M1 Finance’s High-Yield Cash Account currently offers one of the more competitive rates out there — 4.25% APY at writing, paid monthly. But as an added bonus, WallStreetZen readers can nab an 0.500% APY boost for 3 months when you sign up using this link.

If you found this review, chances are you’re curious about the “Finance Super App” M1 Finance. Is M1 safe and legit? Is it a good place to invest your money? Let’s put your curiosity to rest with this comprehensive M1 Finance review.

Having test-driven all of the platform’s features for myself, I believe that M1 Finance is an excellent platform for long-term investors with some level of sophistication (read: not for total newbies) who prefer a “set and forget” approach.

If you’re comfortable choosing your own investments (with a little help from curated “model portfolios”), enjoy the convenience of maintaining several financial tools (including a great high-yield cash account) in one place, M1 might be the perfect platform for you.

I do NOT suggest M1 Finance for:

- Day traders who need lightning-fast execution (for you, I suggest TradeStation)

- Investors who want full automation (M1 has similarities to robo-advisors, but it is not a robo-advisor. It doesn’t choose your investments or invest for you.)

Now that we’ve got that out of the way, let’s dig into the nuts and bolts of M1 Finance.

What is M1 Finance?

M1 Finance brands itself as a “Finance Super App.” Its mantra? “Sophisticated wealth building, simplified.” Since its inception in 2015, this Chicago-based financial services company has attracted over 320K users and currently has $10 billion AUM as of October 2024.

For a membership fee of just $3 per month (which is waived for the first 3 months for everyone, and waived indefinitely for accounts of $10k or more), you gain access to a robust platform organized around four key categories:

- Earn: This category includes M1’s high-yield cash account, which has a competitive interest rate

- Invest: This category includes investing in stocks and ETFs through “pies,” and features plenty of cool automated features

- Spend: This category includes M1’s own credit card, the Owner’s Rewards card

Note: The platform also boasts a variety of educational materials in its “Learn” section.

Let’s take a closer look at each of these categories.

M1 Invest

The “Invest” category on M1 Finance includes some of its most interesting features, so let’s start there.

As an investor on M1 Finance, you can choose from a variety of different types of accounts:

- Brokerage accounts: Individual, joint, or custodial

- Retirement accounts: Traditional IRA, Roth IRA, SEP IRA

- You can also open a crypto or trust account.

Those offerings are pretty standard fare on investing sites. But what really makes M1 Finance stand out: Its innovative “pie” approach to investing.

M1 lets you build “pies” — or “slices” of investments that add up to a larger whole. As an investor, you’re like the baker, but instead of using ingredients like flour and sugar, you’re building a bespoke pie of investments, and your “ingredients” are about 6,000 stocks and ETFs and a variety of pre-built Model Portfolios.

How you build your pie is up to you.

For instance, you could handpick stocks and ETFs like a self-directed account. Alternatively, if you don’t want to create your own portfolio, or want to have a portion of it built for you, M1 offers nearly 100 pre-made portfolios, otherwise known as “Model Portfolios.” These portfolios could be a solution for beginner investors.

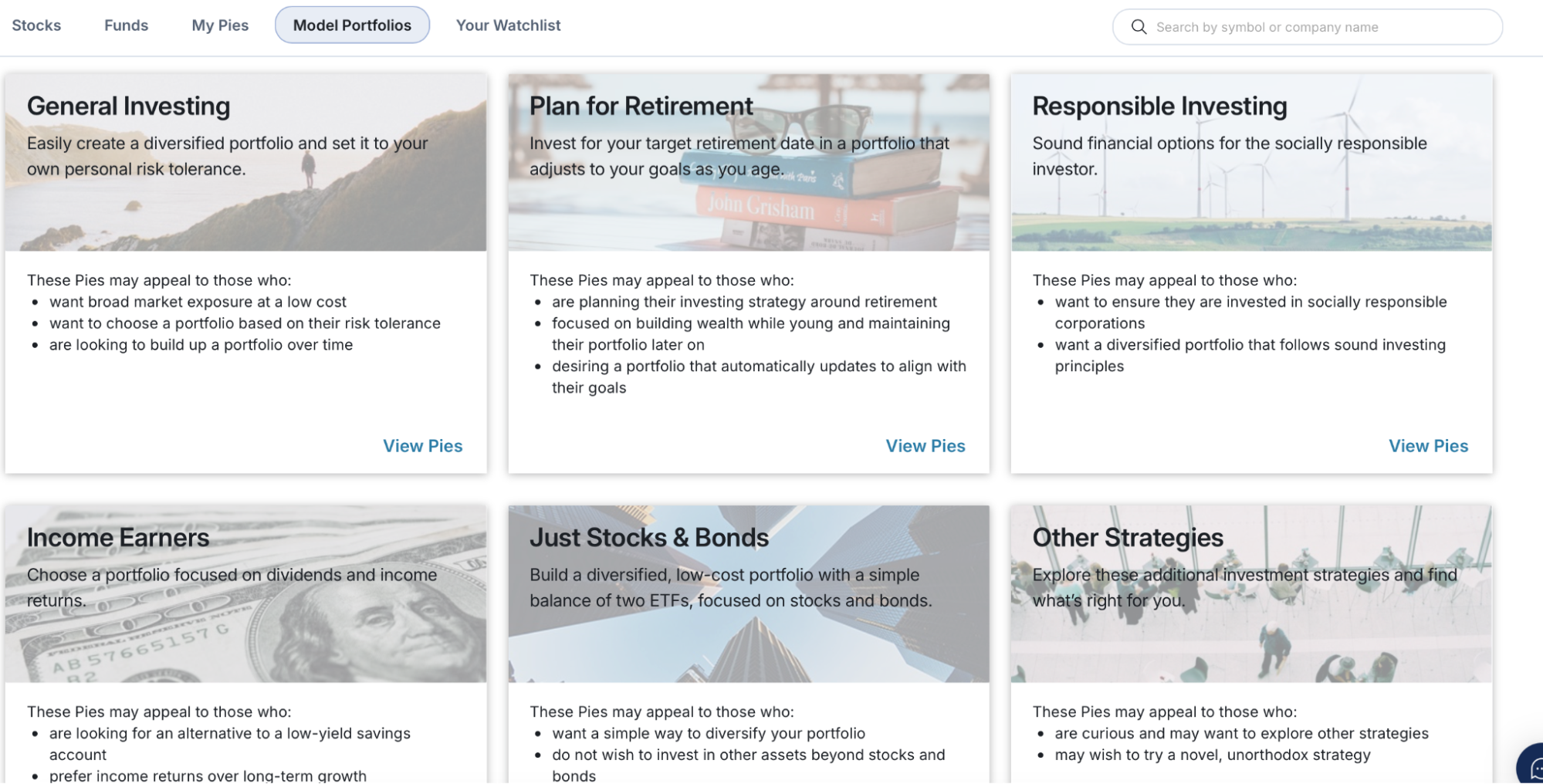

M1 Model Portfolios

Model Portfolios are pre-built, diversified baskets of investments designed to align with a specific investment strategy or goal. They can be used as a starting point for investors to customize and build your own portfolio.

These pies fall into several different categories:

General Investing

These portfolios are similar to standard robo-advisor portfolios and offer seven different options based on risk. Each general investing portfolio holds 6-10 stocks, bonds, and real estate ETFs.

Plan for Retirement

Each pre-made retirement portfolio has a target “retirement date” from 2020 to 2060 and in five-year increments. Each portfolio holds 15-19 diversified ETFs and offers a different allocation depending on how aggressive or conservative you want to be.

Responsible Investing

If you want to invest in ESG (environment, social, governance) causes but need help knowing where to start, a pre-made responsible investing portfolio is for you. These model portfolios hold 5-7 ETFs focused on the ESG space.

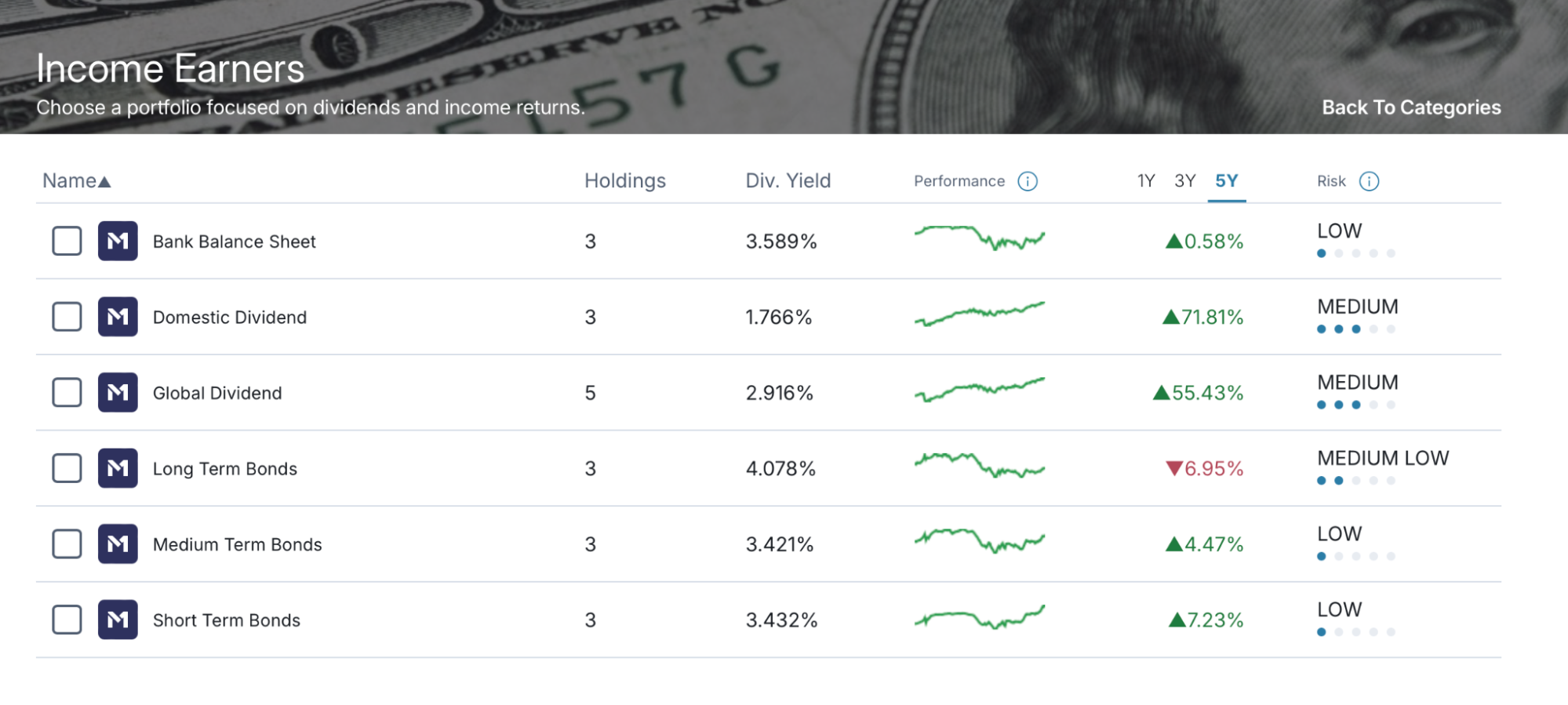

Income Earners

This portfolio is focused on dividends and income returns. You can own a pre-made income portfolio with 5-7 dividend-paying ETFs, individual U.S. dividend stocks, short- to long-term bonds, and a combo of mortgage-backed and bond ETFs.

Just Stocks and Bonds

These are basic pre-made portfolios with two ETFs covering global stocks and bonds.

Other Strategies

This category includes some out-of-the-box strategies — for instance, there’s a “Cannabis Pie” including stocks in the marijuana industry.

One thing I really like about researching different Model Portfolios is that you can see their track record over time. For instance, here are some of the portfolios focused on dividends and income returns. You can see the holdings dividend yield, performance over 1, 3, and 5 year time periods, and risk level.

Allocating Your Investments

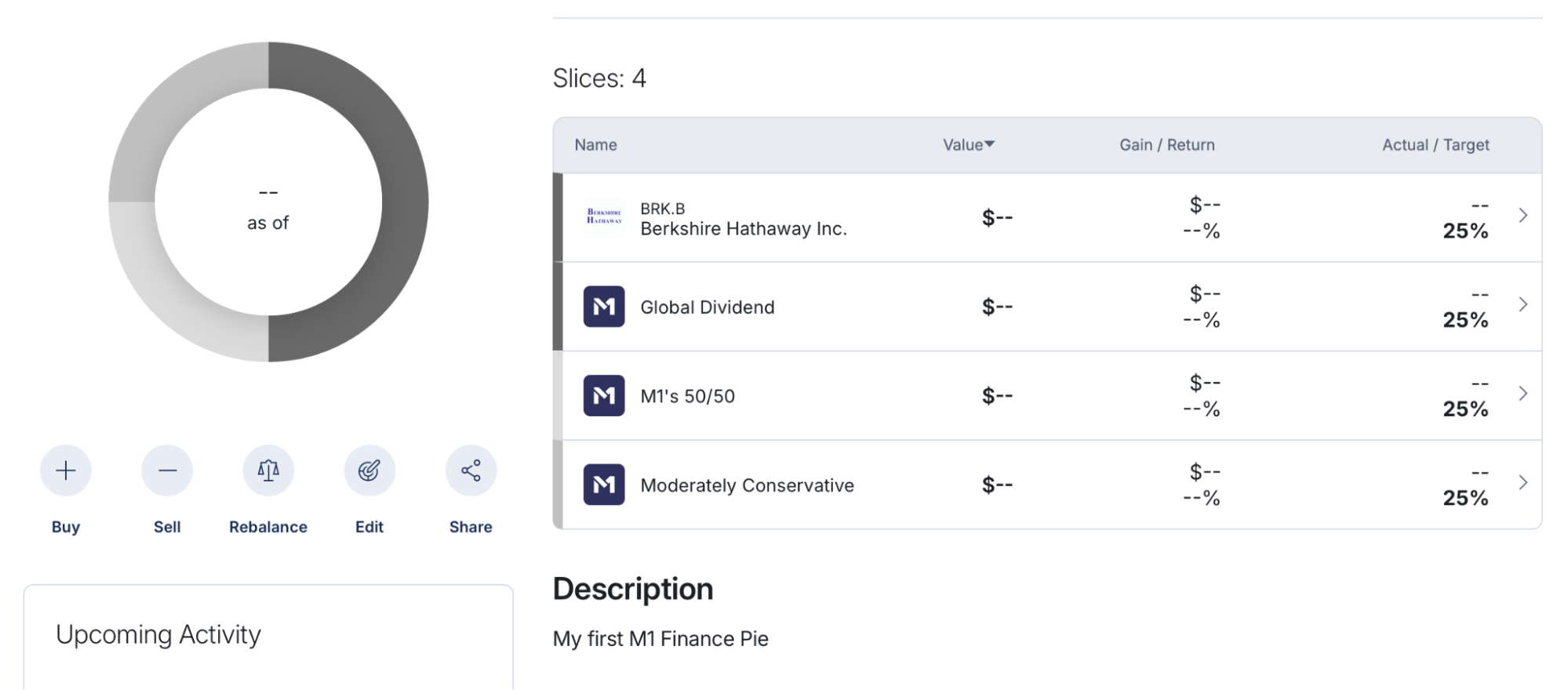

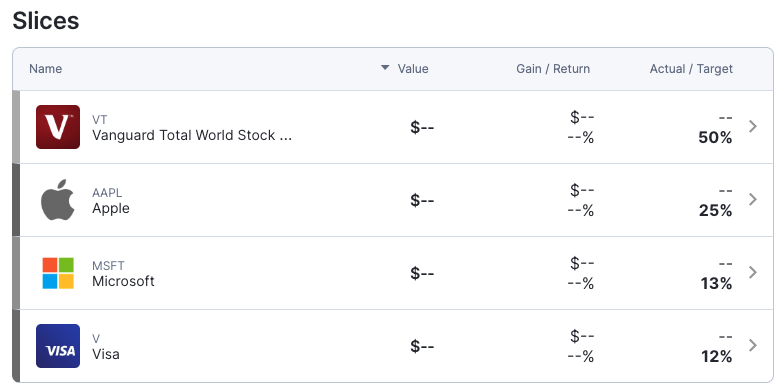

Once you’ve decided on what slices you’d like to add to your pie, you can assign allocations to each investment based on your investments, investment style, and goals. From there, M1 will use automated features to help keep your portfolio in balance.

Let’s say you want to own VT, AAPL, MSFT, and V, but you want VT to be 50% of your portfolio, AAPL to be 25%, and MSFT and V to be about 12.5% each.

Here’s what that looks like:

If you enable the “auto-invest” feature, every time you make a deposit (which you can also automate) the new money you contribute will be invested into the whole pie or individual slices, according to your specifications.

Plus, let’s say AAPL stock skyrockets and becomes 40% of your portfolio. Simply click ‘Rebalance’ to bring your portfolio back into alignment.

Edit your pie whenever by adding or removing “Slices” or changing the target allocation.

You also have the option of creating multiple pies for different strategies.

Like I said, a powerful combination of self-directing and automation, tailored for long-term investors.

Other M1 Invest Features

Here are some cool features you get with M1 Invest:

- Dividend handling: You can decide if your investments’ dividends are reinvested into your pie, reinvested into the underlying securities, added to your cash account, or you can customize on a case by case basis.

- Rebalancing: The stocks and ETFs in your pie won’t always gain or lose in tandem. You can automatically rebalance your portfolio with a few clicks on M1 Finance.

- Share your pies: You can share your M1 Finance pie with friends. (For example, here is the pie I created when setting up my account.) This can be handy if you want to share your investment journey, but you can also get a referral bonus if your friends are so impressed that they sign up for M1 Finance.

Trading Windows

One thing that’s important to know about M1 Finance? It operates on two Trading Window slots. So if you want to make an investment, you can either choose your trade window preference, or choose the next available.

- The morning trade window begins around 9:30 ET every day the NYSE market is open.

- The afternoon trade window begins around 3:00PM ET.

Each account with $25,000 or more in equity can participate in both trade windows in a single day. For all other accounts, you can select which window you want to participate in.

While I don’t find the trade window system to be a problem for long-term investors, it isn’t the best option for active traders who need to time their trades with precision, such as day traders attempting to profit from short-term price swings.

For that reason, I do not suggest M1 Finance for day traders. (Check out our post on the best day trading platforms or scroll down to the “M1 Finance Alternatives” section below for more suggestions.)

M1 Earn

Nestled under the “Earn” category is M1’s High-Yield Cash account. You can open it as a solo or joint account.

At writing, it offers one of which currently offers one of the more competitive rates out there — 4.25% APY, paid monthly. But as an added bonus, WallStreetZen readers can nab an 0.500% APY boost for 3 months when you sign up using the link below.

While the base rate is subject to change, that 0.50% boost will remain — so for the time being, you could collect up to 4.75% APY!

It’s the ideal spot for your uninvested cash; not only can you transfer funds in mere seconds from your cash account to your brokerage account, but you are also entitled to unlimited withdrawals. Additionally, M1 Finance offers $3.75 million FDIC-insured.

M1 Spend

This category includes M1 Finance’s Owner’s Rewards credit card.

In my opinion, the card’s major selling points are:

- No annual card fee (though a $3 monthly platform fee may apply)

- Rewards: With the Owner’s Rewards credit card, you can earn up to 10% cash back on select brands. There are varying tiers of rewards, but you’ll receive 1.5% cash back on all purchases. As for the top-tier rewards? 10% cash back brands include Netflix, Adobe, and Spotify; 5% brands include Chewy, Chipotle, and Starbucks. (Note: you are subject to a maximum of $200 cash back in aggregate per calendar month. Exclusions may apply. See Rewards Terms for additional information and exclusions.)

If you use a lot of the preferred brands listed and like the idea of managing your credit card along with your investments and savings, the Owner’s Rewards card might be a good pick for you.

*For informational purposes only and not a trade recommendation. All product and company names are trademarks or registered trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them.

M1 Borrow

M1 Borrow is M1’s lending service. With a minimum individual or joint brokerage account balance of $2,000, you can use it as collateral for loans.

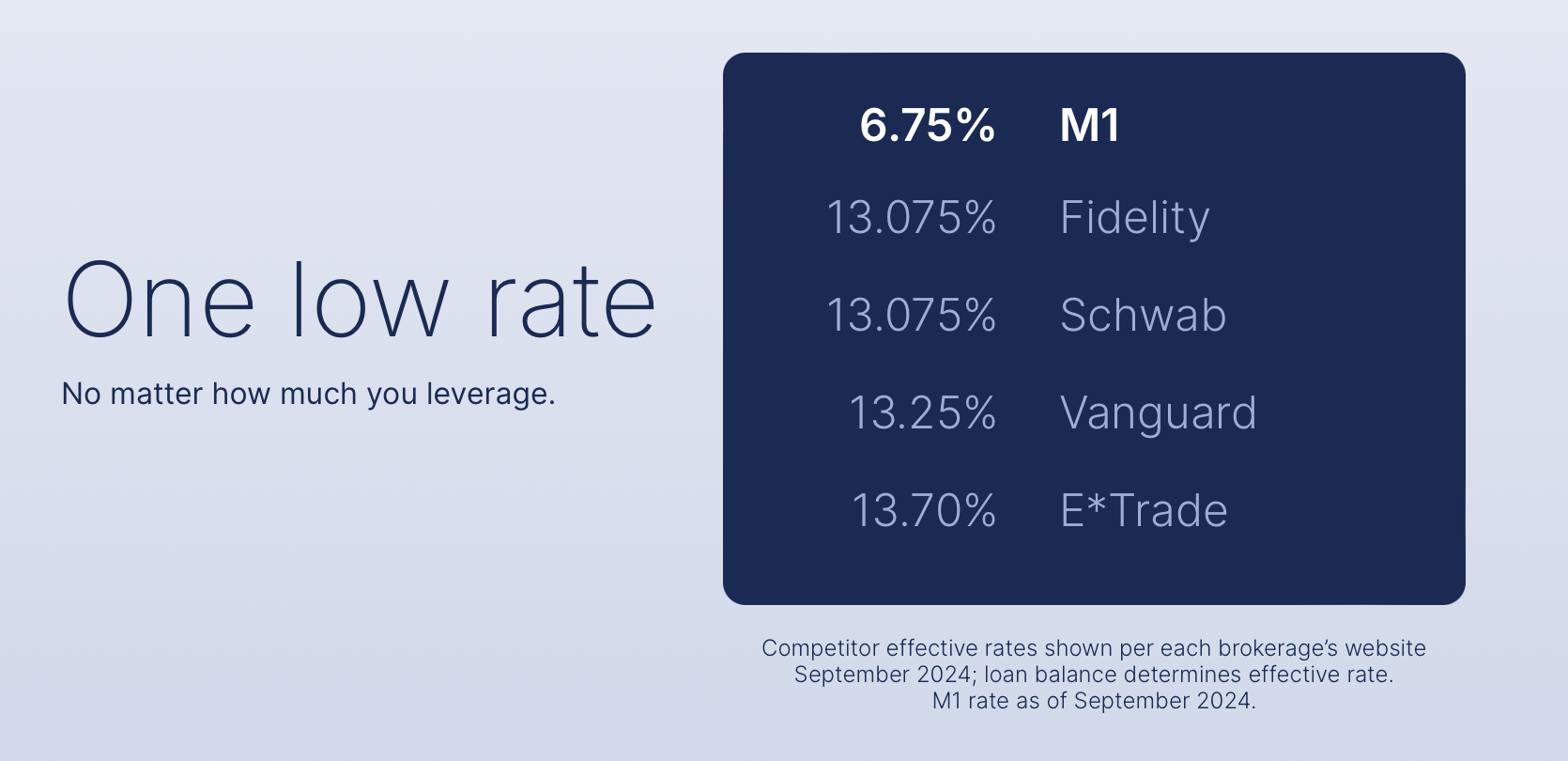

What’s appealing about M1 Borrow is how low its interest rates are. Its margin loan rates are less than half the rates from other brokerages, and the personal loan rates are quite competitive too. You can also set your own repayment timeline.

Margin Loans: Starting at 6.50% APR, any M1 client who has $2,000 or more invested in an M1 Individual Brokerage Account, Joint Brokerage Account, or Trust Account is eligible for an M1 Margin Loan.

To demonstrate how competitive those margin loan rates are, check out the competitors:

Competitor effective rates shown per each brokerage’s website September 2024; loan balance determines effective rate. M1 rate as of September 2024.

How to Get Started With M1 Finance

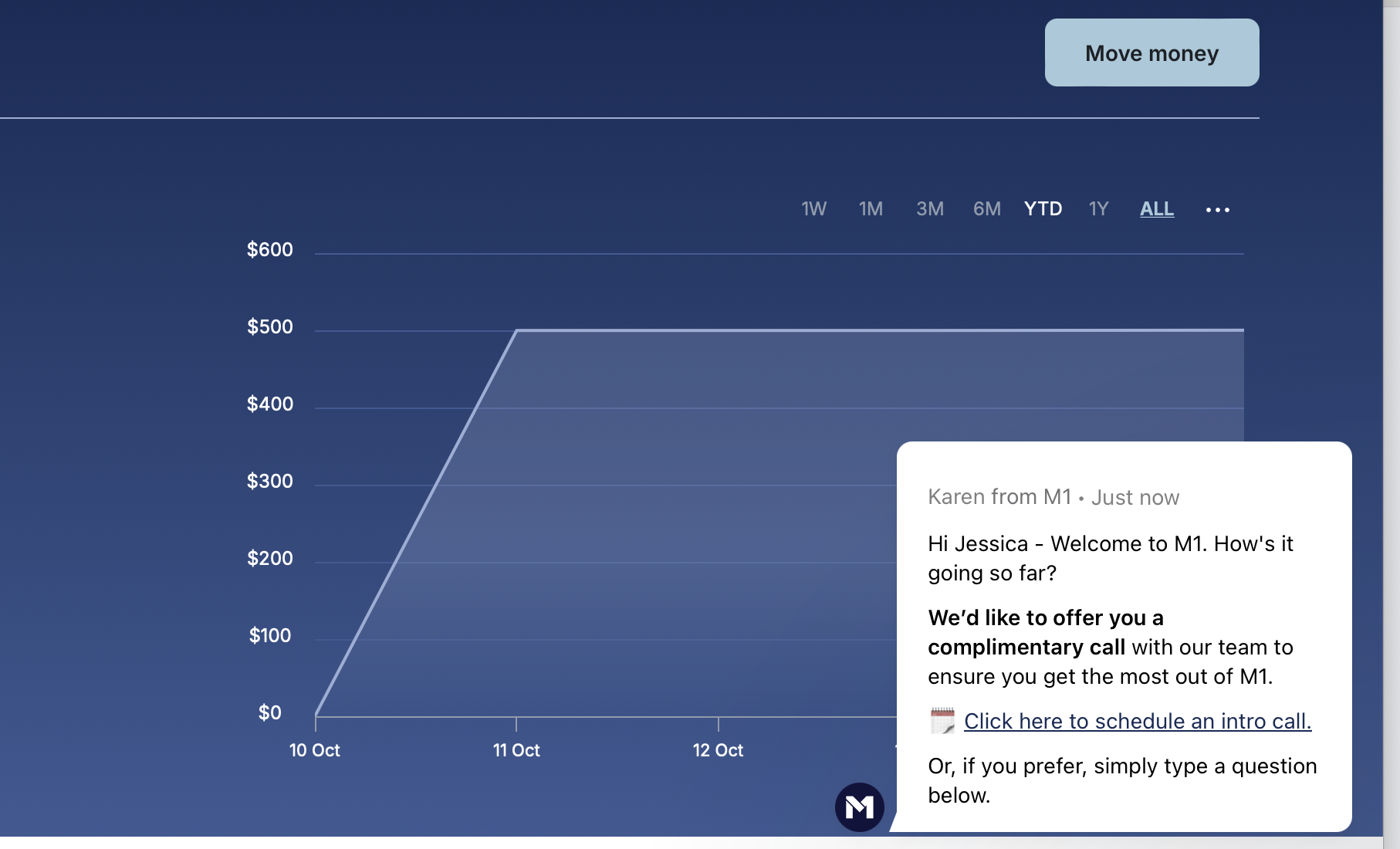

Getting started on M1 Finance is a snap. I timed myself setting up an account — it took just about 10 minutes to fill out a short sign-up form, link my bank account, and fund my M1 account.

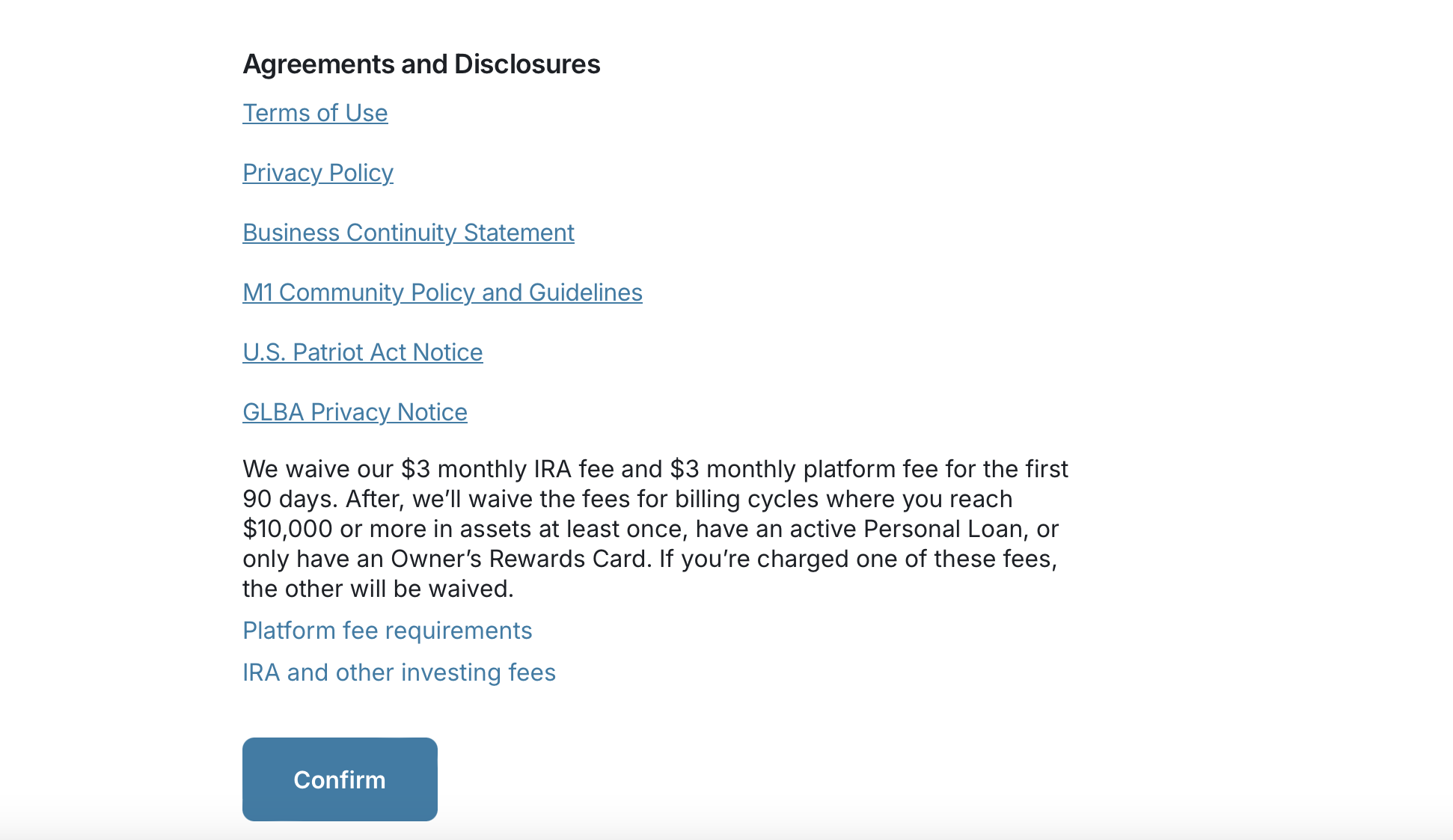

As you can see from the below, M1 will waive the account fee for your first 3 months — which I think is a pretty ample amount of time to decide whether or not it’s working for you.

From there, it’s all about setting up your pie. I decided on a mix* of four different slices chosen from M1’s “Model Portfolios” — and one portion of a single stock, Berkshire Hathaway, because, well, Warren Buffett.

Just look at its track record over the past 5 years:

Here’s the finished pie:

Want to see how my pie is doing? Check it out here.

Because M1 Finance has trading windows, it took a day for my account to actually be funded. The day after I started my account, I received a message asking if I needed any help. I thought it was a nice touch.

Ease of Use & Platform Interface

Here’s a big plus about M1 Finance: It’s very, very easy to use.

The desktop experience is great, with a clean, intuitive design. It’s easy to check on your pies, manage your accounts, and research investments.

The mobile app is similarly excellent — the only feature I couldn’t find on mobile vs.desktop was the ability to track dividends, but since that’s not something I would look at every day anyway, I didn’t feel like it was a big deal.

M1 Safety Features + Customer Service

Before I wrap up the review, I wanted to share a few more important details about security features and customer support options on the platform.

Security Features

- FDIC-insured cash accounts ($3.75M FDIC insurance)

- SIPC coverage for investments

- Encryption and two-factor authentication (2FA)

Customer Support

M1 has great customer service — you can get in touch with a human every business day from 8am to 5pm Central time, by phone or by chat. There’s also a chat bot for simple questions or if you need directions on the platform.

Resources: Under the “Learn” heading on the M1 Finance website, you’ll find a variety of articles, FAQs, and self-service options to learn about the platform and its products.

M1 Finance Fees – How Does M1 Finance Make Money?

Your first 3 months using M1 Finance carry no monthly fee.

From there, the platform can be used for free, so long as certain criteria are met (for instance, if your account balance is over $10,000 at least one day during each billing cycle). Otherwise, a platform fee of $3/month applies.

That said, there can also be inactivity fees, TOD transfer fees, and some bank fees applied in a handful of scenarios. See M1 Finance’s full fee schedule for more details.

M1 Finance Pros and Cons

Pros | Cons |

|---|---|

Clean, easy-to-use platform (desktop + mobile) | Limited investment options (stocks, ETFs, and a limited selection of crypto) |

Commission-free investing with no advisory fees (other fees may apply) | Lack of advanced trading features (not ideal for active traders) |

Customizable pies with fractional shares | Trading windows vs. Real-time trading (not ideal for day traders) |

Automated rebalancing | Limited cryptocurrencies available (only 3) |

Low-interest margin loans | No bonds (though they do offer bond ETFs) |

High-interest cash account with Earn | |

Crypto access |

M1 Finance Alternatives

We believe M1 Finance may be an excellent platform for investors who want to leverage automation to engage in intelligent “set and forget” investing. However, it’s not for everyone. Here are some common situations where investors might not be a good fit, and some suggested alternatives.

For Investors Who Want Full Automation

On M1 Finance, you will need to choose your own investments. Granted, that part is simplified thanks to Model Portfolios, but you will be the one responsible for choosing what you invest in. If you’re looking for full automation — that is, a platform that selects investments and executes trades for you — a platform like Acorns might be a better fit.

On Acorns, the money you invest (including rounded-up change from everyday purchases) is automatically invested based on your user profile, which you set up when you create an account.

For Day Traders

Because M1 Finance operates in two trade windows, you won’t find the lightning-fast execution that day traders need to benefit from short-term price swings. For fast execution times and technical analysis tools, a platform like TradeStation will likely be a better fit. (Check out our full TradeStation review here.)

For Investors Who Want More Assets

M1 Finance is primarily focused on stocks, ETFs, and a small amount of cryptocurrencies. It does not offer bonds (though it does offer bond ETFs) or mutual funds. If you’re looking for a platform with a greater variety of assets, I suggest Public, where you can invest in stocks, bonds, treasury bills, and even some alternative assets like royalties. (Check out my full Public review here.)

Final Word: M1 Finance Reviews

If you’re still wondering “is M1 Finance good?” after reading this M1 Finance review, let me break it down for you again.

Yes, absolutely, it’s good. Especially for long-term investors who realize the benefits of combining self-directed investing and automation.

With M1 Finance, you don’t have to choose between building your portfolio from scratch or having a robot do it. You can do both! You can pick your own investments or select from 100 pre-built portfolios. M1 can then automate your portfolio management and automatically rebalance it based on your selected criteria.

Interested in simplifying your long-term investments, gaining access to an excellent cash account APY, and the ability to manage several financial instruments in one place?

Check out M1 Finance. I tested out the platform to write this review and found I really liked it; I think you will, too.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our June report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.