Chime® provides banking services through its partnerships and is not a bank itself. Chime is essentially a banking interface, from which you connect to its partner banks.

Disclaimer: Chime is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC.

Choosing a provider for banking services has become more complex in the digital age.

Should you stick with an established high street name like Bank of America or Wells Fargo, or go with a nimbler, online-only bank with lower fees and faster services?

Your choice will depend on your exact needs, but for convenient mobile checking, high-interest savings, and debit card services, Chime can’t be beat.

In my opinion, it’s a great option for a variety of different individuals. Are you one of them? Keep reading to find out.

This review of Chime.com explains what Chime is, what it offers and what it doesn’t, and how it manages to be so refreshingly uncomplicated.

Chime Review: Is Chime Legit?

The Bottom Line: Is Chime legit? Yes, Chime is legit and a top pick for best mobile banking app in 2025.

Chime offers basic banking services through an easy-to-use mobile app.

It has no monthly, annual, or minimum balance fees, high savings rates, fee-free ATM network, and Visa debit card make it the perfect banking solution for mobile banking.

Out-of-network ATM withdrawal fees may apply except at MoneyPass ATMs in a 7-Eleven, or any Allpoint or Visa Plus Alliance ATM.

Best For: Anyone who is willing to bank through an online-only company

Overall Rating: 4.5/5

Ease of Use: 4.5/5

Fees/Penalties: 5/5

Chime Bank Review: At-A-Glance

- A financial technology company

- No monthly or annual fees (or transfer or minimum balance fees, yes really!)

- A simple-to-use app (set up direct deposit inside the app, find the closest ATMs, see your daily balance, get transaction notifications)

- Checking and high-yield savings account (2.00% APY on HYSA)

- Easy sign-up (suits the unbanked or those rejected by traditional banks)

What Is Chime?

Technically, Chime is a financial technology company, not a bank. The company provides online banking services through its partnerships with The Bancorp Bank, N.A. or Stride Bank, N.A.

This way, Chime can focus on what it does best: Giving its users the best (and cheapest!) mobile banking experience possible.

The app connects your Chime® Checking and savings account to an existing bank account so you can transfer funds to and from your Chime® Checking account and set up direct deposit.

Notably, like most online-only banks and unlike some traditional banks, Chime does not charge a monthly fee. Instead, the company makes money through interchange fees.

For example, if you use your Chime Visa® Debit Card, Visa processes the transaction and charges an interchange fee to merchants for the service. Chime receives a portion of this fee.

Unlike traditional banks (which need to cover the costs of physical branches), Chime has few operating costs and can pass the vast majority of its savings on to its clients.

Here’s what Chime offers:

- A checking account with direct deposit

- A savings account with 2.00% APY

- An easy-to-use and well-designed app

- A debit card and over 50,000 fee-free ATMs

Most people don’t need any more complicated services than this.

So, is Chime a good bank? Yes, it’s an excellent banking services provider.

Given Chime’s exceptional speed, user-friendly mobile app, high savings rates, and 0 monthly fees, it is easily my favorite banking solution in 2025.

Applying for a Chime checking account, mobile app, and debit card takes less than 2 minutes, and there is no hard credit check.

Chime Checking Account is required to be eligible for a Savings Account.

Why Use Chime?

Chime is the simplest, cheapest, and most convenient way to bank in 2025.

Unlike traditional banks, Chime does not need to pay for physical locations and passes those savings on to its clients.

You can open a checking account and set up direct deposit, open a savings account with 2% APY, and get a debit card and have access to a free ATM network all from the best mobile banking app.

If you…

- are comfortable with mobile banking,

- want a low fee, high-interest paying bank, and

- don’t need to make regular cash deposits,

…you should strongly consider using Chime.

If you’re worried about not being able to make physical deposits, you can do so at Chime’s partners’ 50,000 retail locations, including Walmart, Walgreens, and CVS.

To find an ATM in the Chime network, open the Chime app and tap ATM Map.

Disclaimer: The retailer that receives your cash will be responsible for transferring the funds for deposit into your Chime Checking Account. Cash deposit fees may apply if using a retailer other than Walgreens.

Chime Checking Account

A Chime® Checking Account is an FDIC-insured deposit account.

Chime charges no monthly or transaction fees, and there is no minimum deposit for its checking account. This beats a lot of the best checking account offers from traditional banks.

There are 3 ways to deposit funds to your Chime® Checking Account:

- Transfer from an existing bank account linked through the app

- Mobile deposit of a paper check

- Cash deposit through a retailer (Walmart, Walgreens, Target, CVS, etc.)

You can apply for a Chime checking account online. You must be:

- At least 18 years old

- A U.S. resident with a valid social security number

It will take around 2 minutes to apply. Upon approval, you will download the app to your phone and connect to an existing bank account to transfer funds in and out or set up direct deposit.

It usually takes 5-10 business days for your debit card to arrive (there will be a virtual card you can use while you wait).

Remember, you don’t need to link an existing bank account to your Chime account. You can deposit cash at local retailers, such as Walmart, Walgreens, and CVS.

Chime Savings Account

You will need an active Chime® checking account before you can apply for a Chime Savings Account.

You can add money to your savings account in 2 ways:

- Transfer directly from your Chime checking account.

- Automatically transfer 10% of your direct deposits of $500 or more from your Checking Account.

To apply for Credit Builder, you must have received a single qualifying direct deposit of $200 or more to your Checking Account. The qualifying direct deposit must be from your employer, payroll provider, gig economy payer, or benefits payer by Automated Clearing House (ACH) deposit OR Original Credit Transaction (OCT). Bank ACH transfers, Pay Anyone transfers, verification or trial deposits from financial institutions, peer to peer transfers from services such as PayPal, Cash App, or Venmo, mobile check deposits, cash loads or deposits, one-time direct deposits, such as tax refunds and other similar transactions, and any deposit to which Chime deems to not be a qualifying direct deposit are not qualifying direct deposits.

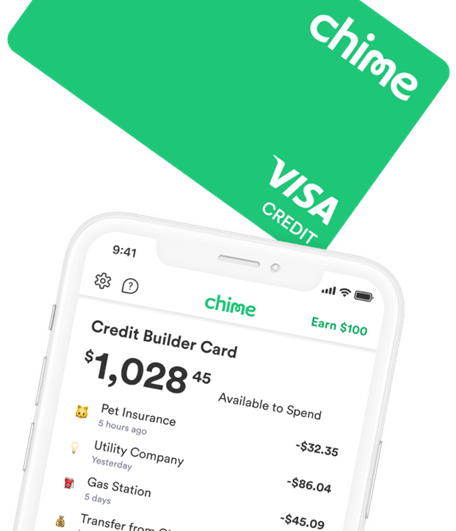

Chime Credit Builder Card Review

If you would like to build credit, The Chime Credit Builder Secured Visa® Credit can help.

Holders of the Chime Credit Builder Secured Visa® Credit Card card deposit money into the Credit Builder account as a security deposit, which is the amount that they can spend on the card.

By swiping the credit card, paying for everyday purchases, and making on-time payments each month, cardholders can build a positive credit history as payments are reported to the credit bureaus.

A few points to highlight:

- There are no annual fees and there is no minimum security deposit.

- For eligibility, you must 1) Apply, 2) Have a qualifying direct deposit of $200 or more, and 3) Have a Chime Checking account.

Chime MyPay

Sometimes, you need a little extra cash. Chime’s MyPay™ offers fast access to cash via a line of credit. You can get access to up to $500 for free in up to 24 hours, or instantly for $2 per advance. There are no mandatory fees and no credit checks required to get money when you need it. Terms and conditions apply; for full details, check out the Chime website.

Chime Fees

Chime charges no monthly or annual fees.

Because Chime is a financial technology company with no physical locations, it doesn’t need to rely on overdraft fees, monthly service fees, and minimum balance requirements like traditional banks. There are also no foreign transaction fees.

Chime does, however, charge a $2.50 fee if you get cash from either an over-the-counter withdrawal or from an out-of-network ATM.

Pros and Cons of Chime

Pros of Chime | Cons of Chime |

|---|---|

No monthly fees | No lending services, CDs, or money market accounts |

Well-designed, intuitive mobile app | No physical locations |

Easy sign-up with few eligibility requirements (easy to qualify) | No joint accounts |

High-yield savings account (2.00% APY) | A $2.50 fee for withdrawals from out-of-network ATMs |

Over 60,000 fee-free ATMspartner locations to make physical deposits (if needed) | Some retailers may charge for cash deposits to a Chime account (Walgreens is free) |

Simple account funding and transfers |

Final Word: Chime Review

The beauty of Chime is its simplicity – in its app and its products.

If you want simple, easy-to-use banking services at your fingertips, Chime delivers.

If you need loans or financing, you will need a more complex provider that throws a few more curve balls, and fees, into the mix.

For everyone else, there’s Chime.

FAQs:

What are the cons to Chime?

Chime does not provide financing services, such as personal loans, or specialized savings products like CDs or money market accounts There are no monthly fees, but there is a fee of $2.50 for withdrawals from out-of-network ATMS. Some retailers may also charge a fee for cash deposits to a Chime account. Lastly, Chime does not allow joint accounts, and there are no physical branches.

Is Chime worth getting?

Chime is worth getting if you’re looking for simple banking services with no monthly fees or minimum balance requirements. You will have access to a debit card, a huge ATM network, a high-interest savings account, and do it all effortlessly from your mobile phone.

Is Chime legit and a trusted company?

Yes, Chime is a legit and trusted financial company. Chime provides trusted banking services through its partnerships with The Bancorp Bank, N.A. or Stride Bank, N.A., both of whom are FDIC members.

Is Chime a good service?

Yes, Chime is a very good service.

Chime is perfect for mobile, simple, hassle-free checking, savings, and debit card services.

You can also start building credit history with The Chime Credit Builder Secured Visa® Credit Card.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.