Most new investors have 2 problems:

- You don’t know when to buy a stock

- You don’t know when to sell a stock

Those are pretty big issues, given that how to know when to buy and sell stocks is the entirety of the investing process.

The truth is, there’s no way to know for sure when is the best time to buy stocks or when is the best time to sell stocks – investing is as much art as it is science.

The good news is the more time you spend buying and selling stocks the better you’ll become at knowing when you should.

But if you’re starting out, there are some general rules of thumb. These aren’t my own rules – I’ve got them from reading every book I can get my hands on about legendary investors like Warren Buffett, Benjamin Graham, and Peter Lynch. If you like what I have to say, thank them, not me.

When to Buy Stocks

I’ve already written an article on how to know what stocks to buy that covers the investment strategy I follow, value investing:

Read more: How to Know What Stocks to Buy

The long-and-short of when to invest in stocks is two-fold:

- Buy great companies

- For fair or better prices

When companies meet those 2 criteria, that’s the best time to buy stocks.

The article linked above dives into the specifics and tactical-side of these points (and how WallStreetZen can help you all along the way), but I’ll add some additional context here.

Identifying great companies at fair or better prices

What makes a company “great”?

What makes a stock’s price “fair” or “better” than fair?

Here’s an overview of the 3 categories I look at when evaluating potential investments:

1. Current Valuation – How is the stock priced?

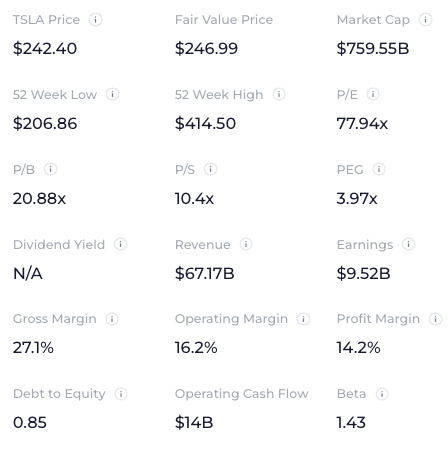

The most common way to value stocks is by using relative valuation ratios, such as the P/E, P/S, P/B, and PEG ratios:

It should be noted: Valuation ratios alone don’t necessarily signal when you should buy a stock or sell a stock. Instead, they indicate which companies are being valued either higher or lower than their peers based on the expectations of their future growth.

If you see stock ABC has a P/E of 15x, that doesn’t tell you much.

If, however, it has a P/E of 15x and its revenue and earnings are expected to grow at 50% per year for several years and its peers are trading at P/E ratios of 30x and are only expected to grow at 20% per year, ABC could increase more than threefold before it’s correctly valued.

In the context of its growth rate and peer valuations, the P/E of 15x may indicate now is a great time to buy ABC.

2. Future Outlook – What is the stock’s potential?

A large part of any stock’s current valuation is investors’ expectations of its future growth.

This is why Tesla (NASDAQ: TSLA) trades at a much higher valuation (88.5x P/E) than Ford (NYSE: F) (4.2x P/E).

The higher a company’s potential for growth and the greater its likelihood of achieving that growth, the higher the valuation the stock should trade at.

If you think stock ABC’s revenue will grow at 50% per year for the next 10 years and the market is projecting it to grow at just 15%, you will value ABC much higher and buy as many shares as you can.

💡 Note: WallStreetZen shows the analyst forecast data on each stock’s ‘Forecast’ tab (here’s TSLA’s analyst forecast data):

If you’re really not sure what the future holds, you can rely on the analysis of Wall Street experts. Our Top Analysts feature allows you to see the latest recommendations from the best performing analysts on Wall Street.

3. Business Risks

All businesses face some risks from competition within their industries, economic headwinds, poor management decisions, or unsustainable operations.

In short, I want to buy financially durable companies with strong competitive advantages. To do this, I check:

- If debt coverage is sustainable

- If short-term assets can cover long-term liabilities

- If operating cash flow is robust

- If profit margins are higher than the industry average

💡 Note: I know I blazed through these checks, but these are just a sampling of the 38 due diligence checks WallStreetZen’s Zen Rating automatically analyzes, allowing you to find each stock’s fundamental strengths and weaknesses in seconds (check out TSLA’s Zen Rating):

Putting them together

Now that we know what makes a great company and how to determine individual stocks’ fair values, it’s time to put them together so we know when is the best time to buy stocks.

- When a company’s value (in terms of its financial results, future outlook, and risks) is higher than its current valuation, we buy.

- When a company’s value is lower than its current valuation, we sell.

Which leads me into my next section…

When to Sell Stocks

Honestly, how to know when to sell stocks can be even more ambiguous than knowing when to buy them.

It’s almost inevitable: If I sell today, the price is sure to cruise even higher. If I plan on selling in a few weeks, the stock is bound to take a dive.

I can’t tell you how many times this happened to me – it was painful.

But I’m about to share something with you that will forever change how you think about when it’s time to sell your stocks:

The stock’s price should have no influence in your decision to hold or sell.

There are only 2 reasons to sell a stock:

1. Your reason for buying no longer exists

Do you remember your original reason for buying your stock?

Hopefully, you bought it because it was a great company at a fair or better price.

Since then, has its price risen beyond the company’s real value? Is the stock valued higher than you believe it should be? If so, there’s probably very little potential upside left, and holding on to stocks that increase in price beyond their intrinsic value because you think it will go even higher is speculating, not investing.

From our example above, let’s assume you bought stock ABC when it was trading at 15x P/E. From there, its price went on to increase five-fold, meaning it is trading at a P/E of 75x. In your opinion, ABC is now overvalued so you decide to sell for a tidy profit.

On the flip side, any business’ fundamentals could deteriorate at any time. If a company makes a series of bad decisions or the economy worsens and the stock price remains elevated above the company’s real value, it may be time to sell. The stock’s story has changed and you must reevaluate your investment.

If you bought ABC and a competitor starts offering a better product, you may expect its growth to increase by just 5% per year. At a P/E of 15x, ABC is overvalued in your opinion, so you sell.

Here’s a good rule of thumb: If you wouldn’t buy more at this price, you should consider selling.

On the other hand, if you wouldn’t hesitate to buy more, keep holding.

2. A better opportunity becomes available

We want to put our money into investments where it will have the highest likelihood of returning the best possible return, based on our risk tolerance, investing style, and time horizon.

If your money is currently invested in a mediocre business with lousy upside, it’s time to sell your stock and invest your money in a more attractive company.

And you should always be on the lookout for better opportunities.

Summary

As I mentioned above, even with all of our models, metrics, analysis, and tools, nobody really knows for sure when the best time is to buy or sell a stock.

After all, investors are humans which means the stock market is heavily influenced by human psychology – something that is anything but predictable.

But, with a few general rules of thumb, we can each develop our own investing style which will guide our buying and selling decisions.

If you’re interested in investing based on quality, fundamental analysis, I highly recommend using WallStreetZen.

We built it specifically for people like you and me – serious investors who know the critical importance of proper research and analysis, but don’t have countless hours to spend in Excel manipulating data.

With our intuitive data visualizations and aggregated analysis, you can make better investing decisions in minutes, not hours.

Plus, who doesn’t love seeing what Wall Street’s Top Analysts are recommending?

Motley Fool Stock Advisor

If all this talk of fundamental analysis makes your eyes glaze over, consider subscribing to Motley Fool’s Stock Advisor.

Stock Advisor is a stock-picking service that delivers 2 high-quality recommendations each month straight to your inbox. Since the service’s inception, the Motley Fool team has vastly outperformed the S&P 500:

Plus, we’ve got a special introductory offer to share: Get your first year of Stock Advisor for just $79!

If you’re new to investing, you may enjoy my article on how to predict stocks or how to invest with little money.

FAQs:

When should you sell a stock for profit?

If your reason for buying the stock no longer exists or a better investment opportunity presents itself, you should sell the stock - regardless of the price.

When should you buy a stock?

If you can find a great company trading at a fair or better valuation, you should buy the stock.

What is the best time of day to buy and sell stocks?

Generally speaking, the exact time of day to buy and sell stocks is irrelevant. However, most institutional investors buy and sell in the first and last hours of the trading day, so things typically move slower in the middle of the day.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.