There are SO many tools for stock research out there. And pretty much all of them claim to be the best stock research website.

But which one really is the best?

I took it upon myself to find out. I’ve tested dozens of stock research websites and tools — many good in their own ways — and narrowed down my findings down to the top 10.

Whether you’re most interested in stock pickers/analysts, stock screeners, investment researchers, news/basic quote providers, or a combo of the above, there’s something for you. Let’s go:

1. WallStreetZen – The Best Stock Research Website Overall

OK, I’m biased. But I think our site is the overall best option for retail investors who want to make intelligent investing decisions and want to reduce noise and information overload. Let’s talk about why.

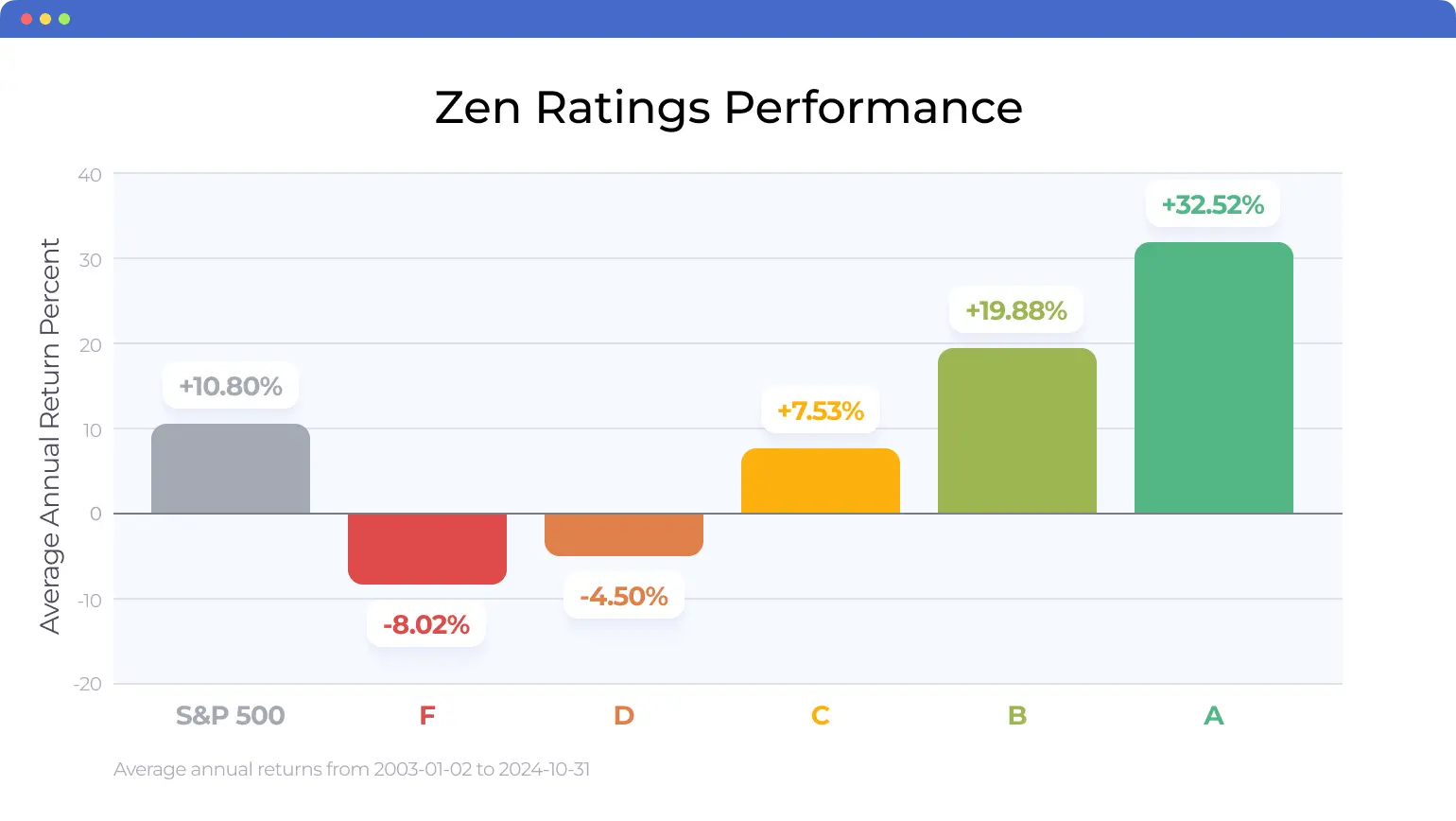

WallStreetZen makes it easy for you to perform in-depth research and get new stock ideas in minutes, not hours. It aggregates the latest financial data and summarizes a stock’s fundamental strengths and weaknesses in a simple, easy-to-read letter grade (A-F, a being highest, just like in school) through the Zen Ratings system.

Zen Ratings

Zen Ratings is our proprietary quant ratings system. It distills 115 factors proven to drive consistent growth in the stock market into an easy-to-read letter score. It looks at everything from price performance to the company’s financial information to analyst ratings and beyond.

Too tired of reading? See it in action right now — enter any ticker here.

When you enter a ticker in the database, you don’t just get an overall grade — you also get valuable insights through the 7 Component Grades that shape the overall grade.

For example, take a look at a current B-rated stock, Wix.com (NASDAQ: WIX), which is also recent Stock of the Week selection from our Zen Investor Editor in Chief, Steve Reitmeister):

You can choose to dig deeper and check out how WIX fares on the seven components (each made up of several individual checks, adding up to over 115 factors total) that play into the score, so you can see its strengths and potential weaknesses:

As you may have noticed, WIX is a “B” rated stock — this represents the top 20% of stocks in our ratings system, which have generated an average return of 19.88% returns per year. Here’s where it gets even better: A-rated stocks using the Zen Ratings system have generated an average annual return of 32.52% since 2003.

After exploring the Zen Rating for WIX, you might be tempted to check out its Forecast page, where you can read analyst commentaries and the thoughts going into their projections (with “Find out why”).

Top Analysts

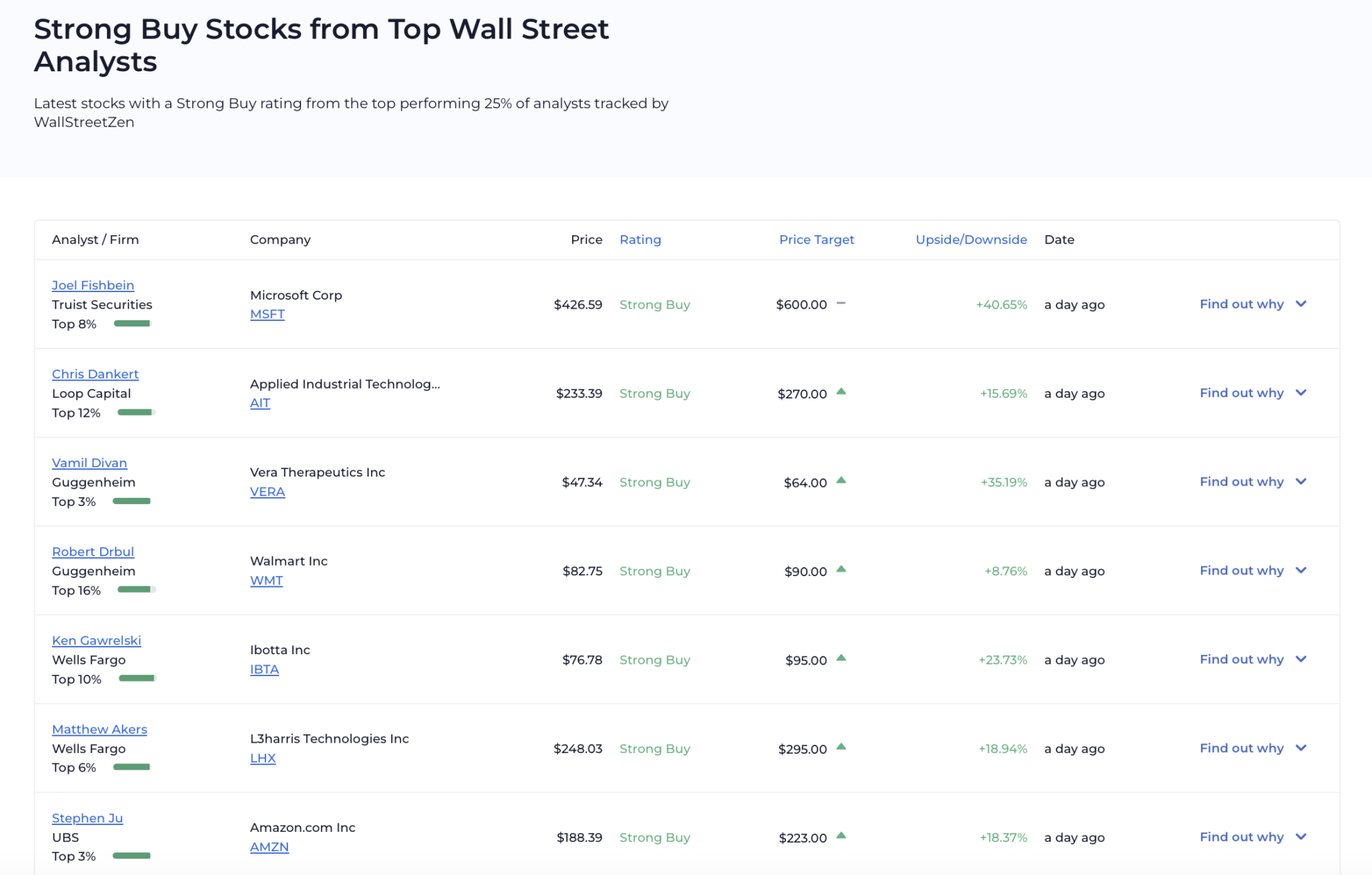

WallStreetZen tracks and ranks nearly 4,000 analysts based on the returns, frequency, and win rate of their stock recommendations over multiple years, so you get the very best ideas from proven performers. Plus, the Top Analysts feature lets you dig into the exact reasons why an analyst made their buy/sell/hold recommendation and read analyst narratives on any stock:

Check out the profile of a Top 1% Analyst Lloyd Walmsley, who turned SNAP into a 500%+ gain in 1 year:

Click here to see what he’s recommending now.

To see the full list of analysts, click here. You can filter by Sector & Industry and sort by date of their Latest Rating.

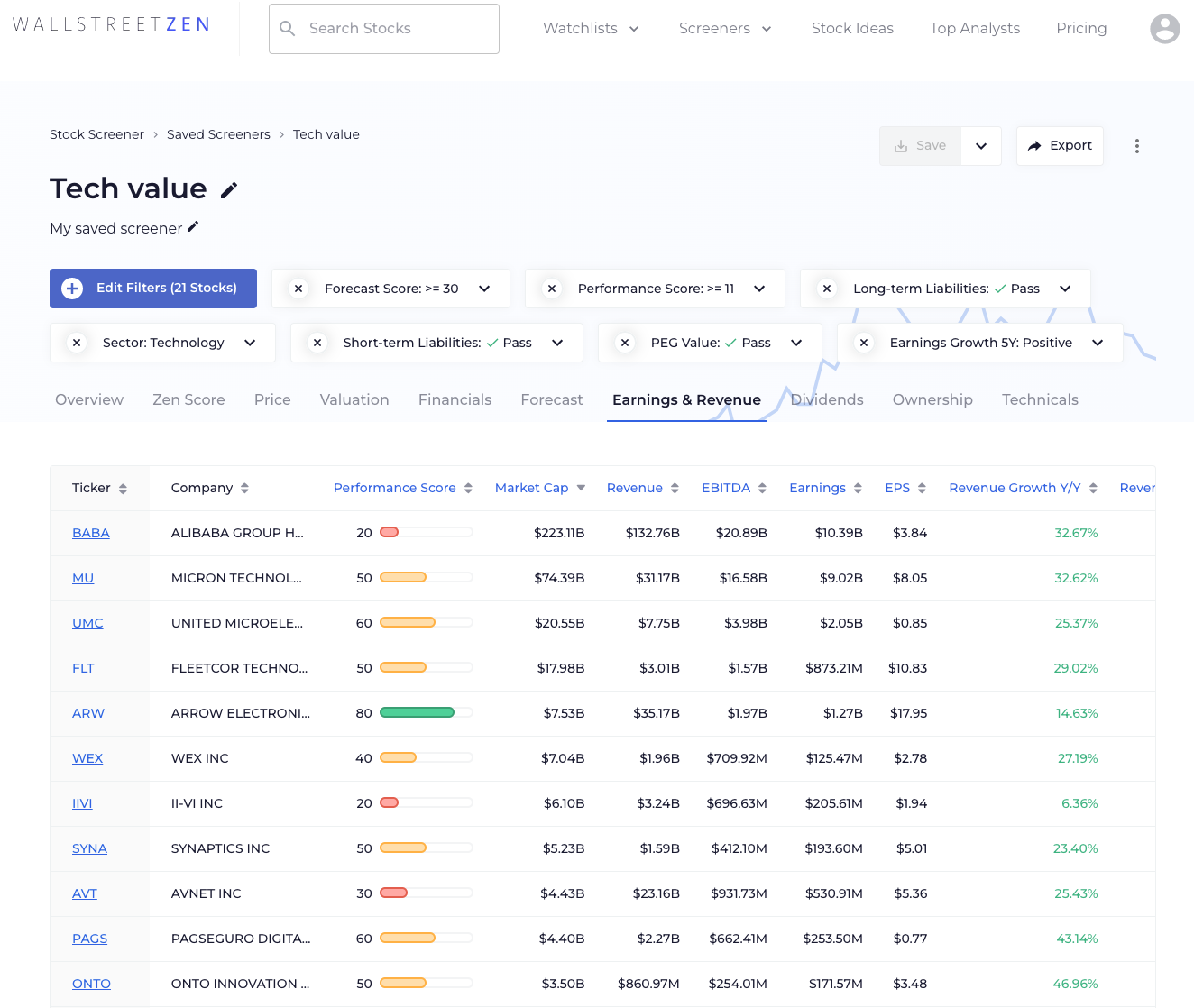

Stock Screener

You probably already have an investing style. What you need now is a way to translate those personal preferences into smart investment decisions.

Unlike its peers, WallStreetZen’s Stock Screener allows you to easily filter on whatever quantitative or qualitative criteria you find most important, and save your setups:

If you’re not sure what criteria to use, WallStreetZen’s stock screener also comes with a library of pre-built Stock Ideas to get you started. How about fast forwarding right to the latest Strong Buy recommendations:

And More…

Watchlists, consensus ratings, “Why Price Moved”, news feeds, visual comparisons across time, and so much more – the more you use it, the more you’ll find.

Plus, unlike the other sites you’ll find on this list of best stock research websites, WallStreetZen offers the vast majority of its features for free, up to a certain number of uses per month. And if you hit a paywall and decide to upgrade, you can try it for just $1 for 2 weeks. (Go ahead, try it now.)

Who It’s For

WallStreetZen is the best stock research website overall because it handles nearly every component of the investing process:

- Fundamental analysis ✅

- Stock screener ✅

- Stock pickers/analysts ✅

- Investment research ✅

- News and quote data ✅

- Technical analysis ❌

I may be biased, but I do believe it’s the most versatile site on this list of best websites for stock research. Investors with varying objectives can all benefit from its comprehensive suite of features (Zen Ratings, Top Analysts, Screener, Stock Ideas, etc.).

WallStreetZen probably won’t be the primary tool for active day traders, though. Yes, it is a good supplement for investors who rely heavily on technical analysis — but it won’t replace their main charting tool.

However, even if you’re a pure day trader, it’s never a bad idea to check the underlying fundamentals of the stocks you’re trading or see the latest analyst stock ratings from Wall Street’s top analysts.

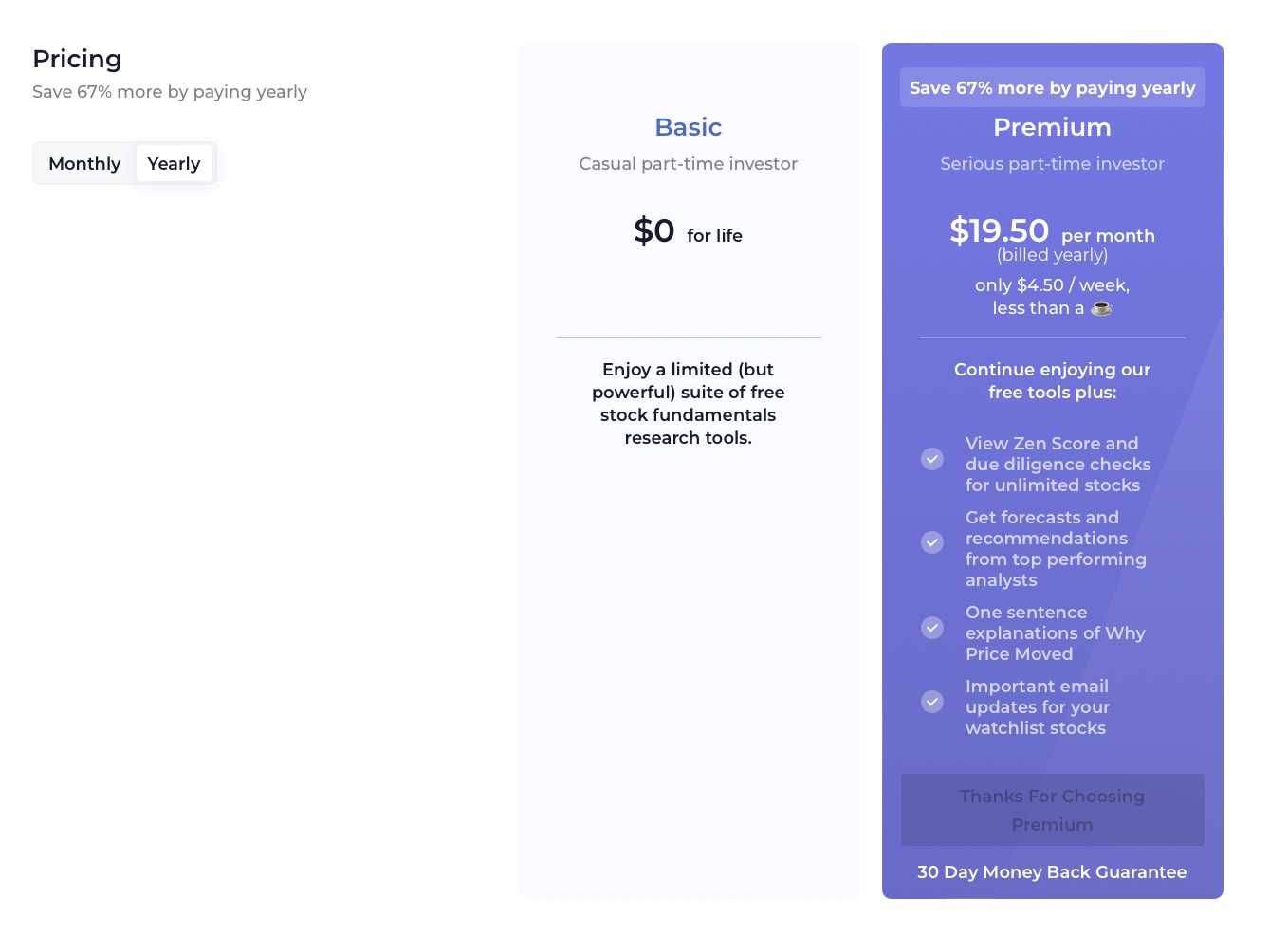

Pricing

WallStreetZen has two plans: Basic and Premium:

Unlike the other sites on this list, the Basic plan is free (just start researching!) and includes almost every feature, but power users will want to upgrade to Premium to unlock unlimited access. The cost?

WallStreetZen has expanded into stock-picking!

With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

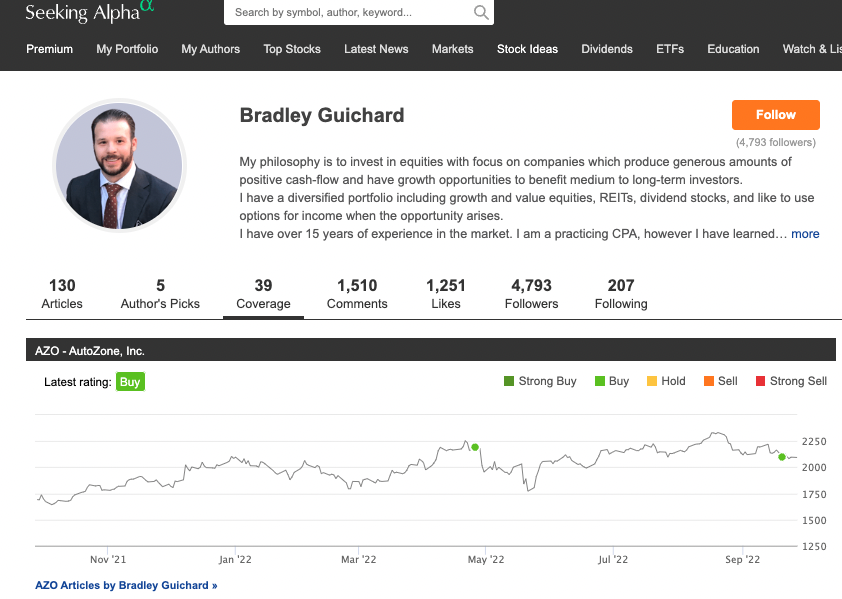

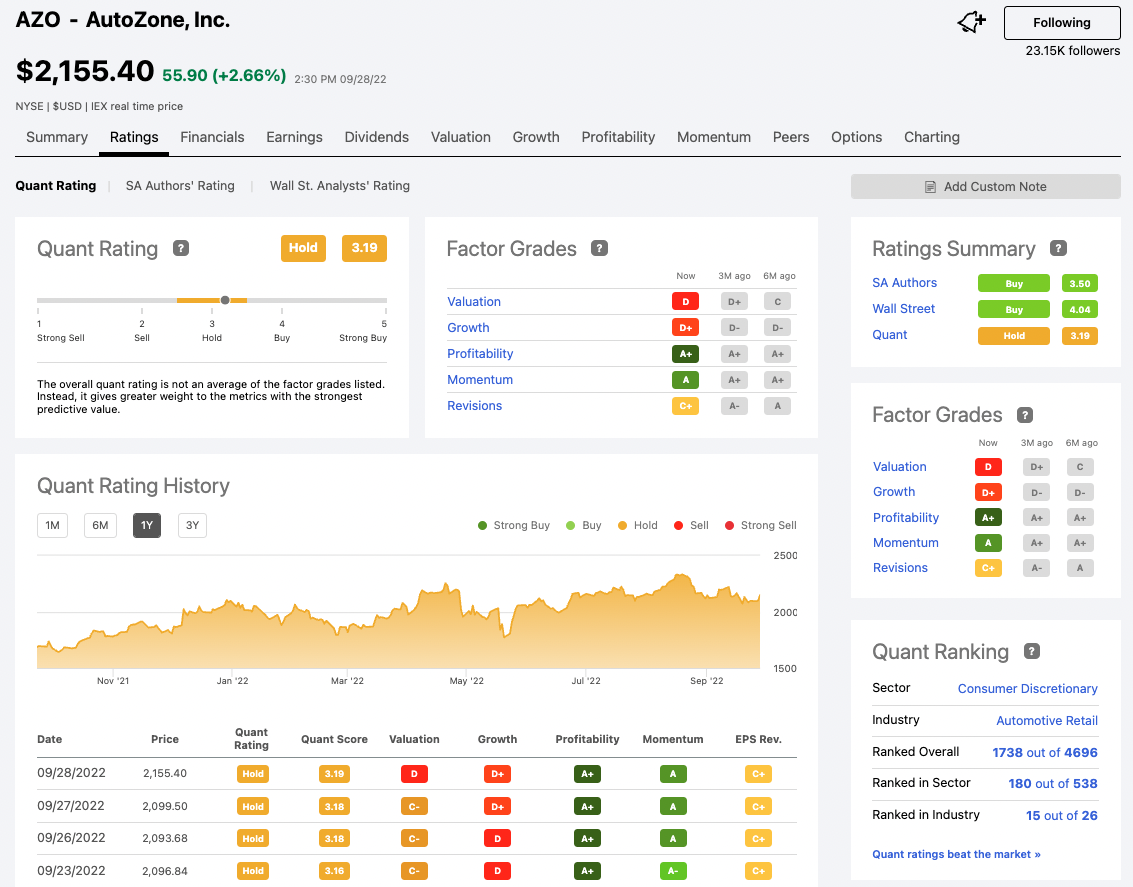

2. Seeking Alpha – The Best Investment Research Website

While WallStreetZen gives you all of the fundamental data and additional analyst reports you need to make your own informed decisions, Seeking Alpha puts its analysts front and center:

Even as an employee of WallStreetZen, I have a personal account with Seeking Alpha – I’m a fan of the product. That’s why it easily ranks as #2 on this list of the best stock research websites.

If you’re a regular investor and/or frequently Google tickers, you’ve likely stumbled across one of the Seeking Alpha analysts’ reports.

Unlike WallStreetZen, however, Seeking Alpha’s articles and blogs (which are typically buy/sell/hold recommendations) are crowdsourced by primarily amateur investors with varying backgrounds – anyone can apply to be a writer.

Users are encouraged to follow their favorite analysts/authors and will typically follow their recommendations for buying and selling equities.

While it does offer data for fundamental analysis, this information serves as a backdrop to its analysts’ research, and – like its screener – is reserved for Premium users only. So is one of its most exciting new features — Virtual Analyst Reports, which are AI-generated research reports on tickers that condense mountains of data into succinct summaries.

However, unlike Zacks or Motley Fool, there’s much more transparency about why SA’s analysts are making their buy/sell decisions for their own portfolios. Personally, this is my favorite feature.

Who It’s For

If you want stock ideas and the accompanying research from fellow investors who are actually putting their own money into their recommendations, Seeking Alpha Premium is a solid choice:

- Fundamental analysis ❌

- Stock screener ✅

- Stock pickers/analysts ✅

- Investment research ✅

- News and quote data ✅

- Technical analysis ❌

Seeking Alpha is built for investors who want to read other investors’ commentaries, opinions, and analyses to help guide their own portfolio decisions.

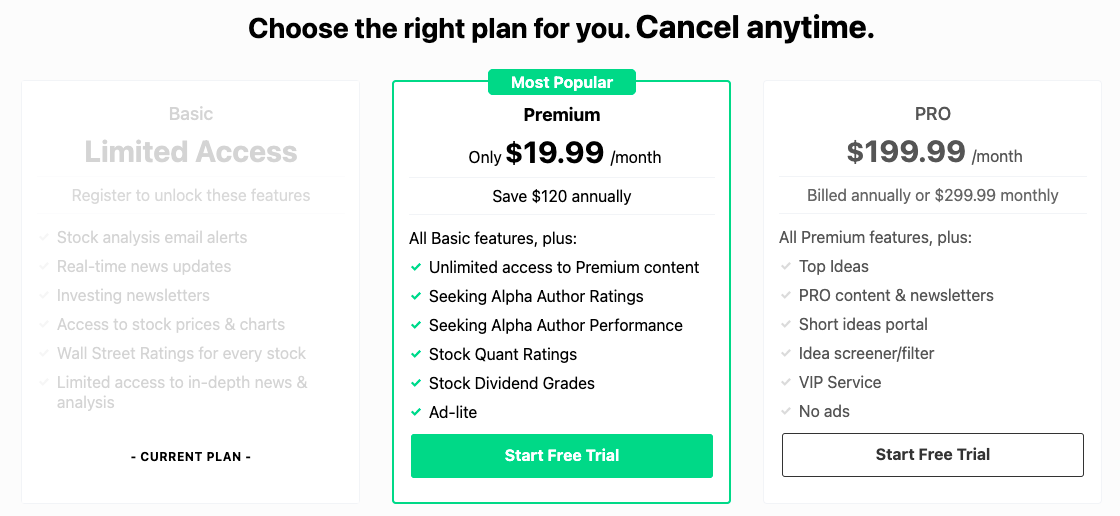

Pricing

Seeking Alpha has 3 membership tiers, but Premium is by far the best value (in my opinion):

After your free trial, the link above will give you a hefty coupon.

(For more info, read my full Seeking Alpha Premium review.)

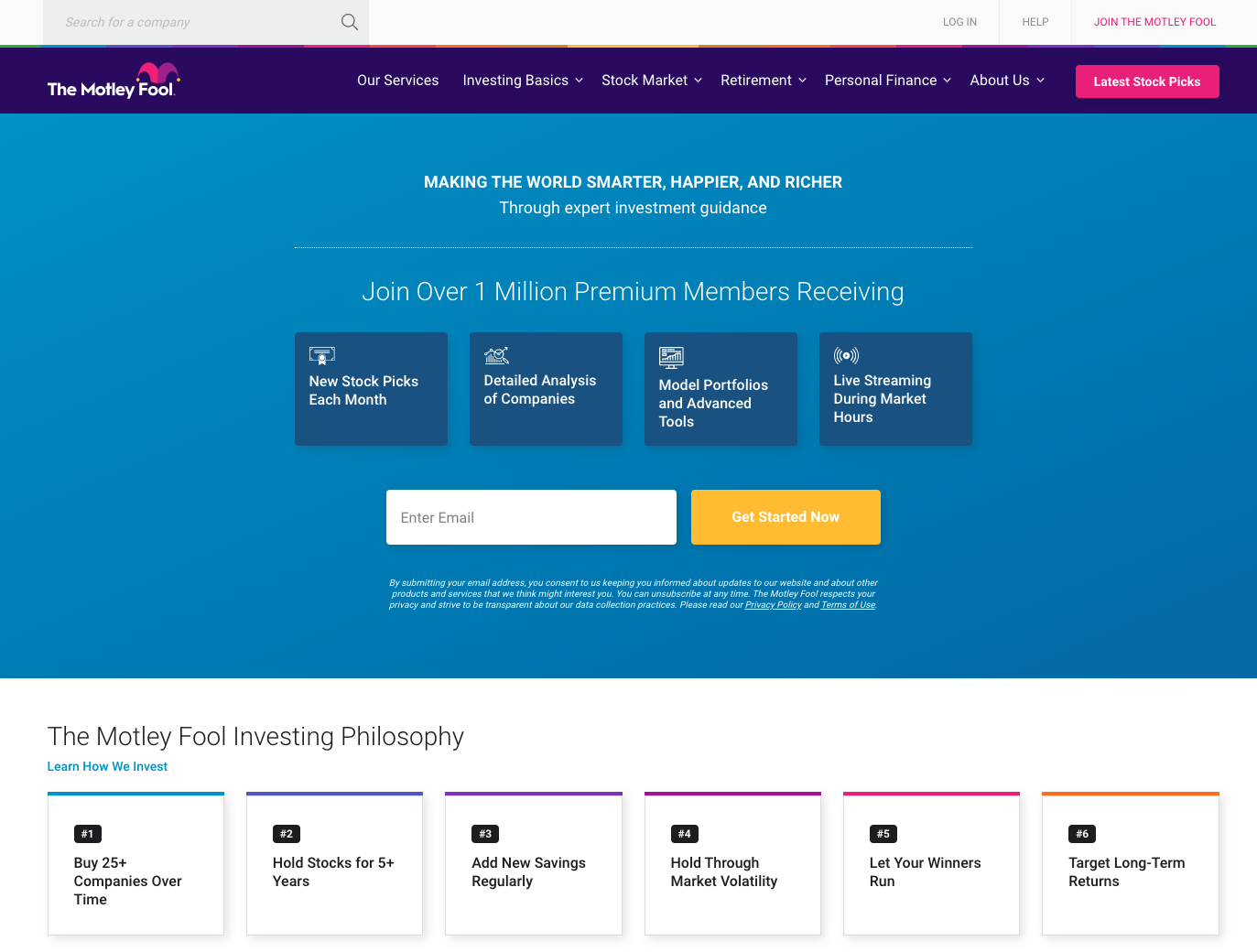

3. The Motley Fool – The Best Stock-Picking Website

Here’s one of the most well-known and best websites for stock research in the world, The Motley Fool:

The Motley Fool focuses on a variety of premium services, all of which espouse a buy-and-hold strategy.

Its most popular product, Stock Advisor, has 6x’ed the S&P over the past 21 years (as of writing in August 2025). That’s a pretty clear sign that they’re doing something right, and one of the reasons why I recommend Stock Advisor to just about anyone looking for solid stock picks.

The site’s investing philosophy revolves around ignoring short-term volatility, choosing instead to focus on companies’ strong fundamentals and riding market trends:

The Motley Fool Stock Advisor service gives out 2 monthly recommendations, alongside a list of 10 “Starter Stocks”, a knowledge base, market news coverage, access to The Motley Fool Community, and more. It also offers some portfolio management tools.

This service’s biggest winners include: Netflix, Amazon, Booking Holdings, Disney, and Activision Blizzard.

Who It’s For

Motley Fool Stock Advisor is for long-term investors looking to get a few premium stock picks per month:

- Fundamental analysis ❌

- Stock screener ❌

- Stock pickers/analysts ✅

- Investment research ✅

- News and quote data ✅

- Technical analysis ❌

Again, you’re only paying for stock picks and some supporting analysis, not the data/information needed to make buy/sell/hold decisions independently.

Pricing

Motley Fool Stock Advisor is typically $199/year, but if you sign up with the link below your first year will cost just $99*:

Also, if you sign up for the annual membership with the link above, there is a 30-day membership-fee-back guarantee.

*$99 promotional price for new members only. Discount based on current list price of $199/year. Membership will renew annually at the then-current list price.

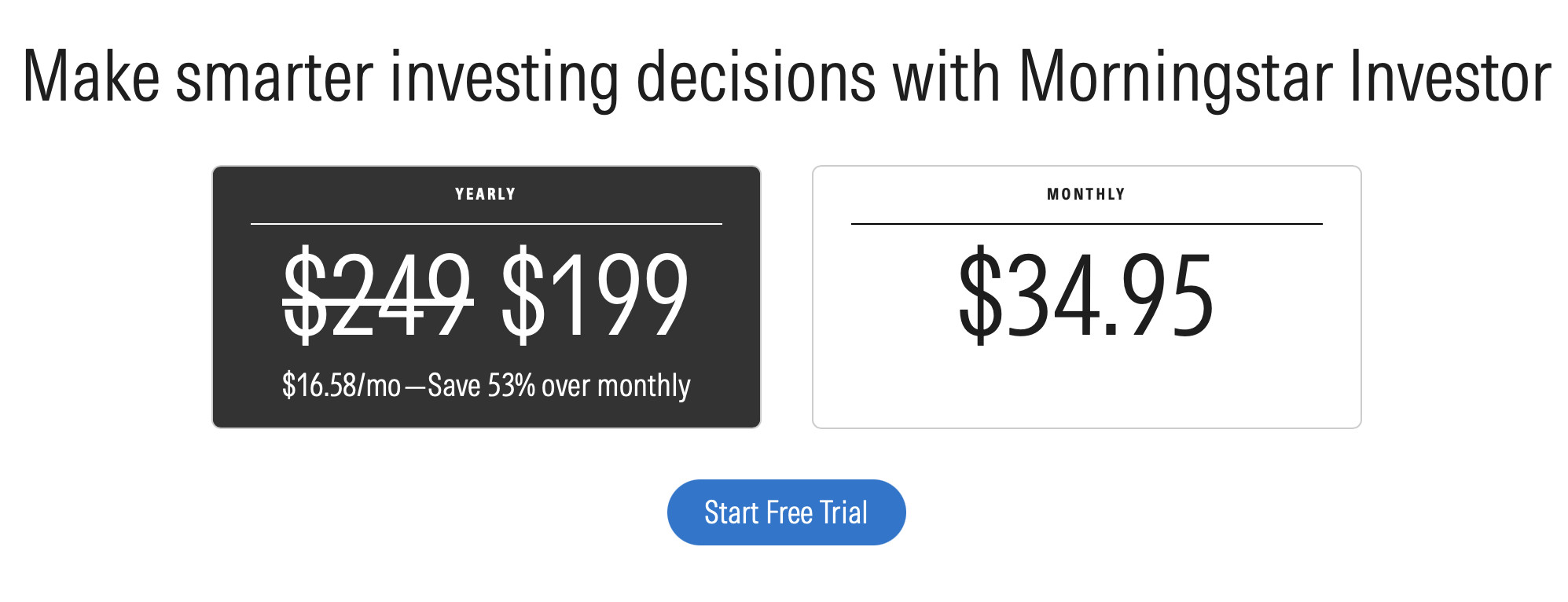

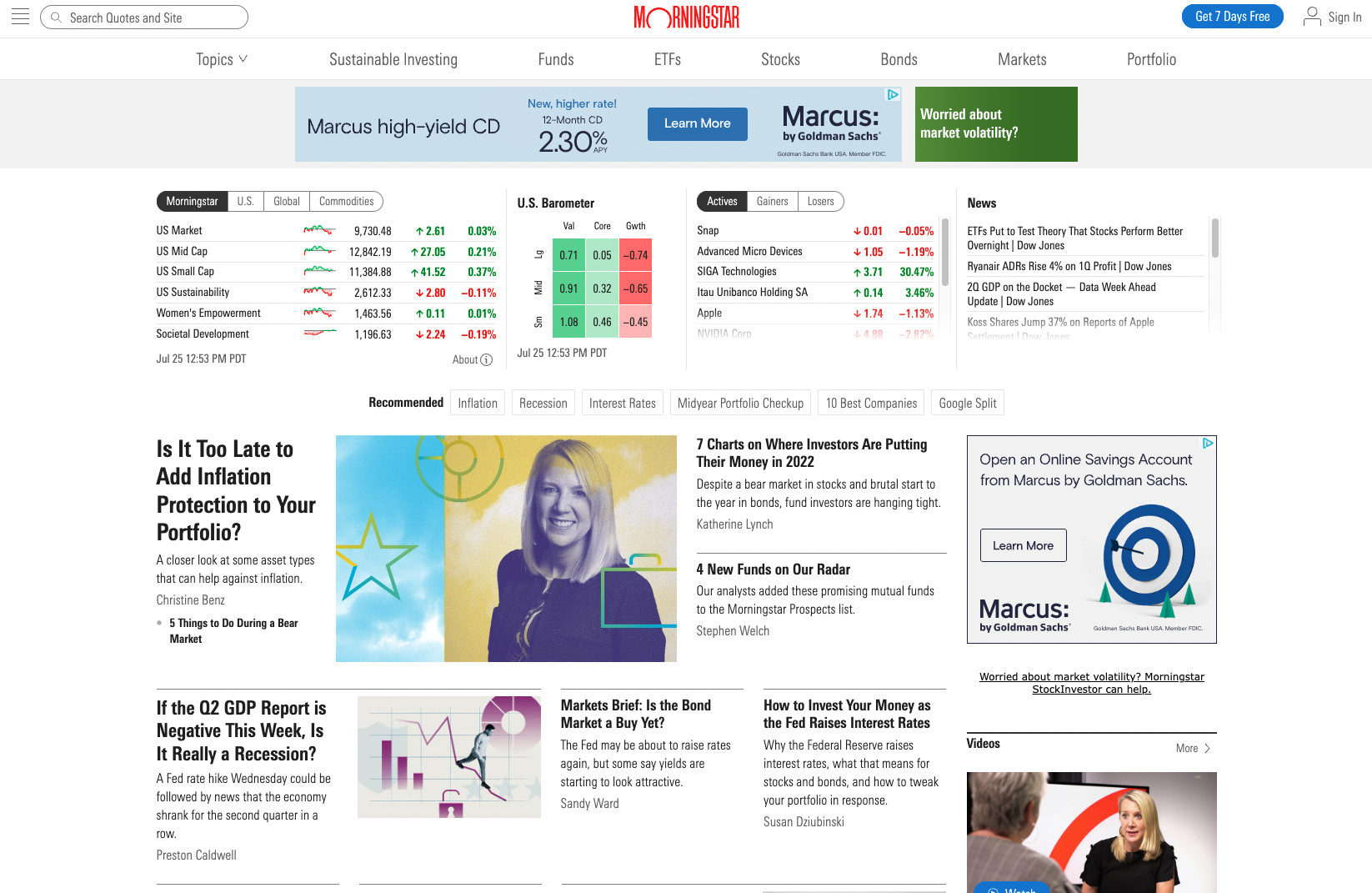

4. Morningstar – The Best Portfolio Research Website

Morningstar is one of the world’s most widely respected equity research firms, used by both retail and professional investors alike. It’s one of the best stock research websites because of its focus on hard data for the long-term value investor.

If you’ve been on more than a couple different stock sites, you’ve likely seen “Morningstar Ratings”, which should give you an idea of the amount of respect Morningstar has earned from its peers.

Beyond financial data, the site is full of content and daily updates via news feeds and multiple newsletters:

While Morningstar allows you to research fundamentals for securities like stocks and bonds, its primary focus is mutual funds.

Morningstar analyst reports provide in-depth analyses from over 150+ independent analysts, enabling you to make decisions with confidence knowing that data and solid due diligence has gone into each rating.

If you like what you’ve seen from the basic version of Morningstar, you have to check out Morningstar Investor (formerly Premium).

Beyond an enhanced version of its core offering, Morningstar Investor has tools for tax planning, asset allocation, personal finance, retirement, and education investing.

Who It’s For

Morningstar is a fantastic tool regardless of the type of investor you are. For long-term investors and those who love to keep their finger on the market pulse, this is a fantastic option:

- Fundamental analysis ✅

- Stock screener ✅

- Stock pickers/analysts ✅

- Investment research ✅

- News and quote data ✅

- Technical analysis ❌

However, the site can be a bit overwhelming because of how much (not always helpful) information you must weed through, and it doesn’t offer as many free features as WallStreetZen.

Pricing

Morningstar has a Basic subscription, but you’ll unlock the best features with Investor:

I know countless financial advisors who use Morningstar Investor as their primary tool and news source. It’s legit.

(Read my Morningstar Investor review.)

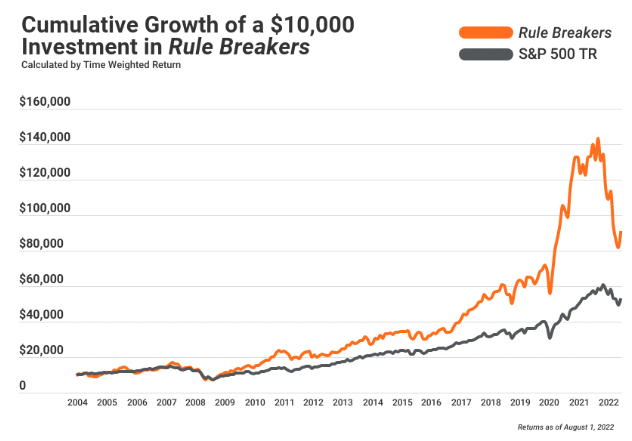

5. Motley Fool Epic

Above, I recommended The Motley Fool’s flagship product, Stock Advisor. What if you want more?

There’s a solution for you, and its name is Motley Fool Epic.

Epic combines four of Motley Fool’s most popular scorecards — Stock Advisor, Rule Breakers, Hidden Gems, and Dividend Investor — along with an incredible array of stock research tools and resources.

I’ve already talked about Stock Advisor. But let’s focus on one of the other most popular scorecards included with Epic — Rule Breakers. This service focuses exclusively on disruptive technology stocks, companies with the potential to completely rearrange an entire industry and create massive returns for early shareholders.

Investing in this type of stocks brings increased volatility, but if you can stomach the large price swings and hold for several years, a Rule Breakers subscription can work wonders for your investment returns.

In addition to two stocks from Stock Advisor and 1 stock from Rule Breakers per month, you also get 1 pick from Hidden Gems, which provides foundational stocks that can anchor your portfolio, and 1 recommendation from Dividend Investor, which focuses on high-quality dividend stocks.

But Epic has a lot more to offer than stock picks. You also get a toolkit including Cautious, Moderate, and Aggressive Portfolio Strategies with specific stock allocation, FoolIQ research tools, simulators; access to full historical financial data, max drawdown, and projected annualized returns for all publicly traded companies in Fool IQ … And a lot more. Check out our Motley Fool Epic review for all the deets.

Who It’s For

If you want high-quality stock picks and comprehensive research resources, Epic is a great selection.

-

-

- Fundamental analysis ✅

- Stock screener ❌

- Stock pickers/analysts ✅

- Investment research ✅

- News and quote data ✅

- Technical analysis ❌

-

Pricing

Motley Fool Rule Breakers is typically $499/year, but if you sign up with the link below, you can save $200 on your first year.

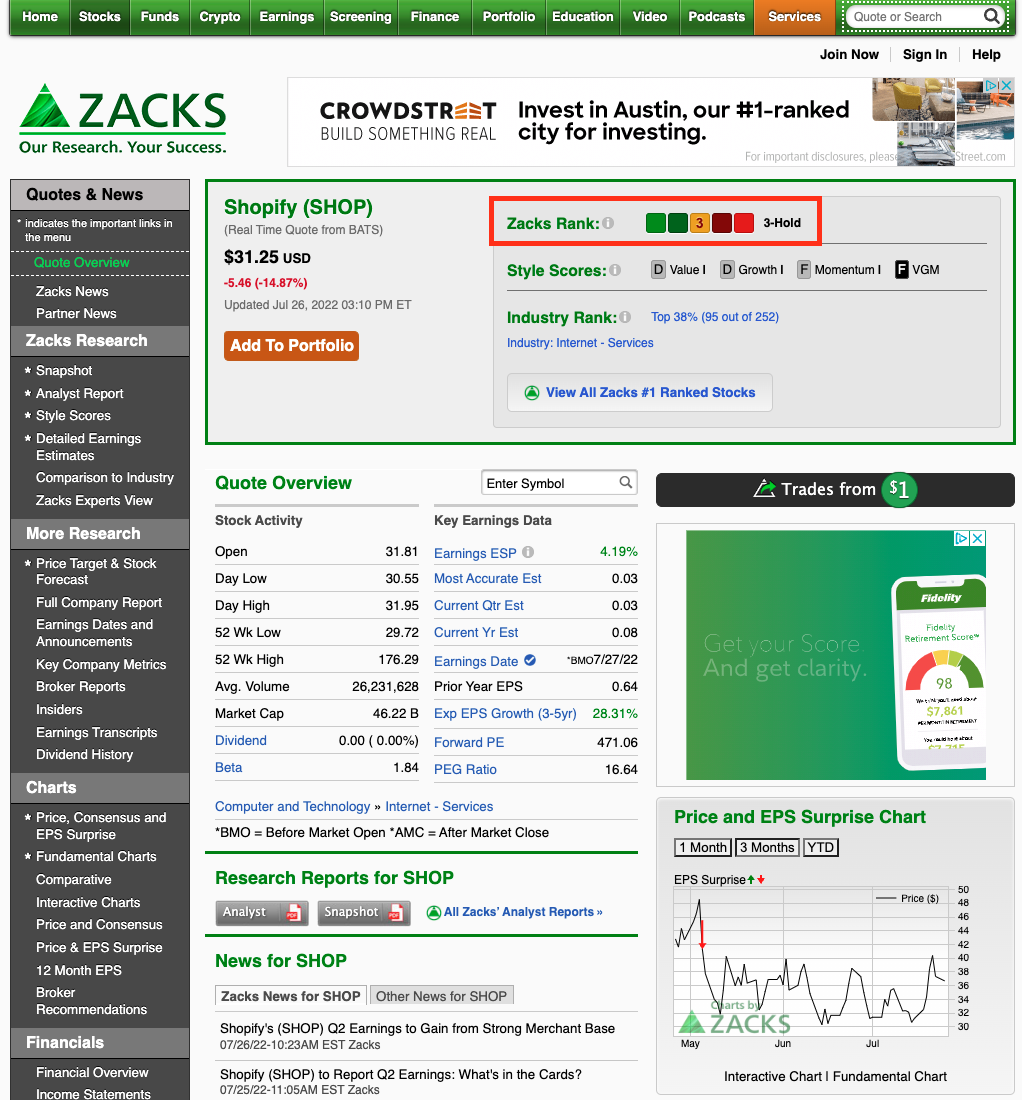

6. Zacks

Zacks Investment Research is one of the largest providers of independent stock, ETF, and mutual fund research in the U.S.:

The site is best-known for its simple rating system, ranging from Rank #1 (Strong Buy) to Rank #5 (Strong Sell).

Zacks members receive research published in daily newsletters including market news and commentary, Zacks Rank #1 (Strong Buy) stocks, Bull and Bear of the Day, stock and portfolio tracking, quote lookups, investment ideas from Zacks’ analysts, Top Stories, and more.

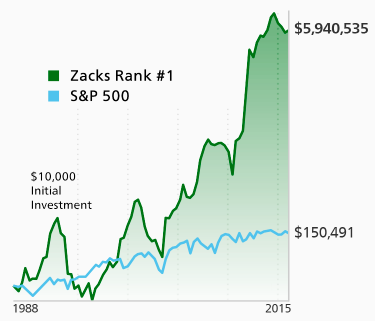

According to the site, Zacks Rank #1 (Strong Buy) stocks have more than doubled the S&P 500 with an average gain of +25.1% per year from January 1, 1988 through April 4, 2022 – quite consistent, and is the single biggest selling point for its service and what merits its spot on our best stock research sites list:

Self-directed short-term traders, long-term investors, and those interested in mutual funds and ETFs, can leverage its independent research and the Zacks Rank through a comprehensive suite of investment newsletters, including value, growth, income, options and more.

It also has educational, video, and podcast content to learn about investing and to gain insights into current market conditions.

Who It’s For

If you’re simply looking for premium stock picks to follow and don’t want to use Motley Fool Stock Advisor, Zacks is an obvious choice:

- Fundamental analysis ❌

- Stock screener ❌

- Stock pickers/analysts ✅

- Investment research ✅

- News and quote data ✅

- Technical analysis ❌

If you’re not interested in copying other analysts’ trades and having access to their research, look elsewhere.

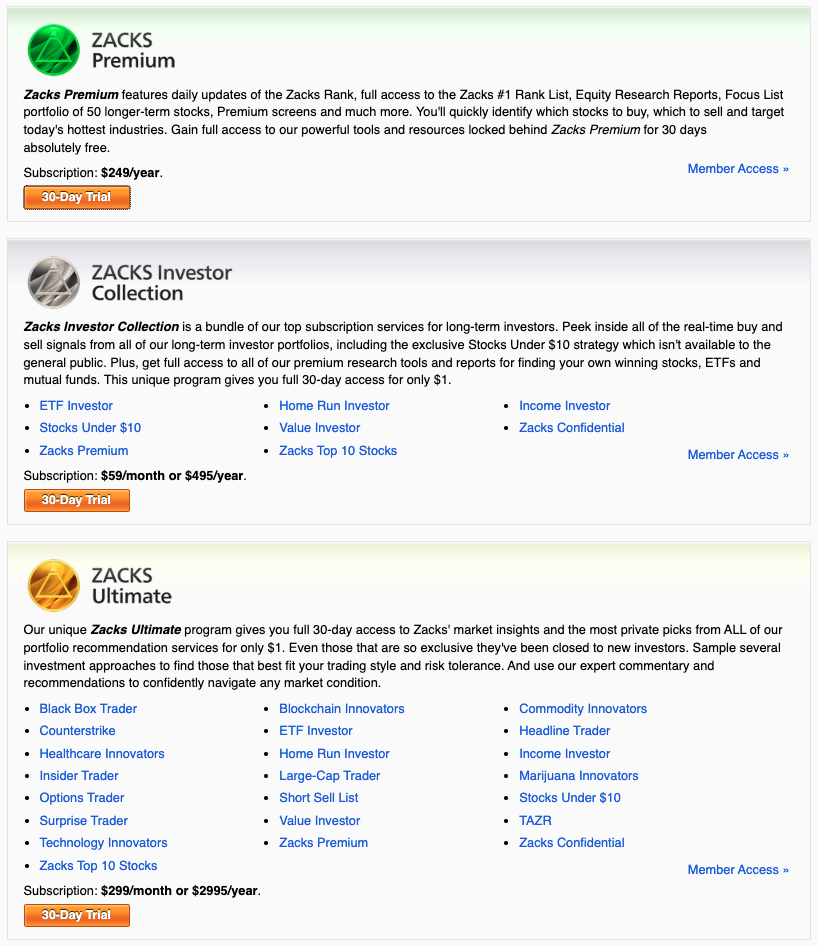

Pricing

Zacks is built as a members-only platform, with quite a few different services. Its service with the best value is Zacks Premium, which you can try for free for 30 days with the link below:

After the trial period, Premium will cost $249/year.

Read my full Zacks Premium review.

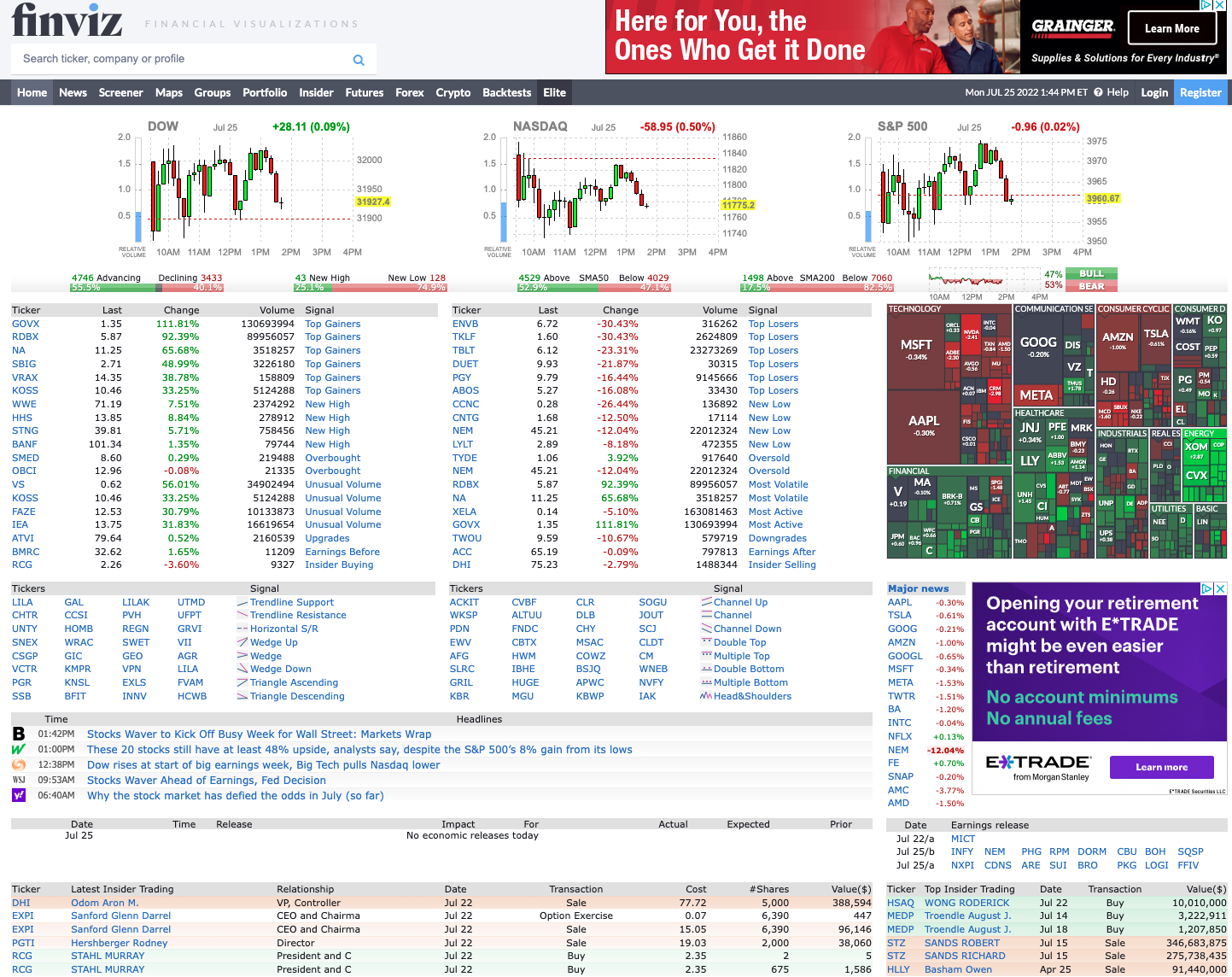

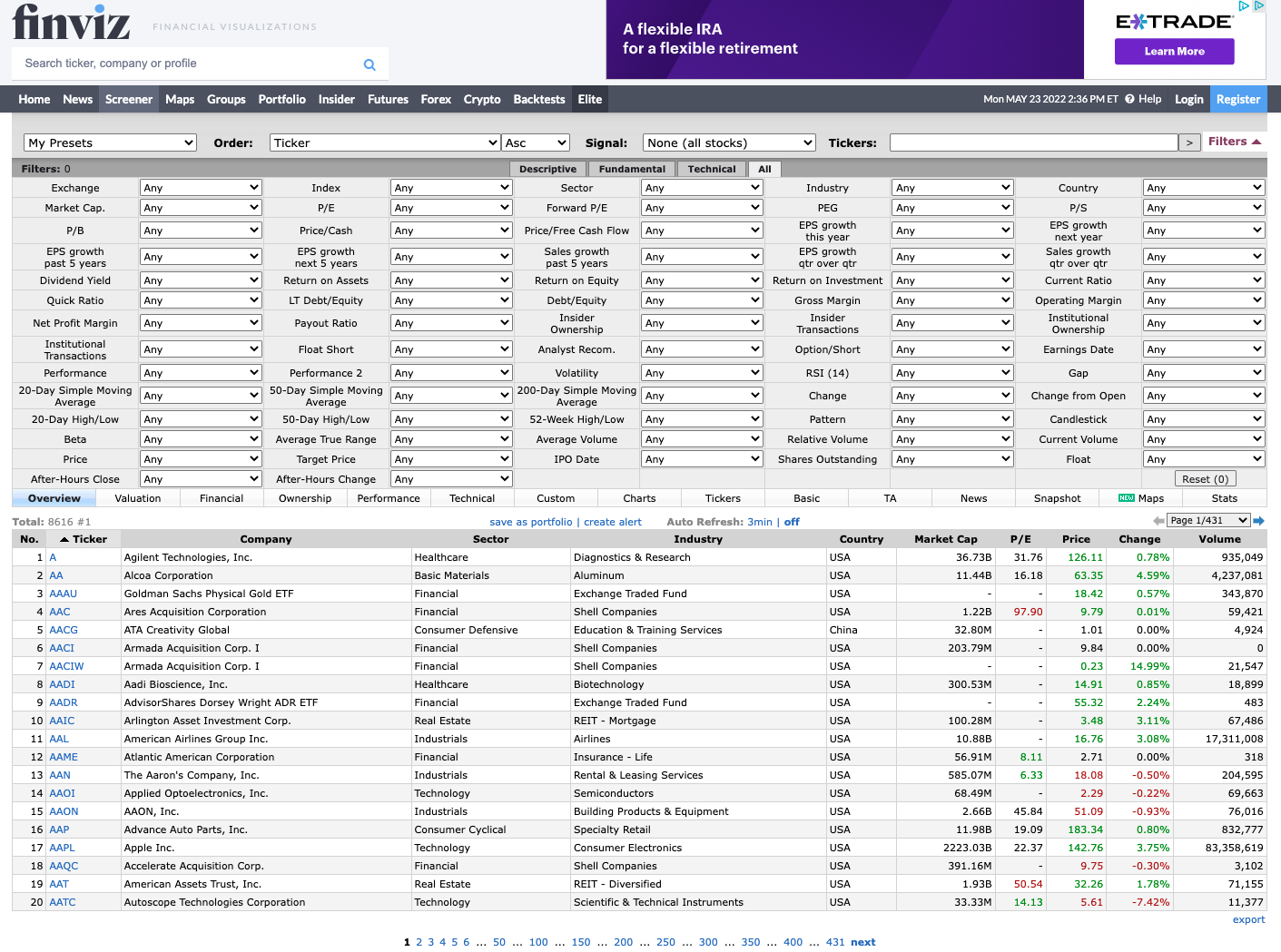

7. FINVIZ – The Best Standalone Stock Screener Website

When it comes to researching and filtering on vast amounts of statistical information, FINVIZ stands alone, which is why it’s the only true screener on this list of best stock research tools.

There aren’t a lot of bells and whistles, just screens and screens of extensive financial data, charts, and statistics:

The FINVIZ screener offers 3 different types of filers: Descriptive, Fundamental, and Technical:

But, unlike WallStreetZen, the interface is not minimal, clean, or overly user-friendly.

The Descriptive filters are the basic set of filters offered on exchanges, such as market cap, dividend yield, earnings date, average volume, industry, price, country, etc. These filters are the first ones used to narrow down your search.

The second set of filters are called Fundamentals, and they go into even greater detail about the stocks. The user can filter tickers based on the basic P/E ratio, margins, sales growth quarter to quarter, EPS growth, insider ownership, and many more. P/E ratio data is important because it shows how a company is expected to perform in the future.

(Get my full Finviz Elite Review here.)

The third filter option is the Technical filters such as moving averages, gap, RSI, volatility, performance, percentage change, after-hours change, and so on. This page also includes candlestick and patterns.

As you can tell, FINVIZ is very complex and can be intimidating for many users who are new to stock trading or prefer a more qualitative approach.

Although it offers news reports, blog reports, maps, groups, Portfolios and Insider Tabs, the heart and soul of FINVIZ is its screener, making it a somewhat limited option beyond a niche group of investors.

Who It’s For

FINVIZ is a powerful tool but its use cases are limited, making it one of the best stock researching websites available for investors looking for a quantitative stock screener:

- Fundamental analysis ❌

- Stock screener ✅

- Stock pickers/analysts ❌

- Investment research ❌

- News and quote data ✅

- Technical analysis ✅

The site is severely lacking when it comes to fundamental analysis and qualitative investment research.

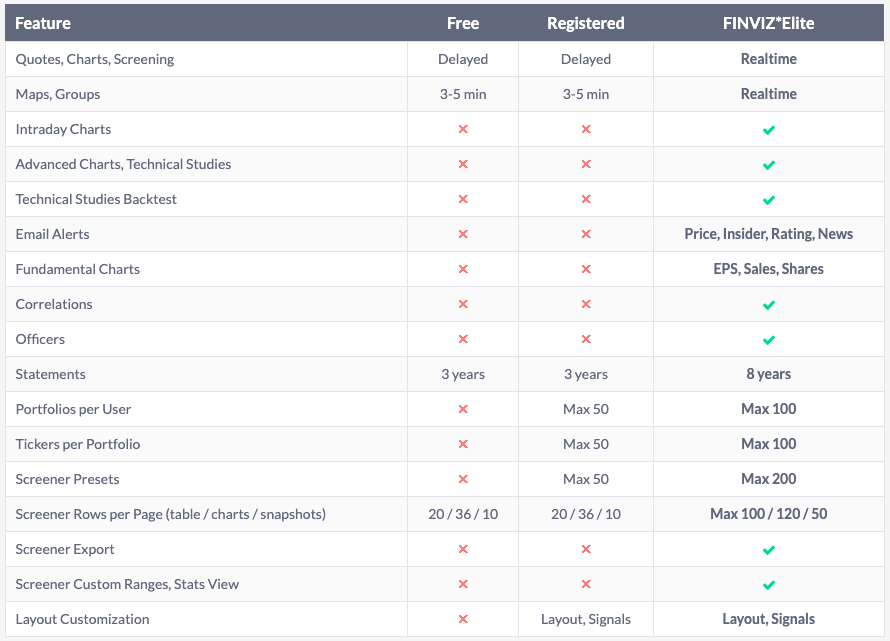

Pricing

Like WallStreetZen, there are two plans to choose from: a free Basic plan and a paid, ad-free plan called Elite:

The free version offers most of the data and charts that a casual or beginner trader would need to be successful. However, many professional day traders find the Realtime data and backtesting features that come with Elite to be invaluable.

You can choose to either pay monthly ($39.50) or annually ($299.50) for the Elite version.

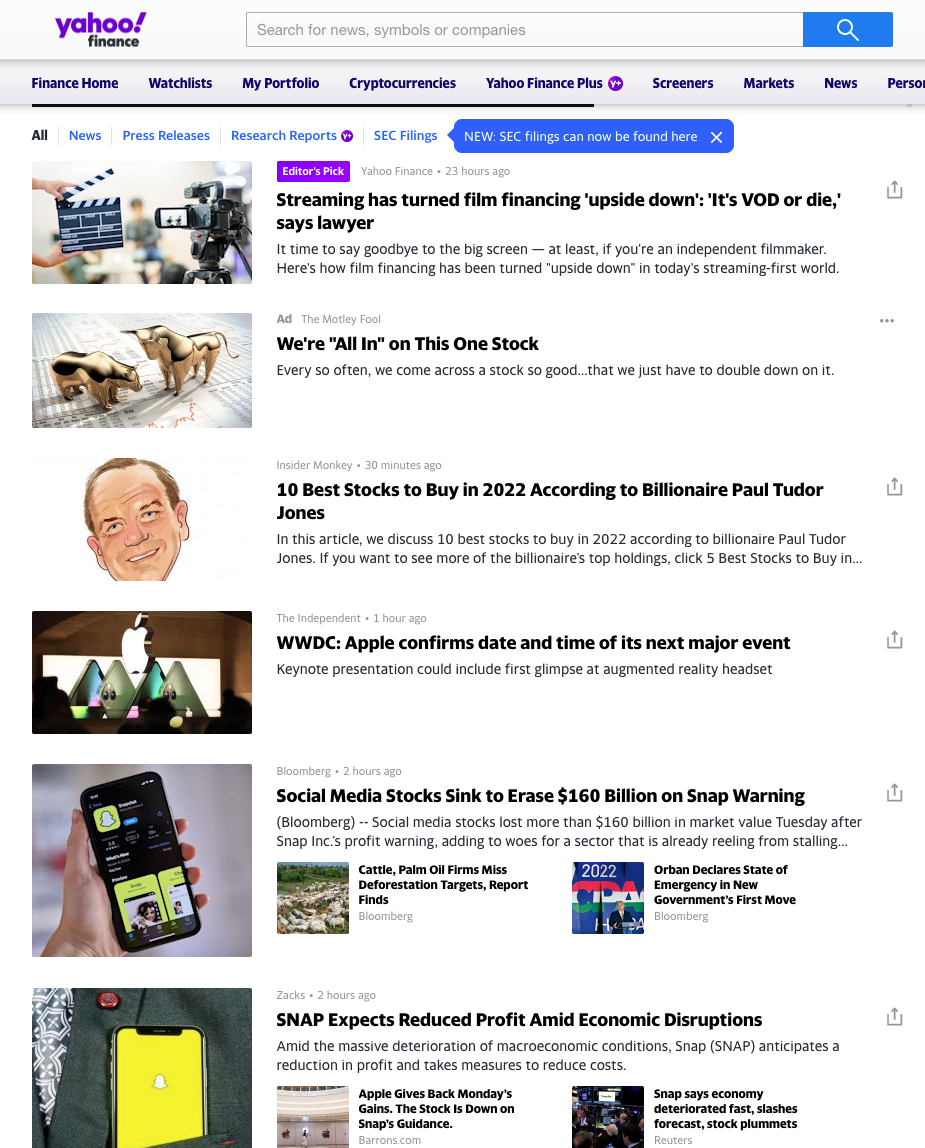

8. Yahoo! Finance

Yahoo! Finance is still the most popular finance website in the U.S., earning its spot on our best stock market websites list.

Personally, my favorite feature is its news feed. Yahoo! Finance is the largest repository of third-party research reports sourced from analysts all over the world:

The quantity of information on its site is challenged by only 1 or 2 others on this list of best stock sites, and a lot of websites (including The Motley Fool, Seeking Alpha, and Zacks) derive a large amount of their traffic through Yahoo! Finance.

Beyond being a news repository, the site has a number of high-quality tools and features which include market data on everything from mutual funds to crypto, watchlists, company profiles, and premium features like advanced charting and portfolio analytics.

(For related websites, read my article on the best stock news apps for stock market news.)

Who It’s For

Yahoo! Finance’s “no fuss, plain Jane” approach attracts experienced investors who know exactly what they’re looking for.

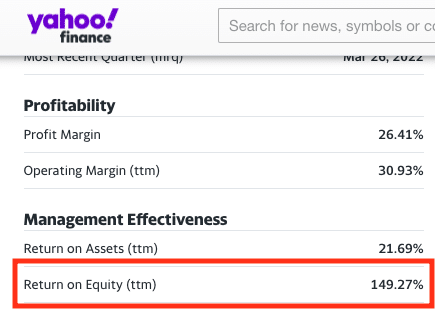

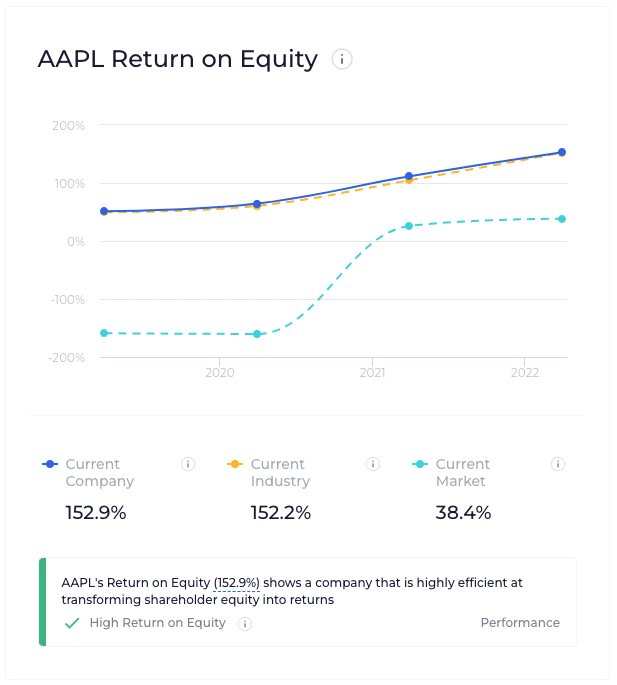

Unlike WallStreetZen, its statistics are fixed, numerical data points that lack any interpretation or comparisons. Compare the two sites’ displays of ROE data:

(Learn what is a good ROE and why Warren Buffett loves this figure.)

This may work for investors who know exactly what they’re looking for and what represents value for an individual company in a specific industry, but non-professional investors may find themselves looking for additional context.

That said, it’s a solid option for the news-centered, experienced investor:

- Fundamental analysis ✅

- Stock screener ✅

- Stock pickers/analysts ✅

- Investment research ✅

- News and quote data ✅

- Technical analysis ✅

While it technically does check all of the boxes, some of the features are not entirely helpful while others are hidden behind paywalls or just links to third-party sources, lowering its rank on our list of best stock analysis websites.

Pricing

Yahoo! Finance offers a few different tiers:

Free – Basic quotes, news, watchlists, portfolio tracking.

Yahoo Finance Plus: Silver – Adds things like top stock picks/strategies, research reports access, and other premium tools. $29.95/month, billed annually ($359.40/yr).

Yahoo Finance Plus: Gold – Everything in Silver plus downloadable/exportable data and model-building tools. $39.95/month, billed annually ($479.40/yr).

Before switching to WallStreetZen, I used the free version of Yahoo! Finance for 5+ years..

For Google’s (albeit much simpler) version, check out Google Finance – it deserves an honorable mention for best stock websites.

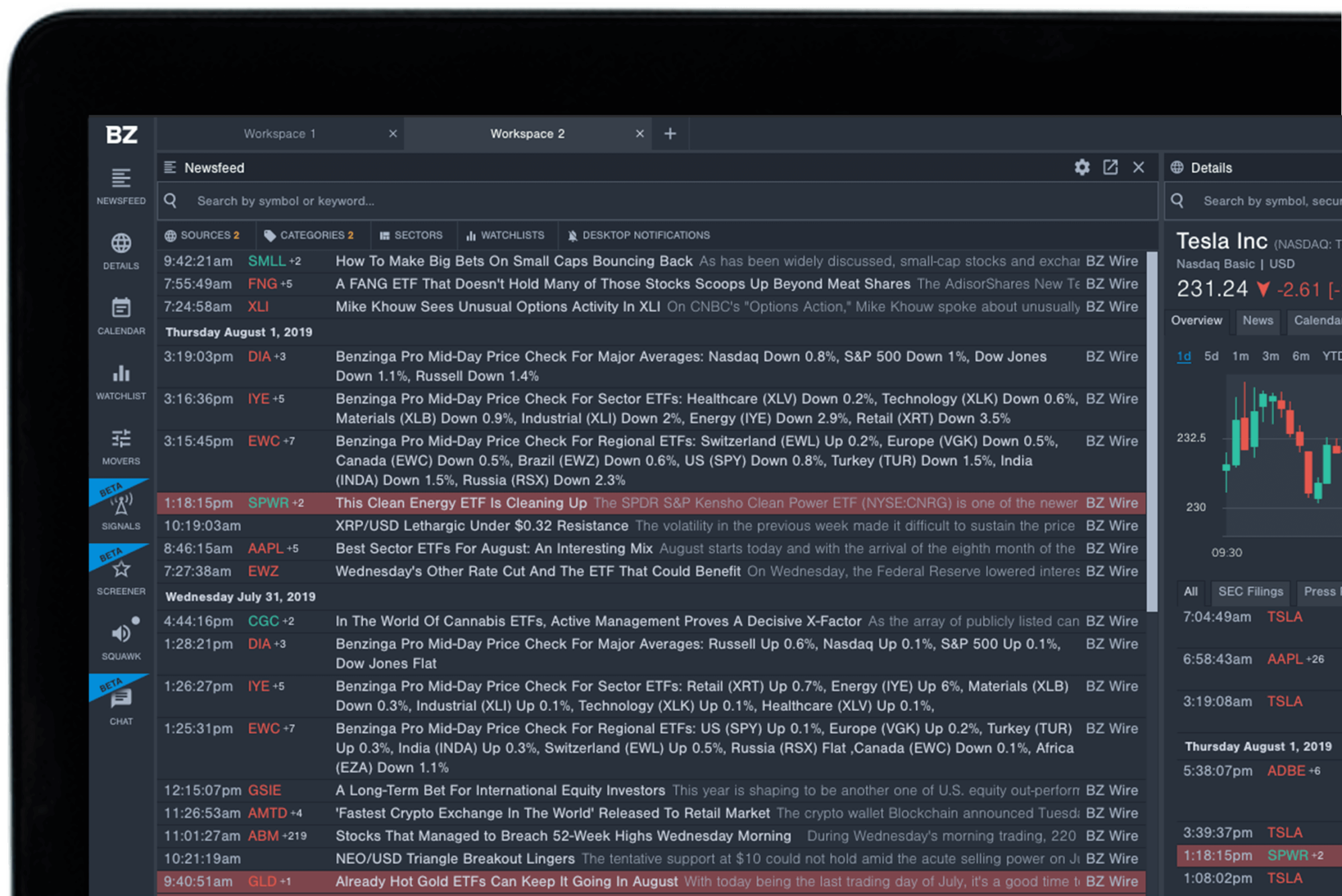

9. Benzinga Pro – The Best Stock Research Website for Fast, Actionable Market News

It’s never fun to check your portfolio after the market closes and see one of your stocks was down 15% on the day because of an analyst downgrade.

You read the analyst’s report and realize your reason for buying is no longer relevant. You want to sell too, but at this point the stock is basically undervalued. Wouldn’t it have been nice to get this news when everybody else did?

If you’re a news-driven trader, Benzinga Pro is your new BFF. The service was created for investors and traders who want to be the first ones to read stock market news catalysts before they drive changes in stock prices. The service provides real-time, exclusive breaking news reports on thousands of publicly-traded companies, as well as a calendar of upcoming notable dates (such as earnings announcements).

If you’re on the fence about whether or not it’s right for you, here’s some good news — you can try Benzinga Pro for 2 weeks FREE, so you can see for yourself whether or not it’s a good fit.

Who It’s For

If you’re tired of being in the dark and want access to exclusive content that drives stock prices, check out Benzinga Pro today:

- Fundamental analysis ❌

- Stock screener ✅

- Stock pickers/analysts ❌

- Investment research ✅

- News and quote data ✅

- Technical analysis ❌

Pricing

After your free trial, I recommend the Basic plan which costs $37/month.

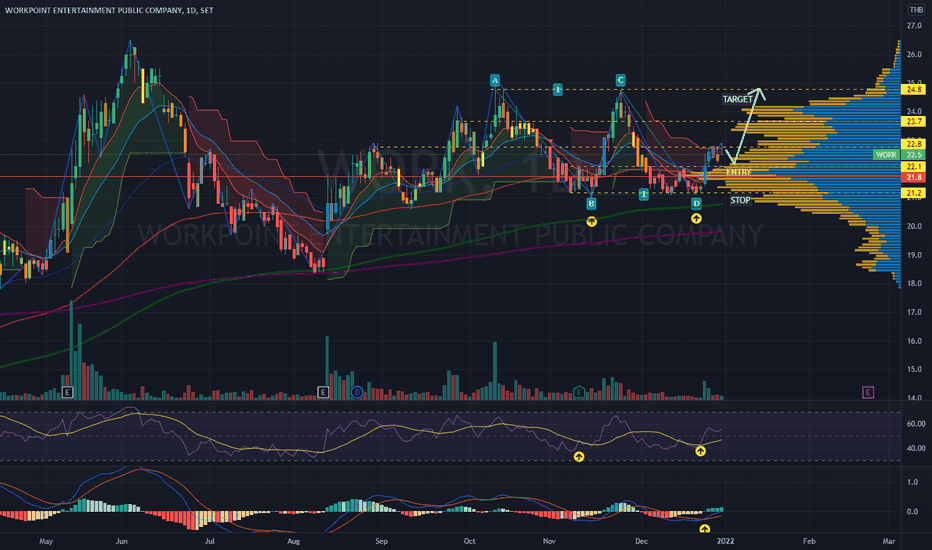

10. TradingView – The Best Stock Research Website for Day Trading

If you’re a trader who relies on technical analysis, you need a stock research tool created to handle your workflow.

In my opinion, TradingView stands alone in this category.

This stock research site has all of the trading bells and whistles: real-time data, indicators, complex charting capabilities, watchlists, screeners, and tools to help you research stocks, mutual funds, ETFs, cryptocurrencies, and more.

But what sets TradingView apart is its user interface. It’s incredibly intuitive, fast, and reliable. If you’re willing to try it, there’s an excellent chance it improves your workflow.

Who It’s For

If you’re a day trader, TradingView deserves to be your #1 choice:

- Fundamental analysis ❌

- Stock screener ✅

- Stock pickers/analysts ❌

- Investment research ✅

- News and quote data ✅

- Technical analysis ✅

Pricing

You can use TradingView for free, but I recommend getting started with the Pro+ membership which costs $24.95/month when billed annually.

Use the link below to snag a 30-day free trial:

Figuring Out the Best Option to Suit Your Needs

There are a few basic types of tools you might be looking for…

The 4 Types of Stock Research Websites & Tools

- Stock Pickers/Analysts

- Stock Screeners

- Investment Researchers

- News/Basic Quote Information Providers

If you’re not sure which category you should be looking in, here’s a few questions to give yourself some clarity:

- Are you looking to gather financial data to perform your own fundamental analysis calculations?

- Are you looking for stock recommendations from industry professionals or opinions on stocks you already know about?

- Are you looking for a screener tool to help you uncover new stock ideas?

- Are you looking for up-to-date news and basic quote data?

What If You Don’t Want to Perform Stock Research Yourself?

OK, real talk.

Maybe after reading about these options your head is spinning. Maybe it seems like a lot of work. Maybe you’re not sure if you’re really capable of carefully selecting and curating a portfolio.

Hey, no judgment. There are options out there for you.

One of the best newcomers is Zen Strategies — a service that goes beyond stock-picking and into full-fledged portfolio curation. With membership, you gain access to 11 different stock portfolios, each containing 7 stocks aligned with a different trading or investing strategy, ranging from “safer” strategies like Value and Large Caps to more speculative (but potentially higher-reward) strategies like Technology and Under $10 stocks.

You can stick with a portfolio that speaks to you, or pick and choose for a diversified approach, all with the knowledge that each and every pick is vetted by the Zen Ratings system, which evaluates each ticker on 115 factors proven to drive growth in stocks. The system works — stocks rated “A” have historically delivered 32.52% annual returns.

As for the portfolios? The Under $10 stock strategy has been particularly impressive, with an all-time annual return of 34.58%.

Summary: The Best Stock Research Websites & Tools in

Did you find the right stock investing tool for you?

If you’re looking for stock picks, Motley Fool Stock Advisor is the best option.

If you’re looking for a heavy screener, FINVIZ should be your tool.

For investment research, Morningstar Premium, Seeking Alpha Premium, and Yahoo! Finance are all viable options.

But, if you’re looking for the single, best overall stock research website, WallStreetZen is the place for you.

It has it all: Recommendations from top analysts, a customizable screener, top-tier fundamental analysis and investment data, and news feeds to keep you abreast of any new developments.

If you’re interested in doing your own stock research, read about the best stock analysis software.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our January report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.