It’s never been easier to score free stocks.

On most platforms, all you need to do is open an account and make a small deposit and you will instantly unlock the chance to get free shares worth hundreds of dollars.

The very first time I referred a friend to Robinhood, he got one share of Meta (then Facebook) worth a little over $140!

Not bad for taking 5 minutes to download an app.

Plus, you can take advantage of several of the offers below and score free stock on multiple apps at the same time.

If you end up not liking the app, just wait until the free share becomes available to sell then transfer it out of the app.

If you’re a new investor and want some free stock to kickstart your portfolio or if you’re just looking for some free stocks, here are the 10 best apps that give free stock.

I’ve ranked them by combining how good the bonus is, how easy it is to unlock, and how much I like the app itself.

I’ll also cover exactly what you need to do to unlock each of the free stock shares and cash bonuses and what I like/dislike about each brokerage.

App | Best For | Promotion | Sign Up |

|---|---|---|---|

Intermediate traders | Up to 30 free stocks (!) | ||

Overall | Referral program; bonus for transferring account | ||

New investors | Free fractional shares for new accounts + referrals; bonus for transferring account | ||

New, active traders | Up to 12 free stocks worth up to $3,000 | ||

Automated, long-term investing | Up to $500 cash bonus | ||

Families | $20 cash bonus | ||

Active traders | $150-$3,500 cash bonus | ||

Young investors | $20 in free stock + more bonuses for referrals | ||

Full-service | $5-$1,000 free stock |

Be sure to use the links in this article! Several of the above offers are only available through referral links.

Here are the 10 best free share apps right now:

1. Moomoo (Up to 30 Free Stocks)

moomoo is a commission-free stock, ETF, and options trading platform built for active traders. Its combination of powerful tools and friendly user interface make it an excellent place for traders of all skill levels.

Pros of moomoo

- Easy requirements to get free stocks

- Commission-free stock, ETF, and options trading

- Earnings calendar and informative earnings hub

- Invest in multiple markets

- Premarket and after hours trading

- Paper trading simulator

Cons of moomoo

- No bonds, cryptocurrency, mutual funds, or CDs are supported

How to Get Free Stocks from moomoo

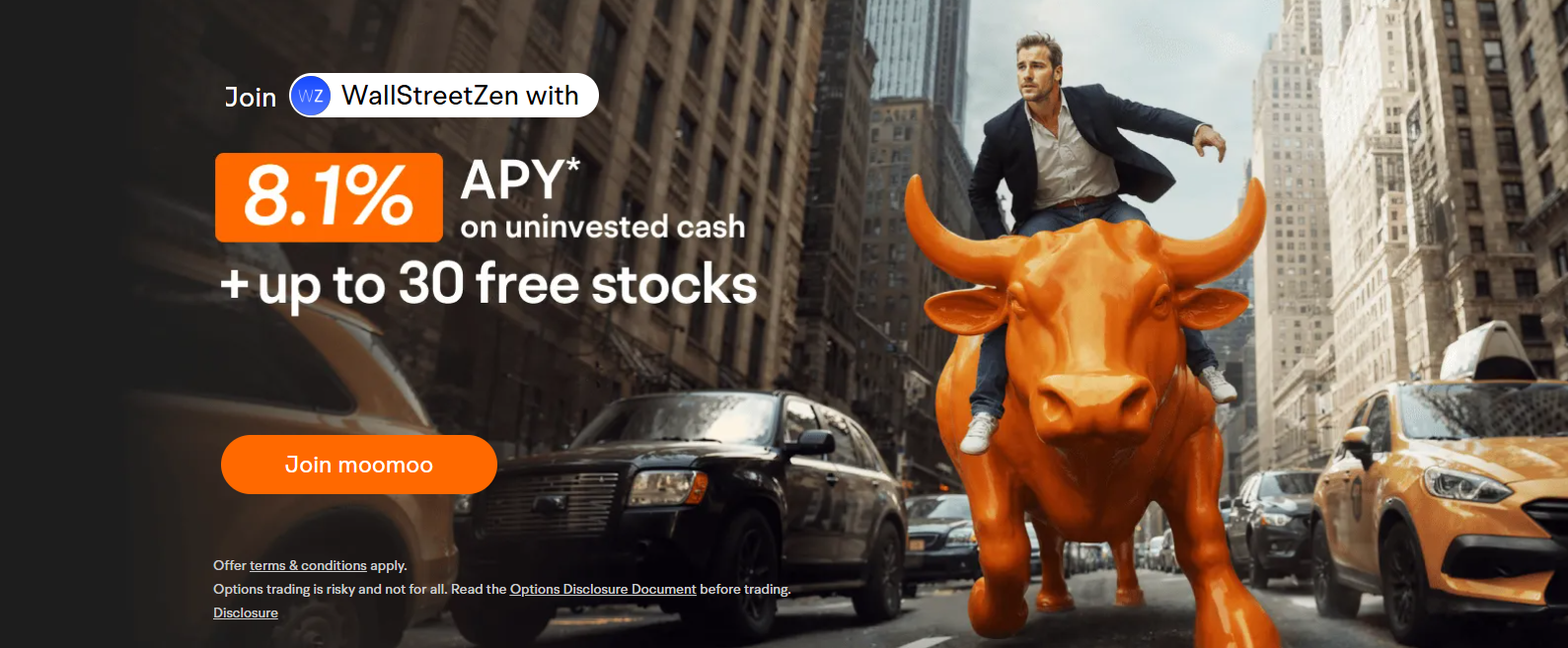

moomoo runs a special promotion with WSZ to give our readers up to 30 free stocks. Here’s how to unlock them:

On moomoo, you can earn up to 30 stocks for signing up. Here’s how it works:

- Deposit $100 and get 5 free stocks. (You need to keep >$100 in your account for 60 days)

- Deposit $2,000 and get 25 additional free stocks. (You need to keep assets in the account >$2,000 for 60 days)

Plus, your uninvested cash can pick up a hefty APY through their cash sweep program, where you can earn up to 8.1% APY for a limited time.

This is the best bonus offering overall, and it’s actually pretty simple to get. You can find all the info you need in our moomoo app review.

2. Public (Free Stock Slice for Sign-up; Up to $10,000 Transfer Bonus)

Public is an all-in-one investing app that allows you to invest in stocks, ETFs, crypto, treasuries, and alternative assets (like real estate, art, and collectibles) all from one portfolio.

Pros of Public

- Invest in stocks, ETFs, crypto, treasuries, and alternative assets

- Commission-free trading for stocks and ETFs

- Alternative assets available include real estate, art, collectibles, and other memorabilia

- Well-designed mobile app and desktop platform

- Fractional shares

Cons of Public

- While you may receive a bonus for signing up with Public, if you’re transferring an account, it might be offset by fees from your old broker.

How to Get Free Stocks from Public

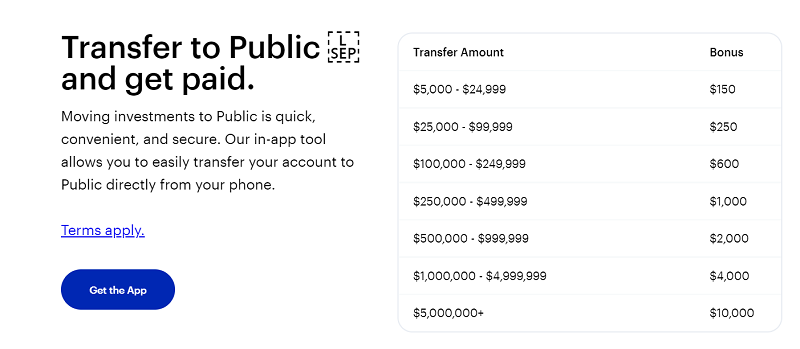

Receive free stock from Public’s referral program. For each friend who makes a deposit of at least $1,000, you both get $20 in an asset of your choice subject to Public’s terms and conditions.

It’s not “free stock” per se, but Public will also pay for you to transfer another brokerage account to their platform — and you can potentially use those extra funds to buy more stock. The table below details the incentives.

I have personally done this transfer, and having done so, I can say that some unforeseen things affected my payout. The amount I was transferring wasn’t large – it was in the lowest, $5,000-24,999 tier. My old brokerage charged me a $100 fee to transfer, which shrunk the bonus considerably. And — another thing I hadn’t anticipated — fractional shares (such as those gained by reinvested dividends) were not eligible for transfer, so I still had weird straggler semi-shares in my old account that I had to deal with. However, since I find Public much more user-friendly, it was still worth it for me.

3. Robinhood ($5-$200 in free stock)

Robinhood is a popular stock, option, and crypto trading app that charges no commissions on trades. It’s incredibly user-friendly design and trading experience makes it popular for new, mobile-first investors.

Pros of Robinhood

- Invest in stocks, ETFs, options, and cryptocurrencies

- Commission-free investing

- Extremely user-friendly app and desktop platform

- Free stock with no deposit

Cons of Robinhood

- Has had a history of outages and trading restrictions

- No bonds or alternative investments

How to Earn Free Stock from Robinhood

You can earn a fractional share of a stock by signing up or by referring a friend. New customers need to sign up, get approved, and link their bank account. At that point, you’ll be eligible for a fractional share of one of 22 stocks that are available to choose from. Per Robinhood, they are “selected by choosing the two largest S&P 500 companies within the top 11 sectors, both based on market cap, per 09/13/2023 data shown by TradingView, an unaffiliated entity.”

Worth noting: Robinhood is also in on the brokerage transfer bonus train. For a limited time, you can earn a bonus when you transfer an outside brokerage account to Robinhood. Whether you transfer $10,000 or $1M, they will give you a 1% bonus, no cap. (Terms and conditions apply.)

4. Webull (Up to 75 Fractional Shares Valued Between $3-$3000)

Webull is another mobile-first brokerage which primarily caters to younger generations. It offers stock, ETF, options, and crypto trading. It’s interface is slightly more difficult to use than Robinhood’s, but it also offers a number of charting tools for active traders.

Pros of Webull

- Invest in stocks, ETFs, options, and cryptocurrencies

- Commission-free investing

- The easiest way to get free stock

Cons of Webull

- No bonds or alternative investments

- Not a very attractive user interface

How to Earn Free Stock from Webull

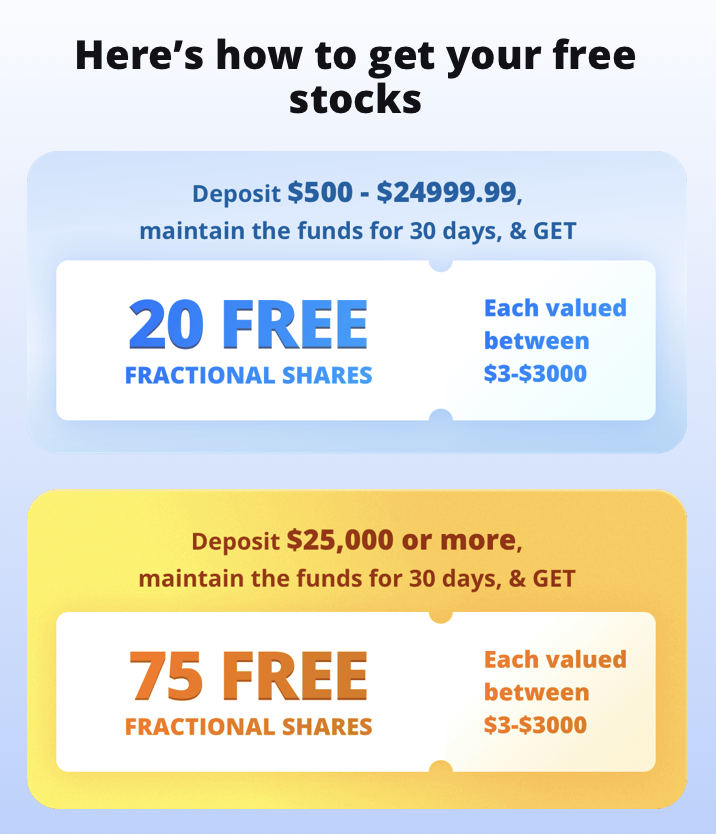

Webull currently offers 20 free fractional shares valued between $3 and $3,000 when you deposit $500 to$24,999.99.

If you deposit $25,000 or more and maintain the funds for 30 days, you can get 75 free fractional shares.

5. M1 Finance (Up to $500 cash bonus)

M1 Finance offers one of the best brokerage account bonuses in 2025.

M1 Finance is an investing and banking app that offers free stock and ETF investing, and access to a high-interest cash account. You can also open a separate account to invest in cryptocurrencies.

M1 Finance is best known for its automations which make long-term, tax-efficient investing easy. In my opinion, it is one of the best net-worth building platforms available. Check out our M1 Finance Review.

Pros of M1 Finance

- Invest in stocks, ETFs, and cryptocurrencies

- Commission-free investing in stocks and ETFs

- Automations and one-click portfolio rebalancing

- Automatically recommends tax-efficient allocation strategies

- User-friendly app and desktop platform

- Solid banking services

Cons of M1 Finance

- No options trading

- Not good for active trading

- Bonus is hard to qualify for

How to Earn Free Stock from M1 Finance

M1 Finance is not offering free shares, but they are giving away large sums of bonus cash for deposits and transfers.

For opening a new M1 Finance account and making a deposit, you can unlock the following bonus amounts based on a tiered deposit schedule:

Deposit | Bonus Amount |

|---|---|

$10,000 – $29,999 | $75 |

$30,000 – $49,999 | $150 |

$50,000 – $99,999 | $250 |

$100,000+ | $500 |

6. Acorns ($20 cash bonus)

Acorns is ideal for families or investors looking to get started with long-term investing. It allows you to make recurring investments in a pre-built portfolio and invest spare change via roundups.

Pros of Acorns

- Invest in stocks, ETFs, options, and cryptocurrencies

- Commission-free investing

- The easiest way to get free stock

Cons of Acorns

- No bonds or alternative investments

- Not a very attractive user interface

How to Earn Free Stock from Acorns

Acorns is offering a $20 sign-up bonus for new users that set up a recurring investment. (Check out this link to learn more.)

Also worth noting — Acorns is constantly offering other bonuses. For instance, I just received a notice that I could get an $1100 bonus if I got 4 friends to join; they always have some sort of referral bonus going.

7. TradeStation ($150-$3,500 cash bonus)

TradeStation is an advanced trading platform for active traders. You can trade stocks, ETFs, options, and futures plus alternative assets like FX, international equities, and cryptocurrencies.

Pros of TradeStation

- Powerful charting and trading platform

- Great selection of assets

- Excellent deposit bonus

Cons of Acorns

- Built for active traders

- Deposit bonus is difficult to earn

How to Earn Free Stock from TradeStation

TradeStation is offering a tiered deposit bonus for new accounts, not free stock shares. You can use your bonus to buy free shares.

Here is the tiered deposit requirements:

Deposit | Bonus Amount |

|---|---|

$5,000 – $24,999 | $150 |

$25,000 – $99,999 | $300 |

$100,000 – $249,999 | $500 |

$250,000 – $499,999 | $1,000 |

$500,000 – $999,999 | $2,000 |

$1,000,000+ | $3,500 |

8. Stash ($20 in free stock)

Stash is an underrated brokerage app that combines the ease-of-use and commission-free structure of Robinhood with some automations like M1 Finance, making it a great mobile-forward broker for investors looking to build long-term wealth.

Pros of Stash

- Invest in stocks, ETFs, and cryptocurrencies

- Commission-free investing

- Easy requirements to get free stock

Cons of Stash

- No bonds or alternative investments

How to Earn Free Stock from Stash

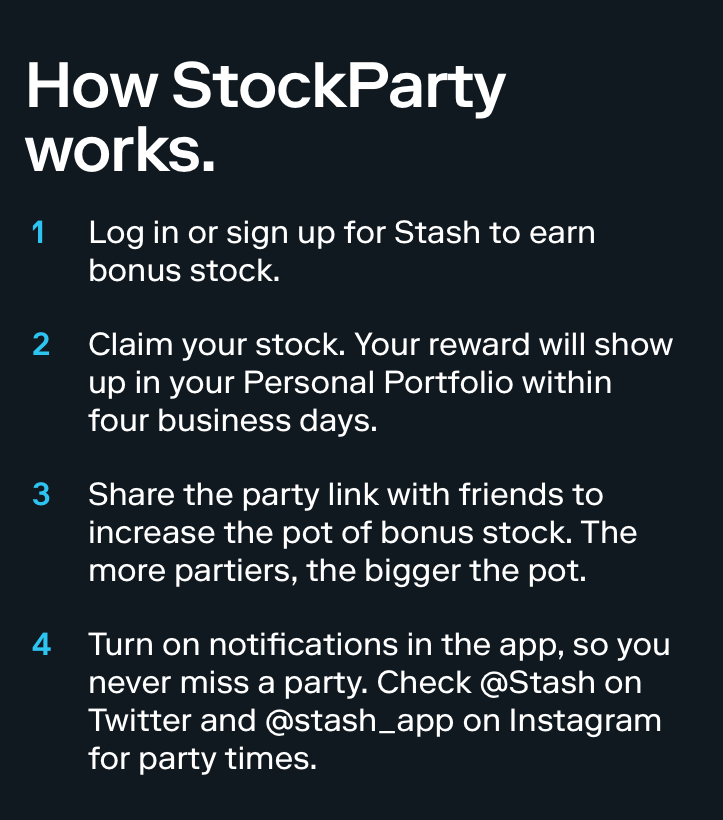

Stash will give new users $20 in free shares when you sign up and deposit at least $5 in your account.

Stash also offers you the opportunity to gain more bonus stock by referring friends. Check out their StashStockParty feature below:

9. SoFi Invest ($5-$1,000 in free stock)

SoFi Invest is a newcomer and offers a variety of investing and banking services. You can invest in stocks and ETFs commission-free and open a variety of retirement accounts. SoFi Invest also offers some automated investing solutions and tools for active traders.

Pros of SoFi Invest

- Invest in stocks, ETFs, and cryptocurrencies

- Commission-free stock and ETF investing

- Solid banking services from the same login

- Easy requirements to get free stock

Cons of SoFi Invest

- No bonds or alternative investments

- Pretty good at many things, but not the best at one thing

How to Earn Free Stock from SoFi Invest

SoFi Invest will give new users between $5 and $1,000 in free shares for opening an account and depositing at least $10.

Final Word: Apps That Give Free Stocks for Signing Up

There are a number of investment apps that give free stock for signing up, and a handful of them have low or non-existent minimum deposit requirements.

While moomoo has the best bonus, my favorite overall is Public.

For new investors, Robinhood and Webull are 2 of the easiest apps that give free stock – I can’t recommend them enough. Try both, then choose which one you like best.

To unlock the best free stock bonuses you will need to deposit or transfer $1,000 or more, but the cash bonuses offered by M1 Finance and TradeStation are exceptional.

If you’re new to investing, want to try a new broker, or just want to score some free shares, use the links above to earn free stocks for signing up.

FAQs:

Where can I get stocks for free?

You can get free stocks by signing up to brokerages offering free stock sign-up bonuses. The best ones are Public, Robinhood, and Webull.

What is the best free stock?

The best free stock being offered right now are from these brokerages: Public, Robinhood, and Webull.

How to get free stock from Public?

You can get up to $300 in free stock from Public by signing up and depositing $20 or more. You’ll then get to claim a fractional share of stock worth $3 to $300.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.