Everyone wants a hack to find the best stocks to buy right now.

Hate to burst your bubble, but there isn’t one. At the end of the day, you’re the one who has to live with your investment decisions — so it’s in your best interest to do your own due diligence.

That said, plenty of trusted pros do have opinions on the top stocks to buy now — and you can use that information to make more informed choices.

Here are some of the best stocks to buy now…

Want to know how we find stocks before they explode?

With a Zen Investor subscription, you can save precious research time and let a 40+ year market veteran do the heavy lifting for you. Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister, former editor-in-chief of Zacks.com with a 4-step process using WallStreetZen tools including the proprietary Zen Ratings system

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

At-a-Glance: The Best Stocks to Buy Now *

- Karooooo (NASDAQ: KARO)

- Micron Technology (NASDAQ: MU)

- Kinross Gold (NYSE: KGC)

- Korn Ferry (NYSE: KFY)

- Alphabet (NASDAQ: GOOGL)

* Your investments are solely your responsibility. Your capital is at risk.

Top Stocks to Buy Now: Before You Trade

As I said earlier, there’s no shortcut to stock market success. You’re responsible for your own trades, so it’s worth taking the time to “build a case” for every trade.

As such, here are a few best practices that every investor should keep in mind before trading:

Consider the Market

When it comes to investing, market conditions matter. A lot. For instance, is the market in a sharp downtrend? It might not be the time to enter a new position. In general, the best time to invest is when the market is in a definite and confirmed uptrend.

Have a Plan in Place

Before you take a position in a stock, take a little pause and consider your objectives. First, why do you think it’s a good idea to take a position? Second, do you want to put a cap on potential losses — and if so, what’s your “sell” price?

Research the Stock

Never trade without doing a little research first. We’re talking a deep dive into the company’s fundamentals, a hard look at the stock chart, and more. Here are some of our favorite resources (which just so happen to be the same ones used to research this post):

WallStreetZen: I curated this list using two WallStreetZen tools:

Zen Ratings: This is our proprietary system of identifying potentially market-beating stocks, and it’s available on the page of each ticker on WallStreetZen. Zen Ratings is a little different from other metrics. It evaluates 115 factors that drive stock growth, and distills them into an easily digestible letter grade for each stock.

Not only can you see a stock’s overall grade, but you can see how it scores in a variety of different areas, such as value, financials, safety, and so on. Stocks with an A rating (Strong Buy) have produced an average annual return of +32.52% since 2003 — so it’s definitely something to check out before you buy a stock. Currently, all of the stocks on this list have an A or B rating.

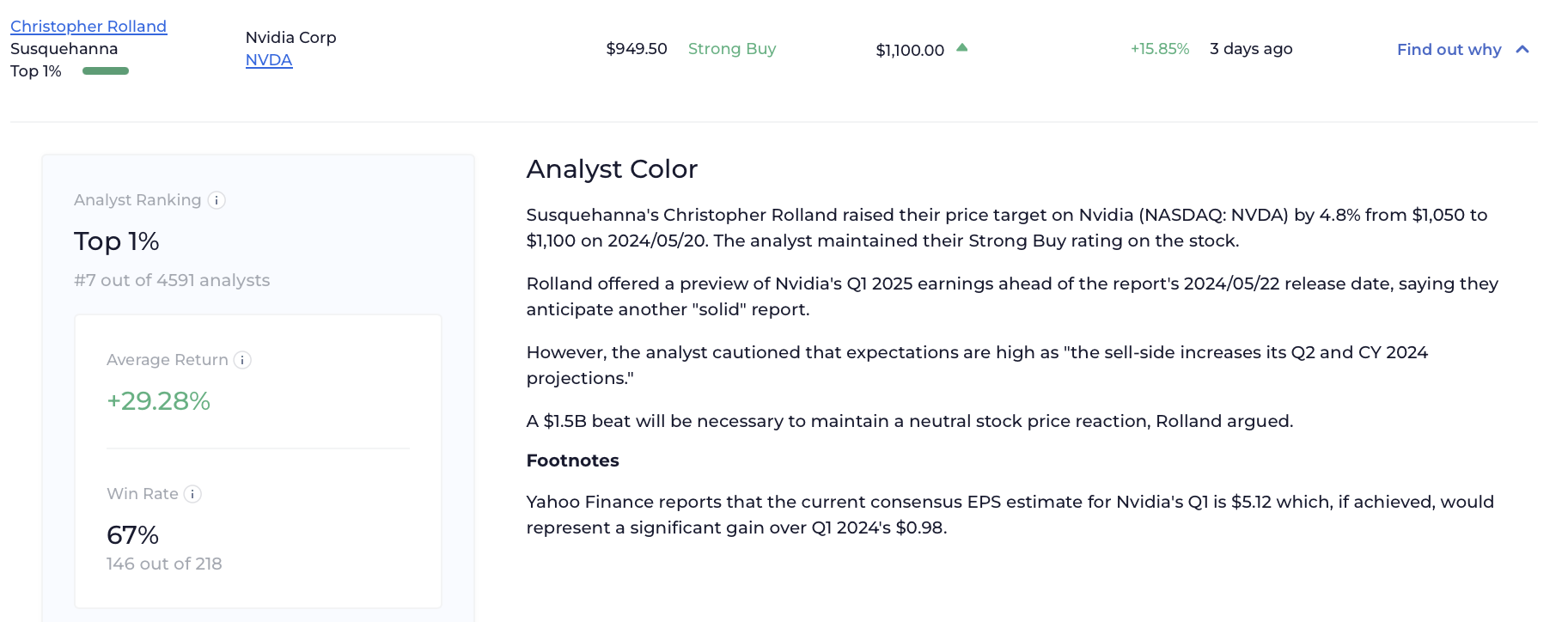

With WallStreetZen Premium, you gain access to top-rated analyst ratings. With WSZ’s Strong Buys from Top Analysts feature, you can zero in on ratings from ONLY top-rated analysts, and you have easy access to their track record and average win rate.

For instance, below you’ll see the Top Analyst entry for one of today’s picks: NVDA. You can easily see the analyst’s track record, plus the “why” behind their rating.

TradingView: This is our go-to program for charts (and the charts in this post are sourced from TradingView). Why? Its comprehensive feature set, speed, ease-of-use, coverage, reliability, and extreme affordability. As a result of these things, we firmly believe it’s the best solution for new and veteran traders alike.

FEATURED OFFER:

If you sign up to TradingView using any of the links in this article, you will receive a $15 credit which will be automatically applied to any plan you select.

Plus, test drive any plan risk-free with a free 30-day trial.

July 2025: Top Stocks to Buy Now (and Why)

There are too many stocks to keep track of on your own. You need a system, and you need recommendations. For the system, WallStreetZen has you covered. For the recommendations, why not start with these five?

They’re all recommended by top analysts and have compelling reasons to add them to your portfolio, as we’ll soon explore.

Note: This article does not provide investment advice. The stocks listed should not be taken as recommendations to buy or sell. Your investments are solely your decisions.

5 Stocks to Watch: Week of July 7, 2025

1. Karooooo (NASDAQ: KARO)

No, that company name is not a typo. Headquartered in Singapore, Karooooo provides subscription-based telematics and AI-powered analytics to help businesses manage mobility more efficiently. While it hasn’t attracted a lot of attention from Wall Street, the two analysts that do cover KARO are quite optimistic.

Zen Rating: A (Strong Buy) — see full analysis >

Recent Price: $48.98 — get current quote >

Max 1-year forecast: $58.00

Why we’re watching:

- Thus far, KARO has flown under the radar. Only 2 Wall Street analysts issue ratings for the stock — 1 has deemed it a Strong Buy, while the other issues a Buy rating. See the ratings

- With that said, the average 12-month price forecast for Karooooo, currently pegged at $55.50, implies a 16.25% upside.

- In addition, both of the aforementioned Wall Street analysts are highly rated.

- Morgan Stanley’s Roy Campbell (a top 23% rated analyst) recently maintained a Strong Buy rating, and hiked his price target from $43 to $53.

- Campbell revised their estimates in advance of Karooooo’s Q1 2026 results, increasing their revenue estimates for FY 2026 and 2027 by 4% and 12%, respectively.

- In addition, the analyst said they boosted their U.S. dollar price target, noting stronger ForEx translation.

- In mid-May, Alexander Sklar of Raymond James (a top 9% rated analyst) reiterated a Buy rating and increased his price forecast from $51 to $58.

- Sklar told readers Raymond James’ view that Karooooo’s growth rate over the next one to two years could ramp up, driving multiple expansion, was founded on the company’s “impressive” GAAP-based “rule of 40+” subscription revenue and EBIT results in the quarter, both of which are at the core of their firm’s positive thesis on the name.

- Our proprietary quant rating system takes into account 115 factors when assigning a rating to a stock. KARO ranks in the top 3% on the whole — giving it a Zen Rating of A, equivalent to an average annualized return of 32.52%.

- As a result of the company’s healthy balance sheet, Karooooo shares rank in the top 15% of the more than 4,600 equities that we track when it comes to Financials.

- Moreover, KARO ranks in the 93rd percentile in terms of Momentum, and the top 2% with regard to Sentiment. (See all 7 Zen Component Grades here >)

2. Micron Technology (NASDAQ: MU)

As one of the world’s largest chipmakers, Micron, which produces DRAM and NAND chips, is currently benefiting from high demand on account of the AI boom. Wall Street is quite bullish on MU — and what’s more, the stock is currently trading at a very attractive valuation.

Zen Rating: B (Buy) — see full analysis >

Recent Price: $122.32 — get current quote >

Max 1-year forecast: $200.00

Why we’re watching:

- Micron Technology receives a lot of coverage — and it is overwhelmingly positive. At present, the stock has 11 Strong Buy ratings, 6 Buy ratings, and 2 Hold ratings — with no Sell or Strong Sell ratings. See the ratings

- In addition, the average price target for MU shares, currently at $157.11, implies a hefty 25.93% upside.

- Susquehanna researcher Mehdi Hosseini (a top 10% rated analyst) doubled down on a Strong Buy rating and increased his price target from $150 to $160 after the company’s Q3 2025 earnings.

- As a result of the quarter’s better-than-expected performance, driven by a rebound in DRAM consumer demand (SP, PC) and consistent DRAM DC demand, Hosseini said they raised their estimates and price target.

- HBM3e 12-Hi yields are increasing at a quicker rate than anticipated, which is good news for margins, the analyst continued.

- However, Hosseini pointed out that a lower Q/Q value in DRAM ASPs was observed, citing an increased variety of consumer products.

- MU stock ranks in the top 9% of the equities we track, giving it a Zen Rating of B — equivalent to an average annualized return of 19.88%.

- Micron Technology shares rank in the top 10% in terms of Artificial Intelligence. In simple terms, a neural network trained on more than two decades of fundamental and technical data has highlighted MU as a likely outperformer.

- However, Value is the stock’s strongest suit — with a price-to-earnings (P/E) ratio of 22.32x and a price-to-earnings growth (PEG) ratio of just 0.64x, it comes as little surprise that MU ranks in the top 6% of equities when in this category. (See all 7 Zen Component Grades here >)

3. Kinross Gold (NYSE: KGC)

Kinross Gold operates low-risk, high-quality gold projects across the Americas and West Africa, with a focus on disciplined cost control and strong free cash flow. As gold prices hover near record highs and investors look for safe-haven assets, Kinross stands out with a solid balance sheet — making it the most hassle-free way to get exposure to the precious metal.

Zen Rating: A (Strong Buy) — see full analysis >

Recent Price: $15.44 — get current quote >

Max 1-year forecast: $18.00

Why we’re watching:

- At present, KGC stock has 1 Strong Buy rating, 2 Buy ratings, and 1 Hold rating. See the ratings

- The average price target set by Wall Street analysts for Kinross Gold shares is currently $16.50, which implies a 10.96% upside.

- Jefferies researcher Matthew Murphy (a top 13% rated analyst) recently upgraded the stock to a Strong Buy rating, and hiked his price target from $14 to a Street-high $18.

- Murphy attributed their upgrade to the “impressive” free cash flow yield Kinross Gold is expected to deliver in 2025 and 2026, which sets it apart from its senior gold peers and allows for increased buybacks.

- Jefferies calculates the company can repurchase 11% of its market cap in 2025 and 2026, the analyst detailed.

- Other catalysts for the upgrade included a clear line of sight on 2M ounces of gold production in 2026 and resource upside at Great Bear, Murphy said.

- On the whole, Kinross Gold ranks in the top 2% of the stocks that we track.

- As it has already rallied by 50.51% since the start of the year, KGC stock ranks in the top 15% when it comes to Momentum.

- However, the stock also ranks highly in several other categories — Value, where it ranks in the top 12%, and Sentiment, where it ranks in the top 7%, for instance.

- With that being said, KGC’s balance sheet is its biggest strength — when it comes to Financials, the stock ranks in the top 2% of the equities we track. (See all 7 Zen Component Grades here >)

4. Korn Ferry (NYSE: KFY)

This is our Stock of the Week. Steve Reitmeister, our Editor-in-Chief, first highlighted KFY’s strengths on May 6 when he added it to his exclusive Zen Investor portfolio. Then, on June 30, he highlighted its resiliency in the face of tariffs. Despite having surged some 14.53% since Steve put it in the spotlight, KFY has retained strong ratings in several key areas and appears set to continue the rally.

Zen Rating: B (Buy) — see full analysis >

Recent Price: $74.64 — get current quote >

Max 1-year forecast: $88.00

Why we’re watching:

- Korn Ferry is our Stock of the Week. Our Editor-in-Chief, Steve Reitmeister, who already highlighted its strengths last month, explained why KFY is his top pick for this week in a Monday article.

- KFY is a true under-the-radar pick, as it currently has only 2 analyst ratings — 1 Strong Buy rating and 1 Hold rating.

- However, the average price target for Korn Ferry shares, currently pegged at $81, implies a 10.94% upside.

- Korn Ferry is a consulting firm that specializes in executive recruiting — which gives it a unique edge, as downturns tend to bring a lot of businesses to the company.

- While it might not be as attention-grabbing as a high-flying AI stock, Steve’s primary point was this — the Zen Ratings system shines when it comes to finding low-profile equities, which often provide more impressive returns than their highly-publicized counterparts.

- Korn Ferry is currently the 2nd highest-rated stock in the Staffing & Employment Service industry, which has an Industry Rating of B.

- The Street-high price target of $88 was issued by Truist Securities researcher Tobey Sommer (a top 7% rated analyst), who maintained a Strong Buy rating on KFY on June 20.

- Our rating system has placed Korn Ferry shares in the top 15% of equities, giving them a Zen Rating of B.

- When it comes to KFY’s Artificial Intelligence and Financials Component Grade ratings, the stock ranks in the top 15% of the more than 4,600 stocks that we track.

- At a P/E ratio of just 15.47x, it comes as little surprise that the stock ranks in the 91st percentile in terms of Value.

- Last but not least, Korn Ferry stock ranks in the top 3% according to Sentiment. (See all 7 Zen Component Grades here >)

5. Alphabet (NASDAQ: GOOGL)

Alphabet needs no introduction — the primary point of contact between most of the world and the internet is a veritable tech juggernaut. While concerns remain regarding the AI arms race, GOOGL is trading at an attractive P/E — and Wall Street’s general outlook is quite positive. To boot, even with high capital expenditures, the company’s balance sheet remains quite healthy.

Zen Rating: B (Buy) — see full analysis >

Recent Price: $79.21 — get current quote >

Max 1-year forecast: $240.00

Why we’re watching:

- Unsurprisingly, Alphabet receives a lot of attention — the stock has a total of 29 analyst ratings, split between 13 Strong Buys, 9 Buys, and 7 Holds. See the ratings

- The average 12-month price forecast for GOOGL shares, currently pegged at $198.03, implies a 10.92% upside.

- Citigroup’s Ronald Josey (a top 3% rated analyst) recently maintained a Strong Buy rating on Alphabet stock, and upped his price target from $200 to $203.

- Takeaways from their attendance at the Cannes Lions International Festival of Creativity led Josey to be “incrementally positive” on their outlook on the larger online advertising macro environment, advancements in AI, and important drivers of web growth.

- The analyst predicted higher values for Alphabet, Meta Platforms, Reddit, and Pinterest, and said they came away from the event with a favorable sector read.

- Further, Josey predicted a bright future for digital advertising, with marketers preparing for an agentic environment and Gen AI user adoption soaring.

- Alphabet shares rank in the top 9% of equities on the whole, giving them a Zen Rating of B.

- GOOGL is currently trading at a P/E of 19.71x, far below the market average of 32.24x. The stock ranks in the top 24% in terms of Value.

- Alphabet shares also rank in the top 12% when it comes to Artificial Intelligence and Sentiment.

- However, Financials are the star of the show here — when it comes to the balance sheet, GOOGL ranks in the top 5% of equities. (See all 7 Zen Component Grades here >)

Gain access to dozens of alerts like this per week — Click the button below.

👉👉 Try WallStreetZen Premium for just $1

Best Stocks to Buy Now: The Final Word

There are literally thousands of stocks out there. What are the best stocks to buy now?

The truth is that there are no guarantees in the stock market. The market is constantly changing, as are the factors that play into stock prices.

That said, this list includes a ton of great watches we discovered on WallStreetZenPremium. Each of these picks has something (or several things) going for them in the near to long-term, so consider keeping them on watch.

But remember — you alone are responsible for your investment decisions. So be sure to do your own research before you buy any stock.

FAQs:

What are good stocks to invest in right now?

According to analyst ratings, good stocks to invest in right now include:

1. Karooooo (NASDAQ: KARO)

2. Micron Technology (NASDAQ: MU)

3. Kinross Gold (NYSE: KGC)

4. Korn Ferry (NYSE: KFY)

5. Alphabet (NASDAQ: GOOGL)

What stock will grow the most in 2025?

It’s impossible to say for sure what stock will grow the most in 2025. However, top-rated analysts are currently bullish on stocks like:

1. Ceragon Networks (NASDAQ: CRNT)

2. Ibex Ltd. (NASDAQ: IBEX)

3. Pilgrims Pride Corp. (NASDAQ: PPC)

4. Precision Drilling Corp. (NYSE: PDS)

5. Ranger Energy Services (NYSE: RNGR)

What stocks to buy today for beginners?

The best stocks to buy for beginners depend on your goals and objectives. While even beginners should do their own research, established companies like Walmart and Microsoft may be worth researching.

Which share is best to buy today under $100?

The best stock shares under $100 will depend on your goals and objectives as an investor, and your investment decisions are solely your own.

However, it’s worth noting that the ability to invest in fractional shares of stocks means that you can access even higher-priced stocks like Amazon (NASDAQ: AMZN) or Google (NASDAQ: GOOGL).

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.