Day trading is a complex job. The right day trading setup is crucial so that you can:

- Monitor multiple charts

- Watch indicators

- Keep an eye out for fresh news

All while making lightning-speed decisions throughout the trading day.

The only way to do it every day without messing up? Make sure your work environment and trading computer setup and tools are top-notch.

Whether you’re building your first stock set up or updating an existing stock market computer setup, I’ll show you what pro traders use to help them stay at the top of their game.

Special Offer: Moomoo x WSZ

We have partnered with moomoo, one of the top trading brokerages in 2025.

On moomoo, you can:

- Trade stocks, ETFs, and options commission-free

- Access moomoo’s Earnings Calendar and Earnings Hub

- Get real-time Level 2 market data for free

Plus, our readers can get up to 20 free stocks using the link below:

Keep reading for a comprehensive list of day trading setup recommendations, complete with costs and suggestions for how to prioritize so you can stay on budget.

The Best Trading Computer Setup:

You can’t find the highest probability trading setups without the right day trading setup.

Day trading is complex, but a great stock market computer setup can help make the complex job of day trading easier.

Here are some elements that can help improve your focus, which can potentially lead to better returns:

At a Glance: The Perfect Day Trading Setup

- Best trading computers: Gladiator X14 EZ Trading Computer

- Best trading monitor: Dell Ultrasharp U2419H 24-inch monitor

- Best trading desk: MAIDeSITe adjustable standing desk

- Best trading chair: Mimoglad office chair

- Best trading keyboard: Lovaky MK98 wireless ergonomic keyboard

- Best trading mouse: Logitech M510 Wireless computer mouse

- Best UPS for traders: APC UPS 1500VA UPS battery backup and surge protector

- Best lighting for traders: SYLVANIA LED TruWave Natural Series A19

- Best brokerage for crypto: eToro*

- Best brokerage advanced traders: TradeStation

- Best charting software: TradingView Pro+

- Best overall day trading course: Investors Underground

- Real-time news: Benzinga Pro

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

1. Day Trading Computer

Your day trading computer setup is the foundation from which everything else should be built.

Choose a desktop or laptop that meets these criteria:

- A high-performance processor (Intel i7 or AMD Ryzen 7)

- At least 16GB of RAM

- A reliable solid-state drive (SSD) for lightning-fast operations

This combination will ensure seamless multitasking, allowing you to analyze data and execute trades without missing a beat.

Pro tip: Opt for an average graphics card. It’s much easier to focus on trading without being tempted by new video games!

Recommendation: The Gladiator X14 EZ Trading Computer.

Cost: $3,299 (get $200 off and get upgraded RAM and SSD with the links above)

For more options, check out our recommendations for great day trading computer setups in varying price tiers!

2. Monitor(s)

For day traders, screen real estate is essential.

Multiple monitors allow you to display various charts, watchlists, and news feeds simultaneously — which you should do because day trading is all about processing information quickly and putting it to use.

Consider starting with two to four high-resolution monitors (24-27 inches) with thin bezels to minimize visual distractions.

As you gain experience, you may want to expand your setup to include even more screens. For example…

- One screen for a chart and indicators

- One for a news feed

- One for your trade journal

- One for your brokerage account

Recommendation: Dell Ultrasharp U2419H 24-inch Monitor. With its thin bezel, 1920×1080 resolution, and 60Hz refresh rate, the Dell Ultrasharp U2419H is a solid choice for traders seeking a budget-friendly option.

Cost: $130 to $250

The BEST multi-screen setup…

- Top-notch charts: TradingView

- Real-time news: Benzinga Pro

- Trading ecourses + community: Investors Underground

- Brokerage: TradeStation

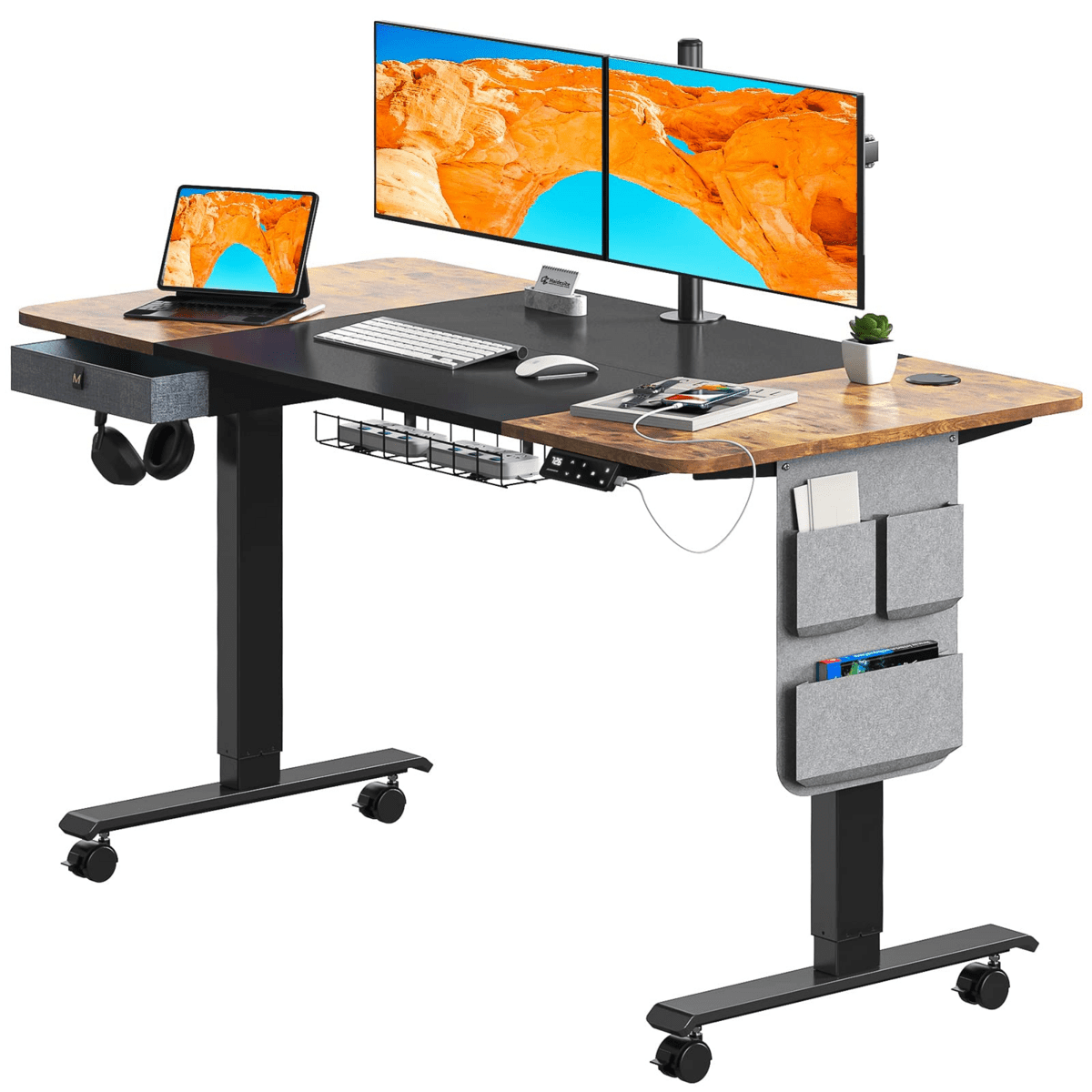

3. Desk

An ample desk is a key part of your trading computer setup. It should be large enough to fit your computer, monitors, and other peripherals comfortably. Plus, there should be enough space between your eyes and your screens so you don’t get a headache after hours of work.

I find that sitting for hours on end makes me tired, less focused, and hurts my back. That’s why I prefer an adjustable-height standing desk.

It’s the best of both worlds, allowing you to alternate between sitting and standing throughout the day. Some studies show that standing desks increase productivity by 65% or even more, so don’t take this advice lightly!

Recommendation: MAIDeSITe adjustable standing desk. Sizable enough to fit two to four large screens, this 55” by 47.3” table has a command console that allows you to adjust its height with a simple push of a button.

If a standing desk isn’t for you, consider a cheaper sitting variant like the Elephance L-shaped desk—this option gives you more space for computer screens and other accessories.

Cost: $200 to $400

4. Other Day Trading Setup Must-Haves

Consider adding some of these essentials to your day trading setup:

1. Ergonomic Chair

As a trader, you’ll probably be sitting for long periods. Make it as comfortable as possible — invest in a chair with lumbar support, adjustable height, and a reclining function to maintain proper posture during long trading sessions.

Recommendation: Mimoglad office chair with adjustable lumbar support.

Cost: $190

2. Keyboard and Mouse

A comfortable and responsive keyboard and mouse setup can make a significant difference in your productivity. My suggestion? Opt for wireless devices to reduce clutter (but be sure to have a few extra batteries in stock just in case).

Recommendation: Lovaky MK98 wireless ergonomic keyboard and Logitech M510 Wireless computer mouse.

Cost: $18 and $23, respectively

3. High-Speed Internet

A reliable, fast internet connection is crucial to execute trades promptly and receive real-time market data. Consider using a high-speed ethernet cable for extra oomph.

Cost: Approximately $60 per month

4. Uninterruptible Power Supply (UPS)

A UPS can protect your equipment from power surges and provide backup power during outages, ensuring you never get stuck with a hot potato or miss an opportunity.

Recommendation: APC UPS 1500VA UPS Battery Backup and Surge Protector.

Cost: $170

5. Natural-Light LED Bulbs

When there’s not enough natural light in the space where I trade, I invest in natural light LED bulbs. I find that they help me feel awake, comfortable, and undistracted.

Recommendation: SYLVANIA LED TruWave Natural Series A19 dimmable light bulb.

Cost: $13 per 6-pack

5. Day Trading Brokerage

Here’s a sneaky section about brokers — know why?

Because even the best desk and lighting can’t compare to the benefits of a great broker.

Your trading platform is the heart of every day trading setup, so make sure to choose the very best. Here are two top picks:

1. eToro – Best for New Traders

eToro has free trading, crypto, a fast platform, and a variety of financial instruments. That’s great, but here’s what really sets eToro apart…

eToro has copy trading seamlessly integrated with its intuitive trading platform. Here’s what it does:

- Lets you follow and analyze the moves of veteran traders.

- Copy their trades by simply subscribing to them or manually pushing the “copy” button.

- Plus, the phone app is so intuitive and smooth that you can easily copy trade and manage your positions when you’re AFK.

Cost: $50 USD for US and UK users, $200 USD for Copy trading

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

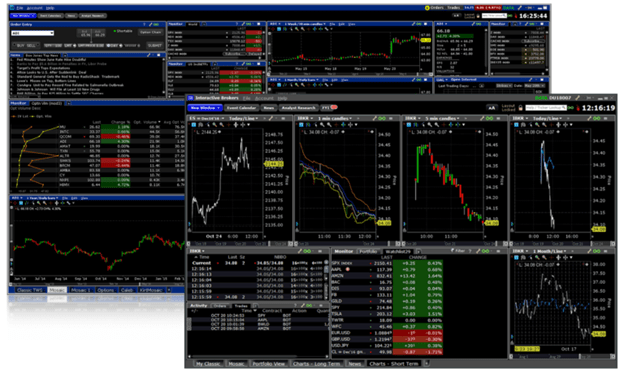

2. TradeStation – Best for Advanced Traders

TradeStation is all about pure power.

TradeStation isn’t meant for beginners. It was designed for serious day traders who want every advanced feature and analysis tool in a neatly-designed and customizable package.

Not only does it give you access to a variety of tools, but it also offers a huge variety of tradable assets and access to international markets.

In summary, eToro is more beginner-oriented, whereas TradeStation is more for advanced traders who want powerful technical analysis and various alternative investment options.

Cost: $0 minimum deposit

6. Charting Software

Reliable charting software is indispensable for day traders. It’s the lens through which you see the markets. Here’s what to look for in a platform:

- A user-friendly interface

- Real-time data

- Customizable charts

- A wide range of technical indicators

A lot of these features can be found for free, but paid subscriptions will generally get you more features and data.

Recommendation: I recommend trying the free version of TradingView because it has almost every financial asset and technical indicator known to man.

If you want more power, consider transitioning to the paid version — TradingView Pro+ can run multiple charts and indicators simultaneously, and allows you to backtest strategies like a pro.

Cost: $0 to $17.95 per month

7. Trading Courses

Trading courses (and their prices) vary from very basic to comprehensive college-level.

If you want to invest in your knowledge, here is one of the best top trading courses you should check out:

Investors Underground – Best Overall Day Trading Course

If you want to take your trading game to a professional level, Investors Underground can take you there.

The lessons start fairly simple, but become more complex at a very pleasant pace.

- The basic course is cheaper and non-interactive.

- Advanced trading courses come with live mentorship and access to a community where traders share their experiences and insights.

The premium option is expensive, but well worth the money if you want to get top-level education and one-on-one guidance from experts in a very student-friendly package.

Cost: $297/month, $697/quarter, or $1,897/year

8. Other Tools

Supplement your day trading setup with these additional tools:

- News feeds: Real-time news sources like Benzinga Pro can help you stay up-to-date on market-moving events.

- Research and analytics: If you want a constant stream of deep dives into financial micro and macro analysis, consider subscribing to a top-level research provider like Morningstar.

- Trade journal: Document your trades and review your performance to learn from your successes and mistakes. This can simply be a custom MS Excel file.

- Stock scanners: Customizable stock scanners like Finviz can help you identify potential opportunities based on your specific criteria.

Cost: Each of these subscriptions costs approximately $20 to $30 per month.

Tools every trader can use

- Real-time news: Benzinga Pro

- Micro and macro financial analysis: Morningstar

- Customizable stock scanner: Finviz

Prioritize Your Day Trading Setup

OK, so to buy all of the items on this list, you’d need anywhere from $1,700 to $4,500 (plus subscriptions).

That’s a lot. So if you need to prioritize, here’s my suggestion:

- Get the things you can’t trade without: a broker, a good computer, and a serious internet connection.

- Get the things that will make your life easy: In my opinion, multiple screens and a standing desk make trading sustainable because they make the whole process easy on your eyes, brain, and body.

- Invest in your knowledge: Apply for courses. Subscribe to reputable news and research sources. With all of the above, you are fully equipped — this is what a pro trader’s setup should look like.

- Treat yourself! You can always get a better mouse, keyboard, and other accessories down the line — they’re nice, but not crucial.

A recap of the above recommendations:

- Best trading computers: Gladiator X14 EZ Trading Computer

- Best trading monitor: Dell Ultrasharp U2419H 24-inch monitor

- Best trading desk: MAIDeSITe adjustable standing desk

- Best trading chair: Mimoglad office chair

- Best trading keyboard: Lovaky MK98 wireless ergonomic keyboard

- Best trading mouse: Logitech M510 Wireless computer mouse

- Best UPS for traders: APC UPS 1500VA UPS battery backup and surge protector

- Best lighting for traders: SYLVANIA LED TruWave Natural Series A19

- Best brokerage for crypto: eToro

- Best brokerage advanced traders: TradeStation

- Best charting software: TradingView Pro+

- Best overall day trading course: Investors Underground

Final Word: Day Trading Setup

Day trading is a very demanding job. But it’s not just about the highest probability trading setups. It’s about preserving your emotional, intellectual, and physical capital.

Not only can the right stock market trading setup improve your productivity and trading results, but your overall well-being. Think of it as a low-risk, high-reward long-term investment that works in every market environment.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. Securities are offered through Moomoo Financial Inc., Member FINRA/SIPC. The creator is a paid influencer and is not affiliated with Moomoo Financial Inc. (MFI), Moomoo Technologies Inc. (MTI) or any other affiliate. The experiences of the influencer may not be representative of the experiences of other moomoo users. Any comments or opinions provided are their own and not necessarily the views of MFI, MTI or moomoo. Moomoo and its affiliates do not endorse any strategies that may be discussed or promoted herein and are not responsible for any services provided by the influencer. This advertisement is for informational and educational purposes only and is not investment advice or a recommendation of a security or to engage in any investment strategy. Investing involves risk and the potential to lose principal. Investment and financial decisions should be made based on your specific financial needs, objectives, goals, time horizon and risk tolerance. Any images shown are strictly for illustrative purposes. Past performance does not guarantee future results. U.S. residents trading in U.S. securities may trade commission-free using the moomoo app through Moomoo Financial Inc. (MFI). Please see our pricing page for other fees. Level 2 data is free to moomoo users that have an approved MFI brokerage account. Trading during Extended Hours Trading Sessions carries unique risks, such as greater price volatility, lower liquidity, wider bid/ask spreads, and less market visibility, and may not be appropriate for all investors.

FAQs:

What is a good setup for day trading?

A good day trading setup includes a powerful computer or laptop, high-resolution monitor or monitors, ergonomic desk and chair, reliable charting software, high-speed internet connection, and access to real-time news feeds and stock scanners.

How much money do you need to day trade?

The minimum amount to day trade with a margin account is $25,000, as mandated by FINRA — traders can only make 4 day trades per week if they don’t meet this requirement.

How much do day traders make a day?

According to a study involving the Taiwan Stock Exchange, the top 1% of day traders generated returns of around 0.47% per day. The same study suggests that only around 17% of traders are profitable and that the average daily return of all day traders is -0.14%.

What is the 5 3 1 rule in trading?

The 5-3-1 trading rule is a guideline for position sizing and risk management. It suggests that traders should not risk more than 5% of their account on a single trade, more than 3% on a single day, and more than 1% on a single loss.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.