Stable cash flow, price appreciation, diversification, and leverage – there’s a lot to like about alternative investments.

But as a retail investor, investing in alternative assets can be tough: It requires access and cash, which not everyone has in multitude.

That’s changing.

It’s 2025, and platforms like Fundrise give you the opportunity to invest in alternative investments including real estate, private credit, and innovative AI companies at an accessible starting point.

But is it the right platform for you?

This Fundrise review will dive deeper into what it is, how it works, and its benefits and limitations.

Fundrise Review 2025: Can You Really Make Money?

Overall Rating: ⭐️⭐️⭐️⭐️

The Bottom Line: Can you make money on Fundrise? Yes. I have been a Fundrise investor for about a year and a half. Currently my net annualized return as of January 2025 is 7.1% (see screen shot from my account below). I have made money, and I am happy with the service.

I believe that Fundrise is an excellent platform to gain exposure to real estate, private credit, and innovative AI companies. The easy-to-use platform lowers the barrier to entry for new investors looking to get into alternative investing.

When you create an account on Fundrise, you can select a diversified portfolio that matches your investment goals: Balanced Investing, Supplemental Income, Long-Term Growth, or Venture Capital. Fundrise does the investing for you, and makes it easy to track your account value, portfolio breakdown, and returns

In the below Fundrise review, I’ll explain how the platform works, how to select a diversified portfolio that matches your investment goals, and more.

Investment Opportunities: 4/5

Accessibility: 4/5

Price: 3/5

Note: We earn a commission for this endorsement of Fundrise.

What is Fundrise?

Fundrise is an investment platform designed for non-accredited investors – those of us without a ton of cash – looking to diversify into alternative assets.

At this time, Fundrise offers exposure to:

- Real estate

- Private credit

- Venture capital

Now, in case you’re new to alternatives, all of the aforementioned asset classes have traditionally been hard to access without very deep pockets (you can learn more in our post, “What is Private Credit?”). Fundrise makes it possible.

Fundrise’s Key Numbers

- Minimum investment: $10

- Total Annual Fees: 1% (AUM)

- 2024 YTD Return: 3.47%

Fundrise Investment Strategies

Fundrise offers a variety of different portfolio types.

When you sign up for Fundrise, you’re guided to choose your investment profile based on your risk tolerance and investment goals:

If you select one of the former three types, Fundrise will create a customized portfolio with real estate and private credit assets in your portfolio. For instance, if you select “Balanced Investing,” the current allocation includes 80% real estate and 20% private credit.

If you select “venture” as your profile, you’ll be guided to invest in the Innovation Fund, and your full allocation goes toward cutting-edge tech companies.

You do have the opportunity to customize your portfolio. You can make a la carte investments in various funds, including Fundrise’s Flagship Real Estate Fund, the private credit Income Real Estate Fund, and the Innovation Fund, to further customize your allocation. For instance, I have the “Balanced Portfolio” but have also invested a small amount in the Innovation Fund.

The bottom line: Fundrise makes it simple to access commercial and residential investments, private credit, and VC darlings all in one platform.

Benefits of Fundrise

Most people are attracted to Fundrise because it allows you to own quality alternative investments with minimal capital and low fees.

Fundrise fees are 1% of assets under management and are split between a 0.85% annual asset management fee and a 0.15% annual investment advisory fee.

Fundrise makes it easy by performing the investment analysis and taking on the management responsibilities for you.

Let’s take a look at some of the different funds you can invest in:

Flagship Fund: This is Fundrise’s real estate fund, which is designed to deliver long-term appreciation from a diverse portfolio of build-for-rent housing communities and multifamily and industrial assets in the Sunbelt.

Income Fund: Fundrise’s Income Real Estate Fund is designed to deliver high current yields from a diversified portfolio of their most favored real estate backed fixed income strategies — primarily, gap financing to stabilized and ground-up multifamily and to the acquisition and development of housing in the Sunbelt. This fund also seeks to capitalize on the current dislocation in real estate credit markets.

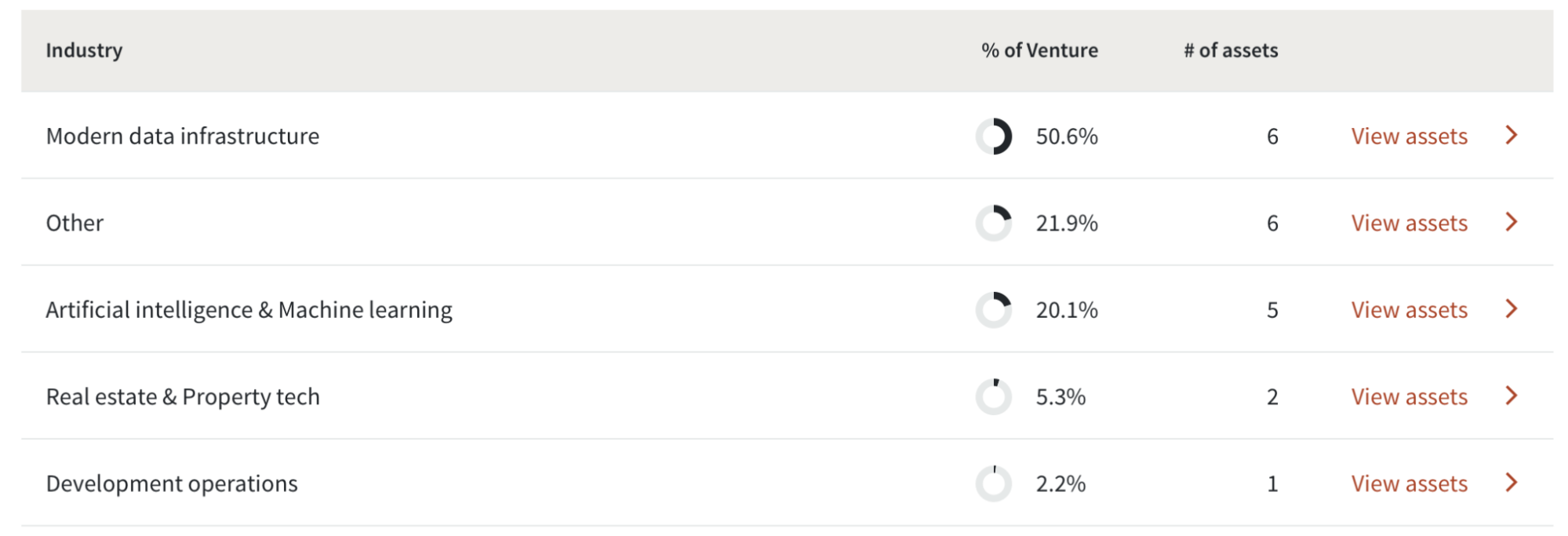

Fundrise Innovation Fund: The Fundrise Innovation Fund is an investment vehicle that primarily focuses on backing high-growth, technology-driven companies poised to drive future innovation. This fund aims to provide investors with exposure to emerging sectors such as artificial intelligence, biotechnology, and advanced manufacturing, leveraging the expertise of Fundrise in identifying and supporting transformative ventures. I recently added the Innovation Fund to my Fundrise holdings, and here’s the breakdown:

While it’s not a purely AI-driven fund, but it does have a significant chunk of AI exposure. So if you’re interested in high-growth-potential companies in that sector, the Innovation Fund might be worth exploring.

Not only do I like the diversity of Fundrise’s offerings, but I like the ease of use. You can use the “auto invest” feature to automatically deposit an amount of your choosing weekly, monthly, or at whatever frequency you like; you can also opt to reinvest your dividends. This set-it-and-forget-it approach makes it easier to build a portfolio with little to no maintenance.

Investing in funds that give you access to real estate, private credit, and up-and-coming companies is a whole lot easier than investing directly in these assets yourself. I personally have found Fundrise to be a great way to diversify and gain access to asset classes I might not otherwise be able to invest in.

Also worth noting: Fundrise’s Self Directed IRAs allow you to shelter alternative assets – like real estate – from taxes. The program comes with an annual $125 fee, but there are ways to waive it:

- Earn a one-year fee waiver when you invest $3,000 or more.

- Secure an automatically recurring fee waiver when you achieve and maintain an account value over $25,000.

Fundrise retirement accounts allow you to invest in any of their projects as part of a retirement savings plan. You can do this with crypto too — check out our iTrustCapital review if you’re interested.

Drawbacks of Fundrise

The primary drawback of Fundrise is lack of liquidity.

While Fundrise investments are intended as long-term vehicles, they do understand that investors need flexibility. One of Fundrise’s most popular features is their share repurchase program, also known as their redemption program.

All of Fundrise’s core investments offer:

- Quarterly liquidity: You can redeem some or all of your shares at any point, and redemptions are processed at the start of each quarter. So, if you make a request to redeem shares in August, the request will be processed in early October.

- There are no redemption penalties.

That said, I wouldn’t hurry to invest any money on Fundrise you plan on needing in the next 5 years (although the same is true for stock market investments). Head over to Crowdstreet vs Fundrise to learn about a competing platform with a shorter average holding period.

Finally, Fundrise pays out quarterly distributions rather than monthly dividends. Fundrise distributions are also taxed as income rather than qualified dividends.

Fundrise vs Yieldstreet

Yieldstreet is another real estate crowdfunding investing platform.

Unlike Fundrise, which has core investment opportunities in real estate, private credit, and venture companies, Yieldstreet gives you access to a variety of alternative investments beyond real estate like art, notes, and financing opportunities.

Annual management fees are higher than on Fundrise, though, and range from 1-4% depending on the asset.

Personally, I find Yieldstreet slightly easier to use but they’re both very powerful.

- If you’re an accredited investor or you want access to a wider class of investments, Yieldstreet is the better choice.

- If you want to passively invest in only real estate, I’d give Fundrise the slight edge.

Final Word: Fundrise Review

Fundrise is a great platform for investors looking to get started with alternative assets. It even topped our list of the best real estate investment apps.

I have been using Fundrise for over a year and have been happy with the results. With an accessible minimum and easy to use platform, it’s a great way to gain entry to these markets.

FAQs:

Can you make money with Fundrise?

You can make money on Fundrise.

This year, Fundrise has posted higher returns than publicly-traded REITs and stocks.

Is Fundrise trustworthy?

Fundrise is a safe and trustworthy platform.

Fundrise offers a variety of funds that you can invest in based on your investment profile. Fundrise is SEC-regulated.

Is Fundrise a wise investment?

Depending on your personal investment strategy, Fundrise could be a good investment opportunity.

Fundrise provides access to real estate investments that many retail investors might not otherwise have access to. Real estate has historically been a strong asset class to invest in.

Does Fundrise pay monthly?

Fundrise pays quarterly dividends, not monthly.

This is less frequent than many publicly-traded REITs which often pay monthly dividends. It’s a minor detail but important to consider because of the benefits of compound interest.

Fundrise dividends are also taxed as income instead of qualified dividends. Again, a minor detail but it is something you’ll want to take into consideration depending on your tax bracket.

What are Fundrise eREITs?

Fundrise eREITs give investors access to off-market real estate projects located across the country. Like traditional REITs, Fundrise eREITs appreciate in value while paying regular dividends.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.