Seeking Alpha is #1 on this list. Here’s an extra-special offer.

For a limited time, Seeking Alpha is offering our readers a FREE 7-day trial of Premium.

And if you love it as much as we think you will, you can also score a $30 discount on your first year.

A stock portfolio tracker is a software in which you can gather all your investments in a single place and monitor their progress.

Beyond just tracking your stocks, portfolio trackers allow you to take a more big picture, holistic view of your investment portfolio. This way, you can understand all of your positions in relation to one another and keep track of them at a glance.

There are many of these trackers available, each one claiming to be the best stock portfolio tracker, and many of them are paid services.

In this article, I’m going to cover the 10 best stock portfolio tracker apps & software in .

Each of these allow you to quickly view the performance of your entire portfolio, take a closer look at individual positions, have research integrated into the investment software, and allow you to perform more in-depth stock analysis.

I’ll also be covering the price of each investment portfolio tracker and who it’s best for, so you know exactly which one to choose to help you make better investment decisions.

1. Seeking Alpha: The Best Stock Portfolio Tracker Overall

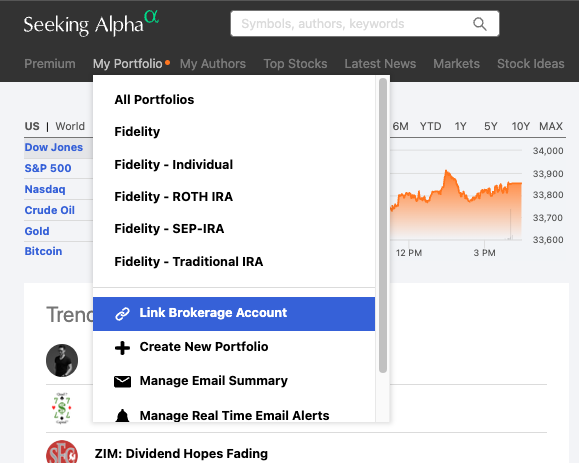

You may know Seeking Alpha Premium as an exceptional investment research platform, but it also leverages its data and reports into a unique portfolio tracker.

If you like Seeking Alpha, you’ll love its portfolio tracker.

You can link your brokerage accounts and start benefitting from Seeking Alpha’s vast array of quantitative and qualitative research in minutes.

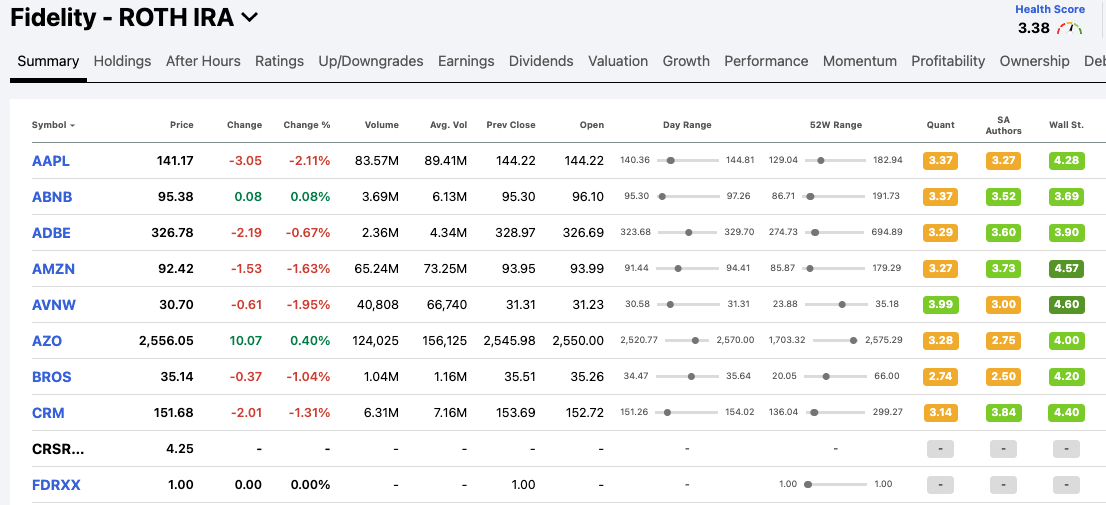

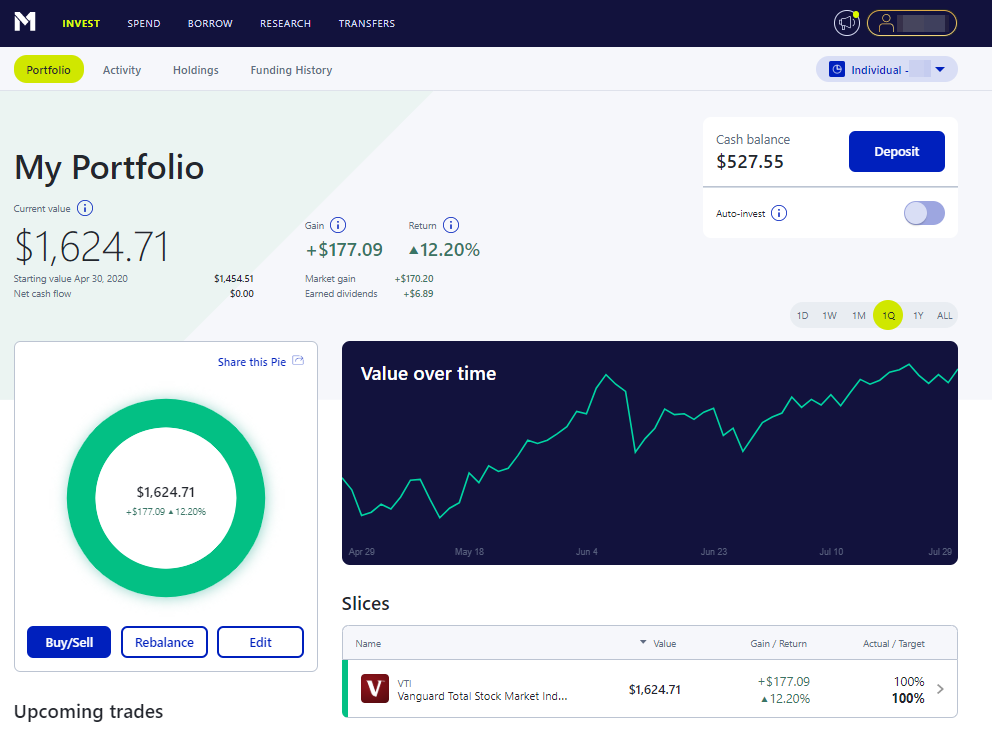

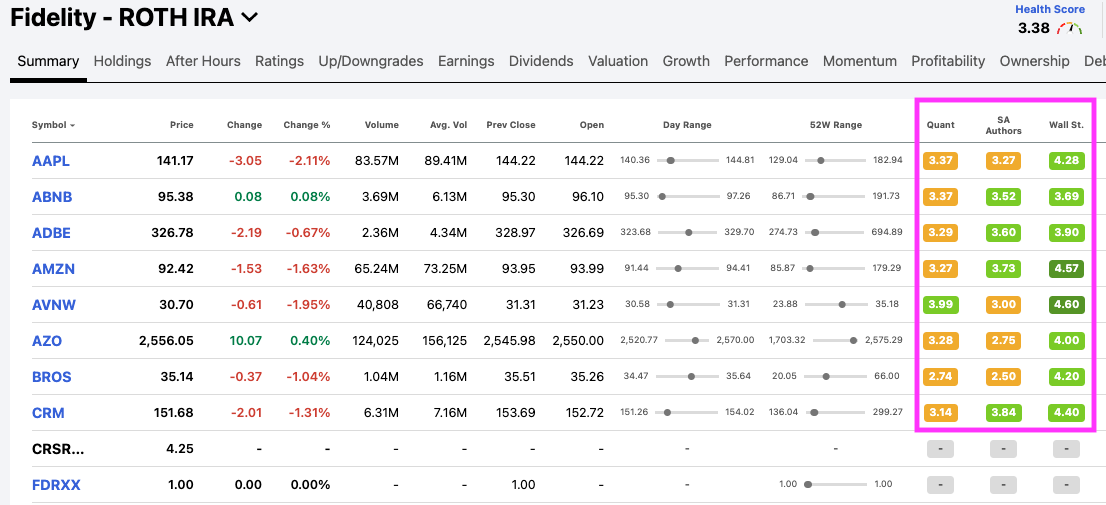

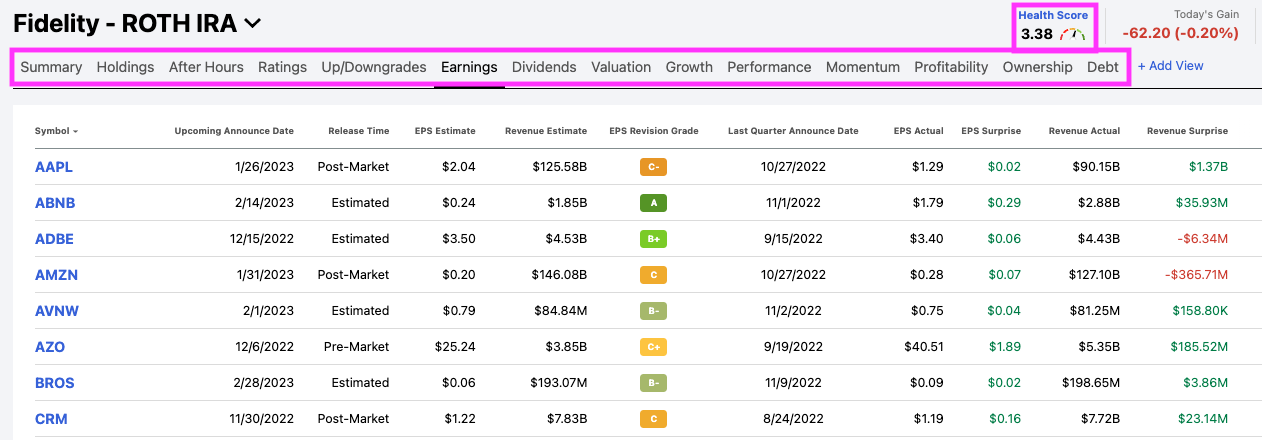

Here’s a picture of my Roth IRA in Seeking Alpha:

Yes, I personally pay for Seeking Alpha Premium, even as a die-hard WallStreetZen employee. That should tell you how highly I value their product.

Down the righthand-side of the page you’ll see the Quant, Seeking Alpha Authors, and Wall Street Analysts scores for each one of my holdings:

From here, I can easily see which positions may need to be re-evaluated or which companies I should be adding more weight to.

Along the top, you’ll see Ratings, Upgrades/Downgrades, and Factor scores for each of Seeking Alpha’s primary dimensions, allowing you to easily analyze your portfolio:

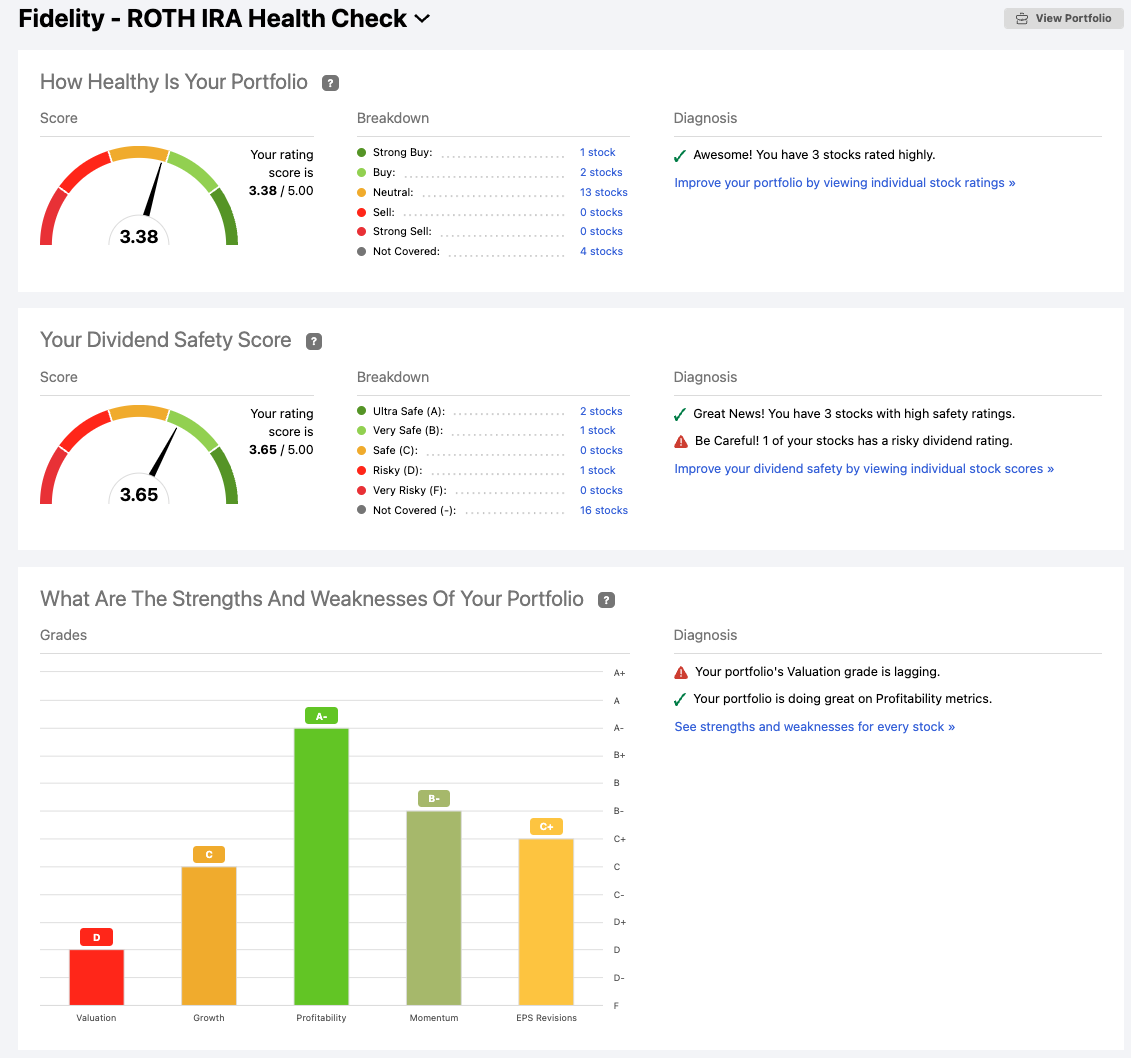

In the top left, you’ll also see your portfolio’s Health Score, a summary figure evaluating all of your positions.

It looks like I need to check on the valuation of some of my positions…

There’s a lot more I could cover regarding Seeking Alpha’s portfolio tracker, but in summation: Seeking Alpha has leveraged its robust research platform into a portfolio analysis feature.

I pay for Seeking Alpha Premium for its investment research, but its portfolio tracker is a huge bonus. Like I said above, if you like Seeking Alpha’s research and analysis, you’ll love its portfolio tracker.

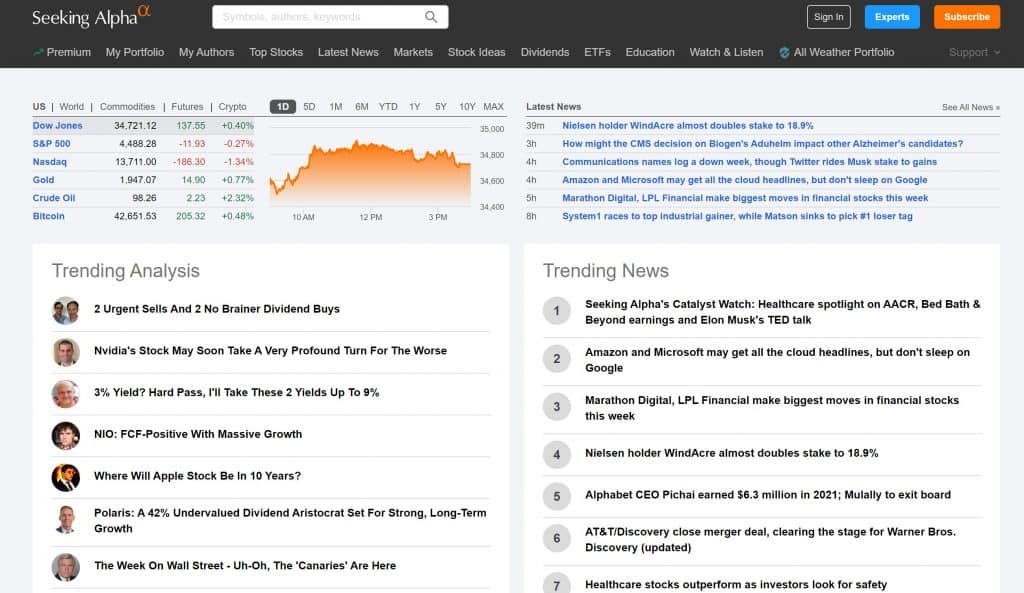

If you’re unfamiliar with Seeking Alpha’s primary offering, it is an investment research platform with individual stock research sourced from thousands of contributors.

These contributors are well-researched and know how to sort through the noise. Their insightful and thorough analysis can quickly educate you on any stock you’re considering buying or selling. There are a wide variety of contributors with differing opinions, so you can get a global perspective on every investment:

I do not make an investment decision without first checking Seeking Alpha. I always make my own decisions, but it’s a fantastic place to read confirming and disconfirming viewpoints from astute investors who (usually) know more than me.

Like other services, it has all of the tools you need to make investing decisions: financial information, news, earnings transcripts, proprietary tools (like its Quant Ratings, Market Analysis, and Stock Screeners), dividend and earnings forecasts, and more:

There’s also a mobile app version, which I think is the best stock portfolio tracker app in 2024 – especially if you decide to go Premium.

Simply put, no other site provides what Seeking Alpha does, and you can get started with a free trial of Seeking Alpha Premium below then take $30 off your first year…

And if you use the link above, you’ll get $30 your first year of Seeking Alpha Premium (after your free trial ends).

Seeking Alpha also gets on our list of the best stock news apps in 2024. You can also read our full Seeking Alpha review here.

The Details

Who It’s For: Seeking Alpha Premium is best suited for intermediate and advanced investors looking for additional peer research.

Price: $299/year; try it free for 7 days here + get $30 off your first year

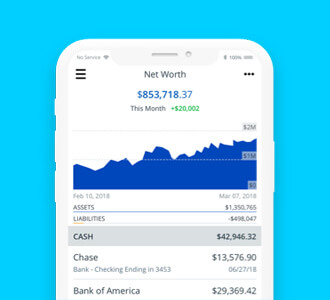

2. Empower (formerly Personal Capital): The Best Free Stock Portfolio and Net Worth Tracker

If you want to track your entire financial picture for free, Empower is the best option. It’s the best free portfolio tracker for your entire networth.

Empower’s FREE Financial Dashboard is a tool that makes it easy you to add all of your financial accounts in one place, including credit cards, savings and checking accounts, loans, and investment accounts:

In an instant, you can have a complete picture of your finances – it sure beats that spreadsheet I’ve been using.

Regarding your investment portfolio, Empower will aggregate your asset allocation and make recommendations to better suit your needs using its analytics tools. You can use these features on the desktop or mobile app:

You may also be interested in other free tools that come with the free dashboard: For example, a Net Worth Calculator and a Retirement Calculator.

You can access all of these free tools under the same login.

Additionally, Empower also offers educational resources and retirement planning guides to help ensure you’re prepared for the future.

Why does it offer these tools for free?

Empower has an upsell for wealth management services. You do not need to show any interest in their advisory services to use their free tools.

The Details

Who It’s For: Empower’s Financial Dashboard is for anyone looking for software to give them a holistic view of their finances.

Price: Free!

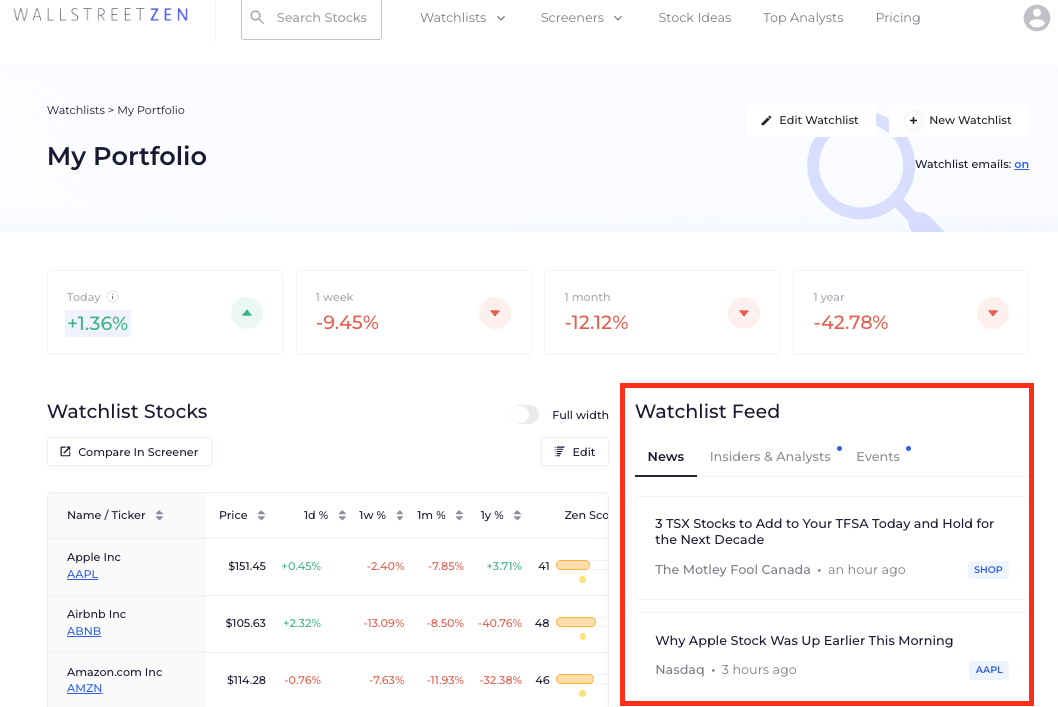

3. WallStreetZen: The Best Stock Portfolio Tracker for Fundamental Investors

If you’re a fundamentally-oriented, long-term investor then a WallStreetZen Watchlist may be perfect for you.

Our Watchlist makes it easy to add your portfolio holdings and keep tabs on what’s affecting your stocks.

We track news, insider activity, analyst upgrades/downgrades, and upcoming events so you can easily stay on top of your portfolio.

And if you’re ready to perform some fundamental analysis on one of your stocks or want to know what the top-performing analysts on Wall Street have to say about it, you’re just one click away.

The Details

Who It’s For: Fundamental investors and/or those who want to track the latest ratings from the top analysts on Wall Street.

Price: Free! (Or, upgrade to Premium)

Need help building your portfolio? We’ve got you.

WallStreetZen tools are designed for serious DIY investors. But if you prefer to rely on professionals to do the heavy lifting, our new Zen Investor newsletter could be just what you’re looking for.

This newsletter is a separate and complementary service to our Premium membership. As a member, you receive stock picks, commentary, portfolio updates, and webinars from stock market veteran Steve Reitmeister, who hand-selects stocks through a proprietary 4-step process using WallStreetZen tools such as the proprietary Zen Ratings system — stocks rated “A” using this system have historically averaged 32.52% annual gains.

4.

Morningstar: The Best Stock Portfolio Tracker for Professional Analysis

In my (well-researched) opinion, Morningstar Premium is the best stock portfolio tracker software for professional analysis in .

Morningstar was founded on providing high-quality investment research to everyone, not just financial professionals. The company seeks to empower investor success and for its users to achieve financial security.

The company’s commitment to independent, object, data-driven analysis is found all over its site, from its individual stock and fund research to its news feed.

Morningstar is the trusted resource of thousands of financial advisors and many individual investors just like you and me. Its commitment to its users is obvious in all of its products.

While Morningstar offers many of its services for free, a subscription to Morningstar Premium unlocks some of its most useful features.

Morningstar Investor (formerly Premium) members get full access to analyst reports, investment picks, research articles, screeners…

Plus, a Portfolio Manager and Portfolio X-Ray tools. Let’s take a closer look at those last two.

Morningstar’s Portfolio Manager provides basic data about each of your investments, including current price, daily changes in value, and portfolio weight. It also gives you data on portfolio performance, showing returns by month and year, and compares it to a benchmark of your choice.

Where Morningstar really shines is its Portfolio X-Ray tool. This is a nifty feature that lets you get a closer look at what you’re holding. You can easily see the distribution of investments and stock sectors you’re invested in, as well as things like your potential capital gains exposure.

Portfolio X-Ray evaluates what you hold from every angle: asset allocation, sector weightings, fees and expenses, stock stats, and more. It also identifies any potential overlap within your portfolio, exposing poor diversification.

This type of insight is truly one-of-a-kind, and is what makes Morningstar Investor one of my top picks for best investment portfolio trackers and apps in .

Once you grow accustomed to Morningstar’s fiercely independent analysis, you’ll never want to live without it again.

Get the tool the pros use:

The Details

Who It’s For: If you’re serious about your investments want one tool to manage your portfolio, stay up-to-date on any changes, uncover unique insights, and get the latest financial news, Morningstar Investor is for you.

Price: $20.75/month (when billed annually) — Get $50 off here

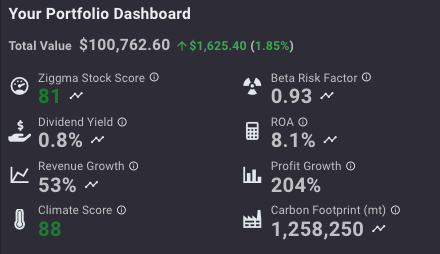

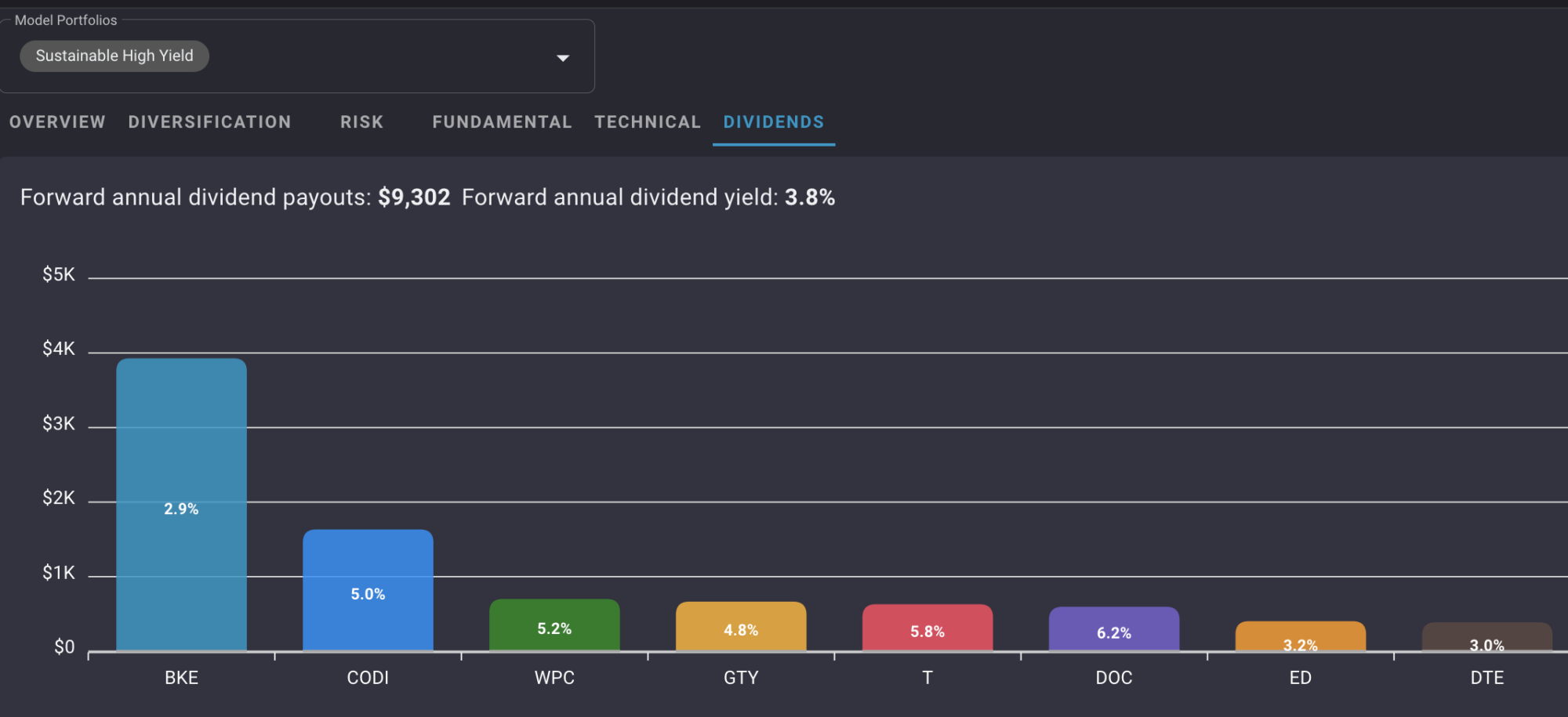

5. Ziggma: The Best Portfolio Tracker for Automated Monitoring

Next up is Ziggma.

Ziggma’s Portfolio Dashboard measures portfolio quality (through its Ziggma Stock Scores) and portfolio risk and yield. It even shows your portfolio carbon footprint and your companies’ average Climate Score (the only portfolio tracker worldwide accounting for climate impact):

You can connect an unlimited number of accounts to Ziggma for free. When connecting several accounts, Ziggma will provide you with an aggregate view of all our portfolios, so you know your exact exposure to each stock at any time.

Ziggma Smart Alerts make it easy to track your portfolio split so you can stay diversified. Link all of your accounts, set your limits, and Ziggma will monitor them for you. You can do the same for stock prices and even P/E ratios and dividend yield.

Additionally, Ziggma computes projected dividend income for the next 12 months so you will always know your expected portfolio revenue:

The Details

Who It’s For: If you’re especially conscious of getting the best risk-adjusted returns and want Smart Alerts to let you know when you should place a trade, check out Ziggma.

Price: $7.49/month (when billed annually)

6. Stock Rover: Best All-in-One Stock Research Tools + Portfolio Tracker

Stock Rover is a great option for investors who want a lot of tools in one place.

The platform includes screening and comparison tools, so you can research and compare thousands of stocks and ETFs. With certain memberships, you can also generate detailed on-demand reports for thousands of securities, so you can instantly gain insight to the company’s financial health, with an overview, fundamental analysis, comparison to peers, and more.

That’s to say — you’ll get a lot more than just portfolio tracking. But given the scope of this article, let’s focus on that part.

Stock Rover helps you keep tabs on your portfolio in several ways, including brokerage integration, in-depth portfolio analysis tools, automatically emailed performance reports, future dividend income projection, Monte Carlo simulation tools for future performance, correlation tools, trade planning, and a re-balancing facility. Stock Rover also has a comprehensive alerting facility so you can find out ASAP when something happens that you need to know.

The Details

Who It’s For: Stock Rover is an excellent pick for investors who want powerful stock research tools and portfolio management all in one place.

Price: Tiers range from $7.99 to $27.99/month. Sign up here.

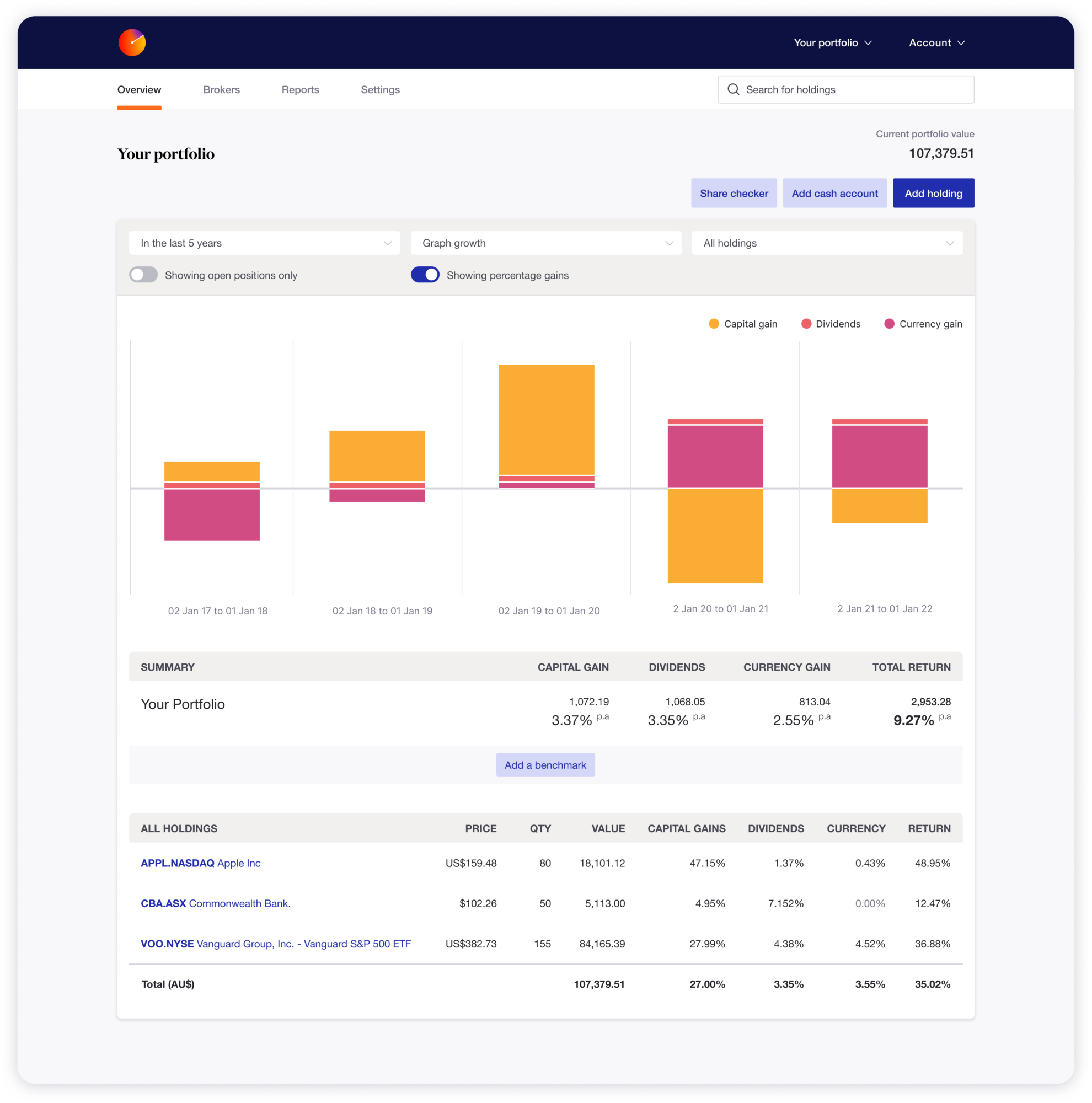

7. Sharesight: The Best International Portfolio Tracker

Sharesight is an all-in-one portfolio tracker that covers 40 international exchanges. It also offers robust dividend-tracking and tax-reporting capabilities.

Sharesight was made for self-directed investors who are adamant about thorough recordkeeping. If you have a spreadsheet to track all of your investment performance, dividend data, tax implications, and other portfolio insights, Sharesight is worth looking into.

The Details

Who It’s For: Sharesight is primarily used by international investors who want one place to keep track of all their investments and want to save time with tax reporting.

Price: $12/month

Here’s a complete overview of Ziggma vs Sharesight.

8. M1 Finance: The Best Portfolio-Tracking Brokerage

If you love easy diversification and are interested in dividends, this is the perfect app for you.

Although it’s primarily used as a broker, M1 Finance has a unique take on portfolio monitoring.

The app makes dollar-cost averaging the default which, combined with its design, makes investing for the long haul easy.

If you’re in need of a brokerage or want to switch to one that will likely increase your long-term returns and make you less focused on the day-to-day gyrations of the market, choose M1 Finance.

The Details

Who It’s For: New investors or those who believe in dollar-cost average and want easy diversification.

Price: Free!

Want to learn more? Ready our full M1 Finance review.

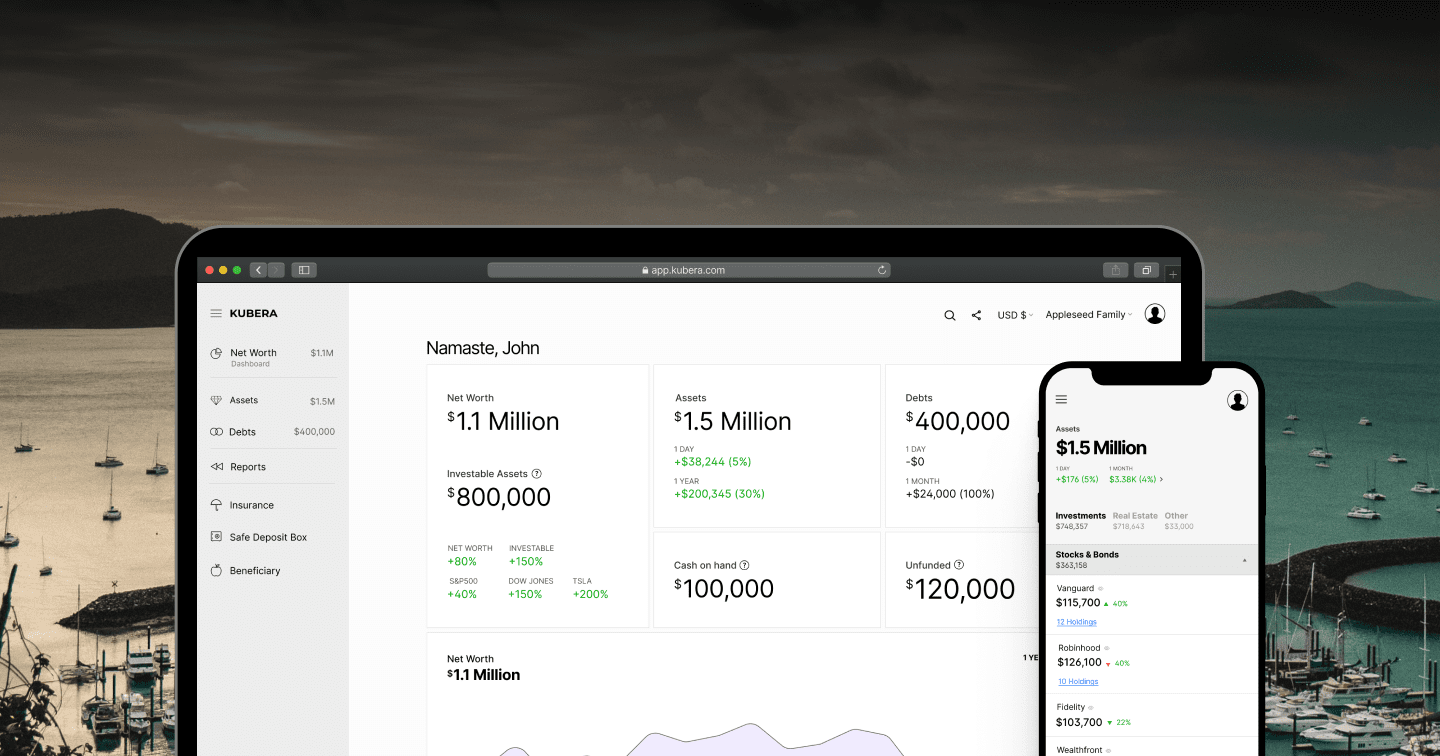

9. Kubera: Holistic Portfolio Tracker

Kubera can track all of your assets in one place. It supports global banks, brokerages, stocks, currencies, crypto, and more.

Kubera is your own personal balance sheet, designed for you to manage your assets and liabilities from a simple dashboard.

With its access to more than 20,000+ international banks, high net worth world travelers are likely to receive the most benefit from this software.

The Details

Who It’s For: Kubera is best for global citizens who want a place to keep track of their entire net worth.

Price: $150/year

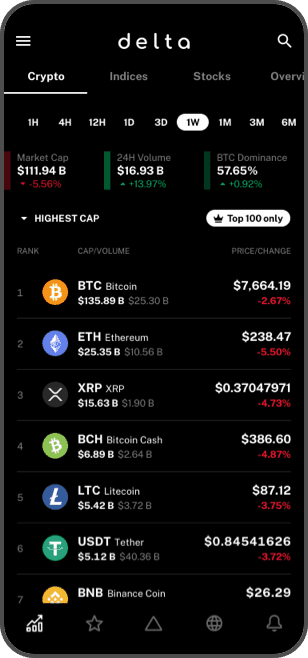

10. Delta Tracker: The Best Crypto App Portfolio Tracker

Delta Tracker is a crypto-centric trading app available worldwide for both iOS and Android users.

While its primary audience is cryptocurrency traders and investors, Delta also has coverage for stocks, bonds, mutual funds, ETFs, options, and futures. Because of this, it may be the best app for tracking all of your investments (if you have a portfolio that includes more than just equities).

Delta allows you to track stocks spanning global markets, such as the NASDAQ, NYSE, Eurnext, HKEX, and more. You can set the charts to display in your local currency and create custom alerts so you never miss a trade.

The Delta Tracker also includes options for tracking NFT prices, though this feature is still somewhat limited at this point.

The Details

Who It’s For: Delta Tracker is the best app for advanced investors who have cryptocurrency exposure and/or own equities in global markets.

Price: Free! (or Pro plan costs $99/year)

At a Glance: Best Stock Portfolio Tracker Apps

Platform | Who it’s for | Promo? |

|---|---|---|

Investors who like data-based portfolio tracking & lots of stock commentary. | 20% off Premium membership with this link | |

Investors on a budget (it’s FREE) who want to track all financial accounts easily, in one place | It’s free; isn’t that enough? | |

Investors looking to test-drive the tools first. FREE to start; option to upgrade to Premium membership or subscribe to the Zen Investor newsletter for more guidance | Charter members of Zen Investor can get started for just $79 | |

Investors who like specialized features. Features like the Portfolio X-Ray help you evaluate asset allocation, sector weightings, fees and expenses, stock stats, and more. | $50 off and 7 days free with this link | |

Investors conscious of getting the best risk-adjusted returns and want Smart Alerts to let you know when you should place a trade, check out Ziggma. | None | |

Investors who want stock and ETF research and comparison tools, detailed reports, and portfolio management all in one place. | Get 2 weeks of Premium free | |

Primarily used by international investors who want one place to keep track of all their investments and want to save time with tax reporting. | Get 4 months free with this link | |

Investors who want multi-function. If you’re in need of a brokerage or want to switch to one that will likely increase your long-term returns, M1 Finance is a solid pick. | None | |

Kubera is best for global citizens who want a place to keep track of their entire net worth. | None | |

Crypto-centric; the best app for advanced investors who have cryptocurrency exposure and/or own equities in global markets. | None |

Bottom Line: The Best Portfolio Trackers

It’s important to have one place where you can go to quickly see how your investment portfolio is performing. If it’s not easy to understand or if it’s not helpful, you won’t use it.

And, considering you’re investing thousands of dollars you’ve worked hard to accumulate, I personally think it’s worth it to invest in a tool that will help you reach your investment goals faster (and easier).

These investment portfolio trackers can deliver unparalleled insight into your asset allocation, risk exposure, and holistic view of your financial situation.

My favorite stock portfolio tracker in 2025 is Seeking Alpha Premium. The Portfolio Manager tool has a diverse feature set that makes it a phenomenal tool for investors at every stage of their journey.

For a free tool that covers more than just your investment portfolio, helping you budget, save, and make better financial decisions in every aspect of your life, I like Empower.

FAQs:

How do you keep track of your stock portfolio?

The easiest way to keep track of the stocks in your portfolio is to use a stock portfolio tracker that you enjoy and has concise, relevant information you need to stay on top of your positions.

Which stock tracker is the best?

My personal favorite stock portfolio tracker is WallStreetZen - it has the exact information I need and helps me stay abreast of important changes in each of my stocks.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.