Real estate investing is a potentially great way to build wealth.

But it typically requires a big initial investment, and you might not have the means to make a massive down payment.

Fractional real estate investing could be the perfect solution. It lowers the barrier to entry for real estate investment while still allowing you to diversify.

But how does fractional real estate work — and how do you get started?

In this article, you’ll learn all about fractional real estate investing, including how shared real estate investment opportunities work and where to find the best fractional ownership properties.

Our favorite fractional real estate investing platform?

Transparency, low feels and a simplified investment process make Yieldstreet our top pick. Get started today.

The 5 Best Fractional Real Estate Investing Platforms in 2025

1. Yieldstreet

- Overall Rating: ⭐⭐⭐⭐⭐

- Asset: Art, real estate, multi-asset class fund, structured notes, supply chain funding

- Investment Minimum: $15,000

- Accreditation Requirement: Primarily accredited

- Average Annual Returns: 9.7%

- Fees: Between 1-4% annually

Yieldstreet is an online investment platform offering individuals a diverse range of alternative investments, primarily for accredited investors.

Yieldstreet aims to democratize investment opportunities for individuals, providing access to previously exclusive asset classes typically reserved for institutional investors.

The platform provides access to unique investment opportunities such as real estate, art, and structured notes. The real estate offerings include commercial properties, apartments, and multi-family properties.

While many of Yieldstreet’s investments require accredited investor status, there are some opportunities for non-accredited investors, too. Namely the Yieldstreet Alternative Income Fund.

The Yieldstreet Alternative Income Fund offers investors diversified exposure to private market assets, including real estate, private credit, and other alternative investments. It aims to deliver consistent income and long-term growth. Designed for accessibility, the fund provides a hassle-free way to diversify portfolios with lower correlation to traditional markets. As of December 31, 2024, the fund reported a net annualized yield of 7.1%.

With a focus on transparency, low fees, and simplified investment processes, Yieldstreet makes it easy for investors to diversify their portfolios and potentially earn higher returns.

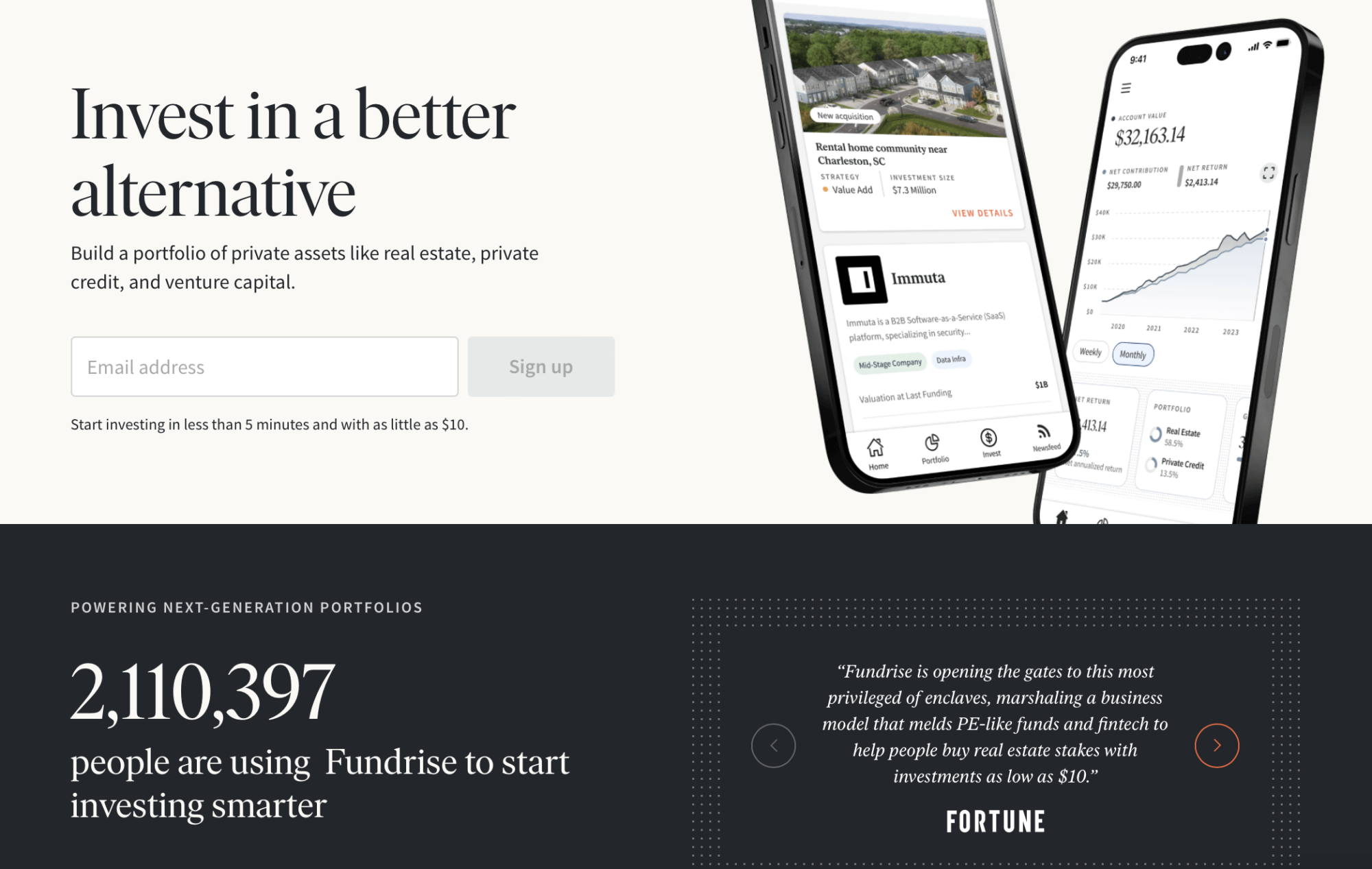

2. Fundrise

- Overall Rating: ⭐⭐⭐⭐

- Asset: A range of different funds

- Investment Minimum: $10

- Accreditation Requirement: None

- Average Annual Returns: For the most up-to-date information, check out their website.

- Fees: Varies by service — see the fee schedule here.

Technically, this is not a fractional real estate investment platform. However, since you can invest in diversified funds related to real estate, I’m including Fundrise on the list.

Fundrise is a popular real estate investing platform that provides various investment opportunities tailored to different investment goals, and investors receive quarterly dividends. (To find out a lot more about the platform, check out our Fundrise review.)

.

Fundrise offers a variety of investment options through funds that let you invest in multiple residential and commercial real estate projects within one streamlined vehicle. Additionally, the platform provides access to funds where you can invest in private credit markets and cutting-edge startup investments.

A big bonus: It’s easy to get started with Fundrise. When I first set up my account, it only took a few minutes.

Real estate-wise, you’ll want to know about The Flagship Fund, which was created to deliver long-term appreciation from a diversified portfolio of Fundrise’s top real estate investment strategies, including build-for-rent housing communities and multifamily and industrial assets in the Sunbelt.

Also related: the The Income Fund (private credit related to the real estate market) was designed to deliver yields from a portfolio of Fundrise’s most favored real estate fixed income strategies. Since 2012, Fundrise has acquired or financed over 37,000 residential units and has made more than 71 unique mezzanine and preferred equity investments in real estate.

Fundrise also offers exposure to tech companies through the Innovation Fund, and it even offers a retirement account (IRA), allowing investors to use Fundrise to save for retirement. Fees are transparent — check out the website to see current fees.

Note: We earn a commission for this endorsement of Fundrise.

3. Arrived

- Overall Rating: ⭐⭐⭐⭐

- Asset: Fractional ownership properties

- Investment Minimum: $100

- Accreditation Requirement: None

- Average Annual Returns: 3.2-7.2%

- Fees: 1% annual management fee

Arrived Homes is another online investment platform focused on investments in residential real estate properties.

The platform primarily offers single-family homes.

The user-friendly interface simplifies the investment process — once you select an initial property, the minimum investment is just $100, but average returns range from 3.2 to 7.2%. Since Arrived Homes is available to both accredited and non-accredited investors, it’s a great starting point for new investors.

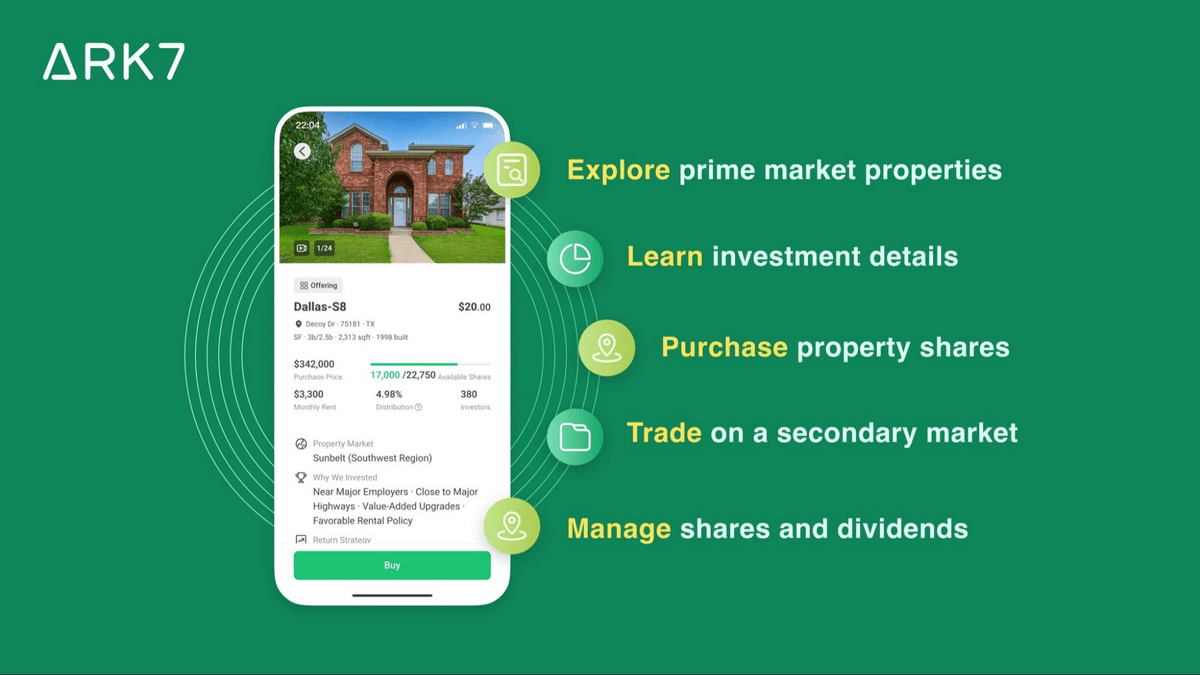

4. Ark7

- Overall Rating: ⭐⭐⭐⭐

- Asset: Fractional shares of rental properties

- Investment Minimum: As low as $20 per share (varies)

- Accreditation Requirement: None (more opportunities are available for accredited investors, though)

- Average Annual Returns: Varies

- Fees: 3% sourcing, 8% – 15% management fee

Ark7 is a fractional real estate platform that allows you to purchase shares of ownership in a property, earn monthly dividends from rents collected and potential home value appreciation.

Ark7 purchases investment properties, puts each property in its own LLC, splits up ownership of that property through investment shares, and sells shares to investors through the platform for as little as $20 per share.

As owner/manager, Ark7 handles all of the nitty-gritty: sourcing, purchasing, renovating, repairing (if needed), and renting the properties. When a tenant calls with a complaint, they deal with it — not you. As an investor, you are entitled to monthly dividends, which will vary depending on how many shares you own.

Ark7 gets points for its low minimum investment, ease of use, simple setup process, and the fact that you can collect monthly dividends. Plus, you can get $50 off your first investment for a limited time (terms and conditions apply).

Want to learn more? Check out our Ark7 review.

5. RealtyMogul

- Overall Rating: ⭐⭐⭐⭐

- Asset: Commercial real estate

- Investment Minimum: $5,000

- Accreditation Requirement: None; accredited investors have access to additional investing options

- Average Annual Returns: 6-8%

- Fees:1-1.25%

RealtyMogul‘s primary focus is democratizing real estate investing and making it accessible to individuals through fractional home ownership options. The platform sources investments from some of the best institutional-grade properties.

With a low investment minimum and transparent fee structure, RealtyMogul is a great pick if you’re looking to expand into commercial real estate but don’t have a ton of money.

The platform’s user-friendly interface makes it easy to browse and select suitable investment opportunities, track your investment performance, and receive regular updates.

5. DLP Capital

- Overall Rating: ⭐⭐⭐⭐

- Asset: Private REITs, real-estate focused private credit funds, and more

- Investment Minimum: $200,000

- Accreditation Requirement: Accredited only

- Average Annual Returns: 9-13% targeted annual return

- Fees: 2.0% / 0.5% rebate available for investments over $1 million

Don’t be fooled by the fact that DLP Capital isn’t at the top of the list. I started with the platforms that are the most accessible to all investors — some of the platforms above require just tens or hundreds of dollars to get started.

DLP Capital has a hefty $200k minimum. I recognize that this creates a barrier to entry for some investors. But if you’re an accredited investor with a higher amount to invest, it’s well worth considering.

DLP offers several unique ways to invest in real estate. The platform offers offers four different funds that allow you to choose your own adventure:

- With the DLP Housing Fund, you can gain access to build-to-rent and multifamily communities

- With the DLP Building Communities Fund, you can gain access to equity and preferred equity investments in entities or senior mortgage loans or mezzanine loans for developing new rental communities

- The DLP Lending Fund gives you access to debt investments for the construction, acquisition, and repositioning of attainable rental housing

- The DLP Preferred Credit Fund offers access to debt investments (senior mortgage loans and/or mezzanine loans) and preferred equity in RV and vacation luxury parks, manufactured housing, and rental housing properties.

The ability to select investments that align with your strategy and values is a big perk. But DLP also has plenty of other benefits. For one, you get monthly preferred returns. For another, the platform offers redemptions with 90 days notice — fairly liquid within the real estate sphere.

How about the potential returns? Let’s take a look at the DLP Housing Fund as an example. The fund lists a 19.47% compounded DRIP IRR Since Inception (2020) as of December 31, 2023, and currently targets a 10-12% annual net return. Other funds report 12.28%, 13.10%, and 10.99% DRIP IRR since Inception.

In my opinion, the higher customization of these funds and impressive historical returns make DLP a top pick for accredited investors.

Bonus: Real Estate-Focused Private Credit Investing

Investing in property isn’t the only way to invest in real estate. You can also invest in private credit funds that focus on real estate deals. DLP Capital, mentioned above, offers access to private credit deals; another platform that solely focuses on private credit is Percent.

Percent

- Overall Rating: ⭐⭐⭐⭐

- Asset: Private credit (Private consumer and small business loans)

- Investment Minimum: $500

- Accreditation Requirement: Must be an accredited investor

- Average Annual Returns: 12.56%

- Fees: None

Percent is an online investment platform that offers accredited investors access to private credit as a form of investment.

These private credit investments can offer a different type of access to real estate investing, and offer potentially great returns — the platform boasts an impressive 12.56% average annual ROI.

As for fees?

Percent charges variable fees depending on the investment product.

- For direct deals, 0% management + a % of yield

- For managed products like Percent Blended Notes, 1% management + a % of yield

For example, if a deal paid 15% APY and the fee charged was 10% of interest, your effective APY is 13.5% after fees.

Beyond what they offer, how they offer it matters. Percent is also known for its knowledgeable and friendly customer support team. If you’re looking for a way to diversify and potentially earn higher returns, Percent might be right for you.

What is Fractional Real Estate Investing?

Fractional real estate investing allows you to purchase a portion (or fraction) of a property. Instead of purchasing the entire property, residential or commercial property is broken down into smaller portions, allowing multiple investors to buy in.

In return for your investment, you get a proportional share of rental income and any potential profits from the property sale.

How Fractional Real Estate Investing Works

With fractional real estate investing, multiple investors pool their resources and invest in larger, higher-value properties that might otherwise be out of reach for individuals.

Fractional real estate investing can be done in various ways, including:

- Crowdfunding websites: These sites typically allow you to browse a marketplace and choose opportunities. Typically, properties are professionally managed, so once you invest, you don’t have to deal with the day-to-day management duties.

- Direct fractional ownership agreements: This is a type of ownership where several people pool together their assets to purchase a property and share the responsibilities associated with property ownership and management.

We’ll dig into the benefits and drawbacks of fractional real estate investing in a little bit. But before we do, let’s talk about some of the best ways to invest in fractional real estate.

Benefits of Fractional Real Estate Investing

Here are some of the reasons why fractional real estate investing is so appealing…

1. Access to higher-value properties

Fractional real estate investing gives you access to a smaller portion of a high-value property versus a large portion of a low-value property.

Often, this means access to properties with a higher rate of return than traditional single-occupancy homes, such as commercial real estate, houses of multiple occupancies (HMOs), and luxury homes.

2. Lower capital requirements

Investing in fractional real estate requires a lower initial investment than purchasing a property alone or outright. This makes it more accessible to a wider range of investors, including those who may not have the resources to invest in real estate otherwise.

3. Diversification of investments

Fractional real estate investing lets you diversify your investment portfolio by giving you access to the real estate market.

4. Passive income

Fractional real estate investments can provide you with regular, passive income from rent and other returns.

Often, fractional real estate investments are professionally managed by agencies. This means you don’t have to deal with the day-to-day duties associated with property management. Typically, agency fees are deducted before you receive payments.

5. Flexibility

Fractional real estate investments offer more flexibility than traditional real estate investments. Because you can invest in multiple properties, you can diversify your investments and select properties or markets that closely align with your investment goals and preferences.

In addition, fractional home ownership allows you to experiment and manage risks at a level that is not feasible with single-owner investments. By purchasing a fraction of a property, you can test the waters without committing to a significant investment method. This allows you to gain valuable experience in the real estate market, learn how to manage risks associated with property ownership, and better understand your personal appetite for risk.

Drawbacks of Fractional Real Estate Investing

No investment strategy is perfect. Here are some of the drawbacks of fractional real estate investing…

1. A volatile market

Real estate investments can be volatile and unpredictable. Property value can be impacted by factors such as:

- Interest rates

- Economic conditions

- Changes in supply and demand

However, fractional home ownership can mitigate this risk since you’re not all-in on a property.

2. A loss of risk or damage to the property

All real estate investments carry the risk of property damage or loss through tenant damage, accidents, or other unforeseen events such as natural disasters.

While to a certain degree, this is unavoidable, fractional ownership lets you avoid the complete burden since you’re just one of many owners.

3. Risk of conflict

Too many cooks in the kitchen: it’s a thing with fractional home ownership.

Conflicts between investors can arise due to differing opinions on risk tolerance, time horizons, or investment objectives. For example, some investors may be more interested in short-term gains, while others may be looking for long-term appreciation.

The solution? Clear lines of communication. Establish goals and expectations from the outset and establish a process for making decisions and settling disputes.

Should You Invest in Fractional Real Estate?

Fractional real estate investing lowers the barrier to entry for real estate investments. It might be right for you if:

You want an investment that requires less initial capital

You don’t want to deal with the burden of property management

- You want an investment that offers flexibility and diversity

- You want access to higher-end properties that may be out of reach otherwise

But remember — as with any investment, fractional home ownership has an element of risk.

So before investing in fractional real estate, you need to consider your personal goals and do your due diligence.

Alternatives to Fractional Real Estate Investing

If shared real estate investing doesn’t seem the right fit for you, there are several other investment alternatives to consider:

- Real estate investment trusts (REITs): REITs allow you to invest in shares of publicly-traded companies that own (and usually operate) income-producing properties of all types. You can buy REITs on the stock exchange — if you need a broker, our favorite is eToro.

- Direct real estate investing: This involves the direct purchase of a property. Usually, the property is purchased outright for the purpose of renting. You have more control of the investment, but you also have to manage it.

- Real estate syndication: This is similar to fractional home ownership. With real estate syndication, a group of investors will pool their resources to purchase and manage a real estate project. It can offer higher returns than other real estate investment options. However, it also carries more risk. Fractional real estate investment may be a more risk-friendly option.

- Peer-to-peer lending: Sometimes called a private equity loan, this type of investment is where investors lend money directly to individuals or businesses (no middleman) for real estate investments or development projects.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Final Word: Fractional Real Estate Investing

Fractional real estate investing can give you access to high-quality real estate properties that might otherwise be inaccessible.

It also offers you the potential to generate passive income through rental income, diversify your portfolio, and potentially earn higher returns than traditional investments.

But like any other type of investment, fractional real estate investing comes with its risks and drawbacks. This includes conflicts between investors, risk of property damage, and housing market volatility.

Ultimately, the best investment option for you will depend on your risk tolerance, financial goals, and personal preferences. Be sure to do your due diligence before making any investment decision.

FAQs:

Is fractional real estate ownership a good investment?

While fractional ownership offers benefits like a lower barrier to entry, passive income, and portfolio diversification, it may not be suitable for everyone. Consider your goals and objectives and do your due diligence before investing.

Can you fractionally invest in real estate?

Yes. Fractional real estate investing lets individuals invest in high-quality properties by purchasing a fraction of a property. This method typically has a lower investment minimum and can be done through crowdfunding or private syndication. Investors can receive rental income or equity proportional to their initial investment.

What is the drawbacks of fractional real estate investments?

Some of the drawbacks of fractional real estate investments include risk of property damage, conflict, and uncertainty in the real estate market. To protect your investment, carefully evaluate the opportunity, associated risks, and find the right investment platform before investing.

What are the downsides of fractional ownership?

As with any investment, there are risks associated with fractional real estate investing. These include property damage, risk of conflict, plus the overall unpredictability of the real estate market in a VUCA (volatile, uncertain, complex, and ambiguous world).

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.