If you think it might be cheaper to have a home storage gold IRA than use one of the official private storage IRAs, think again. Not only is it not cheaper, but it could expose you to an audit, heavy fines, or worse.

…Just ask the couple that had to pay the government nearly $300,000!

In this article, I go over the risks and drawbacks for opting to keep your stored IRA gold at home and what you can do instead.

Let’s look at what the top gold IRA investors do to hedge against economic uncertainties while staying on the sunny side of the law.

The short answer? Storing IRA gold at home is typically not a good idea. If you need a trusted resource for investing and storage, consider iTrustCapital.

Over 400 positive Google reviews praise the platform’s ease of use, affordability, and secure storage facilities.

Plus, iTrustCapital offers more than just gold and silver. You can also invest in crypto to diversify your portfolio even more.

Home Storage Gold IRA: The Bottom Line

The IRS will not let you have stored IRA gold at home unless you meet several prerequisites, including some LLC requirements, provable competencies, legal retention, and more.

Attempting to do so without even one of these conditions could result in significant financial penalties and loss of tax benefits.

Besides the legal issues, there are safety concerns about physically storing gold inside your home, as this could expose you to home invasions. Instead, opting for reliable, IRS-approved, private storage IRAs is a better option. Here are some of the top-rated gold IRA companies.

Alternatively, you can consider investing in gold outside an IRA where you have more flexibility in terms of storage options.

Stored IRA Gold at Home: What Does it Mean?

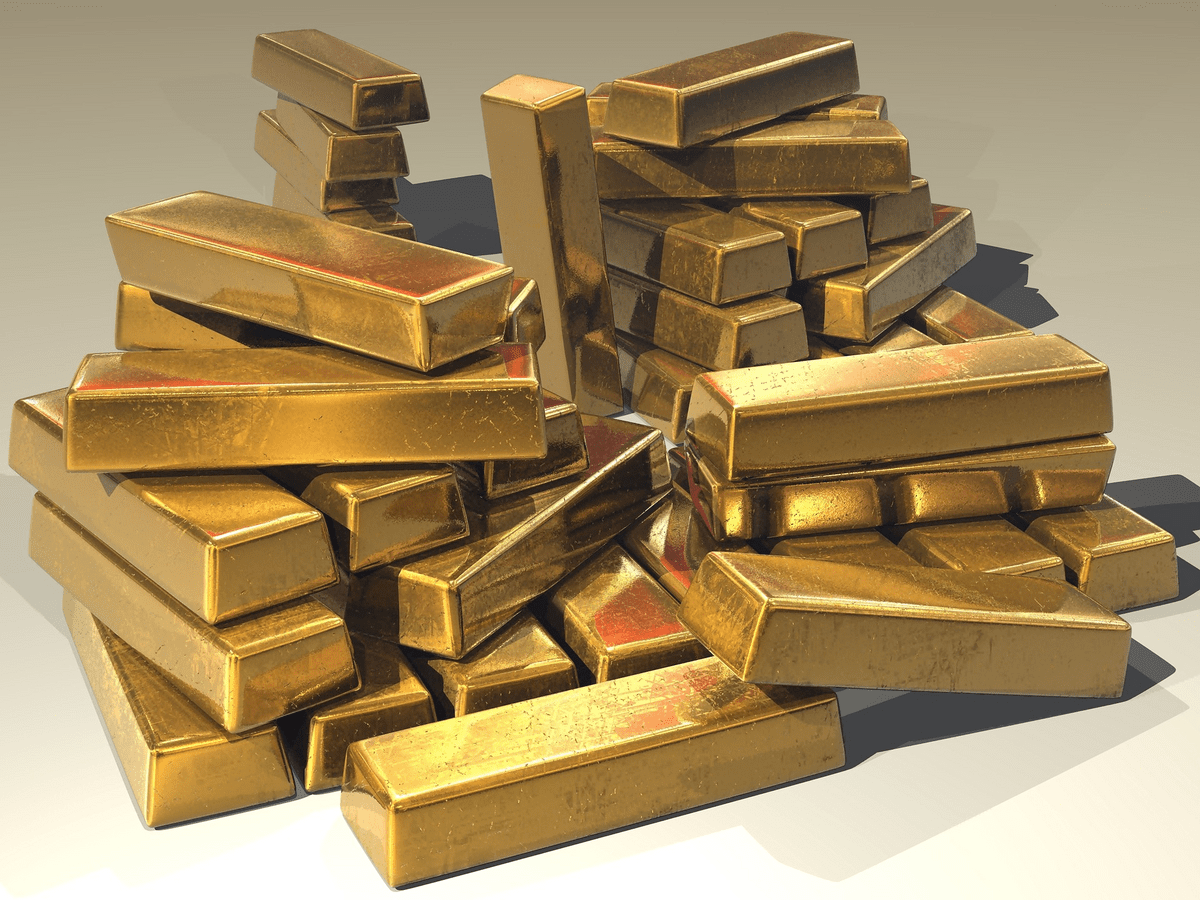

A gold IRA is a type of individual retirement account that allows investors to hold physical gold, silver, platinum, or palladium as investment rather than traditional paper assets, such as stocks and bonds.

Stored IRA Gold at home means attempting to get a tax benefit by keeping your IRA assets inside of your home. This practice violates IRS guidelines and can lead to severe consequences, including fines, taxes, an audit, and more.

Home Storage Gold IRA: Is it a Good Idea?

In short, no.

Storing your IRA gold at home is likely to violate IRS regulations and exposes you to risks. Beyond improper storage and tarnish, your savings could get stolen.

FBI statistics show that in 2019 alone, there were over 1.1 million registered burglary cases.

Flexibility is key…

Investment needs change. Life happens. Goldco gets that, and offers an exceptional buyback program to help you deal with the unexpected.

Goldco’s buyback policy is very attractive — if your situation changes, they guarantee you will get the highest price for your gold. With hundreds of positive reviews and transparent pricing, it’s not hard to see the appeal.

What’s the IRA Stance on Gold IRA Physical Possession?

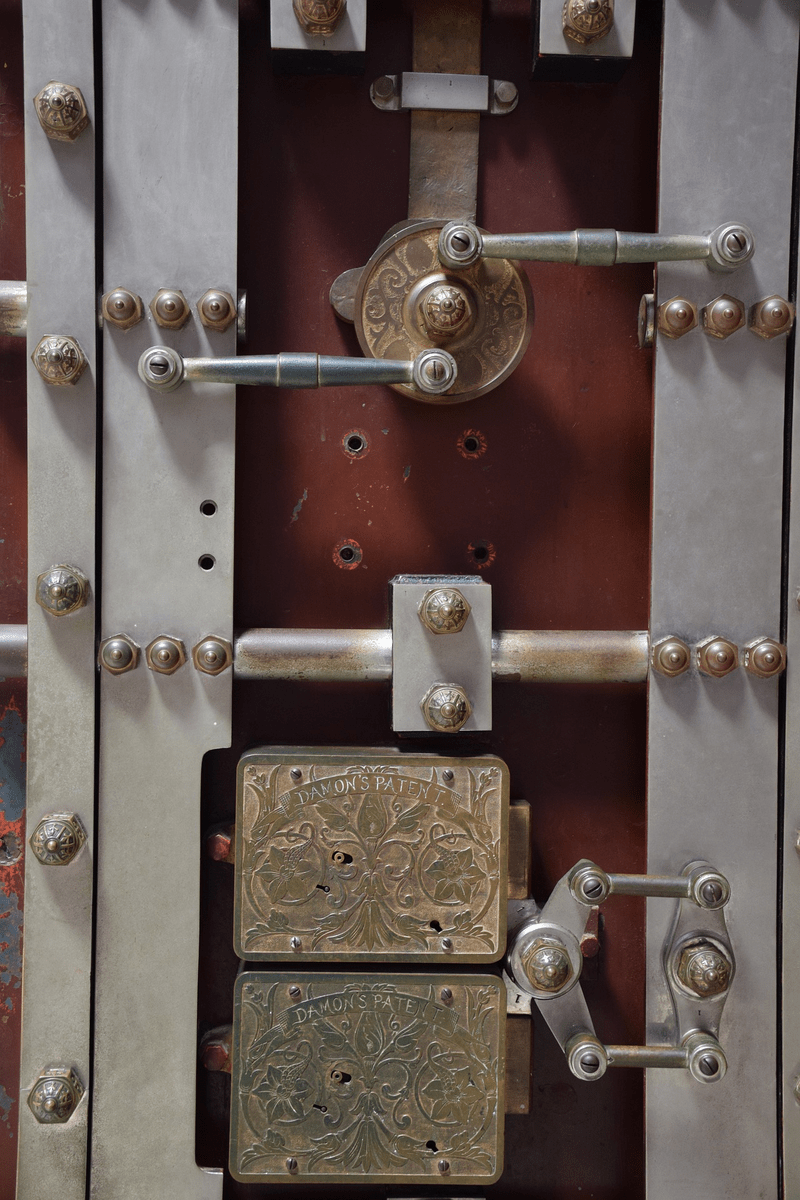

The Internal Revenue Service (IRS) has specific regulations governing how one should store their precious metal investment. Section 408(m) of the IRS code states that IRA gold assets must be “in the physical possession of a trustee.”

This means that your gold IRA custodian is responsible for storing your gold in an IRS-approved depository to ensure compliance.

If you insist, you can learn how to store gold IRA at home, but it is extremely difficult and risky. The IRS standards are very high and subject to change, and include:

- An LLC in Your Name

- A Net Worth Of $250,000+

- Proper Ownership Structure

- A Public Accountant

- Legal Counsel on Retainer

- A Reputable, Financial Background with Verified Experience

and more…

With the penalties being so steep and the standards rigidly high, it is extremely inadvisable to go this route.

Understanding the Penalties

If you decide to hold your gold IRA physical possession at home, you could face severe consequences, including:

- Potential Legal Consequences: Storing your gold IRA at home could be considered a breach of IRS rules and regulations. You could face legal consequences, including audits, fines, penalties, and potential criminal charges.

- Taxes and Early Withdrawal Penalties: Moving the gold to your home is considered a distribution, classified as ordinary income, and forces you to pay income taxes at your current rate. If you are under 59.5 years old, you would be subject to a 10% early withdrawal penalty on the entire value of your gold IRA.

- Loss of Tax-Advantaged Status: You would be liable for taxes on any gains made within your gold IRA.

Cautionary tale: McNulty vs the IRS

Sadly, a couple learned the risks that come with gold IRA physical possession the hard way.

With ANDREW MCNULTY AND DONNA MCNULTY, Petitioners v. COMMISSIONER OF INTERNAL, the court ruled that the McNultys’ home storage gold IRA violated Sec. 1.408-2(e) Income Tax Regs and was subject to penalties based on I.R.C. sec. 6662(a).

They ended up paying more than $250,000 of their nearly $750,000 IRA balance to the IRS as a penalty for untaxed early distributions.

How to Store Gold

When it comes to storing your gold investments, you have two main options: inside an IRS depository or outside one.

Store your gold in an IRS-approved depository: Private Storage IRAs

Most experts will recommend private storage IRAs as the best choice for gold IRA storage, as it makes the most financial sense.

It’s the best way to invest in a gold IRA legally, hedge your portfolio, take advantage of the tax benefits, and add a layer of protection.

How to Store Gold at Home (Outside of an IRA)

If you prefer your gold close at hand, you can purchase gold outside of an IRA and store it at home.

This is called gold stacking, and it is not recommended for many reasons including theft, damage, lack of tax benefits, storage costs (vault, insurance, security system, etc.), and more.

How to Legally Store Gold at Home

If you want to know how to store gold at home legally after you’ve had it in an IRA, there are a couple of ways to do it.

Make a Withdrawal

If you’re over the age of 59½ and meet the IRA withdrawal requirements, you can withdraw gold from your gold IRA and have the physical gold delivered to your home without incurring tax penalties.

If you are under the age of 59½, you can still make a withdrawal, but you’ll need to pay the fines and taxes.

Buy Gold Outside of an IRA: Gold Stacking

Purchasing gold outside of a retirement account allows you to buy and store gold without restrictions. However, this option does not offer any tax advantages.

The best places to buy gold will be trustworthy, safe, and discrete. These places will often allow you to sell your gold with them under the same conditions.

If you don’t use a reputable broker, not only are there no guarantees of quality, it can be extremely risky, with chances of robbery in the transportation, exchange, and storage of your gold.

Downsides of Gold as an Investment

Though gold can be a great way to diversify and hedge against economic volatility and inflation, I want to quickly note that investing in gold and other precious metals comes with its own downsides.

I mentioned the risks of theft that come with storing gold, but gold is also considered illiquid, especially when compared to stocks.

There is a certain amount of expertise required to find and ensure high-quality products and the physical investment has to be stored, transported, and sold/purchased through a trustworthy person or business.

Still interested? Before moving forward, consider learning all of the ins and outs of gold stacking.

How Do Gold IRAs Work?

A gold IRA is a type of self-directed IRA that allows you to invest in physical gold while enjoying the same tax benefits as a traditional IRA. Specialized private storage IRAs offer IRS-approved gold investments and compliant storage options.

Retirement Account Rollovers

Depending on the company you choose to work with, several retirement accounts could roll over into a gold IRA including:

- Traditional IRAs

- Roth IRAs (Provided you pay taxes on converted funds)

- SEP & Simple IRAs

- 401(k) & 403(b)

- Pension plans

Where to Open a Gold IRA the Right Way: Private Storage IRAs

When it comes to opening a gold IRA, it’s crucial to work with a reputable provider that offers IRS-approved gold investments and storage options.

Fortunately, you have some great options.

1. iTrustCapital

- Overall rating: ⭐⭐⭐⭐

- Fees: 1% Crypto Fee, $50 Over Spot/Gold Ounce, $2.50 Over Spot/Silver Ounce

iTrustCapital is a top choice for investors seeking a cost-effective IRA with both precious metals and crypto options.

Despite lacking BBB accreditation, over 400 positive Google reviews celebrate the platform’s ease of use, affordability, secure storage facilities, and outstanding customer service.

iTrustCapital is more diverse than I’ve seen with other IRA options, allowing for the traditional gold and silver, as well crypto.

They also guarantee their precious metals to be at least VaultChain™, investment-grade quality, so there’s no risk of getting a low-grade order.

Pros | Cons |

Tax Advantages | Not BBB Accredited |

Diversification Options In Physical Gold, Silver, and Crypto | $1,000 Minimum |

Competitive, Transparent Fees | Crypto is Considered a Risky, Volatile Investment |

User-Friendly Platform | May be a Bit More Complex Than a Traditional or Gold IRA – Less Beginner Friendly |

Partnered With Secure Storage Through Reputable Depositories | |

Account Setup Process Is Straightforward | |

Can Transfer Bitcoin/ Crypto IRA | |

490+ Reviews With 4.6 Rating on Google | |

Supports a Number of Retirement Account Rollovers | |

VaultChain™, Investment-Grade Precious Metals |

2. Augusta Precious Metals

- Overall rating: ⭐⭐⭐⭐

- Fees: $250 Year #1 (then $200/year)

Augusta Precious Metals is a compelling option for investors seeking to fortify their retirement portfolios with gold or silver investments.

They boast exceptional transparency in their pricing, reporting, and customer service, but it’s their reputation that is really impressive.

They have 350+ positive reviews and have been crowned a top trusted company by big names such as Money Magazine and TrustLink.

They don’t have many precious metal types, and buy options are limited. However, this doesn’t seem to deter seasoned investors, including Mark Levin of the Mark Levin Show, who value its security, ongoing support, precious metals quality, and educational resources, which include webinars, articles, and one-on-one consultations with their team of experts.

Pros | Cons |

Proven Track Record Of Delivering High-Quality Precious Metal Products | Limited Investment Options (Only Gold & Silver) |

Offers A Wealth Of Educational Materials & Resources | Must Buy On The Phone- Can’t Buy Online |

Competitive Transparent Pricing | Limited Return Policy |

Offers A Wide Range Of IRA-Approved Gold And Silver Products | Limited in Which Retirement Accounts can Rollover (Traditional, Roth, 401(k) or 403(b)) |

Excellent Customer Service | |

Established Company Around Since 2012 | |

A+ Rating On BBB 4.95/5 Stars 120 Reviews | |

Money Magazine’s “Best Gold Company” & Seven-Time #1 Trusted Gold Ira Company By Trustlink | |

Backed by Mark Levin of the Mark Levin Show |

3. Goldco Precious Metals

- Overall rating: ⭐⭐⭐⭐

- Fees: ($ 260-year #1), then $180 per year

Goldco is another top-rated gold IRA company known for its “white-glove service” and exceptional buyback program.

With most investors, flexibility is key, making Goldco’s buyback policy very attractive. If your situation changes, they guarantee you will get the highest price for your gold.

They are famed for their top-tier service, seamless investment process, and have thousands of glowing reviews.

Right now, the company is limited to gold and silver, limited with their account rollover types, and has a high initial investment, but they offer tons of resources, high-quality investment plans, and transparent pricing.

Pros | Cons |

Educational Materials (Including Articles, Videos, And Webinars) | Only Focuses On Gold And Silver Investments |

Provides A Range Of IRA-Approved Gold And Silver Coins And Bars | Limited Retirement Account Rollover (IRA, 401(k), 403(b), TSP) |

Competitive, Straightforward Once A Year Fee | $25,000 Initial Investment |

Good Customer Service | |

A+ BBB Accredited, 4.83/5 Stars From Thousands of Reviews, & INC5000 Award 6x | |

Buy Back Guarantee- Will Buy Your Investment Back At The Highest Price | |

High Caliber Supporters & Clients Including Chuck Norris, Sean Hannity, Ben Stein, Fortune Magazine, Fox News, and Others |

4. Advantage Gold

- Overall rating: ⭐⭐⭐⭐⭐

- Fees: Set up: $50 + Storage fee: $100–$150 + Annual Fee $95 – $100

Advantage Gold is a company that prides itself on offering personalized support, a wide range of precious metals, and tailored solutions to its valued customers.

You can easily get started with Advantage Gold’s Precious Metals IRA Transfer Program if you are looking to convert your current IRA. If you’re new to gold IRA investing, they have an extensive library of educational resources.

They are unclear on a couple of policies, including the specifics of their buy-back guarantee and what the initial investment needs to be, which suggests it may be subject to change.

However, if you have questions about that or investing in gold, you can also talk to a customer support team member who, according to reviews, is usually professional, competent, and friendly.

The reviews also mention the company’s delivery speed, coin selection, trustworthiness, and low fees. The Better Business Bureau seems to agree, giving them top ratings for their exceptional service.

Pros | Cons |

Educational Resources (Including Webinars, Articles, And One-On-One Consultations) | No Clear Policy On Their Buy Back Guarantee |

Ira-Approved Products | No Clear Info on Initial Investment |

Praised Customer Service | |

Have A Buy Back Guarantee (No Price Listed) | |

A+ BBB Accredited With 4.84/5 Stars | |

Gold, Silver, Platinum, Palladium Investment Options | |

Supports a Number of Retirement Account Rollovers |

Final Word: Stored IRA Gold at Home

Opting to keep your stored IRA gold at home may seem appealing, but when you look a bit closer, it’s really not a good idea. It’s not federally condoned, safe, or advisable.

Choosing instead to use approved private storage IRAs such as iTrustCapital or Goldco can significantly alleviate security and legal risks.

FAQs:

How do I store gold in my IRA?

To store gold in your IRA, you must work with a reputable gold IRA provider that offers IRS-approved gold investments and compliant storage options in an IRS-approved depository.

Can I take physical possession of gold in my IRA?

Technically, you can take physical possession of gold in your IRA but the IRS considers this a distribution and could require additional taxes and penalties. If you want your gold to continue growing your IRA, your gold must be stored in an IRS-approved depository.

Is it a good idea to have a gold-backed IRA?

It can be a good idea to have a gold-backed IRA if you’re looking to diversify your retirement portfolio and protect your wealth from economic uncertainties and inflation.

Can you hold gold in a self-directed IRA?

Yes, you can hold gold in a self-directed IRA if you use an IRS-approved depository to store your gold.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.