Getting a leg up on the other traders by being active in the early hours might seem appealing — the early bird gets the worm, so to speak.

Here’s the thing: premarket trading works a little differently than trading during market hours. It can be risky. So before you dive in, a little education is key.

In this article, I’ll explain everything you need to know: what does pre market mean? What are the benefits of pre-market trading? Is trading on pre market activity worth the risks … and what are those risks, anyway?

Let’s get into it…

Our top broker for premarket trading…

moomoo. Hands down. Here are just a few reasons why:

- Robust premarket trading hours offered — 4 to 9:30 a.m. in the U.S., and 24 hours a day, 5 days a week, for Singapore and Australia customers

- Low premarket fees: $0.99/order for most U.S. stocks.

- Level 2 NYSE market data for ALL users — often a paid feature with other brokerages

- Plus, you can get FREE stocks just for signing up with moomoo! Terms and conditions apply.

What is Premarket Trading?

The bottom line: Premarket trading enables investors to trade before the market officially opens.

Generally, while most activity happens within regular hours between 09:30 AM EST, and 04:00 PM EST, you could start trading as early as 04:00 AM (though 08:00 AM is considered the “regular” premarket).

This can enable you to better react to news and events when the market isn’t officially open but has several drawbacks including very limited liquidity and significantly higher spread.

At-a-Glance: Best Brokers for Premarket Trading

Broker | Premarket trading hours | Premarket trading restrictions? |

|---|---|---|

04:00-09:30 AM (for US customers)24/5 (for Singapore and Australia customers) |

| |

07:00-09:30 AM24/5 for certain assets |

| |

08:00-09:30 AM |

| |

n/a in the US |

* Despite this fact, we strongly recommend eToro. In the article, you’ll find out why! |

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

How Does Premarket Trading Work?

Traditionally, premarket trading has been available to a rather select group of very rich and institutional investors.

The internet has changed that.

In recent years, individual investors have gained access to extended-hours trading, both before the market opens and after the market is officially closed. (Can I trade options after hours?)

Transactions in pre-market trading hours are usually processed through private systems known as electronic communication networks (ECNs). Perhaps the most recognizable of these is NYSE Arca.

While ECNs enable brokers to effectively match buyers and sellers, they have some limitations you should be aware of:

- Generally, whenever you are trying to move assets in pre-market trading hours, you are generally limited to limit orders.

- Additionally, you should be mindful that not all brokers offer premarket trading.

There are a few more risks we’ll discuss later, too. But moving on with the basics…

What Does Pre Market Mean?

Pre-market refers to the period where trading is available through certain brokers while the market is officially closed. (Regular stock market hours, barring holidays and weekends, are 9:30 a.m. to 4 p.m. Eastern.)

So, what does pre market mean? It refers to the hours before the stock market is officially open.

Traditionally, premarket trading starts at 8 AM, but the exact hour is generally dictated by individual platforms and activity can begin as early as 4 AM.

Pre-market vs. After-Hours

The key difference between pre-market and after-hours? Their names give it away: Pre-market refers to trading before the market officially opens at 9:30 AM, while after-hours trading happens after the close (often until 8 p.m.).

Both pre-market and after-hours trading share some of the same benefits, like the ability to react to timely events.

Why Trade in the Premarket?

Moving beyond what does pre market mean … Why would you want to trade during off hours?

Just like the internet facilitated the emergence of pre-market trading hours, it also established a potential competitive edge in certain situations.

Considering that the world is very extensively and very immediately connected, news and actions from the other side of the globe can quickly affect your local markets.

Additionally, many companies prefer to publish key reports outside regular market hours. Both unexpectedly good and bad news can cause premature and violent swings and the logic is often “give the investors some time to think on things, and not act on shock alone.”

Therefore, trading on premarket activity can potentially help you get in on the action before other investors if the news is good, or try to mitigate the damage if it is bad.

Taking advantage of pre-market trading hours can also help you access the market if your daily schedule prevents you from being active during regular hours.

That said, everything that makes pre-market trading a good idea also sorta makes it a bad one. Let’s get into it…

Risks of Trading Premarket

This may sound counterintuitive…

But acting on news as soon as it happens can be a dangerous business. Results may ultimately be wildly different than what you might expect.

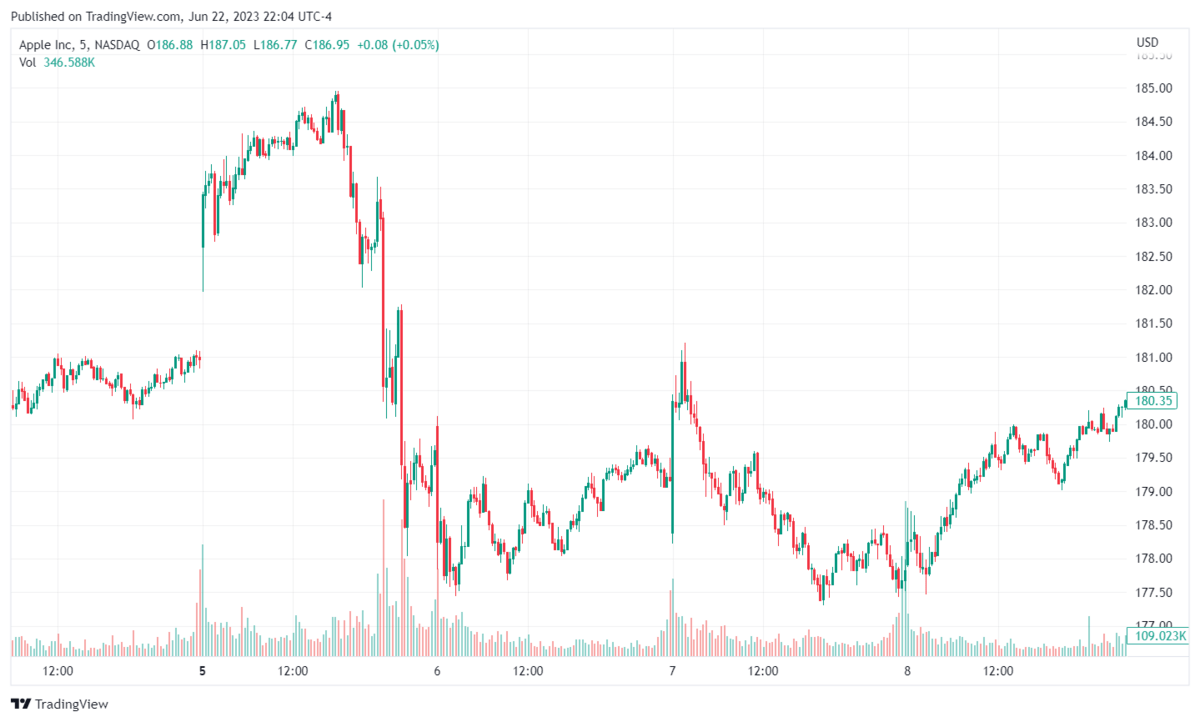

A recent example of things not going quite as expected was connected to Apple’s (NASDAQ: AAPL) much-anticipated announcements of Apple’s Vision Pro.

On the day of the announcement, the excitement pulled the stock price up by about 1% in the premarket and it rose as much as 2% in regular trading.

After the actual announcement was made just as the market closed, the effects were starkly different as the price of the rig was set significantly higher than expected.

The price action that ensued in the following few days with a marked drop before a renewed steady rise highlights pretty decently why the early bird doesn’t necessarily get the bird.

With that general gist out of the way, let’s take a look at what are some more specific drawbacks of pre-market trading that don’t boil down to the rather generic “market can be volatile and unpredictable sometimes.”

(Chart courtesy of TradingView)

Want to study past premarket moves?

The right charting software can help you learn from the past and prepare for the future.

Hands down, our top charting platform is TradingView. (And we’ve tested them all.)

TradingView’s comprehensive features, ease of use, extensive coverage, speed, reliability, and affordability (both free and low-cost membership tiers) make it our top pick for both new and experienced traders.

Can’t See Quotes

A big problem with trading in the premarket is that quotes often either aren’t visible at all or are only partially visible. This makes discerning the actual price you could expect when buying and selling very difficult.

This issue is further compounded by several other quirks of premarket trading.

Illiquid Market

While trading before the market is officially open can offer you a leg up, not everyone is active in the early hours of the dawn. In fact, most traders and investors aren’t.

As the pre-market has a significantly decreased volume compared to what you are likely used to and can be highly illiquid.

That being said, in case of major news, announcements, or other events, many investors might be very keen on getting the worm and some days can offer more than decent liquidity even in the very early hours.

Bigger Bid-Ask Spreads

The inability to see quotes combined with the general illiquidity can make the spreads between ask and bid prices very large.

This can, in turn, make it very difficult to get as good of a price while engaging in premarket trading as during regular market making the activity somewhat redundant.

Volatility

While volatility can happen at any hour to any asset, it can be particularly significant when trading premarket.

The fact that many of the trades can be based on fairly fresh news combined with the larger spreads, lower liquidity, and limited visibility also adds to the issues generally associated with price instability.

Large Price Swings

Volatility becomes an even bigger issue when you figure in the decreased liquidity. The fact that fewer trades are getting executed in premarket trading can turn price instability into a proper rollercoaster with very large and often unpredictable swings in both directions.

Stocks can often whipsaw rather harshly in premarket and after-hours trading dropping by double-digit percentiles before rising above the closing price only to collapse again within minutes.

Limited Order Types

Another way in which trading in the premarket is akin to trading with one hand tied behind your back is the fact that accepted order types are limited compared to the wealth of tools offered during regular hours.

Generally, whenever trading during premarket hours you can expect to only have access to limit orders which are set to execute a trade only at a certain price or better.

You’re Competing with the Pros

While trading is a highly competitive activity under all circumstances, the competition can get particularly tough in the premarket.

Many of the traders active in the early hours of the morning are part of major institutions and the chances are that they have access to significantly more information and a greater wealth of experience than the average individual investor.

Harder to Get Orders Executed

While you will almost always be able to buy or sell the desired asset during regular hours, failing to execute trades in the premarket is not uncommon.

The first cause of the issue can come from the limit orders themselves. As volatility is not only present in premarket trading but also compounded with greater price swings, it is very likely that the asset you wish to buy or sell simply never reaches the limit price you set.

Additionally, much like with regular online trading, your orders in the premarket might get delayed or even completely fail to execute due to unpredictable technical issues.

Knowledge is power! While premarket trading isn’t recommended for beginners, there are resources that can help speed up your learning curve. Here are just a few…

- Great courses to help you along the way from a beginner to an advanced trader: Udemy

- One of the best libraries of learning resources when it comes to trading: Investors Underground

- Best way to improve your trading skills through practice: eToro Demo Account

- Best charting tool to help you visualize just what is going on: TradingView

- And, you can also find more great courses right here.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Pros and Cons of Trading Premarket

Pros | Cons |

Enables you to trade when most competitors are asleep thus offering you a chance to get a leg up on them. | Since there are a lot fewer traders active in the premarket, it can be hard to find buyers/sellers. |

Enables you to act quickly on impactful news that breaks outside the regular trading hours. | Lowered liquidity often leads to heightened volatility and significant price swings which, while increasing risk on its own, is compounded by the fact that quotes generally are not visible. |

Offers you the opportunity to immediately trade on premarket earnings reports. | Limit orders are the only type generally available. |

Extends the time you can use to trade in any single day. | Most of the traders you’ll be competing with are professionals. |

4 Top Brokers for Premarket Trading

moomoo

- Overall rating: ⭐⭐⭐⭐⭐

- Premarket trading hours offered: 04:00-09:30 AM (for US customers). 24/5 for Singapore and Australia customers

- Commissions + fees: $0.99/Order for US stocks.

- Premarket restrictions? Moomoo’s 24/5 trading feature, while offering US stocks, is only available to users based in Australia and Singapore.

Moomoo is a standout broker. While its 24/5 trading is currently not available in the US, it still offers trading at the earliest possible premarket hour.

Additionally, Moomoo offers Level 2 NYSE market data which is usually reserved only for professional investors giving you an edge whenever you are trading.

As an added bonus, moomoo is currently offering FREE stocks to WSZ readers! Click the link below to find out more.

Robinhood

- Overall rating: ⭐⭐⭐⭐

- Premarket trading hours offered: 07:00-09:30 AM. 24/5 for certain stocks.

- Commissions + fees: $0

- Premarket restrictions? Certain securities are not available for fractional trading in the premarket.

Thanks to its accessibility, intuitive design, and zero fees, Robinhood is a very decent choice for individual investors seeking to take advantage of premarket trading.

Additionally, the platform recently rolled out a feature enabling its users to trade 24/5 effectively making assets available at almost every hour.

TradeStation

- Overall rating: ⭐⭐⭐⭐

- Premarket trading hours offered: 08:00-09:30 AM

- Commissions + fees: $0 (up to 10,000 shares in a single trade)

- Premarket restrictions? TradeStation does not impose any specific premarket restrictions, though the relatively short trading hours it offers before the opening set it back somewhat compared to its competitors.

TradeStation has earned its popularity thanks to its wealth and depth of features that extend into premarket trading for the most part.

Its only drawback compared to other popular options is the relatively short window it offers its users before the market is officially open.

eToro

- Overall rating: ⭐⭐⭐⭐

- Premarket trading hours offered: N/A

- Commissions + fees: $0

- Premarket restrictions? Investors can place orders in the premarket, but they will be executed only when the market officially opens.

eToro stands as proof that not all great brokers have to offer premarket trading. While you can place out-of-hours orders, be warned: they won’t be executed until the market opens, which may not be ideal for everyone.

That said, eToro has a bounty of other features that make it worth your while if you’re not a frequent premarket trader. Just a few of its selling points?

- Competitive pricing

- Exceptional user interface

- Unique features, like the ability to copy the trades of established, expert traders with their CopyTrader feature.

Overall, eToro is a solid pick for traders of all types and experience levels.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Should I Trade in the Premarket?

If you are a rookie investor, the common wisdom is that no, you should not trade in the premarket. The fact that liquidity is low, spreads are generally greater, quotes are not visible, and most of the competing traders are professionals make the activity very high-risk.

That being said, if you are a more experienced investor and willing to be careful and patient, premarket trading can offer significant benefits and help you not miss out on lucrative trades just because the market is officially closed.

Whether you choose to invest during market hours or outside of them…

You need to find the right stocks to trade.

WallStreetZen offers one of the top stock-picking services out there.

WallStreetZen’s Top Analysts is our most frequently visited page — here’s why:

Other stock-picking services constantly brag about their winning stock picks — but fail to mention when they’re wrong.

Instead of providing direct picks, we built a service that aggregates the research and recommendations from nearly 4,000 Wall Street analysts — then backtests their performance over multiple years.

See for yourself what WallStreetZen has to offer. Try it today

The Emergence of 24-Hour Trading

Recent years have brought another innovation that might completely remove the difference between pre-market and after-hours trading – 24-hour trading.

In recent months, several major brokers have rolled out this feature often described as 24/5 trading (since it is still only available on weekdays).

Of the two, Robinhood is offering the service to US-based customers and Moomoo to those in Australia and Singapore.

Since the ability to trade at any hour is very new for US stocks, its full impact is yet to be determined. It is, however, likely that many of the benefits of pre-market trading, and many of its drawbacks will be staples of all-hours trading.

Final Word:

Premarket trading can be a useful tool for investors. Among other things, it can help you take advantage of any major news and events.

However, it is important to always remember that trading on premarket activity is not always worth it, and not all overnight events are worth the risk.

Ultimately, you’ll have to decide whether trading in the early hours is worth it on a case-by-case basis, and remember that while all market activity carries risk, the premarket is rife with it.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. Securities are offered through Moomoo Financial Inc., Member FINRA/SIPC. The creator is a paid influencer and is not affiliated with Moomoo Financial Inc. (MFI), Moomoo Technologies Inc. (MTI) or any other affiliate. The experiences of the influencer may not be representative of the experiences of other moomoo users. Any comments or opinions provided are their own and not necessarily the views of MFI, MTI or moomoo. Moomoo and its affiliates do not endorse any strategies that may be discussed or promoted herein and are not responsible for any services provided by the influencer. This advertisement is for informational and educational purposes only and is not investment advice or a recommendation of a security or to engage in any investment strategy. Investing involves risk and the potential to lose principal. Investment and financial decisions should be made based on your specific financial needs, objectives, goals, time horizon and risk tolerance. Any images shown are strictly for illustrative purposes. Past performance does not guarantee future results. U.S. residents trading in U.S. securities may trade commission-free using the moomoo app through Moomoo Financial Inc. (MFI). Please see our pricing page for other fees. Level 2 data is free to moomoo users that have an approved MFI brokerage account. Trading during Extended Hours Trading Sessions carries unique risks, such as greater price volatility, lower liquidity, wider bid/ask spreads, and less market visibility, and may not be appropriate for all investors.

FAQs:

How does pre-market trading work?

Premarket trading entails brokers using electronic communication networks (ECNs) to match buyers and sellers at a time when the market is officially closed. Traditionally, pre-market trading is available between 8 AM and the market’s opening at 9:30 but it can start already at 4 AM. Generally, traders are restricted to limit orders at these hours.

Is it good to buy in premarket?

Buying in premarket can be good as it enables you to take advantage of earnings reports and news published before the official opening helping you to get ahead of the competition. However, low liquidity, high volatility, and order limitations make it very high risk and not recommended to beginners.

Can you buy stocks during pre-market?

Premarket trading offers investors the opportunity to buy and sell stocks before the market is officially opened at 9:30 AM, provided their broker has the feature enabled. It is, however, more risky than trading at regular hours and will generally restrict you to using only limit orders.

Does pre-market price matter?

Pre-market price is often used as a gauge for how a stock will perform on any given day. Additionally. its standing at the official opening of the market is likely to affect how investors interact with it.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.