Free stock and ETF trading is pretty much table stakes these days … So what makes one discount broker better than another? And what’s the best discount broker in 2025?

While they all make the same general claim — low or no-cost commissions — discount brokerage firms still have important differences you need to know.

In this article, I’ll take you on a tour of the best discount brokers. You’ll learn the pros and cons of each so you can figure out the best place to put your money to work based on your goals and investing style.

At a glance: best discount brokerage firms

Best overall: eToro*

Best for long-term investing + HSA investing: Fidelity Investments

Best for social trading: Public

Best for long-term investing + specialty accounts: TD Ameritrade

Best for automated investing: M1 Finance

Best interface: Robinhood

Best for beginner and advanced traders: Charles Schwab

Best for long-term investing + fund investing: Vanguard

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

The Best Discount Brokers in 2025:

1. eToro

Overall rating: 8/10

Best for: Crypto, Options, Trading, Cloning Other Traders & Investors

Commissions:

- Stocks: Commission-free

- ETFs: Commission-free

- Options: No contract fees. Regulatory fees still apply.

- Crypto: Commission-free

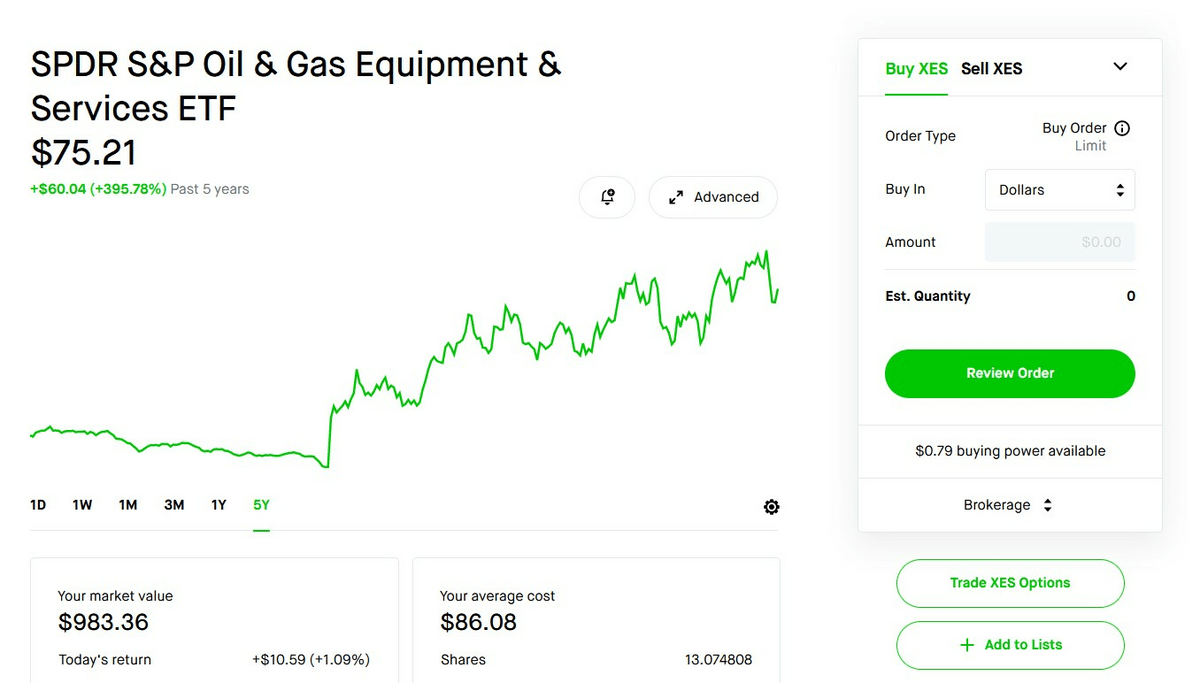

eToro is another popular discount broker that offers commission-free trading.

But that’s not all. eToro also offers cryptocurrency trading and has a powerful options platform, eToro Options:

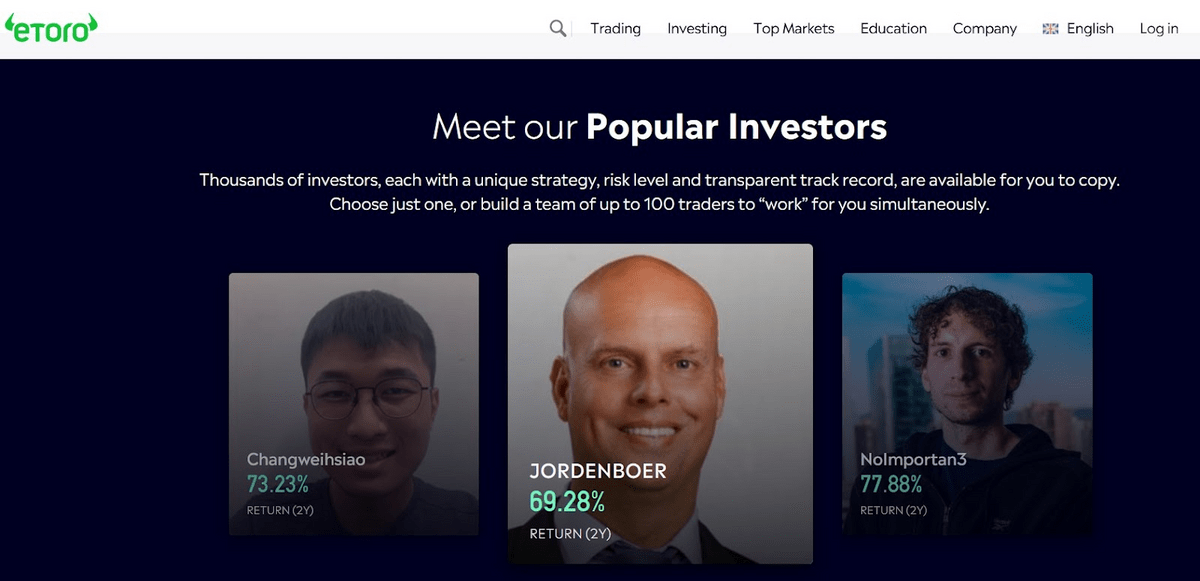

But eToro’s signature feature is that it allows you to copy other successful traders. With CopyTrader, you can see the returns and portfolio holdings of eToro’s top-performing investors:

However, while eToro has a lot to offer, you won’t find retirement accounts on the platform.

If you’re looking for a modern, user-friendly interface, and capabilities beyond commission-free stock trading, eToro may be the best discount broker for you.

2. Fidelity Investments

Overall rating: 9/10

Best for: Retirement Accounts, HSAs, Long-term Investors

Commissions:

- Stocks: $0

- ETFs: $0

- Options: $0 (+ $ 0.65 per contract fee)

- Crypto: $0

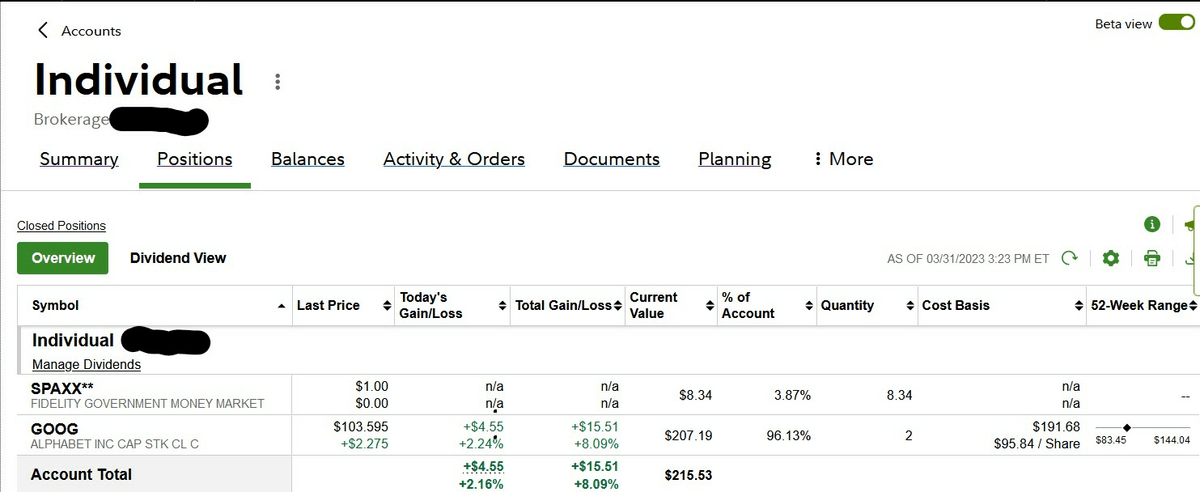

Fidelity Investments is a top-rated discount broker that lets you trade stocks, ETFs, options, and crypto. It offers commission-free trading, making it an excellent choice for investors looking for a low-cost platform.

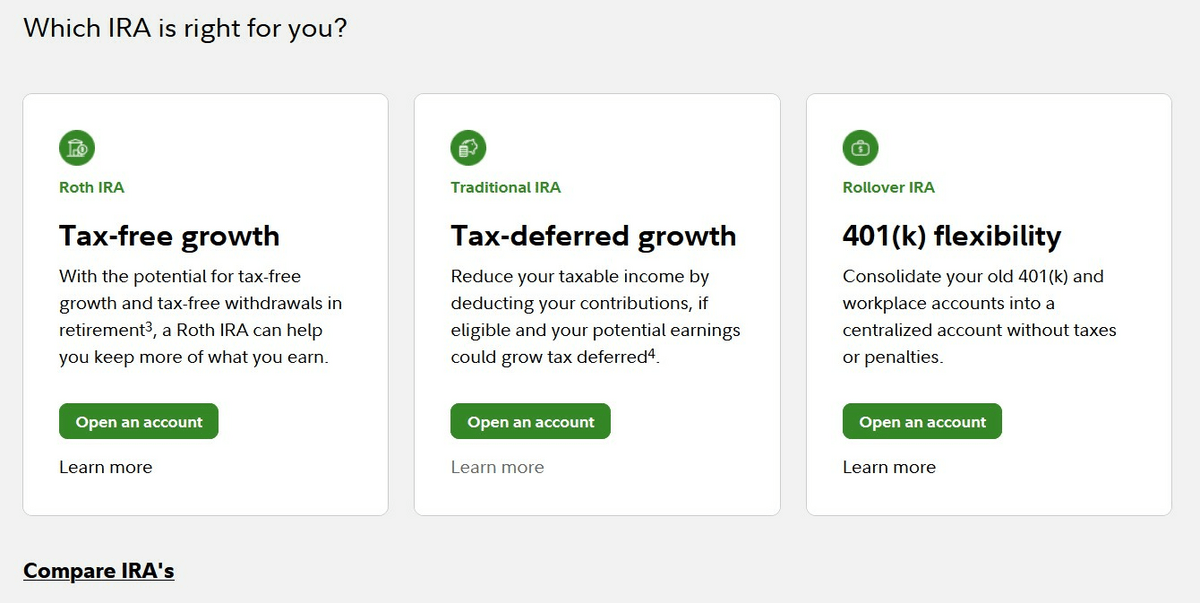

But Fidelity is more than a discount brokerage. It offers a wide range of retirement accounts, and is one of the few discount stock brokers on this list that offers a Health Savings Account (HSA).

In addition to fee-free trades, Fidelity also offers plenty of services for long-term investors who are interested in retirement planning and building a diversified investment portfolio. Plus, Fidelity offers personalized financial advisory and wealth management services.

The only downside that I’ve noticed as a customer is a small one. The interface can feel a bit old-school and dated compared to some of the newer brokers covered below.

3. Public

Overall rating: 8.5/10

Best for: Social Investors, Alternative Investments, Taxable Brokerage Accounts

Commissions:

- Stocks: $0

- ETFs: $0

- Options: Not Offered

- Crypto: $0

Public is a discount broker that’s gotten a lot of attention in recent years.

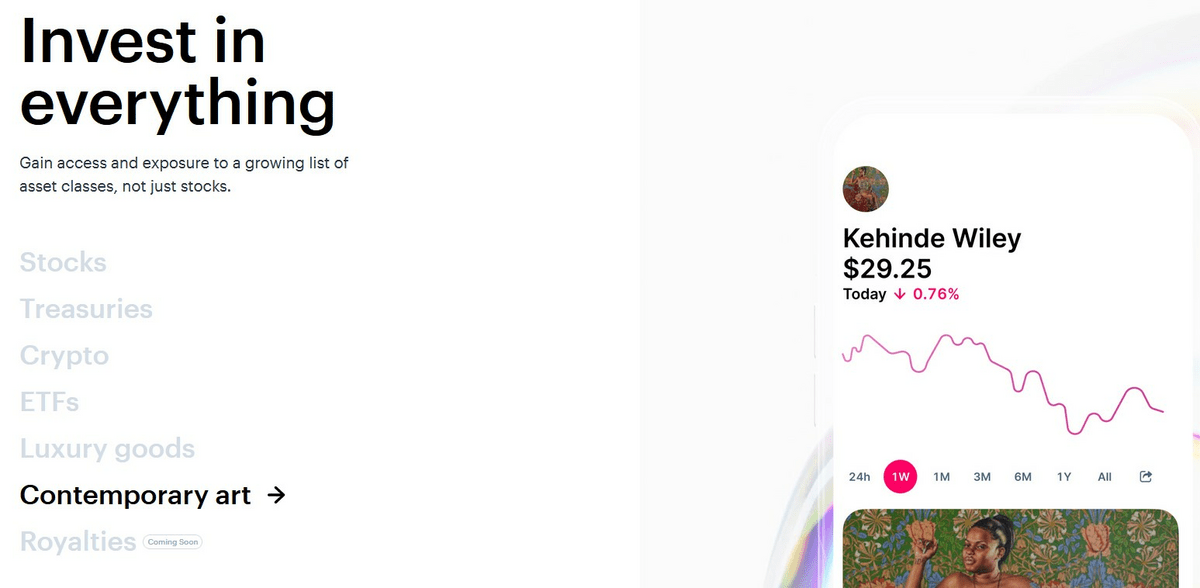

Public offers commission-free trading. On the platform, you can trade stocks, ETFs, crypto, and U.S. Treasuries. Plus, they even offer unique alternative investments like luxury goods, contemporary arts, royalties, and taxable brokerage accounts.

It’s very easy to use, and if you only invest in the assets covered above, it’s an excellent platform. It’s especially good if you’ll be investing in alternative assets.

However, Public does have its limits. For instance, it doesn’t offer options or mutual funds, and it only offers individual taxable accounts.

Overall, Public is a solid choice for investors interested in trading stocks, ETFs and crypto who want a fun social twist.

4. TD Ameritrade

Overall rating: 8/10

Best for: Long-term Investing, Options, Retirement & Specialty Accounts

Commissions:

- Stocks: $0

- ETFs: $0

- Options: $0

- Crypto: Not offered

TD Ameritrade is a well-established discount broker with a robust trading platform, suitable for both beginners and experienced traders.

TD offers investors exposure to stocks, ETFs, and options. It also offers fee-free commissions and no platform fees, making it an affordable option for all investors:

TD Ameritrade also offers a wide range of account types, from your standard taxable accounts to retirement, education, specialty accounts, and more:

The one downside? TD Ameritrade states that they don’t directly offer cryptocurrency trading. However, they do offer access to CME Group (CME) bitcoin futures and CME micro bitcoin futures. These can allow qualified clients to tap into the bitcoin market without actually owning any bitcoin.

Note: TD Ameritrade was recently acquired by Charles Schwab, so their accounts will eventually be merging. More on Schwab below.

5. M1 Finance

Overall rating: 8/10

Best for: Long-term Investing, Automated Investing, Retirement Accounts

Commissions:

- Stocks: $0

- ETFs: $0

- Options: Not offered

- Crypto: $0

Looking for a discount stock broker that offers automated investing? If so, M1 Finance might be the best discount brokerage for you. In addition to commission-free trading, here are some of the features I love:

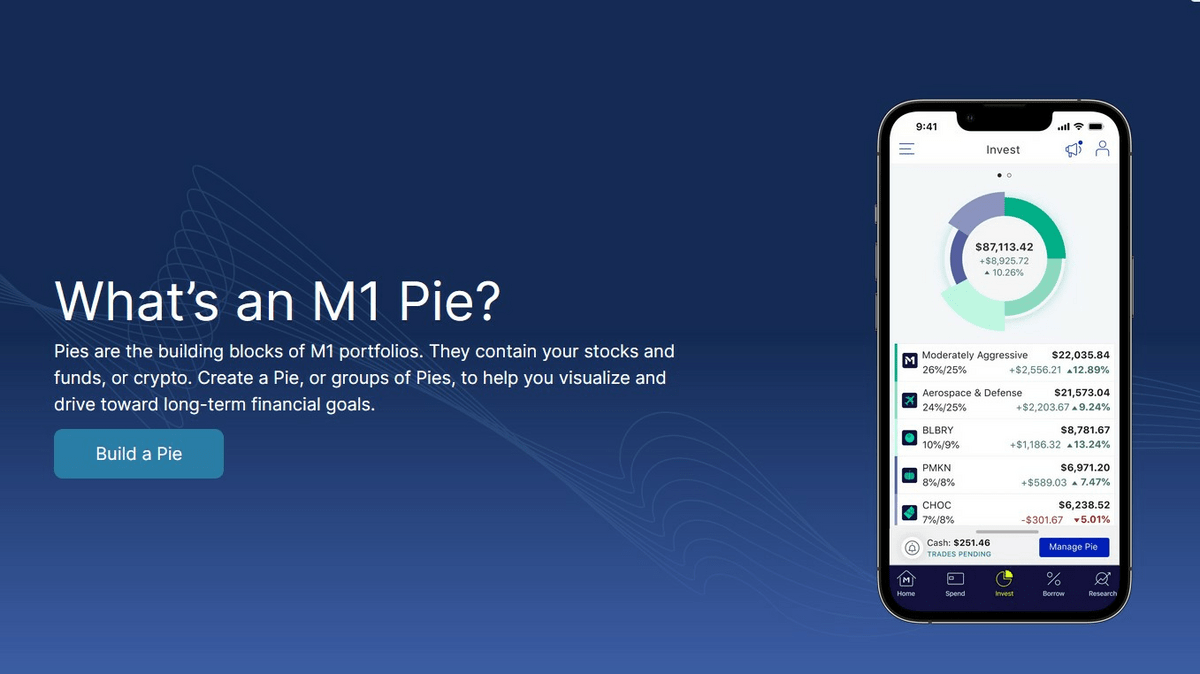

- M1 Finance lets you create a custom portfolio of stocks and ETFs. After you choose your allocation, you can choose to automate by turning on their “autoinvest” feature.

- M1 Finance offers other services, like IRA accounts and cryptocurrency investing.

- M1 Finance lets you create “pies,” which make it easy to visualize and fine-tune your investment portfolio:

I’m a loyal M1 Finance user and love the platform for all the reasons above. However, it does have its downsides.

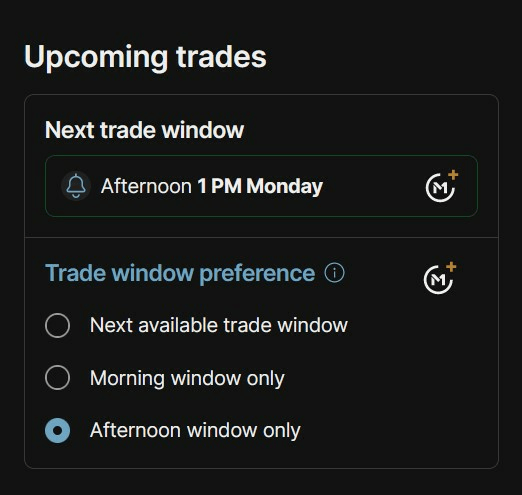

For instance, M1 Finance restricts your trading to “trading windows” in the morning and afternoon. There’s also no option for limit orders, which often means you won’t get the best price on stocks. Additionally, M1 Finance does not offer options trading.

If you’re an active trader, M1 may not be the best discount broker for you. But for long-term investors interested in automated investing, it’s easily one of the top discount brokerage firms.

6. Robinhood

Overall rating: 7/10

Best for: Trading, Options, Mobile Investing, Ease-of-Use

Commissions:

- Stocks: $0

- ETFs: $0

- Options: $0

- Crypto: $0

Robinhood is a one-stop shop for a variety of different assets. Here’s a sampling of what it has to offer:

- Commission-free trading on stocks, ETFs, and options.

- Cryptocurrency trading

- Retirement accounts

Robinhood is also one of the most popular discount brokerage firms among millennials. Why? If you ask me, it’s the user interface. I think Robinhood offers the cleanest, easiest-to-use interface of all the discount brokerage firms on this list:

If you’re a new investor or trader, Robinhood’s simple, modern interface makes it a great discount stock broker to learn the ropes and get started.

7. Charles Schwab

Overall rating: 7/10

Best for: Retirement Accounts, Long-term Investors, Options

Commissions:

- Stocks: $0

- ETFs: $0

- Options: $0

- Crypto: Not offered

Charles Schwab is a well-established discount brokerage that provides a range of investment options.

A big advantage of going with Charles Schwab? Longevity. They’ve built up a really solid reputation over the years, which is always reassuring when you’re handing over your hard-earned money.

Schwab also meets you where you’re at. They have tools and resources to accommodate advanced traders and investors, but they also work hard to provide beginner-friendly content on ETFs, portfolio construction, and more for newbies:

In short, Schwab is an excellent discount brokerage for both beginners and advanced investors. The only downside? Schwab doesn’t offer crypto at this time.

8. Vanguard

Overall rating: 7/10

Best for: Index Funds, ETFs, Long-term Investing, Minimizing Fees, Retirement Accounts

Commissions:

- Stocks: $0

- ETFs: $0

- Options: $0 + $1-per-contract fee

- Crypto: Not offered

If you’re someone who wants to diversify while minimizing the fees you pay along the way, check out Vanguard.

Vanguard pioneered the use of low-cost index funds, so they have a long track record of helping you keep more of your hard-earned money.

Vanguard also provides educational resources to help beginner investors get started. So if you’re new to investing and want to learn more, Vanguard is a great place to start.

But Vanguard doesn’t have everything — for instance, there’s no crypto. And all options trades have to be exercised over the phone, which can be a serious downer for high-frequency traders.

If you’re looking to trade stocks and options, Vanguard probably isn’t the best discount broker for you. But for long-term investors looking to minimize fees, it’s an excellent choice.

Final Word: Best Discount Broker

Finding a discount brokerage firm ultimately comes down to you and what you’re looking for.

- Looking to trade stocks, crypto, and options? A discount broker like eToro or Robinhood could be your best bet.

- Want to get social and explore alternative investments? Check out Public.

- Want to easily visualize your portfolio, or take a “hands-off” approach with automated investing? Go with M1 Finance.

- Interested in a wide range of retirement accounts, low fees, and a long track record of good financial stewardship? If so, it’s hard to go wrong with Schwab, Fidelity Investments, Vanguard, or TD Ameritrade.

So don’t just go with the first discount brokerage firm you see. Take the time to consider what matters to you in terms of investment options and features before you open an account so that your money can work best for you!

FAQs:

Which discount broker has lowest charges?

All of the discount brokers mentioned in this article offer low or no-commission trading: Fidelity Investments, Public, eToro, TD Ameritrade, M1 Finance, Robinhood, Charles Schwab, and Vanguard.

Who is the largest US discount broker?

As of 2023, Charles Schwab is the largest US discount broker with $7.05 trillion in assets under management.

How much do discount brokers charge?

The fees and commissions charged by discount brokers can vary. They generally offer fee-free commissions for buying and selling stocks.

Is Schwab better than Fidelity?

Whether Schwab or Fidelity is better will depend on your individual preferences and needs. Both offer a wide range of investment options with low fees and commissions, as well as a variety of tools and resources.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.