Investing in the stock market is great, but it’s not the only way to get a return.

In fact, diversifying your investments outside of traditional assets can yield higher returns as well as give you a hedge against the volatility and potential risks of investing in traditional assets.

Until recently, you had to have a lot of cash or be well-connected to access investments like commercial real estate, high-end art, fine wine, or private equity. Now, most investors can access these assets through online platforms.

Want to find the best alternative investment platforms?

For this article, I reviewed over two dozen alternative investment apps and platforms (including their available assets, stated returns, fees, and platforms). Below, you’ll find a comprehensive review of the top alternative investments that offer the best experience for investors, whether you’re experienced or looking for your first investment outside of the markets.

Keep reading to find out which one is right for you:

FEATURED OFFER: Masterworks

Want an investment that’s fueled by the ultra-wealthy? Try art.

Actual results: Since 1995, contemporary art has appreciated 11.4% annually on average. That’s 43% more than the S&P over the last 30 years (1995-2024). After all, there’s a reason why many HNW individuals can invest almost an entire 10%+ of their wealth in art.

Want in? You can invest in shares of million-dollar painting offerings with Masterworks, the world’s first art investment platform.

For a limited time, you can skip the waitlist here

*See important disclosures at masterworks.com/cd

The 10 Best Alternative Investment Platforms in 2025:

With a variety of assets available an varying minimums from $10 to higher-end opportunities for HNWIs, here are the best alternative investment platforms in 2025

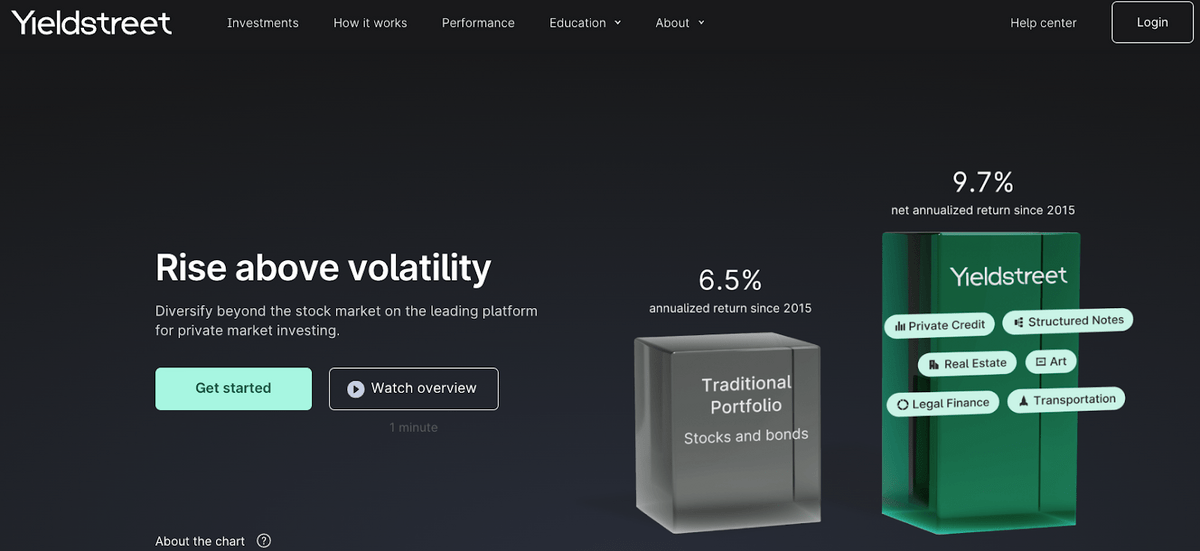

1. Yieldstreet – The Best Alternative Investment Platform Overall

Overall Rating: ⭐⭐⭐⭐⭐

Assets: Real estate, art, crypto, legal, private credit, private equity, short-term notes, transportation, venture capital

Minimum Investment: $15,000

Type of Investor: Primarily accredited

Yieldstreet gives you a lot of bang for your buck as an alternative investment platform — you can access nearly a dozen alternative assets within one account, which features an easy-to-use dashboard and low fees (Fees range from 0% up to 2.5% annually, depending on the investment).

Founded in 2015, Yieldstreet has grown to become one of the best places to invest in just about anything outside of traditional markets. Available assets include crowdfunded real estate, rare artwork, cryptocurrency, private deals, venture capital, and more. A lot of this stuff used to just be available to ultra-connected investors or institutional investors. Not anymore.

Yieldstreet has invested over $4.5 billion for its investors since its founding, and has averaged 9.7% net annualized returns since then. To put that in perspective, a traditional stock/bond “60/40” portfolio has returned about 6.5% in the same amount of time.

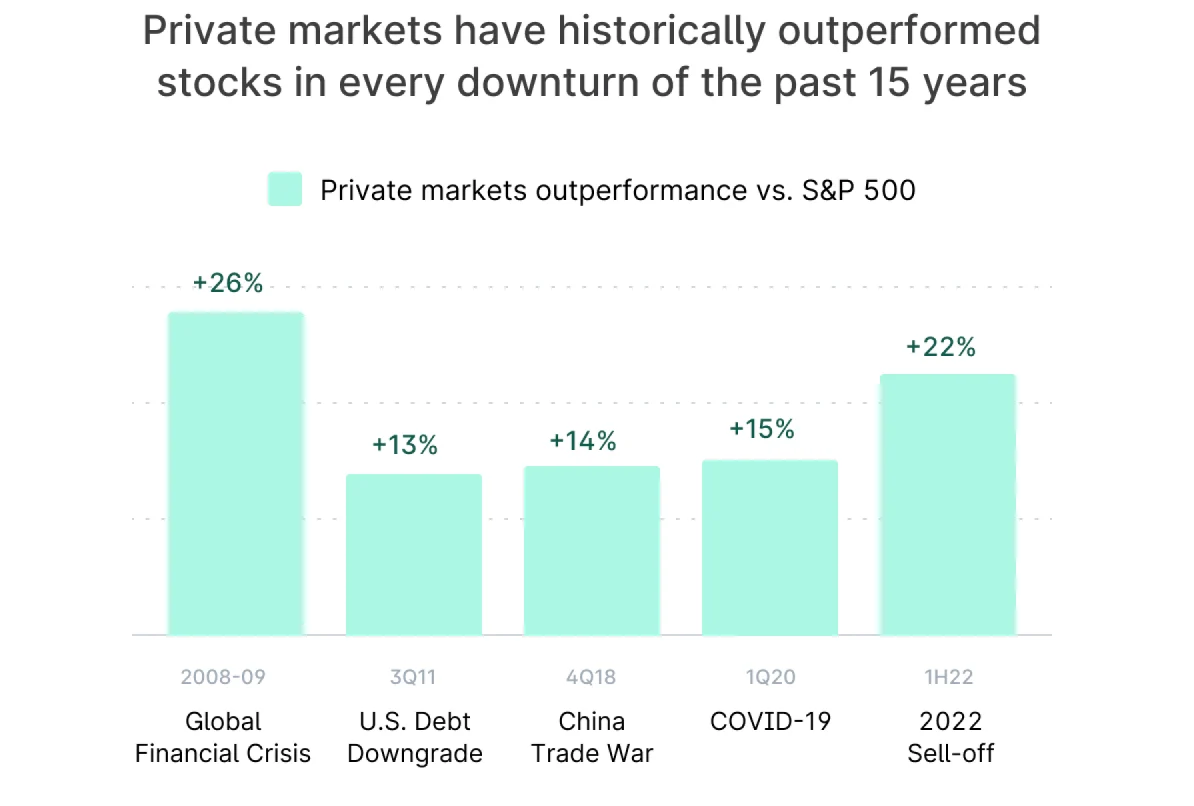

What’s more, Yieldstreet offers access to markets that have historically outperformed stocks during downturns:

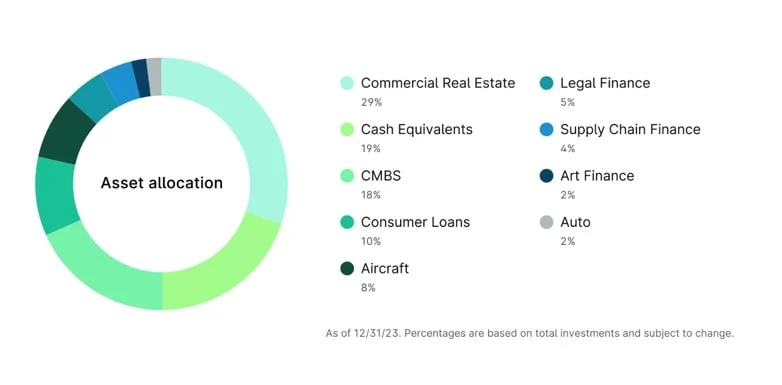

If the variety of individual deals is too overwhelming on Yieldstreet, you may want to consider the Yieldstreet Alternative Investment fund, which happens to be one of the few offerings accessible to both accredited and non-accredited investors. This professionally-managed fund makes it easy to diversify across multiple asset classes of alternative investments:

Yieldstreet is one of the most comprehensive and user-friendly alternative investment platforms out there — I’d recommend it to just about anyone looking to diversify.

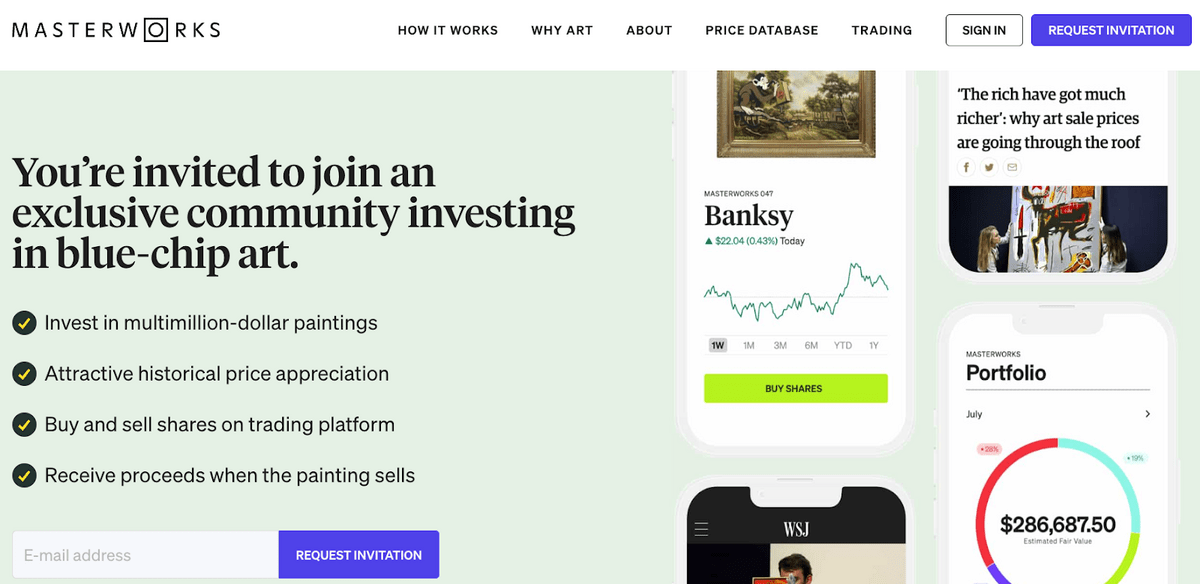

2. Masterworks – Invest in Fine Art

Overall Rating: ⭐⭐⭐⭐⭐

Assets: Contemporary art

Minimum Investment: N/A

Type of Investor: All investors

Masterworks is the best online platform for investing in high-end contemporary art.

What is it? A platform that lets both accredited and non-accredited investors diversify into high-end art offerings for a fraction of the usual cost.

Art can be scary because there’s less regulation in the market than, say, with publicly-traded stocks. However, platforms like Masterworks make it easier than ever to invest in legitimate works of art.

They have a solid track record: Masterworks has purchased over 450 art pieces, with 23 sales so far, generating +17.6%, +17.8% and +21.5% annualized net returns for investors with representative exits (from paintings held 1+ year, not including unsold).

Overall, investing in art is a great way to diversify your portfolio and is uncorrelated with public markets historically (‘95-’24), giving investors a diversifier during upwards and downwards market volatility.

However, investing in fine art does carry a higher degree of risk, as you must choose the pieces to invest in, and there is no guarantee of a return. Check out our complete Masterworks review for all the details.

Masterworks does have a waitlist for onboarding interested investors, but you can skip the line by using the link below.

* Returns are examples of those deals that represent median returns. Past performance is not indicative of future returns.

3. DLP Capital – The Best Real Estate Investment Platform for Large Accounts

Minimum Investment: $200,000

Real estate ranked number 1 in our list of the best alternative investments, so let’s talk about some of the best ways to invest in it. I’ll start with an option for larger accounts — but if the price tag above scared you, don’t worry, I have more platforms to discuss (one of which has a $10 investment minimum) below.

If you have a large account and you’re interested in becoming a real estate investor but don’t necessarily want to buy property outright, DLP Capital might be a great fit.

Yes, the $200K minimum is high, but the company’s legit. Founded in 2006, DLP has a proven track record, with thousands of investors, an inventory of 18,000 housing units, and over $5.25 billion in assets under management.

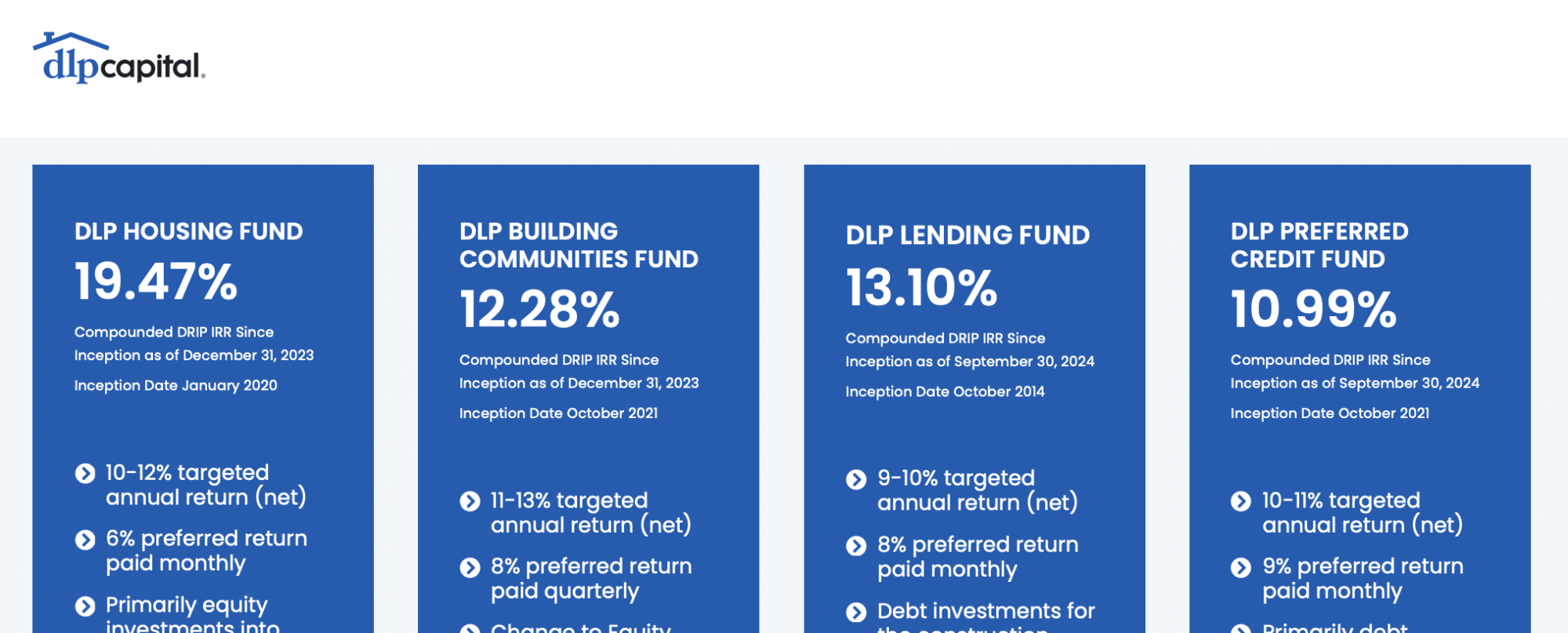

DLP Capital primarily serves wealthy investors, offering access to a variety of real estate funds to align with different investment strategies and objectives:

- The DLP Housing Fund offers access to build-to-rent and multifamily communities

- The DLP Building Communities Fund offers access o equity and preferred equity investments in entities or senior mortgage loans or mezzanine loans for developing new rental communities

- The DLP Lending Fund offers access to debt investments for the construction, acquisition, and repositioning of attainable rental housing

- The DLP Preferred Credit Fund offers access to debt investments (senior mortgage loans and/or mezzanine loans) and preferred equity in RV and vacation luxury parks, manufactured housing, and rental housing properties.

Not only do you have plenty of options and the ability to choose a fund that aligns best with your goals, but DLP also has a number of other unique selling points:

- DLP primarily focuses on impact-based investment strategies, attempting to profit while also benefiting society for the greater good. I’ll be real with you: This is not common with elite investment platforms.

- Additionally, DLP’s fee structure is refreshingly transparent. It offers a 2.0% management fee, with potential rebates for higher account balances.

- Its historical returns are impressive. Looking at the DLP Housing Fund to illustrate, the fund currently lists a 19.47% compounded DRIP IRR Since Inception (2020) as of December 31, 2023, and currently targets a 10-12% annual net return. Other funds report 12.28%, 13.10%, and 10.99% DRIP IRR since Inception.

4. Fundrise – Invest in Residential & Commercial Real Estate (Small + Large Accounts)

Overall Rating: ⭐⭐⭐⭐⭐

Asset classes: Commercial real estate, private credit, pre-IPO companies

Minimum Investment: $10

Type of Investor: All investors

In my opinion, Fundrise is one of the top real estate investing apps and beyond — and it’s accessible to investors at just about every level.

Fundrise offers access to a wide range of investment strategies and opportunities including diversified private real estate funds, private credit funds, and the Innovation Fund, which focuses on up-and-coming companies.

Here’s how it works. Once you set up your account, you can select a strategy that suits you: Balanced Investing, Supplemental Income, Long-Term Growth, or Venture Capital. You don’t have to figure out allocation; Fundrise invests on your behalf, then makes it a cinch for you to see your account value, portfolio breakdown, and returns on your home page. (To learn more about how it works, check out my detailed Fundrise review)

I’m a particular fan of the new-ish Fundrise Innovation Fund, which focuses on backing high-growth, technology-driven companies on the forefront of innovation. If you’re an investor with a smaller account (like me), this is a great fund to gain access to pre-IPO companies and the types of up-and-coming businesses that typically require a Silicon Valley address and contacts to invest in.

Oh, and for those of you with a long-term time horizon? Fundrise even offers retirement accounts (IRAs), so you can also use the platform to save for retirement.

Yes, there are fees. But they’re minimal and fairly simple. Ccheck out their website for the most up-to-date information.

Note: We earn a commission for this endorsement of Fundrise.

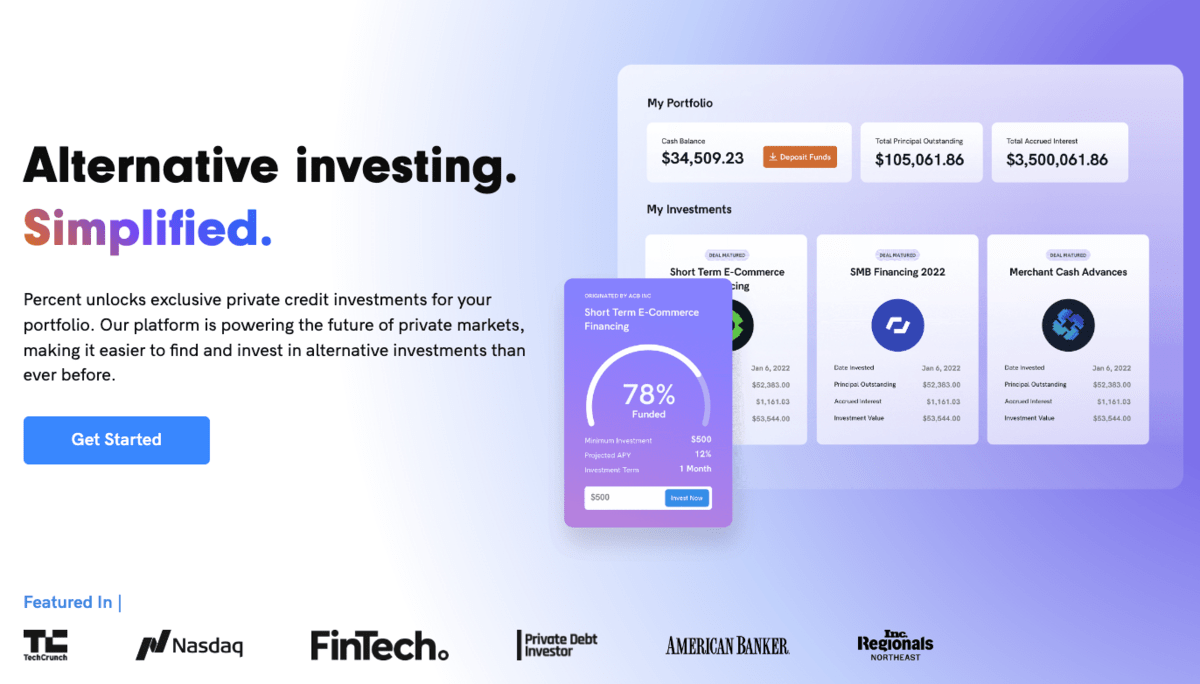

5. Percent – Invest in Private Credit

Overall Rating: ⭐⭐⭐⭐⭐

Assets: Consumer loans, trade receivables, SMB Loans, SMB cash advances, SMB leases, corporate loans

Minimum Investment: $500

Type of Investor: Accredited only

Percent is one of the best platforms for investing in private credit (accreditation required). It offers access to an asset class that has historically been primarily reserved for institutional and ultra-wealthy investors.

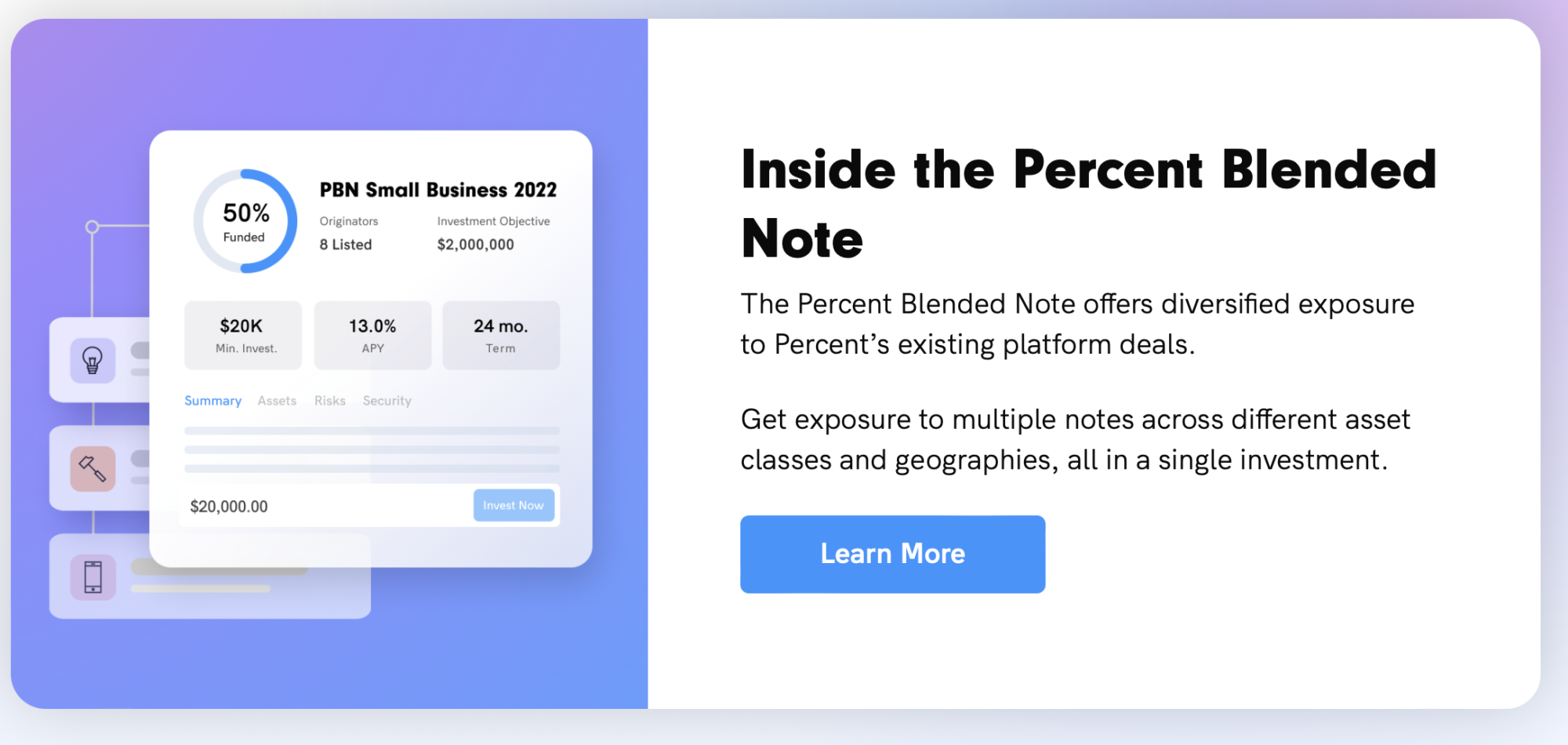

Percent is a crowdfunded platform that offers access to a variety of debt investment opportunities, including corporate and small business loans, as well as trade receivables and consumer loans.

The platform also offers blended note portfolios made up of a variety of loans in a single investment, making it easy to diversify.

With Percent, the process is simple: Percent partners with corporate borrowers that originate loans to small businesses and consumers, and the loans are funded by you, the investors. You collect earnings through loan interest, and most loans are backed by assets, giving you extra protection.

What about fees? Percent charges variable fees depending on the investment product.

- For direct deals, 0% management + a % of yield

- For managed products like Percent Blended Notes, 1% management + a % of yield

For example, if a deal paid 15% APY and the fee charged was 10% of interest, your effective APY is 13.5% after fees.

Percent is available to accredited investors only. Not sure how accredited investor opportunities work? Check out this article.

6. Hiive – Invest in Private Companies

Overall Rating: ⭐⭐⭐⭐

Assets: Private companies

Minimum Investment: $25,000

Type of Investor: Accredited only

There is a way to invest in companies before they go public — Hiive.

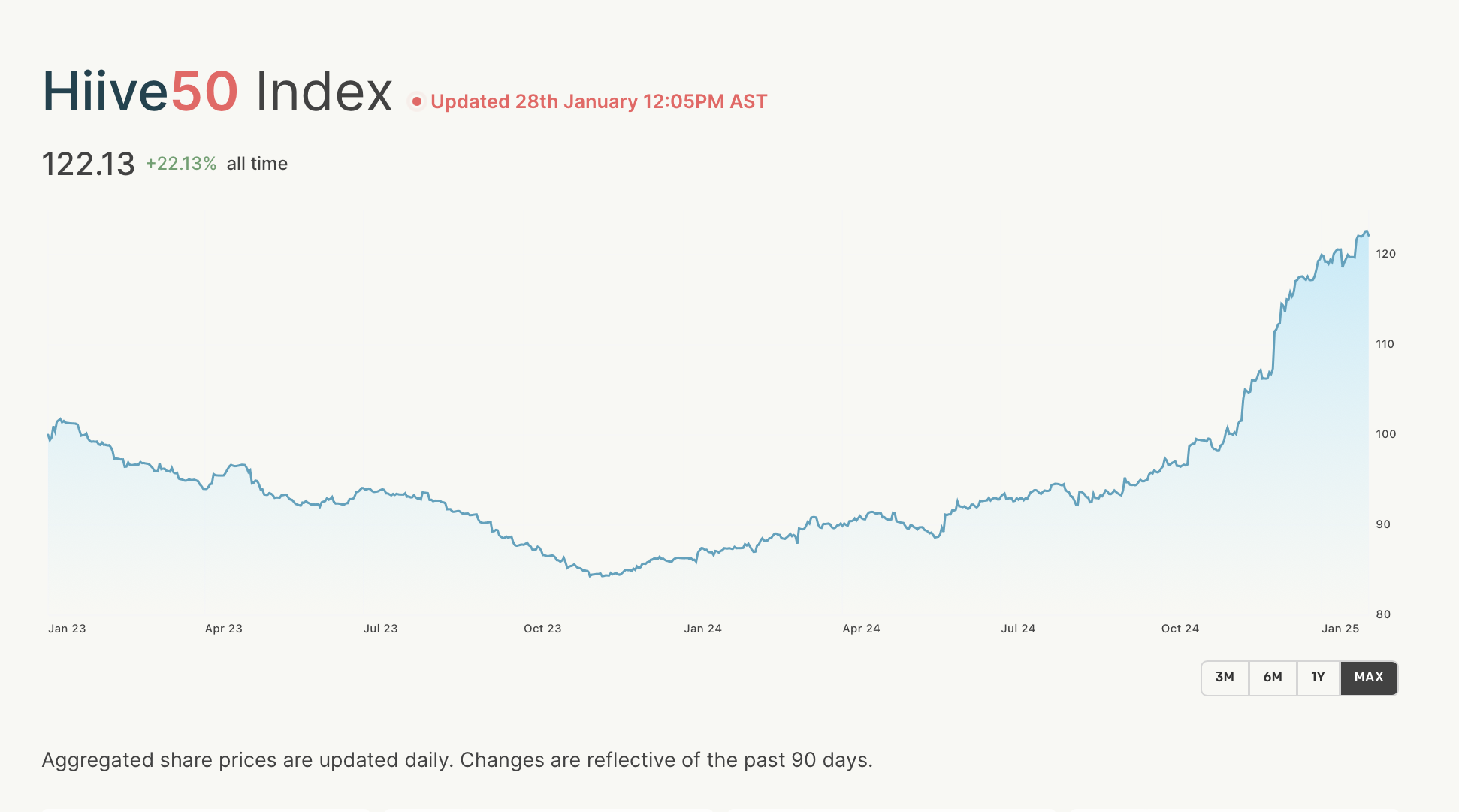

Hiive gives accredited investors access to the private market by connecting them with shareholders of private, VC-backed companies who want to sell their pre-IPO shares. On the platform, you can buy stock options for multi-million-dollar pre-IPO companies, including big names like Waymo and OpenAI.

Interested in seeing what’s trending on Hiive? Check out the Hiive50, which aggregates some of the biggest movers and shakers on the platform:

With no buying fees, the ability to negotiate, and a robust marketplace with thousands of companies, Hiive is a great way to invest in companies before they IPO.

Sign up with Hiive, check out companies you like, add them to your watchlist, and get notified about any new listings and trades.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy or security. Investing in private securities is speculative, illiquid, and involves the risk of loss. Not all private companies will experience an IPO or other liquidity event; past performance does not guarantee future results. WallStreetZen is not affilated with Hiive and may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive Markets Limited, member FINRA/SIPC.

7. Arrived Homes – Invest in Fractional Real Estate

Overall Rating: ⭐⭐⭐⭐⭐

Assets: Single-family home rental properties

Minimum Investment: $100

Type of Investor: All Investors

Arrived Homes is the best crowdfunded real estate platform for investing in single-family rental homes, with an extremely low $100 minimum. Plus, it’s backed by Jeff Bezos.

Arrived offers an intuitive platform that lets you invest a small amount of money into single-family residential investment properties. You can purchase shares of a single property for as little as $100, and earn dividends in the form of monthly rental income.

Among its selling points? Arrived has a stringent vetting process, selecting less than 1% of the deals they review, and they offer both long-term rental and vacation rentals.

While there are a few fees for each property (0.15% annual fee, 8% gross rents fee, additional fees for short-term rentals), expected net returns range from 8% – 20% APY.

8. Public – Invest in Collectibles & Stocks

Overall Rating: ⭐⭐⭐⭐

Assets: Stocks, ETFs, crypto, fine art, collectibles

Minimum Investment: None

Type of Investor: All Investors

Forget stuffy asset managers. Public.com is an easy-to-use and intuitive platform that lets DIYers invest in both traditional stocks and ETFs as well as alternatives like crypto and collectibles with minimal fees.

Public is a trading platform and one of the best alternative investment apps out there. Why? No fees on stocks and ETF trading, plus many more assets, like NFTs, rare sports cards, collectible sneakers, famous artworks, and more.

You can also see what other users are buying and selling — the platform’s very social, and it’s fun to get lost for a while looking at what other people are investing in.

Public is also unique in that it offers a secondary trading market where you can buy and sell shares of ownership in these alternative assets. Plus, there are no accreditation requirements, so anyone can invest in collectibles, stocks, and other assets on Public.

Worth noting: Investing in alternative assets comes with a 2.5% commission per transaction, so if you try to actively trade alternative assets, it can get expensive.

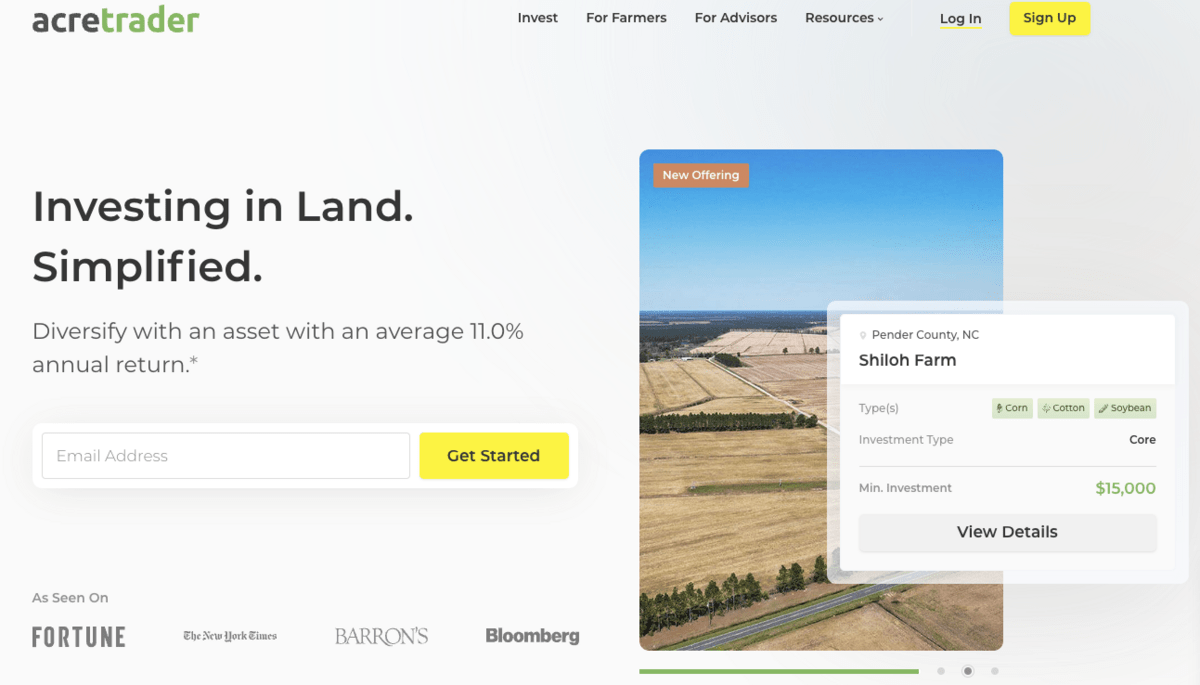

9. AcreTrader – Invest in Farmland

Overall Rating: ⭐⭐⭐⭐

Assets: Farmland

Minimum Investment: $10,000

Type of Investor: Accredited only

Farmland is one of the fastest-growing assets in the U.S., and AcreTrader has made it more accessible by purchasing land and letting investors buy shares of partial ownership without investing directly.

AcreTrader is the best way to invest in farmland, offering ownership shares in farms across the U.S. with a low minimum investment.

The platform lets you browse specific deals and invest in ones that you like, with each providing a full offering circular and full details about the farms and crops on that land. Most deals have minimums in the $10,000 range.

While AcreTrader is relatively new, returns have averaged around 11% APY.

AcreTrader is currently available to accredited investors only. For more info, check out our AcreTrader review.

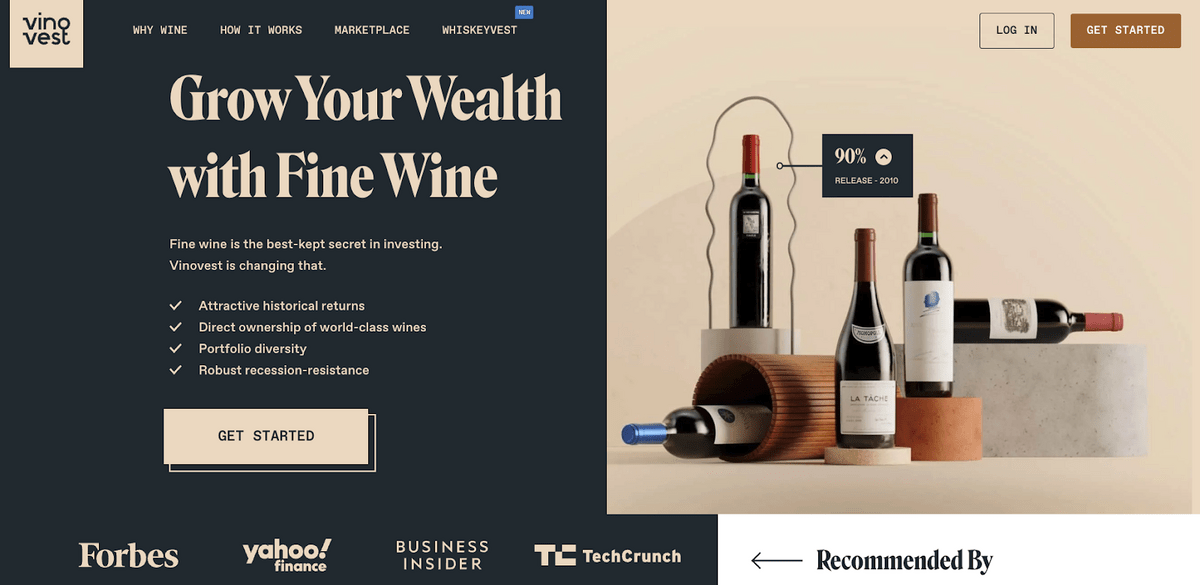

10. Vinovest – Invest in Wine

Overall Rating: ⭐⭐⭐

Assets: Vintage Wine

Minimum Investment: $1,000

Type of Investor: All investors

Vinovest lets you invest in AI-selected wine portfolios and individual wine collections, with a secondary marketplace available.

Vinovest is an investing platform that offers fine wine portfolios and collections to both accredited and non-accredited investors. You can also invest in individual bottles through the Vinovest marketplace. Best of all? You own all the wine that you purchase through the platform.

Vinovest uses artificial intelligence to create a portfolio of selected wines based on thousands of data points, including market liquidity. They also enlist master sommeliers to help them curate wine collections to match your investment choices.

There is an annual 2.50% fee assessed (at the starter investment level) and a $1,000 investment minimum.

Final Word: The Best Alternative Investment Marketplaces & Apps

Investing in alternative assets isn’t just for HNWIs and hedge funds. It’s a great way to diversify your overall holdings in traditional investments while accessing unconventional assets. And the best alternative investment apps help you invest with low minimums, strong security, reasonable fees, and a well-designed platform.

The upside to an alternative investing strategy is that most assets are uncorrelated with traditional markets, and there is the potential for outsized returns.

Of course, with potentially higher returns comes higher risk, including the risk of a total loss of your investment. As always, research any company or asset before investing your money into it, and as a rule of thumb, don’t invest more into alternative assets than you can afford to lose.

FAQs:

What is an alternative investment platform?

Alternative investments are assets outside of traditional markets that only offer stocks, bonds, mutual funds, ETFs, and other publicly-traded assets. Alternative investment platforms allow investors to invest in these alternative assets in a simplified way, typically for less money, and often provide management services.

What are 4 examples of alternative investments?

There are several types of alternative assets, but some of the most popular alternative investment products include commercial real estate, fine art, private credit, and farmland. These assets were once only for the wealthy and well-connected but crowdfunded alternative investment platforms make them more accessible than ever.

What is the most popular alternative investment?

Probably the most popular alternative investment is commercial real estate. There are several popular platforms with hundreds of billions invested, giving both accredited and non-accredited investors access to office buildings, strip malls, storage units, and other high-priced commercial properties.

Which platforms are best for investing?

There are quite a few solid alternative investment platforms available, with Yieldstreet currently being our favorite. It offers access to a huge selection of assets with low fees and the best alternative investment marketplace for investors. There are some great real estate investment platforms too, as well as apps like Public that let you trade alternative assets with others.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.