Morningstar is one of the most well-known investment research companies in the world.

Its proprietary ratings on mutual funds and objective, data-driven analysis are heavily relied on throughout the industry.

While its solutions for investment professionals are reputable, what about its individual investor products?

Today, I’m writing a Morningstar Premium review – Morningstar’s product for individual investors.

Worth noting: Morningstar is attempting to re-brand this service as Morningstar Investor.

Is Morningstar Premium worth it? How much is Morningstar Premium? Who is Morningstar Premium right for?

It’s all in this Morningstar Premium review.

As with my Motley Fool review and Seeking Alpha review articles, I’ll score its Accessibility, Quality of Research/Analysis, and Price, then cover its key features in my review of Morningstar Premium.

Is Morningstar Premium Worth It in ?

The Bottom Line: If you like its portfolio insight tools and enjoy in-depth, objective analysis, a subscription to Morningstar Premium is an excellent investment.

Accessibility: 4.5/5

Quality of Research/Analysis: 5/5

Price: 3/5 (Morningstar Premium costs $20.75/month when billed annually)

What is Morningstar? (Morningstar Review in )

Morningstar (NASDAQ: MORN) was founded in 1984 with the mission of providing objective investment research, primarily focusing on mutual funds.

Since then, the company has become one of the most influential analysis platforms in the industry, generating more than $1.7 billion in revenue each year (primarily from professional and institutional investors).

Morningstar Premium provides individual investors with access to news and analysis on stocks, bonds, mutual funds, and ETFs.

In my opinion, determining if Morningstar Premium is right for you comes down to how much you value the investment research for which the company is known.

If you utilize the company’s “fiercely objective analysis” to guide your investment decisions and feel confident in its quality, Morningstar Premium (cost: $20.75/month when billed annually) is well worth the money.

Since it’s hard to gauge the quality of its research before becoming a member, I highly recommend utilizing the risk-free 7-day free trial.

Key Features of Morningstar Premium

Morningstar views investment ideas as just one component of an investor’s financial picture. As such, its features include portfolio optimization tools and other resources.

Upon signing up for Morningstar Premium you will get access to top investment picks, objective analyst reports, proprietary rating data, fund screeners, and its portfolio tools (Portfolio Manager and Portfolio X-Ray).

Analyst Reports

If you’re looking for a platform with objective, data-driven, in-depth analysis and reports on a particular investment, Morningstar stands alone.

Each Morningstar report is incredibly comprehensive and thorough. Morningstar’s Full Analysis will provide you with everything about the state of a company and where it is likely to go in the future.

Within each Full Analysis, you will find:

- Analyst Note

- Business Strategy and Outlook

- Fair Value and Profit Drivers

- Economic Moat

- Risk and Uncertainty

- Stewardship

With a Premium membership, Morningstar will also give you a star rating for the investment.

This depth of analysis and insight can give you an understanding of any business that you can’t get anywhere else, all in a matter of minutes.

For smaller companies without analyst reports, Morningstar uses Quantitative ratings to compare a company to its peers. In these cases, you’ll see a Q next to the star rating:

Best Investments and Fund Analysis

Let’s be honest, as investors, we’re always looking for the best investment opportunities.

If you’re having trouble finding the best funds, stocks, ETFs, bonds, bond funds, index funds, target-date funds, starter funds, or any combination of these, Morningstar has you covered.

The Best Investments section compiles the best investment ideas from Morningstar’s 220 independent analysts and allows you to sort by categories like Featured, Type, Retirement and Income, Undervalued, or Portfolio Builders.

Each recommendation and rating is backed by the analyst’s deep-dive report. And since the analysts are paid by Morningstar, their incentives are directly aligned with providing you the best possible information. Check out the competition in Motley Fool vs Morningstar.

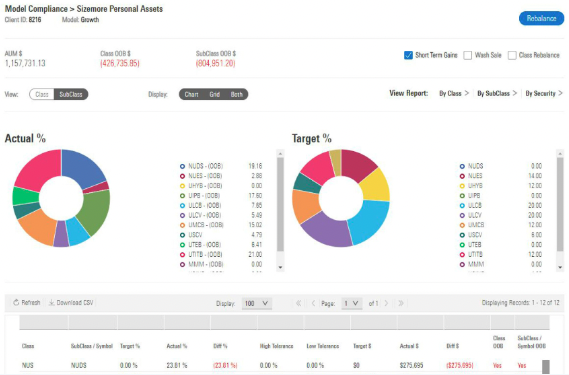

Portfolio Manager

The Portfolio Manager gives you the ability to track your investments, evaluate your portfolio strategy, create watchlists of potential opportunities, and more, all from an easy-to-use dashboard:

It’s the reason we ranked Morningstar the best stock portfolio tracker.

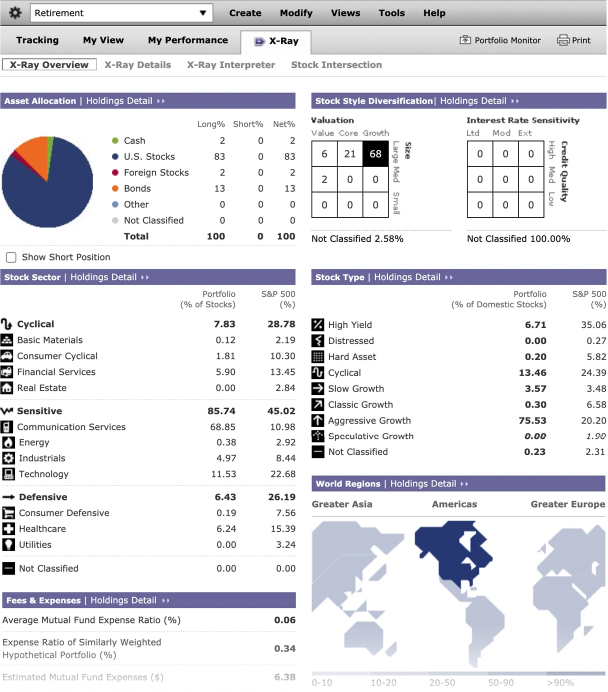

Portfolio X-Ray

Once you’ve created set your portfolio up in Portfolio Manager, X-Ray evaluates your asset allocation and investment mix to reveal any concentrated positions or underweight areas:

Many investors pay their financial advisors hefty fees for portfolio insights just like this. With Morningstar Premium, you can get the exact same information for a fraction of the cost.

Similar Funds

Tax loss harvesting is one of the most effective ways to lower your capital gains tax.

Morningstar’s Similar Funds helps you find mutual funds that are similar to your target fund, allowing you to easily find replacement funds and reduce your annual taxes.

For a lot of investors, this tool alone easily pays for the cost of their Premium subscriptions.

Screeners

Although it also offers screeners for stocks and ETFs, its Basic Fund Screener is a unique tool which enables you to filter mutual funds by performance, rating, or category. This way, you can easily discover funds which best fit your investing style.

The “Premium Fund Screener” takes it a step further, allowing you to filter by more specific Morningstar criteria like rating and risk, sustainability, annual returns, load-adjusted returns, yield, tax-cost ratio, and a plethora of other data points.

For the ultimate screener, check out my Finviz Elite review.

Article Archive

Morningstar Premium offers a variety of planning tools, such as tax planning, personal finance, retirement savings, and saving for college. Within each of these topics, the company hosts a series of educational articles to aid in your planning process.

Educational Resources

In addition, the company provides worksheets (like a budget worksheet, goal planning worksheet, net worth worksheet, etc.) to help with your holistic financial picture and the “Morningstar Investing Classroom”, a self-study course that teaches you about investing.

iOS Apps

Morningstar has a free app that allows you to view your portfolio(s) when you’re away from your computer. The app doesn’t have the same functionality as the website, but it works well for some quick research or on-the-go portfolio monitoring.

Read more: Here are my articles on the best stock market news app and the best stock tracking apps.

Empower

In partnership with Empower, when new users sign up for Morningstar Premium they have the option to have a one-on-one financial review with a licensed financial advisor, though this requires a minimum portfolio value of $100,000.

If you’re interested in Empower, you can sign up for their services directly. Even if you don’t have $100,000 worth of invested assets, you can take advantage of their free tools.

Final Word

Morningstar Premium was built for individual investors who are serious about their investment portfolios – it’s not built for the faint-of-heart. Its platform is intense and robust, meaning you’re either using Morningstar or you’ll avoid it altogether.

At the end of the day, the decision to upgrade to Morningstar Premium comes down to how much you value the company’s investment research. Is it worth the $20.75/month (billed annually) cost?

To make an informed decision, I can’t recommend enough giving the 7-day free trial a shot.

You should pay for Morningstar Premium if you’re a fundamental investor who buys individual stocks (how to buy stocks online), mutual funds, and/or ETFs and want access to objective, data-driven analysis.

If you want a similar service but prefer a more active investing style in individual stocks, Seeking Alpha Premium may be a better fit.

If you prefer a more passive approach to investing and want to take a hands-off approach, I would recommend a robo-advisor like Betterment.

And if you’re looking for the best stock picking service that provides a couple stock picks each month with home-run potential, I always recommend Motley Fool Stock Advisor.

Read more: Looking for the best stock analysis software?

FAQs:

How much does Morningstar Premium cost?

A membership to Morningstar Premium costs $249 annually (which comes out to $20.75/month).

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.