The stock market has long been one of the greatest wealth-generating tools in the world.

It can also be a total money pit – especially if you’re following bad advice.

There are a lot of stock picking services out there, each one claiming to be the best with screenshots to “prove” it (while they conveniently leave out their losers).

Just like investing in stocks, investing in a high-quality newsletter or platform is critical.

(If you’re new to investing, check out this article on how to invest in stocks for beginners.)

So, what makes a good stock-picking service?

- Are they trustworthy?

- How is their track record?

- Is it affordable?

These are the questions you need to answer before choosing a service.

After all, you should know whether or not the analyst recommendations you’re following are likely to prove successful.

Based on these 3 criteria, I’m going to list out the 9 Best Stock Picking Services in 2025.

Remember, you get what you pay for, and if someone is offering you free investment advice, it’s probably not worth much. As such, I’m going to be recommending premium options (keeping annual costs as a relevant factor), although you can benefit from a lot of free features from my first recommendation.

The 9 Best Stock Picking Services

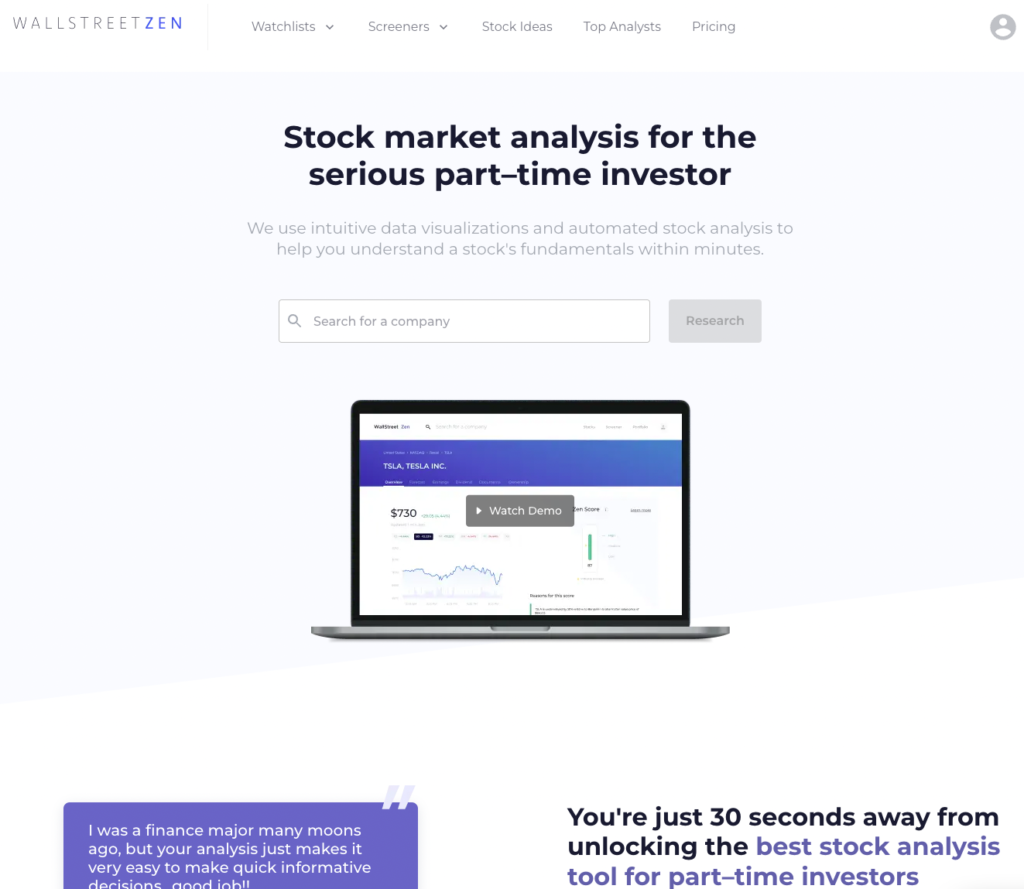

1. WallStreetZen – The Best Stock Picking Service Overall

In my (biased) opinion, WallStreetZen is the best stock picking service available. (Full disclosure, I currently work for WallStreetZen.)

There are two “arms” of WSZ that are perfect for stock picking. The first is our flagship WallStreetZen Premium membership, which offers tools for DIY investors to locate high-potential investments. Let’s dig in.

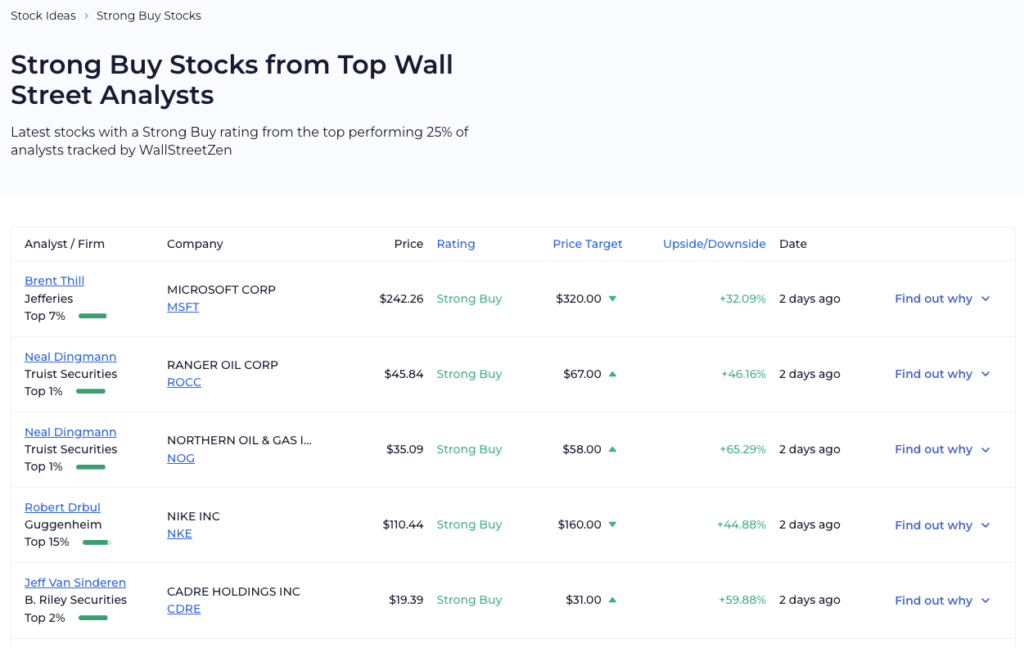

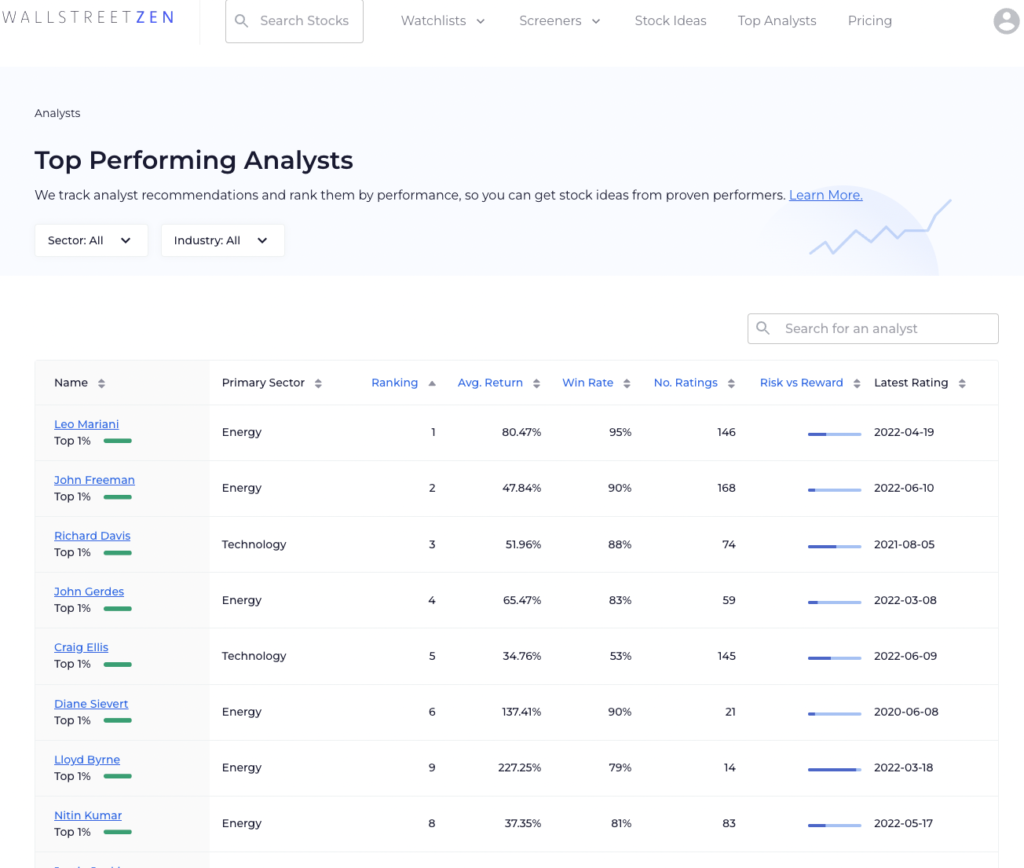

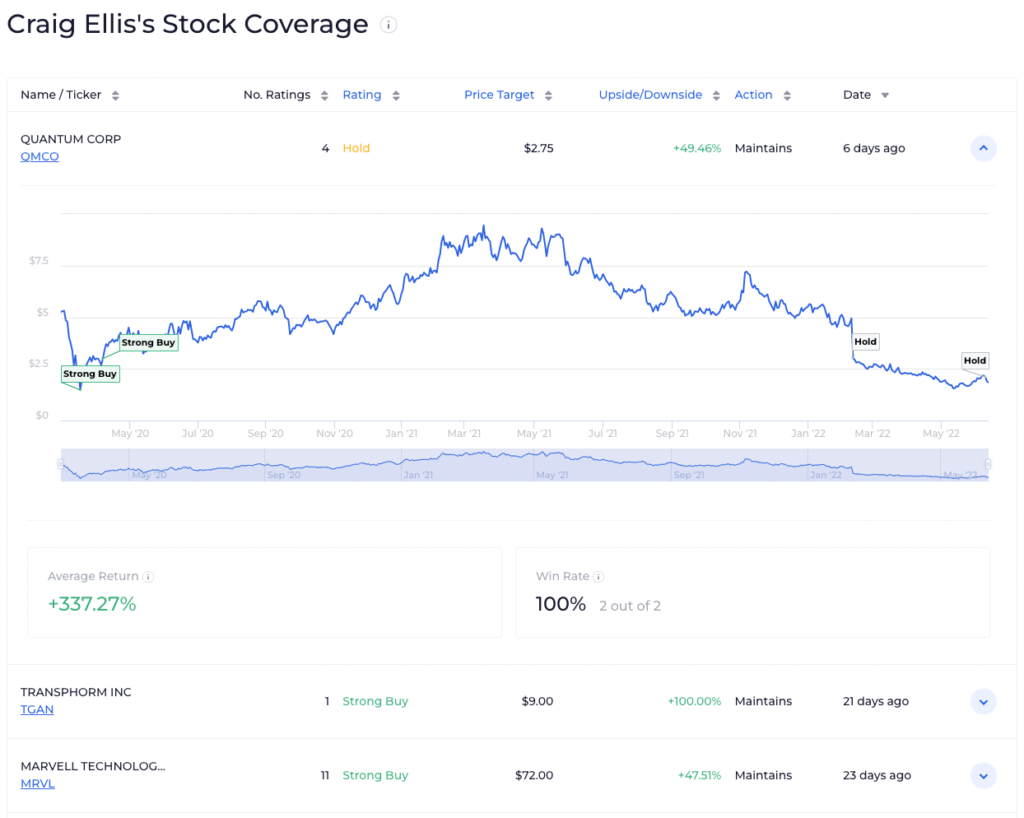

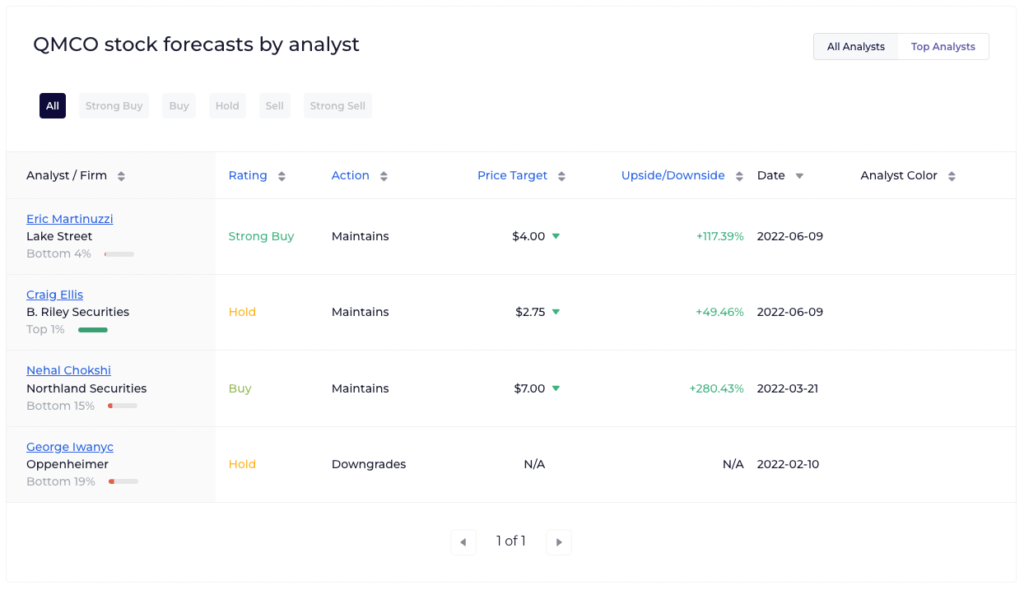

Although it’s far from the only feature, WallStreetZen’s Top Analysts is our most frequently visited page (and for good reason):

Other stock-picking services constantly brag about their winning stock picks but conveniently forget to mention all the times they’re wrong. So instead of providing picks directly, this stock-picking service was built to discover the analysts who are consistently beating the market and display their latest picks.

The site aggregates the research and recommendations from nearly 4,000 Wall Street analysts and backtests their performance over multiple years. From there, analysts are ranked based on average return, frequency of ratings, and win rate so you can follow the latest advice of proven performers.

Because the best person to follow for stock advice is the one who is consistently picking winners.

The analyst research is found throughout the site:

- On each analyst’s page within Top Analysts:

- In a daily updated list of “Strong Buy” stock picks from the Top 25% Analysts:

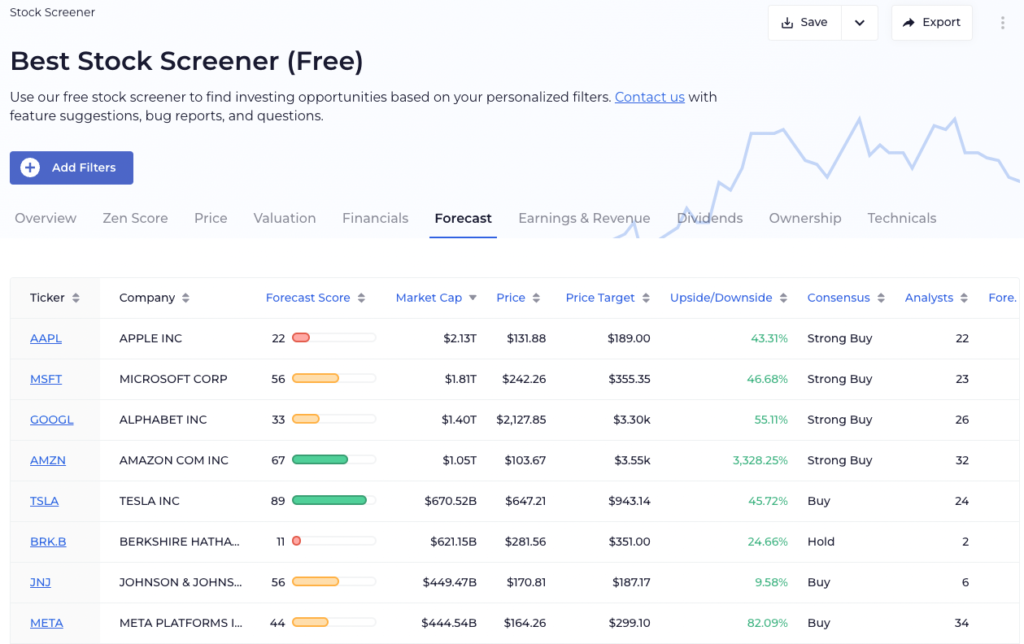

- Incorporated into one of the best free stock screeners available:

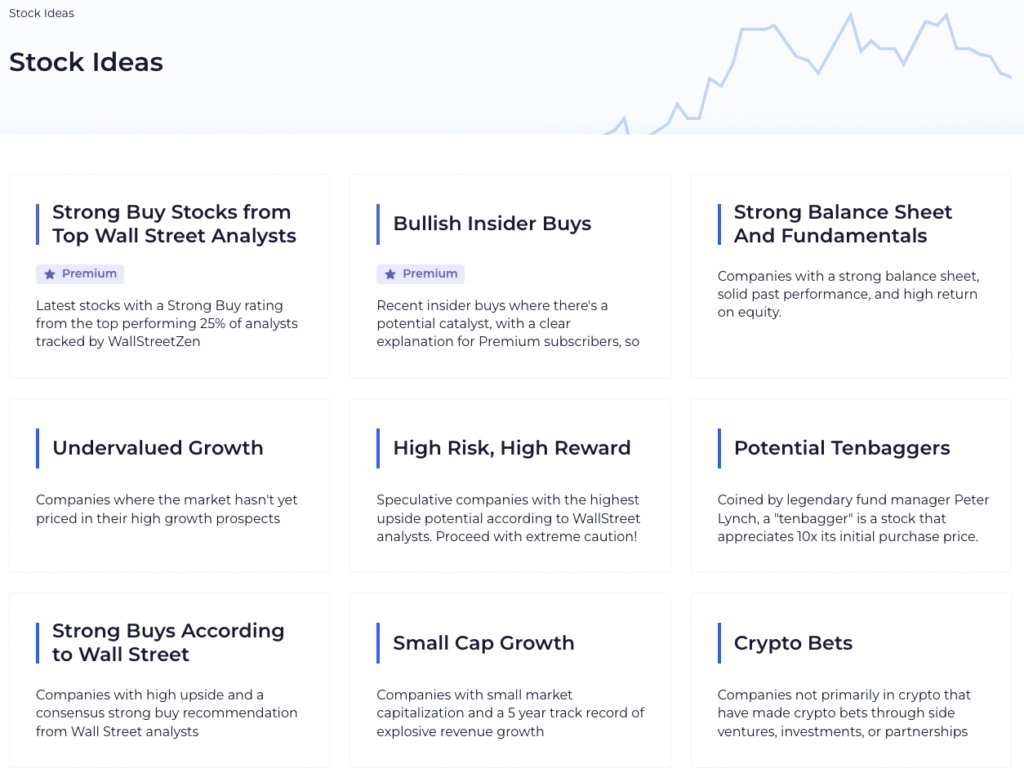

- In a curated library of pre-built Stock Ideas:

- And more…

Check out the Forecast page of TSLA or, if you’re wondering who has the best stock picking record, take a look at the recommendations of the Top 1% Analysts.

The data-driven, transparent, and visually compelling information is integrated throughout the entire site. If you like what you see with Top Analysts, you’ll want to check out Zen Rating and the Stock Screener as well.

Trustworthiness: 5/5

Unlike the other names on this list, WallStreetZen isn’t selling you picks – the site is transparently showing you the most recent recommendations from the best-performing analysts.

The bottom line: Its incentives are aligned with your own.

Track Record: 5/5

There’s a reason Wall Street’s best-performing analysts get paid millions of dollars every year.

WallStreetZen’s Top Analysts have 6X’ed the S&P 500 per year over the last 4 years:

Although past performance does not guarantee future returns, these results are staggering.

Want to see what these Top Analysts are recommending today?

Affordability: 5/5

After a 14-day trial, you may want to upgrade to Premium — which comes with a 30-day money back guarantee.

And for a more in-depth look at WallStreetZen’s Top Analysts feature, head to our YouTube video:

Don’t have the time or inclination for the DIY approach? We also offer a stock-picking newsletter where a 40+ year market veteran does the heavy lifting for you.

Launched in 2024, Zen Investor features curated stock selections from Steve Reitmeister, the former Editor-in-Chief of Zacks.com and a seasoned market pro who has decades of stock-picking experience.

Here’s what you get:

✅ Portfolio of up to 30 of the best stocks for the long haul, hand-selected by Steve Reitmeister via a 4-step process using WallStreetZen tools

✅ Monthly Commentary & Portfolio Updates

✅ Sell Alerts if the thesis changes

✅ Members Only Webinars

✅ 24/7 access to all the elements noted above

✅ Access to an archive of past trades and commentary.

Best of all, you can get Zen Investor for just $79 for your first year (for a limited time only). Gain access to Zen Investor now.

2. The Motley Fool – Stock Advisor

When it comes to selecting the best stock recommendation website, what we really want is one that delivers great returns at a great price – this one fits the bill.

Brothers Tom and David Gardner founded The Motley Fool in 1993 and have grown it into one of the largest and best stock picking services in the world:

Their most popular product is Stock Advisor, an investment service that makes direct stock recommendations.

If you’re looking for a service that delivers a few stock picks per month to add to your portfolio and a report on why you should buy each of them, this is the best option for you.

Upon sign-up, members receive 2 new stock recommendations along with 2 new stock picks each month. Each recommendation comes with an in-depth analysis of the risks and potential upside of each investment.

Stock Advisor also comes with Best Buys Now, an evolving list of what they believe to be the 10 best recommendations to invest in right now.

Updated as of: 7/3/2025

For new investors, they also publish an additional Starter Stocks list they recommend for beginners.

A premium subscription to The Motley Fool also comes with performance tracking, a stock screener, exclusive special reports, educational materials, community discussion boards, and video interviews with team members.

Trustworthiness: 4.5/5

With over 700,000 newsletter subscribers, this service on our list of best prediction websites does not lack credibility or authority – there are plenty of reviews online for each one of its services.

Although not user-friendly as WallStreetZen, the Fool website is feature-rich and fairly intuitive.

Track Record: 5/5

Since Stock Advisor’s inception in 2001, it has vastly outperformed the S&P 500 index:

They’re not shy about talking about their returns – they have nothing to hide.

Affordability: 4.5/5

At $199/year, Stock Advisor is also very affordable – it’s no wonder so many people rank it as the best stock recommendation service.

And they gave us an exclusive offer to share with you:

It’s also perfect timing – they just released this month’s picks!

You won’t want to miss these 2 potential home run stocks.

3. The Motley Fool – Epic

Also coming from The Motley Fool is Motley Fool Epic.

If you feel like you want more tools and more stock picks than Stock Advisor offers, Epic might be the perfect progression for you.

Not only do you get access to Stock Advisor, but you get three of Motley Fool’s other most popular scorecards: Stock Advisor, Rule Breakers, Hidden Gems, and Dividend Investor — along with a bunch of cool stock research tools and resources. Here’s what you get:

- 2 picks from Stock Advisor, Motley Fool’s longest-running service, with an average return of 713%*

- 1 recommendation from Rule Breakers, Motley Fool’s service that focuses on stocks with high growth potential (think: future tech heavyweights, etc)

- 1 pick from Hidden Gems, which provides foundational stocks that can anchor your portfolio

- One recommendation from Dividend Investor, for a high-quality dividend stock

If you like Stock Advisor but find yourself aching for more picks and more tools, Epic is a no-brainer.

Trustworthiness: 4.5/5

As noted above, The Motley Fool is one of the most respected names in the business.

Track Record: 5/5

Two of the key services in Epic, Motley Fool Stock Advisor and Rule Breakers, have incredible track records. I mentioned Stock Advisor returns above. Additionally, since its first investment in 2004, Rule Breakers has clobbered the S&P:

Affordability: 4.5/5

Motley Fool Epic typically costs $499 a year, but using the link below you can get your first year for $200 off using the link below. Plus, if Motley Fool Epic isn’t a good fit, you can cancel within 30 days and get every penny of your membership fee back, no questions asked. Why not give it a try?

Compared to the Edward Jones fees, this is an incredible deal.

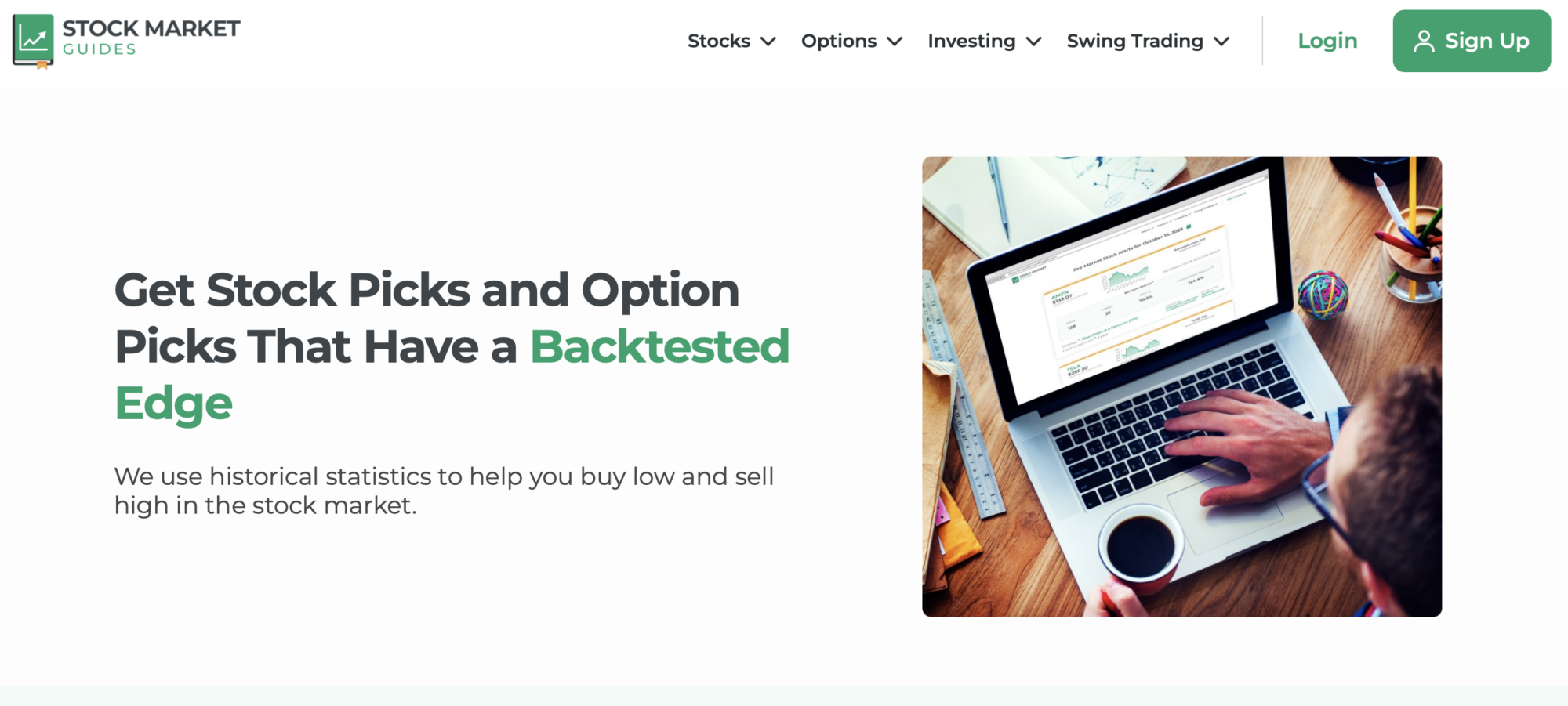

4. Stock Market Guides

If you’re looking for simple, easy-to-understand alerts that can work with your schedule, consider Stock Market Guides.

There are a few reasons why I like Stock Market Guides’ alerts — first up, the alerts themselves. You can opt to receive alerts by email or text, and they’re easy to understand — even for beginners. The process is simple: Stock Market Guides scans for potential trade setups, and when they find one, they send it to you.

Here’s where it gets even better: For every trade setup, Stock Market Guides shows you how the setup has performed in the past.

For instance, say you set up an alert for Apple (NASDAQ: AAPL) based on a breakout trading pattern. The alert will show you how many times the stock has exhibited the same price pattern in the past, and how it played out.

Stocks have “personalities” — so the ability to see how it’s reacted in similar conditions in the past can help inform your strategy.

Stock Market Guides has two different stock alert services. One is their Swing Trade Alerts service for active stock traders, which costs $49 per month. The other is their Stock Investing Picks service for buy-and-hold investors, which costs $29 per month.

(Psst — interested in options trading? They also offer options trading alerts.)

So whether you are looking for new trade ideas every day or just a few new stock investment ideas each month, they have a service that caters to you.

Trustworthiness: 5/5

Stock Market Guides’ transparency with backtesting and their results makes it a very trustworthy service.

Track Record: 4.5/5

The average annualized return for the stock alerts is an impressive 79.4%.

Affordability: 5/5

The Swing Trading Alerts for active stock traders costs $49 per month. The Stock Investing Picks for buy-and-hold investors costs $29 per month.

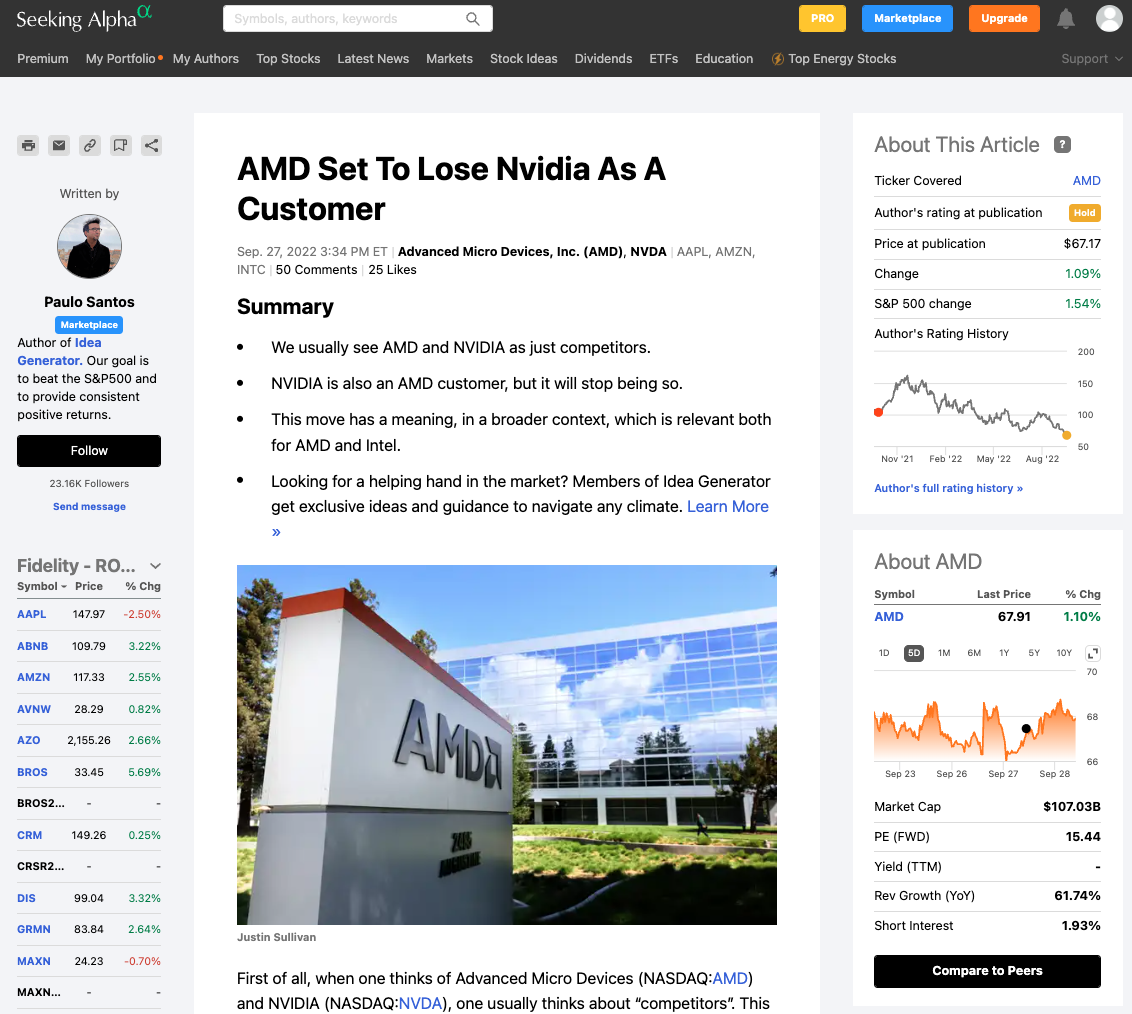

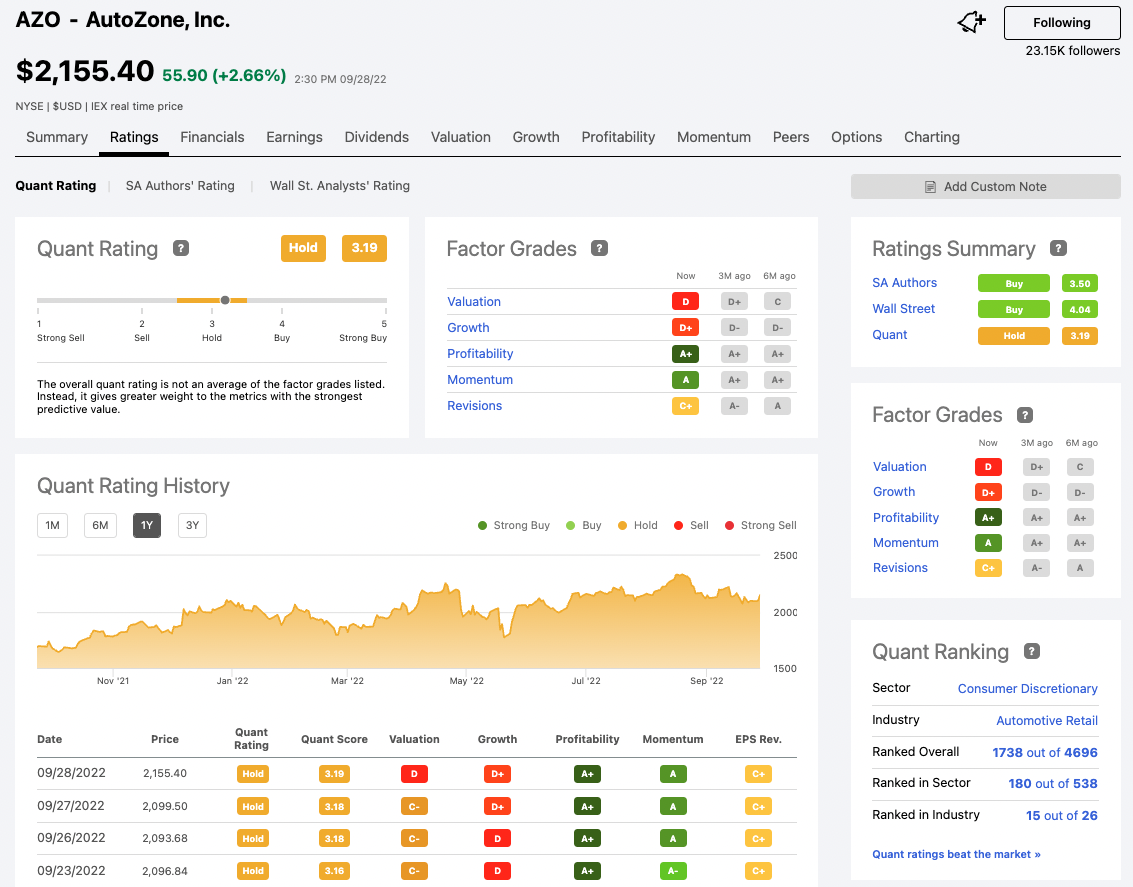

5. Seeking Alpha – The Best Stock Picking Service with Investment Analysis/Research

Seeking Alpha takes a different approach to stock-picking than The Motley Fool: Instead of an in-house team, Seeking Alpha crowdsources investment ideas from nearly 10,000 contributors.

The result: A diverse set of opinions about thousands of individual stocks trading all around the globe.

With a Premium subscription, you can gain access to hundreds of investment ideas and see individual stock ratings based on Seeking Alpha Authors’ ratings, Wall Street Analysts’ ratings, and proprietary scores like Quant Ratings, Factor Grades, and more.

While this requires more legwork than The Motley Fool (stock picks straight to your inbox), it’s a nearly perfect tool for active investors who know what they’re looking for and want to vet their own investments.

Trustworthiness: 4.5/5

Seeking Alpha is a widely-respected name and its research is used by investors all over the world, including professionals.

Track Record: 3.5/5

Since it’s not a simple stock-picking service, it’s difficult to assign a score to this category.

Seeking Alpha posts the results for its proprietary ratings alogrithms and the data for each of its authors’ performance.

Beyond that, it’s up to you to make investment decisions.

Affordability: 4.5/5

Seeking Alpha Premium typically costs $239/year, but you can use the offer below to get a FREE 7-day trial and $50 off your first year.

6. BENZINGA Pro

BENZINGA Pro is the best stock picking service for swing trading and day trading:

Each morning, day traders must scan the markets before the market opens to find the best stocks to trade each day. BENZINGA Pro handles this for you, providing up-to-the-minute alerts, news, technical information, scanners, and alerts for traders all over the world.

(Read more: Benzinga Pro review)

This daily stock picking service has something for everyone. Its audio content and advanced newsfeeds are great for short- and long-term investors alike. Plus, get access to enhanced features (such as unusual options activity).

Trustworthiness: 4/5

BENZINGA receives excellent reviews across a wide swath of investors who use its services. Most of its customers landed on BENZINGA after trying a host of other websites and now say they’ll never leave. Glowing reviews are always a good sign.

Track Record: 4/5

Any day trading service can only take you so far – good traders can make money almost regardless of the tools they’re using, but the opposite is true for those who lack the intangibles.

My score of 4 in this category is heavily reliant on the reviews I’ve read, so do your own homework before joining. We cover some of Benzinga’s win-rate statistics in our Benzinga Options review.

Affordability: 3.5/5

Benzinga Pro Essential is its most popular service, and at $197/month it’s not cheap. Happily, there is a FREE 2-week trial, so you can see for yourself if it’s worth your while. Assuming it adds incremental trading revenue, this price tag could ultimately prove to be just a fraction of the value it’s providing.

7. Mindful Trader

Mindful Trader offers a stock picking service where all his trades are based on algorithmic trading rules he developed.

He’s well qualified to be creating trading algorithmics considering he’s a Stanford grad who got a perfect score on the math SAT test and was the valedictorian of his high school. Working with numbers and doing research is right in his wheelhouse.

Because his trades are based on algorithms, it means the trades have clearly defined rules. This is a really valuable characteristic for a stock picking service to have because it means there is no guesswork needed about when to enter or exit trades.

His stock trades are designed to last about a week, so he’s an active trader and his trades fall squarely into the swing trading category.

Here is an equity curve that shows how his stock trading account performed over a one-month period:

You can see that his account grew 10% during that period, which is a great rate of return. He’s always quick to point out that stock trading comes with risk, though, and his transparency is one of the things we like about his service.

You can tell from that equity curve that he took about 39 trades during that period, which averages out to just a little under two stock trades per day. He says that trade volume with his service varies based on market conditions.

Another area where Mindful Trader sets itself apart is its customer service. Eric personally handles all customer service, which means if you send an email to Mindful Trader, you can expect a response directly from him.

The service at Mindful Trader is available for $47 per month.

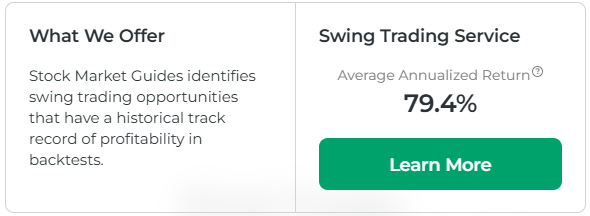

8. FINQ – Best for Going Long and Short

Love the idea of utilizing AI to make smarter investing decisions? FINQ might be for you. The platform, which touts itself as the place “where big data and AI replace the outdated human intermediary,” has an interesting approach.

First, FINQ’s engine scours potentially thousands of sources — analysts, media (both social and traditional) traffic, and company fundamentals. Its proprietary system then breaks down that immense pile of metadata using AI to find patterns and trends. These scientific insights are then passed on to investors, with solutions that suit every risk level.

Here’s what you get with your membership:

- STOCKS DEPOT: FINQ’s Daily-updated ranking of all S&P 500 stocks

- FINQFIRST portfolio: FINQ’s 10 stocks to buy (long strategy)

- FINQLAST portfolio: FINQ’s 10 stocks to short-sell (short strategy)

- FINQNEUTRAL portfolio: FINQ’s top 10 stocks to buy + 10 to short-sell (dual strategy)

Here’s how the FINQFIRST portfolio is faring:

That’s a solid value for just $50 per month — especially if you’re interested in finding stocks to short sell, which is not a common feature of other platforms on this list. If you’re looking for an investment platform that bases its ratings + portfolio picks on science rather than intuition, FINQ might be the perfect fit.

9. Zacks Investment Research

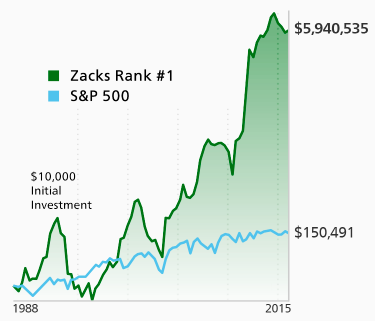

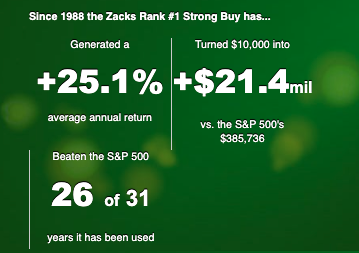

Founded in the 1970s, Zacks Investment Research has consistently provided some of the highest-performing stock recommendations for decades:

Zacks is best known for the Zacks Rank, a stock-rating system that helps individual investors find the best companies to outperform the market. Ranks range from #1 – Strong Buy to #5 – Strong Sell.

While it does offer some free services, Zacks Premium is its most popular product.

With it, members get daily updates of the Zacks Rank, full access to the Zacks #1 Rank List (which you can filter by sector, industry, price, date, value score, and more), research reports, premium screens, a portfolio of 50 long-term stocks, and more.

To get the most out of this stock prediction website, users do have to do some of their own manual research.

Unlike Motley Fool Stock Advisor, Zacks Premium doesn’t directly tell you which stocks to buy each month. Instead, it notifies you of updates to its Zacks Rank list and suggests you buy the Zacks Rank #1 stocks and sell the Zacks Rank #5 stocks.

Trustworthiness: 4.5/5

Like The Motley Fool, Zacks has developed a great brand reputation over the years. Its site is a bit outdated, but it’s easy enough to understand and find what you’re looking for. Like Stock Advisor, Zacks Premium shows its performance data very clearly.

Track Record: 4.5/5

Since 1988, Zacks Rank #1 Strong Buy stocks have clobbered the S&P 500:

Given enough time, these outsized returns can be expected to continue.

Affordability: 4/5

A subscription to Zacks Premium costs $249/year, after a 30-day free trial.

(Interested in Zacks? Read my full Zacks review or my article on Motley Fool vs Zacks vs Morningstar vs Seeking Alpha.)

BONUS: Invest Like a HNWI…

Echo Trade allows you to follow the investments of professional trading portfolios from top registered investment firms.

This “bolt-on” service links up to your existing brokerage account (Supported brokers include Robinhood and many more). With your subscription, you get real-time trade notifications, and trades are made on your behalf, automatically. You can also track portfolio positions and see real-time performance, with regular commentary.

Historically, this type of expertise has not been available to just anyone — it has been reserved for HNWIs. Now, Echo Trade lets you follow these experts and copy their trades for a fraction of the price of a professional advisor. Start your FREE 14-day trial now.

Summary

If you’re looking for the best stock picking service in 2025, you’ll want to know who has the best stock picking record and whether or not you can get the same success as them.

In my opinion, WallStreetZen is both the best free stock picking service and the one offering the best tracking of its analysts. It also is the best stock forecast website, offering a Forecast page for every U.S. stock where you can see a compiled list of analysts who cover the stock.

Try it out today and get unlimited access with a 14-day trial and, after your trial, a 30-day, money-back guarantee.

If you’re looking for weekly stock picks, The Motley Fool’s Stock Advisor is the best option for you. If you like the idea of this type of service, check out my review of the best stock newsletters.

The best stock picking service for day traders and swing traders is BENZINGA Pro Essential.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.