I’m not sure many assets could be considered zombie apocalypse-proof, but gold is probably the closest.

Gold is a robust asset that has been coveted for its beauty and value for thousands of years.

Today, the countless ways to invest in the precious metal can overwhelm new investors. It doesn’t have to be that way. Armed with the right information, investing in gold can be a straightforward process — even for beginners.

Ready to get started? The following article will outline explicitly why gold has stood the test of time, why serious investors use it to lower risk and improve return the potential of their portfolio, and, most importantly, how to invest in gold for beginners.

Top ways how to invest in gold for beginners

- Top platform for gold IRAs: iTrustCapital

- Top platforms for gold bullion/coins: JM Bullion and the American Precious Metals Exchange (APMEX)

- Top platform for gold ETFs: eToro*

- Top platform for new investors to buy gold mining stocks: M1 Finance

eToro securities trading is offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. https://www.wallstreetzen.com is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

Why Investors Like Gold

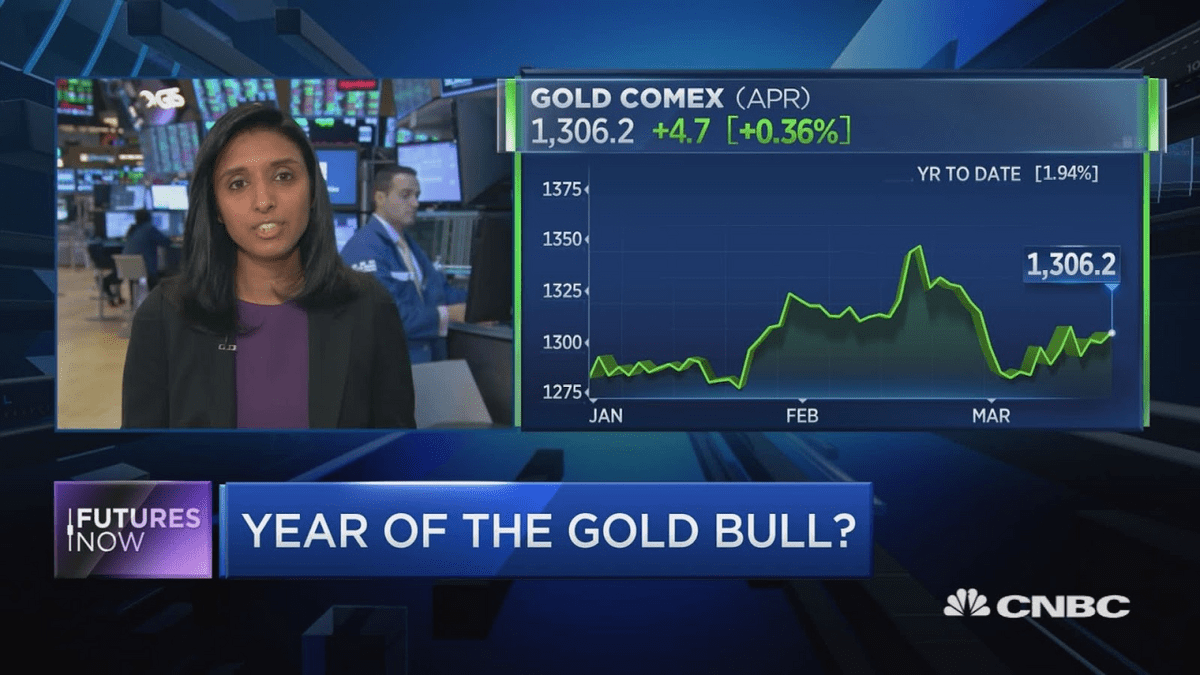

Volatile stock prices, historically high inflation, elevated interest rates, and a looming recession are driving more and more investors back to bullion.

It’s not surprising that many people want to know: is it good to invest in gold in 2023?

For many longtime, experienced investors, the answer is an unequivocal yes.

During periods of economic uncertainty, astute investors tend to increase their exposure to this precious metal. Here’s why.

Meme stocks come and go, but gold is not simply a flavor of the week.

For many, gold is the bedrock of a portfolio, providing a hedge against inflation, diversification benefits, and, hopefully, an appreciating asset.

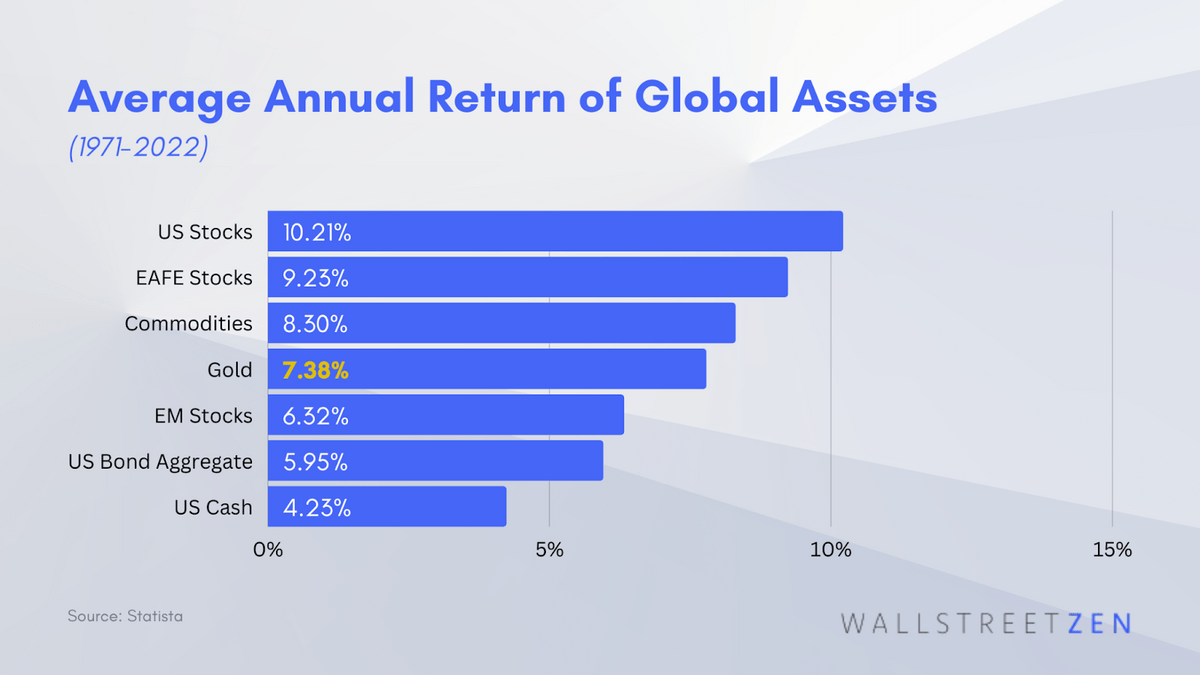

Gold has proved a valuable addition to investor portfolios, averaging nearly 8% annually over the past half-century:

How to Invest in Gold for Beginners – 7 Best Ways:

Flip the TV to any financial talking head, and if you watch long enough, you’ll likely see commentary on gold.

Everyone’s talking about it, but what is the best way to invest in gold?

What do we mean when we have a portion of our portfolio exposed to physical gold? Are people digging a hole in their backyard and storing 10% of their assets underground?

Not exactly.

The following are seven popular ways to invest in physical gold. Ultimately, the best way to invest in gold will vary from person to person.

1. Gold IRAs

Overall Rating: ⭐⭐⭐⭐⭐

Ease: 8 out of 10

Best for: Beginners looking for a stable, safe, and tax-efficient method to begin investing in physical gold.

One of the most popular options for beginners seeking physical gold exposure is via a gold Individual Retirement Account (IRA).

Want more? Check out our review of the best gold IRAs.

Gold IRAs offer Americans a tax-efficient vehicle for investing in the commodity. You can transfer some of your existing IRA balance into a gold IRA with no taxable event.

Over time, your gold exposure will grow within the account on a tax-deferred basis. Tax will only be required once you withdraw from the IRA.

You can also opt for a Roth gold IRA. With Roth gold IRAs, you purchase gold using after-tax dollars. However, the benefit of Roth gold IRAs is you are not taxed when you redeem from the account, no matter how much your gold position appreciated while you held it.

Check out some of the top gold IRAs here:

2. Gold Bullion

Overall Rating: ⭐⭐⭐⭐⭐

Ease: 3 out of 10

Best for: High-net worth individuals and investors concerned about the integrity of custodial institutions.

In some instances, investors not only want to invest in physical gold, but they also want to touch and feel the investment! This is where gold bullion shines.

When we refer to bullion, we refer to the pure, bulk gold used to produce items like coins. It’s been certified to ensure it meets minimum weight and purity requirements.

Typically, gold bullion refers to those beautiful gold bars we see stolen during big heist movies. Just one of those bars can cost upwards of $100,000.

Gold bullion isn’t practical for most people, but some investors prefer to keep the commodity in direct possession. If you lack trust in banks and have a thick wallet, this might interest you.

3. Gold Coins

Overall Rating: ⭐⭐⭐⭐⭐

Ease: 8 out of 10

Best for:

Gold coins can be an excellent option for beginners, especially when compared to gold bullion. Gold coins come in various sizes, including relatively small ones more suitable for novice investors.

Gold coins are typically sold by collectors or private dealers. Specific gold coins can sometimes take on disproportionately high value because they are collector’s items. This unique trait makes coins an attractive option for some investors.

4. Gold ETFs

Overall Rating: ⭐⭐⭐⭐⭐

Ease: 7 out of 10

Best for: individuals with a brokerage account who want a quick way to begin investing in gold without the hassle of physical ownership.

While exchange-traded funds are predominantly used to access underlying stocks, they can also be effective vehicles for gaining exposure to physical gold.

Like all ETFs, you purchase shares in the fund, and the fund itself purchases the underlying assets, in this case, gold.

While ETFs offer a creative way to gain exposure, it’s essential to realize the fund will likely not track the price of gold on a 1:1 basis. In many cases, gold ETFs may even have a small allocation to other commodities. For some investors, this is a bonus, adding further diversification benefits.

The best brokerage for gold ETFs…

There are a lot of great brokerages out there for trading gold ETFs.

Our favorite? eToro.

It combines the speed and ease of speed of modern brokers like Robinhood and Webull with the reputation, stability, and security of brokers like Fidelity and TD Ameritrade.

Plus, eToro is a social trading platform, so you can communicate, learn, and invest alongside other like-minded investors.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

5. Gold Futures & Options

Overall Rating: ⭐⭐⭐⭐⭐

Ease: 6 out of 10

Best for: Savvy traders looking to hedge portfolios or make outsized bets on gold using leverage.

Derivative products can also be used to invest in gold. These products “derive” their price from an underlying reference security. In this instance, the referenced security is gold.

Purchasing gold call options, for example, gives the owner of the call option the right but not the obligation to buy a predetermined amount of gold at a predetermined price if specific criteria are met.

While the intricacies of options are beyond the scope of this article, you can refresh your understanding of the difference between call options and put options here.

Gold futures, on the other hand, obligate the buyer of the future to purchase (or sell) gold at a specific date in the future at a previously agreed-upon price.

Both options and futures allow for a type of leverage. That is, traders can gain exposure to positions in gold larger than the available cash they have on hand.

The best options trading platform for beginners…

If you’re new to options, Robinhood ranked as the top platform for beginners in our roundup of the 9 best options trading platforms. Why?

It’s the most user-friendly and well-designed brokerage out there — plus, you get commission-free options trading.

6. Gold Mining Companies

Overall Rating: ⭐⭐⭐

Ease: 7 out of 10

Best for: Investors looking to gain exposure to gold mining operations.

In some instances, you might not want access to gold directly but instead wish to have exposure to the gold industry. One method to achieve this is by investing in gold mining companies.

This can easily be done by purchasing shares of publicly traded gold mining companies, like Barrick Gold (NYSE: GOLD) or Newmont (NYSE: NEM).

Of course, since you’re not investing directly in gold, the asset won’t necessarily track its performance, though it will likely have a strong correlation.

Our top platform for new investors to buy gold mining stocks?

M1 Finance. This easy-to-use online broker and investing app offers access to thousands of stocks and ETFs. Hands down, it’s one of the best online brokerages for beginners — whether you want to buy gold stocks or stocks from other sectors.

Here’s why. On M1, you create a “pie” — your own personal mix of investments. You can make yours from scratch, or choose from pre-built pies. It’s a fantastic way to diversify with ease.

7. Gold Jewelry

Overall Rating: ⭐⭐⭐

Ease: 5 out of 10

Best for: Investors looking for an asset and an accessory.

Did you know, nearly half of all gold produced is used for jewelry?

For many people, gold jewelry is their first investment. It’s not unheard of for a newborn baby to be gifted gold jewelry that has been passed down from previous generations. We’re talking about a serious long-term investment!

It’s important to understand that not all gold jewelry is the same. The quality and composition can vary widely. As a general rule, gold jewelry at 14k or higher is deemed a gold investment.

Gold jewelry resale is not necessarily as straightforward as some other options on this list. It’s relatively easy to buy but can be harder to sell. As a result, gold jewelry is considered less liquid.

For some traders, gold jewelry is an excellent option because it’s an asset and an accessory. Just make sure you have insurance if you wear your grandfather’s timeless gold chain to dinner tonight!

Why Invest in Gold?

Gold is sought out as an investment for numerous reasons.

For one, gold has stood the test of time.

Unlike some assets, gold is not a new investment. People have used gold as a store of value throughout history.

From a practical standpoint, it’s robust. Gold doesn’t easily deteriorate. It can be buried for hundreds of years and polished off right back to its old self.

Investing in Physical Gold During a Recession

When economic turmoil is on the horizon, investors turn up the heat on gold. Gold is like the mama bear of asset classes, offering comfort to institutional and retail investors alike.

But is it warranted?

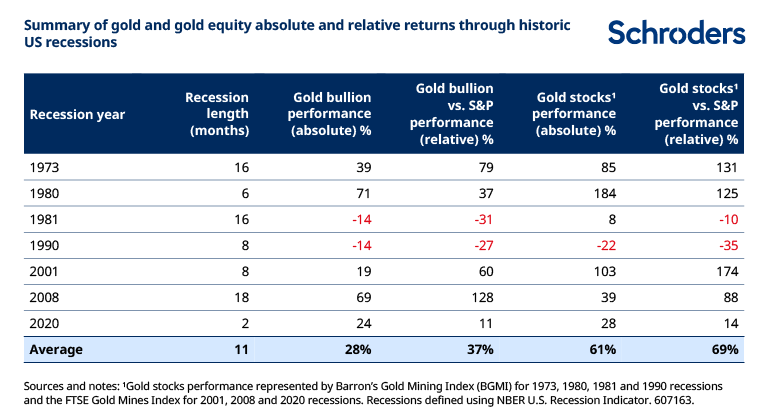

If we look back at the seven recessions between 1973 and 2020, on average, gold outperformed the S&P 500 by an impressive 37%! Gold-focused stocks did even better, beating the benchmark by 69%.

Not bad.

Investing in Gold as an Inflation Hedge and Portfolio Diversifier

Gold has shown itself to be an effective diversifier among portfolios. Gold doesn’t necessarily correlate with other assets, like stocks and bonds. This can help reduce downside risk when other assets in your account are falling.

In particular, gold is often used as a hedge against inflation.

Final Word: How to Invest in Gold for Beginners

Hate or love it, gold is here to stay. This tried and tested asset has been the bedrock of countless investors going back thousands of years.

For many individuals, exposure to gold is a must. Its robust qualities give astute investors peace of mind in a world with increasingly volatile asset returns.

Whether you invest in gold ETFs, buy your partner a new gold necklace, or bury bouillon deep in the woods, gold investments come in many forms that are suitable for beginner to the most advanced traders.

FAQs:

How to invest in gold for beginners?

Gold IRAs are a safe and secure method for beginners to start investing in gold. You can even transfer some of your existing IRA balance into a gold IRA tax-free.

Should beginners invest in gold?

Gold is an excellent investment for beginners, but the method of investment matters. Gold IRAs and gold-focused ETFs, for example, are less risky options suitable for beginners looking to gain exposure to gold.

What is a good amount to invest in gold?

A maximum 10% allocation is a good amount to invest in gold for most people. Most investors' portfolios will be predominantly stocks and bonds, but allocating to commodities like gold can offer diversification benefits.

Is it better to buy gold coins or bars?

For most average investors, gold coins are better to buy than gold bars. Gold bars typically come in very large denominations, making them impractical to buy and sell for most people. For most average investors, gold coins are better to buy than gold bars. Gold bars typically come in very large denominations, making them impractical to buy and sell for most people.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.