When it comes to precious metal investments, Noble Gold stands as a prominent player in the industry.

But before you invest, you need to know the full scope when it comes to their reviews, complaints, and prices.

Below I’ll walk you through all of the above. I’ve combed through all the Noble Gold investments reviews and complaints to give you the truth about its legitimacy and value.

Plus, you may be interested in some of our other favorite IRA companies:

Is Noble Gold Legit and Worth it In 2025?

The bottom line: (Rating: 3.5/5) If you’re seeking a reliable and secure way to invest in gold and silver within an IRA, Noble Gold is a top contender. They have a strong reputation and offer tailored solutions to protect and grow your wealth.

But if you’re looking to purchase precious metals outside of an IRA, you may want to explore other options. Keep reading to see why.

Interested in other options? We’ve listed some Noble Gold alternatives below — you might also like our article about the best gold IRA companies.

What is Noble Gold Investments?

Noble Gold is a renowned company that specializes in precious metal investments, particularly gold and silver. Their main goal? To keep your wealth safe and sound while offering you some rock-solid investment options.

Noble Gold has over two decades of expertise in precious metals. They understand the importance of protecting your hard-earned money, and they’ve built their reputation on providing reliable and secure investment opportunities.

If you’re looking to diversify your investment portfolio with the power of precious metals, Noble Gold can help. From gold IRAs to silver IRAs and even precious metal coins (more on all of these below) … they’ve got you covered.

You can also rest easy knowing they’re committed to excellent customer service and education on the benefits of precious metals investing:

Noble Gold Reviews and Complaints

Rating on BCA: AA | 5 Stars

Complaints on BCA: None

Rating on BBB: A+ | 4.99 Stars

Complaints on BBB: Only 3 Complaints in the Last 3 Years

Rating on Trustpilot 2.9 Stars (Only 2 Ratings)

Rating on Consumer Affairs: 4.9 Stars

Rating on Google: 4.9 Stars

The vast majority of Noble Gold reviews are positive. The platform averages nearly 5 stars on almost every platform. The only exception is Trustpilot — but in that case, the relatively low rating was based on just two Noble Gold reviews.

The positive Noble Gold reviews make particular mention of how great the customer service is.

Specifically, Noble Gold shines when it comes to simplifying and expediting things that customers had assumed would be difficult or take a long time, like:

- Converting an existing IRA to physical gold and silver

- Setting up a 401k rollover

Customers mentioned that Noble Gold took the time to explain every aspect of the transaction in detail, along with transparency about Noble Gold prices.

That said, there are a few Noble Gold complaints. These typically mention the storage fee that Noble Gold charges on IRAs, which is $150/year. Customers can avoid this fee by taking physical delivery themselves.

Also, Noble Gold doesn’t seem to offer precious metals investments outside of IRA accounts. So if you’re looking to buy some gold and silver for yourself as a collectible or an investment outside of an IRA … there are better places to buy gold online.

Want more suggestions for how to get started with precious metals investing? Check out our article on the best places to buy gold.

Noble Gold Products and Services

Here’s what Noble Gold has to offer:

Gold IRAs

Gold IRAs offered by Noble Gold offer you the opportunity to incorporate physical gold into your retirement portfolios.

This unique investment option comes with several benefits and features that could be attractive if you’re looking to diversify your retirement holdings and safeguard your wealth. Let me explain:

What is a Gold IRA?

With a Gold IRA, you can purchase and hold physical gold coins or bars that meet specific purity and quality standards set by the IRS.

It’s a self-directed IRA that provides you with the option of diversifying your investments beyond traditional stocks, bonds, and mutual funds by including physical gold.

Expand your knowledge: learn more about the best self-directed IRAs.

Why Invest in a Gold IRA?

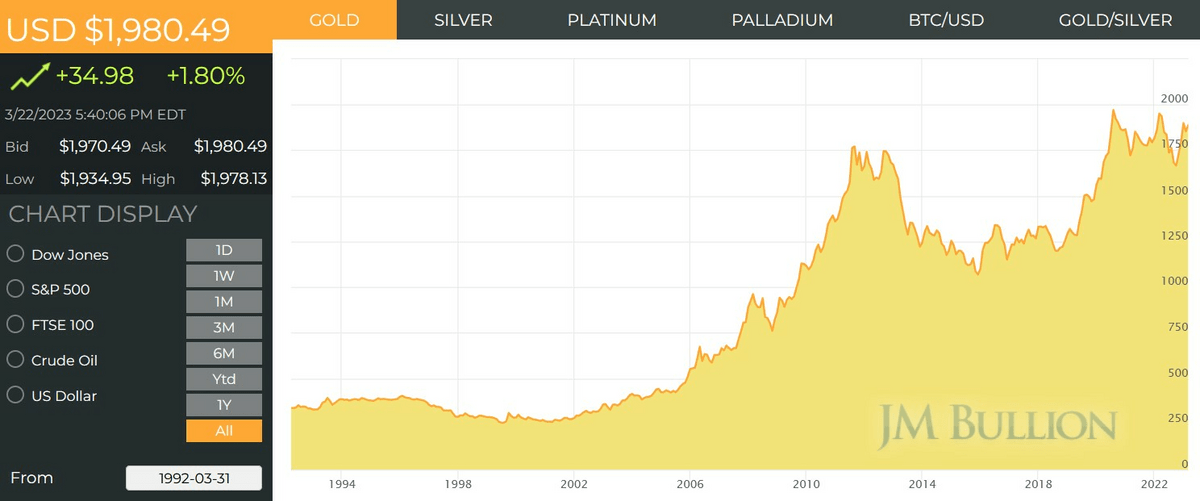

One of the big benefits of a Gold IRA is its ability to act as a hedge against economic uncertainties. Gold has long been recognized as a store of value and a safe haven during times of volatility and inflation. During these times, gold is a SWAN (“sleep well at night”) asset.

Another benefit of Gold IRAs is their potential for long-term growth. Over the years, gold has demonstrated its ability to retain its value and even appreciate in price:

How to Open and Invest in a Noble Gold IRA

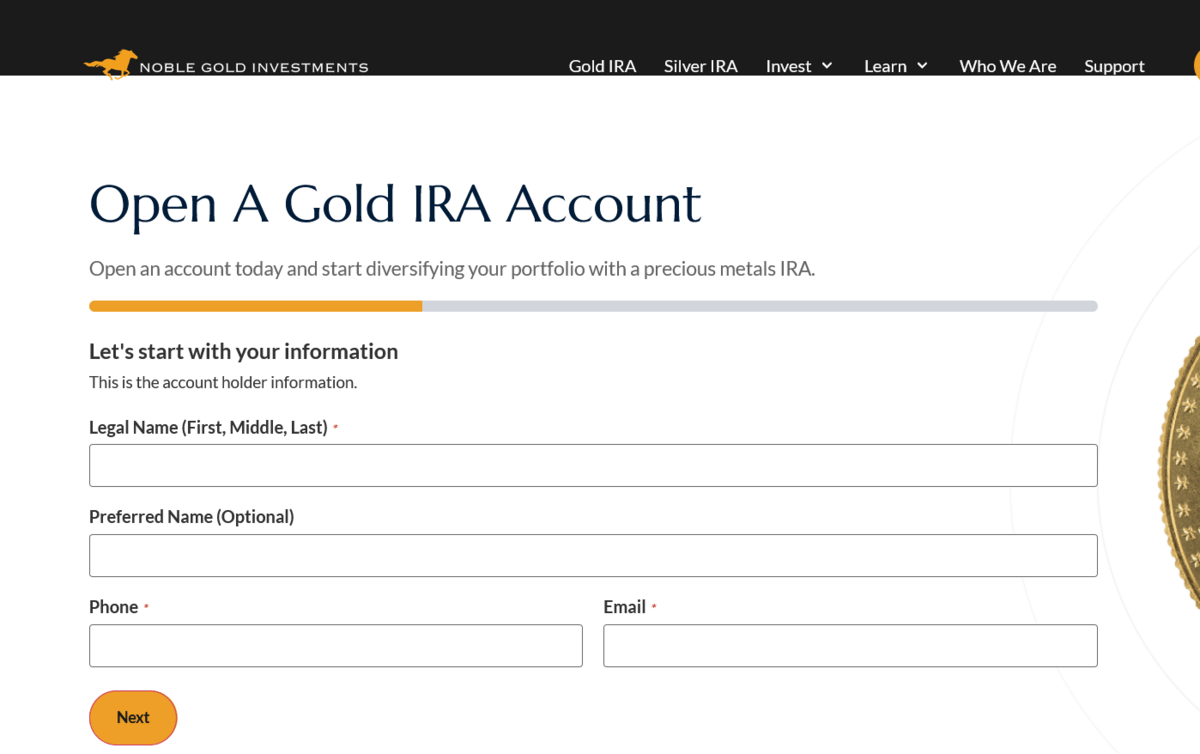

Investing in a Noble Gold IRA is a straightforward process. Follow these steps to get started:

- Visit Noble Gold’s “Get Started” Page on their website.

- Fill out the form and submit details like your name, phone, and email to the Noble Gold team.

- They’ll contact you via phone or email to complete the process of opening and investing in a Noble Gold IRA.

Silver IRAs

What is a Silver IRA?

A Silver IRA is a retirement account that incorporates physical silver as a valuable asset. It provides investors with an opportunity to hedge against inflation and diversify their retirement portfolios with tangible precious metals.

Why Invest in a Silver IRA?

Investing in a Silver IRA offers several benefits, including protection against economic downturns, potential capital appreciation, and portfolio diversification.

Like gold, silver has a historical track record of preserving wealth and acting as a hedge during uncertain times:

How to Open and Invest in a Silver IRA with Noble Gold

To open and invest in a Silver IRA with Noble Gold, just follow these steps to get started:

- Visit Noble Gold’s “Get Started” Page on their website.

- Fill out the form and submit details like your name, phone and email to the Noble Gold team.

- They’ll contact you via phone or email to complete the process of opening and investing in a Noble Gold Silver IRA.

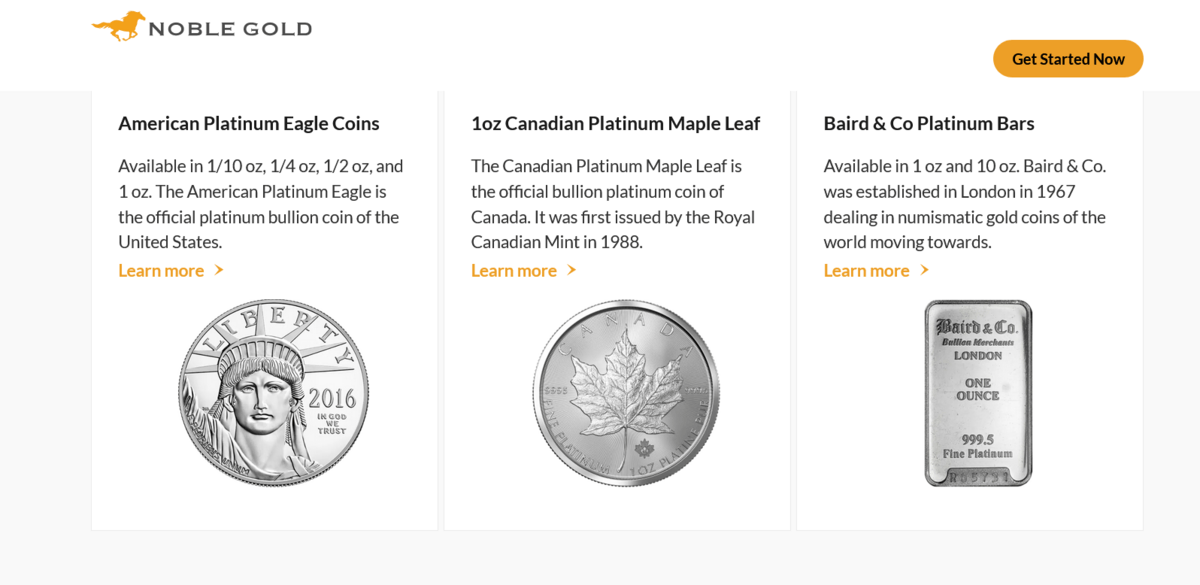

Coins

Noble Gold also offers a wide variety of precious metal coins:

- Gold

- Silver

- Platinum

- Palladium

- Rare coins and collectibles

Not all Gold and Silver IRA companies also allow you to invest in platinum and palladium, so this flexibility is definitely an added bonus.

You can talk to a Noble Gold Representative to learn the benefits of each coin, but here’s a quick overview to get you started:

- Gold coins are a popular choice among investors due to their intrinsic value and historical significance.

- Silver coins, on the other hand, offer a more affordable entry point into the precious metals market while still providing the benefits of tangible asset ownership.

- Platinum and palladium are considered valuable and rare precious metals, often used in industrial applications, such as catalytic converters and jewelry.

How to Buy Precious Metal Coins With Noble Gold

Unfortunately, Noble Gold does not let you purchase their products outside of IRA accounts.

This means you will have to follow the steps of opening a gold or silver IRA to purchase coins:

- Visit Noble Gold’s “Get Started” Page on their website.

- Fill out the form and submit details like your name, phone, and email to the Noble Gold team.

- They’ll contact you via phone or email to complete the process of opening and investing in a Noble Gold IRA.

Other Services

Noble Gold goes above and beyond to provide its clients with exceptional services and valuable resources.

- They prioritize building strong relationships with their clients and strive to provide personalized assistance throughout the investment process. Their team of knowledgeable professionals is readily available to answer questions, address concerns, and guide investors in making informed decisions.

- Noble Gold also offers comprehensive educational resources and materials to help individuals understand the intricacies of precious metal investments, the benefits of diversification, and the potential risks involved.

- Noble Gold is transparent and strives to provide clear and accurate information about its products, fees, and processes, ensuring that clients have a complete understanding of their investment options.

- They aim to simplify the investment process, with streamlined procedures for opening accounts, making deposits, and managing investments, making it convenient and hassle-free for individuals to get started.

Noble Gold Pricing + Fees

Noble Gold charges no setup fee.

However, there’s an $80 annual service fee and a $150 annual storage fee for their IRA accounts. These are competitive rates within the Gold IRA industry.

Some customers’ Noble Gold investments reviews also make positive mention of the company’s low minimum investment requirement ($2000). This low requirement allows you to get started even if you don’t have a ton of money to invest.

How to Get Started With Noble Gold

To get started with Noble Gold, you can download their free gold and silver guide or read the other education resources on their website.

After you’ve done your research and if you wish to go further, you can visit Noble Gold’s “Get Started” Page on their website.

There will be a contract form where you submit details like your name, phone, and email to the Noble Gold team.

Noble Gold will then contact you via phone or email to complete the process of opening and investing in a Noble Gold IRA.

Noble Gold: Pros and Cons

Pros | Cons |

Low minimum investment requirement ($2000) | Only offer IRAs |

Gold and Silver IRAs | |

Also offer platinum and palladium | |

Wide variety of coins to choose from | |

Secure Depository or Home Delivery options |

Noble Gold Alternatives

Looking for alternatives to Noble Gold? Here are a few to consider…

iTrustCapital

Overall Rating: ⭐⭐⭐⭐⭐

Fees: 1% Transaction Fee for crypto, $50 over spot per ounce for Gold, $2.50 over spot per ounce of Silver

Known for: Offering both precious metals AND crypto

If you want to avoid storage fees for your gold and silver and also want the ability to invest in crypto in your IRA, iTrustCapital might be worth considering.

Not only is the added flexibility of investing in crypto unique, but so is their fee structure (almost all gold IRA companies charge annual storage fees).

But while iTrust doesn’t charge storage fees, they still get their cut. You’ll pay $50 over spot per ounce for gold, $2.50 for silver, and a 1% fee on all crypto transactions.

Patriot Gold Group

Overall Rating: ⭐⭐⭐⭐

Fees: N/A

Known for: Investor-direct pricing, Platinum and palladium available

Patriot Gold Group offers a user-friendly online platform and a team of knowledgeable professionals to guide you through the process of setting up and managing a Gold IRA.

The one downside? You’ll have to read Patriot’s gold reviews and fine print to find fee information, as the info isn’t easy to find on their website.

Final Word:

Overall, Noble Gold reviews reveal the company is reputable and reliable, and a clear leader when it comes to Gold IRAs.

Their wide selection of precious metal coins, including gold, silver, platinum, palladium, and rare collectibles, allows for diversification and potential appreciation.

Noble Gold reviews also capture the company’s commitment to simplifying the investment process and offering personalized assistance to ensure a smooth and informed experience for their clients.

But while Noble Gold excels in the realm of Gold IRAs and precious metal coins, it’s worth noting that they don’t offer precious metals investments outside of IRA accounts.

If you’re looking to purchase gold and silver for collectibles or investments outside of an IRA, there may be better options available.

That said, if you’re considering investing in gold and silver within an IRA, Noble Gold is a top contender. Their strong reputation, tailored solutions, and commitment to customer service make them a reliable choice.

Before investing, make sure to conduct thorough research, compare fees and services, and consider your investment goals to make an informed decision that aligns with your needs.

FAQs:

Is Noble Gold legitimate?

Yes, Noble Gold is a legitimate company specializing in precious metal investments.

What are the complaints against Noble Gold?

There are a few Noble Gold complaints mentioning the company’s storage fees charged on their IRAs, but the majority of reviews and ratings are positive.

What precious metals can you buy through Noble Gold?

Noble Gold offers a wide range of precious metals, including gold, silver, platinum, palladium, and rare coins and collectibles.

Who owns Noble Gold?

Noble Gold is privately owned, and the specific ownership details are not publicly disclosed.

Has Noble Gold filed bankruptcies?

At writing, there’s no information indicating that Noble Gold has filed for bankruptcies.

Are Noble Gold prices good?

Noble Gold's prices are competitive within the industry, and they provide transparent information about their fees and processes. Still, it's recommended to compare Noble Gold prices with their competitors and do thorough research to ensure you're getting the best deal.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.