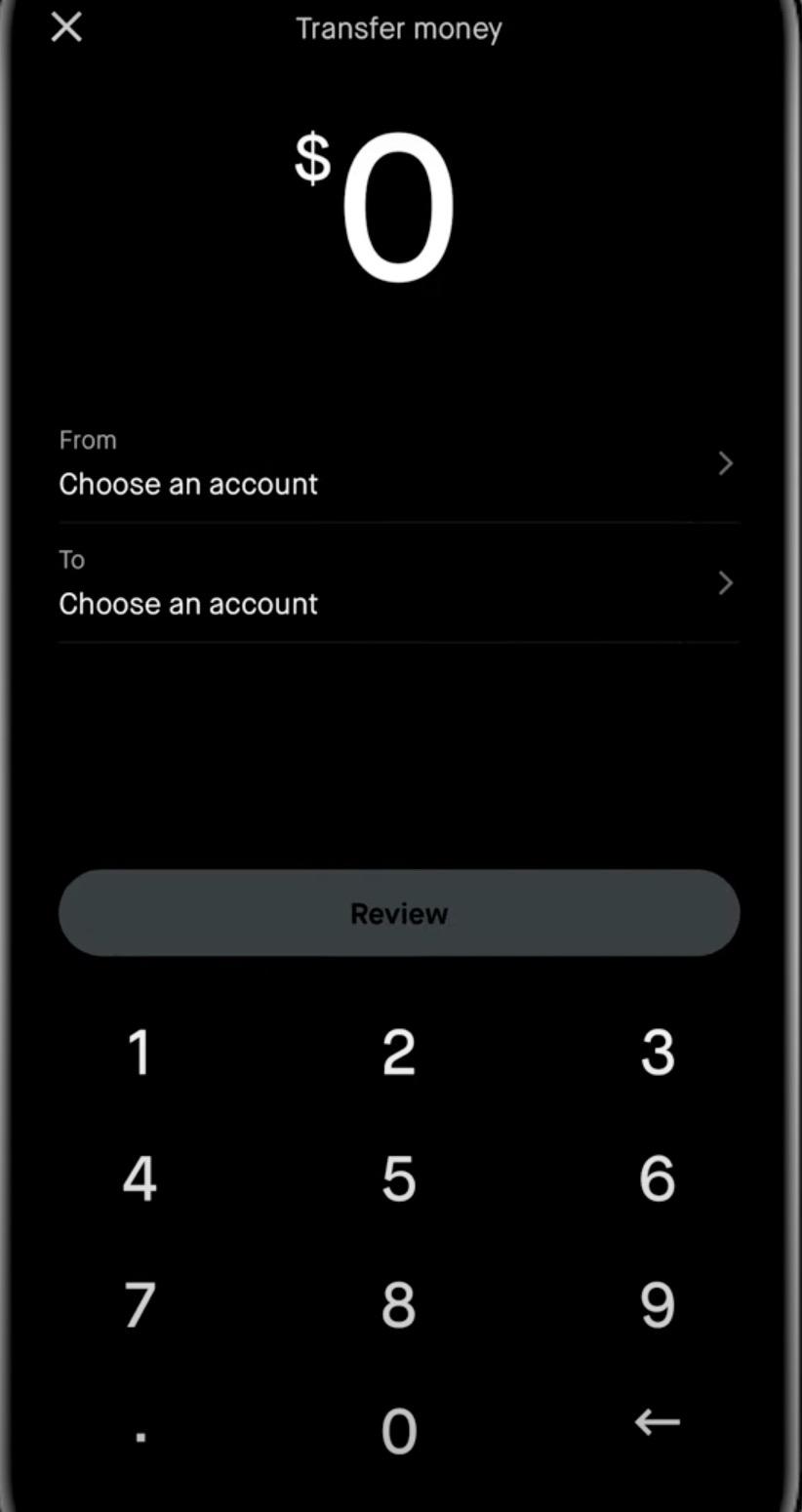

- Click “Transfer Money”

- Enter how much you want to transfer

- Click “From” and select the Robinhood account you want to transfer from (e.g., brokerage, Robinhood IRA, etc.)

- Click “To” and select your linked bank or debit card

- Choose between standard transfer or Instant Transfer and review any fees

- Confirm with the “Withdraw” option

How to Withdraw Money From Robinhood on Your Computer

Are you not sold on the “mobile investing revolution?” Prefer to look at charts on your PC?

No problem!

You can still trade on Robinhood with your desktop.

Just be sure you know how to transfer money from Robinhood to a bank.

- Click “Account” (on the top-right corner)

- Click “Transfers,” then “Withdrawal”

- Enter how much you want to withdraw

- Click “From” and choose the Robinhood account you’re pulling money from

- Click “To” and enter the linked bank account or debit card where you’re sending funds

- Choose between standard transfer or Instant Transfer and review the fees

- Click “Withdraw”

Extra Questions About Withdrawing Money From Robinhood

Are There Fees to Withdraw Money From Robinhood?

Good news: Robinhood doesn’t charge a fee for standard ACH withdrawals to a linked bank!

Bad news: There are fees if you want your funds faster or if you’re using a debit card.

According to Robinhood’s latest fee schedule, these more convenient options will cost 1.75%.

Are There Fees to Transfer Money From Robinhood to Another Brokerage?

Are you thinking of taking your business from Robinhood to another brokerage?

If so, you can transfer your assets directly from Robinhood’s trading platform, but there’s a fee.

For this service, you’ll have to tack on $100 to pay for Automated Customer Account Transfer Service (ACATS). And there are Robinhood withdrawal limits — for instance, you can’t transfer fractional shares.

Of course, if you’d prefer to avoid this fee, you could sell all your positions, wait for the transactions to clear, withdraw your cash to a bank account, and re-buy all your stocks, crypto, and ETFs.

Remember that these assets may not be the same price on the day you choose to re-enter positions. There are also those pesky tax implications to consider.

FYI: If you’re looking for an alternative broker offering many of Robinhood’s features, check out eToro. Voted “Best Trading Platform” by countless sites (including this one!), eToro is loaded with 7,000+ instruments and advanced trading tools.

One of our favorite features? CopyTrading, which allows you to follow — and mimic, if you choose — the trades of top-performing investors.

Another alternative? Public.

Like Robinhood, you can invest in stocks, ETFs, and crypto with a Public account. As a plus, Public also offers a few passive opportunities, including high-yield savings, bonds, and treasuries.

Learn more about Public on this link.

What Are Robinhood’s Withdrawal Limits?

Robinhood’s withdrawal limits vary depending on the specifics of your account privileges.

So, to see the most accurate details on your Robinhood withdrawable cash and transfer limits, visit the “Transfer” screen and choose “Transfer Limits” rather than “Withdrawal.”

That being said, Robinhood has a flat $50,000 withdrawal limit per day for ACH transfers, including a maximum of five daily withdrawals.

How Do You Cancel a Robinhood Withdrawal?

Have you changed your mind about a Robinhood withdrawal? You could still switch things around with a withdrawal cancellation.

As long as your withdrawal is still pending, you can cancel it in your “Account” tab.

Once you’re in your account, click the menu on the top left-hand corner of the app.

From here, click “History” then “Pending.”

Choose the pending transaction you want to cancel and confirm the cancelation.

How Long Do Robinhood Transfers Take?

Robinhood’s quoted time for an average ACH transfer to your bank is 5 – 7 business days.

However, you could choose Robinhood’s Instant Transfer feature with supported banks and debit cards. In this case, you should see funds, well, “instantly” (or within a few minutes at max).

Can You Withdraw Crypto From Robinhood?

Bought some Bitcoin on Robinhood? You don’t have to leave it there if you’ve got a crypto wallet.

Whatever cryptocurrency you bought on Robinhood, you can withdraw it for complete control over your coins.

Once you’re on your crypto detail page, you’ll see a “Send” button where you can enter how much of a particular cryptocurrency you want to withdraw.

Here’s the critical part: Carefully copy and paste the address for the associated cryptocurrency into the wallet you want to receive it.

For example, if you’re transferring Ethereum from Robinhood to a MetaMask wallet, copy your Ethereum address in MetaMask and paste it into Robinhood.

There are no do-overs in crypto, so triple-check before hitting “Submit.”

Final Word: How to Withdraw Money From Robinhood

Whenever you want to take out money from Robinhood, you have to target the “Transfer” screen.

Robinhood made it a bit cumbersome to find this icon on the mobile app because it’s hidden in the menu icon of your Account page. But once you know this sneaky secret, you can let your cash flow freely!

By the way, if you’re looking for more details on all things Robinhood, read our ultimate “Robinhood Review.”

FAQs:

How long does it take to withdraw money from Robinhood?

Typically, it takes 5 - 7 business days to withdraw money from Robinhood to a bank account with ACH transfer.

However, you can speed up this process to minutes with Instant Transfers for a 1.75% fee.

When can you withdraw money from Robinhood?

You can withdraw money from Robinhood at any time, provided the funds are settled.

Robinhood Withdrawable Cash refers to the funds that are settled and available for transfer and withdrawal. Unsettled funds are any money you’ve transacted with in the last 2 business days.

Why can’t I withdraw money from Robinhood?

Chances are you can't withdraw money from Robinhood because your funds are "unsettled."

No, we don't mean your money is moody; "unsettled" means it didn't clear Robinhood's books.

For instance, if you just sold a stock, you must wait for Robinhood to process and confirm the transaction before it finalizes.

Robinhood claims it usually takes one trading day for stocks, ETFs, and options to settle, so plan to wait an extra business day before starting a withdrawal.

If you're still having an issue with withdrawals on Robinhood, it's best to contact Robinhood's support team for personalized guidance.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.