If you’re a long-term investor in Bitcoin or other cryptocurrencies, you may want to consider a retirement account.

iTrustCapital is an investment company that offers self-directed IRA (SDIRA) accounts, allowing you to invest in cryptocurrencies — as well as precious metals — in a tax-advantaged account.

Here’s my iTrustCapital review and a complete breakdown of its features, fees, supported assets, user experience, and how it stacks up against Bitcoin IRA:

Is iTrustCapital Legit?

The Bottom Line: Yes, iTrustCapital is legit based on an apparent history of compliance with IRS regulations, insurance coverage, and positive customer reviews. It is a great way for long-term investors to invest in cryptocurrencies and precious metals in tax-efficient retirement accounts.

iTrustCapital offers self-directed IRA (SDIRA) accounts that allow you to invest in cryptocurrencies and precious metals. Its low fees and top-notch security make iTrustCapital one of the best ways (if not the best way) to invest in crypto, gold, or silver within a retirement account.

What is iTrustCapital?

iTrustCapital is a digital asset IRA platform that allows clients to purchase and trade cryptocurrencies and physical gold and silver in real-time within tax-efficient retirement accounts.

Retirement accounts protect you from capital gains taxes and offer additional tax savings, helping you grow your portfolio larger and faster than regular investment accounts.

iTrustCapital has processed more than $12 billion in trading volume for 200k+ accounts since inception and is among the most liquid crypto IRA platforms available. This allows you to buy or sell crypto in real-time, as opposed to a small lag (and inflated prices) on other platforms.

iTrustCapital supports multiple types of IRAs offered on the platform, including Traditional, Roth, and SEP IRAs. You can even rollover your existing workplace retirement account (such as a 401k) into an iTrustCapital IRA.

Traditional IRAs help you save on taxes in the current year, while a Roth IRA is tax-free in retirement. A SEP IRA allows small business owners (and their employees) to invest in a retirement account, with higher contribution limits than standard IRA accounts.

There are currently over 60 cryptocurrencies available to invest in, as well as physical gold and silver.

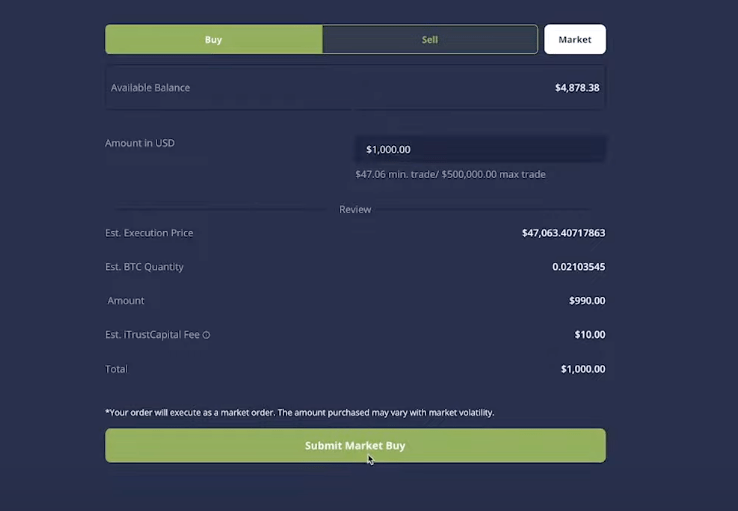

iTrustCapital Fees and Minimums

-

- Minimum investment: $1,000

- Crypto trading fees: 1%

- Gold trading fees: $75 over spot price (per ounce)

- Silver trading fees: $3.25 over spot price (per ounce)

- Traditional IRA to SEP or Roth Conversion: $75 (one-time fee)

iTrustCapital’s crypto trading fees are on-par with many major cryptocurrency exchanges, and lower than other crypto IRA accounts.

Gold trading fee equate to about 2.5% – 3% per trade (at current prices), which is about the industry average. At $3.25 over spot, the silver trading fee is somewhat high.

How Does iTrustCapital Work?

iTrustCapital is an investment platform that supports individual retirement accounts.

You can apply for an account, deposit funds, and start investing in alternative assets, including cryptocurrency, gold, and silver. You can choose between a Traditional or Roth IRA, or open a SEP IRA if you are self-employed or a business owner.

You can fund your account in USD or transfer supported assets in-kind from another self-directed IRA platform. There is a $1,000 minimum to open an account.

iTrustCapital has a simple user interface for buying and selling cryptocurrency and precious metals:

iTrustCapital also supports crypto staking, which is a way to earn interest on your crypto investments. Currently, only one asset is supported (DOT), and iTrustCapital does take a 20% cut of the profits earned from staking DOT, but the process is simple and all interest is earned within your tax-advantaged IRA account.

Crypto assets are stored with a third-party custodian that utilizes cold storage solutions from Fireblocks and Coinbase to keep user assets safe from hackers. The assets are not lent out or invested as some crypto exchanges do (ahem…FTX), but are stored solely for client use.

Upon reaching retirement age (59.5 for IRA accounts), you can begin taking distributions from the IRA account. This includes transferring crypto assets into your own digital wallet for self-custody. You cannot take custody of crypto assets before retirement age, as the IRS prohibits this.

Crypto withdrawals may be a taxable event. Consult with a tax professional before withdrawing your crypto from the platform.

Physical gold and silver sold on the platform are stored by the Royal Canadian Mint.

How to Apply for an iTrustCapital IRA

To apply for an iTrustCapital IRA, you will need to submit an application (similar to signing up for an IRA with a traditional financial firm):

-

- Choose a type of IRA (Traditional, Roth, SEP)

- Choose how to fund the account

- Nominate at least one beneficiary

- Submit some personal information (legal name, address, and social security number)

Once the application is submitted, it will be reviewed by the iTrustCapital team. Upon approval, the account can be funded from your bank account, rollover IRA, or a workplace retirement account.

You are required to have earned income to qualify for an IRA and you can only invest up to the annual limits within the account ($7,000 as of 2025 if you’re under 50; $8,000 if you’re 50 or older). Joint accounts are not available and you cannot open a spousal IRA through iTrustCapital at this time.

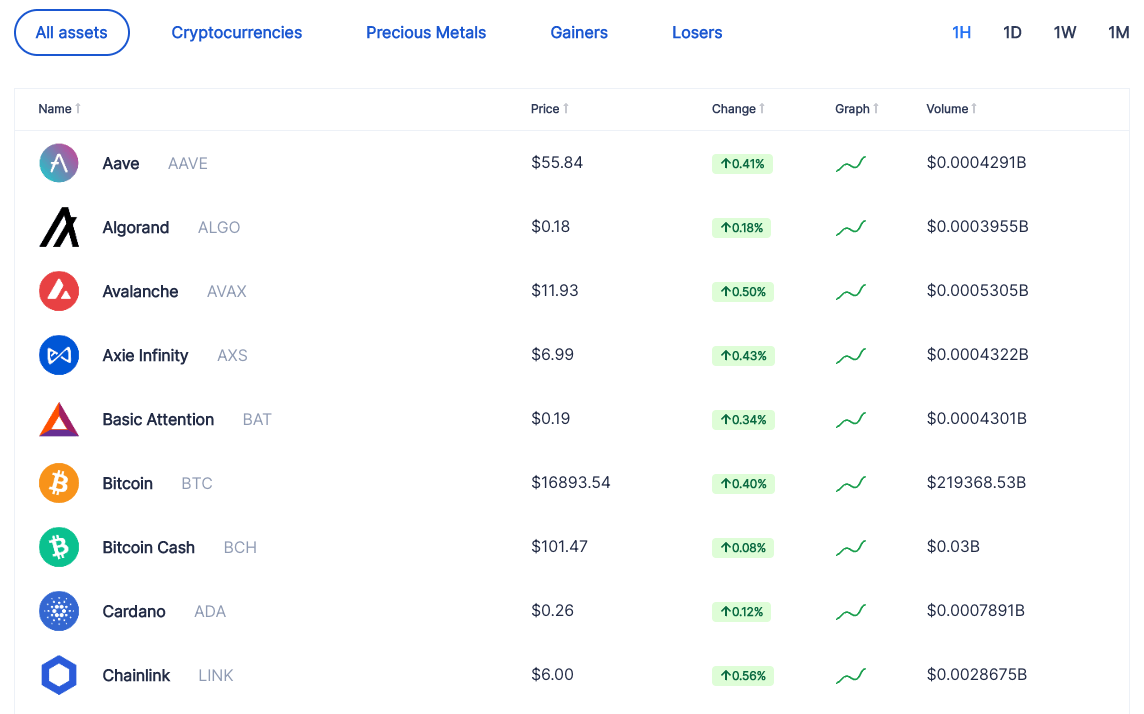

What Assets are on iTrustCapital?

iTrustCapital supports crypto and physical gold and silver. All can be bought or sold directly on the platform, and prices and fees are transparent.

There are currently over 60 cryptocurrencies supported on the platform, including:

- Aave (AAVE)

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Cardano (ADA)

- Dogecoin (DOGE)

- Ethereum (ETH)

- Litecoin (LTC)

- Polkadot (DOT)

- Polygon (MATIC)

- Shiba Inu (SHIB)

- Solana (SOL)

- Stellar (XLM)

See all the cryptocurrencies offered here.

Pros and Cons of iTrustCapital

Pros

-

- Buy crypto, gold, and silver in tax-advantaged accounts. iTrustCapital is one of the few companies that offers crypto and precious metals within a retirement account. You can buy and sell crypto, gold, and silver without causing a taxable event, and both traditional and Roth IRA accounts are available.

- Real-time pricing and trading. iTrustCapital offers real-time pricing for purchases of gold, silver, and all cryptocurrencies. This allows you to get a fair market price for each asset, and transactions happen instantly, instead of waiting until end-of-day or until market close (like many investment platforms).

- Access to 60+ different cryptocurrencies. You can buy or sell 60+ different crypto assets on the platform, including Bitcoin, Ethereum, and Dogecoin.

- Crypto staking available. iTrustCapital offers crypto staking on Polkadot (DOT), which is a great way to earn passive income within your retirement account.

- Can rollover retirement accounts into iTrustCapital. iTrustCapital allows you to roll over several types of retirement accounts, including 401k, 403b, TSP, and other IRA accounts. You can even rollover “in-kind” assets, meaning you don’t have to sell if you own crypto inside another IRA that you are rolling over to iTrustCapital.

Cons

-

- Taking custody of crypto before retirement may be penalized. When investing in crypto with iTrustCapital, your assets are held with a third-party custodian. This is required by law, and you cannot take custody of your assets before retirement age (59.5 years old). If you do decide to withdraw your crypto assets before then, it may cause a taxable event, as well as a penalty from the IRS.

- High account minimums. While some retirement accounts have very low minimums ($10 or less), iTrustCapital requires a $1,000 deposit to open an account.

iTrustCapital has a lot of competitors — head over to our article on the best crypto IRA for an overview of each one.

Should You Use iTrustCapital?

iTrustCapital is the top low-fee crypto IRA platform available. With low trading fees, a wide variety of cryptocurrencies, and access to gold and silver, it is a great option for investing in crypto within a retirement account.

If you want to trade cryptocurrencies and have the ability to take custody of your assets, however, this may not be the best choice. While the selection is good for long-term investors, most crypto exchanges support hundreds of different cryptocurrencies. Additionally, you cannot take custody of your crypto assets without fees and taxes before reaching retirement age.

iTrustCapital is best for long-term crypto (and gold and silver) investors who want a low-fee, tax-advantaged account.

iTrustCapital vs. Bitcoin IRA

Both iTrustCapital and Bitcoin IRA offer access to cryptocurrencies within your retirement account, as well as the ability to invest in precious metals. Both support Traditional, Roth, and SEP IRAs, and both secure your crypto assets in cold storage.

The primary differences are the minimum investment, fees, and asset selection:

Company | iTrustCapital | Bitcoin IRA |

|---|---|---|

Minimum Investment | $1,000 | $3,000 |

Fees | – 1% for crypto trades – $75 over spot (per ounce) for Gold – $3.25 over spot (per ounce) for Silver | – 0.99% – 4.99% setup fee – 2% trading fee – 0.08% maintenance fee ($20 minimum) |

Asset Selection | – 60+ cryptocurrencies – Physical gold – Physical silver | – 60+ cryptocurrencies – Physical gold |

If you want a better crypto selection, Bitcoin IRA is the top choice, but you’ll pay extra for it. The Bitcoin IRA fees are noticeably higher than those of other platforms. If you want to invest in 60+ of the most popular cryptos, you’ll save money by using iTrustCapital.

If you’re not ready to put up the $1000 for the minimum investment, head over to our Alto CryptoIRA review. You can open an account on Alto with only $10.

Final Word: iTrustCapital Review

With transparent (and very low) trading fees, access to more than two-dozen cryptocurrencies, and the ability to stake crypto to earn passive income, iTrustCapital is one of the best crypto IRA accounts out there.

Remember, investing in an IRA means you can’t take custody of your crypto, but funds are kept safe in offline storage while you wait for retirement.

If you want to add some alternative assets to your retirement plan, iTrustCapital is a great option.

That’s a wrap on my iTrustCapital review!

FAQs:

Is iTrustCapital legit?

Yes, iTrustCapital is a legit investment platform that offers self-directed IRA accounts which allow users to invest in cryptocurrencies and precious metals.

USD balances within the account are FDIC insured, and cryptocurrency assets are kept with a third-party custodian in cold storage.

Both physical gold and silver are available for purchase as well, and are kept at the Royal Canadian Mint for safe keeping.

Does iTrustCapital have monthly fees?

No, iTrustCapital does not charge a monthly maintenance fee for personal accounts.

The only fees charged are for buying and selling of assets on the platform, plus a one-time conversion fee if converting a Traditional IRA to an iTrustCapital Roth IRA or SEP IRA.

Is iTrustCapital FDIC insured?

Yes, iTrustCapital utilizes a third-party custodian that uses Signature Bank, an FDIC-insured bank, to hold customer deposits. Signature Bank deposit accounts are insured up to the maximum permitted by federal regulation.

It is important to note that FDIC insurance only covers USD deposits, and not cryptocurrency or precious metal investments.

What Cryptos are on iTrustCapital?

There are 60+ supported cryptocurrencies on the iTrustCapital platform currency, including Bitcoin, Ethereum, Polkadot, Polygon, and Dogecoin.

Where to Invest $1,000 Right Now?

Did you know that stocks rated as "Buy" by the Top Analysts in WallStreetZen's database beat the S&P500 by 98.4% last year?

Our July report reveals the 3 "Strong Buy" stocks that market-beating analysts predict will outperform over the next year.