Financial literacy is one of the most important things you can teach your children. But what’s the best way to build that foundation?

Prepaid debit cards for kids may very well be the answer you’re looking for. And luckily, there are plenty of great options out there.

Looking for the best prepaid debit cards for kids? In this article, I’ll cover some of the best options out there to prep children for a financially-savvy future, from the best reloadable debit card for teenager to prepaid debit cards for minors that offer extra features.

At-a-glance: Best Reloadable Debit Card for a Teenager

Card | Fees | Standout feature(s) |

TOP PICK: GoHenry | $4.99/mo. | Great customer service support |

$0/mo., Some usage fees | Gives teens financial independence | |

Greenlight | $4.99-$14.98/mo. | Customer experience and parental controls |

Chase FIrst | $0/mo. | Stability and the reputation of a proven financial institution. |

Revolut | $9.99/mo. | Utilize parent-paid bonuses |

BusyKid | $4.00/mo. | Balanced financial approach through chores and allowances |

FamZoo | $5.99/mo. | Vast library of financial literacy resources. |

Current | $0/mo. | Combine checking and savings accounts |

Citibank Junior | $0/mo. | Simple savings account with a debit card |

BONUS: Acorns Early | $3/mo. for a brokerage account. $5/mo. extra for Acorns Early kids’ investment accounts | Easy investing with round-ups from normal spending. |

BONUS: Axos Banking First | $0/mo. | Money management tools |

BONUS: UNest | $4.99/month or $33.99/Year | Ability to send gifts to a child’s account |

The Best Prepaid Debit Cards for Minors

1. GoHenry

- Requirements: Ages 6-18, Minimum $5 deposit

- Customer rating on Trustpilot: 4.2 (2,682 Reviews)

- Fees: $4.99 Monthly, No ATM Fees, $4.99 Card Replacement Fee

With money missions lessons to teach kids about finances, easy-to-set-up savings goals, and abundance of teen-friendly card designs, GoHenry is one of my favorites.

Here’s what you need to know:

- GoHenry is touted as an allowance app where parents can set up allowance and chore deposits.

- Kids can only spend what’s on the card — no risk of overdraft fees.

- The app has a variety of options — kids can set savings goals, learn about money, and use the money they’ve earned with a real debit card.

- There’s a bevy of parental controls so parents can rest assured that their kids are practicing safe money habits.

- Cool feature: parent-paid interest, where parents can set the app to pay interest to their kids’ accounts to encourage long-term saving.

- Customer service is also top-notch with phone, email, and social media help centers.

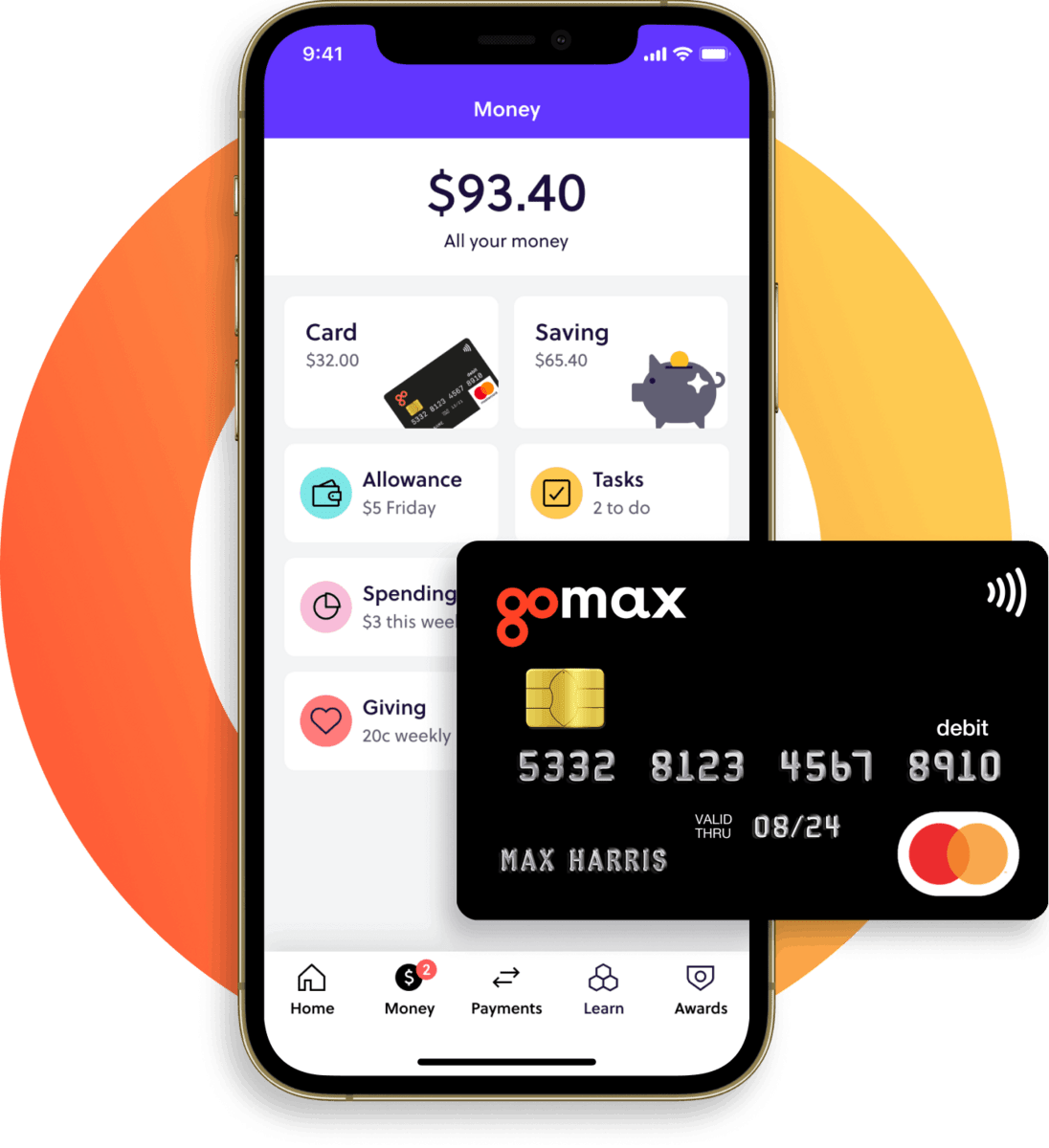

2. Copper Card (Copper Banking)

- Requirements: Ages 6+, No Minimum Deposit

- Customer rating on Trustpilot: N/A (No reviews)

- Fees: $0 monthly, 2.5% + $.30 to debit load

Copper’s core belief? Kids and teens should have access to financial education and be empowered to learn by doing.

Here’s how they do it:

- Copper is a full-featured spending account that includes the ability to send money and withdraw from over 55,000 ATMs. It also includes bite-size lessons from financial experts on gaining healthy relationships with money.

- Guardians can monitor their kids’ money habits from an easy-to-read dashboard.

- There’s the option to set up investment accounts for kids made up of three portfolios based on the profiles of kids’ spending. These portfolios include thousands of stocks and are tailored to investment objectives and investment horizons.

Overall, a good choice for parents and kids who want the features of prepaid debit cards for kids but still want to retain control.

3. Greenlight

- Requirements: No minimum age; No minimum balance

- Customer rating on Trustpilot: 4.0 (4,689 Reviews)

- Fees: $4.99 -$14.98 Monthly; $9.99 for a custom or replacement card

Greenlight acts like a prepaid debit card allowing parents to transfer funds to their kids’ cards, and features robust parental control that gives parents control over where and how their kids spend their money.

Here are some of its finer points:

- Custodians can control when to grant more money to kids for special purchases. (If a child wants to buy something they can send a photo and the custodian can approve the transaction.)

- The card can be used for allowance and chores and it allows kids to load their own money onto the card as well if they have their own job.

- It also offers ETF investment opportunities and savings interest based on the membership level you choose. Only a few of these prepaid debit card services offer this feature.

Overall, Greenlight is a good option for families who want tighter parental controls.

4. Chase First

- Requirements: Ages 6-17; No minimum balance; Custodians must have a qualifying Chase checking account.

- Customer rating on Trustpilot: 4.1 (5,429 Reviews)

- Fees: $0 monthly, $34 Overdraft Fee

What you need to know:

Chase First is a bit different from the other prepaid debit cards for kids on this ist.

It is a complete bank account that includes a debit card.

Good news: kids get the complete banking suite through the Chase app. Custodians get to set spend alerts, limits and specific locations where their kids can spend their money.

If a child tries to buy something outside of the available cash, it will deny the transaction instead of overdraft and causing unnecessary fees — which makes it worth considering.

You do need to have an existing Chase account to set up this account — but that’s not such a bad thing because with that setup, you can easily transfer funds to the child’s account.

5. Revolut

- Requirements: Ages 13+; No minimum balance

- Customer rating on Trustpilot: 4.3 (133,623 Reviews)

- Fees: $9.99 Monthly; No ATM or Overdraft Fees

Revolut <18 is a debit card for teens that aims to teach financial skills for life.

Here’s what you need to know:

- Custodians can use the Revolut app to get full insight into kids’ spending via spending alerts and they can also set spending limits and freeze the card if required.

- Custodians can use the app to educate their kids about things like earning, saving, budgeting, and even investing.

- It’s also great for managing allowances and chore payments and outlining savings goals for kids.

- Further, there’s the option for custodian-paid bonuses for when a child does something above and beyond and/or is deserving of a reward (birthdays, bar mitzvahs, etc.)

- Everything is controlled via the Revolut app and the program is a great option for teaching kids about money in an easy straightforward way.

Want to know more about Revolut? Check out our comprehensive Revolut review.

6. BusyKid (Visa)

- Requirements: Ages 5-17; No minimum balance

- Customer rating on Trustpilot: 3.6 (1,492 Reviews)

- Fees: $4 monthly; $5 replacement card fee

BusyKid is an award-winning app that started as a chore payment app but has since initiated a debit card option for kid’s spending.

BusyKid is a fantastic option if you want an app that can teach your kids about money through lessons. It also offers allowance loading and spending for your kids.

It might very well be the best reloadable Visa card for minors featuring a hybrid account where parents can allocate funds for saving, spending, or donating and kids can learn more about financial literacy including budgeting, saving, and giving back.

BusyKid also offers a QR code option where parents can allow others (grandparents, aunts, uncles) to deposit money using a unique QR code from the app.

In addition, with a separate Apex Clearing account parents can get their kids investing in hundreds of stocks and ETFs for as little as $10.

7. FamZoo

- Requirements: No age restrictions; $5 minimum balance

- Customer rating on Trustpilot: 0.0 (0 Ratings)

- Fees: $5.99 monthly; $3 card replacement fee

FamZoo works like any other reloadable debit card for minors in that it’s easy to set up and load.

Here are some key things to know:

- It offers parents tools like spending alerts for account monitoring, the option to freeze the card temporarily, and account activity alerts.

- What sets it apart? An exhaustive library of financial education resources provides plenty of opportunities for teaching your children about finances and money.

- The app also offers a feature called payment checklists which aim to educate your child about the value of a dollar by tying odd jobs and chores to penalties and rewards.

- Like other cards, it offers parent-paid interest on savings accounts so your child can learn about the rewards of saving long-term.

8. Current

- Requirements: A qualifying parent bank account for ages under 18: No minimum balance

- Customer rating on Trustpilot: 4.1 (3,871 reviews)

- Fees: $0 Monthly; No overdraft or hidden fees

Designed for families, Current offers both teen and parent account options with teen accounts acting as prepaid debit accounts.

What you need to know:

- The app allows parents to track their teen’s spending in real-time and allows for setting limits on what and where their teens can spend money.

- Current offers easy allowance deposits and a budget feature that allows teens to track their own spending and set spending limits for themselves.

- It also features a saving option with transaction round-ups going back into teen’s savings pods.

Overall a great free account loaded with features for teens. (Maybe the best reloadable debit card for teenagers just based on available options, clean design, and overall user-friendliness).

9. Citibank Junior Debit Card

- Requirements: Ages 15+; No minimum deposit

- Customer rating on Trustpilot: 1.2 (259 Reviews)

- Fees: $12 Monthly for basic account

Citibank Junior is a savings account for children under 18. Teens above 15 are eligible for a fee debit card to learn about money and financial best practices.

What you need to know:

- It offers dual insurance, free ATM withdrawals, and the full suite of online banking services.

- Citi aims to offer hassle-free banking like making transactions and withdrawals to teens and parents alike.

- Each account must have 2 holders (the child and the custodian) and the custodian must have a qualifying Citi account before opening the account.

Overall, the account doesn’t have much to offer besides being a straightforward savings account with a debit card for teens.

More Banking Resources for Kids + Parents

Prepaid debit cards aren’t the only ways to set your kids up for future financial success. Keep reading for banks that offer great resources for kids and adults:

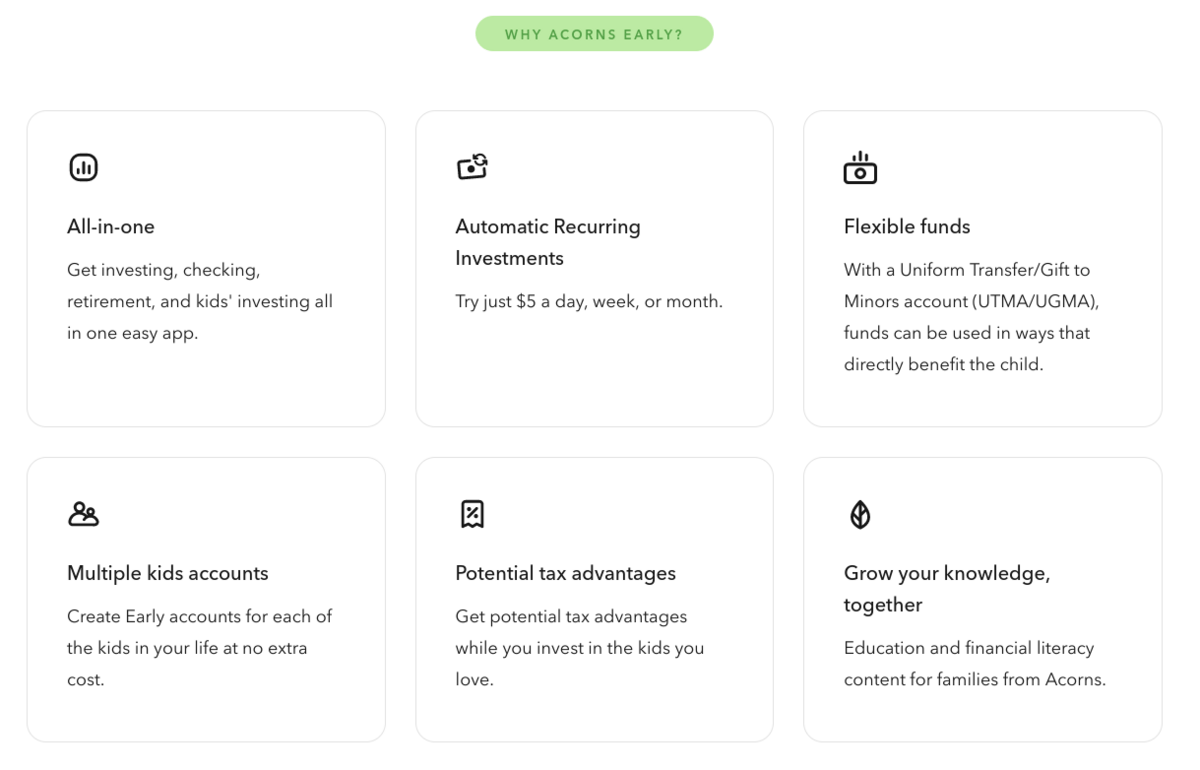

BONUS: Acorns Early

- Requirements: Ages 18+, $5 minimum to invest

- Customer rating on Trustpilot: 2.3 (327 Reviews)

- Fees: $3 Monthly, No minimum balance, no overdraft fees

Acorns isn’t specifically a debit card platform for kids, in fact, to use it you have to be 18 or older.

But here’s the thing.

Although it’s not meant for kids, it has an account option called Acorns Early — an UTMA/UGMA account which is specifically to save up and invest money for your kids.

So while it’s not a prepaid debit card, it is a great app to start saving for your kids.

Opening an account is absurdly easy, and you can manage kids’ (and your) money in one single app. If you’re interested in investing on a child’s behalf, this is the way to go.

Want to know more about investing for kids? Check out our article about stocks for kids.

BONUS: UNest

- Account minimum: $25/month in investments

Once again, this isn’t a prepaid debit card. However, the great thing about UNest is that it makes it easy for you — or friends or relatives — to use their debit cards to make contributions to a child’s account.

The app is incredibly user-friendly, making it easy to get started and set up recurring contributions. It’s up to you — you can take a more passive or active role in investing.

BONUS: Axos Banking First

- Requirements: Ages 13-17; $50 minimum deposit

- Customer rating on Trustpilot: 1.4 (94 Reviews)

- Fees: $0 Monthly; No overdraft fees

One last bonus entry! It’s not a reloadable debit card, but this is the ultimate starter checking account for teens with a linked debit card.

Axos works as a joint checking and savings account between teens and their parents allowing for customizable easy-to-set controls for parents to maintain the account.

The bank is online based and accessible through the proprietary app and the online desktop banking portal.

It’s a real checking account that pays interest and includes a debit card for teens allowing them easy access to their money. Parents don’t need to worry though because they can set daily spending limits on cash and debit transactions.

It doesn’t include any financial literacy resources but it offers the highest level of security via fingerprint, voiceprint, and facial recognition.

Overall, Axos is a wonderful option for a teen’s first checking account.

Final Word: Prepaid Debit Cards for Minors

All said, there are a variety of options for reloadable and prepaid debit cards for kids.

Some offer a lot of bells and whistles — others are bare bones. In my opinion, the best apps for child and teen investing offer engagement for the kids to take control and learn more about their own finances and can build a solid foundation for their financial journeys.

Overall I’d say my favorite is GoHenry — simply because it aims to make learning about money fun and accessible and is clearly built around teaching teens and kids these skills.

FAQs:

Can I get a prepaid debit card for my child?

Yes! There are a number of different options for parents to get a prepaid debit card, ranging from GoHenry and Copper Banking to big banks like Chase and Citi.

How can a 12 year old have a debit card?

Yes! Many services offer debit cards for kids below 15, including GoHenry and Greenlight.

Can an 11 year old get a debit card bank?

Yes! Using services like GoHenry, parents can get kids of all ages a debit card bank account.

What are the benefits of prepaid debit cards for kids?

The biggest benefit of prepaid debit cards for kids is teaching financial literacy to your children so they can grow with a solid foundation of how to use and take care of their money.

Is Greenlight better than GoHenry?

According to Trustpilot reviews, GoHenry is better than Greenlight. Greenlight scored a 4.0 out of 5 while GoHenry scored 4.2 out of 5 for teens and kids banking apps.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.