New to options trading? You may be wondering why some option contract prices change more rapidly than others. The difference can be remarkable — especially when comparing out of the money vs in the money options.

But as I’ll reveal in this article, there’s a reason behind these variations, and it’s no big mystery. It all relates to one key concept: intrinsic value.

If you want to anticipate rapid changes and make accurate decisions as you carry out your trading strategies, it’s crucial to understand the differences between in the money vs out of the money options — and what plays into these differences. Let’s break it down.

If you want to trade options, you need a broker. eToro is our top pick.

There’s a lot to love about eToro — low or no-commission trades, a CopyTrader feature that lets you mirror the trades of pros, and a trading simulator that helps you test out strategies before you put money on the line.

Try it out and see for yourself why eToro is one of the best options trading platforms

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

What’s the Difference Between In the Money and Out of the Money Options?

In options trading parlance, an option that has intrinsic value is said to be “in the money,” whereas an option without intrinsic value is referred to as “out of the money.”

In layman’s terms, the concept of in the money vs out of the money comes down to whether the price of the underlying security is above or below the option’s strike price.

(Also worth noting: In the money vs out of the money will be different for call options and put options.)

To really help you make sense of it, let’s look at a few examples.

In the Money and Out of the Money Call Options

To identify out of the money vs in the money options, start by noticing where the option’s strike price compared to the stock price.

A call option is in the money if the strike price of the option is lower than the current price of the stock. So…

- If you owned a call option on XYZ stock with a strike price of $50, then as long as the share price of XYZ traded at $50.01 or higher, your contract would be in the money.

- If the price of XYZ moves higher in comparison to the strike price, then the call option becomes “deeper” in the money.

You may notice that option contracts with a strike price well below the current trading price of XYZ tend to increase or decrease in ways that are more similar to the moves of XYZ.

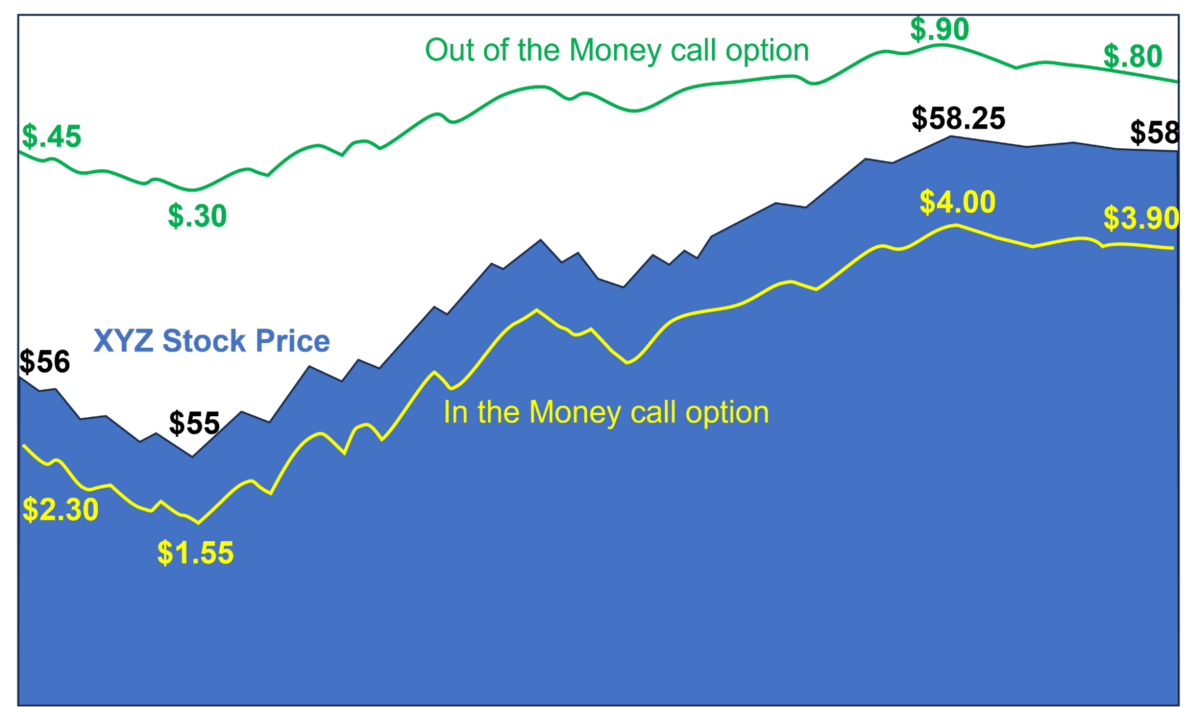

Imagine that the price of XYZ was $56 per share on a Monday and that, with some fluctuation, it rose to $58 per share by Friday.

The price action of an ITM call option (with a strike of $50) will more closely mimic the price action of XYZ’s stock price when compared to an out-of-the-money option.

In the above illustration, an ITM call with a strike of $50 could be depicted by the yellow line.

An OTM call is depicted by the green line.

The illustration shows how an OTM option’s price moves are not as tightly correlated to the price of XYZ than the ITM option.

Notice also that the price changes of the OTM option throughout the week represent lower nominal changes in value, but greater changes in value on a percentage basis.

When comparing ITM vs OTM calls, the comparisons to the underlying are more intuitive than the comparisons of an ITM vs OTM put option. That’s because call option prices are positively correlated with the price of the underlying and put option prices are negatively correlated. That means the price action of puts will appear inverted compared to calls.

The most dynamic way to learn options trading…

If you learn by doing and watching, Benzinga’s option alert service is perfect for you.

It’s a premium alert service is led by pro options trader and mentor Nic Chahine.

You get access to Chahine’s high-conviction and highly profitable options trades — complete with thorough analysis so you can understand the “why” behind his trades. Not only do you get…

- High-probability option trades

- Transparent access to trade explanations and analysis

- Market analysis

- Education

But for a limited time, you can get free access to the next Benzinga Boot Camp to learn how to trade stocks and options like a pro.

In the Money and Out of the Money Put Options

Put option buyers have the right to sell a stock to someone else at the designated strike price.

That means a put option is in the money if the strike price of the option is higher than the current price of the underlying security.

So, if you owned a call option on XYZ stock with a strike price of 60, then as long as the share price of XYZ traded at $59.99 or lower, your contract would be in the money.

If the price of XYZ moves lower in comparison to the strike price, that moves the put option deeper in the money. Put option contracts with a strike price well above the current trading price of XYZ will increase or decrease in ways that are similar, yet inverse, to the moves of XYZ.

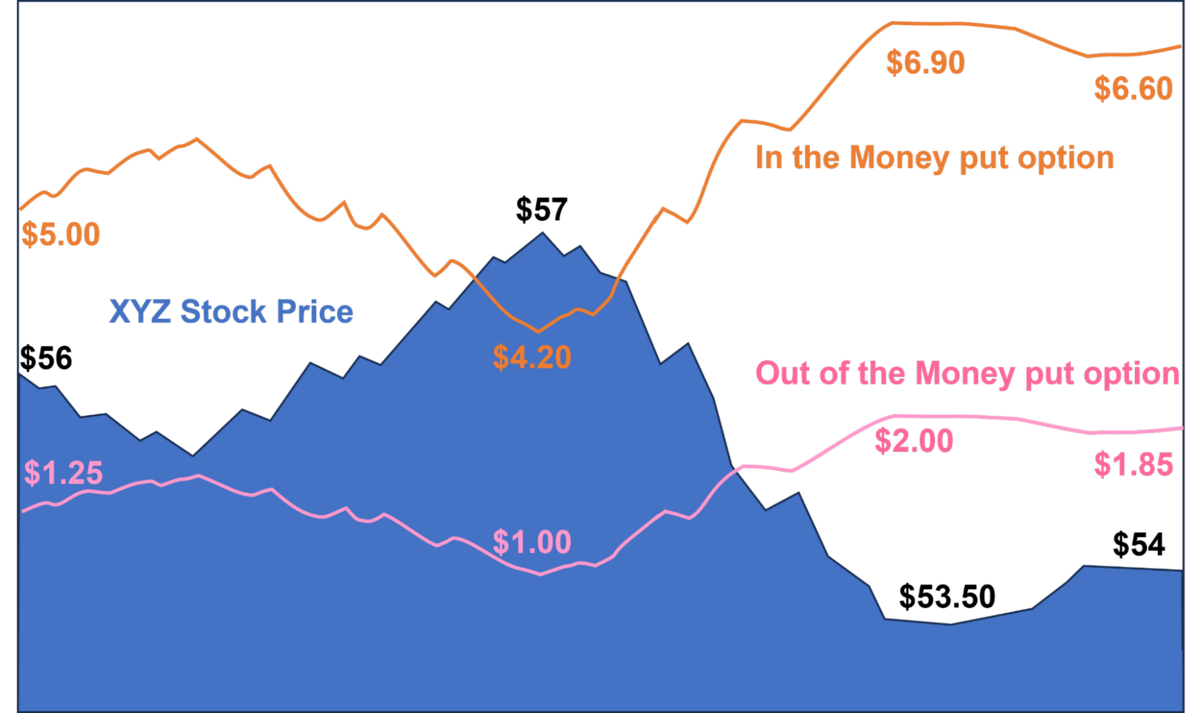

Imagine this time that the price of XYZ was $56 per share on a Monday and that, with some fluctuation, it fell to $54 per share by Friday. The price action of an ITM put option (with a strike of 60) will more closely follow the inverse of XYZ’s stock price as opposed to an out of the money put option.

In the above illustration, an ITM put with a strike of 60 could be depicted by the orange line. An OTM call with a strike of 52 could be depicted by the pink line.

The illustration shows how an OTM option’s price moves are not as sensitive to the price changes of XYZ when compared with the movement of the ITM option prices.

Regardless of whether you trade call options or put options, you’ll notice that OTM option prices represent lower nominal changes in value, but greater changes in value on a percentage basis. This is especially true as time progresses closer to expiration. That’s because of the lack of intrinsic value in OTM options.

Intrinsic vs Extrinsic Value

Intrinsic value is the amount of money that can be captured by an option contract if it is exercised, and if the resulting shares were liquidated.

For example, if XYZ is trading at $58 per share, and you own an XYZ call option with a strike price of $55, then you could immediately get $3 per share (less any transaction costs) by exercising the option and selling the shares.

Any amount that an option contract costs over and above the intrinsic value is considered extrinsic value. For example, if an XYZ call option with a $55 strike trades for $4.00 when the price of XYZ is $58.00, then you’d be able to identify that the option had $3.00 of intrinsic value and $1.00 of extrinsic value.

Extrinsic value decreases as the option gets closer to its expiration date. So the same option that might have $1.00 of extrinsic value today, might have only $0.75 or $0.50 of extrinsic value one week later, even if XYZ remains at the same price. For this reason, extrinsic value is also known as time value.

The Cost of Options Contracts

Option pricing can be very complex because option sellers use a number of variables to arrive at a price they feel comfortable with.

Because options represent significant leverage and opportunity for buyers, sellers recognize they are taking on significant risk. To mitigate that risk, they factor in both intrinsic value and extrinsic value as part of the price.

Intrinsic value is calculated from a set calculation.

Extrinsic value has several components that are used to calculate it:

- Time left before expiration

- Typical fluctuation of the underlying

- Overall demand for the options

Here is how each of these three is related to the extrinsic value.

First, more time increases time value. It’s no surprise that the more time is left before expiration, the higher the extrinsic value will be. As time progresses, however, this value decreases at an exponential rate.

The typical price fluctuation of a security is the next most common influence on extrinsic value. This is also known as historical volatility, and it plays into the way option sellers set their prices. The more volatile a security is, the higher the price the option seller will set so that they can mitigate losses in the event of a big move against them.

The last of these components is demand. Professional option sellers, also known as option market makers, will increase their prices as they see more buy orders for either calls or puts on a security. They may not know what is driving the orders, but they know that they can raise prices simply because there are a larger number of enthusiastic buyers in the market. The greater the demand, the higher the price an option seller will set.

Regardless of how the price gets set, all other things being equal, extrinsic value will decrease as the days go by. This time decay is so prevalent that it leads many option traders to try strategies designed to profit from the consistent, natural decline in prices over time.

Time Value (Theta)

Since an option contract has a set expiration date, the opportunity for a buyer to make a profit from speculating on the price moves in the underlying is limited by this period. The value of that opportunity is often calculated based on how much time is left before expiration, the more time, the greater the value.

That’s why extrinsic value is also known as time value, and the persistent decrease of extrinsic value over time is known as time decay.

Professional options traders apply the names of Greek letters to the variables in the standard models for option pricing. These labels, known as the option Greeks, describe various components of option pricing. The Greek used to measure time decay is known as Theta.

Many professional option sellers structure all their trading based on optimizing the gains they can make from collecting Theta as time passes. This is the most reliable way to make gains in options trading, but it requires significant risk-taking.

Anticipating the price changes of ITM vs. OTM options can be tricky, but the main thing to remember is that OTM options experience more time decay than ITM options. That’s why option sellers use OTM options for collecting theta.

Risks for Options Buyers and Sellers

Options trading comes with the risk of losing money no matter what strategy a trader may employ. Risks can be characterized in two ways:

- Taking small losses more frequently in hopes of achieving very large gains occasionally

- Risking larger losses so that you can take smaller gains more frequently.

Both trading styles have their pros and cons, but it is important to recognize that the dynamics of option pricing make it more likely that option buyers will have to take losses more frequently, while option sellers will have to risk occasional large losses.

At-the-Money Options

Option traders have a special designation for the call or put option with the strike price that is closest to the currently traded price. This is known as the at-the-money option.

At-the-money options typically have the highest amount of extrinsic value compared to any other strikes offered. That makes them excellent candidates for selling strategies that aim to collect Theta.

In the Money vs Out of The Money: Which is Better?

Trading ITM vs OTM options each have respective tradeoffs. Which one of these is better for you depends entirely on the goals of your trading strategy and the risks you are willing to tolerate.

- The advantage of trading ITM options is that even a small move in the stock still generates profits in the options contracts. The disadvantages of ITM options are that they cost more than ITM options, and that a strong move in the opposite direction can rapidly generate losses.

- The advantage of OTM options is that they cost less and the gains they make usually have a higher rate of return on trading capital. The disadvantage is that the underlying shares must make a more significant move for an OTM contract to show the desired level of profit.

Which Options Should You Buy or Sell?

For most Theta-collection strategies, the best contracts to sell will either be ATM or OTM options. That’s because the movement of the underlying shares will have less impact on the price of the option. This allows the trader to patiently wait for time decay to kick in.

For most rapid-growth strategies, the best contracts to buy will be either ITM or ATM options. That’s because the movement of the underlying shares will have a greater impact on the price of the option. This allows the trader to capture gains quickly and not have to suffer the effects of time decay.

That said, you should employ a wide variety of strategies to meet your needs. Everyone is different.

Must-have resources for options traders

- Options trading brokerage: eToro*

- Options alerts + educational resources: Benzinga Options

- At-your-own-pace digital options course: Selling Options for Income

- Our #1 charting platform: TradingView

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Final Word: In The Money vs Out Of The Money

ITM options have intrinsic value. This characteristic gives the contract the ability to rapidly change in ways that are highly similar to the underlying security, making it a more efficient replacement for the underlying and tying up less capital.

By contrast, OTM options have no intrinsic value. This characteristic gives the contract a lower price and a higher degree of leverage as prices change. But larger price moves are needed to create more significant gains.

Ultimately, you need to determine what characteristics you favor and what risks you’re willing to take.

FAQs:

Is it better to buy in the money or out of the money?

OTM options are better for moving closely with the underlying security, but ITM options provide more leverage when they make gains.

What do you mean by in the money?

ITM options have intrinsic value. That means that the current price of the stock would allow the option to generate cash if the option were exercised and the resulting position of shares were liquidated. For example, a call option with a strike of $55 would generate $3 per share in cash if the stock were trading at $58 and the contract owner decided to exercise the option.

What is the difference between in the money and at the money?

OTM options have no intrinsic value and ITM options have some intrinsic value. That means ITM option prices are more sensitive to the moves of the underlying security.

Which is more profitable ITM or OTM?

ITM options tend to be more profitable on a nominal basis, whereas OTM options tend to be more profitable on a percentage basis. That’s because ITM options have intrinsic value and therefore cost more and are more sensitive to movements in the security.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.