This article is outdated. Motley Fool Rule Breakers is now part of Motley Fool Epic, which also gets you access to another one of Motley Fool’s most popular scorecards, Stock Advisor, which has delivered 884% returns since its 2002 inception.*

Click here to read our Motley Fool Epic review, and click here to get $200 off your first year.

If you’ve read other reviews on The Motley Fool’s Rule Breakers, you’ll know that almost everyone recommends the service.

But is it better than Motley Fool Stock Advisor?

That’s exactly what we’re going to cover in this Motley Fool Rule Breakers review.

As usual, I’ll start with my conclusion and then add the details afterward (if you’re interested in learning more).

Conclusion: Is Motley Fool Rule Breakers worth it? Is it better than Stock Advisor?

The Bottom Line: A Motley Fool Rule Breakers subscription is well worth the $299/year membership cost and, if you can afford it, I would also subscribe to Motley Fool Stock Advisor ($199/year).

In the remainder of this review, I’ll break down why I think you should pay for both services.

But, if you can only afford 1 of these 2 services I would choose Stock Advisor.

*$99/year is an introductory offer for new members only. Discount based on the current list price of Rule Breakers of $299/year. Membership will renew annually at the then-current list price.

*$99 promotional price for Stock Advisor new members only. Discount based on current list price of $199/year. Membership will renew annually at the then-current list price.

The Motley Fool

The Motley Fool was founded in 1993 by Tom and David Gardner.

The brothers set out to help people reach financial freedom through educational content and premium investing services.

Nearly 30 years and several million customers later, it’s safe to say they’ve accomplished their goal.

And they’re showing no signs of slowing down.

By far, The Motley Fool’s 2 most popular services are Stock Advisor and Rule Breakers.

Motley Fool Rule Breakers vs Stock Advisor – Service Comparison

Stock Advisor | Rule Breakers | |

|---|---|---|

Price | $199/year | |

Introductory Offer | ||

Founded | 2002 | 2004 |

Best For | Beginner – Advanced Investors | Intermediate – Advanced Investors |

Investment Style | Growth, moderate-risk | High-growth, moderate-high risk |

Volatility | Moderate | High |

Quantity of Stock Picks | 2x monthly | 2x monthly |

Best Buys Now List | 10 stocks | 5 stocks |

Starter Stocks | ✅ | ✅ |

Community Access | ✅ | ✅ |

Investing Resources | ✅ | ✅ |

30-Day Membership Fee Refund | ✅ | ✅ |

Stock Advisor Returns

Since 2002, Motley Fool Stock Advisor has had phenomenal success outperforming the market:

This graph alone has sold hundreds of thousands of Stock Advisor subscriptions and pretty much speaks for itself.

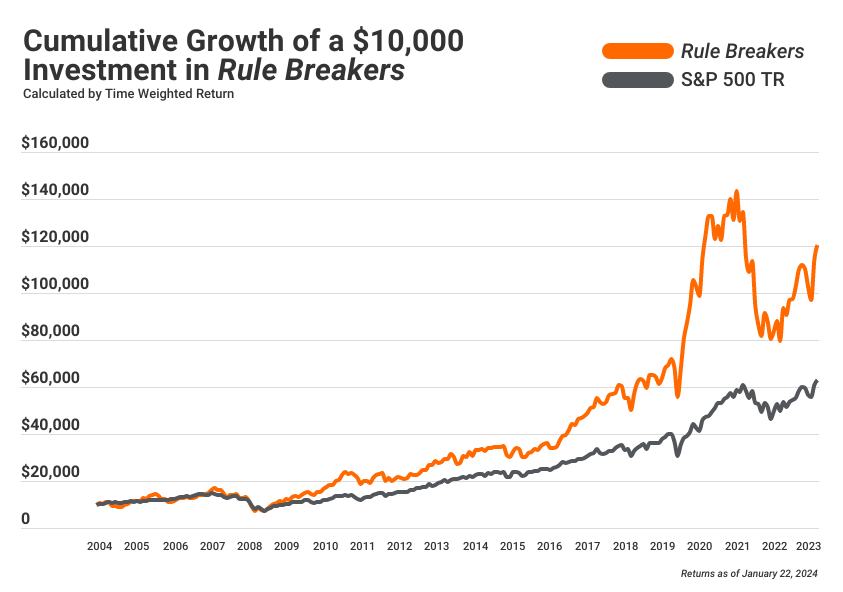

Rule Breakers Returns

Since its inception in 2004, Motley Fool Rule Breakers members have enjoyed the same success as their Stock Advisor counterparts:

While the returns aren’t quite as staggering (266% vs 582% as of 1/25/24), much of the difference can be attributed to Rule Breakers beginning its service 2 years after Stock Advisor.

By any measure, The Motley Fool’s services are performing exceptionally well, a testament to the company’s investment philosophy and the quality of its research.

Rule Breakers vs Stock Advisor: The Real Difference

So, what’s the difference between Motley Fool Stock Advisor and Rule Breakers? Is it something to do with the Motley Fool Rule Breakers picks? How do the two services’ stock recommendations differ?

Why does Motley Fool Rule Breakers cost more than Stock Advisor?

The difference between The Motley Fool’s Rule Breakers and Stock Advisor services is their investment strategies/styles.

The Rule Breakers service seeks out the handful of companies that break the rules of the business status quo, primarily through disruptive technology. These stocks can create serious profits for investors who find them early on and can stomach the inherent volatility.

Stock Advisor | Rule Breakers | |

|---|---|---|

Investment Strategy | Stocks and ETFs selected from a variety of sectors. | High-growth stocks primarily clustered in emerging technology sectors. |

Company Criteria | Any stock with high upside | Disruptive technology |

Securities Analyzed | 300+ | 200+ |

Diversification | SA recommends at least 25 stocks in a portfolio. | RB recommends at least 15 stocks in a portfolio. |

Best Use | Moderate-risk investing | High-risk investing |

Volatility | Moderate | High |

My Overall Rating | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

My Final Conclusions: Rule Breakers vs Stock Advisor

Personally, I believe Motley Fool Stock Advisor is the better-valued option for 90% of investors.

Read more: Motley Fool Review: Is Stock Advisor Worth It in 2022?

That said, if you can stomach the volatility of a Rule Breakers portfolio, the RB team is bound to pick some massive winners in the years to come.

**$99/year is an introductory offer for new members only. $200 discount based on the current list price of Rule Breakers of $299/year. Membership will renew annually at the then-current list price.

And like I said at the top, if you can afford both subscriptions, The Motley Fool has an incredible track record of earning its members returns that far exceed the subscription fees they charge.

FAQs:

What is the difference between Motley Fool Stock Advisor and Rule Breakers?

The primary difference between the 2 services is the type of companies they invest in.

While Stock Advisor may choose any stock in any industry with high potential, Rule Breakers only invests in disruptive technology. For this reason, Rule Breakers is a much more volatile, high-risk/high-reward service.

Is the Motley Fool legitimate?

Yes, the Motley Fool is a trustworthy company with quality products.

Which is better Motley Fool or Rule Breakers?

In my opinion and experience, Motley Fool Stock Advisor is a better value service than Rule Breakers.

Read more: If you enjoyed this Motley Fool Rule Breakers review, you should read my review of the best investment newsletters.

Read more: And if you’re looking to compare some of the most popular premium subscription services, check out my article on Motley Fool vs Zacks vs Morningstar vs Seeking Alpha

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.