As the name implies, a full service broker provides a multitude of services, from trade execution to tax advice to retirement planning.

But do you really need all of that, or should you skip the fees and stick with a discount broker? It depends.

On the one hand, a full service brokerage firm charges more fees. But it also offers a difficult-to-measure sense of ease and comfort that their services can provide.

On the other hand, some investors are better suited to a DIY approach — armed with the right resources and tools, they do just fine with a discount broker.

Is a full service broker right for you? Keep reading for a comprehensive review of full service brokers including what they do, the pros and cons, and several worthwhile alternatives.

Don’t need a full service stockbroker? Here’s a lower-cost alternative.

With low minimums, a wide variety of tradable assets, and an easy to use interface, it’s no wonder eToro has gained such an enthusiastic following (30+ users and counting!).

eToro also has a truly unique feature: CopyTrader, which lets you see the returns and portfolio holdings of eToro’s top-performing investors. You can use this information to learn and inform your own trades.

What is a Full Service Brokerage?

Full-service stockbrokers are like five-star hotels with all the amenities.

A full service broker provides comprehensive, personalized investment management. They also provide discretionary portfolio management, which means they trade on your behalf.

They also typically offer tax planning advice, retirement planning, research, and other services.

How your portfolio is ultimately managed is determined by a consultation or questionnaire with the firm that typically covers:

- Your starting capital

- Your recurring expenses

- Your ability and desire to take on risk

- Your short and long-term financial goals

However, this “white glove” service comes at a cost. For that reason, many investors choose a more DIY approach with discount brokers like eToro or Public.

Both approaches have their benefits. Depending on your preferences and circumstances, one style might be more appropriate. Let’s dive in:

Differences Between a Full Service Broker and a Discount Broker

While both types of brokers offer investment trading services, there are some important differences:

- Full service brokers involve more human involvement. The brokerage firm works directly with you and offers various financial services above and beyond trade execution. However, these services come at a higher cost than discount brokers.

- Discount brokers are typically self-directed. You’ll rarely speak with a representative at a discount broker. Instead, you execute your own trades via a digital platform.

Full Service Broker | Discount Broker | |

|---|---|---|

Service Offering | Trade execution, financial advice, discretionary trading, tax advice, research, and other services | Mostly self-directed trade execution |

Cost | Typically far costlier. Annual fees typically range from 1% to 2% of your total assets being managed for discretionary accounts. | Most discount brokers offer low or no-commission trades; many offer low or no minimum balances. |

Financial Advice? | Yes | No |

Suitable For |

|

|

Full Service Brokers vs Financial Advisors

Financial advisors are part of the package with full service brokers.

While discount brokers usually only execute trades, full service brokers typically advise on investments using professionally designated financial advisors.

In most cases, financial advisors that work for full service brokers possess an industry-approved certification, like the Chartered Financial Analyst designation.

These certifications signal to potential clients that the professional likely possesses the skills to manage finances prudently.

Should You Use a Full Service Brokerage Firm?

There are several reasons why you might want to use a full service brokerage firm:

- You’re intimidated by the markets and want the peace of mind that comes with working with trained industry professionals.

- You’re a high-net-worth individual who can justify the cost. Full service brokerage firms often require large asset bases to become a client — sometimes $1 million or more.

- You’re uncomfortable navigating the increasingly digital-only platforms used by discount brokerages.

Here are some of our top picks for full service brokers.

The 3 Best Full Service Brokers:

1. Morgan Stanley

With great wealth comes great complexity. Morgan Stanley’s Private Wealth Management can help simplify things.

This premier division offers clients a “hands-on tailored approach” to asset management.

This bespoke service offers far more than trade execution, including:

- Customized alternative investment strategies

- Trust and estate planning

- Access to alternative investments

- Impact investing

- Cybersecurity services

- Lifestyle advice

Morgan Stanley’s hands-on approach and range of services make it one of our top picks for a full service broker.

2. Charles Schwab

Charles Schwab offers a range of brokerage accounts, from digital-only with no minimum account balance to fully-serviced advisory accounts requiring a minimum $1 million account balance.

When it comes to high-net-worth individuals, they really pull out all the stops. Schwab Advisor Services offers you:

- Access to a wide range of investment types

- Access to advisors

- Banking services

- Trust services

- Estate services

- Tax planning

- And more…

Attention to detail and a wide array of services make Charles Schwab one of our top picks for full service brokerage accounts.

3. JP Morgan

Like Morgan Stanley and Charles Schwab, JP Morgan is a well-established and trusted financial institution. JP Morgan offers a variety of investing tiers.

Its top-tier service is the J.P. Morgan Private Client Advisor program, which involves:

- Working in person, one-on-one with a dedicated advisor in your community

- Personalized financial strategy

- Customized portfolio

- Wealth planning and advice

- Banking services

- Tax planning

- And more…

Worth noting: J.P. Morgan also offers self-directed investing. They also offer an in-between option called J.P. Morgan Personal Advisors where you work with a team of advisors remotely to craft a personalized financial plan and help you build a portfolio.

Should You Use a Discount Broker?

For many people, using a discount broker makes the most sense. You should consider a discount broker if the following apply:

- You’re confident in your investment abilities. In other words, you prefer to make buy and sell decisions independently.

- You are not high net worth. If you have a lower net worth, you may not be eligible for a full service brokerage account, making a high-quality discount broker the next best option.

- You are comfortable navigating digital platforms and mobile apps.

The 3 Best Discount Brokers:

1. eToro

When it comes to learning from other investors, eToro reigns supreme.

Whether you’re a beginner, advanced, or anywhere in between, this unique free platform gives traders insight into the wisdom of peers in the market.

The platform allows you to trade stocks, crypto, fractional shares, ETFs, and options, with only a $10 minimum deposit.

Plus, eToro also has a truly unique feature: CopyTrader, which lets you see the returns and portfolio holdings of eToro’s top-performing investors. You can use this information to learn and inform your own trades.

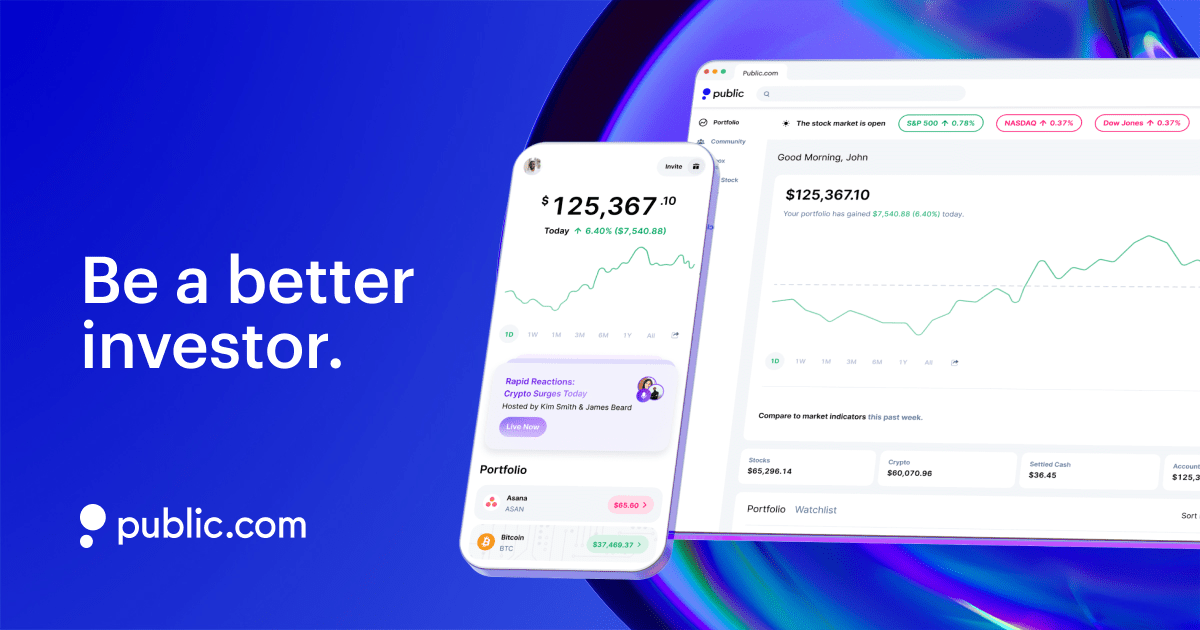

2. Public

Public is another one of my favorite discount brokers. Here’s why.

First, clients enjoy the same SIPC and FDIC insurance and bank-grade encryption you’d find at major institutions like Charles Schwab and Fidelity.

Next, you have the ability to trade most major assets — stocks, ETFs, crypto, and even more obscure alternative assets like art and collectibles, all on a single platform. This is not a common feature. (Want more? Check out our comprehensive review of Public.)

Plus, Public is among the more social platforms. Here’s why I like that: Because you can see what other investors are up to, which can give you investing inspiration. For instance, if you see that a ton of people are suddenly posting about buying a certain stock or stocks in a certain sector, it can alert you to trends that you might not have otherwise known about.

For instance, a little while back, before the big Fed rate cut in September 2024, I saw that a lot of traders were posting about home builder stocks, REITs, and stocks related to real estate in general. As a result, I started watching home-building stocks more carefully. That’s just one small example — but overall I think social investing is great because it helps you keep your finger on the pulse of the market.

3. Fidelity Investments

With 80 million users and $3.6 trillion in assets under management, Fidelity Investments enjoys one of the largest market shares of all brokerage firms.

But it’s also one of the top discount brokerages for beginners. Here are just a few reasons why:

- You can trade stocks, ETFs, options, and even crypto.

- Commission-free trading

- You can start passively investing with a $0 minimum balance.

There’s a lot to love about Fidelity (learn more in our Best Discount Brokers post) — it’s accessible and offers a lot of features without costing an arm and a leg.

Don’t need a full service stockbroker? Explore these lower-cost alternatives:

-

- Social, alternative assets, great interface: Public

- Low minimums, cool features, easy to use: eToro*

- Great for beginners, great reputation: Fidelity Investments

Final Word: Full Service Broker

A full service broker might be right for you if you…

- Desire bespoke, personalized portfolio management.

- Want peace of mind from working directly with an industry professional, like a financial consultant.

- Need the broader services they typically provide, like tax planning.

- Have a sufficiently large asset base to meet the minimum requirement.

But while full service brokerage firms play an important role for such individuals, their high minimums and high fees rule them out for most average retail investors.

However, self-directed tools have made it a lot easier for people to participate in the markets.

If you’re working with a smaller account and are comfortable making your own financial decisions, a discount broker like Public or eToro might be a great fit.

FAQs:

Which is full service broker example?

Morgan Stanley Private Wealth Management is a full service broker. The service offers individuals a wide range of custom personal financial services, like portfolio management, bespoke investment strategies, and estate planning.

What is the difference between a full service and discount broker?

A full service broker provides a variety of services beyond portfolio management, including access to a financial advisor, tax planning, and estate planning. Discount brokers typically focus on providing low-cost, self-directed digital trading services.

Should you use a full service broker?

You should use a full service broker if you are a high-net-worth individual who desires the peace of mind that comes with working directly with a financial advisor, and want personalization and expanded services, like estate planning.

Who uses full service brokers?

Full service brokers are used by high-net-worth individuals seeking bespoke investment management with a wide range of additional resources, like estate planning and tax advice.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our June report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.