Are you an accredited investor?

If so, you’re part of an elite group of investors that have access to private markets that most people don’t.

Why? According to the Securities and Exchange Commission (SEC), if you qualify as an accredited investor, you’ve proven that you’ve got the mettle (or at least the financial means) to play ball with alternate investments that might be too risky or expensive for the average retail investor.

Accredited investors investments include but are not limited to commercial real estate, fine art, private credit, and more.

There’s no shortage of accredited investor investment opportunities. But you’re probably wondering — what are the best accredited investor investments?

In this article, you’ll find a curated list of the best investments for accredited investors. Whether you’re looking for an accredited investor real estate investment or more niche opportunities, there’s something for every investing style on this list…

FEATURED OFFER: Masterworks

Want an investment that’s fueled by the ultra-wealthy? Try art.

Since 1995, contemporary art has appreciated 11.4% annually on average. That’s 43% more than the S&P over the last 30 years (1995-2024). After all, there’s a reason why many HNW individuals can invest almost an entire 10%+ of their wealth in art.

Want in? You can invest in shares of million-dollar painting offerings with Masterworks, the world’s first art investment platform.

For a limited time, you can skip the waitlist here

*See important disclosures at masterworks.com/cd

The 11 Best Investment Opportunities for Accredited Investors:

Before we get to the best investment opportunities for accredited investors…

What is an accredited investor, exactly?

An accredited investor is either a financial professional who meets certain criteria or an individual who meets certain income requirements:

- Individuals with an income over $200,000 ($300,000 if filing jointly), with a reasonable expectation of maintaining that level of income

- Individuals with a net worth exceeding $1 million, excluding the value of their primary residence

Still not sure if you’re accredited or not? Check out the SEC website for more info.

Now that we’re clear on that, here are some of the best accredited investor investments out there:

1. Percent – Invest in Private Credit

Overall Rating: ⭐⭐⭐⭐⭐

Minimum Investment: $500

Percent gives accredited investors access to one of the least-discussed investment opportunities available – private credit.

Today, the private credit market stands at over $2 trillion.

Companies without access to public markets borrow money from non-bank lenders to finance operations and growth.

Why are investors flocking to private credit?

- Shorter terms

- Higher yield potential

- Less correlated with public markets

Plus, many of these loans are secured by assets, loan portfolios, or corporate debt. For these reasons, private credit can be an attractive alternative asset class for risk-adjusted returns.

And while private credit used to be exclusively funded by institutions, Percent is dedicated to bringing the power of private credit to accredited investors.

The platform offers transparency and ease of use while giving you access to an asset class that has traditionally been reserved for institutional (or very rich and very well connected) investors.

On the platform, all deals are curated by Percent’s team and trusted underwriters.

If you’re interested in exploring offers and opportunities, the advance platform makes it easy by letting you do things like compare opportunities and track performance. The platform also does a great job of helping you understand potential risks.

And if you’re not sure where to start? Percent Blended Notes are one of the platform’s most popular offerings and a great entry into private credit investing. The Notes are professionally managed private credit products that are combined into a single note. Diversity is the benefit here: these Notes give you exposure to multiple borrowers and asset classes, making it easy to diversify your private credit investment within a single vehicle.

How does private credit stack up against other alternative investment strategies?

The bottom line? Percent offers access to private credit deals on an easy-to-use (and extremely transparent) platform and makes it easy to find alternative investments that align with all of your portfolio objectives.

Plus, right now, Percent is offering a bonus of up to $500 for new investors who make their first investment.

Want to know more? Check out our Percent Review.

2. Masterworks – Invest in Fine Art

Overall Rating: ⭐⭐⭐⭐⭐

Minimum Investment: None; Masterworks retains complete discretion to determine that subscribers are “qualified purchasers” (as defined in Regulation A under the Securities Act) in reliance on the information and representations provided to us regarding their financial situation.

Type of investor: All investors

Wanna be a mover and shaker in the art world, but don’t have millions? Masterworks is an investment platform that lets accredited and non-accredited investors diversify with blue-chip contemporary art, from internationally-known artists like Basquiat, Banksy, and Picasso.

Masterworks does the hard work of finding, authenticating, buying, and storing the art. You invest in shares of your chosen offerings, or can work with a Masterworks advisor to choose pieces that suit your strategy.

From there, you can either wait until Masterworks sells the art, or you can sell shares to other users in an unaffiliated secondary market (that secondary market is currently only available to U.S. clients).

The platform requires a signup before you invest, and first you need to register and request an invitation. If you meet their requirements and believe art investing is right for you, you’ll get a coveted invite and entry into the world of fine art investing.

Plus, the potential price growth is exciting — compared to the S&P’s yearly price appreciation of 10.0% over the last 30 years (‘95-’24), contemporary art has outpaced it at an average of 11.4% yearly.

Want to know more? Check out our Masterworks Review.

3. Hiive – Invest in Private Companies

Overall Rating: ⭐⭐⭐⭐⭐

Minimum Investment: $25,000

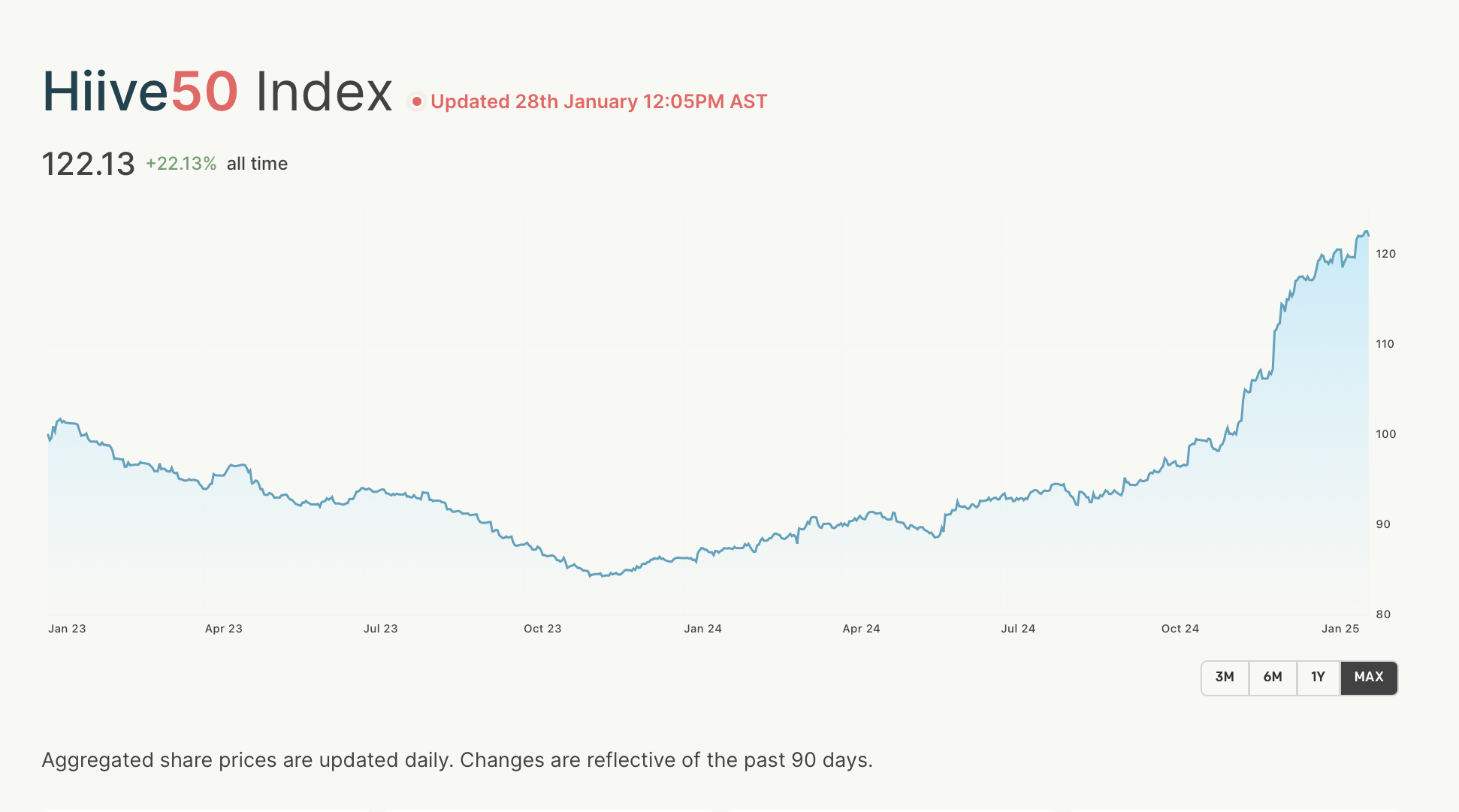

Interested in investing in a company that hasn’t gone public yet? Hiive can give you access. This pioneering platform gives accredited investors the ability to become stakeholders in private, VC-backed companies.

Note: Want to see what’s trending on Hiive? On the Hiive website, you can check out the Hiive50 Index, an equal-weight price index of the 50 most liquid securities on the platform, generated directly from user orders and transactions on the Hiive platform. Here’s a recent screenshot of the Hiive50 Index:

Hiive acts as a matchmaker between accredited investors who want a stake in private and/or pre-IPO companies and employees, venture capital firms, or angel investors who want to sell shares.

Hiive has a lot of cool features — for instance, there’s a live pricing chart for each company which includes prevailing bids and asks, and you can create watchlists and get notified about price changes or new listings offered.

Additionally, you have flexibility. Buyers can either accept the asking price as listed, place a bid, or negotiate directly with the sellers. As an added perk for investors, for standard transactions, the sellers are the only ones who pay fees.

Another interesting tidbit about Hiive: In 2023, 54% of accepted bids on Hiive were approved, 16% meet a buyer from cap table, 30% are blocked altogether. (2023 report)

The bottom line? Hiive is one of the best ways to become an investor in private companies like Groq, Anthropic, and OpenAI.

4. eToro – Invest in Stocks, ETFs, Crypto, & More

One of the greatest things about stocks is that they are accessible to all investors — accredited or not. But just because you’re an accredited investor and can now flex beyond the stock market, it doesn’t mean stocks shouldn’t be in your investment portfolio. Case in point: Nvidia (NASDAQ: NVDA) is up about 90% in just the past year, as of January 2025. Kind of makes a compelling case for stocks, doesn’t it?

To buy stocks, you need a broker. At WallStreetZen, our undisputed favorite broker is a global one: eToro. Here’s why:

- CopyTrader, a service that lets you follow (and mirror, if you choose) eToro’s top investors

- The Popular Investor feature, where Popular Investors can receive up to 1.5% payment based on average AUC (Assets Under Copy).

- And related to the above, a social media newsfeed where you can see what’s going on in investing — it’s a great way to get a market pulse check.

- A paper trading option where you can test strategies without putting actual cash on the line

- Educational materials that are pretty good on a variety of topics from how to use the platform to trading strategies and more.

Overall, eToro is a user-friendly platform that makes it easy to manage your holdings. (Having personally used Schwab for stocks in the past, I find eToro’s interface a lot easier to understand.)

(As a side note — If you’re interested in optimizing your portfolio but feel like you could use a little work picking stocks, it’s worth investing in a resource like Zen Investor, our newest newsletter featuring stock picks from market veteran (and former Zacks.com Editor in Chief) Steve Reitmeister. As a member, you receive stock picks, commentary, portfolio updates, and webinars led by Steve, who hand-selects stocks through a proprietary 4-step process using WallStreetZen tools.)

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

5. Yieldstreet – Invest in Real Estate, Art, VC, Crypto, Private Credit, & More

Overall Rating: ⭐⭐⭐⭐⭐

Minimum Investment: $15,000

Diversification station! Yieldstreet gives accredited investors the chance to diversify their portfolios with all sorts of cool alternative investments that used to be reserved for institutional and mega-wealthy investors, like art, private equity, and more.

Yes, Yieldstreet is available to retail investors as well as accredited investors. However, the opportunities are limited for retail investors — accredited investors really get to choose their own adventure.

First, you get to choose what you’d like to invest in — the platform has more asset classes than just about any other platform out there, including (but not limited to) art, crypto, diversified funds, real estate, private credit, and venture capital.

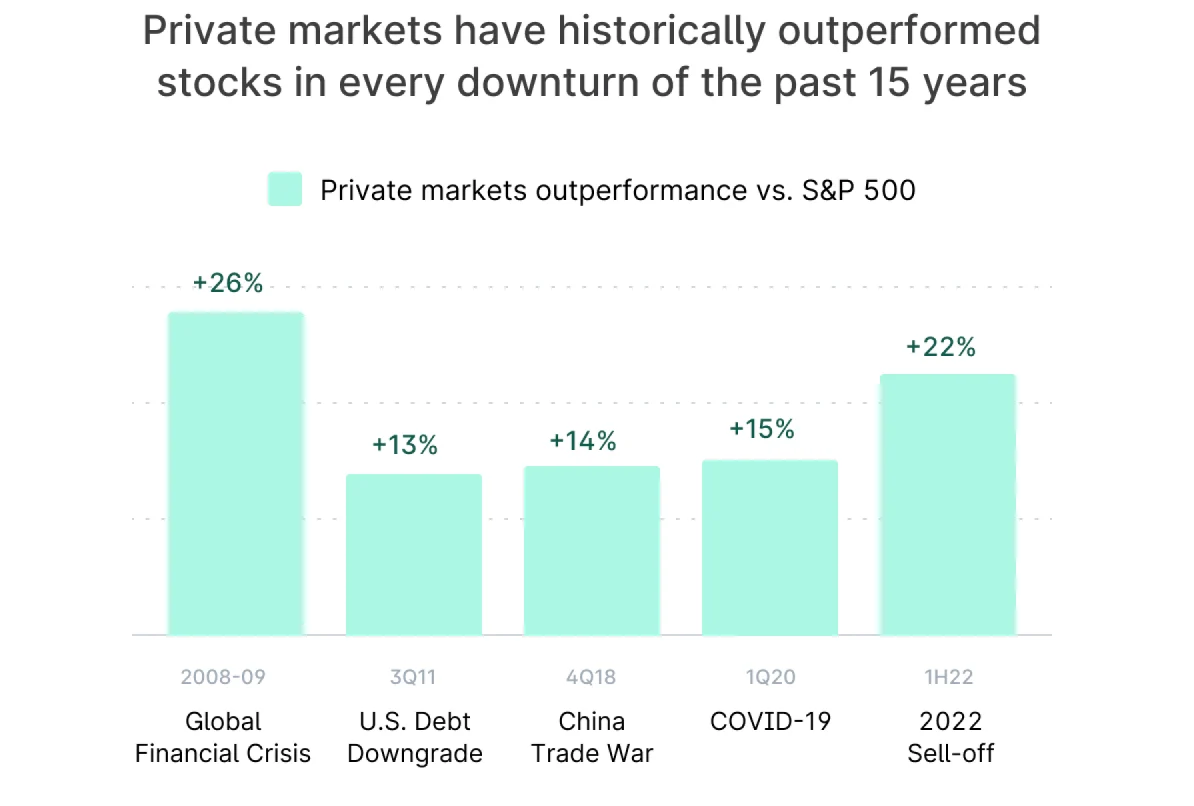

Since these are private investments, you’re less connected to the volatility of the stock market than you would be with many other public investments.

And let’s not forget the potential returns. Private-market investments have limited availability and can deliver higher returns — Yieldstreet’s target net returns per year range from 8 to 20%.

Not an accredited investor? The Yieldstreet Alternative Income Fund (formerly the Prism Fund), which launched in 2020, is open to non-accredited investors — assets include art, commercial real estate, and more. The minimum investment of the Yieldstreet Alternative Income Fund is $10,000. Currently, the AUM is $152 million and the net annualized yield is listed as 8.3%.

Moreover, Yieldstreet is more than just an accredited investor real estate investment opportunity. You could consider it a one-stop-shop for accredited investors investments.

Want to know more? Check out our Yieldstreet Review.

6. AcreTrader – Invest in Farmland

Overall Rating: ⭐⭐⭐⭐⭐

Minimum Investment: $10,000

Let’s face it, you’re probably never going to become a farmer. But thanks to AcreTrader, that doesn’t have to stop you from investing in farmland and potentially profiting through the land’s appreciation and rental income.

AcreTrader offers accredited investors the opportunity to own farmland without ever having to milk a cow or sow the fields. They subdivide properties into smaller portions, so you can invest at a more affordable price point.

AcreTrader has a vigorous vetting process and only moves forward with about 5% of the land they review — so as an investor, you can rest assured that the investment has gone through serious due diligence.

The initial investment is $10,000; AcreTrader expects between 3 to 5% returns. However, according to the AcreTrader website, the cumulative rate of returns for farmland has been 12.24% since the year 2000.

With fairly low fees and the potential for great returns, AcreTrader provides one of the best investments for accredited investors.

Want to know more? Check out our AcreTrader Review.

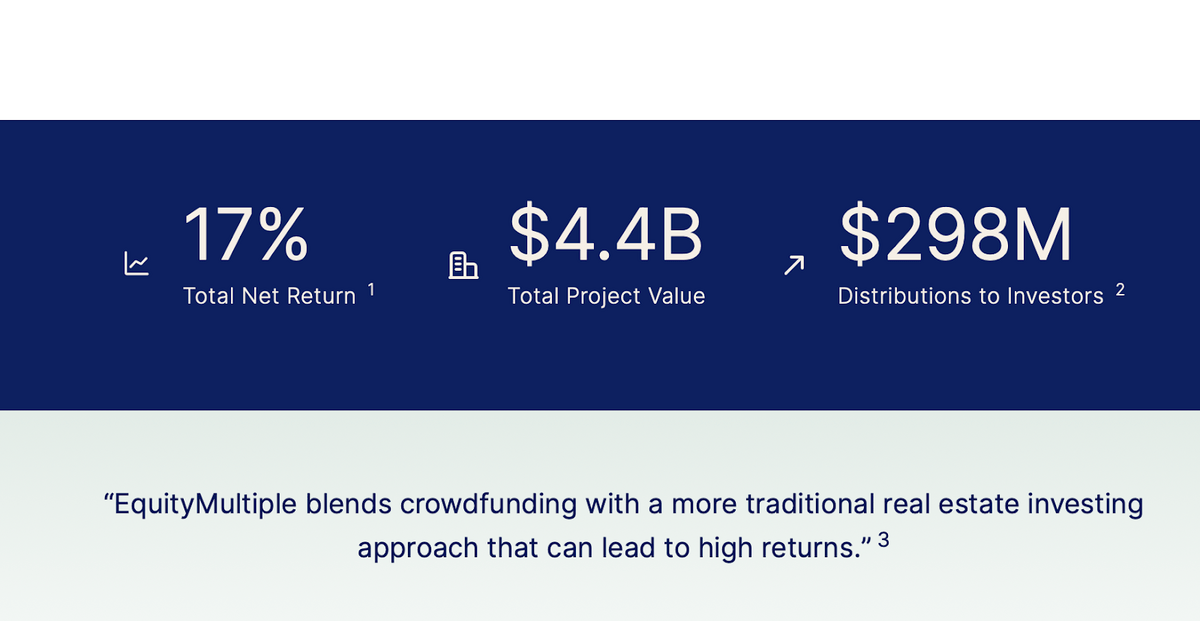

7. EquityMultiple – Invest in Commercial Real Estate

Overall Rating: ⭐⭐⭐

Minimum Investment: $5,000

EquityMultiple is a crowdfunded real estate investment platform that gives accredited investors access to professionally-managed properties.

Once upon a time, private-market commercial real estate was only available to institutional investors. Not anymore.

With EquityMultiple, a crowdfunding group accredited investors like you become the lender for real estate investors; you have the potential to earn high-yield returns.

The opportunities include a diverse mix of property types and price points. Minimums range from as low as $5,000 to $30,000 depending on the project. You can also invest directly in commercial real estate deals.

The platform boasts $4.4 billion in project value, and the average historical returns are 17% — which far outpaces many other asset classes.

Fees vary depending on the investment; equity investments may charge between 0.5 to 1.5%, which is similar to other crowdfunded real estate platforms.

Not an accredited investor? EquityMultiple has stated that it is considering vehicles to allow them to accommodate non-accredited investors, at this point the platform is only available to accredited investors. Here are some other ways to invest in private companies.

8. DLP Capital – Invest in Private REITs and Real Estate-Focused Private Credit

Overall Rating: ⭐⭐⭐⭐

Minimum Investment: $200,000

If you’re a HNWI who’s interested in getting serious about real estate investing but don’t want to own property outright, DLP Capital presents a compelling opportunity.

With a $200K minimum investment, the first thing you probably want to know is whether or not DLP is legit. Yes. Founded in 2006, it’s not a flashy newcomer — it has a proven track record, with thousands of investors, and it currently maintains an impressive 18,000 housing units and over $5.25 billion in assets under management.

DLP Capital primarily serves affluent investors, offering access to a variety of real estate funds to align with different investment strategies and objectives:

- The DLP Housing Fund offers access to build-to-rent and multifamily communities

- The DLP Building Communities Fund offers access to equity and preferred equity investments in entities or senior mortgage loans or mezzanine loans for developing new rental communities

- The DLP Lending Fund offers access to debt investments for the construction, acquisition, and repositioning of attainable rental housing

- The DLP Preferred Credit Fund offers access to debt investments (senior mortgage loans and/or mezzanine loans) and preferred equity in RV and vacation luxury parks, manufactured housing, and rental housing properties.

The ability to choose your own adventure in terms of how to invest with DLP isn’t the only thing that makes it unique. Here are a few other things that make it stand out:

- DLP primarily focuses on impact-based investment strategies, attempting to profit while also benefiting society for the greater good. I’ll be real with you: This is not common with elite investment platforms.

- Additionally, DLP’s fee structure is refreshingly transparent. It offers a 2.0% management fee, with potential rebates for higher account balances.

- Its historical returns are impressive. Looking at the DLP Housing Fund to illustrate, the fund currently lists a 19.47% compounded DRIP IRR Since Inception (2020) as of December 31, 2023, and currently targets a 10-12% annual net return. Other funds report 12.28%, 13.10%, and 10.99% DRIP IRR since Inception.

9. Vinovest – Invest in Fine Wine

Overall Rating: ⭐⭐⭐⭐

Minimum Investment: $1,000

Vinovest lets you become a fine wine investor and collector with ease. Starting with just $1,000, you can get access to the wine market — no expertise required.

Vinovest is a platform that lets you invest in a portfolio of fine wines without requiring sommelier-level expertise, and it’s accessible to accredited and non-accredited investors.

Investing in wine requires a lot of knowledge and know-how. It needs to be authenticated, insured, and properly stored — if you don’t have the right temperature, light, or humidity, your investment could become a very expensive bottle of vinegar.

The company does all the hard work for you — they source and store it for you. Want to drink some? No problem. You can have a bottle shipped to you whenever you’d like.

There’s also a secondary market where you can buy and sell bottles with other investors.

There are several tiers of membership to Vinovest, making it accessible to a variety of investors. However, there are fees — including an early liquidation fee — and the ideal holding period is 10-15 years. So if you want a fast return, this may not be the investment opportunity for you.

Want to know more? Check out our Vinovest Review.

10. Arrived – Invest in Single Family Homes

Overall Rating: ⭐⭐⭐⭐

Minimum Investment: $100

Arrived Homes is a little different from most crowdfunded real estate platforms out there. It allows both accredited and non-accredited investors to invest small amounts in single-family residential properties.

The platform was only launched in 2021, but a star-studded cast of investors including Amazon (NASDAQ: AMZN)’s Jeff Bezos put the company on the map fast.

Arrived Homes gives investors access to the benefits of being a landlord without actually being a landlord or buying the property yourself. Plus, the initial stakes are low — you can invest for as little as $100.

The company may not have been around for long, but so far returns appear to be solid and investors get quarterly dividends on each investment.

Yes, there are fees involved, but they’re warranted — Arrived handles obtaining and vetting the property and all of the management details.

Plus, it’s growing. As of 2023, Arrived Homes has purchased over 225 homes in 39 markets and has over $85 million in total investments. So if you’re interested in a low-stakes way to enter the real estate market, it may be worth your time.

Want to know more? Check out our Arrived Homes Review.

11. RealtyMogul – Invest in Commercial & Residential Real Estate

Overall Rating: ⭐⭐⭐⭐

Minimum Investment: $5,000

RealtyMogul is a crowdfunded real estate platform that lets you invest in a variety of different commercial properties.

Like the other crowdfunded real estate platforms on this list, RealtyMogul is designed to give investors access to institutional-quality investments without the massive initial investment.

But they do it in a slightly different way.

On RealtyMogul, both accredited and non-accredited investors can invest in commercial real estate through non-traded REITs. It’s sort of like a buy-and-hold-style investment where you get dividends.

They offer two types of REITs — income-focused funds, and growth-focused funds. The minimums are $5,000 and expected returns range from 6 to 8% on the low end.

If you’re an accredited investor, you can also make direct investments in LLCs that own specific properties; the minimums are in the $25,000+ range and include student housing, multifamily properties, and industrial buildings.

Overall, the variety of assets and investment types make RealtyMogul an accredited investor real estate investment worth checking out.

At-a-Glance: Best Accredited Investments

Asset | Expected Returns* | Minimum Investment | Investor Requirement | |

|---|---|---|---|---|

Private, pre-IPO companies | Varies | $25,000 | Accredited only | |

Private credit | 13-18% | $500 | Accredited only | |

Fine art | N/A | N/A | Accredited and non-accredited | |

Stocks, ETFs, & crypto | N/A | $10 | Accredited and non-accredited | |

Real estate, art, VC, crypto, private credit, & more | 8-20% (Results may vary) | $15,000 | Primarily accredited | |

Farmland | 3-5% | $10,000 | Accredited only | |

Commercial real estate | 17% | $5K | Accredited only | |

Real estate investment funds | 9-13% | $200K | Accredited only | |

Wine | 5.5 – 12% | $1,000 | Accredited and non-accredited | |

Residential properties | 8%-20% | $100 | Accredited and non-accredited | |

Commercial real estate | 6-8% | $5,000 | Primarily accredited |

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

* Based on historical data and/or company-stated target returns. Actual results may vary. This article should not be taken as investment advice. No investment offers a guarantee of returns. Your capital is at risk.

Final Word: Best Investments for Accredited Investors

As an accredited investor, you’ve got access to a ton of exciting and potentially profitable investments that most people can’t access.

However, just because you can seek out different investment opportunities doesn’t mean you should sink your cash into the first thing that comes along. Learning how to invest a million dollars or more in a financially responsible way is not a simple task.

This list of the best investments for accredited investors includes a variety of well-reviewed and legit companies. While every investment carries risk, the track record of each of the platforms in this article is solid — which makes it a great starting point for your accredited investment journey!

FAQs:

What investments can accredited investors make?

According to the Securities and Exchange Commission (SEC), accredited investors are individuals who have the prowess or the financial means to play ball with alternate investments that might be too risky or expensive for the average retail investor, such as commercial real estate, fine art, private credit, and more.

Do accredited investors get better returns?

Accredited investors have access to a greater variety of investment opportunities. Some of them have the potential to deliver impressive returns. However, the potential for increased returns comes with increased investment risk.

Why are some investments only for accredited investors?

Commercial real estate, private credit, and farmland are some examples of accredited investment opportunities that may not be available to non-accredited investors.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.