If you’re trying to choose between Personal Capital vs Mint to manage your money, I’ve got good news – it’s really not a difficult decision.

While there is some overlap, these apps were designed for two very different types of users.

Personal Capital (now Empower) is better at helping you invest and manage your portfolio, while Mint is much better at helping you budget and save your money.

So it’s really just a matter of figuring out which area, investing or budgeting, you need help with.

Need help figuring it out?

In this article, I’ll make it abundantly clear which one, Personal Capital or Mint, is right for you. You’ll learn about their features, what they have in common, and what sets them apart.

Plus, since they’re both free to use, I’ll also talk about the pros and cons of using both in tandem.

Summary: Personal Capital vs Mint

Personal Capital vs Mint isn’t actually a battle — they’re not competing personal finance platforms.

Rather, Personal Capital (Empower) is an investment platform with few budgeting features, and Mint is a budgeting platform with few investment features.

Personal Capital (Empower) is best for investing. Although Personal Capital (Empower) does have some budgeting features, it focuses on investing and planning for future financial goals like retirement, buying a house, or saving for college.

Mint is best for budgeting. Although Mint has some holistic net worth tracking features that include your investment portfolios, it focuses on your bank accounts, credit cards, and other loans to make budgeting and saving money easy.

Let’s break down Mint vs Personal Capital to help establish which one is right for you.

What is Personal Capital (Empower)?

Best for: Investing

Cost: Free

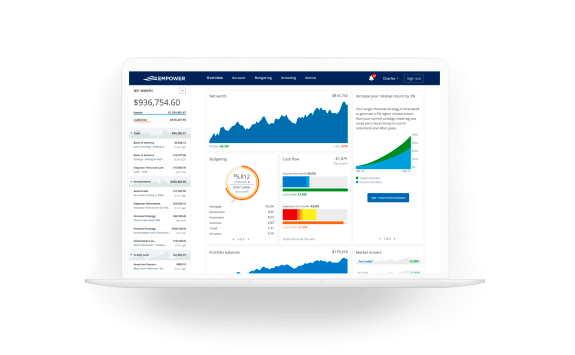

Personal Capital (Empower) is an investment platform that helps you manage your investments, grow your net worth, and track your progress toward financial goals such as retirement, buying a house or car, saving for college, and more.

Who is Personal Capital (Empower) Best For?

If you already have a handle on your budget and savings, your next step should be building an investment portfolio. Personal Capital (Empower) offers a variety of tools to take your investment strategy to the next level, whether you’re just starting your investment journey or you’re preparing for retirement.

You can easily stay on top of your positions, monitor your diversification, and track your progress toward your key financial goals.

Plus, if you have multiple investment accounts (say one at Fidelity, two at TD Ameritrade, and one at Vanguard), Empower will aggregate your portfolios to show you the holistic view of your total investment mix.

Personal Capital (Empower) Features:

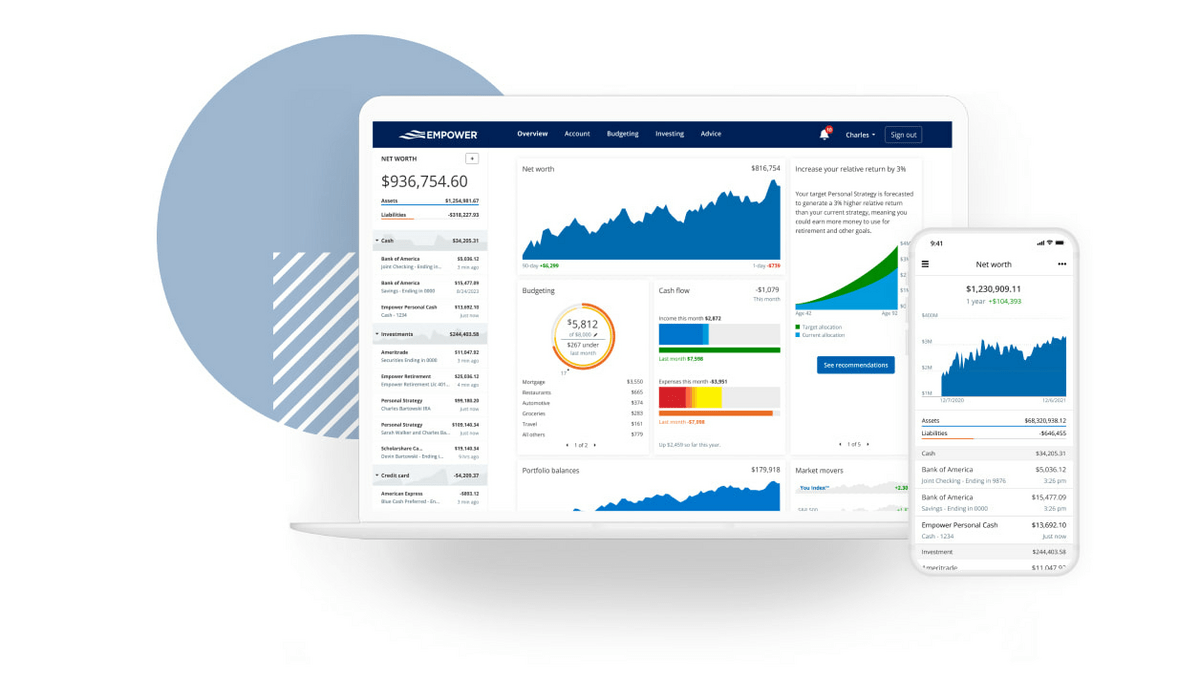

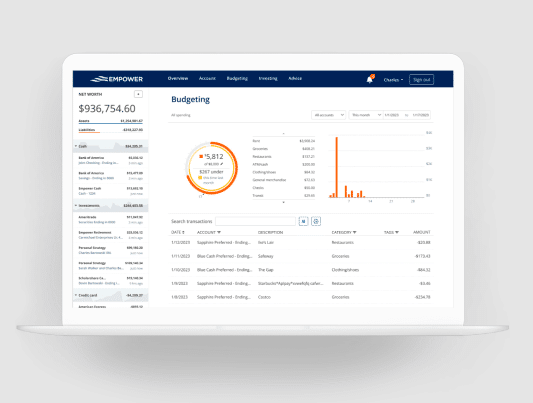

1. Dashboard

Empower’s Dashboard can be your “investment headquarters.” The Dashboard shows you all of your accounts, positions, fees, and offers access to all of Empower’s calculators.

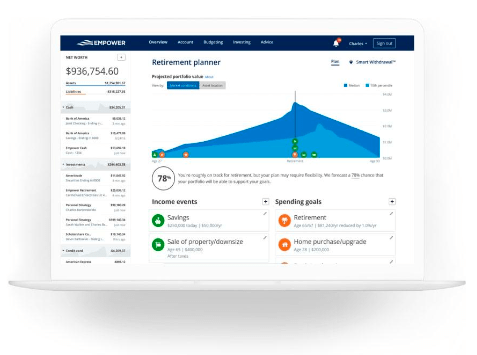

2. Retirement Planner

You don’t need to guess if you will be prepared for retirement or not — there’s a handy calculator for that!

Empower’s Retirement Calculator can project your future net worth based on current savings rates and returns, then provide targeted withdrawal rates depending on how much you’re planning to spend.

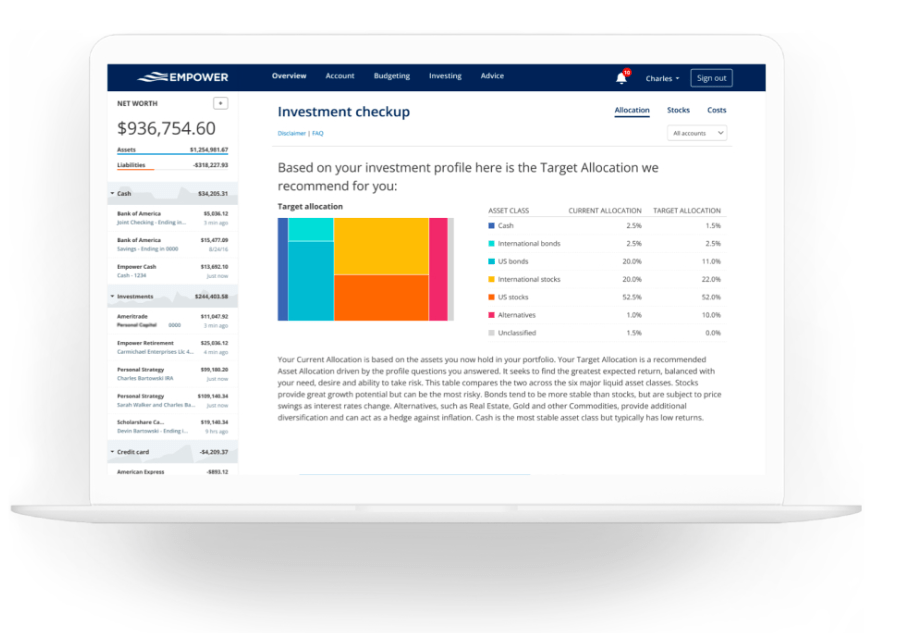

3. Investment Checkup

After importing your accounts into the Dashboard, the Investment Checkup will:

- Assess your portfolio risk

- Analyze past performance

- Model individualized asset allocations

These tools can help you evaluate if your mix of stocks, bonds, cash, and other investments are aligned with your goals, financial situation, and risk tolerance.

4. Other Financial Calculators

Personal Capital (Empower) has a host of other financial calculators such as:

- The Budget Planner

- Emergency Fund Calculator

- College Saving Calculator

- Life Insurance Calculator

- Investment Return Calculator

- Debt Payoff Calculator

- 401(k) Early Withdrawal Calculator

- Pension Calculator

- Roth Conversion Calculator

- Required Minimum Dispersion Calculator

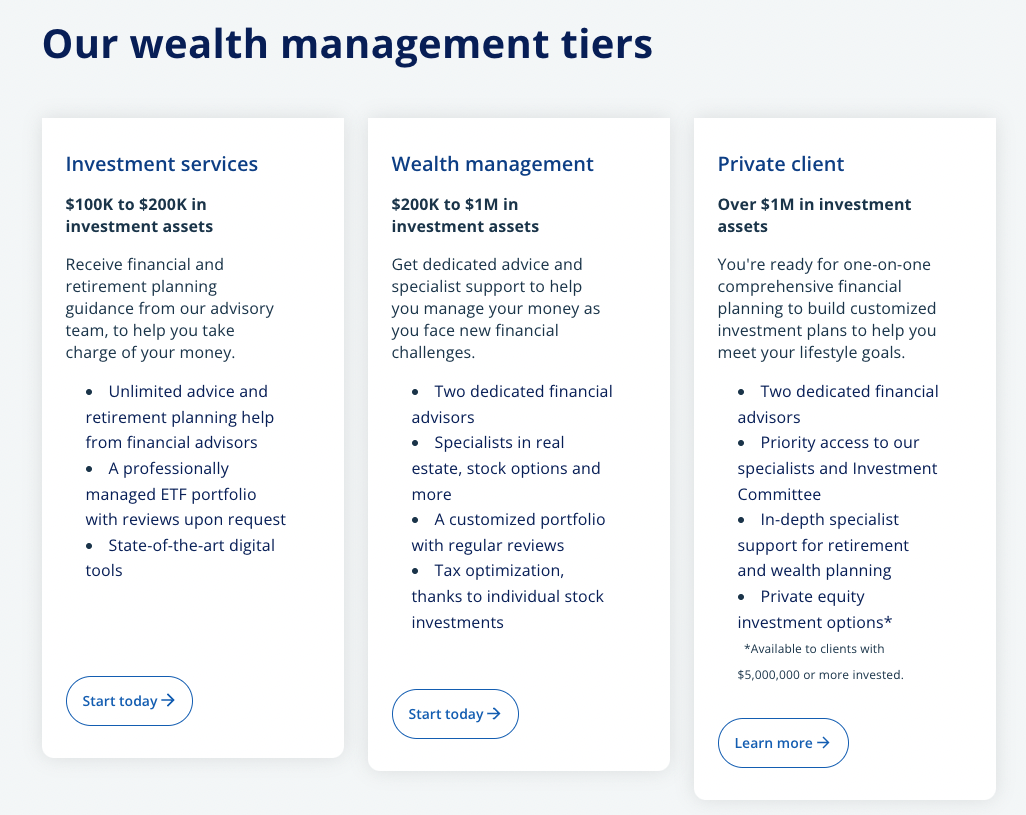

5. Wealth Management

In addition to its free tools, Empower also offers wealth management services.

If you have a portfolio with $100,000 or more, you can get a free consultation.

To get your free consultation, use the link below then link your accounts. If you have $100,000+ in investable assets, an Empower advisor will reach out to you via email.

What is Mint?

Best for: Budgeting & Saving

Cost: Free

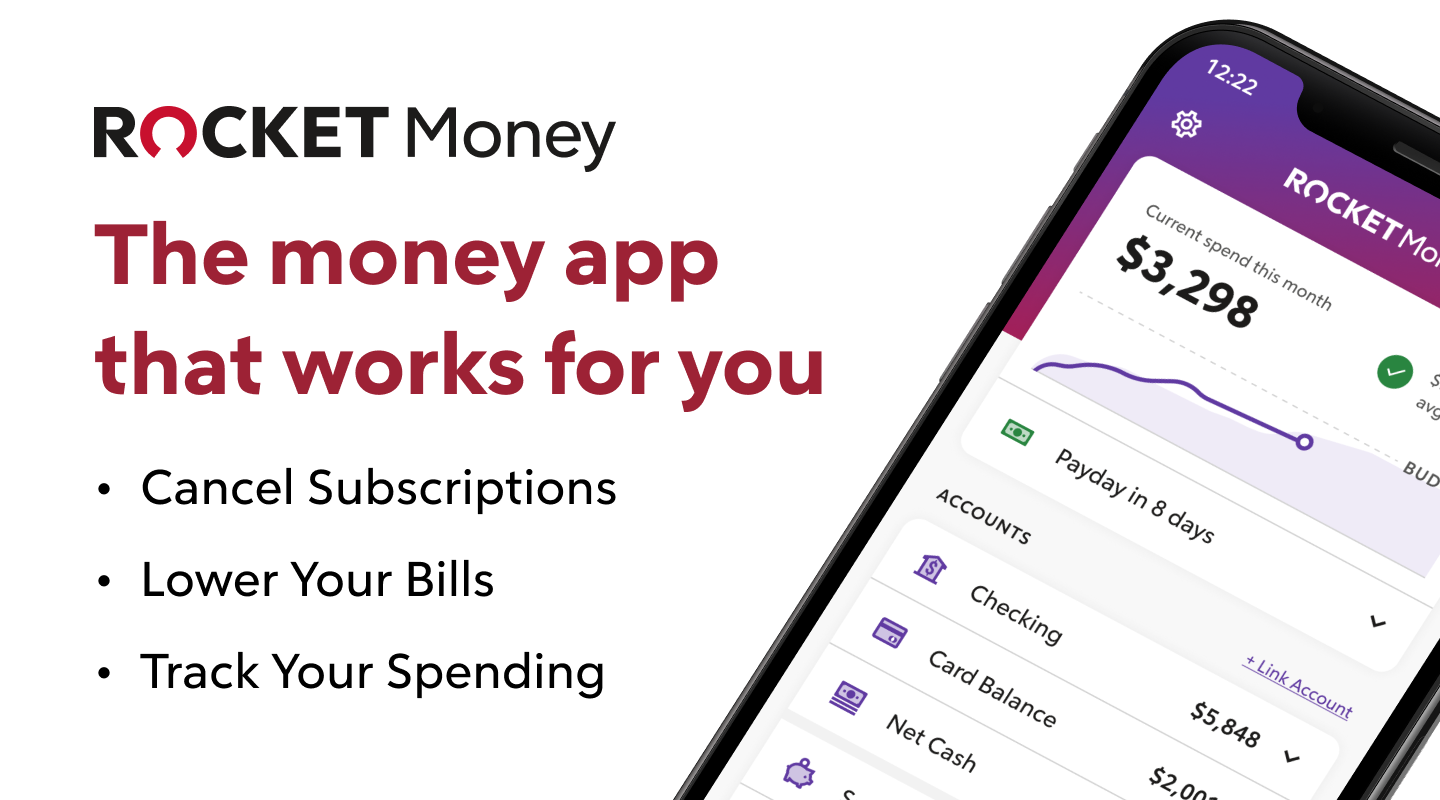

Mint is a budgeting app that gives you an overview of your spending and balances and gives you insights into your budget and credit score.

The app automatically downloads and categorizes your transactions, making it easy to track your spending, stick to a budget, and save money.

It also offers a snapshot of your financial situation by hooking up to your investment accounts and measuring your performance against standard benchmarks, though this is the extent of its investment insights.

Who is Mint Best For?

Mint is the best solution for people who need a tool to help with budgeting and saving money.

If you’re tired of using spreadsheets and manually inputting information, Mint automatically downloads your financial data from your accounts and, like magic, categorizes it according to rules you’ve set up in advance, making money management a breeze.

The app is intuitive and easy to use and is perfect for people with busy schedules.

Mint Features:

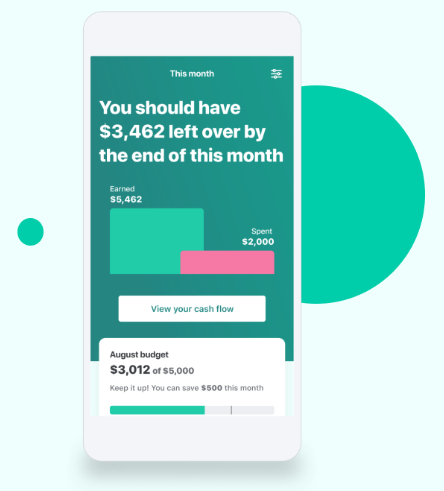

1. Budgeting

Mint is a budgeting powerhouse.

After connecting to your bank accounts and credit cards, it quickly categorizes the transactions and can give you deep insights into your spending habits.

Plus, it uses real-time data to create your budgets, which ensures accuracy and makes them easier to stick to.

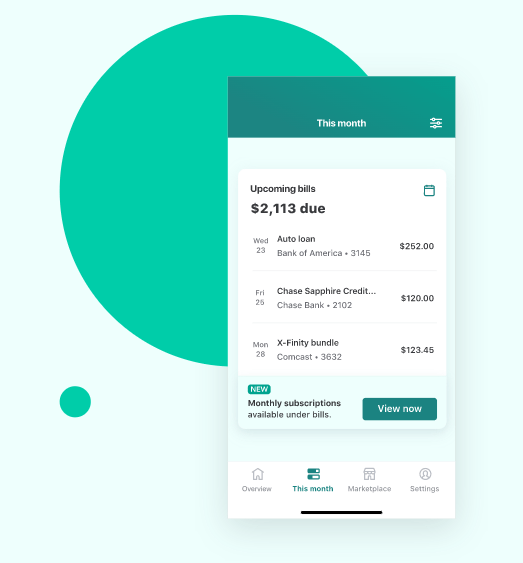

2. Bill Alerts

I don’t know about you, but time flies for me. As such, it’s nice to get a heads-up when I have bills coming so I can make sure there’s enough in my account to cover them.

With Mint’s Bill Alert feature, you get helpful alerts that can help you plan ahead and avoid overdraft fees.

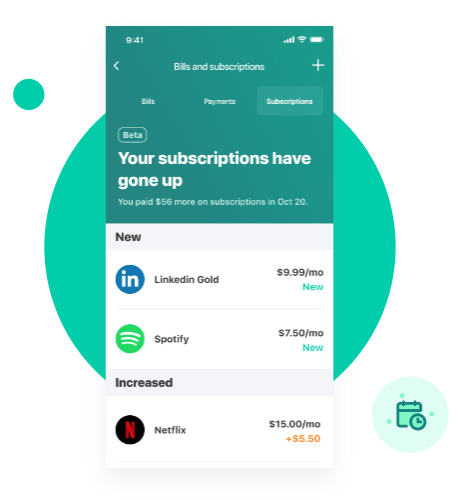

3. Subscriptions

Subscriptions can create major leaks in your budget. It’s easy to miss things like fees, price hikes, or automatic renewals that you didn’t realize you authorized. If you have multiple subscriptions, it can get pretty complicated and hard to track.

Mint makes it easy. The app will notify you if there’s been a change to the amount you’re charged, giving you a heads-up to query it or shop around for a cheaper option.

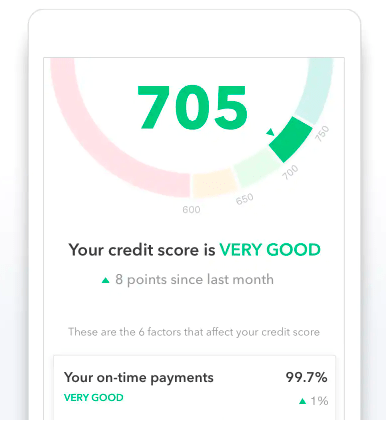

4. Credit Score

It’s always a good idea to keep track of your credit score. Mint will notify you in real-time whenever there are changes to your credit information.

5. Other Features

Other noteworthy features include:

- Warnings if you’re spending too much

- Notification of large transactions

- Tax tools that integrate with TurboTax

- It helps you understand your spending habits through Mintsights.

Comparison: Mint vs Personal Capital

Here’s a more in-depth comparison to help you choose between Personal Capital or Mint:

Feature | Personal Capital (Empower) | Mint |

|---|---|---|

Primary focus | Investing | Budgeting |

Cost | Free | Free |

Dashboard | Yes | Yes |

Account syncing | Yes | Yes |

Budgeting tools | Basic | Advanced |

Investment tracking | Advanced | Basic |

Retirement planning | Yes | No |

Credit score | No | Yes (through TransUnion) |

Tax tools | No | Yes (integrates with TurboTax) |

Suitable for | Investors | Budgeters |

Similarities:

Both Personal Capital (Empower) and Mint have these things in common:

- They’re both personal finance apps that help you manage your money.

- Both offer a dashboard that provides a snapshot of your financial situation.

- Both programs allow you to sync your bank accounts and credit cards to track your spending.

- Both feature reminders for upcoming bills.

- Both offer budgeting tools to help you manage your expenses.

- Both have investment tracking features, although Personal Capital (Empower) is more robust in this area.

Differences:

- Personal Capital (Empower) is primarily an investment app that helps you manage your retirement account and track the performance of your investments.

- Mint’s focus is on budgeting. It helps you track your spending and create budgets. It does some investment tracking like Personal Capital (Empower), but it is basic in comparison.

- Personal Capital (Empower) offers advanced investment tracking features, such as an investment check-up tool, net worth calculator, and retirement planning calculator.

- Mint offers credit score monitoring and tax tools, while Personal Capital (Empower) does not.

Should You Use Both Personal Capital and Mint?

Since both apps are good at different things, you may be tempted to use both Personal Capital (Empower) and Mint.

However, I recommend sticking with just one: Mint or Personal Capital (Empower). Although they’re both free, using both apps simultaneously can be time-consuming and overly complicated, which increases the odds of you not using the apps.

If both apps interest you, here’s a potential approach:

If you’re still working on budgeting and saving, start with Mint.

Then, once you have your budget and savings nailed, consider switching to Personal Capital (Empower) for more investment tools.

Final Word: Personal Capital vs Mint

Now that you’re an expert on Personal Capital vs Mint, which should you choose?

Both programs have plenty of benefits. But each is appropriate for different goals. To sum it up…

- If you need a tool for budgeting and saving, choose Mint.

- If you need a tool for tracking and managing your investments, choose Personal Capital (Empower).

Or, take a progressive approach. If you’re a beginner, start with Mint if you need to increase your savings. As you increase your net worth, you can switch to access the investment features of Personal Capital (Empower).

But if you already have your savings dialed in and want greater insights and control over your investments, head straight to Personal Capital (Empower).

FAQs:

Is Personal Capital better than Mint?

Personal Capital is better than Mint at tracking your investments, while Mint is better at budgeting and helping you save money.

How is Personal Capital different from Mint?

Personal Capital (Empower) is an investing platform to help you track and monitor your investment portfolio, whereas Mint’s strength is in helping you with your budgeting. It also tracks your investments, but it doesn’t offer the depth and sophistication of Personal Capital (Empower).

Is there anything better than Personal Capital?

Personal Capital (Empower) offers many strong analytical features for free, so it is hard to beat. If you are looking for an easy and cost-effective way to manage your portfolio and retirement, Personal Capital (Empower) has got you covered.

Is there anything better than Mint?

It’s hard to beat Mint when it comes to budgeting. It’s easy to use and offers helpful insights and features that help you stay on top of your money management tasks.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.