Feeling stuck with limited income streams? Ready to make your money work harder for you?

You’re in the right place. In this article, I’ll walk you through the best high yield investments for generating substantial cash flow and providing you with a steady stream of passive income.

From dividend stocks and real estate to peer-to-peer lending and the best passive income apps, we’ll delve into a wide range of high-yield options that suit various risk appetites and investment goals.

FEATURED OFFER: Masterworks

Want an investment that’s fueled by the ultra-wealthy? Try art.

Since 1995, contemporary art has appreciated 11.4% annually on average. That’s 43% more than the S&P over the last 30 years (1995-2024). After all, there’s a reason why many HNW individuals can invest almost an entire 10%+ of their wealth in art.

Want in? You can invest in shares of million-dollar painting offerings with Masterworks, the world’s first art investment platform.

For a limited time, you can skip the waitlist here

*See important disclosures at masterworks.com/cd

16 Best High-Yield Investments in 2025

Let’s get to it! These are some of the best high-yield investments out there right now. You’ll find options suitable for just about any account size and risk tolerance level.

1. Private Credit

- Risk level: Moderate to High

- Expected returns: Moderate to High

- Who it’s good for: Accredited Investors, Fixed Income Seekers

Let’s start out the list with a high-yield investment you may not have considered: Private credit.

With private credit, you’re essentially the cool lender who provides loans or investments to companies or individuals that can’t go to the regular banks for financing.

Investing in private credit can actually give you some pretty attractive returns, even better than other fixed-income options.

But as with anything, there are risks involved. Borrowers might not have the best creditworthiness, and the investments themselves can be a bit hard to sell quickly if you need to get your money back fast. So it’s important to know what you’re getting into.

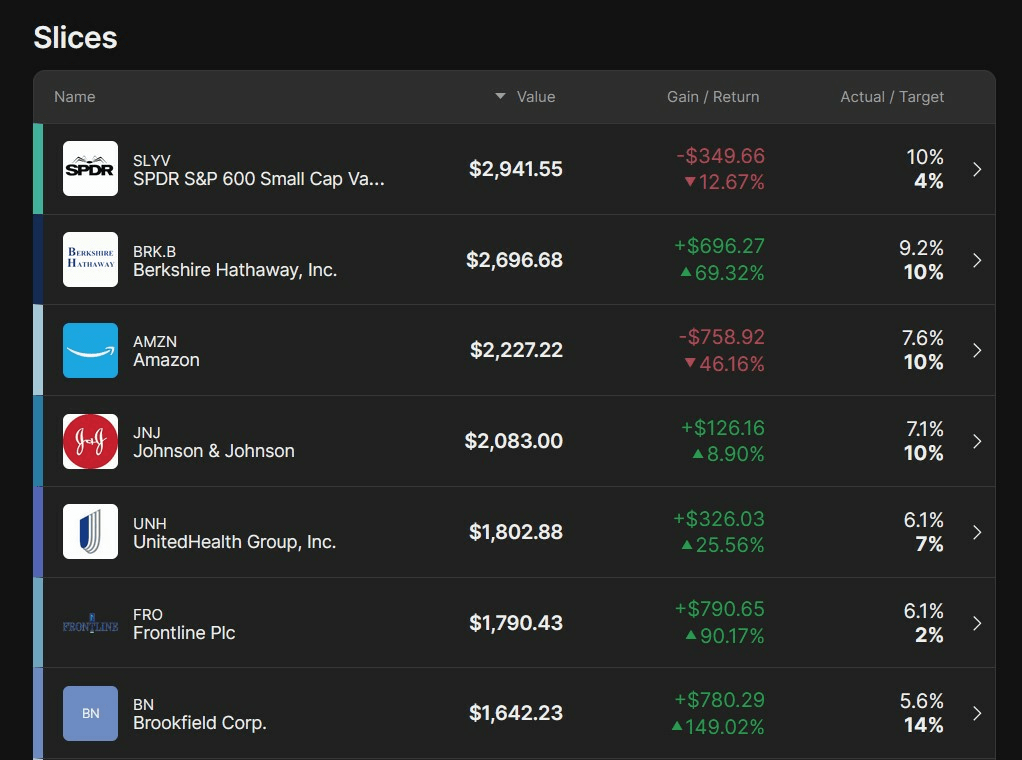

Percent is one of the leading platforms to invest. As of December 31, 2024, the platform reported an impressive weighted average APY of 18.13%.

Overall, Percent is a solid platform where accredited investors can enter the wonderful world of private credit investing.

If you’re new to private credit investing, there’s no need to select your own deals — you can diversify instantly by investing in Percent Blended Notes. Within a single investment vehicle, you can gain access to multiple notes across different asset classes and geographies.

If you prefer to select your own deals, you can do that, too. You can also compare deals and review the risk potential for each, so you can select the investments that best match your style.

Just remember to do your due diligence and make sure everything aligns with your investment goals.

2. Private Companies

- Risk level: High

- Expected returns: High

- Who it’s good for: Accredited Investors, Venture Capitalists

Investing in private companies can be a rollercoaster of high risk and high rewards. Since these companies aren’t publicly traded, it means you won’t be able to easily buy or sell their stocks like you would with big-name public companies.

That’s why it’s important to do your homework, evaluate the risks, and make sure you’re comfortable with the uncertainties that come with private companies. That said, these can generate large returns.

So if you’re itching to dive into the world of private companies, you should definitely check out Hiive.

They’ve got a platform where you can explore and invest in private companies. It enables accredited investors to connect investors with private and/or pre-IPO companies and employees, venture capital firms, or angel investors who want to sell shares. It has a star-studded list of companies available, including Groq, Anduril, OpenAI, and more.

As a buyer, you can accept the asking price as listed, place a bid, or negotiate directly with the sellers. As an added perk for investors, for standard transactions, the sellers are the only ones who pay fees.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. This communication is for informational purposes only, and is not a recommendation, solicitation, or research report relating to any investment strategy or security. Investing in private securities is speculative, illiquid, and involves the risk of loss. Not all private companies will experience an IPO or other liquidity event; past performance does not guarantee future results. WallStreetZen is not affilated with Hiive and may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive Markets Limited, member FINRA/SIPC.

3. Fine Art

- Risk level: Moderate

- Expected returns: Moderate to High (Varies significantly)

- Who it’s good for: High-net-worth Individuals, Anyone looking to diversify

If you’re an art enthusiast, a collector, or just a high-net-worth individual wondering where to invest in 2025, investing in fine art might be your thing.

If you want access to a world of art investing opportunities, check out Masterworks. They offer a unique platform that allows you to invest in shares of iconic artworks, even if you don’t have a massive art collection or a Picasso hanging in your living room.

With Masterworks, you can diversify your portfolio by owning a fraction of a valuable artwork alongside other like-minded investors.

4. Real Estate

- Risk level: Moderate

- Expected returns: Moderate to High

- Who it’s good for: Long-term Investors, Passive Income Seekers

Real estate investors purchase properties with the intention of generating income through rental payments or capital appreciation.

Real estate can provide a bunch of benefits, like:

- Stable cash flow

- Potential tax benefits

- Hedge against inflation

Real estate investments can range from rental properties to commercial buildings, and there are multiple strategies to consider, like buy-and-hold, fix-and-flip, or real estate investment trusts (REITs).

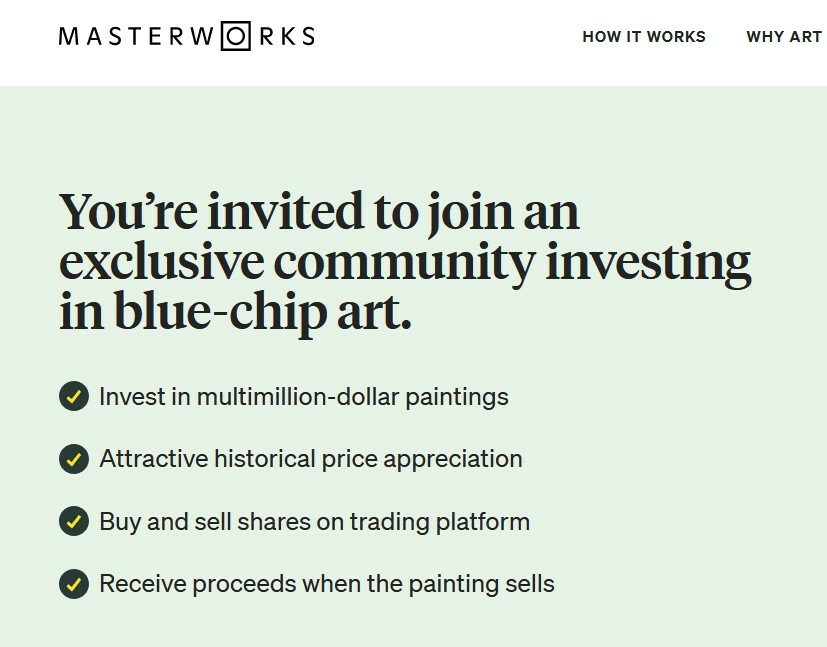

For investors who want turnkey real estate, Doorvest can be a great option. They source, renovate, lease, and manage your property for you … so you can minimize your cost, time, and risk.

5. Crowdfunded Real Estate

- Risk level: Low to Moderate

- Expected returns: Low to Moderate

- Who it’s good for: Investors Seeking Real Estate Exposure, Passive Real Estate Investors

Crowdfunded real estate platforms bring people together to pool their money and dive into exciting opportunities like residential or commercial properties, development projects, and even real estate loans.

Best of all, it doesn’t take a lot of cash.

Whether you’re an accredited investor looking for high-end options (check out YieldStreet) or just starting out (give Fundrise a shot), there’s something for everyone.

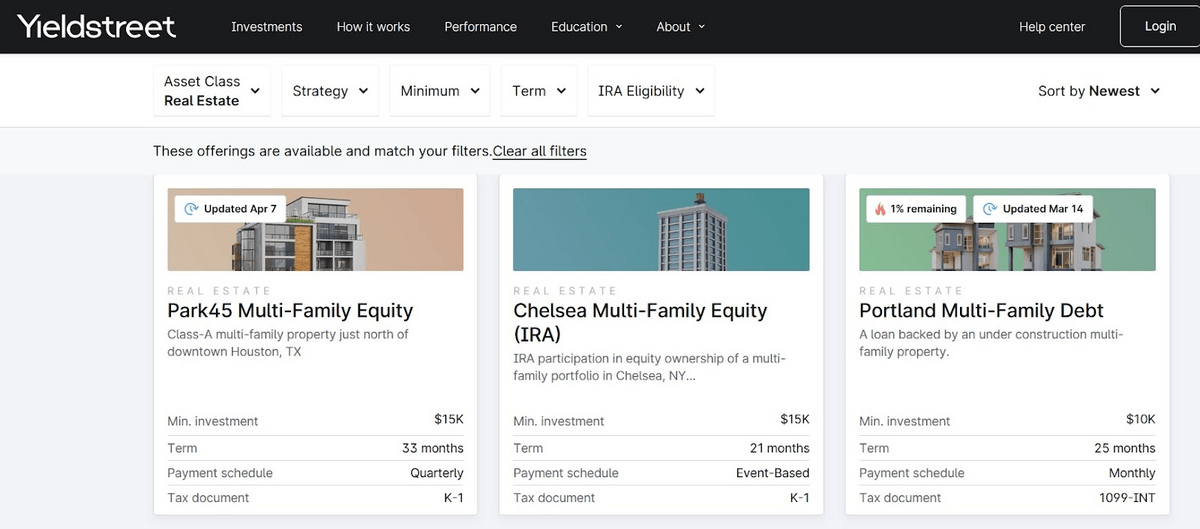

Just look at some of the multi-family properties you can get exposure to by investing with YieldStreet:

While many of the individual deals on Yieldstreet are only available to accredited investors, the platform does offer a great investment vehicle for non-accredited investors, too. It’s called the Alternative Income Fund. With a minimum investment of $10k, this fund gives you access to an impressive array of alternative assets within a single vehicle — real estate, private and structured credit, legal finance investments, and more.

If you want to get serious about alternative investments but aren’t sure where to start, Yieldstreet is a standout platform. (Check out our Yieldstreet review, too.)

6. Real Estate Investment Trusts (REITs)

- Risk level: Moderate

- Expected returns: Moderate

- Who it’s good for: Income Investors, Diversification Seekers

REITs are companies that own and take care of properties that make money, like apartments, offices, and shopping centers.

The cool thing is, you can invest in these companies and enjoy the benefits of real estate without the hassle of being a landlord. And it’s easy to invest, because you can buy them on the stock market, just as you’d buy shares of any stock.

Looking for high-quality REITs? I strongly recommend filtering down the hundreds of options out there by researching REITs on WallStreetZen. On the site, you can see the Zen Rating for each REIT and stock we track, which is a letter grade that distills a proprietary 115-factor review we perform on every stock.

For example, at writing in late January 2025, I located a promising REIT in CBL & Associates (NYSE: CBL), an REIT that owns and operates commercial properties. With a Zen Rating of A, it’s in a class with stocks that have averaged 32.52% annual returns. As you can see, the Zen Rating also shows you Component Grades for where the stock shines:

You can start your REIT-seeking journey by looking at WallStreetZen’s Top REIT Stocks to Buy now screener.

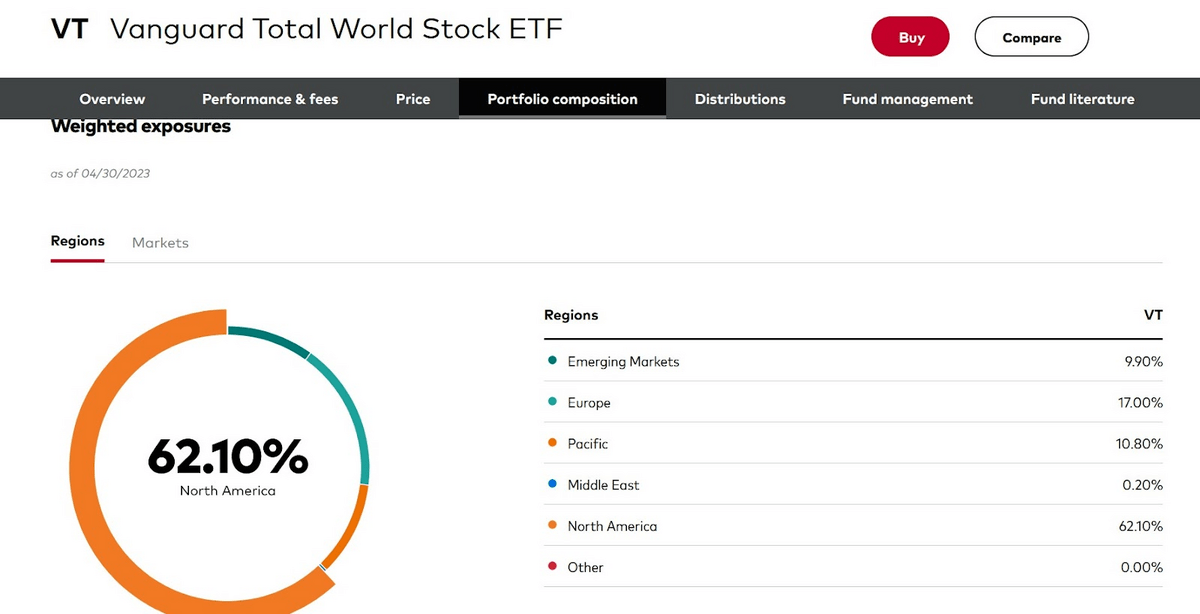

7. Dividend ETFs

- Risk level: Low

- Expected returns: 8-10%

- Who it’s good for: Income Investors, Long-term Investors

When you invest in a dividend ETF, you’re actually buying shares of a fund that holds a bunch of different stocks from various companies that are known for dishing out juicy dividends.

Dividend ETFs are one of the best high-yield investments because they offer you a diversified portfolio without the need to individually pick and choose stocks. Plus, they tend to focus on companies that have a history of regularly paying out dividends, which can bring you a consistent income stream.

The Schwab US Dividend Equity ETF (NYSE: SCHD), for example, currently yields about 3.6%. So if you invested $10,000 dollars into it, you’d receive about $360 dollars every year in dividend payments.

Our pick for dividend ETFs? eToro, where you get the benefits of Dividend ETFs while enjoying the convenience of a user-friendly platform.

For what it’s worth, eToro has a bunch of other cool tools that make it worth checking out.

For one, it has a Paper Trading tool that lets you practice investing without putting actual cash on the line.

Additionally, eToro’s CopyTrader feature lets you can automatically copy top-performing traders, instantly replicating their trading in your portfolio – a great feature for beginners. (It ranks #1 on my list of the best copy trading platforms.)

Anyhow — there’s a lot to like about eToro. If you’re interested in stocks and ETFs, I can’t recommend it strongly enough.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results. Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

8. Index Funds

- Risk level: Low

- Expected returns: 8-10%

- Who it’s good for: Long-term Investors, Passive Investors, Most Investors

Index funds simply follow a specific market index, like the S&P 500, which means you get a piece of the action in a whole bunch of different companies.

The beauty of index funds is that they give you broad exposure to the market without the stress of picking individual stocks. Instead of trying to outsmart the market, you’re essentially saying, “Hey, I’ll just ride along with everyone else and enjoy the overall growth.”

Since Index Funds aren’t actively managed by a team of stock-picking gurus, they typically have lower fees compared to other funds.

If you don’t own index funds yet, these could be one of your best investments for 2023.

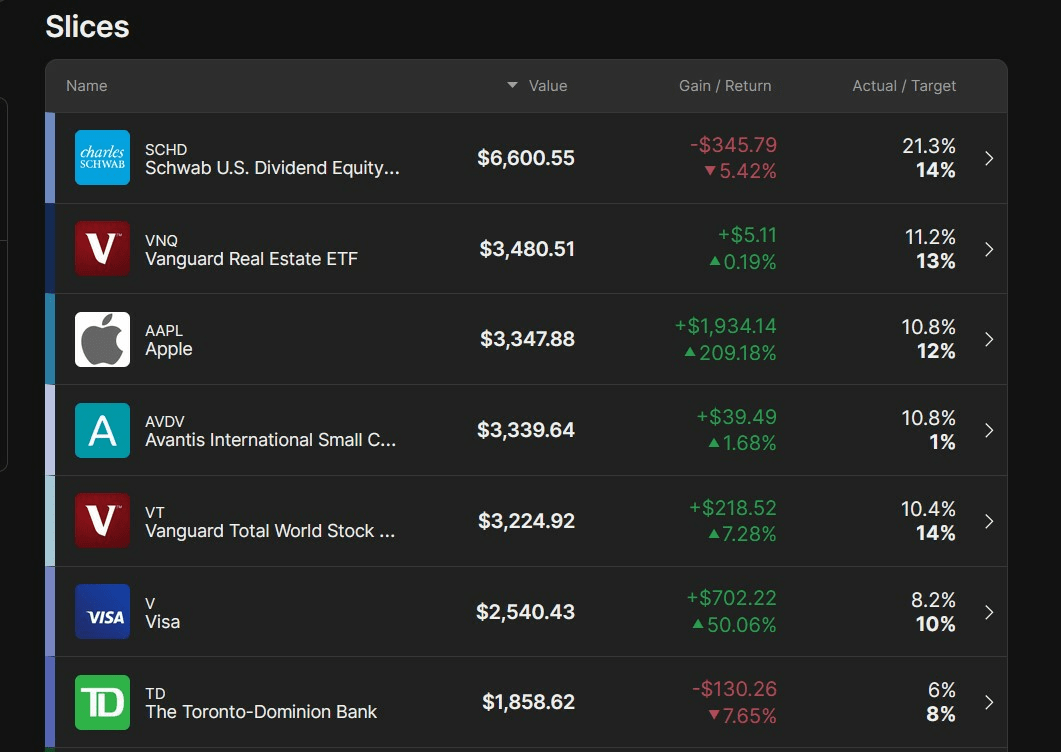

My favorite index fund? Vanguard’s Total World Stock Market Fund (NYSE: VT), which gives you exposure not just to the US market but to the entire world! You don’t have to worry about how to get internation exposure outside of the US … VT does it for you with about a 60/40 split between the North America and abroad:

I invest in VT using eToro, where they make it easy to include index funds as part of your portfolio.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

9. Mutual Funds

- Risk level: Low

- Expected returns: 8-12%

- Who it’s good for: Passive Investors, Investors Seeking Active Managers

Mutual Funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. They’re managed by professional fund managers who live and breathe investments.

As with index funds, you get the benefit of instant diversification here, because mutual funds will hold multiple positions in various companies, industries, and even different types of assets.

However, these funds charge much higher fees than index funds. And they don’t always outperform them.

To make sure you’re getting your money’s worth, it’s good to do your research and pick a fund with excellent management, clear strategy, and a history of solid performance.

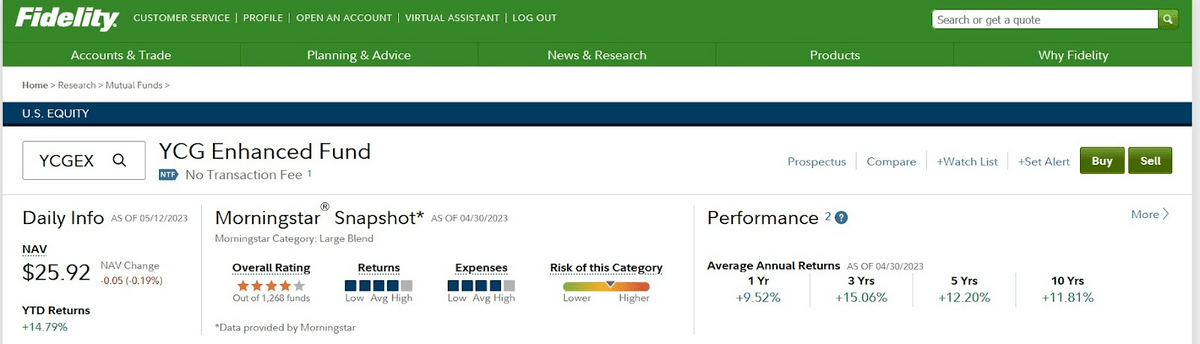

For example, Brian Yacktman’s YCG Investments (MUTF: YCGEX) invests in global champions with strong network effects who are thought to be “toll takers” along the road to rising global wealth:

My favorite mutual fund platform? Fidelity. You can easily purchase funds, see their rating, and check out their past performance:

10. Dividend Stocks

- Risk level: Moderate

- Expected returns: 8-12%

- Who it’s good for: Individual Stock Pickers, Long Term Investors, Fundamental Investors

Dividend stocks are shares of companies that are extra generous with their profits. Instead of just holding onto all the cash, they distribute a portion of it as dividends to their beloved shareholders.

Picture this: you invest in a dividend stock, and boom, you become part-owner of a company! And guess what? As a shareholder, you get a sweet piece of the pie. Regularly. These companies share their wealth with you in the form of those lovely dividend payments.

Some popular examples:

- Pepsi (NYSE: PEP) – yields 2.6%

- Johnson & Johnson (NYSE: JNJ) – yields 2.96%

- JP Morgan Chase (NYSE: JPM) – yields 2.98%

I invest in dividend stocks with eToro.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

11. Value Stocks

- Risk level: Moderate

- Expected returns: 8-12%

- Who it’s good for: Individual Stock Pickers, Long Term Investors, Fundamental Investors

As the name implies, value stocks are shares of companies that are believed to be undervalued. How do we know that? Well, it’s all thanks to fundamental analysis.

Finding value stocks requires a bit of research and strategy. To get the best return on investment, you want to dig deep, analyze the company’s financials, understand its competitive advantage, and assess its growth prospects.

Value stocks can also require extreme patience and emotional control if you want to get the best return on investment.

So if you have limited time on your hands or limited knowledge of fundamentals, picking individual value stocks might not be one of your best investments for 2023. No problem, you’ll do great sticking to some of the index funds mentioned earlier.

When it comes to investing in value stocks, I once again recommend eToro thanks to its user-friendly platform.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

12. Small Cap Stocks

- Risk level: High

- Expected returns: High

- Who it’s good for: Aggressive Investors, Growth-oriented Investors, Experienced Investors

Small cap stocks typically refer to stocks with a market cap ranging from a few hundred million to a few billion dollars.

Investing in small cap stocks can be one of the highest return investments, because these small companies are often ignored by institutions and hedge funds who have multiple billions of dollars to invest. Still, it’s important to do thorough research and diversify your portfolio.

I like eToro for small caps because you can find most small-micro cap stocks and even OTC (over the counter) stocks.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

.

13. Bonds

- Risk level: Low

- Expected returns: Low

- Who it’s good for: Income Investors, Risk-averse Investors, Retirees

Bonds are like loans you make to governments, municipalities, or companies. In return, these parties pay interest — plus, you get the full amount back when the bond matures.

Bonds are one of the best high yield investments for folks who prefer steady income and want to play it safe with their investments. So they’re deal for retirees or anyone who doesn’t like taking big risks.

If you’re new to bond investing, I highly recommend Public’s high-yield bond account. It gives you immediate access to a diversified set of 10 investment-grade and high-yield corporate bonds across a variety of industries and time horizons.

With a Public Bond Account, you can generate interest every month. When your income reaches the amount to purchase another bond, it’s reinvested. While holding your bonds until maturity ensures the highest yield, you can also withdraw your cash early.

Currently, the yields on Public’s high-yield bond account are impressive — 6.78% at writing in January 2025, but the yield can change daily, so be sure to check the latest info before you invest.

14. Certificates of Deposit

- Risk level: Low

- Expected returns: Low

- Who it’s good for: Risk-averse Investors, Prospective Homebuyers

Certificates of Deposit (CDs) are time deposits offered by banks and credit unions. They provide a fixed interest rate for a specified period, and your principal amount is also returned at maturity.

Pro tip: While they pay high interest rates, CDs also lock up your money in for whatever term (or length) you’ve agreed to. If you have to take money out of your CD before it matures, you may be subject to penalties.

If you don’t want to invest in the stock market, but still want to earn returns, CDs are a great pick that lets you save and grow your money.

Right now, CIT Bank has some of the best CD rates out there, with term CDs delivering 3.00% APY or higher.

15. High-Yield Savings Accounts

- Risk level: Low

- Expected returns: Low

- Who it’s good for: Anyone with Cash Savings

High-Yield Savings Accounts are like turbocharged versions of regular savings accounts.

They give you the chance to earn some interest on your hard-earned cash, which means your money grows faster than if you kept it under your mattress … or in a “regular” checking account.

While regular savings accounts with the big banks pay next to nothing, high-yield savings from firms like Public offer much higher rates. (Note: Public’s account is a high-yield cash account, not a high-yield savings account. Your balance may be swept between partner banks, but you can rest assured that it’s FDIC-insured.)

Currently, Public’s high-yield cash account offers 4.10% APY — among the higher rates I’ve seen out there in January 2025.

The best part? Unlike a CD, you still have easy access to your funds whenever you need them.

16. BONUS: Farmland

- Risk level: Moderate to High

- Expected returns: Moderate to High

- Who it’s good for: Long-term Investors

Let’s close out the list with another investment you may not have considered: Farmland.

Investing in farmland is all about getting agricultural land and using it to grow crops, raise animals, or renting it out to farmers.

The best part? You can enjoy a steady income, watch your investment grow, and be a part of the thriving world of agriculture.

However, not everyone is able to run out and buy one hundred acres of farmland. That’s where AcreTrader comes in.

AcreTrader provides accredited investors with access to pre-vetted U.S. farmland investments starting from $10,000.

The platform offers investments in a variety of crops, including:

- Row crops

- Permanent crops

- Timberland

Since they pay you annual rent payments in the form of dividends, AcreTrader can also be one of the highest yield investments.

Final Word: Best High Yield Investments

When it comes to seeking high yield investments, it’s essential to carefully evaluate the risks and potential returns associated with each option.

To review, here are some of my favorite platforms for high-yield investments:

- For high-yield savings accounts: Public

- For bonds: Public

- For farmland: AcreTrader

- For fine art: MasterWorks

- For private companies: Equitybee

- For real estate: Doorvest, Fundrise, and Yieldstreet

- For private credit: Percent

Remember, high yield investments can come with higher risks, so it’s crucial to diversify your portfolio, do thorough research, and understand the specific characteristics and potential drawbacks of each investment option.

It’s always recommended to consult with a financial advisor who can provide personalized guidance based on your financial goals, risk tolerance, and investment horizon.

Happy investing!

FAQs:

Which investment usually yields the highest return?

Investments with the highest potential returns often come with higher risks, such as stocks, real estate, or private equity.

What investments pay 10%?

Investments that offer potential returns of around 10% or higher include high-yield bonds, peer-to-peer lending, or certain dividend stocks.

What's the safest investment with the highest return?

While there is no investment that guarantees both safety and high returns, some relatively safer options with the potential for higher returns include index funds, diversified bond funds, or blue-chip stocks.

How to turn 10k into 20k?

To potentially double your investment, consider strategies like investing in high-growth stocks, starting a small business, or exploring real estate investing opportunities, but be aware that these come with risks and require careful research and planning.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our June report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.

![10 Investments That Earn A High Return [10% ROI or more]](https://www.wallstreetzen.com/blog/wp-content/uploads/2022/10/10-Investments-That-Earn-A-High-Return-10-ROI-or-more-scaled-e1666197396945.jpg)