While most use options for speculation, you’re about to discover there’s a better way. 3 better ways, actually.

There are some options strategies that could be (and should be!) used by every single investor to enhance their portfolio. You can use options to increase your returns, lower your risk, create monthly cash flow, and create a more rounded portfolio. And no, we’re not going to day trade SPY options.

Seem too good to be true?

Give me 3 minutes, I’ll cover the 2 best options selling strategies and the best buying call options strategy.

The secret to profitable trading? Win more than you lose.

How can you start working toward that goal? With a top-rated options alert service The Trading Analyst. This service understands that trading is risky and that some losses are inevitable; that’s why they take a realistic approach to options trading that emphasizes minimizing losses and attempting to maximize gains on winning trades.

Is the approach working? Per their website, “since January of 2018, we’ve had 310 winning trades and 248 losing trades. But it’s our risk management that really sets us apart. Our average win is $4,526.05 — while our average loss is -$2,498.37.”

That impressive ratio, plus the fact that the service claims a win rate of over 50% makes it one of the top-rated options alerts services out there. While the $787 annual price tag may seem steep at first, you get a lot for your money. With The Trading Analyst, you’ll get about 2-10 trades per week, with an average of around 165 trades a year, making its maximum cost per alert about $7.75.

The 3 Best Options Strategies Everybody Should Know

1. Selling Covered Calls – The Best Options Trading Strategy Overall

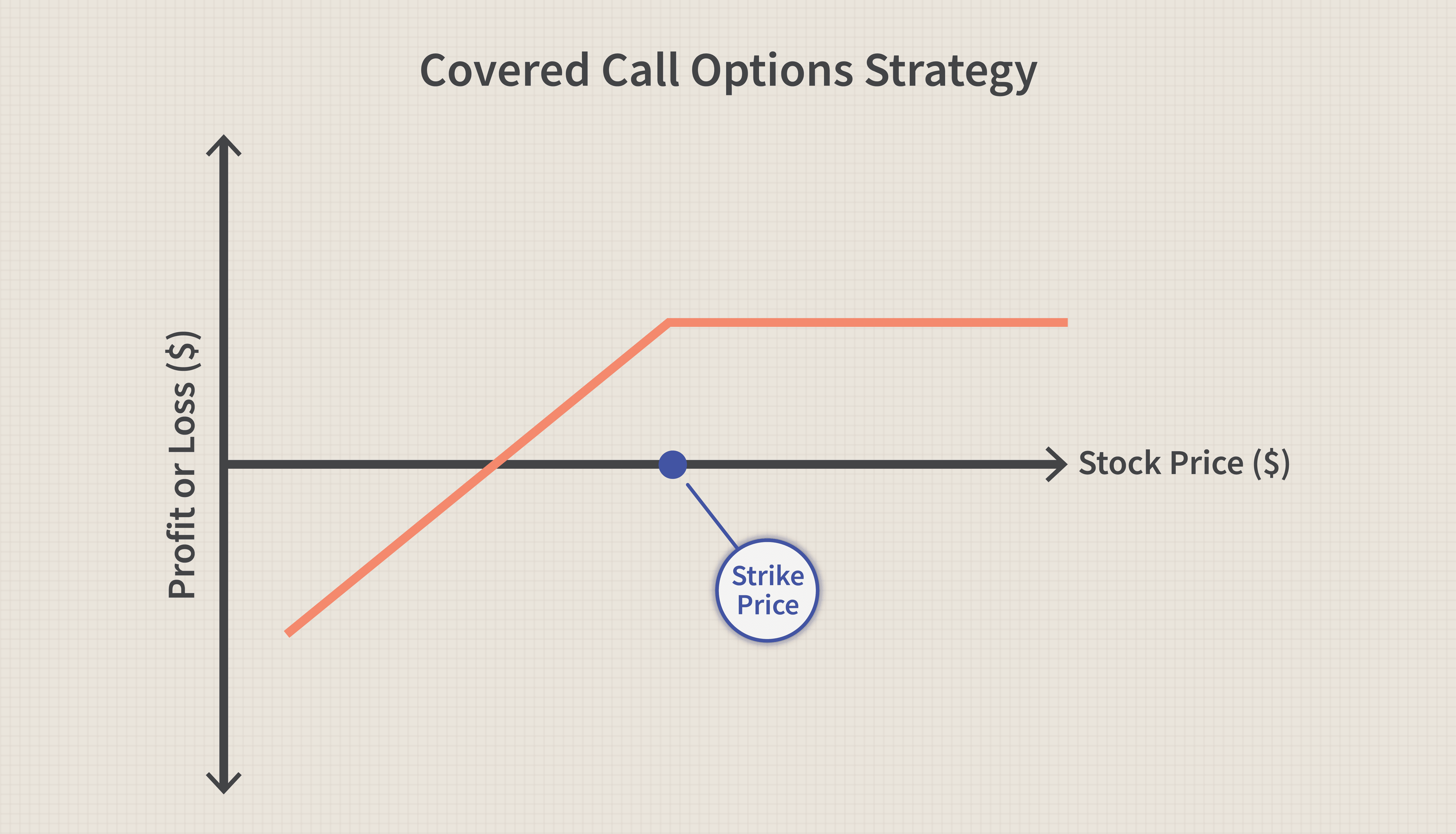

The What: Selling a covered call obligates you to sell 100 shares of the stock at the designated strike price on or before the expiration date. For taking on this obligation, you will be paid a premium.

The Why: You can get paid for committing to sell shares of a stock you own at whatever price you choose within a set period of time. Selling covered calls is also on our list of options strategies for income.

The Math: Max Gain = ([Strike Price – Cost Basis] + Contract Price) * 100

While the other two strategies may require some portfolio adjustments, this one does not, and is a near sure-fire way to increase your existing portfolio’s returns and generate income while offering a slight reduction in risk.

When you sell a call, you’re giving the buyer the right to purchase 100 shares of stock from you at the strike price.

A covered call is selling a call on shares you already own – the shares act as the collateral.

For example, if you own 300 shares of Apple, you can write 3 covered calls.

If you own 100 shares or more of any stock, you should be selling covered calls. There are traders who will give you money today for the right to take your stock away from you if it reaches a higher price – a price that you set.

Why would you sell covered calls?

- Someone is giving you good money for it.

- You’re going to sell the stock anyways, so you might as well get paid for it.

Let me ask you a question: Let’s say you own 100 shares of AAPL and it’s currently trading for $150. If it hit $200 in the next 3 months, would you sell your shares?

If yes, someone will pay you to take on that obligation – sell a covered call.

There is a right way and a wrong way to sell covered calls.

Here’s the right way:

- Do I own 100 shares or more of a stock?

- Is there a certain price I would be happy to sell these shares at?

- Is there a time frame I’m willing to commit to?

If yes, sell the call.

I made a checklist for selling covered calls (and selling cash-secured puts, #3 below). You can download the checklists for free here.

You should choose your strike price and choose your expiration date, then find the contract to sell. You can put yourself in trouble by not following this sequence (and “chasing premium”).

Select call options that are out of the money (OTM) – the strike price is higher than the current price of the stock.

There are 3 potential outcomes:

- The contract expires out of the money. The contract is worthless – you keep the premium and the shares.

- The contract expires at the money. The contract is worthless – you keep the premium and the shares.

- The contract expires in the money. The contract is exercised – you will keep the premium and sell the shares at the strike price you chose.

Selling OTM covered calls is like creating a synthetic dividend while waiting for your shares to increase in value. Even if the contract expires in the money, you sold your shares at a price you would have sold your shares at anyway.

Want to learn more about these strategies?

I cover all #1 and #3 in more depth in my Selling Options for Income ecourse.

2. Buying DITM LEAPS – The (Potentially) Most Profitable Options Strategy

The What: Buying a Deep-in-the-Money (DITM) LEAP option involves acquiring a long-term call option with a strike price significantly below the current market price of the underlying asset. This gives you the right to buy the asset at a favorable price for an extended period.

The Why: Opting for DITM LEAPs allows you to gain exposure to an asset with limited upfront capital. It’s a strategic move to benefit from potential price appreciation over time.

The Math: Max Gain = (Current Market Price – Strike Price) * 100 – Cost of the Option Contract.

This is the only option-buying strategy you will ever see me recommend. It’s a bullish option strategy will allow you to spend less cash up front, take on less downside risk, and participate in nearly all of the same movement as you would if you owned the stock outright.

Leverage, low levels of extrinsic value, massive upside, and limited risk – these stock-simulating contracts have it all.

If you’re a stock buyer, you’re going to love this.

We are going to substitute long call options in place of long stock.

The primary problem for option buyers is that they are constantly battling the time decay in their options. Time decay, however, can only erode extrinsic value – intrinsic value cannot be touched.

What option contracts have low extrinsic value and high intrinsic value? I’ll answer that in a moment.

The second biggest problem for option buyers is that while options give you leverage (one contract represents 100 shares of stock), that leverage is worthless if your contracts expire worthless. Buying OTM calls gives you great leverage, but the probability of profit is incredibly low.

What option contracts have leverage but a high probability of profit?

The answer to both questions: DITM LEAPS.

- Deep-in-the-money (DITM) = contracts with very high deltas, ideally 0.85+

- Long-term equity anticipation securities (LEAPS) = contracts with expiration dates longer than one year, ideally 18+ months

Buying DITM LEAPS will give you control of 100 shares of stock for a fraction of the cost of 100 shares.

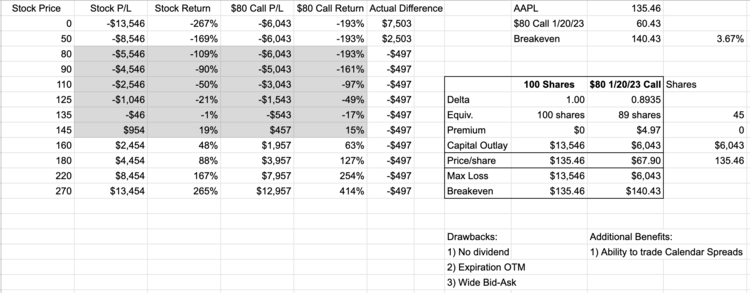

How can you pay $6,043 for something that’s worth $13,546?

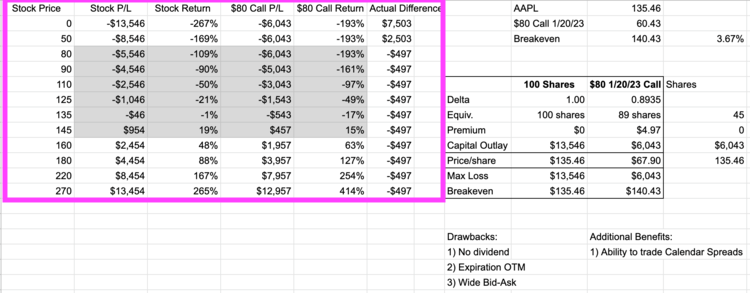

At the time I’m writing this, Apple is trading for $135.46. The $80 call expiring in 2 years is trading for $60.43 and has a delta of 0.89.

What’s delta?

Delta tells us what a $1 change in the stock price will do to the price of our option. You can see our call has a delta of 0.89, which means a $1 increase in the stock price will increase the call option by $0.89.

You can also think about the delta as representing a certain number of shares. What is the delta of a share? It’s 1.00. For every $1 increase in stock price, a share increases $1. That means, a contract with a delta of 0.89 is the equivalent of 89 shares.

When putting it this way, we can see the leverage in much simpler terms: 100 shares of AAPL will cost $13,546, whereas buying 89 shares, via the DITM LEAPS, will cost us $6,043, or $67.90 per share.

Look hard at the screenshot above and you’ll see 3 main benefits:

- Less money invested ($6,043 vs $13,546)

- Less downside risk (max loss is $6,043 vs $13,546)

- A higher ROI (more leverage)

I broke down the potential outcomes on the left side, depending on where Apple is at on the expiration date:

No, these aren’t as cheap as the highflier OTM options you used to buy – you’re not here for that. You’re here to replicate owning shares.

Buying DITM LEAPS lets you do just that while paying just 3.67% in extrinsic value.

Told you you’d love it.

Interested in learning more about options?

Benzinga Options is my most recommended way to learn options in 2025.

It is an options alert service that provides star option trader’s (Nic Chahine’s) high-conviction and highly profitable trades. Each trade comes with a complete explanation and analysis of why he took the trade, so you can learn his exact trading strategies in real-time.

3. Selling Cash-Secured Puts – The Safest Options Strategy

The What: Selling a cash-secured put obligates you to buy 100 shares of the stock at the designated strike price on or before the expiration date. For taking on this obligation, you will be paid a premium.

The Why: You can get paid for committing to buy shares of a stock you want to own at whatever price you choose within a set period of time.

Want to learn more about these strategies?

I cover all #1 and #3 in more depth in my Selling Options for Income ecourse.

The Math: Max Gain = Contract Price * 100

How many times have you waited to buy a stock until it came down to a more reasonable buying price?

You could get paid for that.

Someone will offer you cash today for the opportunity to buy your favorite stock at a lower price than it trades for today.

Writing cash-secured puts is a powerful way to generate income while sitting on the sidelines.

Do not sell puts on stocks that you don’t want to own. This strategy should only be used on stocks that you want to keep in your portfolio.

When you’re selling a put, you’re giving the buyer the right to sell you 100 shares of stock at the strike price.

Let’s look at Apple again.

It’s at $135.46 today. Instead of setting a limit order to buy 100 shares when it falls to $130/share, you write a cash-secured put at the $130 strike, expiring in two weeks, and collect $212.

You’ve entered into an agreement to buy 100 shares of AAPL at $130 under any condition until expiration.

The put is considered cash-secured because you have at least $13,000 of cash in your account, ready to buy 100 shares at the strike if you’re assigned.

If AAPL closes below the strike price at expiration, you’re in luck. You get to buy 100 shares for $130 per share, and keep the $212 in premium we collected.

If AAPL closes above the strike price at expiration, you get to keep the premium but the option buyer will not exercise the option (it would be unprofitable to do so) and you will not get to buy 100 shares. Instead, you can repeat the process over again and collect some more premium.

As illustrated, there’s a right way to sell cash-secured puts.

Here’s the checklist:

- Do I want to own 100 shares or more of a stock?

- Is there a certain price I would be happy to buy those shares at?

- Is there a time frame I’m willing to commit to?

If yes, sell the put.

You should choose your strike price and choose your expiration date, then find the contract to sell. You can put yourself in trouble by not following this sequence (and “chasing premium”).

There are 3 potential outcomes:

- The contract expires out of the money. The contract is worthless – you keep the premium and don’t buy the shares.

- The contract expires at the money. The contract is worthless – you keep the premium and don’t buy the shares.

- The contract expires in the money. The contract is exercised – you will keep the premium and buy the shares at the strike price you chose.

Thus, the idea of the strategy is to potentially buy the stock below its current price, and to get paid regardless of assignment.

And since you’re acquiring shares for less than you would by buying them outright, this is one of the safest options strategies.

Final Word: The Best Options Trading Strategies

Those 3 options trading strategies have a place in even the most conservative portfolios which is why I believe they are the 3 best options trading strategies everybody should know.

SPECIAL OFFER:

WSZ readers can get my Selling Options for Income ecourse for just $79!

The goal of the course is to teach you how to sell options the right way and recoup your investment within 2 hours of starting the course.

Plus, there’s a lifetime money-back guarantee, so there’s no risk in trying it.

BONUS OFFER: Benzinga Options

Benzinga’s option alert service is the best way to trade and learn about options, profitably.

Star options trader, Nic Chahine, not only shares his high-conviction and highly profitable options trades, he also provides complete explanations and analysis so you learn how to replicate his system for yourself.

Twice per month, you’ll receive:

- High-probability option trades

- Transparent access to trade explanations and analysis

- Market analysis

- Education

Plus, if you subscribe now, you can get free access to the next Benzinga Boot Camp to learn how to trade stocks and options like a pro.

FAQs:

What are the best options trading strategies?

The 3 best options trading strategies are selling covered calls, buying DITM LEAPS, and selling cash-secured puts.

What is the best strategy for options trading?

The best strategy for options trading for most people is selling covered calls.

What is the most profitable options strategy?

The potentially most profitable options strategy on this list is buying DITM LEAPS.

What are the safest options strategies?

Two of the safest options strategies are selling covered calls and selling cash-covered puts.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.