Investing using multiple brokerage accounts is more common than ever. Brokers are usually purpose-made to fill a niche — whether it is investing in stocks, trading crypto, or selling options contracts.

The problem? Managing multiple accounts can be a huge hassle.

This is exactly the problem that Sharesight aims to tackle. Sharesight isn’t a brokerage — it is a portfolio tracking service that lets you manage multiple accounts at the same time.

Plus, it helps you handle sometimes-confusing tax obligations and can be integrated with various popular brokerages.

Is Sharesight right for you? In this Sharesight review, we’ll take a hard look at every aspect of the platform to help you find out.

Sharesight Review: Is This Stock Portfolio Tracker Legit?

The Bottom Line: Yes, Sharesight is legit and is an exceptional portfolio tracker, especially for international investors.

The platform has three main selling points:

- In-depth portfolio tracking and integration with brokerages

- Dividend tracking

- Tax reporting

A basic version of the service is available for free; three premium plans introduce more powerful capabilities.

Best for: Long-term buy-and-hold investors, those with multiple accounts, and international investors or those invested in international markets will find the most value. Sharesight will save you time and maybe some money too.

Short-term traders who focus on scalping, day trading, and investors who are heavily into crypto don’t have much need for what the Sharesight portfolio tracker offers.

Why Choose Sharesight

While the portfolio analysis features are handy, Sharesight portfolio tracker’s main utility is as a timesaving tool.

Having a clear overview of how all of your holdings are faring in one place makes it much easier to keep tabs on your investments. This also means you’ll have a much easier time identifying which assets you should keep and which you should divest from.

There are a few key points that make Sharesight a strong contender in the portfolio tracking arena:

- The service offers a free version that isn’t designed solely for upselling; it provides tangible benefits

- The user interface is intuitive and beginner-friendly

- Trades can be automatically imported into the tracker

- Corporate actions, such as stock splits and dividends are automatically tracked

- Automatically generated tax reports

Now that you know the basics, let’s move on to a more in-depth Sharesight review.

Sharesight Features:

Portfolio Tracker

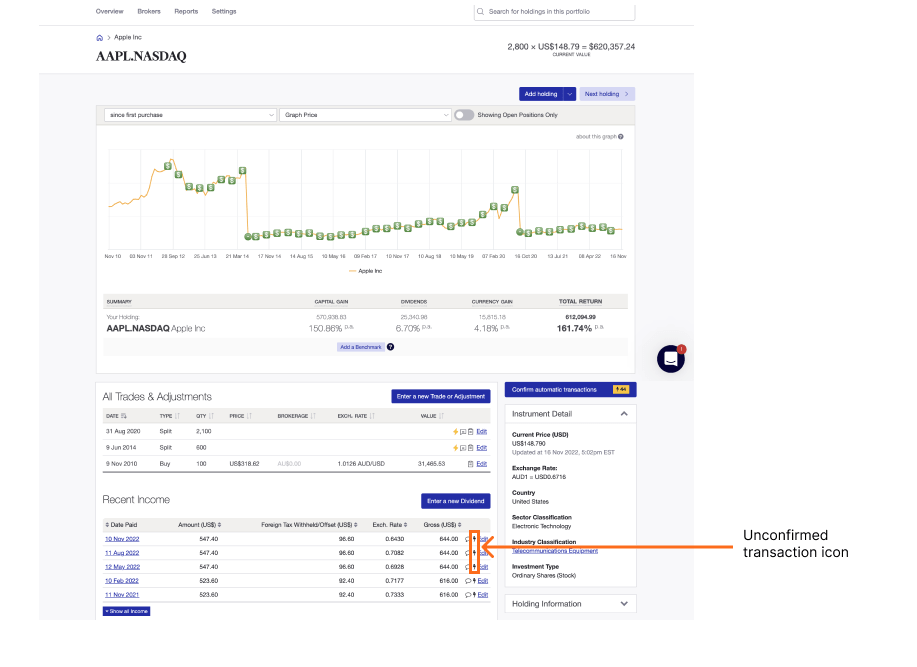

Sharesight’s primary feature is portfolio tracking. Investors can connect the service to more than 150 supported brokerages and automatically import all of their trades and holdings.

This feature brings the most value to investors who have multiple brokerage accounts, but even those using only one brokerage will find some benefits.

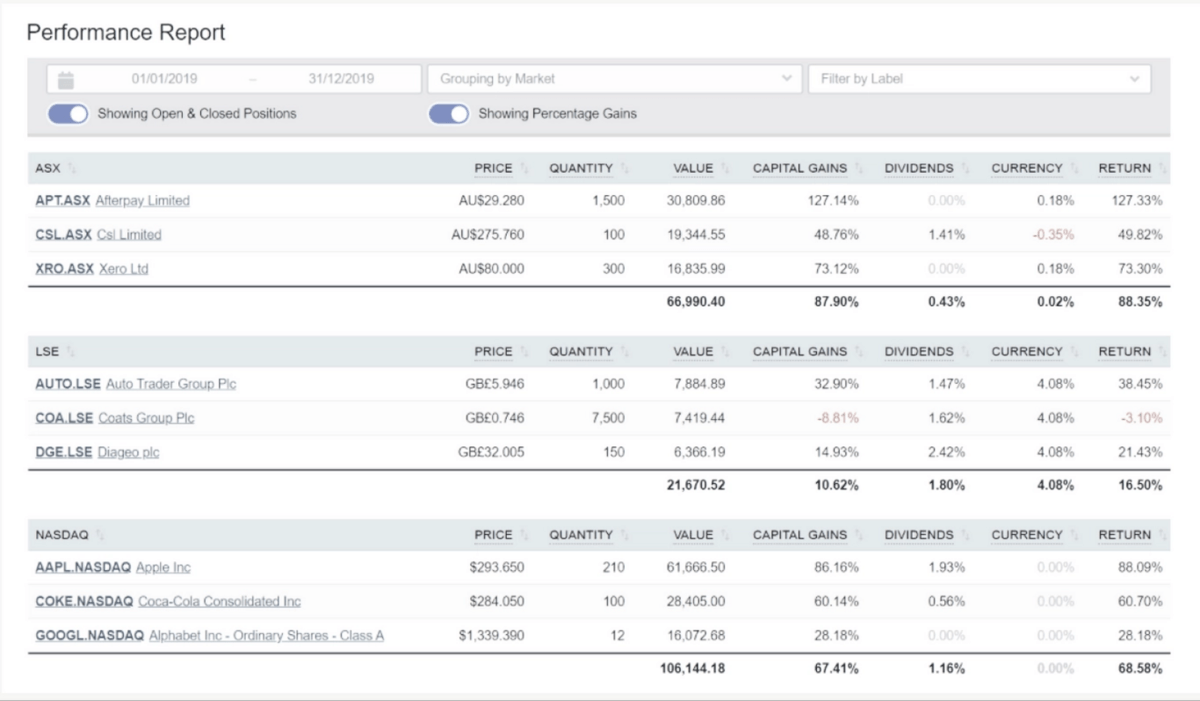

Unlike most portfolio trackers provided by brokerages, which simply factor in the buy and sell price differences of your trades, Sharesight takes into account:

- Capital gains

- Brokerage fees

- Dividends

- Currency fluctuations

By default, the portfolio tracker calculates your returns on an annualized basis, but you can set any date range you want.

The tracker can group your investments according to various factors such as market or industry, and also allows you to set price alerts for your entire portfolio.

Subscribing to the Investor or Expert plans also allows clients to add cash accounts to the portfolio tracker.

Dividend Tracker

Keeping track of dividends across multiple markets and brokerage accounts is quite a chore.

Sharesight is connected to more than 40 stock exchanges, as well as numerous ETFs, mutual funds, and managed funds. In total, the service’s automatic tracking feature covers more than 240,000 assets — and the dividends they pay out are likewise automatically tracked.

This means that the dividend tracker calculates your dividend income, as well as total and individual dividend yield, and how dividends and distributions impact the performance of your portfolio.

No manual entry is required, but you will have to confirm dividend payments on the platform once they occur.

Since the service also allows you to import historical trades, you can get a good overview of how your dividend strategy panned out through the years.

Although almost every Sharesight review touts support for automatic dividend reinvestment plan (DRIP) tracking, the feature is limited to stocks on the ASX and NZX — for all other holdings, dividend reinvestments will have to be recorded and entered manually.

Subscribing to the Investor or Expert plans also gives access to the future income report, which gives an estimate of future passive income that will stem from dividends, distributions, and interest payments on fixed-income securities.

Tax Reporting

The single biggest standout feature of Sharesight is tax reporting.

Your tax residency will determine the base currency used to calculate portfolio value, and it also incorporates currency fluctuations as a factor in your total returns. On top of that, you can adjust tax reporting settings to sync up with the financial year of your tax residency.

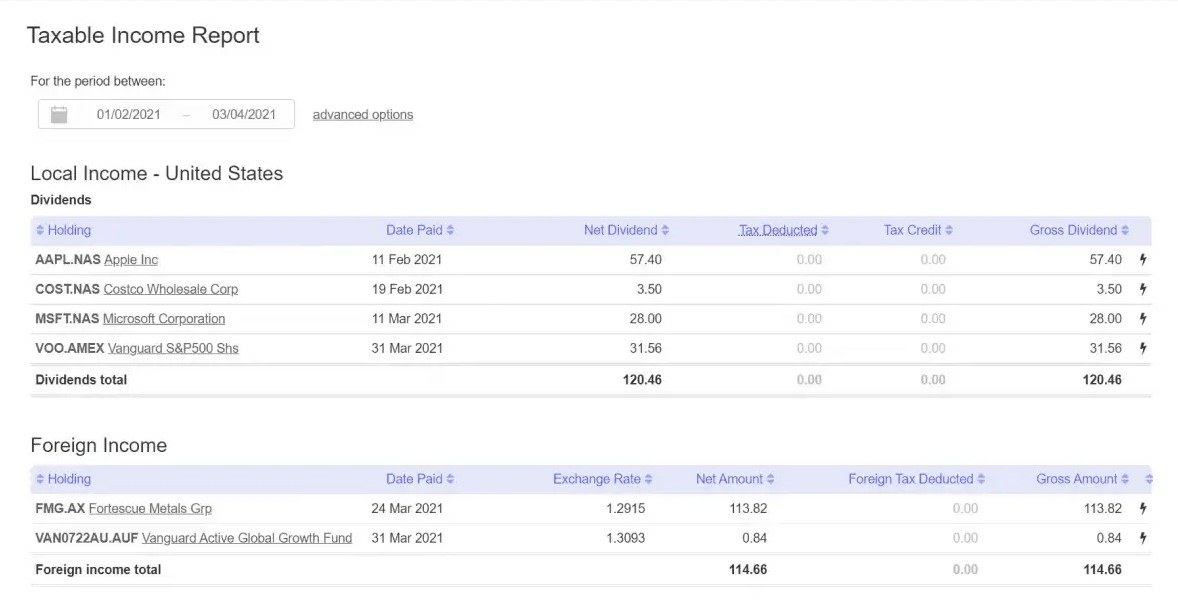

The platform offers three reports that make filing taxes a much simpler affair.

The Taxable Income Report gives investors a straightforward list of all dividends, interest rate payments, and distributions in your portfolio in a selected period to help do the heavy lifting of calculating the tax burden of your passive income.

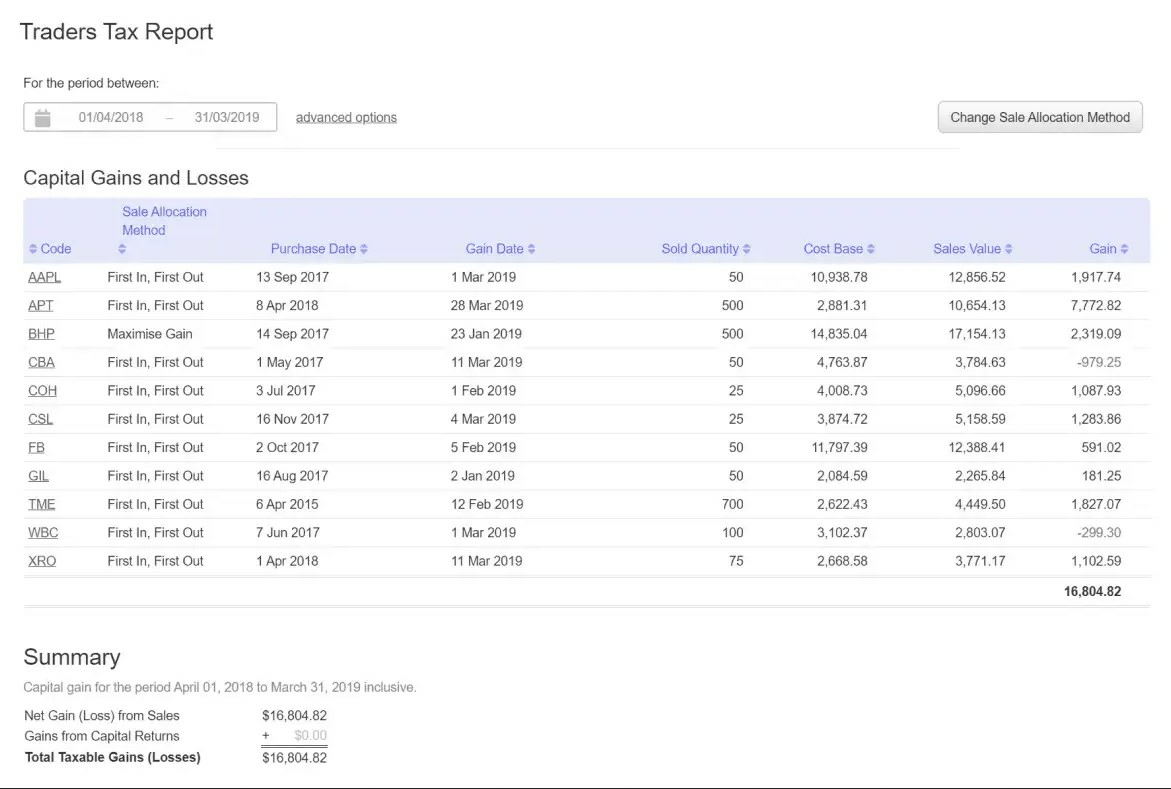

The Sold Securities Report gives clients an equally readable list of all capital gains and losses that they have accrued in a period. (Always double-check the figures.) The report can also be tweaked to include only holdings in specific industries or countries, so it doubles as an analysis tool.

The All Trades Report Provides a clear overview of all buying and selling activity across all trading accounts in a given financial year, which can be exported into a variety of file formats.

Plus, all of these reports are available with the free plan.

Most Sharesight reviews mention the platform’s capital gains tax report and unrealized CGT report — however, these features are only available to Australian and Canadian investors.

Assets, Brokers, and Markets Covered

Sharesight’s automatic tracking feature covers a wide variety of assets, including:

- Stocks and ETFs from more than 40 stock exchanges

- Mutual funds and managed funds from Australia, New Zealand, the U.K., Canada, and the U.S.

- FX holdings in more than 100 currencies

- Bonds listed on the ASX and NZX

While cryptocurrency tracking is supported, only 8 crypto tokens are automatically tracked, with intraday price updates occurring every 5 minutes:

- Bitcoin (XBT)

- Ethereum (ETH)

- Ripple (XRP)

- Litecoin (LTC)

- Stellar (XLM)

- Dash (DAS)

- Monero (XMR)

- Bitshare (BTS_

For all others, you will have to manually input them as custom investments and readjust prices on a regular basis.

The only major drawback as far as asset coverage goes (apart from cryptocurrencies) is the lack of support for fixed-income securities outside of Australia and New Zealand.

However, having to manually input your bonds and treasury notes is a small price to pay for all the automation that you’re afforded.

Just as in the case of crypto tokens, you can also add alternative investments, such as gold, real estate, and peer-to-peer loans to your portfolio as custom investments.

Sharesight currently supports integration with more than 150 international brokerages. Some of the more popular among them available in the United States include:

- Ally Invest

- Charles Schwab

- E*TRADE

- Interactive Brokers

- Robinhood

- TD Ameritrade

- Wealthsimple

- And more…

Check out the full list of brokers & apps supported here.

Sharesight also supports access to more than 40 stock exchanges from around the world.

Sharesight Security

With Sharesight, your personal and financial information won’t ever be shared, and security is serious business:

- The platform supports two-factor authentication and all data traffic is protected using industry-standard TLS (Transport Layer Security).

- Data on the platform’s servers is encrypted; data centers storing that data are enterprise-grade and feature 24/7 monitoring with various measures of physical security.

- Sharesight also has automated online backups, and the company undergoes regular independent security audits.

Sharesight Pricing

Sharesight offers clients a choice between 4 different plans. Here are the prices and what you get:

Free plan

- A single portfolio of up to 10 holdings

- Automatic dividend tracking and adjustment

- Trade importing via email forwarding

- Portfolio sharing

- Performance and taxable income reports.

- Basic customer support

Starter plan

- $15 a month, $11.25 if billed annually

- A single portfolio of up to 30 holdings, which can also be tracked in 3 custom groups

- Benchmarking

- The ability to store and attach files such as annual reports

- Standard customer support

Investor plan

- $24 a month, $18 if billed annually

- 4 portfolios with no limit on the number of holdings and up to 5 custom groups

- Future income reports based on dividend and interest payments,

- Diversity reports

- Contribution analysis features

- Integration of cash accounts

- Integration with accounting software Xero

Expert plan

- $31 a month, $23.25 if billed annually

- 10 portfolios with no limit on the number of holdings, and up to 10 custom groups

- Multi-period reports

- Multi-currency valuation

- Priority customer support

This wouldn’t be much of a Sharesight review if I didn’t weigh in on the plans.

Most of the utility that the service provides is contained in the Free and Starter plans. The Free plan is a bit too restrictive with the limit of 10 maximum holdings, but it should be sufficient for beginner investors.

Up from there, the Starter plan’s limit of 30 holdings can accommodate the portfolios of a vast majority of retail investors, and the benchmarking and analysis tools are useful additions.

For most investors, this is the Goldilocks zone — features geared toward realistic needs at a fair price.

From there, few investors will need to go to higher levels unless they have very large portfolios or need extremely niche features.

Pros and Cons of Sharesight

Pros | Cons |

Automatic importing of trades | Limited selection of cryptocurrencies supported |

Useful portfolio analysis tools | Only AUS and NZ-listed bonds are automatically tracked |

Comprehensive tax analysis | Limited benefits for short-term traders |

How to Create an Account on Sharesight

Setting up an account with Sharesight is a quick and simple process. After filling out a fairly standard form you just need to link your brokerage to the portfolio tracking service.

To do this, navigate to the “Let’s get you started with Sharesight” page and select “Import from a Broker”, select your brokerage of choice, and follow the instructions for that particular brokerage.

Important note: Only trades made after the connection between a brokerage and Sharesight is established will be automatically logged.

If you want a performance overview looking back, you will have to import your historical trades.

Final Word: Sharesight

Sharesight’s wide array of features make it a very useful tool for investors of most stripes.

Its ability to “share sight” of all your holdings and their performance at once is a huge boon for making rational choices, particularly if you’re invested across multiple markets or currencies.

While there are a few weak spots, such as only 8 cryptocurrencies supported and limited support for alternative investments, I’m confident that many investors, particularly those focused on the long term, will find the platform very useful. At the very least, it’s worth checking out the free trial.

FAQs:

Is Sharesight trustworthy?

Yes. Sharesight is a legitimate and trustworthy business. It was founded in 2007 and is registered with the ASIC (Australian Securities and Investments Commission).

Is Sharesight worth the money?

Most Sharesight reviews agree that the platform is well worth the asking price for long-term buy-and-hold investors, those with multiple accounts, and international investors or those invested in international markets. It may not be worth it for short-term investors.

What is the best stock portfolio tracker?

What the best portfolio tracker will be for you chiefly depends on individual needs and preferences. Sharesight’s portfolio tracker is a great tool for investors with multiple accounts.

Other portfolio trackers to consider include Seeking Alpha Premium, Kubera, Morningstar Premium, Empower, and our very own WallStreetZen watchlist.

Is Sharesight a trading platform?

No. Sharesight isn’t a trading platform. It does, however, support seamless integration with plenty of the most popular trading platforms on the market.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.