What are the best short term investments?

There’s not a single answer to that question. The best short term investments for you depend on your goals and objectives.

The best short term investment is one that fits your investment goals and appetite for risk and pairs well with the rest of your investment portfolio. Short term investment options with high returns can come with higher risk, so it’s up to you to decide what suits you best.

Below, I’ve detailed 10 of the best short-term investment options in 2025. I’ve tried to incorporate a variety of assets and risk levels so that every investor can find something that works for them. Let’s get to it:

A short-to-medium term investment you may not have considered…

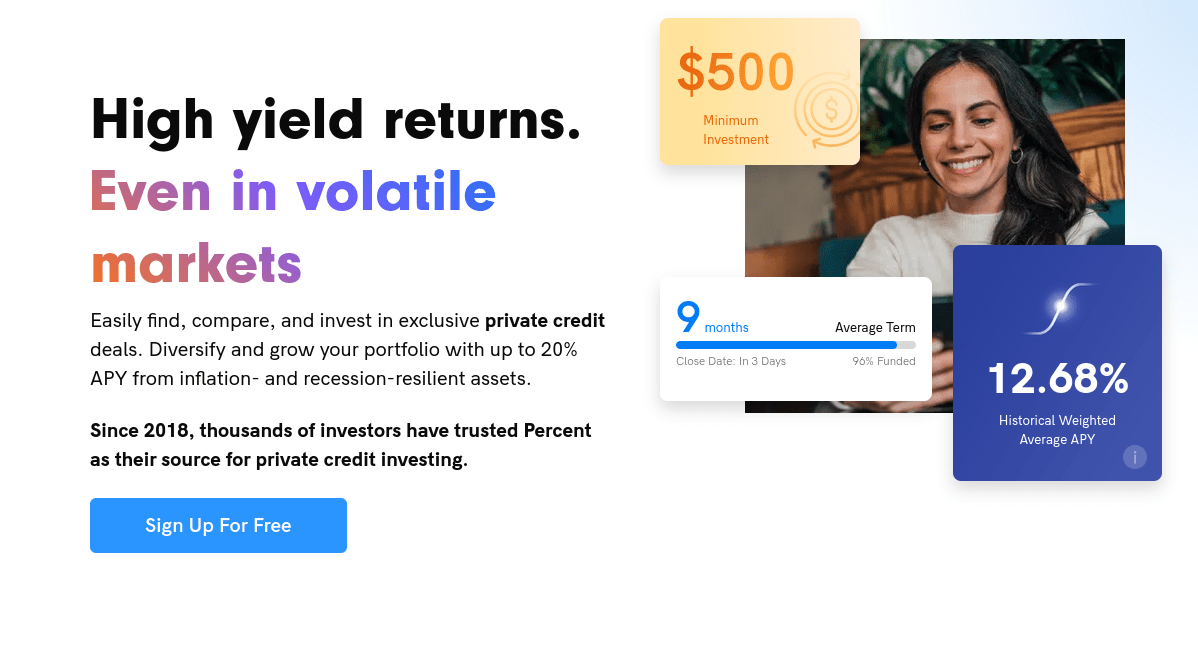

Thanks to pioneering platform Percent, private credit investments are now accessible to everyday accredited investors, with minimums starting at just $500.

One of the nice things about private credit investment is that it doesn’t have to lock you in for years and years. For example, in 2023, Percent’s average term length of an investment was 9 months; deals are typically 6 to 36 months.

The shorter investment term also diminishes interest rate risk. Here’s why. Interest rate risk involves the decline in the value of longer-term bonds when interest rates rise. As new bonds are issued with higher yields, the prices of existing bonds decrease. Bonds with shorter maturity dates are less susceptible to this risk.

Best Short Term Investments in 2025

1. Stocks

- Time period: Any

- Potential returns: Varies

- Who it’s good for: Investors with capital to spare

Stocks always show up on lists of the best investments, regardless of time horizon.

There’s a reason for that. Investing in stocks is something that can be tailored to just about any budget and risk tolerance. For instance, more risk-averse investors might choose to invest in blue-chip stocks. More aggressive investors might pursue day trading or swing trading.

The bottom line? Whether you want to invest short term or long term, it’s worth considering stocks as part of your strategy.

That leaves the important question: What stocks should you trade, and how do you trade them?

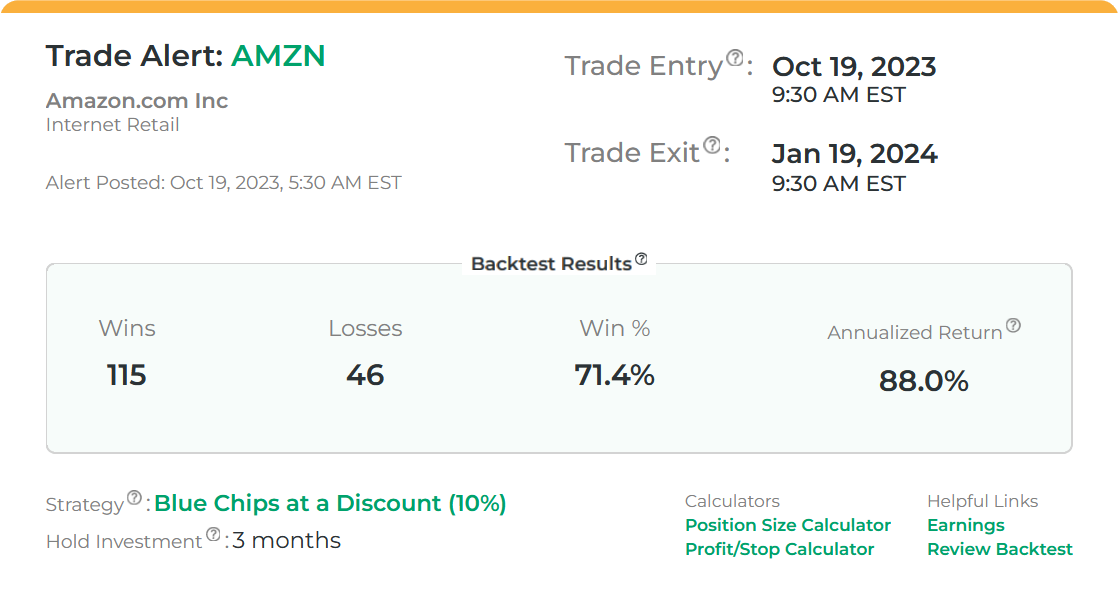

When it comes to locating high-quality picks, I strongly suggest subscribing to a high-quality stock-picking service. I don’t suggest blindly following what others tell you to trade, but services like this can help you identify high-potential stocks and shorten your research time.

If you ask me, one of the best services out there for investors with a short time horizon is Stock Market Guides, since the service allows you to customize your alert preferences based on things like strategy and time horizon. Regarding the latter, you can get trade ideas that last anywhere from 3 days to 1 year. Here’s an example of an alert:

You can opt to receive alerts by email or text, and they’re easy to understand — even for beginners. The process is simple: Stock Market Guides scans for potential trade setups, and when they find one, they send it to you.

But here’s what’s really special about the service: For every trade setup, Stock Market Guides shows you how the setup has performed in the past.

For instance, say you set up an alert for Apple (NASDAQ: AAPL) based on a breakout trading pattern. The alert will show you how many times the stock has exhibited the same price pattern in the past, and how it played out.

The fact that Stock Market Guides is just $69 a month, plus the flexible time horizon, makes it my top stock picking service for short-term traders. (See more of our favorite stock-picking services here)

But once you’ve located a high-potential stock, you need to buy shares, and for that you need a brokerage. My top pick, regardless of your time horizon? eToro.

eToro gives you zero-commission trading, a sleek modern UI, and options access (as long as you qualify). Plus, they offer a unique CopyTrader feature that lets you follow the trades of pros — one of the best ways for new and seasoned investors to learn from others and gain more insight into the trading process.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

2. Private Credit

- Time period: 1 month and up

- Potential returns: 5%–15%

- Who it’s good for: People with a higher risk tolerance

Here’s a short-term investment option you may not have considered: Private credit. Investing in private credit involves lending money directly to private companies that aren’t listed on exchanges and don’t have access to public bond markets. (Want to know more? Check out this post: What is Private Credit?)

Basically, investing in private credit is lending money to a business in hopes that it will succeed and pay you back with interest.

Fundamentally, It’s no different than buying stock in a publicly traded company, except the company you’re investing in is not publicly traded.

In my opinion, Percent is by far the best way to get into private credit investing for people who have never been featured in Forbes.

The company’s platform makes private credit investing as easy as any traditional brokerage. Even better is that Percent offers investment horizons as low as one month, so you should be able to find an opportunity that meets your needs without much difficulty.

Unlike some private credit investing companies, Percent offers low minimum investments of only $500, which makes it way more accessible to get started than most people think. They also remove a barrier to entry by offering an innovative diversified product called Percent Blended Notes (PBNs), which simplifies the investment process by allowing you to easily invest in a variety of diversified, high-yield opportunities at once.

Here’s an important note: Percent is only available to accredited investors at this time. Want to learn more? Check out our article about the best investments for accredited investors.

3. High Yield Cash or Savings Account

- Time period: Any

- Potential returns: 3%–5%

- Who it’s good for: Investors with a 6 to 12-month horizon

If safety and security are the name of the game for you, a high-yield savings account (HYSA) is one of the best high-yield short-term investments you can make. It’s my pick for the best 1-year investment on this list.

What’s a high-yield savings account? It’s like a savings account on steroids, and that added brawn is APY.

Where the average savings account offers about 0.55% APY, high-yield savings accounts deliver higher returns — in the current market, you can easily find accounts with 4% APY or higher.

While it’s technically not a HYSA, I’m a big fan of Public’s High Yield Cash Account. It looks and acts a lot like a HYSA, but the key difference is that your cash isn’t kept in a single bank — it’s swept to Public’s partner banks. However, your account IS still eligible for FDIC insurance, and you can withdraw at will.

Currently, Public’s High Yield Cash account offers 4.1% APY. That’s pretty good, but what’s even better is that Public also offers a lot of other short-term assets to invest in, all in a single platform — bonds, T-Bills, stocks, and crypto, to name a few. This makes Public’s high-yield cash account a bit more like a Cash Management Account (CMA) since you can invest and save all within a single account.

This makes it easy to diversify your short-term investments, or invest in a mix of different assets (for instance, I maintain some long-term positions in stocks on Public, but I also invest in some shorter-term assets like T-bills.)

4. Short-Term Bond Funds

- Time period: Varies

- Potential returns: 1%–4%

- Who it’s good for: Investors with low risk tolerance

Another one of the best short-term investment options is putting your money in a short-term bond fund.

Bond funds are mutual funds or exchange-traded funds (ETFs) that hold bonds and debt securities instead of stocks. If you’re familiar with stock ETFs — like NYSEARCA: SPY or NASDAQ: QQQ — then you already know how bond funds work.

One point of confusion I see many people get stuck on is that the “short-term” in the phrase “short-term bond fund” does not mean that the investment is short-term. Short-term bond funds hold bonds with shorter maturity periods, typically between one and five years.

With that said, short-term bond funds happen to make excellent, safe short term investments. Bond funds have way less volatility than funds built with stocks, which means you don’t have to worry as much about being at a loss in the near term.

To invest in short-term bond funds, you have a few options.

First, you can buy bond fund ETFs, which are available on the stock market. If that option appeals to you, I suggest eToro for short-term bond funds due to its simple user interface and low commissions.

Another option? Buy into a pre-built bond fund on Public, which recently introduced a high-yield bond account. Currently, yields are impressive — 6.89% as of January 2025.

Here’s how the Bond Account works on Public:

- Fund your account. From here, your deposit will automatically be invested in a portfolio of 10 investment-grade and high-yield corporate bonds.

- Get monthly payments. Public’s Bond Account generates a monthly yield. When your income reaches $1,000, it’s automatically reinvested.

- Hold, or don’t. If you hold to the maturity date, you’ll receive the highest yield; however, you can withdraw early.

One small thing you should know? A Bond Account does carry a $3.99 monthly fee on Public unless you upgrade your account.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

5. Certificates of Deposit (CDs)

Time period: 1, 3, 6, or 12 months

Potential returns: 3%–5.5% (but varies)

Who it’s good for: Investors who want guaranteed returns

If you’re looking for an extremely safe short term investment option, it’s hard to beat CDs. They have known returns, are backed by the FDIC, and usually have slightly higher returns than savings accounts.

Most banks offer 1-month, 3-month, 6-month, and 12-month CDs, with the longer-term options sometimes coming with marginally higher rates, depending on how interest rates are expected to change. Keep in mind that CD returns fluctuate with interest rates. Since rates are still decent on CDs right now, I still consider them one of the best ways to invest money short term.

Important: Some CDs come with penalties if you need to take your money out before the maturity date. If you know for sure you won’t need your money before the maturity date, that’s fine, otherwise, look for no-penalty CDs at a trusted financial institution like CIT Bank.

6. U.S. Government Treasury Bills

Time period: 4, 8, 13, 17, 26, and 52 weeks

Potential returns: 3%–5%

Who it’s good for: Investors with low risk tolerance

Treasury Bills (T-bills) are one of the best investments for short term yields. They have virtually no risk because if the U.S. government can’t pay, you and I have bigger problems to worry about than our investments, like which post-apocalyptic tribe we want to join.

Seriously though, T-Bills are perfect for people who need a place to park their money for a few months. The returns are modest — typically a few percent — but the interest you earn is exempt from state and local income taxes, which gives T-bills a slight edge over other safe short term investments.

The easiest way to purchase T-bills is directly from the Treasury through the aptly-named website TreasuryDirect. The minimum purchase for T-bills is $100, and you can purchase in increments of $100.

But I’ll be real with you: The TreasuryDirect website is a pain in the butt.

That’s why I have a monthly recurring Treasury Account buy on Public.com, where you can invest in T-bills in increments of $100 and they’ll automatically roll over at maturity until you decide to cash in your investments.

7. Peer-to-Peer Lending

Time period: 6 or 12 months (but it varies)

Potential returns: 5%–12%

Who it’s good for: Investors with modest capital looking for higher returns

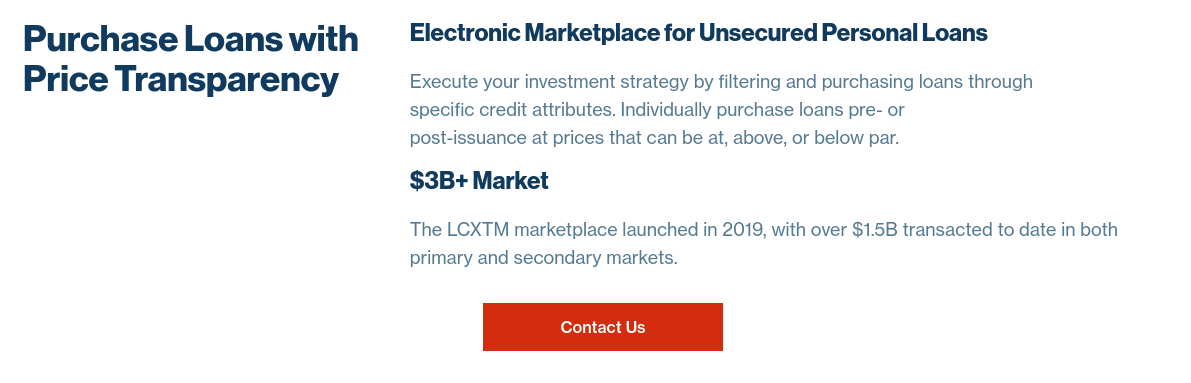

If you like the sound of private credit investing but don’t want to go through an asset management firm, peer-to-peer lending might be for you.

Peer-to-peer (P2P) lending bypasses the middleman and directly connects individual investors with borrowers. The minimum investment requirement is usually much lower, which benefits both the lender and the borrower.

In my opinion, P2P lending is the best 6-month investment you can make, assuming you can find a borrower with a 6-month time horizon. These opportunities aren’t as scarce as you might think, and they can really boost your returns if you find the right opportunity.

LendingClub is one of the best online resources for finding and investing in P2P lending opportunities, for my money.

If you decide to check out LendingClub and get into P2P lending, keep in mind that you’re taking on more risk than most of the other short term investments on this list.

8. Options Trading

- Time period: Varies

- Potential returns: Varies

- Who it’s good for: Risk-tolerant investors who have taken the time to learn how options trading works

While I dipped my toe into “riskier” investments on this list with stocks and private credit, I’ve mainly kept things safe. Now, I’m going to introduce two higher-risk, but potentially higher-reward, methods of short-term investing.

The first is options trading, which can be carried out using just about any time horizon — some people even day trade options, attempting to benefit from short-term fluctuations that could potentially lead to profits. (Not sure what options trading is? Our post on options trading strategies for income should bring you up to speed.)

There are a number of reasons why short-term options trading might appeal to risk-tolerant investors:

- Leverage: As an options day trader, you can use borrowed funds from your broker to take on larger trading positions than your available capital might permit. This means you can trade larger amounts of an asset while making a smaller upfront investment. Leverage can help you take advantage of fast fluctuations in the market.

- Lower capital requirements than stocks: Investing in stocks requires a higher initial investment, where options allow you to take control over larger positions.

- Flexibility: Options trading offers day traders a broader array of strategies to address market dynamics such as volatility and time decay. Given the fast-paced nature of day trading, this flexibility makes options an ideal choice for quickly seizing profit opportunities.

But options trading can be risky, so I strongly suggest that you arm yourself with the right resources to help increase your chances of success.

First up, check out an options trading course to get familiar with common strategies and the lay of the land. One of the best (and most affordable!) courses I’ve come across is called “Selling Options for Income.” In this detailed ecourse, you’ll learn the rules of the game so you can start selling options the right way. (For a preview, you can also score the instructor’s free options trading checklists here.)

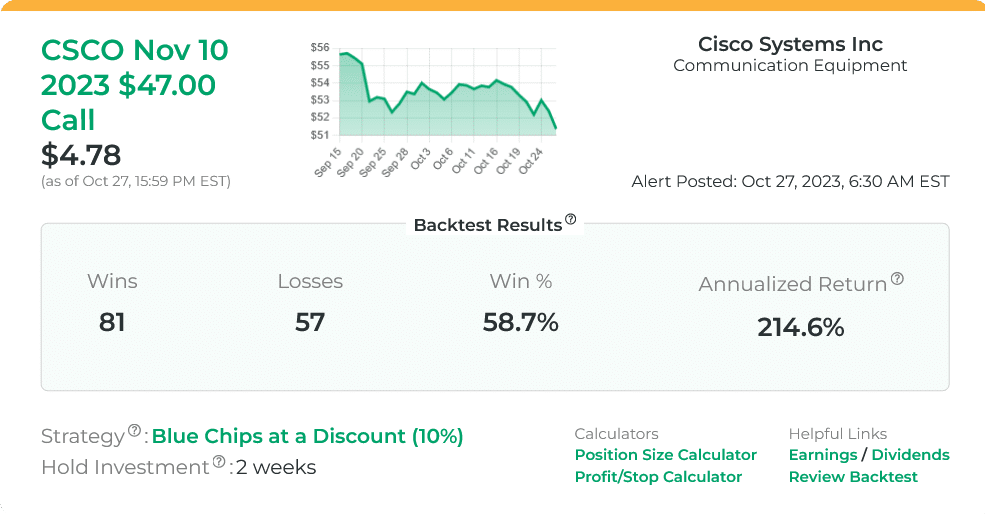

To really uplevel your options trading, I strongly suggest investing in an options alert service. One of the best is actually offered by the same stock-picking service I recommended in #1 above — Stock Market Guides. Like the stock alert service, SMG’s options alerts costs $69 per month.

On a per-alert basis, Stock Market Guides’ pricing is very competitive. If you don’t fine-tune the filters on their scanner, you might receive 40 or more alerts per month — a little over $1 per alert.

In terms of the alerts themselves, they’re simple and actionable. They show you the exact call option to buy, including the expiration date and strike price and how long the trade is to be held. Here’s an example:

But if you want to focus on a specific strategy or filter down your alerts based on specific preferences, you can. For example, you can only receive alerts within a certain price range, or a certain suggested hold time.

9. Crypto

Cryptos have been referred to as “digital gold” — perhaps because they have the potential to deliver glittering gains. But keep this in mind: Just as it is possible to win with crypto, it’s just as possible that you’ll lose everything.

If you do choose to invest in crypto, you’ll need a few things:

- An education. Courses like Udemy’s Blockchain and Bitcoin Fundamentals and Cryptocurrency Fundamentals are a good starting point.

- A solid broker. I like eToro because it provides a comprehensive crypto trading experience, on a powerful yet user-friendly platform. You can also invest in other assets like stocks on the platform.

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

What is a Short Term Investment?

Just for a sec, let’s talk about what “short term” means.

Everyone has a slightly different definition of what counts as a short term investment, but I like to keep things simple. If I expect an investment to yield returns within one year, it’s a short term investment. That’s it.

You’ll often see much lower risk in short term investments since short term investors are often looking to preserve capital (read: fight inflation) rather than pursue aggressive growth.

That doesn’t mean that short term investments can’t offer respectable returns. I just mean that they should play a different role in your broader investment strategy.

Final Word: High Yield Short-Term Investments

High-yield short-term investments might sound like the holy grail of investing, but they’re actually easier to find than most people think. If you’re just interested in chasing the highest yields, I think you’ll have the most success looking into HYSAs, private credit, and peer-to-peer lending opportunities.

If you’re a bit more risk averse, you can’t go wrong with a good old high-yield cash account or T-bills (both available on Public, btw).

FAQs:

What are high yield short term investments?

High yield short term investments offer returns between 3.5% and 6% on time frames no longer than one year. Some short term investments can return more than 10%, but these are far from the norm and require more capital and risk tolerance than the average investor has.

What is the best short term investment to make money?

It depends on your goals, but T-bills or a HYSA are your best options over 3- to 12-month time horizons. Both offer virtually zero-risk and can return between 3% and 5% depending on the current interest rate environment.

What is good to invest in short term?

Any financial vehicle can be the right option short term, depending on your goals. Traditional securities like CDs, T-bills, and bond funds fit most short-term investors’ goals, but stocks, private credit, and HYSAs can also be great options.

Where to invest $10,000 for 3 months?

The answer is “it depends,” but I would consider a HYSA or T-bills if I couldn’t afford to take any losses. If I wanted to maximize growth, I’d look at putting it in stocks or a short-term peer-to-peer lending opportunity.

Where to invest $10,000 for 6 months?

Some options include T-bills, high-yield savings accounts, and CDs. Six-month CDs often have great rates in high-interest rate environments like the one we’re in now. More speculative investors might consider putting money in the stock market or a cash management account and splitting it between a broad market ETF and cash.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.