Day trading success isn’t guaranteed. And it doesn’t happen overnight. To get to where you want to go, you’ll need plenty of experience — and the right day trading tools.

The right software can make a huge difference in your trajectory in your career as a day trader. But what are the best tools for active day traders?

In this article, I did the hard work for you. Here, you’ll find careful research on the best day trading software in 2025, from stock scanning software to charting software and beyond so that you can make more informed decisions and potentially maximize profits.

The Best Day Trading Platform for Beginners

The right day trading platform for you depends on your individual goals and trading style. We believe that moomoo is the best pick. Here’s why:

With its high customizability, access to professional-grade Level 2 NYSE market data, and zero-commission trading, moomoo is a great choice for both beginners and intermediate investors alike.

As an added bonus, you can get up to 20 free stocks when you create a new account on moomoo — plus, you can earn a staggering 8.1% APY on uninvested cash for a limited time. Terms and conditions apply.

The Short Version: The Best Day Trading Software, Tools, & Apps

If you only take one key lesson from this post, it’s this: The most important day trading tool you’ll need is a great online broker. Our two top picks are moomoo and eToro.

moomoo is our top pick for beginners, thanks to a user-friendly platform, plenty of free day trading tools like free Level 2 Data, and of course, its excellent promo where you can get up to 20 stocks FREE when you set up your account.

eToro is also an excellent pick for established and advancing traders due to its low fees, a variety of tradable assets (including crypto), an excellent paper trading tool to help you learn the markets, and its unique CopyTrader tool, where you can mirror the positions of popular investors in real time.

But there are so many other great tools out there for day traders, including day trader apps and resources that can help you on your journey. In this article, we’ll dig into all of them.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Before You Trade: Essential Day Trading Tools

Before we begin our hunt for the best day trading software, there are some essential day trading tools you need…

Computer

A great computer is one of the best day trading tools at your disposal.

While some traders are content with a laptop, most serious day traders prefer a desktop computer for speed, versatility, and flexibility.

In the market for a new computer? My suggestion: invest in a Radical X13 EZ Trading Computer, which is hands down one of the best tools for day trading out there. The Intel Core Processor and upgraded RAM is powerful enough to keep up with even the most expert and active day traders.

Education

A little education can save you a lot of heartache when it comes to the high-stakes world of day trading.

Fortunately, you don’t have to go back to college to learn what you need to know.

Programs like Investors Underground cost significantly less than taking one class at a traditional college! And since IU has such a robust community of traders, it’s easy to get more help when you need it.

With Investors Underground, you can choose a per-course cost or pay for monthly access. Monthly access to 1000+ video lessons starts at $297/month or you can opt into a course structure that includes the Textbook Trading Course, Tandem Trader Course, Swing Trading Course for $1297 — no prerequisite courses needed!

Best Day Trading Software

Let’s take a look at some of the best day trading software…

Day Trading Platforms

Here are some of the best day trading platforms out there…

eToro – Best Overall

eToro is special because of its social trading features. For example, with its CopyTrader tool, you can find a “popular investor”, push COPY, and you will mirror their positions in real-time. It’s a great way to expand your portfolio in new directions without spending a ton of time researching.

Overall Rating: ⭐️⭐️⭐️⭐️

Available Assets: Stocks, ETFs, Cryptocurrency

Trading Hours: 24/7 Crypto Trading Hours, 9:30 – 1600 EST for Stocks & ETFs

Commissions and Fees (USA Only):

- No Commission on Stocks and ETFs

- 1% Fee for Buying or Selling Cryptocurrency

- Very Nominal Regulator Fees

Account Minimum: $100 USD

What’s great: The social trading feature definitely sets it apart from other trading brokers. I like the wide range of assets including Crypto and there are no commissions on stocks and ETFs.

What’s not so great: There are spread-based fees on cryptocurrency trades.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

moomoo – Best Broker for Beginners

Most don’t have a lot of time to spend learning how to use their chosen day trading tools. That’s why we like online apps that are ultra-user-friendly.

moomoo fits that criterion and is the leading reason I have highlighted it as the overall best software for day trading.

Overall Rating: ⭐️⭐️⭐️⭐️⭐️

Available Assets: 5,000+ Stocks, International Stock, ETFs, Options, Funds, & Futures

Trading Hours: Pre-Market, Market, & After-Market Hours Available

Commissions and Fees (USA Only):

- Commission-free Trading For ETFs, Funds, & Futures

- $0.99 Platform Fee Per Order for Stocks

- $0.65 Commission from $0.65 per Contract for US Stock Options Trading

Account Minimum: $0

What’s great: Beyond the user interface, the fees are minimal, there’s no account minimum, there’s a wide range of assets you can trade, and the trading hours are extensive.

What’s not so great: Though they offer real time stock analysis and have 63 + indicators, the research and analysis tools are limited compared to other platforms.

TradeStation – Best for Advanced Traders

For more seasoned traders, I suggest TradeStation. With more advanced features and analysis resources, it’s got the day trading tools you need to level up.

Overall Rating: ⭐️⭐️⭐️⭐️

Available Assets: Stocks, ETFs, Options, Futures, and Crypto

Trading Hours: Pre-Market & Market Hours Available

Commissions and Fees:

- (Crypto Only) .35%-.025% Depending on Trading Volume ($2 Minimum)

- Others- $0 Commission

- Small Transaction Fee per Contract (per Side)

Account Minimum: $0

What’s great: Customizable chart features, powerful trading tools, and advance order types. For those hoping to look deeper into the nuances in stocks, ETFs, options, futures and bonds behavior, TradeStation is a solid choice.

They also have a trading simulator you have access to when you open a TradeStation Brokerage or Analytics Software Subscription Account. This day trading tool allows you to invest unlimited “virtual pretend dollars” using real-time data to test your knowledge and day trading skills — an enormous benefit if you want to test out new strategies.

What’s not so great: This broker has a much higher learning curve. Outside of the simulator, it’s not ideal for beginners.

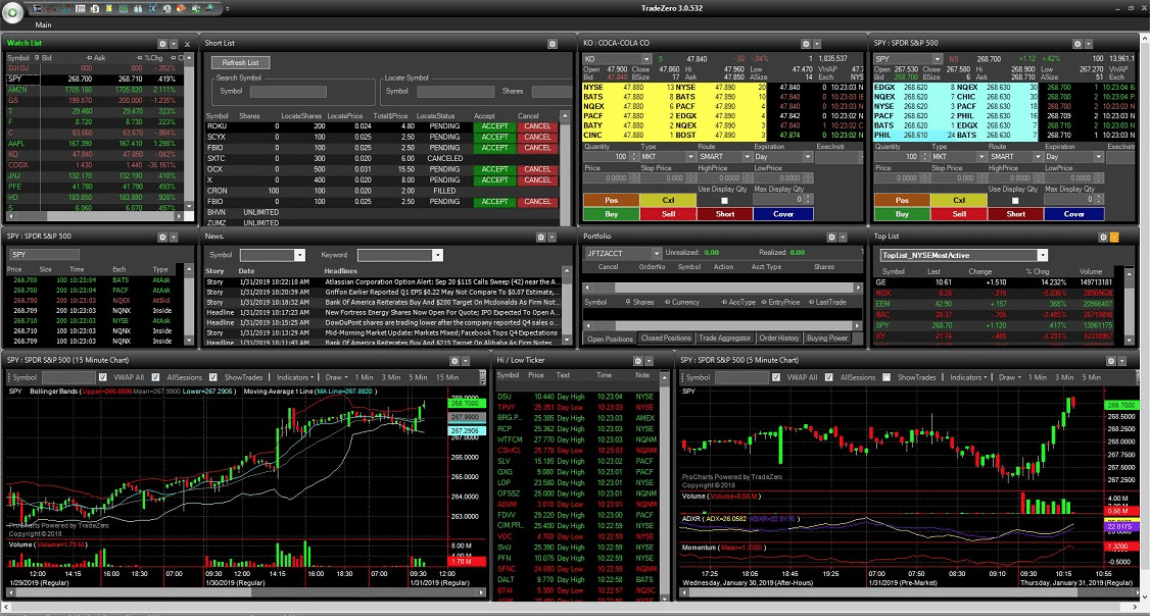

TradeZero – Best for Shorting

Interested in trying your hand at shorting stocks? This platform makes it easy.

Overall Rating: ⭐️⭐️⭐️

Available Assets: US Stocks, Options, & ETFs

Trading Hours: Pre-Market, Market, & After-Market Hours Available

Commissions and Fees:

- Commission-Free Trading on Stock Orders Greater Than 200 Shares

- Zero Pro $59/month (Free After 100k Shares)

- Annual Margin Debit Fees 9% + Overnight Borrow Fees (Market Rate)

- $.99 per Transaction Fee

- $5-$15/month per OTC Market Levels 1 & 2

Account minimum: $500

What’s great: TradeZero has the best short side trading tools I’ve seen and also has commission-free trading. The ZeroPro platform has advanced HotKeys, chart indicators, real-time news, breaking news alerts, customizable layouts, and more. They provide 6:1 day trading leverage and free limit orders.

What’s not so great: While the platform has access to over 14,000 stocks, it has limited asset options. The only available assets you can buy and sell are stocks, and there is a higher account minimum. Also, if you’re not familiar with shorting, this might be a more complex platform to get started with in the beginning.

Interested in learning more about shorting stocks? Check out our picks for the best broker for short selling.

Charting

Charting is a crucial tool for most day traders to decide when to enter and exit your position.

Hands down, one charting software app rises above the rest…

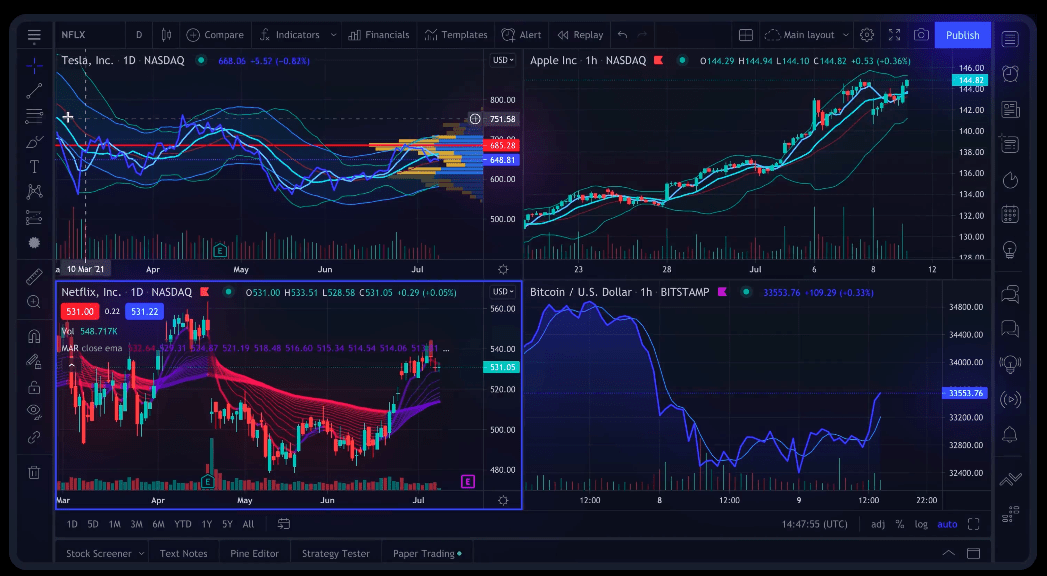

TradingView

TradingView offers powerful charting features that are accessible to beginners, but sturdy enough to satisfy active day traders.

In addition, they have an extensive library of technical analysis indicators and charting tools. I also love the collaboration aspects of this platform, which makes it easy to share, comment, and collaborate with other traders.

Rating: ⭐️⭐️⭐️⭐️

Cost: Free Account | Pro – $14.95, Pro + 29.95, Premium $59.95

What You Get: Real-Time Data, Comprehensive Library of Technical Indicators, Charting Tools

What’s great: This powerful charting software has what you need to analyze stocks from every angle. You can save chart layouts, set price alerts, and even customize your alerts and indicators based on strategies. The data is extensive, with 20k data bars on their charts and up to 25 indicators per chart. I also like the active online community and collaboration tools.

The free account shows how the market is doing and is perfect for those beginning their day trading career. I like that there is a free 30-day trial for paid plans to help you decide if the extra features are worth it for you.

What’s not so great: The free plan is extremely limited

Premium Day Trading Tools

Looking to enhance your edge? Consider Benzinga Pro.

For those who need premium, real-time news alerts, 1:1 training and help, as well as a wide variety of data and analysis tools, Benzinga Pro is a great option.

Benzinga Pro offers unique advantages for active traders, including a real-time newsfeed that aggregates information from over 1,000 sources, ensuring timely access to market-moving events. Its Audio Squawk feature provides live audio updates, so you can stay informed without constant screen monitoring. It also includes advanced stock screening tools with customizable filters, which can help you identify potential investment opportunities based on specific criteria. Additionally, Benzinga Pro offers a comprehensive calendar suite, highlighting upcoming earnings reports, IPOs, and economic events to assist in strategic planning.

Rating: ⭐️⭐️⭐️⭐️⭐

Cost: Free Account, Free Trial for Paid Accounts, then $37/month Basic, $197/month Essential, $497 Options Mentorship

What You Get: Real-time/15 Minute Delay (basic account) News and Alerts, Watchlists, Data and Analysis tools, Optional Mentorship, and Premium Articles (Any Paid Account)

What’s great: I love the powerful news and alert service on this platform. I also love that premium members get extensive data and analysis tools that can make day trading decisions a lot easier.

What’s not so great: I consider the Essentials account price point of $197 a month to be high, especially when starting off. Happily, there IS a 2-week free trial period, so you can try before you buy.

Final Word:

There really are a lot of great tools for day traders out there. While it really depends on your experience, but I would say, overall, the Best Day Trading Software Award would go to moomoo.

Of course, these are only recommendations. Downloading the software will not make you an instant expert. Stated simply — focus on education first and profits after!

For those looking for an ideal pathway to becoming a day trader, I recommend:

- Check out ecourses on Investors Underground.

- Study the market with a news feed designed for traders, like Benzinga Pro.

- Test your skills with free day trading software like TradeStation’s simulator.

- Choose a day trading app for beginners such as moomoo or eToro* that can help with basic analytics.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. Securities are offered through Moomoo Financial Inc., Member FINRA/SIPC. The creator is a paid influencer and is not affiliated with Moomoo Financial Inc. (MFI), Moomoo Technologies Inc. (MTI) or any other affiliate. The experiences of the influencer may not be representative of the experiences of other moomoo users. Any comments or opinions provided are their own and not necessarily the views of MFI, MTI or moomoo. Moomoo and its affiliates do not endorse any strategies that may be discussed or promoted herein and are not responsible for any services provided by the influencer. This advertisement is for informational and educational purposes only and is not investment advice or a recommendation of a security or to engage in any investment strategy. Investing involves risk and the potential to lose principal. Investment and financial decisions should be made based on your specific financial needs, objectives, goals, time horizon and risk tolerance. Any images shown are strictly for illustrative purposes. Past performance does not guarantee future results. U.S. residents trading in U.S. securities may trade commission-free using the moomoo app through Moomoo Financial Inc. (MFI). Please see our pricing page for other fees. Level 2 data is free to moomoo users that have an approved MFI brokerage account. Trading during Extended Hours Trading Sessions carries unique risks, such as greater price volatility, lower liquidity, wider bid/ask spreads, and less market visibility, and may not be appropriate for all investors.

FAQs:

Is it possible to make $100 a day day trading?

Yes, it is possible to make $100 a day day trading. Some traders make much more. Many traders lose. There are no guarantees in the stock market; a strong foundation of knowledge can help you work toward your goals.

What is the best platform for day to day trading?

The best platform for day to day trading depends on the trader’s experience and goals. moomoo is a fantastic platform with some of the best day trading software for beginners due to its simplified user platform; TradeStation is the best for advanced traders due to its sophisticated analytic tools.

Can you make 500 a day day trading?

While it is possible to make $500 a day day trading, it is important to note that this is not a guaranteed amount, and there are many risks involved. A solid understanding of the market, a defined strategy, and a disciplined approach can help you work toward this goal.

How to day trade without $25,000?

In the U.S., traders with under $25,000 are limited to three day trades within a rolling five-day period. While it is possible to bypass this rule with online brokers in various ways, it’s worth considering that it was put in place to protect inexperienced traders — it may be worthwhile to keep day trades to a minimum until you’re a more established trader!

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.