Earning a yummy yield on savings has never been so simple.

With the explosion of digital-only banks and high-yield savings accounts, you can get a decent chunk of change without fretting about market volatility.

Sounds too good to be true, right? Well, in some cases, the fine print can put a dent in this strategy.

However, there are many legit ways to earn from a nearly 5% interest savings account—you just have to know where to look (and what to look for).

Reviewing the best high-interest savings accounts will put you in a stronger position to make low-risk interest.

What bank has the highest interest rate?

On paper, Varo offers the most attractive APY with a 5% interest savings account, but that’s not technically the best deal.

You see, Varo only offers this 5% for your first $5,000 (then 3% on everything after that). So, if you plan to put in more than $5,000, Varo’s offering won’t give you the most bang (or “bank?”) for your buck.

CIT Bank, by contrast, offers up to 4.35% APY on deposits above $5,000 via their Platinum Savings Account. So, people who plan to park over $5,000 in savings will get a better overall return with CIT Bank.

That being said, keep in mind that APYs on savings accounts are constantly shifting. Unlike CDs, you won’t get a locked-in rate for however long you keep your money in one of these accounts.

Therefore, it’s best to keep an eye on whichever bank you start out with and shop around for the most competitive rates.

For scannable reference, here’s a table showing the highest APY savings accounts, along with the actual total interest you would earn if you deposited $10,000:

Savings Account | APY | Total Interest Earned Annually | Learn more |

|---|---|---|---|

Up to 4.35% on accounts over $5,000 | $435 | ||

4.6% | $460 | ||

4.25% (temporary boost to 4.75% using this link) | $475 | ||

4.2% | $420 | ||

5% on the first $5,000; 3% on balances after that | $400 |

Pros and cons of a 5% interest savings account

With close to a 5% kickback plus FDIC insurance, there isn’t much to complain about.

It’s true; high-yield savings accounts are a sweet deal for conservative and passive investors. However, there are a few potential downsides that might dampen your “money dance.”

Pros:

- Cash accessibility: Unlike bonds, CDs, or fixed-income investments, a high-yield savings account lets you withdraw your money without paying penalties, making it an extremely liquid option.

- Low deposit requirements: Many of the best high-interest savings accounts don’t have minimum account requirements. Plus, even those that do have these minimums often require low amounts.

- Accessible and user-friendly: Many companies offering high-yield savings accounts are digital-first banks or platforms, making them super simple to install and use on laptops, tablets, and smartphones.

Cons:

- May have special account requirements: Some high-interest savings accounts have sneaky requirements — like making constant direct deposits or using products like debit cards — to unlock the holy grail of APYs.

- Sometimes includes interest caps: Some 5% APY savings accounts cap the maximum interest rate at a certain amount before offering a lower rate on the remaining funds.

- Variable APYs: High-interest savings accounts aren’t fixed-rate products. So, expect some fluctuation in your monthly earnings, especially after significant events like FOMC meetings.

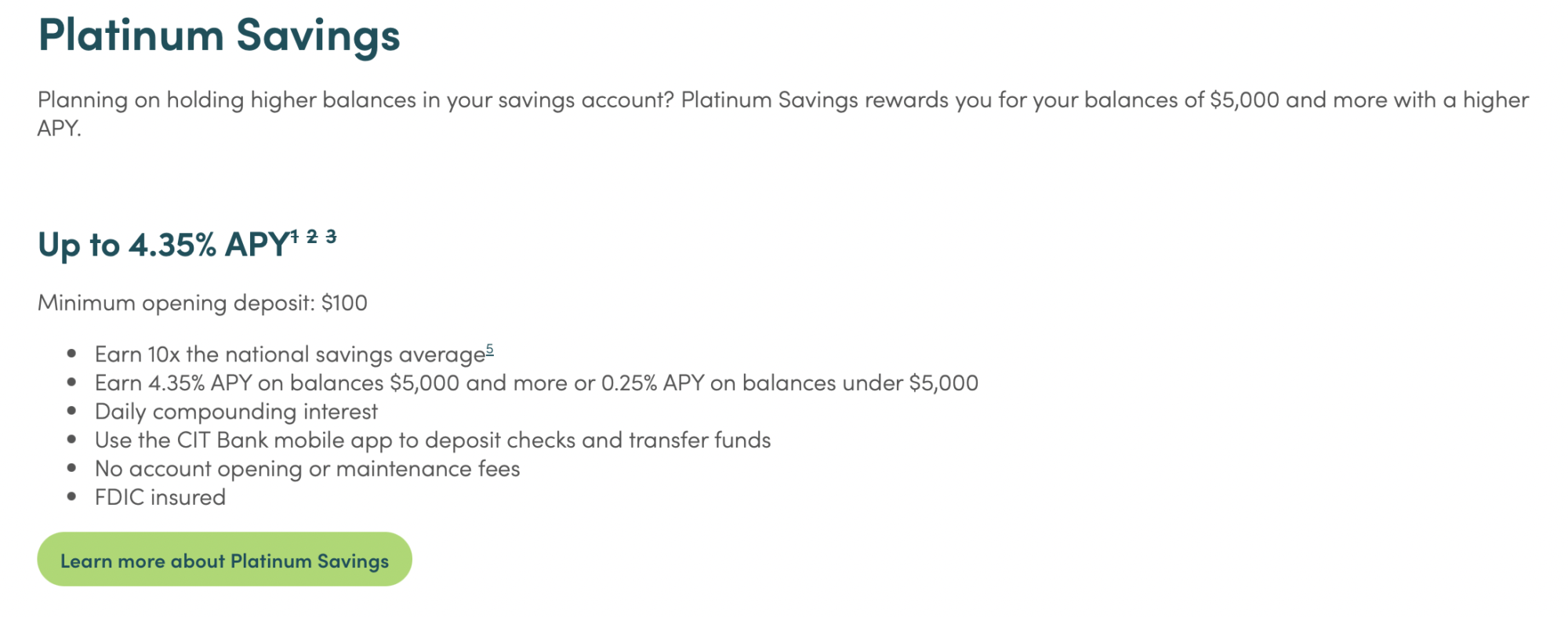

1. CIT Bank Platinum Savings

- Overall rating: ⭐️⭐️⭐️⭐️⭐️

- Account minimum: $100 / $5,000 to earn best APY

- APY: Up to 4.35%

- Annual interest earned on $10,000: $435

- Fees: None

If you plan to store at least $5,000 in savings, CIT Bank’s Platinum Savings may be the best APY savings account.

Currently, this online-only bank offers an FDIC-insured savings account with daily compounding, offering up to 4.35% APY.

As you might’ve guessed, the catch is you need to invest at least $5,000. Any account below that figure will get 0.25% APY.

So, while this isn’t a great option if you’re looking to store under $5,000, it’s certainly one of the most attractive rates for larger long-term savings.

Pros

- Attractive rate for a $5,000+ investment.

- No account opening or maintenance fees.

- Daily compounding interest.

Cons

- APY drops to 0.25% for sub-$5,000 accounts

- No access to trading services found on some other savings platforms.

2. Public

- Overall rating: ⭐️⭐️⭐️⭐️

- Account minimum: $0

- APY: Up to 4.6%

- Annual interest earned on $10,000: $460

- Fees: None

Public.com is a financial “super app” that offers a lot on one platform, including trading for assets like stocks, ETFs, and crypto. You can even invest in T-bills and bonds with Public.

Heck, Public.com even lets you own slices of coveted collectibles, including the glistening glory of a 1st edition Charizard card.

But what about Public’s high-yield savings? Well, this platform now offers a generous 4.6% APY on your cash.

No fees, minimums, or maximums. Simple!

While Public.com is one of the newer kids on the financial block, it’s well worth considering for its attractive offerings.

Pros

- No minimums or maximums.

- $5 million FDIC coverage.

- Zero fees and subscription costs.

- Access to other assets on Public.com, including stocks, collectibles, and crypto.

Cons

- No phone support.

- Works with affiliate banks rather than a standalone bank.

- Shortest track record on this list (founded in 2019).

3. M1 Finance – High Yield Cash Account

- Overall rating: ⭐️⭐️⭐️⭐️⭐️

- Account minimum: None

- APY: Up to 4.75% (The current APY is 4.25% — Get a short-term boost to 4.75% using this link)

- Actual annual interest earned on $10,000: $450

- Fees: $3 for accounts under $10,000; no monthly fee for accounts above $10,000

With M1 Finance, you can earn up to 4.25% APY on your cash without any fees, provided you deposit at least $10,000.

While you’ll still get the 4.25% on accounts under $10,000, you’ll have to subtract a $3 monthly fee from your interest earnings.

(FYI: M1 Finance used to make users sign up for a special “M1 Plus membership” to get this savings account at $10 per month.)

Beyond earning a decent reward on your savings, the M1 Finance app has many other investment-friendly features if you’re looking for a more active way to invest your money.

In fact, M1 brands itself as a “Finance Super App,” so be sure to take a peek at all of these superpowers (like stocks, ETFs, and options).

Pros

- Access to many other financial products, including stocks, ETFs, and crypto.

- No minimum deposit required, and no fees for over $10,000.

- Offers features like custodial accounts, IRAs, and personal loans.

Cons

- A relatively high minimum to qualify for no fees.

- $3 per month fee for under $10,000.

4. Empower Personal Cash

- Overall rating: ⭐️⭐️⭐️⭐️

- Account minimum: $0

- APY: Up to 4.2%

- Annual interest earned on $10,000: $420

- Fees: None

Empower is a powerhouse in the investment and retirement planning spheres.

Going back to the 1890s, this company has certainly withstood the test of time, and it continues to innovate to remain competitive in the financial planning landscape.

For example, Empower now offers a “Personal Cash” portal where you can earn 4.2% APY on savings without minimums or fees.

Empower also has aggregate FDIC insurance of up to $5 million — so, yeah, your funds are pretty safe here.

While the APY is less competitive than some other names on this list, Empower still deserves attention for its ease of use, decent returns, and solid reputation.

Pros

- Zero minimums or account fees.

- $5 million FDIC insurance.

- Easy set-up for solo or joint accounts.

- Long history, plus a dedicated customer care phone line.

Cons

- Currently offers APY slightly lower than competitors.

- Daily withdrawal limit of $25,000 might be inconvenient for large accounts.

- Works as an intermediary for UMB Bank rather than a direct banking provider.

5. Varo

- Overall rating: ⭐️⭐️⭐️⭐️

- Account minimum: $0

- APY: Up to 5%

- Actual annual interest earned on $10,000: $400

- Fees: None

With Varo’s savings account, your base interest rate starts at 3% APY. But wait a second—you can get a 5% APY boost if you meet this bank’s requirements.

What’s the deal?

The key to enjoying this 5% supercharge is setting monthly direct deposits of $1,000.

If you meet this criteria and have a positive account balance, you’ll get 5% APY on the first $5,000 in your savings account.

And don’t worry, you’ll still get that decent 3% APY if you happen to go over the $5,000 threshold.

Pros

- Varo doesn’t charge any fees.

- Offers a combination of 5% and 3% APY for minimal effort.

- Ideal for a moderate savings account (below $5,000).

Cons

- You need consistent $1,000 direct deposits to qualify for 5% APY.

- It’s not perfect for accounts larger than $5,000.

Final Word: The Highest APY Savings Account Doesn’t Actually Offer 5% Interest Rate

The highest APY savings accounts aren’t usually the ones with the highest interest rates unless you maintain a balance of only a few thousand dollars.

This is because these banks typically limit the 5% interest rate to small balances and then drastically reduce interest rates on additional cash. So, for balances exceeding $5,000, options like M1 Finance and UFB Direct are your best bet.

There’s still money to be made with these 5% interest savings accounts, especially if you leverage welcome bonuses from companies like Current. If anything, park most of your savings in an account that doesn’t limit cash and move smaller amounts of cash around to take advantage of higher rates elsewhere.

FAQs:

Are there any savings accounts that pay 5% interest?

Yes, some savings accounts offer 5% interest, but they might have special requirements like direct deposits or max caps. There are also plenty of near-5% interest savings accounts with fewer or no restrictions.

What bank currently has the highest savings interest rate?

Rates offered on high-yield savings accounts constantly change, but CIT Bank consistently offers attractive rates. Currently, they offer 4.7% APY on accounts with at least $5,000. Just be sure to search for the current APYs at FDIC institutions for the latest intel in this field.

Are there 6% or 7% interest accounts?

In the current interest rate environment, FDIC banks are unlikely to offer 6% and 7% interest for savings accounts. Rates this high should serve as warning flags since they're above the industry average.

Is 1% APY on a savings account good?

Sure, 1% APY is better than nothing, but it's pretty weak. Nowadays, you don't have to look far to find many reputable banks and investment apps offering 3%, 4%, or even 5% interest savings accounts.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.