When it comes to online precious metal dealers, Orion Metal Exchange is one of the industry’s top players due to their competitive live 24 hour online product pricing, and fee-free buy-back policy.

But before you fork over your money, it’s still crucial to fully understand the company by examining their reviews, complaints, and pricing.

In this guide, I’ll provide you with an unbiased overview based on extensive research of Orion Metal Exchange’s legitimacy and the value it offers.

Plus, if you’re exploring other IRA companies, we’ve curated a list of our top recommendations that you might find interesting. Keep reading…

Is Orion Metal Exchange Legit and Worth it In 2025?

The bottom line: When it comes to precious metal investments, Orion Metal Exchange is worth considering. Just be aware that the company requires a minimum investment of $10,000 to get started.

Orion Metal Exchange is definitely legit, considering…

- Orion Metal Exchange is a Consumer Affairs Top-Rated Precious Metal IRA dealer

- Best precious metal company in the United States nominee (by Retirement Living)

- It’s BBB accredited and A+ rated with a 5-star customer satisfaction rating

- The Chicago Tribune called it “The best gold IRA service” in the United States

- Money.com named it “Best for low fees” in the United States for 2022

Clearly, this is a top-ranked metal money exchange.

But keep reading, because we’ll take a closer look at the Orion Metal Exchange reviews below to get a better idea of the company.

Don’t have $10K to invest in precious metals? (Yeah, that’s the minimum on Orion Metal Exchange.)

Silver Gold Bull is a platform with no minimum investment. Plus, they offer a best-price guarantee on all coins and bullion bars.

With 286K+ five-star reviews, it’s definitely another top contender in the precious metals market that’s worth considering if Orion Metal Exchange isn’t in your budget.

What is Orion Metal Exchange?

Orion Metal Exchange is all about precious metal investments. They’re experts when it comes to helping you invest in metals like gold, silver, platinum, and palladium.

Whether you’re interested in a Precious Metal IRA or want to invest directly in precious metals, Orion Metal Exchange has the know-how to guide you through the process.

They can help you set up a self-directed IRA that includes precious metals, giving you the opportunity to safeguard your retirement savings with assets that have stood the test of time.

Orion Metal Exchange Reviews and Complaints

- Rating on BBB: 5 stars | 52 reviews

- Complaints on BBB: 0 complaints

- Rating on Trustpilot: 4.9 stars | 174 reviews

- Rating on Consumer Affairs: 4.9 stars | 172 reviews

- Rating on Google: 4.9 stars | 219 reviews

Orion Metal Exchange Products and Services

Precious Metal IRAs

Orion Metal Exchange offers Precious Metal IRAs, which allow you to incorporate physical precious metals into your retirement portfolio.

Here’s a high-level overview of everything you need to know:

- Minimums: There’s a $10,000 minimum required for IRAs.

- Fees: For their IRA accounts, annual fees are between $150 and $225.

- Security: Orion’s IRA department will help you find the best custodian and depository program to suit your personal needs.

What is a Precious Metal IRA?

A Precious Metal IRA is a type of self-directed individual retirement account that allows investors to hold physical precious metals as part of their retirement savings.

By investing in a Precious Metal IRA, individuals can diversify their holdings beyond traditional stocks, bonds, and mutual funds, which can help protect against economic uncertainties and inflation. Here are just a few we like:

Why Invest in a Precious Metal IRA?

Investing in a Precious Metal IRA offers several potential benefits, but these are perhaps the two biggest:

- Precious metals, such as gold and silver, have a long history of retaining value and acting as a hedge against inflation.

- Precious metals can provide a level of stability and diversification to a retirement portfolio, especially during times of market volatility.

How to Open and Invest in an Orion Metal Exchange IRA

Opening and investing in an Orion Metal Exchange IRA is simple.

You can follow these general steps:

- Contact Orion Metal Exchange: Reach out to Orion Metal Exchange to inquire about their Precious Metal IRAs and express your interest in opening an account.

- Consultation and Account Setup: Work with an Orion Metal Exchange representative to set up your IRA account. They’ll assist you in completing the required documentation.

- Funding Your Account: Once your account is set up, you can fund it by transferring funds from an existing retirement account or make a new contribution.

- Selecting Precious Metals: With your IRA funded, you can work with Orion Metal Exchange to choose the specific precious metals you want to include in your IRA. They can provide guidance and options based on your investment objectives.

- Storage and Maintenance: Orion Metal Exchange will assist you in arranging secure storage for your precious metals within your IRA. They may offer various storage options, including approved depositories.

Orion Metal Exchange isn’t the only gold IRA game in town.

Later on in the article, you’ll learn about two of its top competitors, iTrustCapital and Silver Gold Bull. Keep reading to compare and contrast these top-rated gold IRA companies. For even more options, check out our article about the best gold IRA companies.

Invest in Precious Metals

In addition to Precious Metal IRAs, Orion Gold also allows you to invest directly in precious metals outside of an IRA structure. You can either hold these metals yourself at home or utilize Orion Metal Exchange’s secure third-party storage.

Here’s everything you need to know about investing in precious metals outside of an IRA with Orion:

- Minimums: $10,000 minimum purchase required

- Fees: Fees and premiums over spot vary depending on the metal and quantity. It’s best to call for the best pricing.

- Security: Orion Precious Metals will connect you with a 3rd party storage depository that can store, secure, and insure your precious metal holdings. You can also choose to take insured delivery of the metals to your home.

Why invest in precious metals?

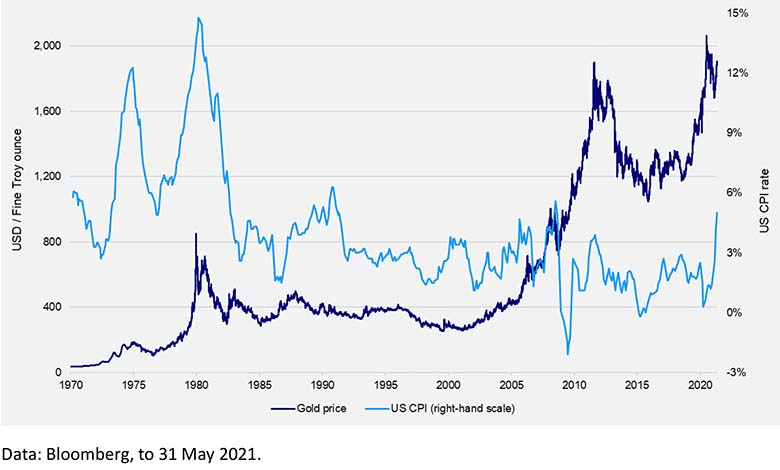

Historically, precious metals have acted as a store of value and a hedge against inflation. You can see in the chart below that gold has healthily outperformed CPI, or US consumer price inflation:

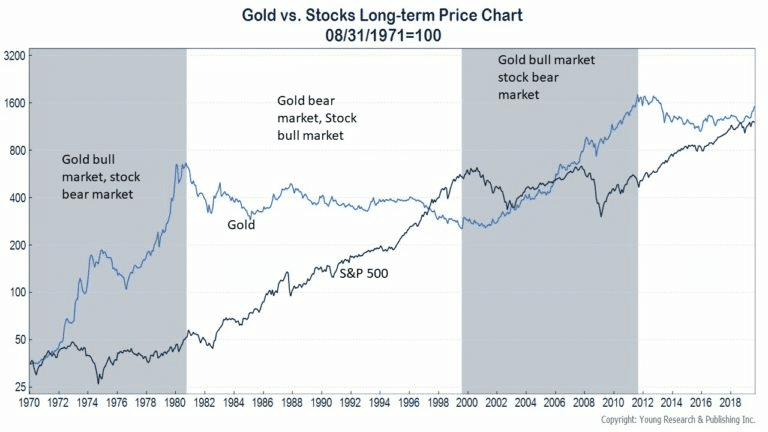

Precious metals also provide a level of diversification to an investment portfolio, helping to mitigate risk during economic downturns or periods of market volatility.

Precious metals are a particularly good diversifier because they are often uncorrelated with the broader stock market. In other words, the times that precious metals do well is often the same time when stocks are not doing so well. This can help stabilize the portfolio and smooth out returns over the long haul.

How to invest in precious metals with Orion Metal Exchange

Important: Orion Metal Exchange requires a minimum purchase amount of $10,000.

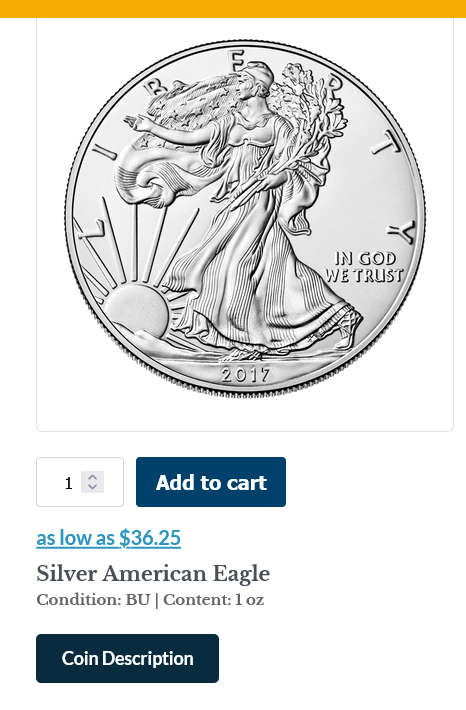

To invest in precious metals with Orion Metal Exchange outside of an IRA account, you can simply add the metals to your online shopping cart by clicking the “Add to Cart” button, and then checkout:

At checkout, you’ll enter your address and payment info.

If you want absolute transparency on pricing, you can also call the company on the phone. On their site, Orion Gold states, “We offer our clients the ability to guarantee transaction pricing with a phone call.”

So if you have a specific price you’re trying to lock in, it may be best to do so with a quick phone call.

Other Services + Features

Orion Metal Exchange offers a few standout services and features that sets it apart from other precious metals dealers:

- They offer investors full transparency by posting their competitive live online product pricing 24 hours a day

- They exclusively offer their clients a fee free buy-back policy

- They offer clients the benefits of a dedicated full-service in-house IRA department for the life of the account

- They offer clients the ability to guarantee transaction pricing with a phone call

Orion Metal Exchange: Pros and Cons

Pros | Cons |

Specializes in precious metal investments, offering a range of products and services. | High minimum purchase amount of $10,000 |

Provides the opportunity to invest in Precious Metal IRAs, which can offer tax advantages and portfolio diversification. | |

Offers direct investments in precious metals for individuals who prefer to hold physical assets outside of an IRA structure. | |

Provides secure third party storage options for precious metals. |

Orion Metal Exchange: Pricing + Fees

For their IRA accounts, Orion Metal Exchange charges an annual fee of between $150 and $225. This amount can vary depending on the amount you invest and where you choose to store your precious metals. This is a competitive fee and in line with other precious metals IRAs.

When it comes to purchasing gold and silver outside of an IRA, it’s best to call the company for their direct pricing and ask for transparency regarding the fees. However, the live prices are also posted for their coins and bullion, so you can do the math and calculate the premium Orion Precious Metals is charging above the spot price.

Orion Metal Exchange Alternatives

Silver Gold Bull

- Overall Rating: ⭐⭐⭐⭐⭐

- Fees: 1% of the account’s value per annum

- Known for: No account minimums, Platinum and palladium available

Silver Gold Bull is a leading platform that makes it easy to start a gold IRA and invest in a wide range of gold products.

With no minimum investment, it’s not hard to see why so many people are attracted to the platform. But here are a few more selling points:

- Silver Gold Bull boasts 324,000+ customers and more than $4 billion in customer transactions

- The platform has 286,000 five-star reviews online

- Low-cost bullion is the name of the game — Silver Gold Bull offers a best-price guarantee on all coins and bullion bars.

You can’t take physical delivery of the IRA metals you purchase, but considering the competitive pricing and no account minimum, it’s pretty easy to see why Silver Gold Bull is considered one of the best gold IRA companies out there.

iTrustCapital

- Overall Rating: ⭐⭐⭐⭐

- Fees: $50 over spot, per ounce for Gold

- Known for: No recurring fees

iTrustCapital is a platform that allows investors to buy and sell precious metals, including gold and silver, within a self-directed IRA. They provide a user-friendly online platform and offer competitive pricing, making it easier for individuals to invest in precious metals.

iTrustCapital also offers crypto, so if you’re looking for a platform that offers all-in-one access to multiple alternatives, this could be a fit. They also offer a unique fee structure: there’s no monthly or yearly fee, but you’ll pay a transaction fee for crypto and a $50 over spot fee per ounce for Gold.

Final Word:

If you’ve got at least $10,000 to invest, and want to diversify your portfolio with precious metals, Orion Metal Exchange is worth your consideration.

Investing in precious metals can be a strategic move to safeguard your wealth and diversify your investment portfolio. But remember — it’s your money. It’s advisable to reach out to them directly to gather more details, including pricing, fees, and minimum investment requirements so you can know for sure if this is the right company for you.

FAQs:

Is Orion Metal Exchange legitimate?

Yes, Orion Metal Exchange is a legitimate company specializing in precious metal investments.

What are the complaints against Orion Metal Exchange?

Most complaints against Orion Metal exchange involve daily market updates on gold or silver commodity spot pricing. However, complaints can vary and context is important, so it's advisable to research and evaluate any complaints against Orion Metal Exchange yourself directly before making an investment decision.

Who owns Orion Metal Exchange?

The ownership information of Orion Metal Exchange is not publicly available.

How much does Orion Metal Exchange cost?

The cost of investing with Orion Metal Exchange can vary depending on factors such as the type of investment and specific services required. For their IRA accounts, Orion Metal Exchange charges an annual fee of between $150 and $225. Contact Orion Metal Exchange directly for detailed pricing information.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.