Private credit has grown immensely in popularity among institutional and retail investors in the past decade.

According to a Morgan Stanley report, the private credit market grew from $1 trillion in 2020 to $1.5 trillion in just four years.

And that’s not the most impressive part.

Morgan Stanley forecasts this market to grow to $2.8 trillion by 2028.

With top private credit funds sometimes often offering attractive yields and lower volatility, it’s no wonder private credit has become a cornerstone in diversified portfolios.

If you’re interested in investing in private credit funds yourself, it’s important you understand what they are and how they work. So let’s delve into the world of private credit and explore some of the industry giants leading the space.

It’s worth studying the top private funds to get a better sense of how the private credit world works. However, many of their strategies are only open to institutions. That’s what makes platforms like Percent a priceless alternative.

Fusing transparency with a rigorous due diligence process, Percent democratizes the private credit realm, offering both individual and institutional investors an entrée to this lucrative sector.

Plus, it allows for built-in diversity with its Percent Blended Notes, which give you exposure to multiple notes across different asset classes and geographies, all in a single investment.

We’ll talk more about Percent a little later — but first, let’s get to the top private credit funds in the world.

Top Private Credit Funds in 2025: The Bottom Line

Some of the top private credit funds in 2025 include:

- Blackstone Group

- Apollo Global

- KKR

- Carlyle Group

- Ares Management

- Oaktree

- Goldman Sachs Asset Management

But that list won’t make sense unless you know a few basics. Keep reading to learn what private credit is, how these funds work, and why investors are attracted to them.

What Are the Largest Private Credit Funds in the World?

When it comes to the largest private credit funds, several firms stand out. They’re worth knowing about because of their sheer size, sophisticated strategies, and proven track records.

Let’s delve into a closer examination of these dominant players, shedding light on their strategies, specialties, and the reasons behind their esteemed positions in private credit.

With further ado, here’s a list of private credit funds worth watching:

As noted above, the below groups tailor their services to institutional investors. If you’re an individual investor, these might not be the best choices for you. Percent provides a more accessible entry point to the world of private credit for accredited investors.

1. Blackstone Group

- Assets under management: $1 trillion (source)

- Firm’s specialties: Private Equity, Alternatives, Real Estate

- Investment strategy: Emphasizes direct lending, particularly to middle-market companies, leveraging its global network and operational expertise for value-driven private credit investments.

As one of the largest private credit funds, the Blackstone Group‘s private credit strategy focuses on direct lending, especially in middle-market companies that can benefit from the firm’s operational expertise.

With a vast global network and an eye for value-driven investments, Blackstone’s robust approach to sourcing, vetting, and managing private credit investments and specializing in the middle market are all reasons why it’s become a significant player in the sector.

Blackstone (NYSE: BX) is also available as a publicly listed company on the NYSE. For those looking to buy into one of the biggest asset managers, consider adding BX to your watchlist on WallStreetZen.

2. Apollo Global Management

- Assets under management: $696 billion (source)

- Firm’s specialties: Distressed Debt, Non-traditional Lending

- Investment strategy: Emphasizes asset-based underwriting, focusing on collateral to minimize risk while identifying hidden value in distressed debt and non-traditional lending.

Apollo Global Management‘s approach to private credit investing hinges on its deep industry expertise and asset-based underwriting.

By focusing on collateral first, the firm minimizes downside risk while identifying hidden value. Its prowess in distressed debt and non-traditional lending makes it a leader in the private credit space; that, plus the firm’s impressive size warrants it a place on this list.

Like Blackstone, Apollo (NYSE: APO) is a dividend-paying stock on the NYSE for retail investors who like their business model. See 1-year forecasts, analyst ratings, and more — click here to research APO on WallStreetZen.

3. KKR

- Assets under management: $553 billion (Source)

- Firm’s specialties: Private Equity, Infrastructure, Renewables, Life Sciences, Alternatives

- Investment strategy: Commits to patient capital, focusing on long-term relationships and aligning financing with the strategic goals of its partners across diverse asset classes.

KKR‘s private credit endeavors are characterized by their commitment to patient capital. The firm believes in building long-term relationships and thus extends financing that aligns with the strategic goals of its partners.

By leveraging its global platform and extensive industry knowledge, KKR can tap into opportunities others might overlook, making it one of the best private credit funds when it comes to getting unique exposure to infrastructure, renewables, life sciences, and other asset classes.

KKR & Co. (NYSE: KKR) equity is also available on the stock market, so it shouldn’t be hard to find this ticker on your preferred brokerage. (Need a brokerage? We like eToro.)

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

4. Carlyle Group

- Assets under management: $447 billion (Source)

- Firm’s specialties: Alternatives, Emerging Markets

- Investment strategy: Combines rigorous due diligence with innovation, focusing on niche sectors and geographies to drive value and long-term growth

The Carlyle Group‘s approach to private credit combines rigorous due diligence with an emphasis on innovation.

As one of the early movers in the space, they’ve continually evolved their strategy to tap into niche sectors and geographies (14% of the firm’s AUM is in Europe, the Middle East, and Africa).

This pioneering spirit, backed by meticulous asset management, sets Carlyle apart in the private credit realm.

For those who like the Carlyle Group’s (NASDAQ: CG) strategy, shares are publicly available on the stock exchange.

While private credit used to be exclusively funded by institutions, Percent is dedicated to bringing the power of private credit to accredited investors. Right now, Percent boasts an impressive 18.13% Current Weighted Avg. Coupon Rate.

In addition to the ability to browse individual deals, you can also invest in a variety of private credit deals across different industries and geographies within a single investment with the Percent Blended Note — one of the firm’s most popular offerings.

5. Ares Management

- Assets under management: $464 billion (Source)

- Firm’s specialties: Alternatives, Mid-market Companies

- Investment strategy: Integrates insights across liquid and illiquid credit markets, tailoring flexible financing solutions for underserved markets like alternatives and mid-tier companies.

Ares Management stands out for its integrated approach to private credit, leveraging insights from other parts of the firm to inform credit decisions.

Their expertise in both liquid and illiquid credit markets allows them to tailor financing solutions that are both flexible and favorable to all parties involved — no small feat in the world of finance. The firm’s focus on lesser-served markets such as alternatives and middle markets offers higher yields, cementing its presence on this list.

Ares Management (NYSE: ARES) also offers stock to Wall Street investors, including a dividend yield.

6. Oaktree

- Assets under management: $205 billion (Source)

- Firm’s specialties: Cyclicals, Distressed Assets, High Yield

- Investment strategy: Emphasizes risk control while seeking superior returns, extensively utilizing its expertise in distressed debt and high-yield bonds.

With legendary investor Howards Marks at the helm, Oaktree is renowned for its emphasis on risk control while seeking superior returns. This philosophy translates seamlessly to their private credit strategy, where they extensively utilize their prowess in distressed debt and high-yield bonds.

Oaktree’s methodical, value-oriented approach to credit investment and its focus on distressed opportunities and cyclicals cements its place on this list of private credit funds.

7. Goldman Sachs Asset Management

- Assets under management: $3.1 trillion (Source)

- Firm’s specialties: Alternatives, Structured Financial Products, Bespoke Solutions

- Investment strategy: Leverages its global network to offer structured finance products, creating bespoke credit solutions tailored to individual borrower needs.

Another of the most well-known and largest private credit funds, Goldman Sachs Asset Management brings its Wall Street finesse into the world of private credit with an array of structured finance products, focusing on creating bespoke solutions for its borrowers.

By integrating market intelligence from its vast global network, the firm continually refines its credit strategies while focusing on a wide range of alternatives, warranting its position on this roster.

As a stalwart of American finance, Goldman Sachs (NYSE: GS) is also one of Wall Street’s most actively traded financial stocks. With GS equity, you’ll get exposure to all this financial firm offers, including a quarterly dividend.

What are Private Credit Funds?

Private credit funds are alternative investment vehicles that offer loans or credit to private companies, typically bypassing traditional banking systems.

The top private credit funds often focus on mid-market companies that may find it challenging to secure financing from conventional sources.

Other private credit funds focus on different specialties, such as infrastructure or emerging markets like Asia, Latin America, Africa, Central and Eastern Europe (CEE), and the Middle East.

These funds have surged in popularity in recent years due to their potential for high returns and the diversification they offer in an investment portfolio.

Why Invest in Private Credit?

So what exactly sets the best private credit funds apart from other investments and asset classes?

Top private credit firms offer a few unique benefits, including:

- Potential for Higher Returns: With higher risk comes the potential for higher rewards, and private credit often offers yields that are superior to traditional bonds. How? By directly lending to companies without intermediaries, these funds can charge higher interest rates, which are often tailored to the specific risks associated with the borrower

- Diversification: Private credit also offers an alternative source of income, independent of stock and bond markets. This can potentially provide a hedge against market volatility and add a non-correlated asset to the portfolio.

- Income Investing: Private credit funds can be particularly attractive if you’re retired or seeking income. Aside from the high yields and potential diversification, many private credit investments also come with predictable interest payments.

Private credit also gives you an alternative to the classic 60/40 portfolio, which could leave opportunities (and potential returns) on the table.

Consider a recent study from investment giant KKR that examined the benefits of adding alternative investments into the mix over almost a century of returns. Their findings?

The 40/30/30 portfolio (including real estate, infrastructure, and private credit assets)…

Offered both higher returns — with lower volatility — during periods of high inflation.

Up until recently, the latter asset — private credit — was only available to an elite population of well-connected individuals and institutions.

While firms like those mentioned above are mainly the purview of institutional and deep-pocketed investors, platforms like Percent now offer accredited investors access to private credit.

How Does Private Credit Investing Work?

To simplify things, you can think of private credit as a direct lending process that bypasses traditional banking institutions.

To see how the lending process works and the advantages it offers private credit funds and their customers, let’s take a closer look at how the top private credit firms engage in lending:

Origination & Due Diligence

The initial phase involves sourcing opportunities and conducting rigorous background checks. Private credit firms maintain strong relationships with intermediaries, brokers, and industry insiders to identify viable lending opportunities.

Once a potential borrower is identified, analysts at the private credit firms undertake an exhaustive review of the borrower’s financial statements, business model, market positioning, and management team. This kind of analysis ensures that the firm understands the risks associated with the loan.

Structuring the Deal

After the due diligence is completed, the terms of the loan are negotiated.

This could involve determining terms like:

- The interest rate

- Loan tenure

- Collateral requirements

- Covenants

The flexibility in structuring these deals is a hallmark of private credit investing, allowing for bespoke solutions tailored to the borrower’s needs and the lender’s risk appetite. This is part of what makes private credit firms so attractive to borrowers.

Collateral & Protection

To mitigate risk, many private credit deals are secured, meaning they have specific assets backing them. This is so that in case of default, the lender has a claim on these assets.

This collateral can range from real estate, machinery, receivables, or even a stake in the borrowing company.

Covenants are then set in place. These are contractual obligations the borrower must adhere to, providing additional layers of protection for the private credit firm.

Monitoring & Management

After the funds are disbursed, active monitoring is essential. Investors and analysts keep a close eye on the borrower’s financial health, industry trends, and any potential red flags.

This proactive approach ensures timely intervention if any issues arise, maximizing the chances of loan repayment.

Interest & Repayment

The primary return for private credit investors comes from interest payments made by the borrower. These payments can be fixed, floating, or tied to specific performance metrics of the borrower.

Eventually, upon the loan’s maturity, the principal amount is repaid, marking the culmination of the investment. Some deals might also involve profit-sharing or equity conversion clauses, providing additional upside potential.

A Few Caveats

Remember, the private credit landscape is vast.

There are even different sub-strategies, such as:

- Direct lending to mid-market companies

- Distressed debt investing

- Trade finance

These all have their own set of dynamics and risk-reward profiles. Investors often diversify across these sub-strategies to optimize returns and spread risks.

Private credit investing isn’t just for institutions and HNWIs anymore. Percent offers private credit investing to accredited investors.

Should You Invest in Private Credit?

By now, you know some of the benefits of private credit. It promises potentially higher yields compared to traditional bonds and offers a degree of diversification away from public equities and fixed-income markets.

But does this mean you should invest in private credit? It all depends on you.

If you’re seeking:

- Higher yields

- Income investing

- Diversification out of the traditional stock and bond market

Then private credit could possibly be a fit.

However, like all investments, private credit still comes with risks:

- The market is less liquid than the public debt markets

- The investments are often more complex

- Understanding the underlying collateral and the terms of the deal is crucial

Private credit also isn’t immune from hiccups in the economy. There’s always a risk that economic downturns or industry-specific disruptions could impact borrowers’ ability to pay.

But for those with a longer-term perspective, the ability to stomach some degree of illiquidity, and a desire for diversification, private credit might be an enticing addition to the portfolio.

As with all investments, it’s best to consult with financial advisors or conduct your own thorough research and due diligence before diving in.

Percent offers accredited investors access to private credit investing.

How to Invest in Private Credit

Historically, private credit was solely the domain of institutional and high-net-worth investors.

But technological advancements and financial innovations have provided new avenues for retail investors to dip their toes into this asset class.

If you’re interested, here’s how you can get started:

Invest with the Top Private Credit Funds Above

It’s tempting to gravitate towards the heavyweights in the industry. After all, the top private credit funds I highlighted above have built reputations on robust performance, in-depth due diligence, and strategic prowess. Investing with these behemoths offers a sense of security.

However, it’s essential to understand the potential barriers. Many of the largest private credit funds demand significant capital commitments, sometimes stretching into the millions.

Also, they typically cater to accredited or institutional investors, potentially sidelining everyday individual investors.

For individual investors, buying the stock of the aforementioned companies may be a more accessible alternative. For more direct access to the private credit market, consider the platforms listed below:

Percent

Percent is an innovative platform catering to both individual and institutional investors interested in private credit opportunities. What sets it apart is its commitment to transparency and its robust due diligence process.

The platform provides a curated list of credit investment opportunities, each with detailed information about the borrower, the terms of the deal, and the underlying collateral.

The user-friendly interface and data-rich dashboard ensure that investors remain informed and can track their investments in real time. With its democratized approach to private credit, Percent makes it simpler for investors to diversify their portfolios and potentially reap the rewards of this previously hard-to-access asset class.

Percent is a pioneering platform that offers accredited investors access to an exciting alternative investment — private credit.

As an investor, you’ll gain access to a wide variety of high-yield, short-duration (9-month average) offerings that have historically paid over $28 million in interest.

You can invest as little as $500 and unlock yields up to 20% APY.

Note: Percent is only open to accredited investors at this time. Are you an accredited investor? Great news — there are all sorts of cool opportunities available to you. Check out our article about the best investments for accredited investors.

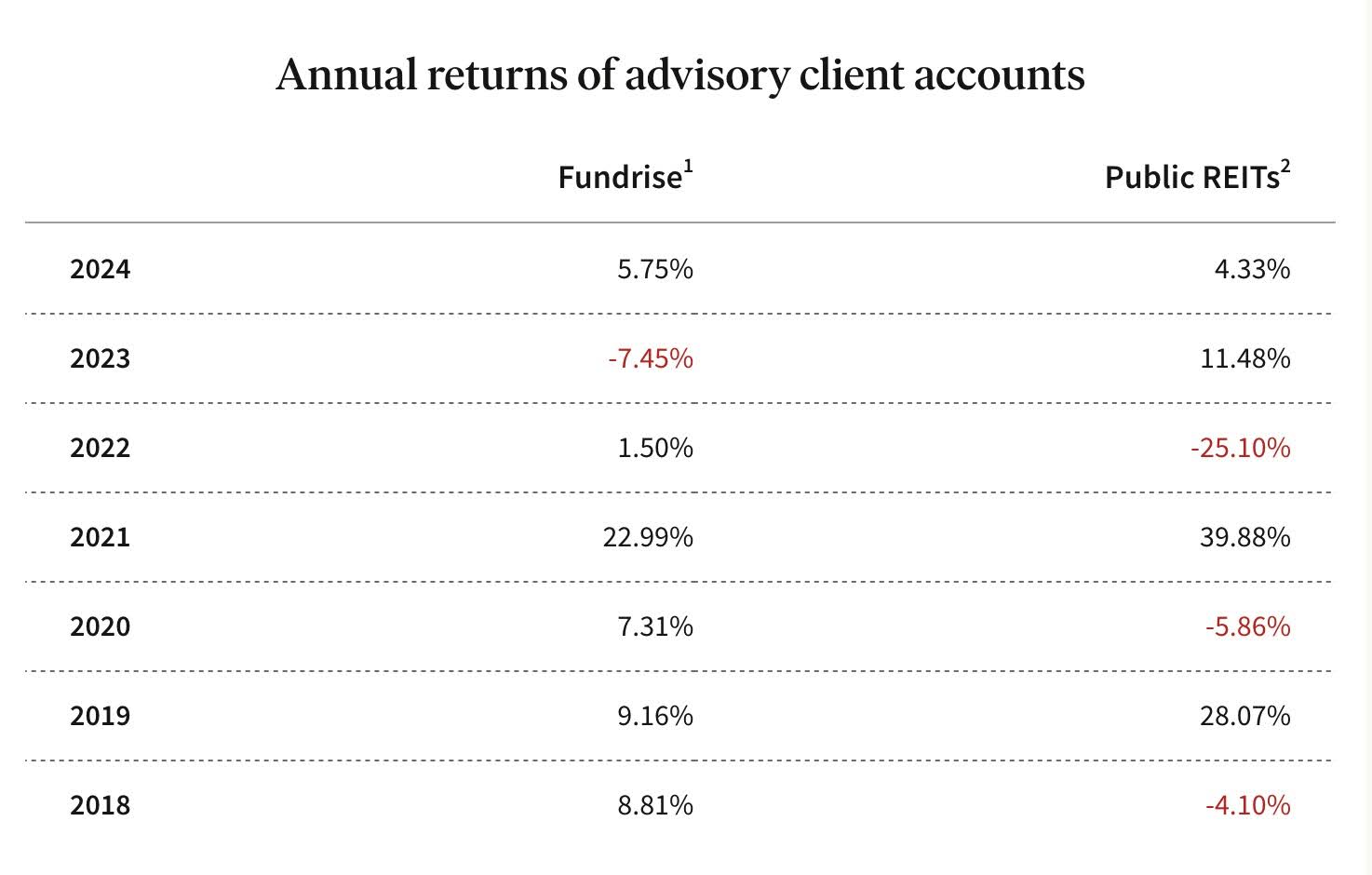

Fundrise

Fundrise often initially appeals to investors as a real estate platform. But it also provides a gateway for retail investors, including those who are not accredited, to tap into the private credit market, albeit indirectly.

Through its diversified funds, investors can gain exposure to real estate-backed debt opportunities, which in essence is a type of private credit. Past performance has been impressive compared to both public REITs and the S&P 500:

Though not as direct or pure a play on private credit as other platforms, Fundrise is nice because it’s open to non-accredited investors. So it offers an accessible way for everyday investors to invest in private credit.

Note: We earn a commission for this endorsement of Fundrise.

Final Word: Private Credit Funds

The allure of higher yields, income diversification, and potential capital appreciation makes private credit a compelling consideration if you’re looking to diversify your investment portfolio.

But private credit isn’t without its challenges or risks. The need for proper due diligence, understanding of the investment structure, and recognition of associated risks is paramount.

It’s not just about chasing higher yields but comprehending the intricacies of each deal and the collateral behind it.

For the more conservative investor, platforms like Fundrise can provide a gentler introduction to the world of private credit, without diving deep into its complexities. Meanwhile, platforms like Percent give the more seasoned (and accredited) investor a refined approach to selecting and diversifying their private credit portfolio.

The world of private credit is vast and varied, but with the right approach, it can be a lucrative addition to a well-rounded portfolio.

FAQs:

What are the biggest private credit funds?

The biggest private credit funds include Apollo Global Management, Blackstone Group, Ares Management, KKR, Oaktree, Goldman Sachs Asset Management, and Carlyle Group.

Are private credit funds good investments?

Private credit funds can offer higher yields and portfolio diversification, but like all investments, they come with risks and require thorough due diligence.

Is private credit booming?

Private credit has witnessed significant growth in recent years, with investments in emerging markets in particular increasing substantially.

Who are the top players in direct lending?

The top players in direct lending encompass industry giants such as Apollo Global Management, Blackstone Group, and Ares Management, known for their robust strategies and vast assets under management.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.