Before we get to the stock picks newsletters, I’ve got a quick question. Have you heard Warren Buffett’s Top 2 Rules of Investing?

Rule #1 – Don’t lose money.

Rule #2 – Never forget Rule #1.

Similarly, Stephen Schwarzman, co-founder of Blackstone (the world’s largest alternative asset manager with nearly $1 trillion in assets under management), says the number one rule at Blackstone is “Don’t. Lose. Money.”)

If 2 of the best stock market investors of all time have the same rule, it’s probably a good one for the rest of us to adopt. Unfortunately for us “regular investors”, we don’t have massive teams of analysts to do this work for us.

That’s where investment newsletters come in.

After experimenting with A LOT of the so-called “top investment newsletters”, I sorted through the noise and put together some criteria so you can determine which is the best stock newsletter for you. I’ve compiled it into this list.

For each of these stock newsletters, I’ll share the value (what you’ll be getting), the price (what you’ll be giving up) and who each investment newsletter is right for.

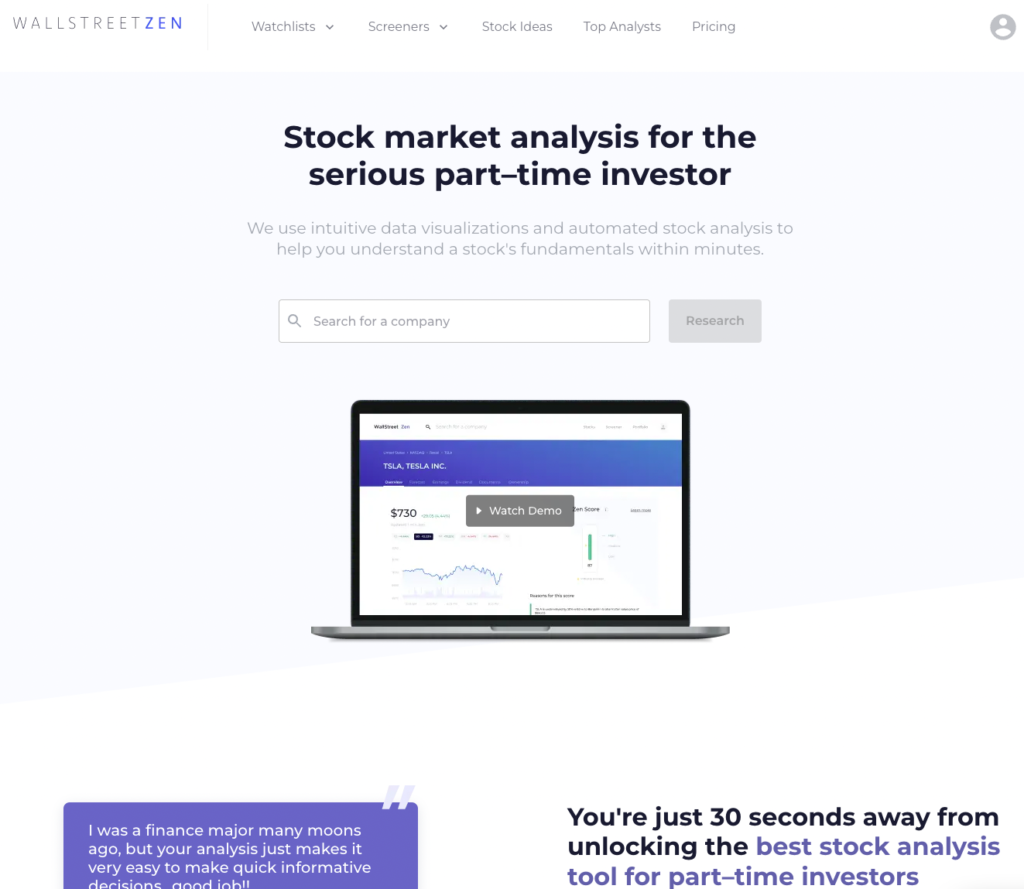

1. WallStreetZen

Full disclosure, I work for WallStreetZen, but I applied for the job because I absolutely love the product.

This is a 2-part entry, because WSZ actually has two products that deserve a spot on this list: WallStreetZen Premium and Zen Investor. Let’s dig into both.

WallStreetZen Premium

As Buffett and Schwarzman point out, investing is all about 1) Identifying opportunities and, 2) Mitigating risk. No one does these 2 things better than WallStreetZen, which is why it earns the top overall spot.

Let’s examine WallStreetZen tackles both sides of investing:

How to Identify New Investing Opportunities with WallStreetZen

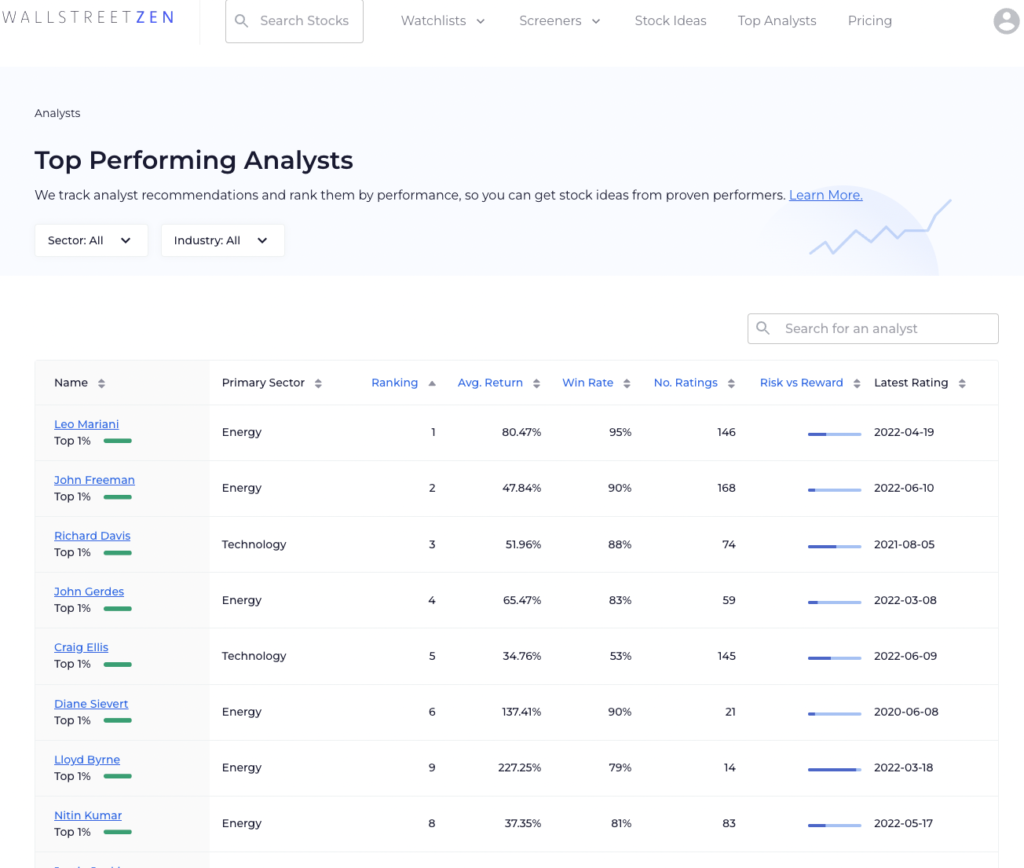

Top Analysts

We collect performance data on nearly 4,000 Wall Street analysts, who we rank by return, frequency, and win rate (backtested over multiple years).

After sorting them, you can see exactly what the top-ranked analysts are recommending right now:

Remember, these are the best performing analysts out there. And you get to see what they’re recommending.

Picks like:

- SNAP, which was recommended by Top Analyst Jim Kelleher, and resulted in a gain of more than 500% in less than one year

- CRK, which was picked by Vincent Lovaglio (an energy stock specialist) and twice gave him 200%+ gains

Stock picks and analysis from professional analysts – sound familiar? (hint: Buffett’s and Schwarzman’s round table discussions)

Stock Ideas

Nearly 30 pre-built screener setups, filtering on the qualitative and quantitative criteria you find most important. Click one and get a complete list of investment inspiration.

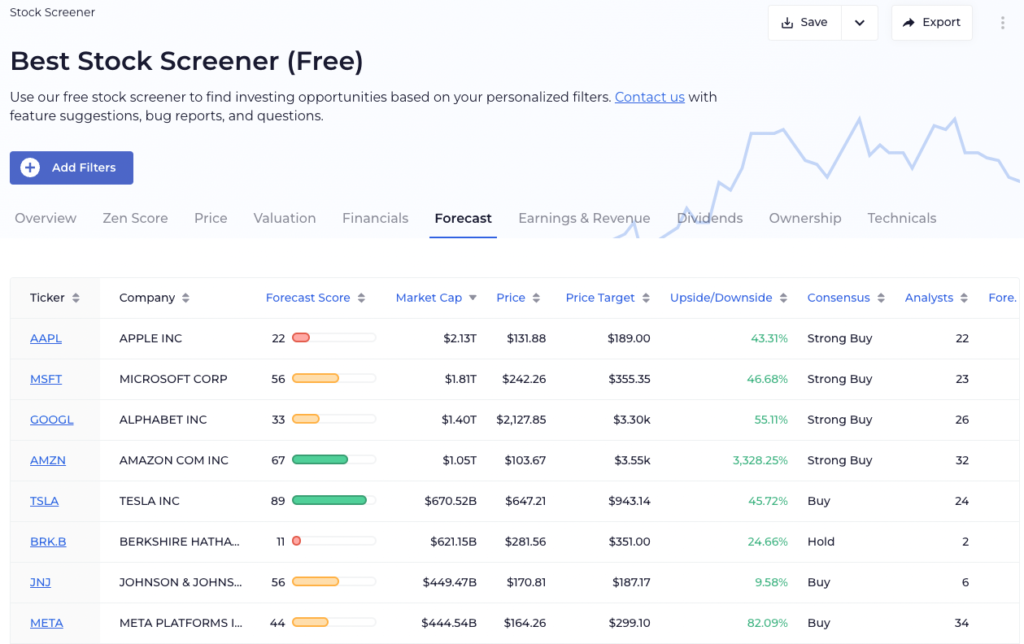

Stock Screener

You probably already have an investing style – what you need now is a way to translate those personal preferences into investment ideas:

The Screener combines WallStreetZen’s automated analysis (think Due Diligence score, DCF, relative and intrinsic valuation information, to name a few) found elsewhere on the site with the layout and screening capabilities of a typical screener – the result is one-of-a-kind.

Don’t believe me? Try it out for yourself – it’s free.

“WallStreetZen Ideas” Newsletter

Each week, subscribers receive 4 emails with timely market information and trade ideas.

During the week, the newsletter features “Strong Buy” recommendations from analysts (for example, we alerted Nvidia (NASDAQ: NVDA) when it was trading below $400, and it’s currently trading for about $1200). It also features “Hot or not” stocks (the biggest winners and losers) and stories about small and large-scale catalysts that could move stocks.

On the weekend, WSZ Ideas sends out a weekly list of five stocks to watch in the coming week — for instance, we featured Walmart Inc. (NYSE: WMT) right before the company’s earnings, and it quickly shot up about 10% after our feature. it’s quickly become one of our most popular emails.

How to Mitigate Investing Risks with WallStreetZen

Zen Ratings

What is fundamental analysis?

Sure, it’s the process of determining a stock’s fair value, but what are you really doing?

Identifying a stock’s strengths and weaknesses.

Put another way: Opportunities (reward) and threats (risk).

With Zen Ratings, you can see a stock’s fundamental strengths and weaknesses in seconds and immediately launch into further investigation:

Our proprietary ratings system distills 115 factors proven to drive consistent growth in stocks into an easy-to-read letter score. Plus, to dive in deeper, you also get individual grades for the key components that go into the score.

Let me walk you through an example. Let’s take a look at a current stock that has a B rating — Wix.com (NASDAQ: WIX). Side note: WIX also happens to be a recent Stock of the Week selection from our Zen Investor Editor in Chief, Steve Reitmeister. Here’s what its Zen Rating looks like:

Buy sounds good, but what goes into that rating? On the same page, you can also see how WIX fares on the seven components (each made up of several individual checks, adding up to over 115 factors total) that play into the score. Now, you have a better idea of where the stock really shines — as well as any potential areas of concern.

As a B rated stock, WIX is in the 20% of stocks based on the Zen Ratings system, which have generated an average return of 19.88% returns per year. Here’s where it gets even better: A-rated stocks using the Zen Ratings system have generated an average annual return of 32.52% since 2003. At any time, hundreds of stocks have an A or B rating, giving you plenty of high-potential stocks to choose from.

Try it for yourself – type in your favorite ticker here.

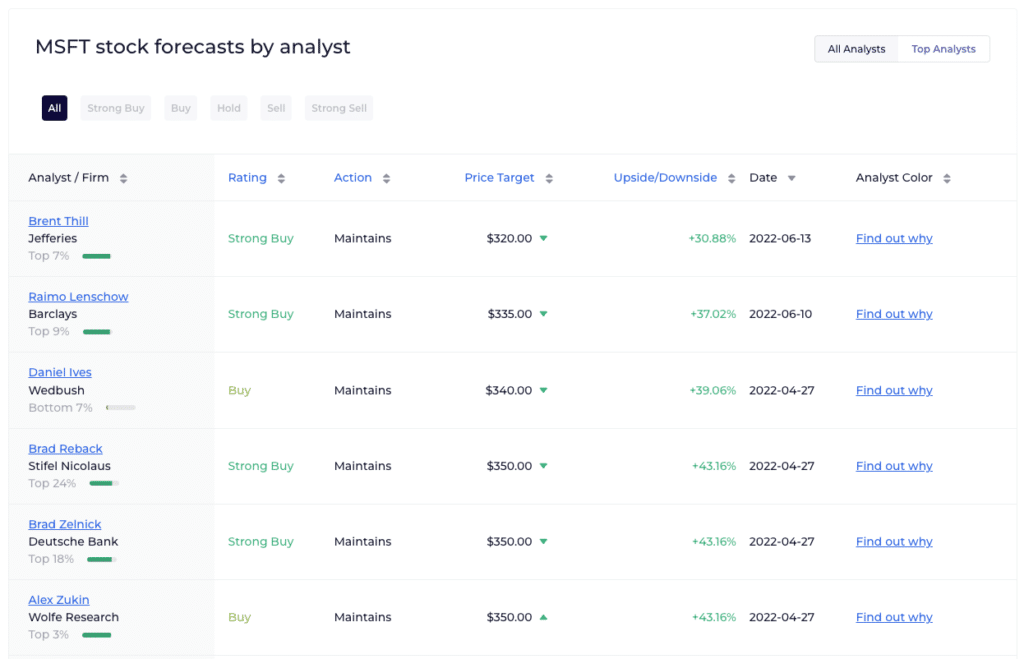

Forecast pages

Each recommendation and research report performed by the Top Analysts will be displayed on each respective stock’s Forecast page:

Commentaries, earnings and revenue forecasts, price targets, growth rates, consensus ratings – it’s all here.

Watchlists (and Daily Alerts), Why Price Moved, & News Feeds

We all know the importance of keeping our finger on the pulse, especially given current market conditions.

We need a reliable system for staying on top of the latest news on price changes for each of the stocks in our portfolios. WallStreetZen has you covered.

(Want to learn how to predict stocks or what makes stocks go up and down?)

With Watchlists, easily add your favorite stocks to multiple watchlists (personally, I have “Current Portfolio” and “Further Due Diligence” watchlists).

From inside a Watchlist, sign up for Watchlist emails, view your Watchlist Feed (which includes News, Insiders & Analysts, and Events), and discover “Why Price Moved” (a 1-2 sentence synopsis on large price swings).

Pricing

Unlike the other options on this list, WallStreetZen gives away most of its features for free, though frequent users will likely bump into a paywall.

To unlock full access, these power users will want to upgrade to Premium.

WSZ Premium includes a 30-day, money-back guarantee.

Zen Investor

Here’s part 2 of the entry for WallStreetZen on this best investment newsletters list.

Zen Investor is a brand-new offering from WallStreetZen — a stock-picking newsletter based on an investment portfolio managed and led by market veteran Steve Reitmeister. It has a fantastic track record, as you can see below…

Now, in case you’re not familiar with Steve (or “Reity” as he likes to be called), he has been active in the markets for four decades, notably as the Editor in Chief of Zacks.com for many years.

Now, he’s partnered up with WSZ to offer an exciting new stock picking newsletter. As a member, you receive stock picks, commentary, portfolio updates, and webinars from Steve, who hand-selects every stock pick through a proprietary 4-step process using WallStreetZen tools including the Zen Ratings system I mentioned above.

I won’t go into his entire process here (you can read about it here), but I do want to spotlight one of the steps — how he evaluates upside potential:

- First, focus on stocks with attractive growth potential. To do this, Steve does a deep dive analysis of the company to appreciate the story driving that growth (Examples include turnarounds, unique sales approach, acquisitions or new product innovation.)

- Next, make sure not to overpay for shares. Steve has many reliable methods for evaluating — he breaks them down in his frequent updates to subscribers.

- Finally, focus on stocks that could deliver a stream of earnings surprises in the future. As he puts it, “There are few greater joys in this world than waking up in the morning to find that one of your stocks has beaten estimates with shares flying 10-20% higher on the news.”

Unlike WallStreetZen Premium, which is designed for investors who want a DIY approach to investing, this service does a lot of the heavy lifting for you, giving you stock suggestions and commentary that you can choose to act on or not. Oh, and if a stock pick doesn’t work out? Steve issues a Sell alert. The goal is to only focus on and maintain positions in high quality stocks.

Pricing

Zen Investor is available for $99 / year — but right now it’s available for an incredible $79/year using the link below.

2. The Motley Fool – Stock Advisor

If you’re a long-term investor looking for monthly stock picks, The Motley Fool’s Stock Advisor is the best investment service for you.

The Motley Fool is run by former hedge fund managers and brothers David and Tom Gardner who have an incredible eye for value. As such, the company’s Stock Advisor newsletter stock picks have performed exceptionally well since the service’s inception:

This service is for investors who want regular stock picks and analysis performed by an investment team with an incredible track record.

Here’s a quick mention of some of their former recommendations, in which they got in at or near the ground floor: Amazon (Recommended on 9/6/2004), Nvidia (Recommended on 4/15/2005), and Netflix (Recommended on 12/17/2004).

And they just announced their latest 2 recommendations:

What You’ll Get with Stock Advisor

- 2 new stock picks each month – The team’s latest stock recommendations, delivered monthly.

- Best Buys Now List – 10 timely buys chosen from over 300 stocks.

- Starter Stocks List – Foundational stock recommendations for new investors.

- Community access and investing resources – Educational materials and membership into an ever-growing community of investors to help you invest.

From this stock service, you’ll get picks from an analyst team that has historically beaten the market quite consistently.

Pricing

We have access to an exclusive offer of Stock Advisor, just $199 74* for a new member’s first year:

You can read my full Motley Fool review here.

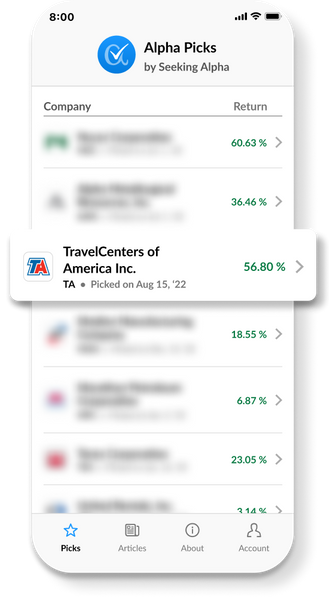

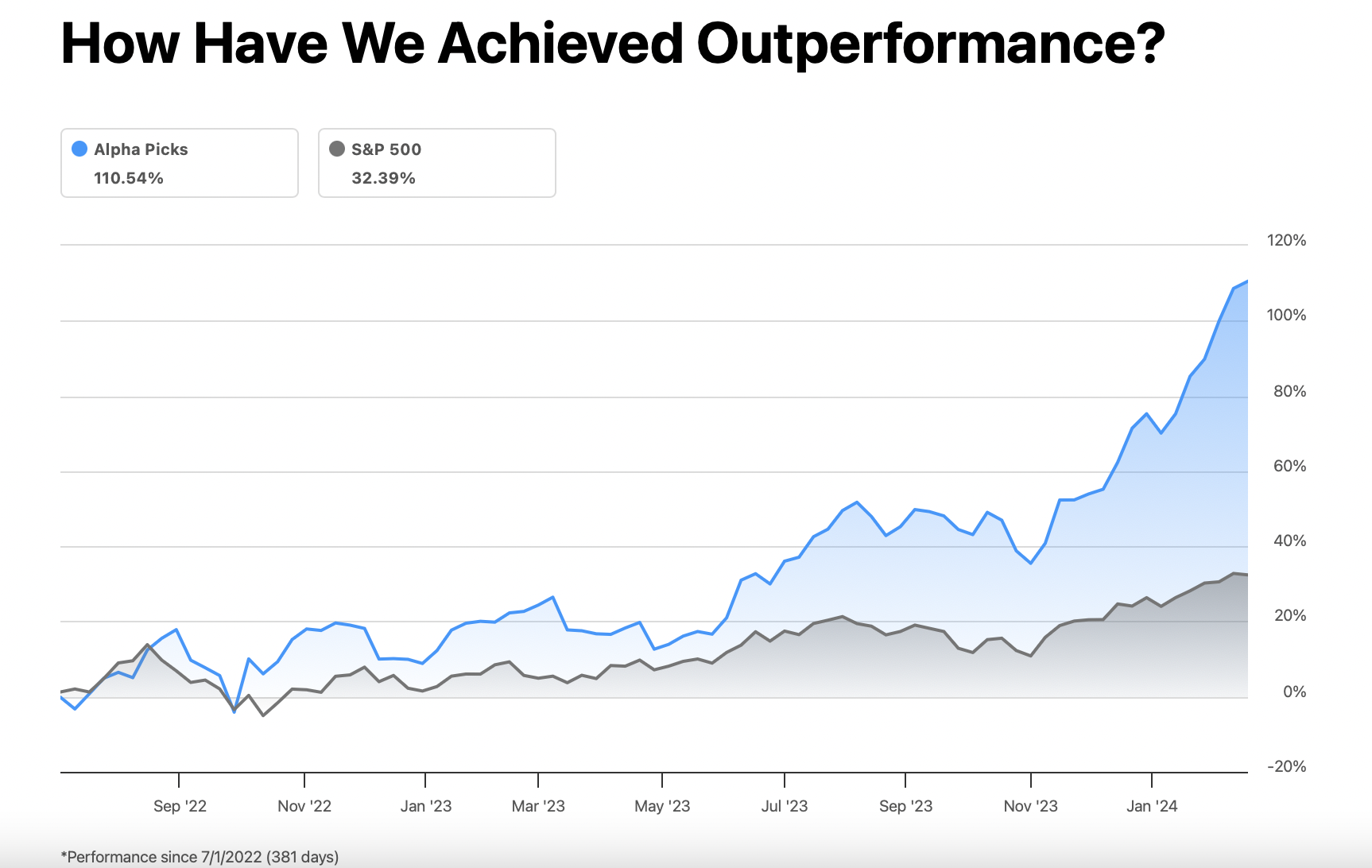

3. Seeking Alpha – Alpha Picks

Seeking Alpha has multiple newsletters, including an investment newsletter service of its own, called Alpha Picks.

If you have a Seeking Alpha Premium subscription, you’ll know just how much detailed analysis the website has aggregated on every stock it has covered. Author ratings, Quant scores, Factor grades – the list goes on.

Seeking Alpha has taken this mountain of research and created a product to provide 2 monthly stock picks sifted from the thousands of stocks covered on its site.

Seeking Alpha also just released a cool new feature — Virtual Analyst Reports, which use AI algorithms to analyze vast amounts of financial data, earnings reports, and analyst ratings to help you make informed investment decisions based on data-driven insights. This feature helped nab Seeking Alpha a spot in our best AI stock pickers post.

The stock picks are generated by Seeking Alpha’s proprietary data-driven system, which analyzes valuation, growth, profitability, momentum, EPS trends, and other key metrics.

Here’s how Alpha Picks has performed so far:

I’m a huge fan of Seeking Alpha, and I’m pretty confident Alpha Picks will give Stock Advisor a run for its money.

What You’ll Get with Alpha Picks

- 2 long-term stock picks each month (past examples include Super Micro Computers (NASDAQ:SMCI), a stock that went up 250% in a single year…

- Detailed explanations of why each stock is rated so highly

- An alert if they think you should sell a stock that was previously recommended

- Regular updates on current ‘Buy’ recommendations

The service is for busy, investing professionals who are already fans of Seeking Alpha’s products.

Pricing

Alpha Picks is $499 a year — but you can nab 20% off if you use the link below. It’s more expensive than Zen Investor (below), but considering the track record and time it saves you, it’s worth considering.

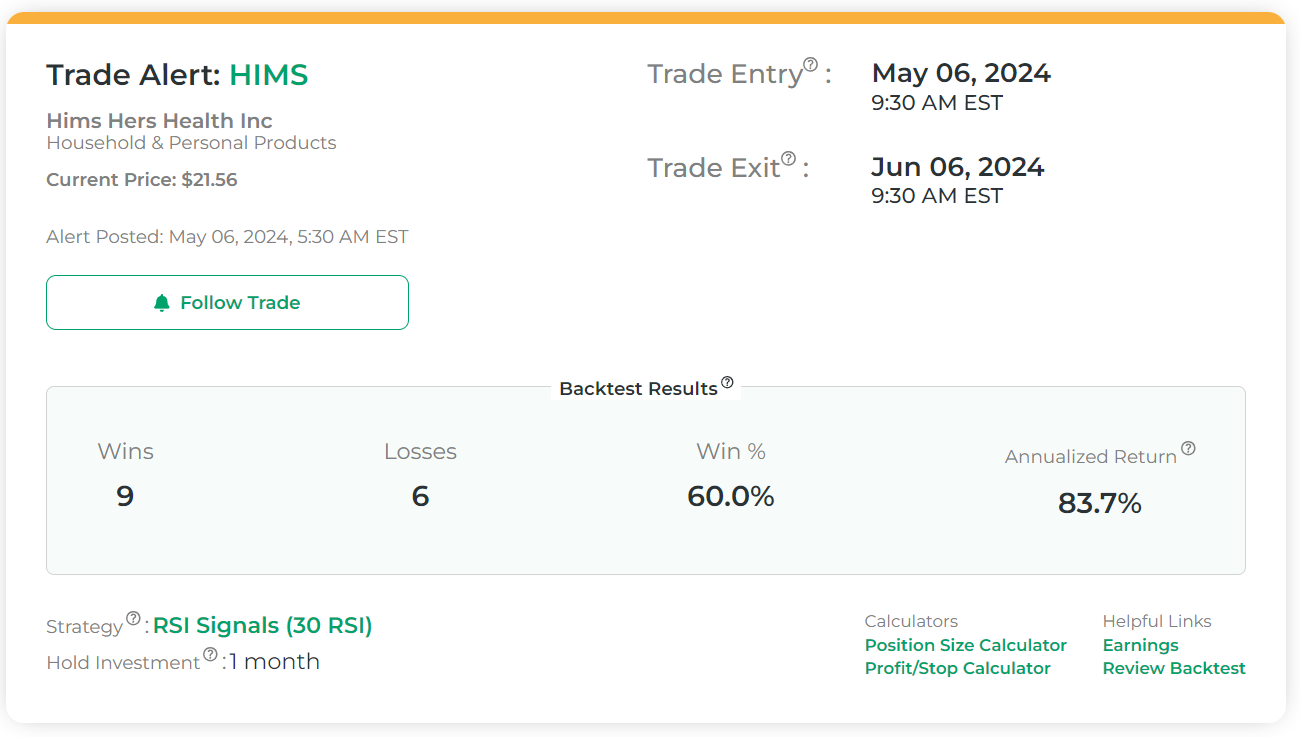

4. Stock Market Guides

There’s a lot to like about Stock Market Guides.

First off, you’ve got options — including options trade alerts. In fact, you have three different choices in terms of subscriptions:

- Stock investment picks

- Swing trade picks

- Option picks

Don’t be overwhelmed — these different variations mean you can choose the service best suited to your investment or trading style and your schedule. And since the subscriptions vary in price between $29/month to $69/month, you might even consider multiple subscriptions.

Regardless of which subscription you choose, Stock Market Guides offers something unique: it shows you how a setup has performed in the past. So when you get an alert, you’ll get access to the stock’s past performance in similar situations. The service is also transparent about its average annualized returns.

To demonstrate how the newsletter works, take a look at an alert from May 2024, for Hims & Hers Health (NYSE: HIMS). When Stock Market Guides published the stock pick on May 6, 2024, the stock price was $11.80. By the time the prescribed trade had ended, on June 6, 2024, the stock price was $21.50. That’s a gain of 82% for an investment that was held for just 1 month.

In addition to frequent alerts, you’ll also receive regular market updates from Stock Market Guides.

Hopefully I’ve done the system justice — if you want to know more, check out our detailed Stock Market Guides review. But suffice it to say: This is one of the better newsletters, and stock-picking services, period, on the market right now.

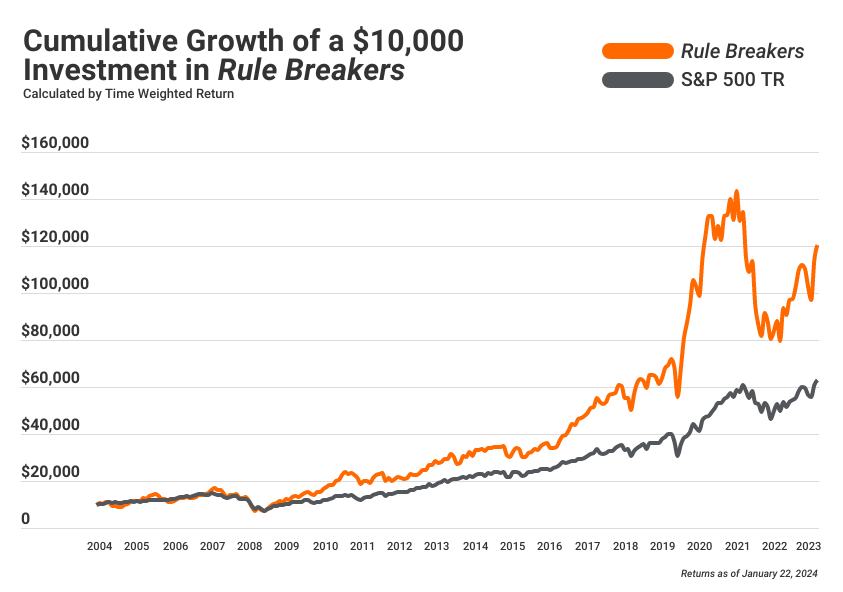

5. Motley Fool Epic

I already shared Stock Advisor’s impressive returns … The only reason Epic isn’t right up there with it is that it’s a bit more expensive ($499 / year, but you can get $200 off for your first year using the links in this post), and because it’s suggested for investors with a portfolio of $50k or higher. I recognize that might not be everyone, so it’s slightly further down on this list. But it’s still on the list. Here’s why.

With Epic, not only do you gain access to Stock Advisor, but you also gain access to their Rule Breakers service, which also boasts an impressive track record:

And more. You actually gain access to 4 of Motley Fool’s most popular scorecards — Stock Advisor, Rule Breakers, Hidden Gems, and Dividend Investor — along with a bunch of cool stock research tools and resources.

All in all, you get 5 stock picks per month, as well as a bunch of other great stuff:

- Monthly recommendations and rankings from Stock Advisor, Rule Breakers, Hidden Gems, and Dividend Investor

- A robust toolkit including Cautious, Moderate, and Aggressive Portfolio Strategies with specific stock allocation, FoolIQ research tools, simulators, and more.

- Access to full historical financial data, max drawdown, and projected annualized returns for all publicly traded companies in Fool IQ.

- Access to Motley Fool’s GamePlan+ financial hub and financial planning articles.

- Access to Motley Fool’s proprietary stock scoring system, driven by their Quant team (Quant 5Y).

- Premium access to Epic Opportunities, a members-only podcast.

- Articles and earnings coverage on an expanded universe of stocks.

If you’re interested in upleveling your portfolio, I strongly recommend Epic. (Check out my Motley Fool Epic review here.)

6. The Mindful Trader

Mindful Trader offers a stock newsletter service where he tells subscribers which stock trades he’s taking in his live accounts.

All his trades are based on algorithmic trading rules he developed, which means the trades have clearly defined rules and are easy to follow along with.

He sends out an email newsletter every trading day. There aren’t many stock newsletter services that send out such a high volume of emails, which is something that sets Mindful Trader apart from the rest.

That volume of communication seems fitting for his service considering that his stock trades only last about a week. There is a high volume of trade turnover, which means this is a pretty active newsletter service.

In his daily email newsletter, he talks about the state of the market as well as the performance of his stock trades. He’s different from a lot of other services because he doesn’t try to upsell his subscribers in his newsletters.

Here is an equity curve showing the performance of his stock picks over a one-month period:

Eric personally handles all customer service, which means if you send an email to Mindful Trader, you can expect a response directly from him.

The service at Mindful Trader is available for $47 per month.

7. The Average Joe

The Average Joe isn’t your average Joe in the world of stock market newsletters. It’s a free 4x-weekly investing newsletter filled with market insights and trends that helps you become a better investor. You’ll learn about the latest news with big players like Tesla (NASDAQ: TSLA) and Meta (NASDAQ: META), as well as overall market trends.

They call themselves the “IKEA instructions for investing” and you’ll see why the moment you subscribe. Their newsletters are simple, concise and impactful and easily consumed in just 5 minutes.

But you don’t read IKEA instructions in your spare time and you likely wouldn’t read financial publications for fun either. Until now… This is like nothing you’ve ever read before. It’s entertaining and informative, rare for a financial publication.

Pricing

Completely free.

Join 50,000+ investors by subscribing below:

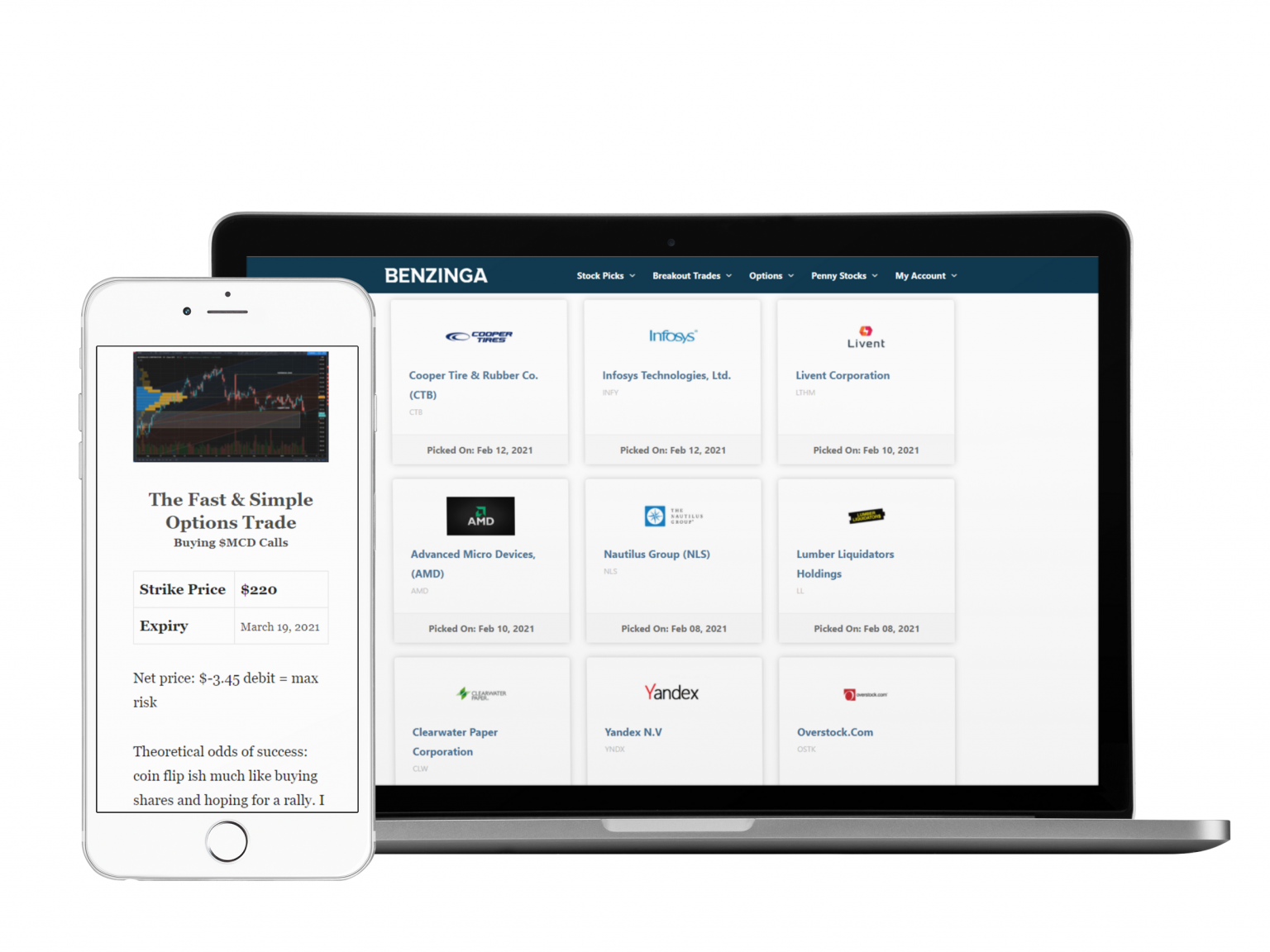

8. Benzinga Options

Enough with stock-picking newsletters, time for something with more upside.

Benzinga Options provides winning options trades from Nic Chahine, a veteran (and highly profitable) options trader. Nic has had a very successful career trading options and releases only his highest conviction trades to newsletter subscribers.

Get high-quality, high-probability trades twice per month with holding periods that range from 1 week to 3 months.

And if you’re totally new to options trading, don’t worry – the callouts are easy to follow and simple to implement. Plus, each option trade can be tailored to any portfolio, regardless of size.

Pricing

Get Benzinga Options for $297/year:

9. The Oxford Communique

The Oxford Communique is an investment newsletter curated by Alexander Green which provides members with monthly stock recommendations, buy and sell alerts, and bonus reports. You can look at some past reports online — for instance, in February 2024, the publication featured Life Time Group Holdings Inc. (NYSE: LTH), which is up 25% in the past 3 months as of June 2024.

Alexander Green is a Wall Street veteran with over 20 years of experience as a writer, research analyst, portfolio manager, and financial advisor. Green has been featured in The Wall Street Journal, Businessweek, and Forbes. He’s also the Chief Investment Officer at The Oxford Club.

The Oxford Club’s lead stock picker, Alexander Green, is calling this $4 stock the “Single-Stock Retirement Play”. Get the investment report with a subscription to The Oxford Communique.

Regarding performance, an initial investment of $100,000 would have grown to $434,000 by investing in the Communique’s picks. Over the same ~20-year period, the S&P returned just $332,000.

Pricing

The retail price for the Communique is $249 per year, but using our links you can get it for as low as $49 (an 80% discount). It also comes with a 1-year, money-back guarantee.

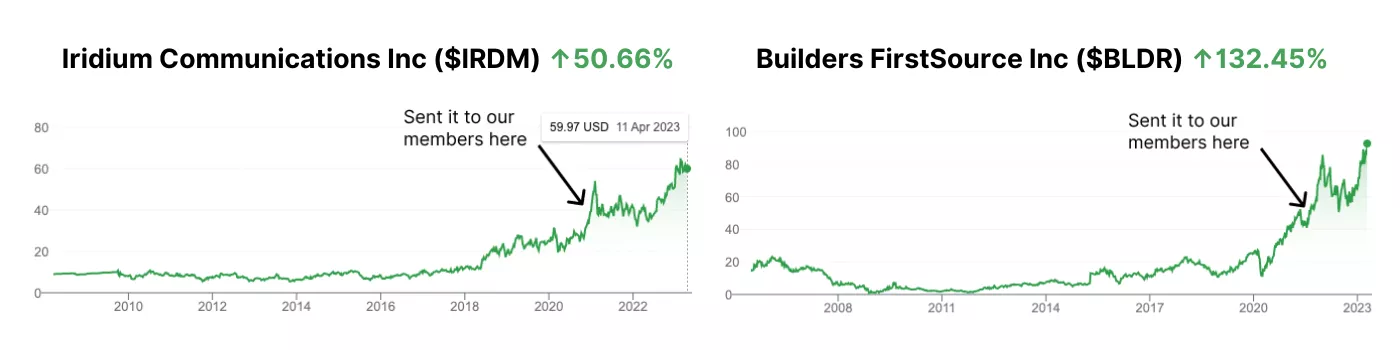

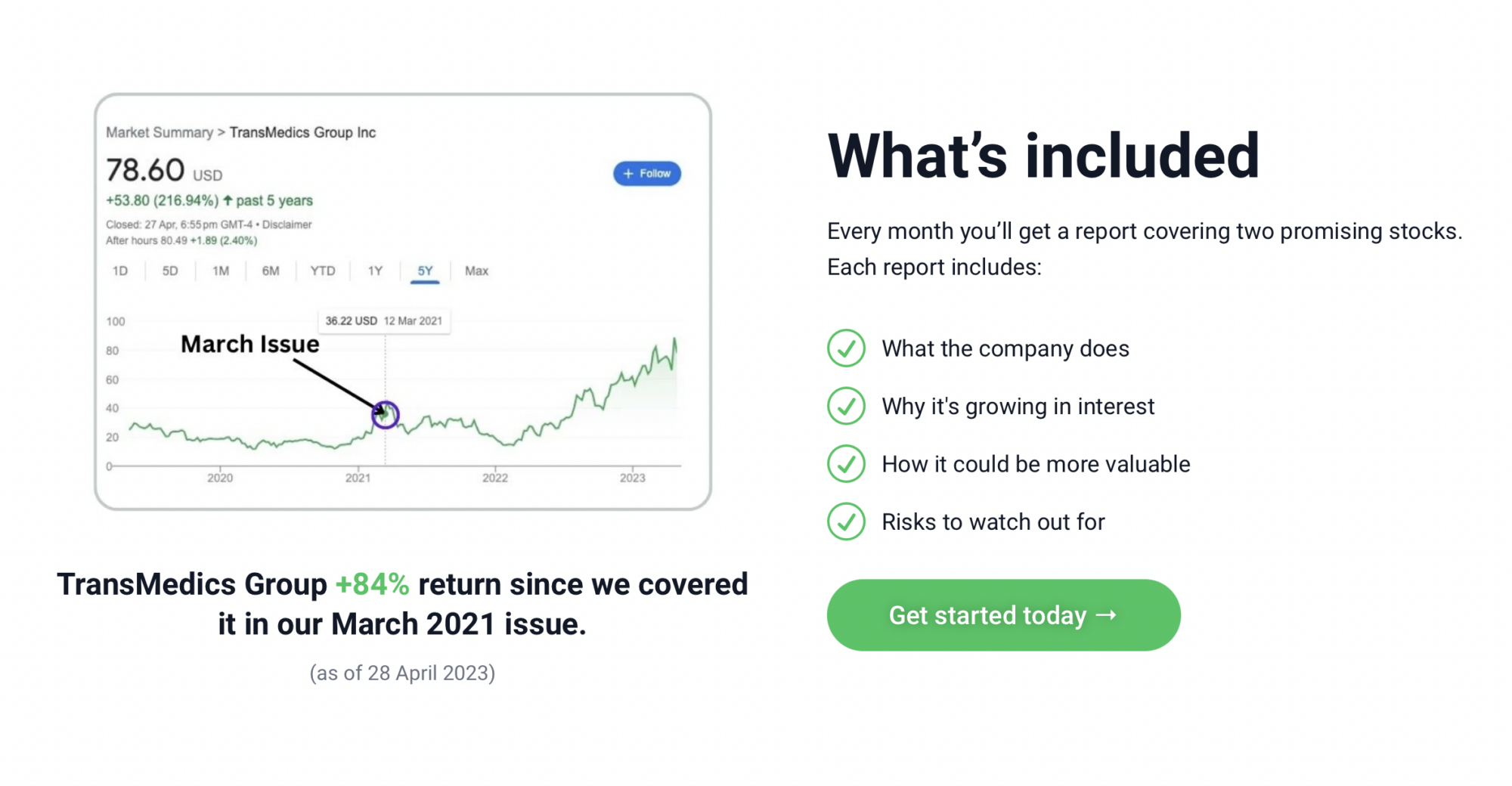

10. Ticker Nerd

Ticker Nerd‘s mission is simple: They aim to identify stocks with a high chance of growth. They share them with you via two detailed stock reports per month.

The site is quick to say that it’s not a stock recommendation service but a research service. They don’t hold positions in the stock; they’re just reporting on them. “All reports are data-driven, unbiased, and objective. Ticker Nerd will save you lots of time but works best when combined with your own research.” The idea is to save you time by giving you a head-start on the all-important due diligence process.

To come up with their stock selections, Ticker Nerd sifts through all sorts of data, including:

- Hedge fund trading data

- Wall St analyst ratings

- Social media sentiment data on Reddit and Twitter

- Fundamental analysis

- Quantitative analysis

Once they’ve found a promising stock, their team does even more research and provides a report on what they’ve found.

Here are just two of their past picks, Iridium Communications Inc. (NASDAQ: IRDM) and Builders FirstSource Inc. (NYSE: BLDR):

Plus, as a member, you get access to their library of previous reports. And since history doesn’t repeat but tends to “rhyme” in the stock market, there’s a lot of value in the ability to look at previous research on stocks.

Access to the tools Ticker Nerd uses to create their in depth reports could cost hundreds of dollars alone — making it well worth the price of admission ($149/year). If you’re looking for a service that can help expose you to trade ideas and individual stocks you might not have considered, along with detailed research on them, Ticker Nerd might be for you.

10 Best Investment Newsletters (Top Stock Returns) in July 2025

Newsletter | What Users Like | Price |

|---|---|---|

– Free and paid services available 4x/ weekly newsletter with stock market news and trade ideas, plus a weekly watchlist – A suite of stock research tools for DIY investors that can be applied to your specific long term investment strategy – Access to thousands of analyst ratings | $19.50/month ($234 billed yearly) or $59/monthly. Save 60% by going annual. You can also subscribe to the newsletter for free (no Premium membership required) | |

– High-conviction, high quality stock picks for long term investors from a 4-decade market veteran – Stock picks using a simple 4-step process – Stock picks chosen using WallStreetZen tools | $99/year; right now, charter members can gain access for $79 / year for a limited time only | |

– One of the best-known stock newsletters on this list; proven record over the past 2 decades – Regular picks and thorough analysis | Intro price: $99 for your first year (only with links from this post) | |

Seeking Alpha – Alpha Picks | – Strong performance since its inception – Picks are based on a proprietary data-driven system, which analyzes valuation, growth, profitability, momentum, EPS trends, and other key stock market metrics. | $499/year (get $50 off using links from this post) |

– Easy to read + follow trade alerts – Different investment newsletter options that can be tailored to your investment goals + preferences | $69/ month | |

– Curated by a stock market veteran with over 20 years of experience as a writer, research analyst, portfolio manager, and financial advisor. – Its picks have consistently outperformed the S&P | $249 per year, but using our links you can get it for as low as $49 (an 80% discount) | |

– Combines 4 of Motley Fool’s top stock scorecards: Stock Advisor, Rule Breakers, Hidden Gems, and Dividend Investor — along with a bunch of cool stock research tools and resources. | List price is $499; using the links in this article, you can get your first year for $200 off* | |

– Totally free stock newsletter – Market news expressed in a funny, easy to read, and informative format | Free | |

– Comes from an options trading pro, Nic Chahine – Get high-quality, high-probability trades twice per month with holding periods that range from 1 week to 3 months. | $297/year | |

– Very user-friendly; easy to follow | $149/ year |

Honorable Mentions

Here are a few honorable mentions for best investment newsletter, along with what they provide, who they’re right for, and how much a premium membership costs:

Newsletter: | Value Add: | Pricing: |

– Supplementary research from a plethora of on-site contributors – Great source of supplementary research on stocks you own or are considering buying | $19.99/month (after a free trial through our link) | |

– Investment research platform – Unbiased, objective, independent analysisTop investment newsletters – Stay up-to-date on current market headlines | $249/year (after a free trial through our link) | |

– A publisher of business forecasts and personal finance advice – Newsletters include: The Kiplinger Letter, The Kiplinger Tax Letter, Kiplinger’s Personal FInance, and Kiplinger’s Retirement Report | $29.95/year | |

– Stock market and financial news (a Dow Jones offering) – Financial newsletter | $36.99/month (you can find numerous discount codes online) |

Summary

If you’re looking for the top option for best investment newsletters in , WallStreetZen is it.

Given the number of times our investing heroes Warren Buffett and Stephen Schwarzman have repeated it over and over to their staffs, we know the importance we should be placing on not losing money.

While Stock Advisor and Zacks Premium are great places to identify opportunities, WallStreetZen is the place to perform the fundamental analysis you need to minimize your downside.

Plus, get access to their weekly “Strong Buys” email, Top Analysts, Stock Ideas, and the Stock Screener for plenty of investment opportunities.

Even if you’re just looking for a couple stock picks and opt for a Stock Advisor subscription, you may want to pair it with WallStreetZen’s platform to avoid investing blindly.

If you are thinking about Motley Fool, check out my review of Motley Fool Stock Advisor vs Rule Breakers, its 2 flagship services.

There are plenty of opportunities – we need to find the ones with the lowest risk.

FAQs:

What are the most successful investment newsletter?

The Motley Fool Stock Advisor newsletter has the most successful history of outstanding stock returns and has outperformed the S&P 500 by more than 3x over the last 20 years.

Are investment newsletters worth it?

Yes, investment newsletters are worth it.

You can receive high-quality stock and economic analysis straight to your inbox on a daily, weekly, or monthly basis.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.