Is Alto CryptoIRA the right IRA provider for your long-term crypto investments?

There’s a good chance that it is.

Alto CryptoIRA is easily one of the 3 best crypto IRA providers, and is by far the best solution for a specific segment of crypto investors.

Does that include you?

You’re about to find out.

Alto Crypto has the widest selection of cryptocurrencies, some of the lowest fees, and a solid selection of account types. It also has the lowest minimum investment required of the major crypto IRA providers (just $10 to open an account).

In this Alto Crypto IRA review, I’ll cover the most important factors you need to see if Alto is the right crypto IRA platform for you – tradable assets, fees, features, security, and more.

I’ll also compare Alto Crypto side-by-side with its main 2 competitors: Bitcoin IRA and iTrustCapital.

Is Alto CryptoIRA Legit in 2025?

The Bottom Line: Yes, Alto CryptoIRA is a legit and trustworthy crypto IRA provider. It is one of the premier services of its type, and it provides a secure way to invest in cryptocurrencies for retirement.

Alto Crypto IRA excels in the number of cryptocurrency offerings (via its partnership with Coinbase), low fees, and an extremely low minimum investment requirement.

If you want to invest in cryptocurrencies in a tax-advantaged account, you won’t go wrong with Alto Crypto IRA.

What is Alto CryptoIRA?

Alto IRA is a platform for investing in alternative assets for retirement—leveraging tax-advantaged accounts to secure gains from asset classes such as art, collectibles, farmland, and many others. Alto CryptoIRA is a subset of the platform which focuses on cryptocurrencies.

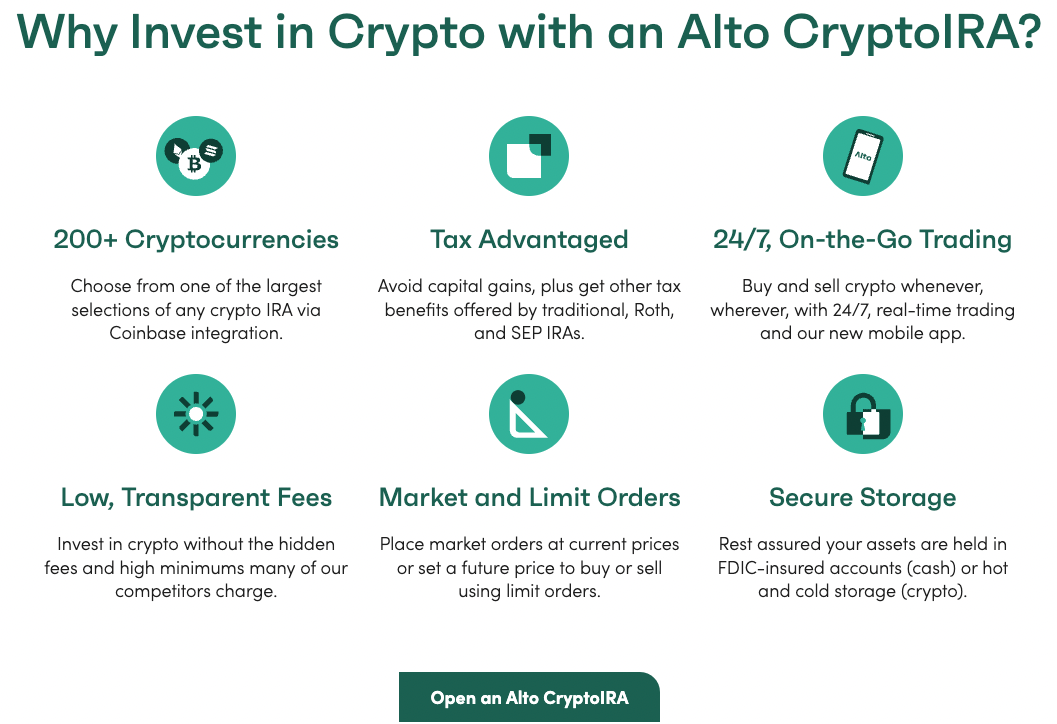

Alto CryptoIRA offers 200 cryptocurrencies which you can buy in your tax-advantaged retirement portfolio. Alto Crypto offers a range of retirement accounts, including Traditional, Roth, and SEP IRAs, as well as 401(k)s for small business owners.

Traditional IRAs help you save on taxes in the current year, while a Roth IRA is tax-free in retirement. A SEP IRA allows small business owners (and their employees) to invest in a retirement account, with higher contribution limits than standard IRA accounts.

Alto CryptoIRA stands out by offering a huge selection of cryptocurrencies to invest in through its partnership with the crypto exchange Coinbase. The list exceeds 200 cryptocurrencies that are available to the user 24/7.

Alto Crypto IRA also has a very user-friendly platform and a team of in-house experts available to assist clients set up an account and choose their investments.

The platform is available in all U.S. states except Hawaii.

How Does Alto CryptoIRA Work?

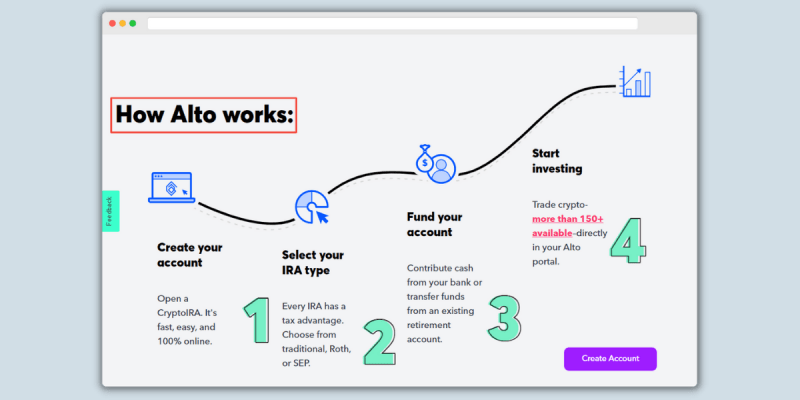

To start investing on Alto CryptoIRA, you need to complete a simple, online application (takes about 10 minutes).

After being verified and having your account activated, you can transfer funds from your bank account or rollover another retirement account and start investing in cryptocurrencies.

When buying digital assets on Alto CryptoIRA, the assets are held in a Coinbase wallet. You can buy and sell whenever you want, but you don’t control the wallet directly, so you cannot transfer, stake, or earn interest on your cryptos.

Alto CryptoIRA also provides access to Alto IRA, a general IRA platform that allows you to invest in a variety of alternative assets, such as real estate, precious metals, farmland, and private equity.

Alto CryptoIRA Fees and Minimums

- Minimum investment: $10

- Crypto trading fees: 1% of the order size per trade

- Minimum investment: $10

Alto CryptoIRA charges a one-time setup fee of $250 and an annual maintenance fee of $360. There are also transaction fees for buying and selling cryptocurrencies, which vary depending on the specific crypto being traded.

Alto Crypto IRA fees are below average.

What Assets Are on Alto CryptoIRA?

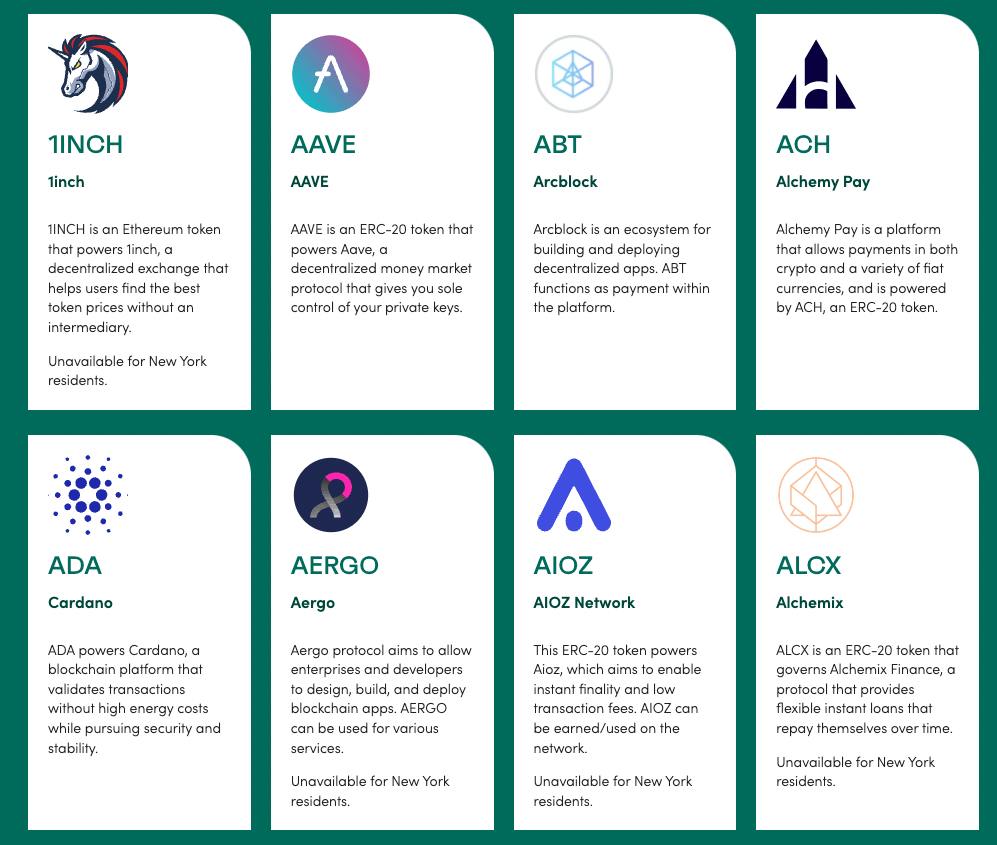

Alto CryptoIRA currently offers over 200 cryptocurrencies, including:

- Bitcoin (BTC)

- Ethereum (ETH)

- Cardano (ADA)

- Bitcoin Cash (BCH)

- Polygon (MATIC)

- Solana (SOL)

- Tether (USDT)

- USD Coin(USDC)

- Binance USD (BUSD)

- Dogecoin (DOGE)

- Stellar (XLM)

- Litecoin (LTC)

- Polkadot (DOT)

Unlike the other popular crypto IRA providers, Alto Crypto IRA does not offer physical gold or silver.

Pros and Cons of Alto CryptoIRA

Pros

- Various tax-advantaged accounts. Alto CryptoIRA offers traditional, Roth, and SEP IRAs to crypto investors.

- Access to 200 different crypto tokens. Alto CryptoIRA’s main advantage is its unrivaled selection of available investments, which spans everything from big league tokens such as BTC and ETH to stablecoins and altcoins.

- Simple onboarding process and user-friendly platform. Alto’s platform is intuitive and easy to use, while the onboarding process usually lasts just a week.

- Low minimum investment requirement. With only a $10 requirement to start investing, Alto CryptoIRA’s accessibility is unparalleled.

- FDIC insurance. All of the cash in your Alto CryptoIRA account is stored in FDIC-insured accounts insured for up to $250,000

- Mobile app availability. Alto’s mobile app allows for 24/7 oversight of your portfolio.

Cons

- Average fees. Admittedly, this isn’t a “con” per-se – but the service’s fees are higher than some of the competition’s.

- No crypto staking available. Staking allows investors to “lock up” their crypto tokens for a certain amount of time in exchange for interest payments—unfortunately, the platform does not support this feature.

- Lacks solo 401k. The platform does not support opening a solo 401k.

Should You Use Alto CryptoIRA?

Alto CryptoIRA is best for long-term investors who want access to the widest selection of cryptocurrencies that can be bought in a tax-advantaged retirement account. Alto is also one of the lowest fee providers and has the lowest minimum deposit requirements of any major crypto IRA provider.

Alto Crypto IRA users should not be interested in investing in precious metals.

The platform’s partnership with Coinbase leads to one of its premier strengths—over 200 crypto tokens available to investors.

At the same time, both the signup and trading processes are quite simple and intuitive—and although the fees aren’t the lowest, they are on par with what investors would normally pay on exchanges like Coinbase.

Also, the availability of other alternative investments like farmland, art, and real estate (via the main Alto IRA platform) is another huge benefit.

Alto CryptoIRA Competitors

Alto CryptoIRA vs Bitcoin IRA

Both Alto Crypto IRA and Bitcoin IRA offer Traditional, Roth, SEP, and SIMPLE IRAs but the similarities end there:

Alto CryptoIRA | Bitcoin IRA | |

|---|---|---|

Minimum Investment | $10 | $3,000 |

Fees | – $250 setup fee – 1% trading fee – $25 outbound wire transfer fee – $50 account closure fee | – 0.99% – 4.99% setup fee – 2% trading fee – 0.08% maintenance fee ($20 minimum) |

Asset Selection | – 200+ cryptocurrencies | – 60+ cryptocurrencies – Physical gold |

Alto CryptoIRA vs Bitcoin IRA: Bitcoin IRA has higher fees, a higher minimum investment, fewer cryptocurrencies, and access to Solo 401(k) accounts and the ability to invest in physical gold.

Bitcoin IRA uses BitGo as its custodian, whereas Alto Crypto IRA uses Coinbase.

Additionally, Bitcoin IRA users can earn up to 6% APY on their crypto holdings.

Check out our full Bitcoin IRA review.

Alto CryptoIRA vs iTrustCapital

Alto CryptoIRA and iTrustCapital have similar account offerings, trading fees, and have the same custodian. The differences are more subtle:

Alto CryptoIRA | iTrustCapital | |

|---|---|---|

Minimum Investment | $10 | $1,000 |

Fees | – $250 setup fee – 1% trading fee – $25 outbound wire transfer fee – $50 account closure fee | – 1% for crypto trades – $50 over spot (per ounce) for Gold – $2.50 over spot (per ounce) for Silver |

Asset Selection | – 200+ cryptocurrencies | – 30 cryptocurrencies – Physical gold – Physical silver |

Alto CryptoIRA boasts more than 200 cryptocurrencies, while iTrustCapital only offers the 30 most-traded tokens on the market, but also offers gold and silver.

AltoIRA also has a lower minimum investment requirement but slightly higher fees than iTrustCapital.

Check out our full iTrustCapital review.

Final Word: Alto CryptoIRA Review

The 3 leaders in this space are Alto CryptoIRA, Bitcoin IRA, and iTrustCapital – your decision to open a crypto IRA should come down to one of those 3.

For the biggest selection of cryptocurrencies and some of the lowest fees, choose Alto CryptoIRA, but only if you’re not interested in owning precious metals.

For a solid selection of the most popular cryptocurrencies and both physical gold and silver, iTrustCapital has a wide range of account options and very low fees.

If you want the leader in the crypto IRA space, choose Bitcoin IRA – it’s the most expensive for good reason.

A huge range of cryptos available for trading along with unassuming fees make Alto CryptoIRA one of the best IRA providers for retirement investors who want a diverse cryptocurrency portfolio at an accessible price.

Although my Alto CryptoIRA review was focused on its crypto solution, it does bear repeating that Alto’s wider ecosystem also spans other unconventional retirement assets, including farmland, venture capital, etc.

At the end of the day, there are plenty of investors who simply don’t have thousands of dollars laying around to take care of those pesky minimum investment requirements. With Alto, if you have as little as $10, you can start investing in one of over 200 crypto tokens in a retirement account.

FAQs:

Is Alto Crypto IRA legitimate?

Yes, Alto CryptoIRA is a legitimate service that allows users to invest in cryptocurrencies as part of their tax-advantaged retirement portfolio.

It is registered with the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC) and follows all applicable regulations.

What is Alto crypto IRA?

Alto Crypto IRA is a service that allows users to invest in cryptocurrencies as part of their tax-advantaged retirement portfolio. It offers a range of retirement accounts, including Traditional, Roth, and SEP IRAs, as well as 401(k)s for small business owners.

Which IRA is best for crypto?

The best IRA for crypto investment depends on the specific needs and goals of the investor, though I recommend Bitcoin IRA, iTrustCapital, or Alto CryptoIRA.

Some factors to consider when choosing an IRA for crypto investment include the selection of cryptocurrencies available for investment, fees, minimum investment requirements, and the overall reputation and track record of the service.

How does AltoIRA work?

To use Alto CryptoIRA, you can apply for and open a retirement account. Once the account is set up, you can transfer money from your bank account or rollover funds from an existing retirement account and start investing in cryptocurrencies.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.