If you’re a long-term investor in Bitcoin, you should probably own it in a tax-efficient retirement account.

Bitcoin IRA is one of a few companies that allow you to invest in cryptocurrencies and gold within individual retirement accounts (IRAs).

Is Bitcoin IRA the right crypto IRA provider for you?

Probably.

Here’s my Bitcoin IRA review, which includes a deep-dive of its features, fees, supported assets, user experience, and how it compares to competitors.

Is Bitcoin IRA the Best Crypto IRA Provider?

The Bottom Line: Yes, Bitcoin IRA is the best crypto IRA provider in 2025. With access to over 60 cryptocurrencies, 24/7 trading, the widest selection of retirement accounts, and a slick mobile app, Bitcoin IRA is the leader in crypto retirement accounts.

Bitcoin IRA offers self-directed IRA accounts for investing in cryptocurrencies and physical gold, plus you can roll over your existing retirement account (IRA or 401k) directly to the platform. The fees are slightly higher than some competitors, but Bitcoin IRA offers a safe and secure way to invest in crypto and precious metals inside your retirement account.

What is Bitcoin IRA?

Bitcoin IRA is a cryptocurrency IRA platform that allows clients to invest in over 60 cryptocurrencies and physical gold within a retirement account.

Retirement accounts protect you from capital gains taxes when buying and selling assets (like crypto), which helps compound your gains and grow your investment accounts faster. If you’re a long-term investor, you should probably be using a retirement account.

Bitcoin IRA has more than 170,000 clients, making it the largest crypto IRA platform. Clients can trade crypto 24/7, be confident in its industry-leading asset protection, and use its intuitive mobile app available for Android and Apple devices.

Bitcoin IRA allows you to open Traditional, Roth, SEP, and SIMPLE IRA and Solo 401k accounts. You can also rollover your existing 401k or IRA account into a Bitcoin IRA account.

Additionally, Bitcoin IRA offers a recurring investment option through their Saver IRA account.

- Traditional IRAs lower your taxes in the current year, while a Bitcoin Roth IRA allows you to withdraw funds tax-free in retirement.

- A SEP or SIMPLE IRA allows small business owners (and their employees) to invest in an IRA with higher contribution limits than standard IRA accounts.

- Solo 401k accounts are for individual business owners that want higher contribution limits than an IRA.

Bitcoin IRA is available to U.S. investors only.

Bitcoin IRA Fees and Minimums

- Minimum investment: $3,000, or a $100/monthly contribution for Saver IRA accounts

- Account setup fee: 0.99% – 4.99% (varies)

- Account maintenance fee: 0.08% of assets under management ($20 minimum)

- Crypto trading fees: 2%

- Gold trading fees: 2%

- Roth Conversion: $100 (one-time fee)

Bitcoin IRA’s account setup fees vary depending on deposit size and what type of account you are opening.

Bitcoin IRA’s crypto trading fees are higher than other crypto IRA accounts, but on-par with major crypto exchanges like Coinbase. The Alto CryptoIRA fees are slightly lower, and you can open an account with only $10.

Bitcoin IRA also has other various fees for deposits and withdrawals, and may charge $300 for terminating your account.

The gold trading fee is lower than competitors, and you don’t have to pay for storage of your gold as you do with other companies.

How Does Bitcoin IRA Work?

Bitcoin IRA makes it simple to apply for an account and invest in cryptocurrencies or physical gold.

You can apply online and have an account set up in minutes.

After choosing between a Traditional, Roth, SEP, or SIMPLE IRA or Solo 401k account, you can fund your account via USD or by transferring supported crypto assets from another self-directed IRA platform.

There is a $3,000 minimum to open an account, and all future deposits require requesting a deposit form and filling it out manually. If you don’t have $3,000, you can open a Saver IRA account, which requires a $100 monthly deposit.

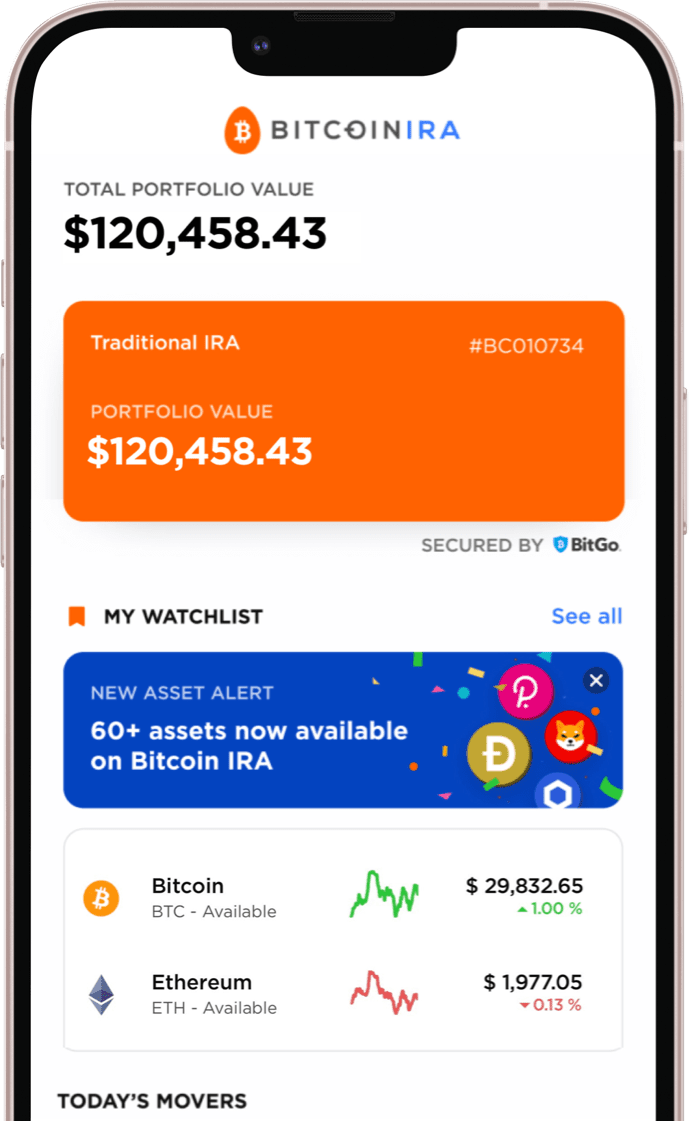

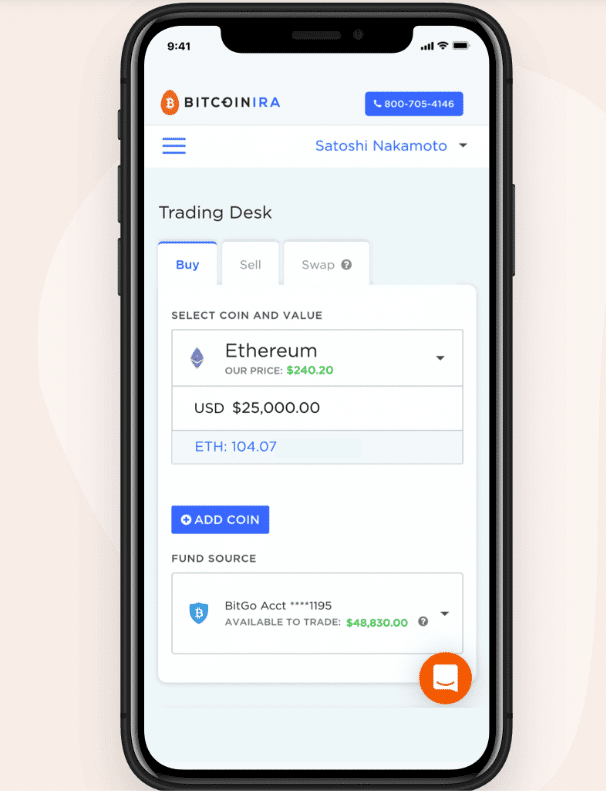

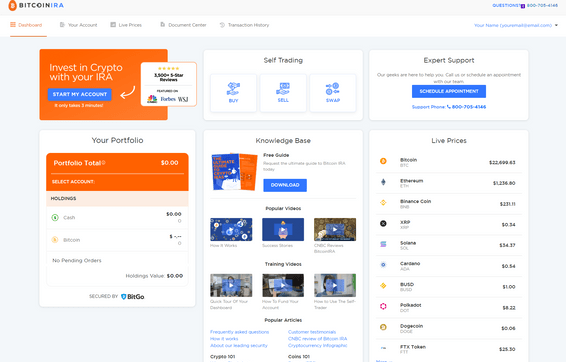

Buying and selling cryptocurrency and gold is straightforward on Bitcoin IRA’s user-friendly trading interface. You can place market orders only (no limits orders), and prices are displayed in real-time. You can trade from the desktop platform or from the mobile app:

Bitcoin IRA is one of the few crypto IRA providers that offers direct crypto swaps, so you can trade one cryptocurrency for another. This can save you money in transaction fees as you don’t have to sell one crypto into cash, and then make another transaction to purchase the new crypto.

Bitcoin IRA Security

Digital assets are stored with BitGo, the largest crypto custodian in the world. BitGo offers up to $700 million in digital asset insurance, and secures all cryptocurrency in cold storage to keep them offline. Crypto assets are not lent out to borrowers or used for any other purposes, and are kept in storage until you want to sell, trade, or withdraw them.

Physical gold sold on the platform is stored in the Brink’s bullion vault, and is insured for any gold held in transit.

Withdrawing Funds from Bitcoin IRA

Bitcoin IRA accounts allow you to withdraw crypto assets (or cash) when you reach retirement age (currently 59.5 for IRA accounts). You can withdraw crypto assets into your own digital wallet for self-custody, or simply sell them on the Bitcoin IRA platform to cash out.

Withdrawing assets from Bitcoin IRA may be a taxable event. Consult with a tax professional before withdrawing your assets from the platform.

How to Apply for a Bitcoin IRA Account

To apply for a Bitcoin IRA account, you will need to submit an application with the following information:

- Create an online account (name, phone number, email address)

- Choose how to fund the account (rollover or cash)

- Choose a type of IRA (Traditional, Roth, SIMPLE, SEP, Solo 401k)

- Submit your full name, address, and social security number

Once the application is submitted, it will be reviewed by the Bitcoin IRA team and approved within one business day. Once approved, you will fund your account with a cash deposit or rollover another IRA or workplace retirement account.

What Assets are Available on Bitcoin IRA?

Bitcoin IRA supports cryptocurrencies and physical gold.

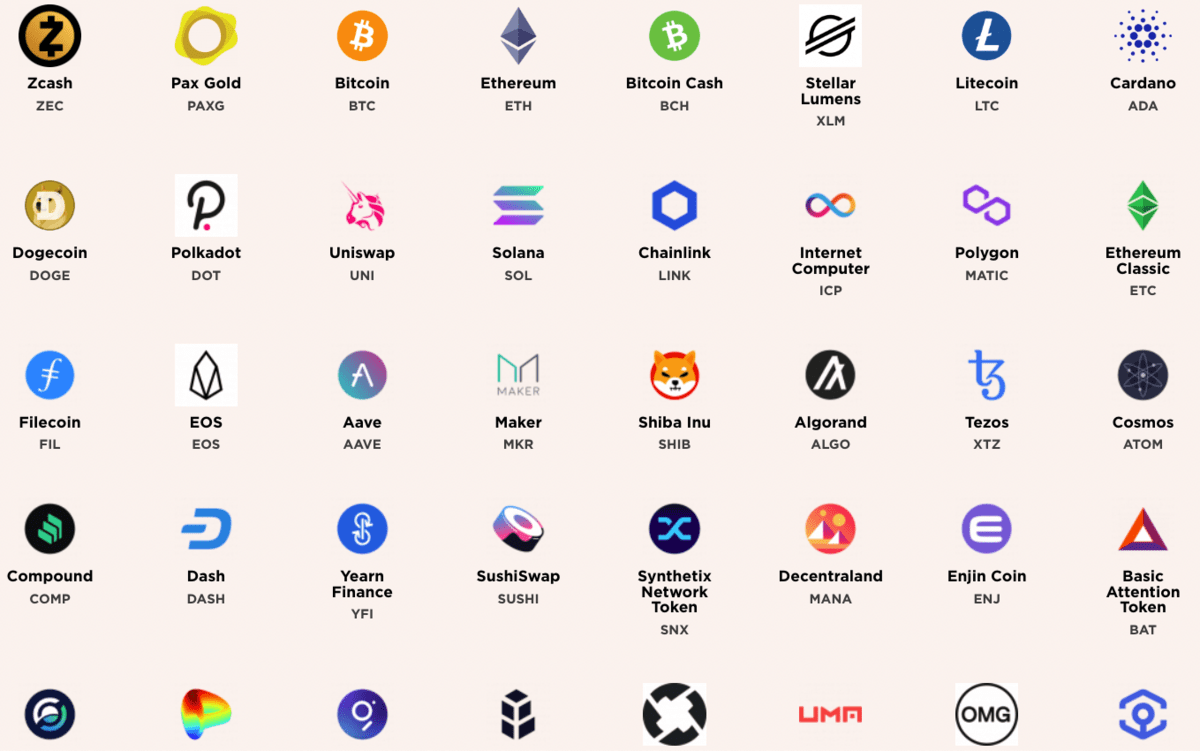

There are currently over 60 cryptocurrencies supported on the platform, including:

- Bitcoin (BTC)

- Ethereum (ETH)

- Dogecoin (DOGE)

- Aave (AAVE)

- Cardano (ADA)

- Polygon (MATIC)

- Solana (SOL)

- Polkadot (DOT)

- Chainlink (LINK)

- Uniswap (UNI)

- Litecoin (LTC)

- Shiba Inu (SHIB)

See all 60+ cryptocurrencies offered here.

Pros and Cons of Bitcoin IRA

Pros

- Buy crypto and gold in a retirement account. Bitcoin IRA allows you to invest in cryptocurrencies and physical gold within a retirement account. This allows you to buy, sell, and trade these assets without creating a taxable event.

- Access to 60+ different cryptocurrencies. Bitcoin IRA has one of the best selections of crypto within an IRA account, including Bitcoin, Ethereum, Dogecoin, Solana, and Cardano.

- Automated investing available. The Saver IRA account allows you to invest on a regular basis, with a $100/month minimum investment required.

- 24/7 trading. Cryptocurrency can be traded on the platform 24 hours a day with real-time pricing and fast trade execution.

- Full-service IRA rollovers. Bitcoin IRA offers full-service IRA rollovers from other IRA providers. This includes contacting the provider and setting up the transfer, and walking you through required documents for signing.

Cons

- High fees. Bitcoin IRA charges a high setup fee (up to 4.99%), and trading fees are more expensive than some competitors. Plus, there is an account maintenance fee charged every month.

- High minimum investment. Bitcoin IRA requires $3,000 to be deposited or rolled over into your account to qualify for an IRA account, or a $100/month automated investment (for Saver accounts).

- Deposit and withdrawals are cumbersome. Bitcoin IRA requires filling out a separate deposit request form for every new deposit (unless using the Saver IRA account), and withdrawals require requesting a distribution form and video verification.

Should You Use Bitcoin IRA?

Bitcoin IRA is easily one of the best crypto IRAs. With access to 60+ cryptocurrencies, low fees for buying physical gold, multiple account types, and excellent customer service, Bitcoin IRA is a great platform for investing in crypto within a retirement account.

Bitcoin IRA does charge higher fees for trading than some competitors and the setup fee varies by account size. And while the Saver account allows you to open an account for only $100, standard IRA accounts require a $3,000 minimum investment, which is on the high end.

Bitcoin IRA is best for long-term investors that want access to a full service requirement account with the ability to invest in a wide selection of crypto, as well as physical gold.

Bitcoin IRA vs. iTrustCapital vs Alto CryptoIRA

The 3 leaders in crypto IRAs are Bitcoin IRA, iTrustCapital, and Alto CryptoIRA.

Below is a quick summary of the primary differences and the head-to-head matchups of Bitcoin IRA vs iTrustCapital and Bitcoin IRA vs Alto CryptoIRA:

Bitcoin IRA | iTrustCapital | Alto CryptoIRA | |

Minimum Investment | $3,000 ($100/mo for Saver IRA) | $1,000 | $10 |

Fees | – 0.99% – 4.99% setup fee – 2% trading fee – 0.08% maintenance fee ($20 minimum) | – 1% for crypto trades – $50 over spot (per ounce) for Gold – $2.50 over spot (per ounce) for Silver | – 1% for crypto trades |

Asset Selection | – 60+ cryptocurrencies – Physical gold | – 30 cryptocurrencies – Physical gold – Physical silver | – 200+ cryptocurrencies |

Accounts Available | – Traditional and Roth IRAs – SEP and SIMPLE IRAs – Solo 401ks | – Traditional and Roth IRAs – SEP IRAs | – Traditional and Roth IRAs – SEP IRAs |

If you want access to lower fees and don’t mind a smaller crypto selection, iTrustCapital is a great choice.

If you want a more flexible account for crypto trading and asset selection, Alto CryptoIRA is a good choice.

If you want a more full-service experience, a large selection of crypto, the most account types, and the ability to swap cryptos, Bitcoin IRA is the best option.

If you’re still undecided, head over to iTrustCapital vs Alto Crypto IRA vs Bitcoin IRA for a more in-depth comparison.

Final Word: Bitcoin IRA Review

While it’s not the cheapest option, there’s a reason BitcoinIRA is the leader in crypto IRA accounts and why many of its users switched from iTrustCapital or Alto CryptoIRA.

Bitcoin IRA has the most robust service offering, including a large selection of cryptocurrencies, access to physical gold investments, $700 million in crypto insurance, the best selection of retirement accounts, crypto swapping, and a great mobile experience.

If you’re a long-term investor in Bitcoin or other cryptos and want to use a tax-efficient account to further compound your savings, Bitcoin IRA is a great option.

That’s a wrap on my BitcoinIRA review!

FAQs:

Is Bitcoin IRA trustworthy?

Bitcoin IRA is a safe and secure company that has over 170,000 customers and has never been hacked or exploited (unlike many crypto exchanges).

Cash deposits all carry FDIC insurance up to $250,000 per account, partners with BitGo for crypto insurance, and uses Brink for physical gold storage and insurance. Crypto assets are held in offline cold storage.

What fees does Bitcoin IRA charge?

Bitcoin IRA charges a one-time setup fee (which varies by account type and size), as well as a trading fee on all crypto and gold transactions. There are other various fees as well, including an account maintenance fee, withdrawals fees (via ACH, wire, or check), and a Roth conversion fee.

Should you invest in Bitcoin IRA?

Bitcoin IRA is a reputable platform for investing in crypto and gold within a retirement account. With stellar customer service, access to a wide selection of cryptocurrencies, and full service rollovers from other accounts, Bitcoin IRA is the industry leader for good reason.

But investing in alternative assets typically carries more risk than standard investments, and should be only a part of your overall investment strategy.

Does Bitcoin IRA pay interest?

No, BitcoinIRA does not pay interest on crypto or gold investments.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.