When markets are bullish you make money and when they are bearish you lose money, right?

Wrong.

With options, the market trend doesn’t actually matter much. Bearish or bullish, passive or volatile – you can make profit in any environment.

Plus, in down markets, buying puts is significantly cheaper, less risky, and offers much more upside than shorting stocks.

In this article, I will share some of my favorite bearish options strategies, to show just how powerful they can be in a bear market.

Think of these like having a toolbox full of safe shorting tools—everything you need is there, it’s just a question of knowing what to use.

Here’s your complex toolbox of bearish option strategies, how they work, when they should be used, and why a bit of know-how can be super-useful (with examples!).

What is a Bearish Option Strategy?

A bearish option strategy is one that profits from a drop in the price of a stock or asset.

Depending on how bearish your outlook is and how confident you are in that outlook, you can apply different strategies to capture the most amount of profits while limiting your downside risk.

Some strategies are conservative and protect you against unexpected price jumps, while very bearish strategies seek to maximize your returns when a stock price tumbles.

- Mildly bearish – When a stock is passive and seems slightly bearish, it is best to use a strategy that can benefit from that passivity, as well as a potential decline in price.

- Moderately bearish – Making a bearish bet while making an opposite bet as insurance is usually the best way to go about most trades.

- Very bearish – Very bearish strategies put a cap on max losses while allowing for unlimited upside potential.

Why Use Bearish Options Strategies

Using a bearish options strategy instead of just buying a put option or shorting a stock directly has a few benefits.

- Limits risk compared to shorting a stock – When you short-sell a stock, your potential losses are unlimited if the stock price keeps rising. But with some bearish options strategies, you can set your max loss at an acceptable level.

- Offers flexibility to adjust strategy – Using an options strategy allows you to adjust your trading position to your exact market outlook.

- Potentially better risk-reward ratio – Some bear options strategies—like the bear iron condor spread— allow you to potentially make a profit even if the stock price doesn’t drop as much as you expected.

Trading options can be very hard and time-consuming.

Benzinga Options is an inexpensive options alert service curated by Nic Chahine, a very successful options trading veteran who regularly sends you trading ideas you can use to profit and learn.

The 7 Best Bearish Options Strategies:

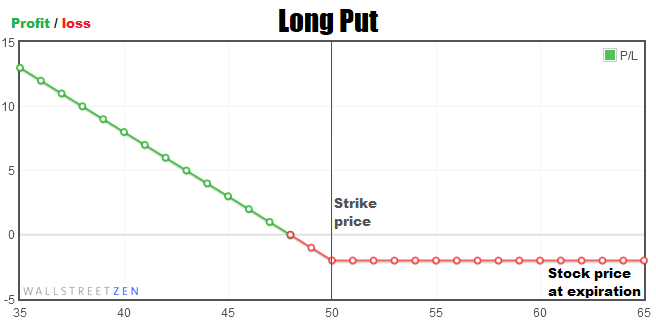

1. Long Put

- When to use: Very bearish. The upside is unlimited.

- Max loss: Price of the premium.

The first bearish option strategy (and the most popular) is the long put.

A long put strategy means buying a put option on a stock you think will decrease in value. By buying a put, you can profit from the drop in a stock’s price without owning it.

Here’s how it works:

- You buy a put option at a certain “strike price” that gives you the right, but not the obligation, to sell the stock at that price before the option’s expiration date.

- If the stock or asset price drops below the strike price before expiration, you can sell back the put you bought at a higher price for a profit.

- If the stock or asset price stays above the strike price, the option expires worthless and you lose the premium.

Long Put Example:

Let’s say you are bearish on ABC Corporation stock, which is currently trading at $60 per share. You want to profit from a decline in price.

Here’s how the trade works:

- You buy a put option with a strike price of $50 and an expiration date of one month from now for a premium of $2 per share.

The total cost of the trade is $200 = ([ $2 premium] x 100 shares per contract).

Breakeven |

|

Profit |

|

Loss |

|

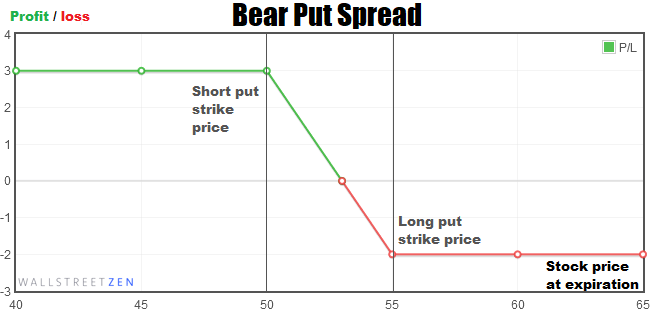

2. Bear Put Spread

- When to use: Moderately bearish. Potential upside and downside are capped.

- Max loss: The premium paid minus the premium received.

Next on my list of options bearish strategies is the bear put spread.

A bear put spread is when you buy a put option with a higher strike price and sell a put option with a lower strike price on the same underlying stock and expiration date.

The idea is to profit from the expected decrease in the stock price while limiting your potential loss. By selling the lower strike price put, you gain a premium that offsets the cost of the higher strike put option.

Here’s how it works:

- Buy a put option with a higher strike price. (long put)

- Simultaneously sell a put option with a lower strike price with the same underlying stock and expiration date. (short put)

- Selling the lower strike put option gives you a premium—this makes the trade cheaper.

- If the stock price drops below the higher strike price, the long put option will start making a profit.

- If the underlying stock goes below the lower strike price, you will be obligated to buy shares at a low price, and you can use your long put to sell them immediately at a higher price. Max profits are capped by the lower strike price.

- If the stock price goes above the higher strike price, both options will expire worthless. Max losses are offset by selling the lower stroke price put.

Bear Put Spread Example:

Suppose you’re moderately bearish XYZ Corporation stock, which is trading at $60 per share. You want to profit from a decrease in the stock price while limiting your potential loss.

Here’s how the trade works:

- Buy a put option with a strike price of $55 and an expiration date of one month for a premium of $3 per share.

- Simultaneously sell a put option with a strike price of $50 with the same expiration date for a premium of $1 per share.

The total cost of the trade is $200

[( premium $1 – premium $3 ) x 100 shares] = -$200

Breakeven |

|

Profit |

|

Loss |

|

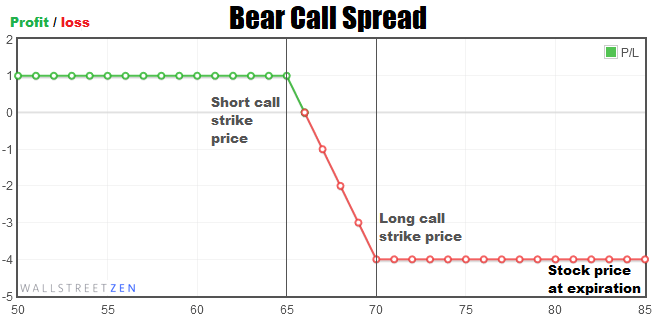

3. Bear Call Spread

- When to use: Mildly bearish. The strategy is profitable as long as the underlying stock doesn’t rise significantly. The potential upside is very limited.

- Max loss: The difference between the strike prices minus the net premium received.

Third up on the best options bearish strategies list is the bear call spread.

A bear call spread strategy is all about selling a call option with a lower strike price (expensive option) and simultaneously buying a call option with a higher strike price (cheaper option) on the same underlying asset and expiration date.

The idea is to profit from the expected mild decrease in the stock price while limiting potential losses. By selling a call option and buying another call option with a higher strike price, you can reduce the overall cost of the trade.

Here’s how it works:

- Sell a call option with a lower strike price (expensive).

- Buy a call option with a higher strike price (cheaper) on the same underlying asset and expiration date.

- Buying the higher strike call option limits the potential loss from the short call option sold.

- If the stock price drops below the lower strike price, both call options will expire worthless, and you keep the entire net premium received.

- If the stock goes above the higher strike price, the short call option sold will start losing money, but the long call option bought will also start making a profit, offsetting some of the losses.

- The maximum profit is the net premium received.

- The maximum loss is the difference between the two strike prices minus the net premium received.

Bear Call Spread Example:

Let’s say you’re mildly bearish on the stock of XYZ Corporation, which is currently trading at $60 per share. You want to profit from a decrease in the stock price while heavily limiting your potential loss.

Here’s how the trade works:

- Sell a call option with a strike price of $65 and an expiration date of one month from now for a premium of $2 per share.

- Simultaneously buy a call option with a strike price of $70 and an expiration date of one month from now for a premium of $1 per share.

The net premium received is $100, which is your maximum profit.

Breakeven |

|

Profit |

|

Loss |

|

Very few brokers offer cheap and reliable options trading suitable for beginners and experts alike. Check out our picks for the best options trading platforms in 2025.

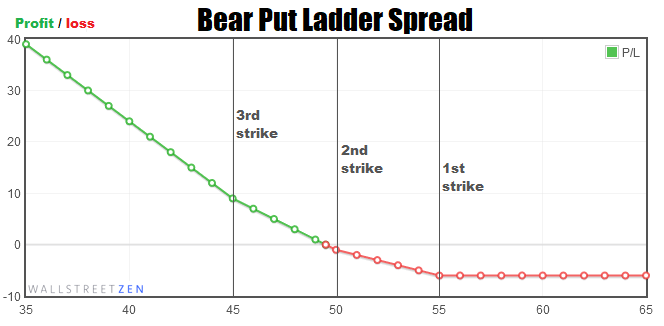

4. Bear Put Ladder Spread

- When to use: Extremely bearish. Potential profit is unlimited.

- Max loss: The total amount paid for the options.

The next of the bearish option strategies is the bear put ladder spread.

A bear put ladder spread strategy is when you buy multiple put options on the same underlying asset and expiration date with different strike prices.

The idea is to profit from the expected decrease in the stock price while maximizing your potential gain. By buying multiple put options with different strike prices, you can create a ladder that allows you to profit as the stock falls.

Here’s how it works:

- Buy multiple put options on the same underlying asset and expiration date with different strike prices.

- Each put option provides a different level of protection, depending on its strike price. That means, the higher the strike price, the more likely it is to be profitable, and the more protection it offers.

- The maximum profit potential is unlimited, while the maximum loss is the total amount paid for the options.

Bear Put Ladder Spread Example:

Suppose you’re extremely bearish XYZ Corporation stock, which is currently $60 per share. You want to profit and maximize your potential gain but you don’t feel like you need to protect yourself against a potential bull run.

Here’s how the trade works:

- Buy a put option with a strike price of $55 and an expiration date of one month from now for a premium of $3 per share.

- Buy a put option with a strike price of $50 with the same expiration date for a premium of $2 per share.

- Buy a put option with a strike price of $45 with the same expiration date for a premium of $1 per share.

The total cost of the trade is $600—that’s the total price of all 3 puts.

Breakeven |

|

Profit |

|

Loss |

|

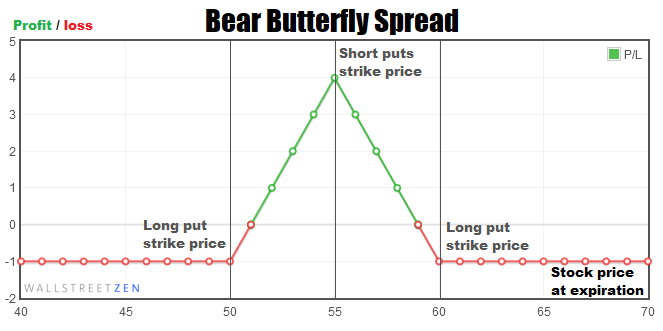

5. Bear Butterfly Spread

- When to use: Moderately bearish. The upside and downside are capped.

- Max loss: The net premium paid for the options.

A bear butterfly spread strategy is when you buy and sell multiple put options on the same underlying asset and expiration date, but with different strike prices.

The idea is to profit from a modest decrease in the stock price while limiting your potential loss. By buying and selling multiple put options with different strike prices, you can create an inverted “V”-shaped profit graph that allows you to make money if the stock price falls within a specific range.

Here’s how it works:

- Buy one put option with a lower strike price.

- Sell two put options with a middle strike price.

- Buy one put option with a higher strike price.

- The middle strike price of the sold put options should be halfway between the lower and higher strike prices of the puts you bought.

- If the stock price goes below the highest strike price, you start making a profit.

- If the stock price goes significantly below the two middle strike price options, you start losing money, but your max losses are capped by the lowest strike price option.

- The maximum profit potential happens if the stock price at expiration is the same as the middle strike price—the 2 options in the middle expire worthless, and you keep the profit from the higher strike price put.

Bear Butterfly Spread Example:

Suppose you’re moderately bearish on the stock of XYZ Corporation, which is currently $60 per share. You predict a small dip in price, but want to play it extra safe.

Here’s how the trade works:

- Buy a put option with a strike price of $50 and an expiration date of one month from now for a premium of $2 per share.

- Sell two put options with a strike price of $55 and an expiration date of one month from now for a premium of $3 per share.

- Buy a put option with a strike price of $60 and an expiration date of one month from now for a premium of $5 per share.

You lose $700 for buying two options [($2 premium + $5 premium) x 100 shares] and you get $600 for selling the two options in the middle. The total cost of the trade and maximum loss is $100.

Breakeven |

|

Profit |

|

Loss |

|

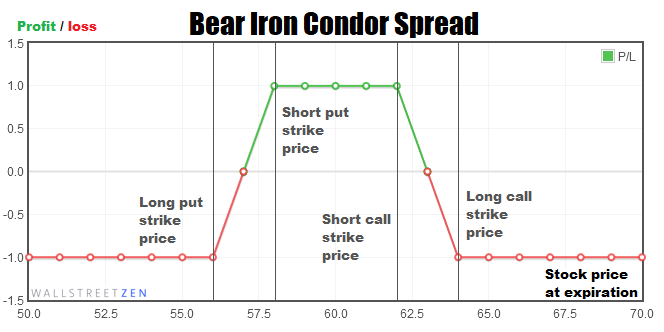

6. Bear Iron Condor Spread

- When to use: When you’re mildly bearish or believe that the underlying stock will not move up or down significantly.

- Max loss: The net credit received difference between the two puts / two calls.

The bear iron condor spread strategy involves buying and selling multiple calls and puts on the same underlying asset and expiration date with different strike prices.

The idea is to create a trading range with limited risk and profit potential. As long as the underlying’s price is that specific range, you make money. If you believe the stock will make a sudden move, consider using the inverted iron condor.

Here’s how it works:

- Buy a put option with a lower strike price.

- Sell a put option with an even lower strike price.

- Buy a call option with a higher strike price.

- Sell a call option with an even higher strike price.

- The current price of the stock should be exactly in the middle of the 4 strike prices.

- This creates a net premium received, which is your maximum profit potential.

- If the undelying’s price moves significantly below the strike price of the put you sold or above the call you sold, you lose.

- If the stock price falls between the sold put and call options, you profit. The max profit is the net premium you received.

- The max loss is the net premium minus the difference between the strike price of the two put options or the two call options.

Bear Iron Condor Spread Example:

Suppose you’re slightly bearish on the stock of XYZ Corporation, which is currently trading at $60 per share. But to be safe, you want to bet that the stock will not move up or down significantly.

Here’s how the trade works:

- Buy a put option with a strike price of $56 and an expiration date of one month from now for a premium of $3 per share.

- Sell a put option with a strike price of $58 and an expiration date of one month from now for a premium of $3.5 per share.

- Sell a call option with a strike price of $62 and an expiration date of one month from now for a premium of $3 per share.

- Buy a call option with a strike price of $64 and an expiration date of one month from now for a premium of $2.5 per share.

The total credit received from the trade is $100 = [( $3.5 + $3 – $3 – $2.5) x 100 shares]

Breakeven |

|

Profit |

|

Loss |

|

By the way, if you are looking for a beginner-friendly options broker, check out eToro.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

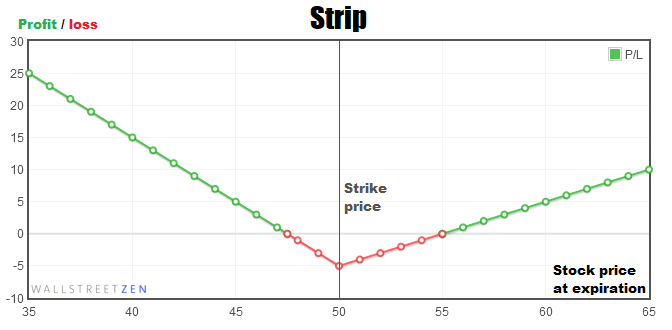

7. Strip

- When to use: When you are long volatility—you make the most money when the stock goes down a lot, but you still profit if it goes up a lot. You lose if the underlying stock remains passive.

- Max loss: The price of the premiums.

A strip strategy is when you buy two ATM (at-the-money) put options and buy one ATM call option on the same underlying asset and expiration date.

FYI: When an option is “at-the-money” (ATM), it means that its strike price is the same as the current market price of the underlying stock. For more information, read In The Money vs Out of The Money.

The idea is to profit regardless of whether the underlying stock goes up or down, as long as it moves significantly from the strike price. Because you bought 2 put options, you profit more if the underlying stock goes down.

Here’s how it works:

- Buy 2 ATM put options with the same expiration date.

- Buy 1 ATM call option with the same expiration date.

- If the stock price goes down, the two put options may make money.

- If the stock price goes up, the call option can make money.

- The maximum profit potential is unlimited, while the maximum loss is the price of the premium.

Read through what is vega in options to get a better idea of when to use this strategy.

Strip Example:

Suppose you’re very bearish on ABC Corporation, which is trading at $50 per share. You want to profit from a significant decrease in the stock price, but want to prepare for a bull run as well because ABC Corp. is very volatile.

Here’s how the trade works:

- Buy two put options with a strike price of $50 and an expiration date of one month from now for a premium of $2 per share.

- Buy one call option with a strike price of $50 and an expiration date of one month from now for a premium of $1.5 per share.

The total cost of the trade is $550 = ($4 total premium for the two puts + $1.5 premium for the sold call option) x 100 shares

Breakeven |

|

Profit |

|

Loss |

|

Final Word: Bearish Option Strategies

All of the strategies mentioned above have their purpose in a bear market. They aren’t hard to master, but knowing when to use them is key.

To figure out which one to use, you need to look at the underlying asset and see where it’s going—and then use the strategy with the best odds of success in that scenario.

Trading bear markets isn’t about striking gold every once in a while as much as it is about raking in profits consistently over time—and that means playing it safe first, and maximizing your profits second if possible.

FAQs:

Which option strategy is best for a bearish market?

It depends on your risk tolerance and market outlook. If you’re very bearish and don’t mind taking risks, then a more aggressive strategy is like the bear put ladder spread, strip, or a simple long put is better. Strategies like the bear call spread and bear put spread would work better in a moderately bearish scenario.

What is a bearish spread option strategy?

The bearish spread strategy involves buying and selling multiple call and/or put options on the same underlying asset and expiration date with different strike prices. The goal is to profit from a decrease in the stock price while limiting your potential losses and capping potential returns.

What is the most successful option strategy?

The best options strategy is the one that fits the current market environment the most. Moreover, strategies that heavily limit potential losses like the bear butterfly spread are usually considered to have the best odds of being profitable when used in the appropriate market environment.

What is the riskiest option strategy?

Options trading is inherently risky but there are several especially aggressive strategies like the short call, short put, ladder spreads, and naked call options. These strategies have the potential for unlimited profit but are generally only recommended for experienced traders with a high risk tolerance.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.